f3c7050fd24d2a7e7c6b89f3b8a69db0.ppt

- Количество слайдов: 10

Incentives to vertical integration Vertical integration is the replacement of a market transaction with an internal accounting transfer All business enterprises are integrated to some degree; at the same time, no enterprise is fully integrated.

Incentives to vertical integration Vertical integration is the replacement of a market transaction with an internal accounting transfer All business enterprises are integrated to some degree; at the same time, no enterprise is fully integrated.

International Petroleum Majors Firms such as British Petroleum and Gulf-Chevron are “fully-integrated, ” meaning they engage in crude extraction, transportation by ship or pipeline, refining, and wholesale and retail distribution. At the same time, they are NOT integrated into manufacturing of pipelines or oil extraction equipment. Thus, even the most integrated firms are not ‘perfectly’ integrated.

International Petroleum Majors Firms such as British Petroleum and Gulf-Chevron are “fully-integrated, ” meaning they engage in crude extraction, transportation by ship or pipeline, refining, and wholesale and retail distribution. At the same time, they are NOT integrated into manufacturing of pipelines or oil extraction equipment. Thus, even the most integrated firms are not ‘perfectly’ integrated.

The “make or buy” decision • Should the big food processors such as General Foods integrate upstream into agriculture? • Should GM manufacture brakes for trucks at its Dayton, OH parts facility, or should it “outsource. ” • Should SBC communications manufacture telecommunications equipment “in house. ” • Should Amheiser-Bush get into the aluminum packaging business? • Should Sears manufacture appliances?

The “make or buy” decision • Should the big food processors such as General Foods integrate upstream into agriculture? • Should GM manufacture brakes for trucks at its Dayton, OH parts facility, or should it “outsource. ” • Should SBC communications manufacture telecommunications equipment “in house. ” • Should Amheiser-Bush get into the aluminum packaging business? • Should Sears manufacture appliances?

Issue: Why do firms choose to vertically integrate (by way of merger or internal expansion) instead of "outsource"? Economists have identified three basic incentives to vertical integration: 1. The elimination of transactions costs 2. Technological economies 3. Elimination of successive monopoly

Issue: Why do firms choose to vertically integrate (by way of merger or internal expansion) instead of "outsource"? Economists have identified three basic incentives to vertical integration: 1. The elimination of transactions costs 2. Technological economies 3. Elimination of successive monopoly

The Coase contribution Transactions costs that can be avoided through “making” instead of “buying” include: • Search • Negotiation 1 Professor Coase argued that using markets can be costly and that the systematic replacement of the market with organization through vertical integration could result in vast cost savings • Contracting • Contract compliance Ronald H. Coase, "The Nature of the Firm, " Economica, Nov. 1937: 368 -405] 1

The Coase contribution Transactions costs that can be avoided through “making” instead of “buying” include: • Search • Negotiation 1 Professor Coase argued that using markets can be costly and that the systematic replacement of the market with organization through vertical integration could result in vast cost savings • Contracting • Contract compliance Ronald H. Coase, "The Nature of the Firm, " Economica, Nov. 1937: 368 -405] 1

Technological economies • The integration of iron-making and steel-making eliminates the cost that would be incurred to reheat the iron if the two stages were non-integrated. • Just-in-time inventory (JIT) management can economize on firms' inventory carrying costs--but only when units operating at different stages of production are tightly coordinated.

Technological economies • The integration of iron-making and steel-making eliminates the cost that would be incurred to reheat the iron if the two stages were non-integrated. • Just-in-time inventory (JIT) management can economize on firms' inventory carrying costs--but only when units operating at different stages of production are tightly coordinated.

The successive monopoly model Consider the case of an upstream manufacturer of motors and a downstream boat manufacturer (both monopolists). The model is based on the following assumptions: 1. Manufacturing one boat requires one motor plus C dollars worth of other inputs, where C = $100. Since there is one motor per boat, Q measures motor and boat production. 2. The boat monopolist is a price-taker in the market for motors-i. e. , there is no monopsony or oligopsony power (hear audio explanation (wav)). 3. The marginal cost of manufacturing a motor is equal to (a constant) $100.

The successive monopoly model Consider the case of an upstream manufacturer of motors and a downstream boat manufacturer (both monopolists). The model is based on the following assumptions: 1. Manufacturing one boat requires one motor plus C dollars worth of other inputs, where C = $100. Since there is one motor per boat, Q measures motor and boat production. 2. The boat monopolist is a price-taker in the market for motors-i. e. , there is no monopsony or oligopsony power (hear audio explanation (wav)). 3. The marginal cost of manufacturing a motor is equal to (a constant) $100.

Let PM denote the price of a motor. Thus the marginal cost function for the boat maker is given by: MC = PM + C [1] Recall that to maximize profits, MR should be equal to MC. Thus: MR = PM + C [2] Thus the derived demand function (D')(hear audio explanation (wav)) for motors is given by: PM = MR – C [3]

Let PM denote the price of a motor. Thus the marginal cost function for the boat maker is given by: MC = PM + C [1] Recall that to maximize profits, MR should be equal to MC. Thus: MR = PM + C [2] Thus the derived demand function (D')(hear audio explanation (wav)) for motors is given by: PM = MR – C [3]

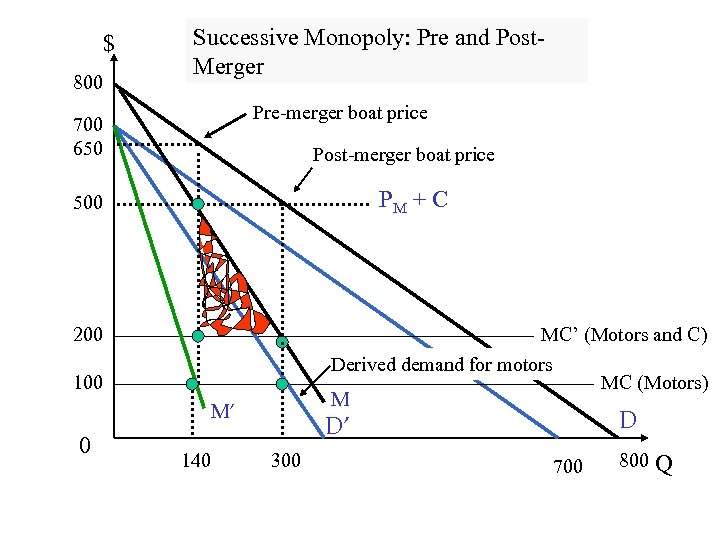

$ 800 Successive Monopoly: Pre and Post. Merger Pre-merger boat price 700 650 Post-merger boat price PM + C 500 200 MC’ (Motors and C) Derived demand for motors MC (Motors) M 100 M’ 0 140 D D’ 300 700 800 Q

$ 800 Successive Monopoly: Pre and Post. Merger Pre-merger boat price 700 650 Post-merger boat price PM + C 500 200 MC’ (Motors and C) Derived demand for motors MC (Motors) M 100 M’ 0 140 D D’ 300 700 800 Q

Summary Back to Lesson 7 Notice the following: • If the manufacture of motors and boats remains nonintegrated, then PM = $400; hence PM + C = $500; hence the price of boats will be equal to $650. • However, if the two monopolists merge, then the marginal cost of manufacturing a boat declines from $400 to $200. The profit maximizing price of boats decreases from $650 to $500. The quantity produced of boats increases from 140 to 300. Hence vertical integration is welfare-enhancing. • Notice that profit increases by the red shaded area.

Summary Back to Lesson 7 Notice the following: • If the manufacture of motors and boats remains nonintegrated, then PM = $400; hence PM + C = $500; hence the price of boats will be equal to $650. • However, if the two monopolists merge, then the marginal cost of manufacturing a boat declines from $400 to $200. The profit maximizing price of boats decreases from $650 to $500. The quantity produced of boats increases from 140 to 300. Hence vertical integration is welfare-enhancing. • Notice that profit increases by the red shaded area.