1 Tasks Models of the firms behavior.pptx

- Количество слайдов: 6

In “Time” magazine D. B. Tinnin wrote: "the Historical irony is that in the United States, that are the bastion of the world capitalism, so few citizens understand that profits provide the basis for the prosperity on which the well-being of individuals and the country as a whole rests. “ A. Explain the vital role that economic profit plays in the "market – enterprise” system. B. Telephone companies, electric companies and other utilities are examples of the industries regulated by the government in many countries. If the profit is so powerful incentive, why the government continues to regulate them?

Some economists develop theory of the firm which postulates that firms seek to maximize sales rather than income or the value of the firm. A. Explain how motivation of the managers can guide them to maximize sales more than profits. B. Explain the reasons why we maintain theory of the firm, giving priority to maximizing the value of the firm instead maximizing sales.

Another model, alternative to model of maximising the value of the firm posits that with the advent of modern corporations and separation of the ownership from management, managers will be more interested in maximizing their personal wealth than in profit of Corporation. A. Specify how you can measure the benefits of managers. B. Explain why this theory cannot replace our theory of the firm, expressed in terms of maximising the value.

The "Global" Corporation has a capitalized value of $ 25 per share with an annual income of 3 $ per share. The Corporation has received an investment offer that allows it to increase the income by 95 cents per share, but at the same time increasing business risk, which requires an increase in the return on investment by 15%. A. What is the current value of the return on investment of the "Global" company? B. Should the company accept such a proposal? C. Explain how the risk is associated with income.

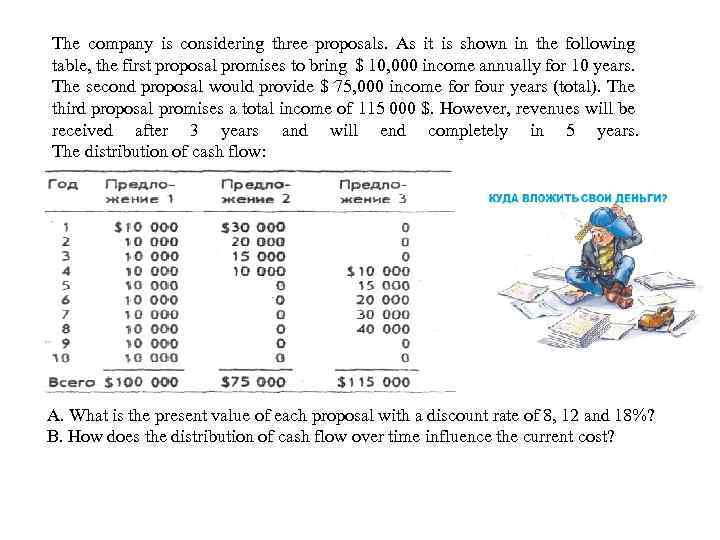

The company is considering three proposals. As it is shown in the following table, the first proposal promises to bring $ 10, 000 income annually for 10 years. The second proposal would provide $ 75, 000 income for four years (total). The third proposal promises a total income of 115 000 $. However, revenues will be received after 3 years and will end completely in 5 years. The distribution of cash flow: A. What is the present value of each proposal with a discount rate of 8, 12 and 18%? B. How does the distribution of cash flow over time influence the current cost?

1 Tasks Models of the firms behavior.pptx