bfbb4bb6126217714f391c0625331cd4.ppt

- Количество слайдов: 61

IMPORTANT PROVISIONS FOR REGISTRATION AND RETURNS UNDER MODEL GST LAWS FOR SEMINAR HELD BY PUNE BRANCH OF WIRC OF ICAI AT PUNE ON 6 -11 - 2016 CA MAYUR PAREKH & ASSOCIATES CA MAYUR R PAREKH FCA/DISA(ICAI) 1

IMPORTANT PROVISIONS FOR REGISTRATION AND RETURNS UNDER MODEL GST LAWS FOR SEMINAR HELD BY PUNE BRANCH OF WIRC OF ICAI AT PUNE ON 6 -11 - 2016 CA MAYUR PAREKH & ASSOCIATES CA MAYUR R PAREKH FCA/DISA(ICAI) 1

Introduction q GST is the biggest reform in indirect taxation system the country has ever seen. q Preparations at all levels for legislative, infrastructural, systemic changes are being made. q GST council is the most important body under the new legislation. q Discussion here in under based on the GST model law And Draft Rules. CA MAYUR R PAREKH FCA/DISA(ICAI) 2

Introduction q GST is the biggest reform in indirect taxation system the country has ever seen. q Preparations at all levels for legislative, infrastructural, systemic changes are being made. q GST council is the most important body under the new legislation. q Discussion here in under based on the GST model law And Draft Rules. CA MAYUR R PAREKH FCA/DISA(ICAI) 2

Registration: Law, Business Process and Transitional Provisions Why Registration is necessary? Registration will confer following advantages to a taxpayer: q He is legally recognized as supplier of goods or services. q He is legally authorized to collect tax from his customers and pass on the credit of the taxes paid on the goods or services supplied to the purchasers/ recipients. q He can claim input tax credit of taxes paid and can utilize the same for payment of taxes due on supply of goods or services. q Seamless flow of fund from Centre / Exporting States to IGST Fund and then to importing States. q Seamless flow of Input Tax Credit from suppliers to recipients at the national level. CA MAYUR R PAREKH FCA/DISA(ICAI) 3

Registration: Law, Business Process and Transitional Provisions Why Registration is necessary? Registration will confer following advantages to a taxpayer: q He is legally recognized as supplier of goods or services. q He is legally authorized to collect tax from his customers and pass on the credit of the taxes paid on the goods or services supplied to the purchasers/ recipients. q He can claim input tax credit of taxes paid and can utilize the same for payment of taxes due on supply of goods or services. q Seamless flow of fund from Centre / Exporting States to IGST Fund and then to importing States. q Seamless flow of Input Tax Credit from suppliers to recipients at the national level. CA MAYUR R PAREKH FCA/DISA(ICAI) 3

Liability for Registration Based on Aggregate Turnover: q Every supplier shall be liable to be registered under this Law in the State from where he makes a taxable supply of goods and/or services if his aggregate turnover in a financial year exceeds threshold: q Threshold for registration is [Rs. 9 Lakh] –GST COUNSIL RECOMMENDED THRESHOLD LIMIT RS. 19 LAKHS q Threshold in North Eastern States including Sikkim is [Rs. 4 Lakh] - GST COUNSIL RECOMMENDED THRESHOLD LIMIT RS. 9 LAKHS Aggregate Turnover : Section – 2(6) “aggregate turnover” means the aggregate value of all taxable and non-taxable supplies, exempt supplies and exports of goods and/or services of a person having the same PAN, to be computed on all India basis and excludes taxes, if any, charged under the CGST Act, SGST Act and the IGST Act, as the case may be; Explanation. - Aggregate turnover does not include the value of supplies on which tax is levied on reverse charge basis and the value of inward supplies. CA MAYUR R PAREKH FCA/DISA(ICAI) 4

Liability for Registration Based on Aggregate Turnover: q Every supplier shall be liable to be registered under this Law in the State from where he makes a taxable supply of goods and/or services if his aggregate turnover in a financial year exceeds threshold: q Threshold for registration is [Rs. 9 Lakh] –GST COUNSIL RECOMMENDED THRESHOLD LIMIT RS. 19 LAKHS q Threshold in North Eastern States including Sikkim is [Rs. 4 Lakh] - GST COUNSIL RECOMMENDED THRESHOLD LIMIT RS. 9 LAKHS Aggregate Turnover : Section – 2(6) “aggregate turnover” means the aggregate value of all taxable and non-taxable supplies, exempt supplies and exports of goods and/or services of a person having the same PAN, to be computed on all India basis and excludes taxes, if any, charged under the CGST Act, SGST Act and the IGST Act, as the case may be; Explanation. - Aggregate turnover does not include the value of supplies on which tax is levied on reverse charge basis and the value of inward supplies. CA MAYUR R PAREKH FCA/DISA(ICAI) 4

Liability for Registration ( Contd…. ) q The liability to pay tax , however, will start only when the registered person reaches a threshold limit of turnover [Rs. 10 lakhs] (Gst Council recommendation Rs. 20 Lakhs) and [Rs. 5 lakhs] (Gst Council recommendation Rs. 10 Lakhs ) respectively except the cases where threshold is not applicable q The taxable threshold shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals (by an agent). q The supply of goods, after completion of job-work, by a registered job-worker shall be treated as the supply of goods by the “principal” and the value of such goods shall not be included in the aggregate turnover of the registered job worker. CA MAYUR R PAREKH FCA/DISA(ICAI) 5

Liability for Registration ( Contd…. ) q The liability to pay tax , however, will start only when the registered person reaches a threshold limit of turnover [Rs. 10 lakhs] (Gst Council recommendation Rs. 20 Lakhs) and [Rs. 5 lakhs] (Gst Council recommendation Rs. 10 Lakhs ) respectively except the cases where threshold is not applicable q The taxable threshold shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals (by an agent). q The supply of goods, after completion of job-work, by a registered job-worker shall be treated as the supply of goods by the “principal” and the value of such goods shall not be included in the aggregate turnover of the registered job worker. CA MAYUR R PAREKH FCA/DISA(ICAI) 5

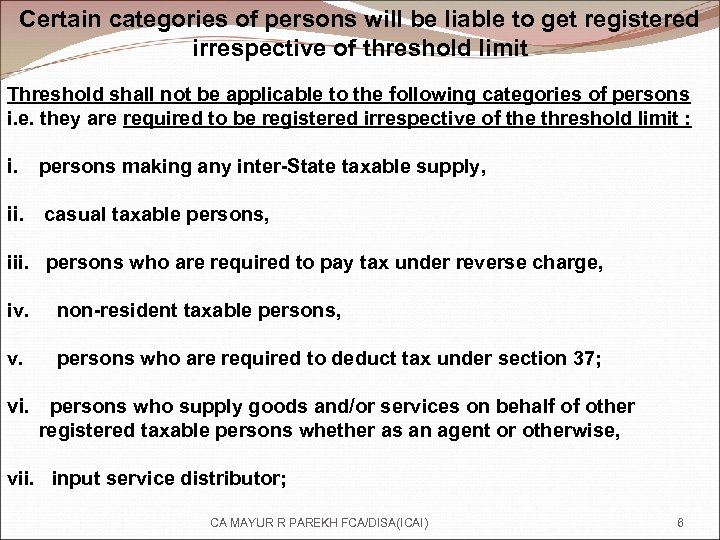

Certain categories of persons will be liable to get registered irrespective of threshold limit Threshold shall not be applicable to the following categories of persons i. e. they are required to be registered irrespective of the threshold limit : i. persons making any inter-State taxable supply, ii. casual taxable persons, iii. persons who are required to pay tax under reverse charge, iv. non-resident taxable persons, v. persons who are required to deduct tax under section 37; vi. persons who supply goods and/or services on behalf of other registered taxable persons whether as an agent or otherwise, vii. input service distributor; CA MAYUR R PAREKH FCA/DISA(ICAI) 6

Certain categories of persons will be liable to get registered irrespective of threshold limit Threshold shall not be applicable to the following categories of persons i. e. they are required to be registered irrespective of the threshold limit : i. persons making any inter-State taxable supply, ii. casual taxable persons, iii. persons who are required to pay tax under reverse charge, iv. non-resident taxable persons, v. persons who are required to deduct tax under section 37; vi. persons who supply goods and/or services on behalf of other registered taxable persons whether as an agent or otherwise, vii. input service distributor; CA MAYUR R PAREKH FCA/DISA(ICAI) 6

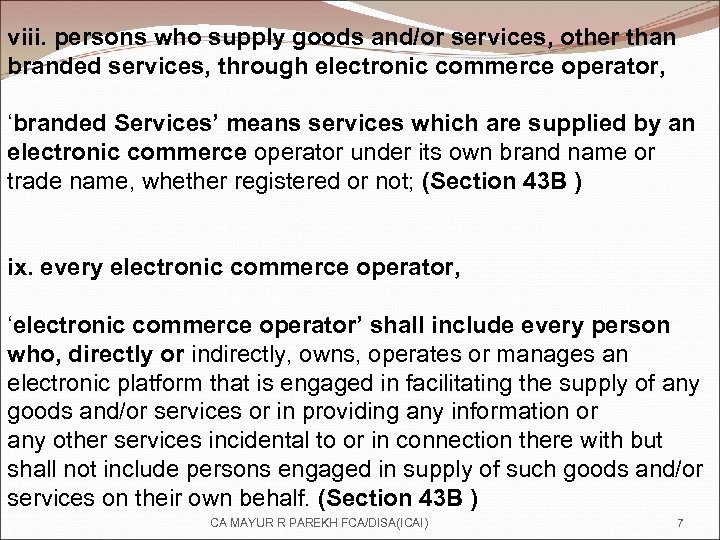

viii. persons who supply goods and/or services, other than branded services, through electronic commerce operator, ‘branded Services’ means services which are supplied by an electronic commerce operator under its own brand name or trade name, whether registered or not; (Section 43 B ) ix. every electronic commerce operator, ‘electronic commerce operator’ shall include every person who, directly or indirectly, owns, operates or manages an electronic platform that is engaged in facilitating the supply of any goods and/or services or in providing any information or any other services incidental to or in connection there with but shall not include persons engaged in supply of such goods and/or services on their own behalf. (Section 43 B ) CA MAYUR R PAREKH FCA/DISA(ICAI) 7

viii. persons who supply goods and/or services, other than branded services, through electronic commerce operator, ‘branded Services’ means services which are supplied by an electronic commerce operator under its own brand name or trade name, whether registered or not; (Section 43 B ) ix. every electronic commerce operator, ‘electronic commerce operator’ shall include every person who, directly or indirectly, owns, operates or manages an electronic platform that is engaged in facilitating the supply of any goods and/or services or in providing any information or any other services incidental to or in connection there with but shall not include persons engaged in supply of such goods and/or services on their own behalf. (Section 43 B ) CA MAYUR R PAREKH FCA/DISA(ICAI) 7

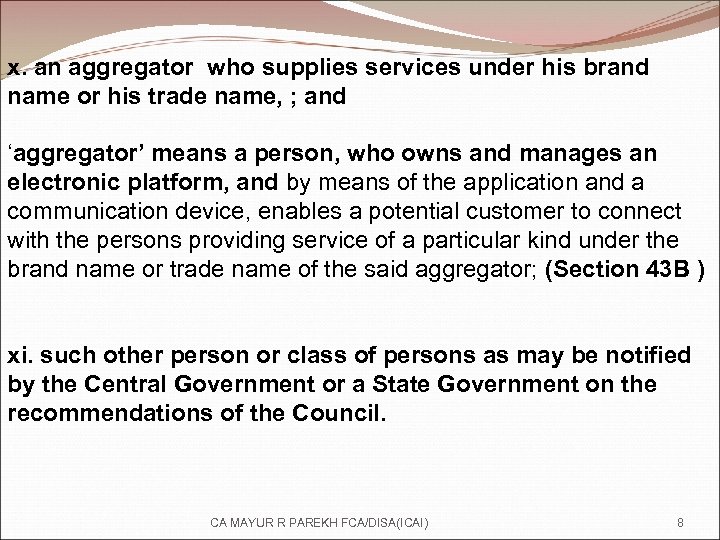

x. an aggregator who supplies services under his brand name or his trade name, ; and ‘aggregator’ means a person, who owns and manages an electronic platform, and by means of the application and a communication device, enables a potential customer to connect with the persons providing service of a particular kind under the brand name or trade name of the said aggregator; (Section 43 B ) xi. such other person or class of persons as may be notified by the Central Government or a State Government on the recommendations of the Council. CA MAYUR R PAREKH FCA/DISA(ICAI) 8

x. an aggregator who supplies services under his brand name or his trade name, ; and ‘aggregator’ means a person, who owns and manages an electronic platform, and by means of the application and a communication device, enables a potential customer to connect with the persons providing service of a particular kind under the brand name or trade name of the said aggregator; (Section 43 B ) xi. such other person or class of persons as may be notified by the Central Government or a State Government on the recommendations of the Council. CA MAYUR R PAREKH FCA/DISA(ICAI) 8

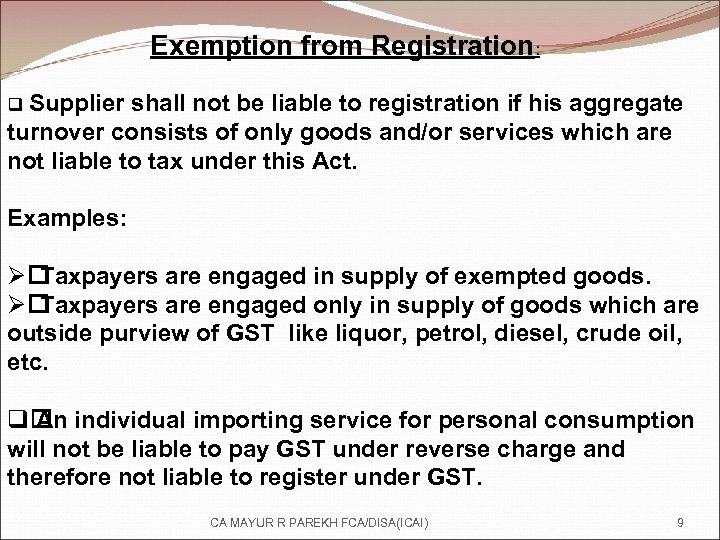

Exemption from Registration: q Supplier shall not be liable to registration if his aggregate turnover consists of only goods and/or services which are not liable to tax under this Act. Examples: Ø Taxpayers are engaged in supply of exempted goods. Ø Taxpayers are engaged only in supply of goods which are outside purview of GST like liquor, petrol, diesel, crude oil, etc. q An individual importing service for personal consumption will not be liable to pay GST under reverse charge and therefore not liable to register under GST. CA MAYUR R PAREKH FCA/DISA(ICAI) 9

Exemption from Registration: q Supplier shall not be liable to registration if his aggregate turnover consists of only goods and/or services which are not liable to tax under this Act. Examples: Ø Taxpayers are engaged in supply of exempted goods. Ø Taxpayers are engaged only in supply of goods which are outside purview of GST like liquor, petrol, diesel, crude oil, etc. q An individual importing service for personal consumption will not be liable to pay GST under reverse charge and therefore not liable to register under GST. CA MAYUR R PAREKH FCA/DISA(ICAI) 9

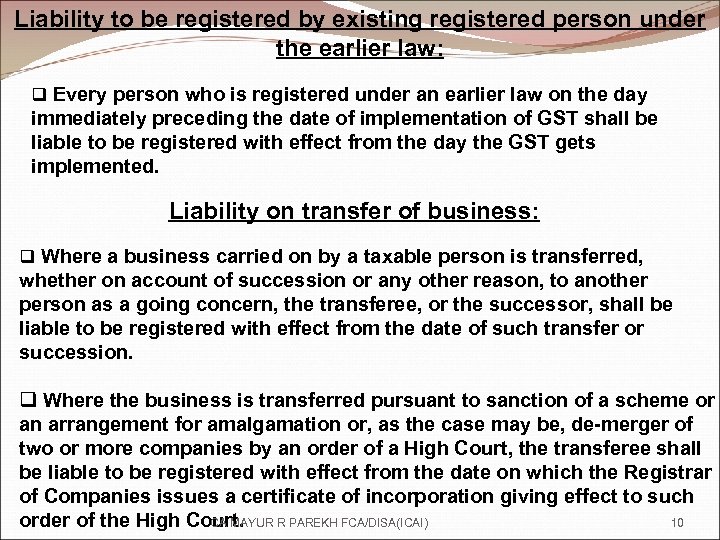

Liability to be registered by existing registered person under the earlier law: q Every person who is registered under an earlier law on the day immediately preceding the date of implementation of GST shall be liable to be registered with effect from the day the GST gets implemented. Liability on transfer of business: q Where a business carried on by a taxable person is transferred, whether on account of succession or any other reason, to another person as a going concern, the transferee, or the successor, shall be liable to be registered with effect from the date of such transfer or succession. q Where the business is transferred pursuant to sanction of a scheme or an arrangement for amalgamation or, as the case may be, de-merger of two or more companies by an order of a High Court, the transferee shall be liable to be registered with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such CA MAYUR R PAREKH FCA/DISA(ICAI) 10 order of the High Court.

Liability to be registered by existing registered person under the earlier law: q Every person who is registered under an earlier law on the day immediately preceding the date of implementation of GST shall be liable to be registered with effect from the day the GST gets implemented. Liability on transfer of business: q Where a business carried on by a taxable person is transferred, whether on account of succession or any other reason, to another person as a going concern, the transferee, or the successor, shall be liable to be registered with effect from the date of such transfer or succession. q Where the business is transferred pursuant to sanction of a scheme or an arrangement for amalgamation or, as the case may be, de-merger of two or more companies by an order of a High Court, the transferee shall be liable to be registered with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such CA MAYUR R PAREKH FCA/DISA(ICAI) 10 order of the High Court.

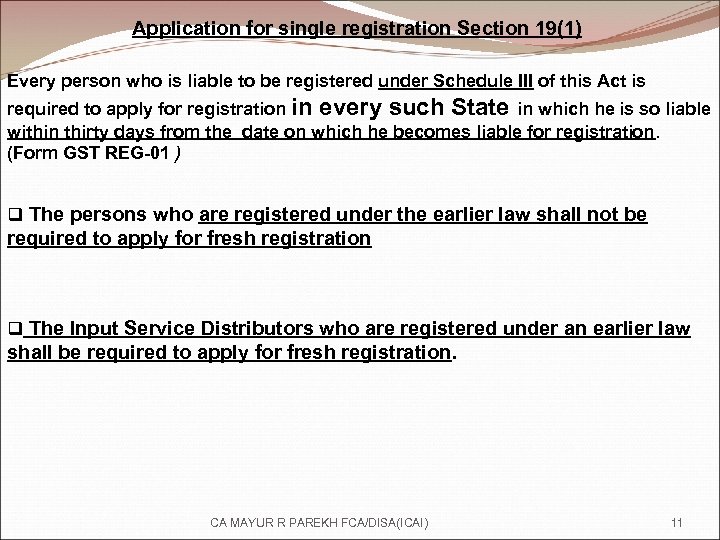

Application for single registration Section 19(1) Every person who is liable to be registered under Schedule III of this Act is required to apply for registration in every such State in which he is so liable within thirty days from the date on which he becomes liable for registration. (Form GST REG-01 ) q The persons who are registered under the earlier law shall not be required to apply for fresh registration q The Input Service Distributors who are registered under an earlier law shall be required to apply for fresh registration. CA MAYUR R PAREKH FCA/DISA(ICAI) 11

Application for single registration Section 19(1) Every person who is liable to be registered under Schedule III of this Act is required to apply for registration in every such State in which he is so liable within thirty days from the date on which he becomes liable for registration. (Form GST REG-01 ) q The persons who are registered under the earlier law shall not be required to apply for fresh registration q The Input Service Distributors who are registered under an earlier law shall be required to apply for fresh registration. CA MAYUR R PAREKH FCA/DISA(ICAI) 11

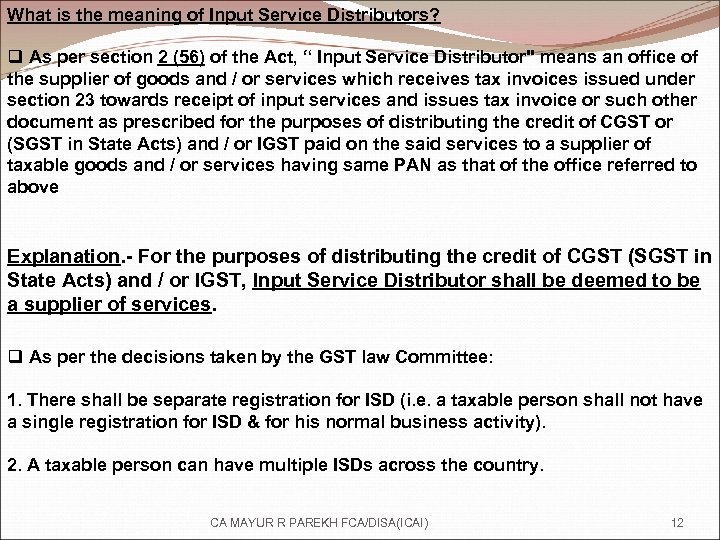

What is the meaning of Input Service Distributors? q As per section 2 (56) of the Act, “ Input Service Distributor" means an office of the supplier of goods and / or services which receives tax invoices issued under section 23 towards receipt of input services and issues tax invoice or such other document as prescribed for the purposes of distributing the credit of CGST or (SGST in State Acts) and / or IGST paid on the said services to a supplier of taxable goods and / or services having same PAN as that of the office referred to above Explanation. - For the purposes of distributing the credit of CGST (SGST in State Acts) and / or IGST, Input Service Distributor shall be deemed to be a supplier of services. q As per the decisions taken by the GST law Committee: 1. There shall be separate registration for ISD (i. e. a taxable person shall not have a single registration for ISD & for his normal business activity). 2. A taxable person can have multiple ISDs across the country. CA MAYUR R PAREKH FCA/DISA(ICAI) 12

What is the meaning of Input Service Distributors? q As per section 2 (56) of the Act, “ Input Service Distributor" means an office of the supplier of goods and / or services which receives tax invoices issued under section 23 towards receipt of input services and issues tax invoice or such other document as prescribed for the purposes of distributing the credit of CGST or (SGST in State Acts) and / or IGST paid on the said services to a supplier of taxable goods and / or services having same PAN as that of the office referred to above Explanation. - For the purposes of distributing the credit of CGST (SGST in State Acts) and / or IGST, Input Service Distributor shall be deemed to be a supplier of services. q As per the decisions taken by the GST law Committee: 1. There shall be separate registration for ISD (i. e. a taxable person shall not have a single registration for ISD & for his normal business activity). 2. A taxable person can have multiple ISDs across the country. CA MAYUR R PAREKH FCA/DISA(ICAI) 12

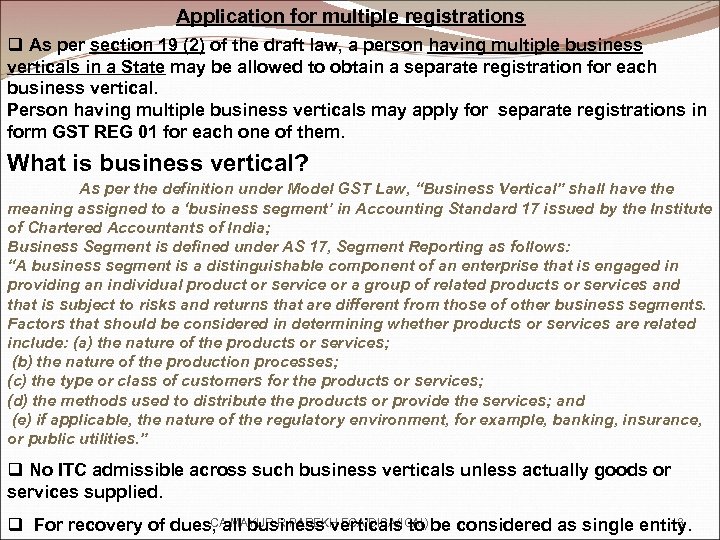

Application for multiple registrations q As per section 19 (2) of the draft law, a person having multiple business verticals in a State may be allowed to obtain a separate registration for each business vertical. Person having multiple business verticals may apply for separate registrations in form GST REG 01 for each one of them. What is business vertical? As per the definition under Model GST Law, “Business Vertical” shall have the meaning assigned to a ‘business segment’ in Accounting Standard 17 issued by the Institute of Chartered Accountants of India; Business Segment is defined under AS 17, Segment Reporting as follows: “A business segment is a distinguishable component of an enterprise that is engaged in providing an individual product or service or a group of related products or services and that is subject to risks and returns that are different from those of other business segments. Factors that should be considered in determining whether products or services are related include: (a) the nature of the products or services; (b) the nature of the production processes; (c) the type or class of customers for the products or services; (d) the methods used to distribute the products or provide the services; and (e) if applicable, the nature of the regulatory environment, for example, banking, insurance, or public utilities. ” q No ITC admissible across such business verticals unless actually goods or services supplied. CA MAYUR R PAREKH FCA/DISA(ICAI) 13 q For recovery of dues, all business verticals to be considered as single entity.

Application for multiple registrations q As per section 19 (2) of the draft law, a person having multiple business verticals in a State may be allowed to obtain a separate registration for each business vertical. Person having multiple business verticals may apply for separate registrations in form GST REG 01 for each one of them. What is business vertical? As per the definition under Model GST Law, “Business Vertical” shall have the meaning assigned to a ‘business segment’ in Accounting Standard 17 issued by the Institute of Chartered Accountants of India; Business Segment is defined under AS 17, Segment Reporting as follows: “A business segment is a distinguishable component of an enterprise that is engaged in providing an individual product or service or a group of related products or services and that is subject to risks and returns that are different from those of other business segments. Factors that should be considered in determining whether products or services are related include: (a) the nature of the products or services; (b) the nature of the production processes; (c) the type or class of customers for the products or services; (d) the methods used to distribute the products or provide the services; and (e) if applicable, the nature of the regulatory environment, for example, banking, insurance, or public utilities. ” q No ITC admissible across such business verticals unless actually goods or services supplied. CA MAYUR R PAREKH FCA/DISA(ICAI) 13 q For recovery of dues, all business verticals to be considered as single entity.

Application for voluntary registration - section 19 (3) q Person not required to obtain registration based on TO limit also can apply voluntarily for registration. q Person who gets himself registered voluntarily shall be liable for payment of tax. q Registration may get cancelled if the business is not commenced within 6 months. q Person can enter credit chain by obtaining voluntary registration. CA MAYUR R PAREKH FCA/DISA(ICAI) 14

Application for voluntary registration - section 19 (3) q Person not required to obtain registration based on TO limit also can apply voluntarily for registration. q Person who gets himself registered voluntarily shall be liable for payment of tax. q Registration may get cancelled if the business is not commenced within 6 months. q Person can enter credit chain by obtaining voluntary registration. CA MAYUR R PAREKH FCA/DISA(ICAI) 14

Procedure for obtaining Registration: New applicant can apply for registration: 1. at the GST Common Portal directly; or 2. at the GST Common Portal through the Facilitation Center (FC) CA MAYUR R PAREKH FCA/DISA(ICAI) 15

Procedure for obtaining Registration: New applicant can apply for registration: 1. at the GST Common Portal directly; or 2. at the GST Common Portal through the Facilitation Center (FC) CA MAYUR R PAREKH FCA/DISA(ICAI) 15

Procedure for Registration q Application to be made within 30 days from the date on which the taxpayer becomes liable to pay tax. q GST common portal will be set up by GSTN with backend integration with respective IT systems of Centre and State. q Procedure - Application in form GST REG-01 on GST portal to be submitted with all fields duly filled up. Part A thereof consists of PAN, email address and mobile no. which shall be first verified in the prescribed manner with the respective database and then application reference no. shall be generated. q Part B of the form to be submitted duly filled up using the said ref. no. and duly signed along with necessary documents. q Once a complete application is submitted online, a message asking for confirmation will be sent through e-mail and SMS to the authorized signatory of the applicant. q On receipt of such confirmation from the authorized signatory, Acknowledgement Number in form GST REG-02 would be generated and intimated to the applicant CA MAYUR R PAREKH FCA/DISA(ICAI) 16

Procedure for Registration q Application to be made within 30 days from the date on which the taxpayer becomes liable to pay tax. q GST common portal will be set up by GSTN with backend integration with respective IT systems of Centre and State. q Procedure - Application in form GST REG-01 on GST portal to be submitted with all fields duly filled up. Part A thereof consists of PAN, email address and mobile no. which shall be first verified in the prescribed manner with the respective database and then application reference no. shall be generated. q Part B of the form to be submitted duly filled up using the said ref. no. and duly signed along with necessary documents. q Once a complete application is submitted online, a message asking for confirmation will be sent through e-mail and SMS to the authorized signatory of the applicant. q On receipt of such confirmation from the authorized signatory, Acknowledgement Number in form GST REG-02 would be generated and intimated to the applicant CA MAYUR R PAREKH FCA/DISA(ICAI) 16

Procedure for Registration q Casual/non resident taxable person shall be allotted a temporary ID no. for payment of advance amount of tax. q Multiple applications can be filed at one go where a taxable person seeks registration in more than one State or for more than one business vertical located in a single / multiple State(s). q Proper officer shall examine the application along with accompanying documents and has to approve the same within 3 working days only if it is found in order. In any other case, he shall intimate the deficiencies to the applicant in form GST REG-3 within 3 working days. q Applicant may submit the clarification, information, additional documents etc. in form GST REG -04 within 7 working days. Contd…. CA MAYUR R PAREKH FCA/DISA(ICAI) 17

Procedure for Registration q Casual/non resident taxable person shall be allotted a temporary ID no. for payment of advance amount of tax. q Multiple applications can be filed at one go where a taxable person seeks registration in more than one State or for more than one business vertical located in a single / multiple State(s). q Proper officer shall examine the application along with accompanying documents and has to approve the same within 3 working days only if it is found in order. In any other case, he shall intimate the deficiencies to the applicant in form GST REG-3 within 3 working days. q Applicant may submit the clarification, information, additional documents etc. in form GST REG -04 within 7 working days. Contd…. CA MAYUR R PAREKH FCA/DISA(ICAI) 17

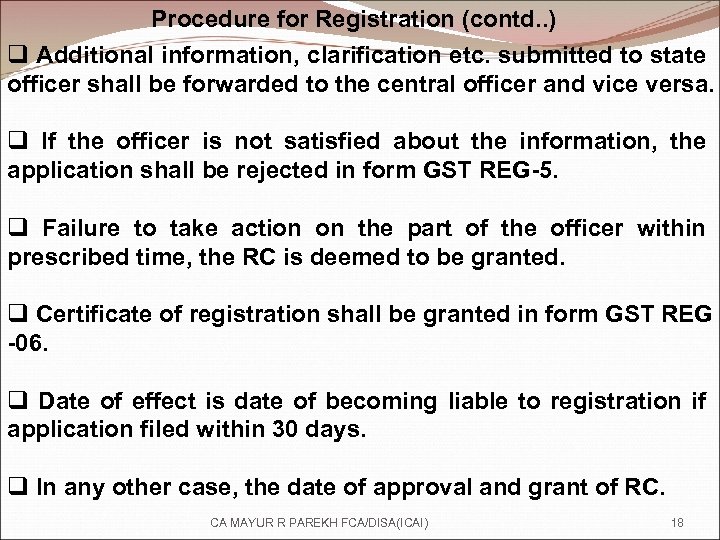

Procedure for Registration (contd. . ) q Additional information, clarification etc. submitted to state officer shall be forwarded to the central officer and vice versa. q If the officer is not satisfied about the information, the application shall be rejected in form GST REG-5. q Failure to take action on the part of the officer within prescribed time, the RC is deemed to be granted. q Certificate of registration shall be granted in form GST REG -06. q Date of effect is date of becoming liable to registration if application filed within 30 days. q In any other case, the date of approval and grant of RC. CA MAYUR R PAREKH FCA/DISA(ICAI) 18

Procedure for Registration (contd. . ) q Additional information, clarification etc. submitted to state officer shall be forwarded to the central officer and vice versa. q If the officer is not satisfied about the information, the application shall be rejected in form GST REG-5. q Failure to take action on the part of the officer within prescribed time, the RC is deemed to be granted. q Certificate of registration shall be granted in form GST REG -06. q Date of effect is date of becoming liable to registration if application filed within 30 days. q In any other case, the date of approval and grant of RC. CA MAYUR R PAREKH FCA/DISA(ICAI) 18

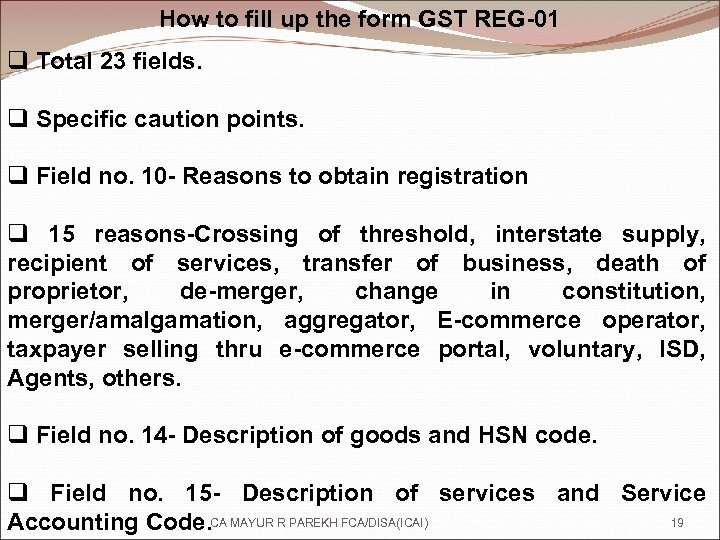

How to fill up the form GST REG-01 q Total 23 fields. q Specific caution points. q Field no. 10 - Reasons to obtain registration q 15 reasons-Crossing of threshold, interstate supply, recipient of services, transfer of business, death of proprietor, de-merger, change in constitution, merger/amalgamation, aggregator, E-commerce operator, taxpayer selling thru e-commerce portal, voluntary, ISD, Agents, others. q Field no. 14 - Description of goods and HSN code. q Field no. 15 - Description of services and Service 19 Accounting Code. CA MAYUR R PAREKH FCA/DISA(ICAI)

How to fill up the form GST REG-01 q Total 23 fields. q Specific caution points. q Field no. 10 - Reasons to obtain registration q 15 reasons-Crossing of threshold, interstate supply, recipient of services, transfer of business, death of proprietor, de-merger, change in constitution, merger/amalgamation, aggregator, E-commerce operator, taxpayer selling thru e-commerce portal, voluntary, ISD, Agents, others. q Field no. 14 - Description of goods and HSN code. q Field no. 15 - Description of services and Service 19 Accounting Code. CA MAYUR R PAREKH FCA/DISA(ICAI)

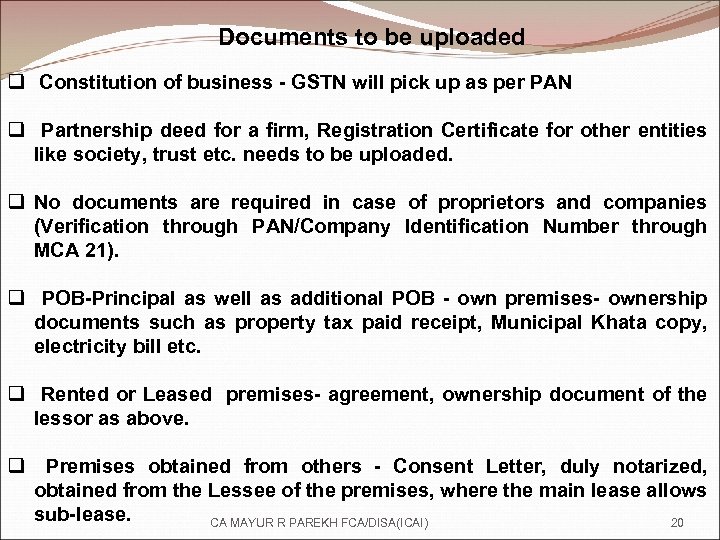

Documents to be uploaded q Constitution of business - GSTN will pick up as per PAN q Partnership deed for a firm, Registration Certificate for other entities like society, trust etc. needs to be uploaded. q No documents are required in case of proprietors and companies (Verification through PAN/Company Identification Number through MCA 21). q POB-Principal as well as additional POB - own premises- ownership documents such as property tax paid receipt, Municipal Khata copy, electricity bill etc. q Rented or Leased premises- agreement, ownership document of the lessor as above. q Premises obtained from others - Consent Letter, duly notarized, obtained from the Lessee of the premises, where the main lease allows sub-lease. CA MAYUR R PAREKH FCA/DISA(ICAI) 20

Documents to be uploaded q Constitution of business - GSTN will pick up as per PAN q Partnership deed for a firm, Registration Certificate for other entities like society, trust etc. needs to be uploaded. q No documents are required in case of proprietors and companies (Verification through PAN/Company Identification Number through MCA 21). q POB-Principal as well as additional POB - own premises- ownership documents such as property tax paid receipt, Municipal Khata copy, electricity bill etc. q Rented or Leased premises- agreement, ownership document of the lessor as above. q Premises obtained from others - Consent Letter, duly notarized, obtained from the Lessee of the premises, where the main lease allows sub-lease. CA MAYUR R PAREKH FCA/DISA(ICAI) 20

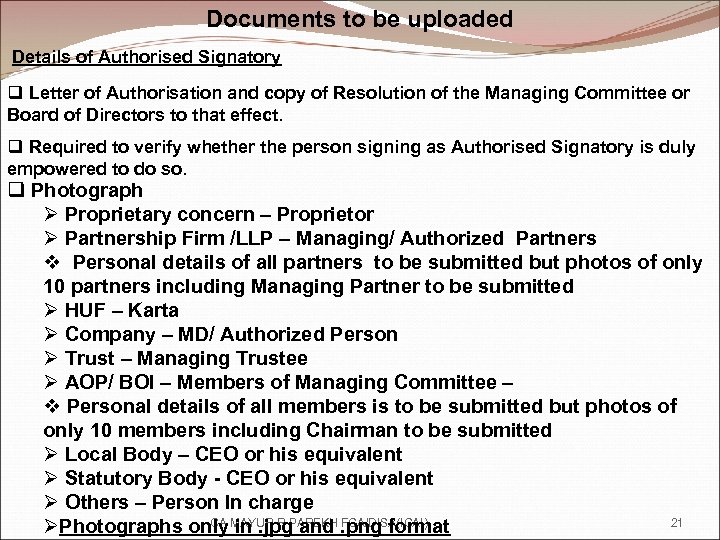

Documents to be uploaded Details of Authorised Signatory q Letter of Authorisation and copy of Resolution of the Managing Committee or Board of Directors to that effect. q Required to verify whether the person signing as Authorised Signatory is duly empowered to do so. q Photograph Ø Proprietary concern – Proprietor Ø Partnership Firm /LLP – Managing/ Authorized Partners v Personal details of all partners to be submitted but photos of only 10 partners including Managing Partner to be submitted Ø HUF – Karta Ø Company – MD/ Authorized Person Ø Trust – Managing Trustee Ø AOP/ BOI – Members of Managing Committee – v Personal details of all members is to be submitted but photos of only 10 members including Chairman to be submitted Ø Local Body – CEO or his equivalent Ø Statutory Body - CEO or his equivalent Ø Others – Person In charge CA MAYUR R PAREKH FCA/DISA(ICAI) 21 ØPhotographs only in. jpg and. png format

Documents to be uploaded Details of Authorised Signatory q Letter of Authorisation and copy of Resolution of the Managing Committee or Board of Directors to that effect. q Required to verify whether the person signing as Authorised Signatory is duly empowered to do so. q Photograph Ø Proprietary concern – Proprietor Ø Partnership Firm /LLP – Managing/ Authorized Partners v Personal details of all partners to be submitted but photos of only 10 partners including Managing Partner to be submitted Ø HUF – Karta Ø Company – MD/ Authorized Person Ø Trust – Managing Trustee Ø AOP/ BOI – Members of Managing Committee – v Personal details of all members is to be submitted but photos of only 10 members including Chairman to be submitted Ø Local Body – CEO or his equivalent Ø Statutory Body - CEO or his equivalent Ø Others – Person In charge CA MAYUR R PAREKH FCA/DISA(ICAI) 21 ØPhotographs only in. jpg and. png format

Documents to be uploaded q Details of Bank account - opening page copy of the Bank passbook in the name of the proprietor/business concern containing A/c No. , name of the account holder, MICR, IFS code and branch details. q Required for all bank accounts where business is conducted by the entity. q Discrepancies in documents will flag the case as “risk case” warranting post registration visit for verification. CA MAYUR R PAREKH FCA/DISA(ICAI) 22

Documents to be uploaded q Details of Bank account - opening page copy of the Bank passbook in the name of the proprietor/business concern containing A/c No. , name of the account holder, MICR, IFS code and branch details. q Required for all bank accounts where business is conducted by the entity. q Discrepancies in documents will flag the case as “risk case” warranting post registration visit for verification. CA MAYUR R PAREKH FCA/DISA(ICAI) 22

Documents to be uploaded q All applications are required to be uploaded online with DSC/E-signature/ EVC. q Applicant is not required to send a signed copy of the summary extract of submitted application form. q In case of EVC (Electronic verification code), post /pre site verification of the business premises would be done. q GST portal would acknowledge the receipt of application for registration and issue an Acknowledgement Number which could be used by the applicant for tracking his application q Such Acknowledgement Number would not contain the details of jurisdictional officers. CA MAYUR R PAREKH FCA/DISA(ICAI) 23

Documents to be uploaded q All applications are required to be uploaded online with DSC/E-signature/ EVC. q Applicant is not required to send a signed copy of the summary extract of submitted application form. q In case of EVC (Electronic verification code), post /pre site verification of the business premises would be done. q GST portal would acknowledge the receipt of application for registration and issue an Acknowledgement Number which could be used by the applicant for tracking his application q Such Acknowledgement Number would not contain the details of jurisdictional officers. CA MAYUR R PAREKH FCA/DISA(ICAI) 23

Documents to be uploaded q The application form will be passed on by GST portal to the IT system of the concerned State/ Central tax authorities for onward submission to appropriate jurisdictional officer q On receipt of application in their respective system, the Centre / State authorities would forward the application to jurisdictional officers who shall examine whether the uploaded documents are in order and respond back to the common portal within 3 common working days, excluding the day of submission of the application on the portal, using the Digital Signature Certificates. q If applicant files application through the Facilitation Center, then the above procedure shall be followed by him through the FC by making available the requisite documents to the FC. q The User ID and Password of taxable person will however be forwarded by portal to the e-mail furnished by the taxable person (that of primary authorized signatory) and by SMS to the mobile number furnished by taxable person or by post, if the taxable person so desires. It will not be sent to FC. CA MAYUR R PAREKH FCA/DISA(ICAI) 24

Documents to be uploaded q The application form will be passed on by GST portal to the IT system of the concerned State/ Central tax authorities for onward submission to appropriate jurisdictional officer q On receipt of application in their respective system, the Centre / State authorities would forward the application to jurisdictional officers who shall examine whether the uploaded documents are in order and respond back to the common portal within 3 common working days, excluding the day of submission of the application on the portal, using the Digital Signature Certificates. q If applicant files application through the Facilitation Center, then the above procedure shall be followed by him through the FC by making available the requisite documents to the FC. q The User ID and Password of taxable person will however be forwarded by portal to the e-mail furnished by the taxable person (that of primary authorized signatory) and by SMS to the mobile number furnished by taxable person or by post, if the taxable person so desires. It will not be sent to FC. CA MAYUR R PAREKH FCA/DISA(ICAI) 24

Verification of RC Application q Dual control of CGST and SGST officers q Proper officers under both laws to verify the application. q Officer to grant RC within 3 working days if application found in order. q If application found deficient, officer has to inform applicant in form GST REG 03 within 3 working days and applicant to comply with them within 7 working days from the receipt of the said notice. q Officer examining the application first under respective State GST law may forward the reply of the applicant to CGST officer and vice-versa. Proper officer to grant RC in form GST REG 06 if compliance by the applicant is found satisfactory q RC to be displayed on PPOB and APOB. q Physical verification may be done at the discretion of the officer. Verification report shall be uploaded in form GST REG 26 incl. CA MAYUR R PAREKH 25 photographs, on the following day. FCA/DISA(ICAI)

Verification of RC Application q Dual control of CGST and SGST officers q Proper officers under both laws to verify the application. q Officer to grant RC within 3 working days if application found in order. q If application found deficient, officer has to inform applicant in form GST REG 03 within 3 working days and applicant to comply with them within 7 working days from the receipt of the said notice. q Officer examining the application first under respective State GST law may forward the reply of the applicant to CGST officer and vice-versa. Proper officer to grant RC in form GST REG 06 if compliance by the applicant is found satisfactory q RC to be displayed on PPOB and APOB. q Physical verification may be done at the discretion of the officer. Verification report shall be uploaded in form GST REG 26 incl. CA MAYUR R PAREKH 25 photographs, on the following day. FCA/DISA(ICAI)

Verification of RC Application q If either of the two authorities (Centre or State) refuses to grant registration, the registration will not be granted. q In case registration is refused, the applicant will be informed about the reasons for such refusal through a speaking order. CA MAYUR R PAREKH FCA/DISA(ICAI) 26

Verification of RC Application q If either of the two authorities (Centre or State) refuses to grant registration, the registration will not be granted. q In case registration is refused, the applicant will be informed about the reasons for such refusal through a speaking order. CA MAYUR R PAREKH FCA/DISA(ICAI) 26

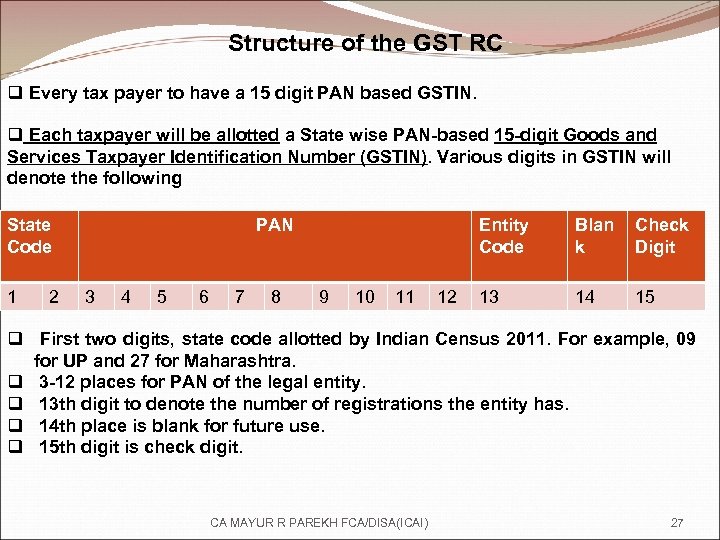

Structure of the GST RC q Every tax payer to have a 15 digit PAN based GSTIN. q Each taxpayer will be allotted a State wise PAN-based 15 -digit Goods and Services Taxpayer Identification Number (GSTIN). Various digits in GSTIN will denote the following State Code 1 2 PAN 3 4 5 6 7 8 Entity Code 9 10 11 12 Blan k Check Digit 13 14 15 q First two digits, state code allotted by Indian Census 2011. For example, 09 for UP and 27 for Maharashtra. q 3 -12 places for PAN of the legal entity. q 13 th digit to denote the number of registrations the entity has. q 14 th place is blank for future use. q 15 th digit is check digit. CA MAYUR R PAREKH FCA/DISA(ICAI) 27

Structure of the GST RC q Every tax payer to have a 15 digit PAN based GSTIN. q Each taxpayer will be allotted a State wise PAN-based 15 -digit Goods and Services Taxpayer Identification Number (GSTIN). Various digits in GSTIN will denote the following State Code 1 2 PAN 3 4 5 6 7 8 Entity Code 9 10 11 12 Blan k Check Digit 13 14 15 q First two digits, state code allotted by Indian Census 2011. For example, 09 for UP and 27 for Maharashtra. q 3 -12 places for PAN of the legal entity. q 13 th digit to denote the number of registrations the entity has. q 14 th place is blank for future use. q 15 th digit is check digit. CA MAYUR R PAREKH FCA/DISA(ICAI) 27

Effective date of registration: q Effective date of registration shall be date of liability, if the application for registration is filed within 30 days from the date on which the taxpayer becomes liable to pay tax q Effective date of registration shall be the date on which the registration is granted by the tax authority if taxpayer doesn’t apply for registration within time. q The liability of taxpayer to pay tax will be from the date of liability but he will be eligible for ITC from the date of registration only q The ITC on inputs held in stock will be permitted only if the taxpayer has applied for registration within 30 days from the date he became liable for registration (Section 16 (2)) CA MAYUR R PAREKH FCA/DISA(ICAI) 28

Effective date of registration: q Effective date of registration shall be date of liability, if the application for registration is filed within 30 days from the date on which the taxpayer becomes liable to pay tax q Effective date of registration shall be the date on which the registration is granted by the tax authority if taxpayer doesn’t apply for registration within time. q The liability of taxpayer to pay tax will be from the date of liability but he will be eligible for ITC from the date of registration only q The ITC on inputs held in stock will be permitted only if the taxpayer has applied for registration within 30 days from the date he became liable for registration (Section 16 (2)) CA MAYUR R PAREKH FCA/DISA(ICAI) 28

Unique Identity Number for certain categories of person: q As per section 19 (6) of the Act, following categories of persons will be required to obtain a Unique Identity Number (UIN): q UNO agencies, Multinational Financial Organizations, Consulate or Embassy of foreign countries, any other notified person as may be notified by the Board / Commissioner q The purpose of granting UIN is to provide refund of taxes on the notified supplies of goods and/or services following international conventions and treaties. q Granting UIN to certain class of persons also helps to ascertain that due amount of credit of IGST comes to the importing States through IGST mechanism. q Application to be made in form GST REG 09 and RC to be issued in form GST REG 06 within 3 working days. CA MAYUR R PAREKH FCA/DISA(ICAI) 29

Unique Identity Number for certain categories of person: q As per section 19 (6) of the Act, following categories of persons will be required to obtain a Unique Identity Number (UIN): q UNO agencies, Multinational Financial Organizations, Consulate or Embassy of foreign countries, any other notified person as may be notified by the Board / Commissioner q The purpose of granting UIN is to provide refund of taxes on the notified supplies of goods and/or services following international conventions and treaties. q Granting UIN to certain class of persons also helps to ascertain that due amount of credit of IGST comes to the importing States through IGST mechanism. q Application to be made in form GST REG 09 and RC to be issued in form GST REG 06 within 3 working days. CA MAYUR R PAREKH FCA/DISA(ICAI) 29

Special provisions relating to casual taxable person and non-resident taxable Person q What does it mean by a casual taxable person? q As per section 2 (21) of the Act, a casual taxable person means a person who occasionally undertakes transactions involving supply of goods and/or services in the course or furtherance of business whether as principal, agent or in any other capacity, in a taxable territory where he has no fixed place of business Examples- works contractors, exhibition holders, etc. q What does it mean by a non-resident taxable person? q As per section 2 (69) of the Act, a non-resident taxable person means a taxable person who occasionally undertakes transactions involving supply of goods and/or services whether as principal or agent or in any other capacity but who has no fixed place of business in India; CA MAYUR R PAREKH FCA/DISA(ICAI) 30

Special provisions relating to casual taxable person and non-resident taxable Person q What does it mean by a casual taxable person? q As per section 2 (21) of the Act, a casual taxable person means a person who occasionally undertakes transactions involving supply of goods and/or services in the course or furtherance of business whether as principal, agent or in any other capacity, in a taxable territory where he has no fixed place of business Examples- works contractors, exhibition holders, etc. q What does it mean by a non-resident taxable person? q As per section 2 (69) of the Act, a non-resident taxable person means a taxable person who occasionally undertakes transactions involving supply of goods and/or services whether as principal or agent or in any other capacity but who has no fixed place of business in India; CA MAYUR R PAREKH FCA/DISA(ICAI) 30

q Application in form no. GST REG 10 to be made at least 5 days prior to commencement of business. q Extension may be granted for further 90 days ( GST REG 25 ) q Temporary ID no. will be granted to above persons for making advance payment of tax in terms of section 19 A. q Such person has to make an advance deposit equivalent to estimated tax liability for the said period. q Amount deposited is credited to the electronic cash ledger and is utilized for discharge of output liability. q Remaining procedure of approval same as in case of other dealers. CA MAYUR R PAREKH FCA/DISA(ICAI) 31

q Application in form no. GST REG 10 to be made at least 5 days prior to commencement of business. q Extension may be granted for further 90 days ( GST REG 25 ) q Temporary ID no. will be granted to above persons for making advance payment of tax in terms of section 19 A. q Such person has to make an advance deposit equivalent to estimated tax liability for the said period. q Amount deposited is credited to the electronic cash ledger and is utilized for discharge of output liability. q Remaining procedure of approval same as in case of other dealers. CA MAYUR R PAREKH FCA/DISA(ICAI) 31

Registration of TDS Deductor and E-commerce operator q Special persons like Central/State Govt. departments, local authority, Govt. agencies or other notified persons required to deduct tax from the payments made to suppliers u/s 37(1) have to obtain RC. q Similarly, E-commerce operators while making payments to suppliers of goods/services have to deduct tax u/s 43 C are required to obtain RC q Application in form GST REG 06. q Officer may cancel the RC if deduction is no more reqd. to be done. Cancellation order in form GST REG 08. Dealer to be heard. CA MAYUR R PAREKH FCA/DISA(ICAI) 32

Registration of TDS Deductor and E-commerce operator q Special persons like Central/State Govt. departments, local authority, Govt. agencies or other notified persons required to deduct tax from the payments made to suppliers u/s 37(1) have to obtain RC. q Similarly, E-commerce operators while making payments to suppliers of goods/services have to deduct tax u/s 43 C are required to obtain RC q Application in form GST REG 06. q Officer may cancel the RC if deduction is no more reqd. to be done. Cancellation order in form GST REG 08. Dealer to be heard. CA MAYUR R PAREKH FCA/DISA(ICAI) 32

Failure to Obtain registration q As per section 19 (5) of the Act, a person, who is liable to be registered under this Act, fails to apply for registration, the tax authority will proceed to register such person. q As per clause (x) in section 66 (1) of the Act, where a taxable person who is liable to be registered under this Act but fails to obtain registration, he shall be liable to a penalty of: 1. Rs. 10, 000/- or an amount equivalent to the tax evaded or the tax not deducted or short deducted or deducted but not paid to the Government or 2. input tax credit availed of or passed on or distributed irregularly, or 3. the refund claimed fraudulently, whichever is higher. CA MAYUR R PAREKH FCA/DISA(ICAI) 33

Failure to Obtain registration q As per section 19 (5) of the Act, a person, who is liable to be registered under this Act, fails to apply for registration, the tax authority will proceed to register such person. q As per clause (x) in section 66 (1) of the Act, where a taxable person who is liable to be registered under this Act but fails to obtain registration, he shall be liable to a penalty of: 1. Rs. 10, 000/- or an amount equivalent to the tax evaded or the tax not deducted or short deducted or deducted but not paid to the Government or 2. input tax credit availed of or passed on or distributed irregularly, or 3. the refund claimed fraudulently, whichever is higher. CA MAYUR R PAREKH FCA/DISA(ICAI) 33

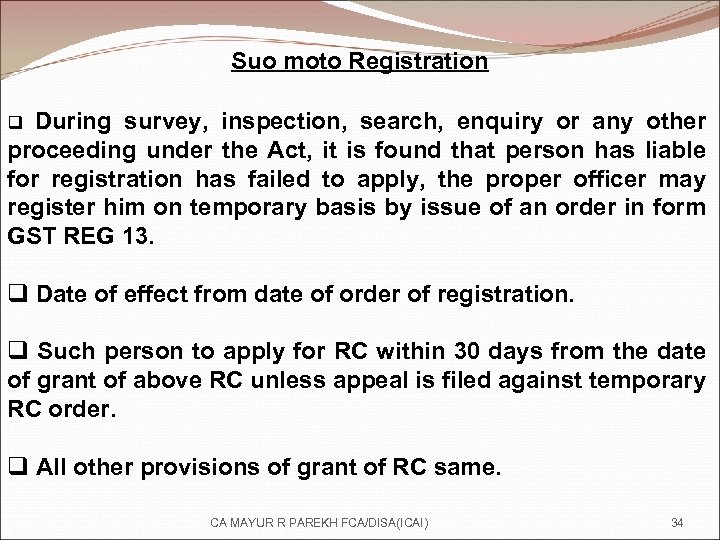

Suo moto Registration During survey, inspection, search, enquiry or any other proceeding under the Act, it is found that person has liable for registration has failed to apply, the proper officer may register him on temporary basis by issue of an order in form GST REG 13. q q Date of effect from date of order of registration. q Such person to apply for RC within 30 days from the date of grant of above RC unless appeal is filed against temporary RC order. q All other provisions of grant of RC same. CA MAYUR R PAREKH FCA/DISA(ICAI) 34

Suo moto Registration During survey, inspection, search, enquiry or any other proceeding under the Act, it is found that person has liable for registration has failed to apply, the proper officer may register him on temporary basis by issue of an order in form GST REG 13. q q Date of effect from date of order of registration. q Such person to apply for RC within 30 days from the date of grant of above RC unless appeal is filed against temporary RC order. q All other provisions of grant of RC same. CA MAYUR R PAREKH FCA/DISA(ICAI) 34

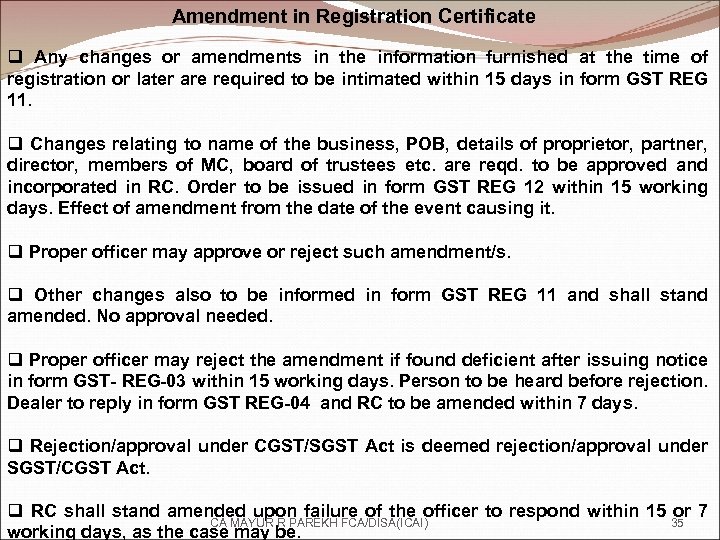

Amendment in Registration Certificate q Any changes or amendments in the information furnished at the time of registration or later are required to be intimated within 15 days in form GST REG 11. q Changes relating to name of the business, POB, details of proprietor, partner, director, members of MC, board of trustees etc. are reqd. to be approved and incorporated in RC. Order to be issued in form GST REG 12 within 15 working days. Effect of amendment from the date of the event causing it. q Proper officer may approve or reject such amendment/s. q Other changes also to be informed in form GST REG 11 and shall stand amended. No approval needed. q Proper officer may reject the amendment if found deficient after issuing notice in form GST- REG-03 within 15 working days. Person to be heard before rejection. Dealer to reply in form GST REG-04 and RC to be amended within 7 days. q Rejection/approval under CGST/SGST Act is deemed rejection/approval under SGST/CGST Act. q RC shall stand amended upon failure of the officer to respond within 15 or 7 CA MAYUR R PAREKH FCA/DISA(ICAI) 35 working days, as the case may be.

Amendment in Registration Certificate q Any changes or amendments in the information furnished at the time of registration or later are required to be intimated within 15 days in form GST REG 11. q Changes relating to name of the business, POB, details of proprietor, partner, director, members of MC, board of trustees etc. are reqd. to be approved and incorporated in RC. Order to be issued in form GST REG 12 within 15 working days. Effect of amendment from the date of the event causing it. q Proper officer may approve or reject such amendment/s. q Other changes also to be informed in form GST REG 11 and shall stand amended. No approval needed. q Proper officer may reject the amendment if found deficient after issuing notice in form GST- REG-03 within 15 working days. Person to be heard before rejection. Dealer to reply in form GST REG-04 and RC to be amended within 7 days. q Rejection/approval under CGST/SGST Act is deemed rejection/approval under SGST/CGST Act. q RC shall stand amended upon failure of the officer to respond within 15 or 7 CA MAYUR R PAREKH FCA/DISA(ICAI) 35 working days, as the case may be.

Migration of the registered persons from earlier law q All registered persons under existing law(Excise, Service Tax, VAT) and having a PAN shall be granted provisional GSTIN valid for 6 months or any extended period in form GST REG 21. q Every person with such provisional RC shall apply in form GST REG 20 giving the additional information and documents. q Such application to be submitted within the period prescribed in section 142 (6 months) or the extended period, as the case may be. q If the application is approved, RC in form GST REG 06 shall be issued electronically. q If the application is not found correct or complete, the proper officer may reject the application by order in form GST REG 22. q If person who is granted provisional RC is not liable to be so registered may apply in form GST REG 24 and get such RC cancelled. CA MAYUR R PAREKH FCA/DISA(ICAI) 36

Migration of the registered persons from earlier law q All registered persons under existing law(Excise, Service Tax, VAT) and having a PAN shall be granted provisional GSTIN valid for 6 months or any extended period in form GST REG 21. q Every person with such provisional RC shall apply in form GST REG 20 giving the additional information and documents. q Such application to be submitted within the period prescribed in section 142 (6 months) or the extended period, as the case may be. q If the application is approved, RC in form GST REG 06 shall be issued electronically. q If the application is not found correct or complete, the proper officer may reject the application by order in form GST REG 22. q If person who is granted provisional RC is not liable to be so registered may apply in form GST REG 24 and get such RC cancelled. CA MAYUR R PAREKH FCA/DISA(ICAI) 36

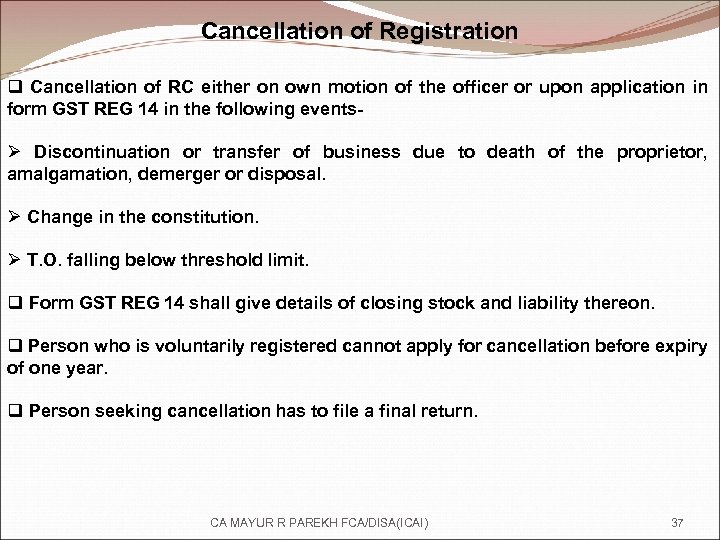

Cancellation of Registration q Cancellation of RC either on own motion of the officer or upon application in form GST REG 14 in the following eventsØ Discontinuation or transfer of business due to death of the proprietor, amalgamation, demerger or disposal. Ø Change in the constitution. Ø T. O. falling below threshold limit. q Form GST REG 14 shall give details of closing stock and liability thereon. q Person who is voluntarily registered cannot apply for cancellation before expiry of one year. q Person seeking cancellation has to file a final return. CA MAYUR R PAREKH FCA/DISA(ICAI) 37

Cancellation of Registration q Cancellation of RC either on own motion of the officer or upon application in form GST REG 14 in the following eventsØ Discontinuation or transfer of business due to death of the proprietor, amalgamation, demerger or disposal. Ø Change in the constitution. Ø T. O. falling below threshold limit. q Form GST REG 14 shall give details of closing stock and liability thereon. q Person who is voluntarily registered cannot apply for cancellation before expiry of one year. q Person seeking cancellation has to file a final return. CA MAYUR R PAREKH FCA/DISA(ICAI) 37

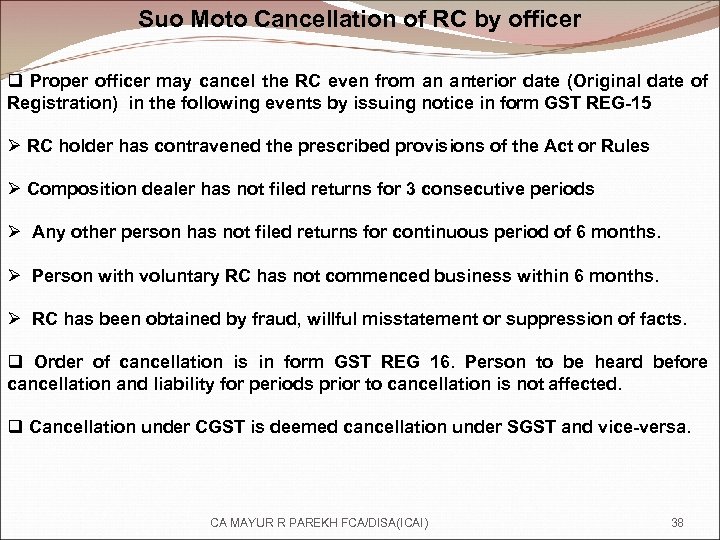

Suo Moto Cancellation of RC by officer q Proper officer may cancel the RC even from an anterior date (Original date of Registration) in the following events by issuing notice in form GST REG-15 Ø RC holder has contravened the prescribed provisions of the Act or Rules Ø Composition dealer has not filed returns for 3 consecutive periods Ø Any other person has not filed returns for continuous period of 6 months. Ø Person with voluntary RC has not commenced business within 6 months. Ø RC has been obtained by fraud, willful misstatement or suppression of facts. q Order of cancellation is in form GST REG 16. Person to be heard before cancellation and liability for periods prior to cancellation is not affected. q Cancellation under CGST is deemed cancellation under SGST and vice-versa. CA MAYUR R PAREKH FCA/DISA(ICAI) 38

Suo Moto Cancellation of RC by officer q Proper officer may cancel the RC even from an anterior date (Original date of Registration) in the following events by issuing notice in form GST REG-15 Ø RC holder has contravened the prescribed provisions of the Act or Rules Ø Composition dealer has not filed returns for 3 consecutive periods Ø Any other person has not filed returns for continuous period of 6 months. Ø Person with voluntary RC has not commenced business within 6 months. Ø RC has been obtained by fraud, willful misstatement or suppression of facts. q Order of cancellation is in form GST REG 16. Person to be heard before cancellation and liability for periods prior to cancellation is not affected. q Cancellation under CGST is deemed cancellation under SGST and vice-versa. CA MAYUR R PAREKH FCA/DISA(ICAI) 38

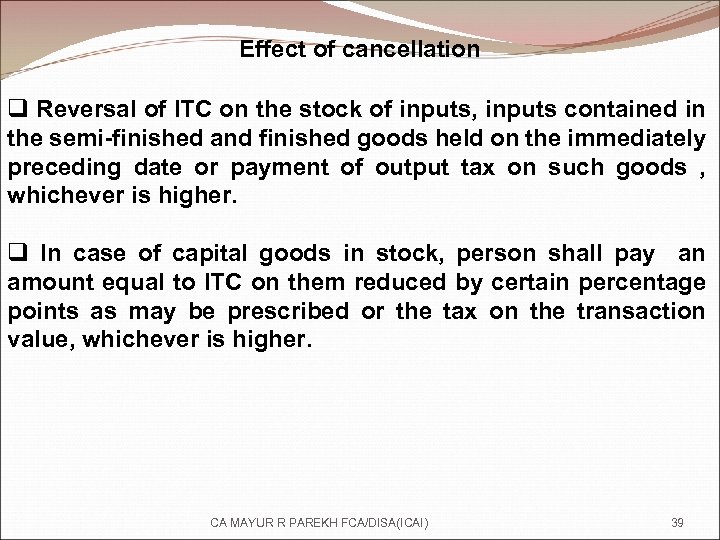

Effect of cancellation q Reversal of ITC on the stock of inputs, inputs contained in the semi-finished and finished goods held on the immediately preceding date or payment of output tax on such goods , whichever is higher. q In case of capital goods in stock, person shall pay an amount equal to ITC on them reduced by certain percentage points as may be prescribed or the tax on the transaction value, whichever is higher. CA MAYUR R PAREKH FCA/DISA(ICAI) 39

Effect of cancellation q Reversal of ITC on the stock of inputs, inputs contained in the semi-finished and finished goods held on the immediately preceding date or payment of output tax on such goods , whichever is higher. q In case of capital goods in stock, person shall pay an amount equal to ITC on them reduced by certain percentage points as may be prescribed or the tax on the transaction value, whichever is higher. CA MAYUR R PAREKH FCA/DISA(ICAI) 39

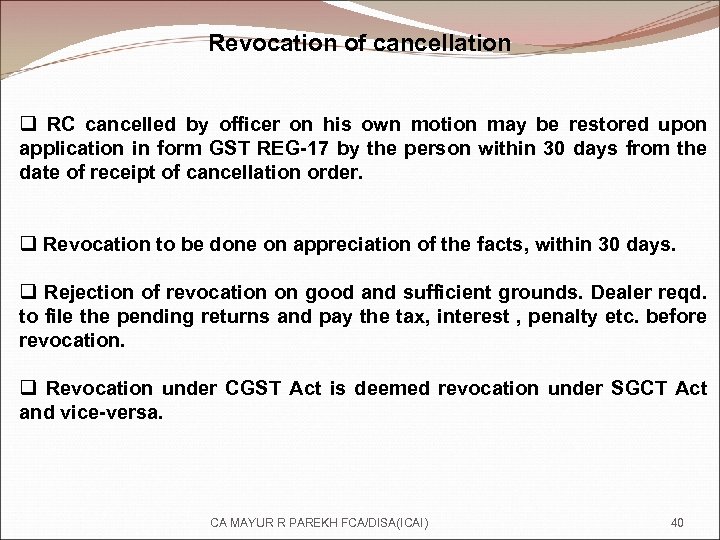

Revocation of cancellation q RC cancelled by officer on his own motion may be restored upon application in form GST REG-17 by the person within 30 days from the date of receipt of cancellation order. q Revocation to be done on appreciation of the facts, within 30 days. q Rejection of revocation on good and sufficient grounds. Dealer reqd. to file the pending returns and pay the tax, interest , penalty etc. before revocation. q Revocation under CGST Act is deemed revocation under SGCT Act and vice-versa. CA MAYUR R PAREKH FCA/DISA(ICAI) 40

Revocation of cancellation q RC cancelled by officer on his own motion may be restored upon application in form GST REG-17 by the person within 30 days from the date of receipt of cancellation order. q Revocation to be done on appreciation of the facts, within 30 days. q Rejection of revocation on good and sufficient grounds. Dealer reqd. to file the pending returns and pay the tax, interest , penalty etc. before revocation. q Revocation under CGST Act is deemed revocation under SGCT Act and vice-versa. CA MAYUR R PAREKH FCA/DISA(ICAI) 40

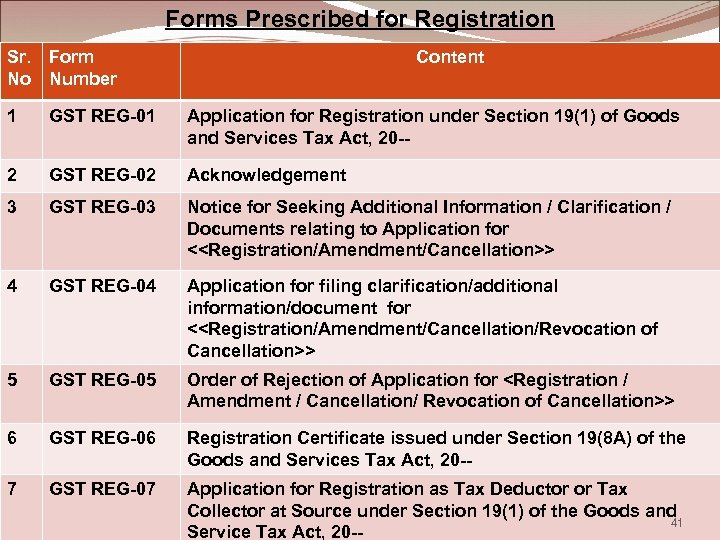

Forms Prescribed for Registration Sr. Form No Number Content 1 GST REG-01 Application for Registration under Section 19(1) of Goods and Services Tax Act, 20 -- 2 GST REG-02 Acknowledgement 3 GST REG-03 Notice for Seeking Additional Information / Clarification / Documents relating to Application for <

Forms Prescribed for Registration Sr. Form No Number Content 1 GST REG-01 Application for Registration under Section 19(1) of Goods and Services Tax Act, 20 -- 2 GST REG-02 Acknowledgement 3 GST REG-03 Notice for Seeking Additional Information / Clarification / Documents relating to Application for <

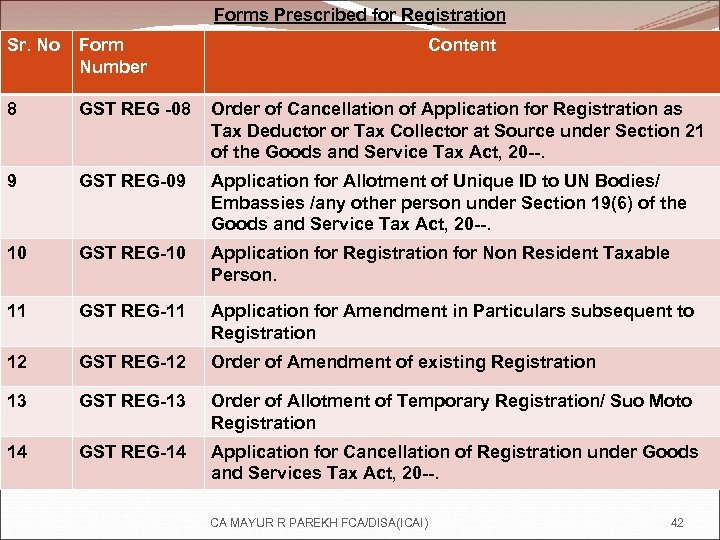

Forms Prescribed for Registration Sr. No Form Number Content 8 GST REG -08 Order of Cancellation of Application for Registration as Tax Deductor or Tax Collector at Source under Section 21 of the Goods and Service Tax Act, 20 --. 9 GST REG-09 Application for Allotment of Unique ID to UN Bodies/ Embassies /any other person under Section 19(6) of the Goods and Service Tax Act, 20 --. 10 GST REG-10 Application for Registration for Non Resident Taxable Person. 11 GST REG-11 Application for Amendment in Particulars subsequent to Registration 12 GST REG-12 Order of Amendment of existing Registration 13 GST REG-13 Order of Allotment of Temporary Registration/ Suo Moto Registration 14 GST REG-14 Application for Cancellation of Registration under Goods and Services Tax Act, 20 --. CA MAYUR R PAREKH FCA/DISA(ICAI) 42

Forms Prescribed for Registration Sr. No Form Number Content 8 GST REG -08 Order of Cancellation of Application for Registration as Tax Deductor or Tax Collector at Source under Section 21 of the Goods and Service Tax Act, 20 --. 9 GST REG-09 Application for Allotment of Unique ID to UN Bodies/ Embassies /any other person under Section 19(6) of the Goods and Service Tax Act, 20 --. 10 GST REG-10 Application for Registration for Non Resident Taxable Person. 11 GST REG-11 Application for Amendment in Particulars subsequent to Registration 12 GST REG-12 Order of Amendment of existing Registration 13 GST REG-13 Order of Allotment of Temporary Registration/ Suo Moto Registration 14 GST REG-14 Application for Cancellation of Registration under Goods and Services Tax Act, 20 --. CA MAYUR R PAREKH FCA/DISA(ICAI) 42

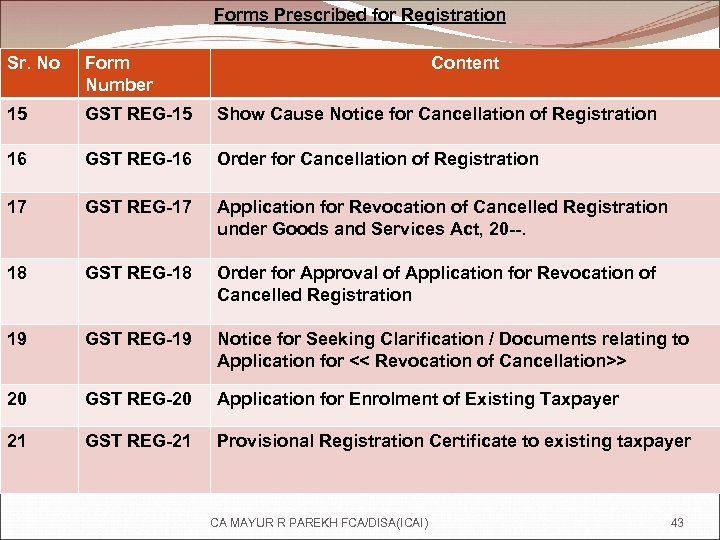

Forms Prescribed for Registration Sr. No Form Number Content 15 GST REG-15 Show Cause Notice for Cancellation of Registration 16 GST REG-16 Order for Cancellation of Registration 17 GST REG-17 Application for Revocation of Cancelled Registration under Goods and Services Act, 20 --. 18 GST REG-18 Order for Approval of Application for Revocation of Cancelled Registration 19 GST REG-19 Notice for Seeking Clarification / Documents relating to Application for << Revocation of Cancellation>> 20 GST REG-20 Application for Enrolment of Existing Taxpayer 21 GST REG-21 Provisional Registration Certificate to existing taxpayer CA MAYUR R PAREKH FCA/DISA(ICAI) 43

Forms Prescribed for Registration Sr. No Form Number Content 15 GST REG-15 Show Cause Notice for Cancellation of Registration 16 GST REG-16 Order for Cancellation of Registration 17 GST REG-17 Application for Revocation of Cancelled Registration under Goods and Services Act, 20 --. 18 GST REG-18 Order for Approval of Application for Revocation of Cancelled Registration 19 GST REG-19 Notice for Seeking Clarification / Documents relating to Application for << Revocation of Cancellation>> 20 GST REG-20 Application for Enrolment of Existing Taxpayer 21 GST REG-21 Provisional Registration Certificate to existing taxpayer CA MAYUR R PAREKH FCA/DISA(ICAI) 43

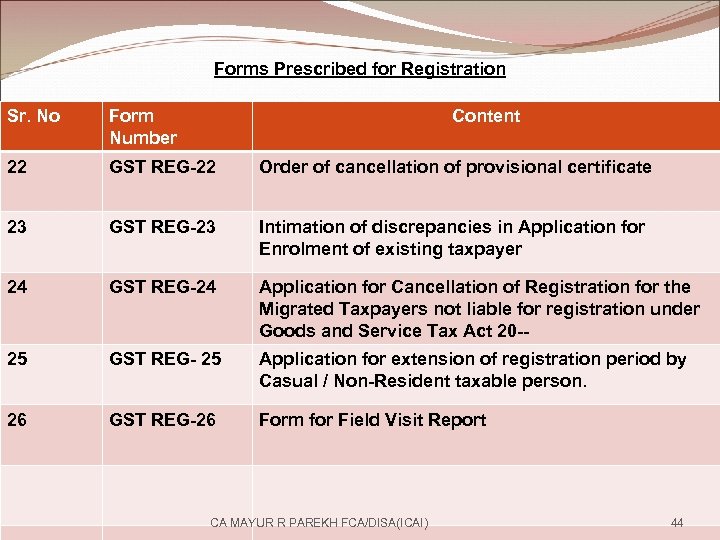

Forms Prescribed for Registration Sr. No Form Number Content 22 GST REG-22 Order of cancellation of provisional certificate 23 GST REG-23 Intimation of discrepancies in Application for Enrolment of existing taxpayer 24 GST REG-24 Application for Cancellation of Registration for the Migrated Taxpayers not liable for registration under Goods and Service Tax Act 20 -- 25 GST REG- 25 Application for extension of registration period by Casual / Non-Resident taxable person. 26 GST REG-26 Form for Field Visit Report CA MAYUR R PAREKH FCA/DISA(ICAI) 44

Forms Prescribed for Registration Sr. No Form Number Content 22 GST REG-22 Order of cancellation of provisional certificate 23 GST REG-23 Intimation of discrepancies in Application for Enrolment of existing taxpayer 24 GST REG-24 Application for Cancellation of Registration for the Migrated Taxpayers not liable for registration under Goods and Service Tax Act 20 -- 25 GST REG- 25 Application for extension of registration period by Casual / Non-Resident taxable person. 26 GST REG-26 Form for Field Visit Report CA MAYUR R PAREKH FCA/DISA(ICAI) 44

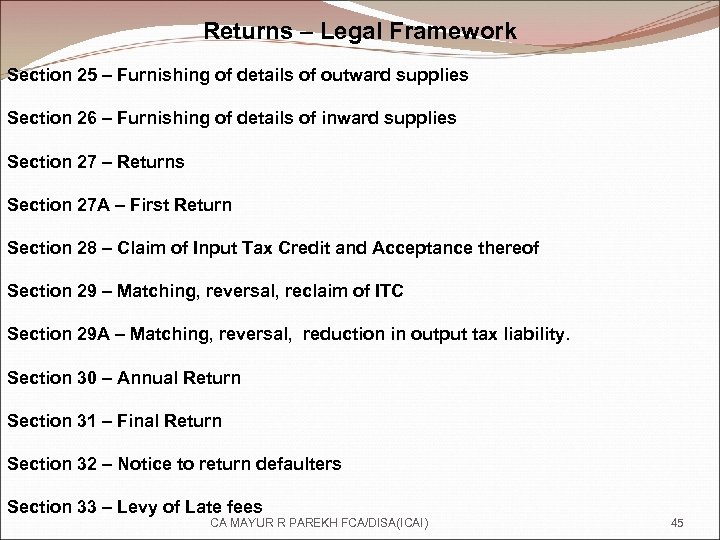

Returns – Legal Framework Section 25 – Furnishing of details of outward supplies Section 26 – Furnishing of details of inward supplies Section 27 – Returns Section 27 A – First Return Section 28 – Claim of Input Tax Credit and Acceptance thereof Section 29 – Matching, reversal, reclaim of ITC Section 29 A – Matching, reversal, reduction in output tax liability. Section 30 – Annual Return Section 31 – Final Return Section 32 – Notice to return defaulters Section 33 – Levy of Late fees CA MAYUR R PAREKH FCA/DISA(ICAI) 45

Returns – Legal Framework Section 25 – Furnishing of details of outward supplies Section 26 – Furnishing of details of inward supplies Section 27 – Returns Section 27 A – First Return Section 28 – Claim of Input Tax Credit and Acceptance thereof Section 29 – Matching, reversal, reclaim of ITC Section 29 A – Matching, reversal, reduction in output tax liability. Section 30 – Annual Return Section 31 – Final Return Section 32 – Notice to return defaulters Section 33 – Levy of Late fees CA MAYUR R PAREKH FCA/DISA(ICAI) 45

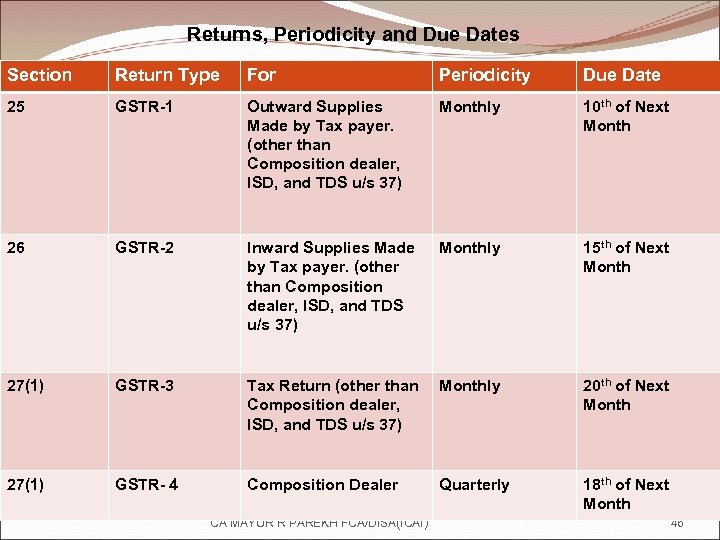

Returns, Periodicity and Due Dates Section Return Type For Periodicity Due Date 25 GSTR-1 Outward Supplies Made by Tax payer. (other than Composition dealer, ISD, and TDS u/s 37) Monthly 10 th of Next Month 26 GSTR-2 Inward Supplies Made by Tax payer. (other than Composition dealer, ISD, and TDS u/s 37) Monthly 15 th of Next Month 27(1) GSTR-3 Tax Return (other than Composition dealer, ISD, and TDS u/s 37) Monthly 20 th of Next Month 27(1) GSTR- 4 Composition Dealer Quarterly 18 th of Next Month CA MAYUR R PAREKH FCA/DISA(ICAI) 46

Returns, Periodicity and Due Dates Section Return Type For Periodicity Due Date 25 GSTR-1 Outward Supplies Made by Tax payer. (other than Composition dealer, ISD, and TDS u/s 37) Monthly 10 th of Next Month 26 GSTR-2 Inward Supplies Made by Tax payer. (other than Composition dealer, ISD, and TDS u/s 37) Monthly 15 th of Next Month 27(1) GSTR-3 Tax Return (other than Composition dealer, ISD, and TDS u/s 37) Monthly 20 th of Next Month 27(1) GSTR- 4 Composition Dealer Quarterly 18 th of Next Month CA MAYUR R PAREKH FCA/DISA(ICAI) 46

Returns, Periodicity and Due Dates Section Return Type For Periodicity Due Date 27(6) GSTR - 6 ISD Monthly 13 th of Next Month 27(5) GSTR - 7 Return of TDS u/s 37 Monthly 10 th of Next Month 30 GSTR - 8 Annual Return Annually 31 st December of Next FY. Bus. Process GSTR - 5 Periodic Return Non. Resident Foreign Taxpayer CA MAYUR R PAREKH FCA/DISA(ICAI) Last Day of Registration 47

Returns, Periodicity and Due Dates Section Return Type For Periodicity Due Date 27(6) GSTR - 6 ISD Monthly 13 th of Next Month 27(5) GSTR - 7 Return of TDS u/s 37 Monthly 10 th of Next Month 30 GSTR - 8 Annual Return Annually 31 st December of Next FY. Bus. Process GSTR - 5 Periodic Return Non. Resident Foreign Taxpayer CA MAYUR R PAREKH FCA/DISA(ICAI) Last Day of Registration 47

Returns q Periodicity is monthly. q First step is furnishing details of outward supplies by 10 th of the succeeding month is mandatory except to input service distributors, composition dealers u/s 8, tax deductors u/s 37. To be furnished prior to filing the return. q Section 25 ( Furnishing details of Outward Supplies ) “details of outward supplies” shall include details relating to Zero rated supplies inter-state supplies goods returned Exports Debit Notes / Credit Notes and supplementary invoices. q Person can rectify any errors/omissions in the above details based on the match/mismatch exercise u/s 29. q No rectification will be permitted after the earlier of following events ØReturn u/s 27 for the Month of September of Next FY to which rectification pertains is filed Or ØAnnual Return for the concerned FY to which rectification pertains is CA MAYUR R PAREKH FCA/DISA(ICAI) 48 filed.

Returns q Periodicity is monthly. q First step is furnishing details of outward supplies by 10 th of the succeeding month is mandatory except to input service distributors, composition dealers u/s 8, tax deductors u/s 37. To be furnished prior to filing the return. q Section 25 ( Furnishing details of Outward Supplies ) “details of outward supplies” shall include details relating to Zero rated supplies inter-state supplies goods returned Exports Debit Notes / Credit Notes and supplementary invoices. q Person can rectify any errors/omissions in the above details based on the match/mismatch exercise u/s 29. q No rectification will be permitted after the earlier of following events ØReturn u/s 27 for the Month of September of Next FY to which rectification pertains is filed Or ØAnnual Return for the concerned FY to which rectification pertains is CA MAYUR R PAREKH FCA/DISA(ICAI) 48 filed.

Returns q Section 26 (Inward Supplies) q Person to file similar details of inward supplies incl. services on which tax is payable on RCM, interstate inward supplies on or before 15 th of subsequent month. q The information submitted in GSTR-1 by the Counterparty Supplier of the Taxpayer shall be auto-populated in the concerned Tables of GSTR-2. q Taxpayer then shall, verify, modify or delete, if required and validate such details and prepare details of his inward supplies q Inward supplies include supplies on which tax is payable on reverse charge basis. q Rectification of errors in respect of unmatched entries u/s 29 (Pay tax and interest) q No rectification will be permitted after the earlier of following events Ø Return u/s 27 for the Month of September of Next FY to which rectification pertains is filed Or Ø Annual Return for the concerned FY to which rectification pertains is filed. q ITC claimed as self assessed is credited to electronic credit ledger of the person. q Credit in such ledger cannot be utilized unless valid return is filed. CA MAYUR R PAREKH FCA/DISA(ICAI) 49

Returns q Section 26 (Inward Supplies) q Person to file similar details of inward supplies incl. services on which tax is payable on RCM, interstate inward supplies on or before 15 th of subsequent month. q The information submitted in GSTR-1 by the Counterparty Supplier of the Taxpayer shall be auto-populated in the concerned Tables of GSTR-2. q Taxpayer then shall, verify, modify or delete, if required and validate such details and prepare details of his inward supplies q Inward supplies include supplies on which tax is payable on reverse charge basis. q Rectification of errors in respect of unmatched entries u/s 29 (Pay tax and interest) q No rectification will be permitted after the earlier of following events Ø Return u/s 27 for the Month of September of Next FY to which rectification pertains is filed Or Ø Annual Return for the concerned FY to which rectification pertains is filed. q ITC claimed as self assessed is credited to electronic credit ledger of the person. q Credit in such ledger cannot be utilized unless valid return is filed. CA MAYUR R PAREKH FCA/DISA(ICAI) 49

Returns Section 27 (Return ) q Every person to file monthly return in prescribed form within 20 days after the end of the month. q Composition dealer to file quarterly return within 18 days from the end of the quarter. q Deductors to file monthly returns within 10 days from the end of the month. q Input Service Distributor to file monthly return within 13 days from the end of the month. CA MAYUR R PAREKH FCA/DISA(ICAI) 50

Returns Section 27 (Return ) q Every person to file monthly return in prescribed form within 20 days after the end of the month. q Composition dealer to file quarterly return within 18 days from the end of the quarter. q Deductors to file monthly returns within 10 days from the end of the month. q Input Service Distributor to file monthly return within 13 days from the end of the month. CA MAYUR R PAREKH FCA/DISA(ICAI) 50

Returns Section 27 (Return ) q It shall include both details of inward supply and outward supply besides other details q A registered taxable person shall not be allowed to furnish return for tax period if valid return for any previous tax period is not furnished. q Due date of payment is linked to due date of return u/s 27. q If tax due as per return is not paid in full, return shall not be regarded as Valid Return for allowing input tax credit to counter party. q Filing of Nil Return is also mandatory. q Errors in return filed for a particular period can be rectified in the return to be filed for the month/quarter during which such erros/ommissions are discovered. q No rectification in return is permitted if there is change in liability due to scrutiny, audit, inspection or enforcement activity by tax authorities. q No rectification will be permitted after the earlier of following events Ø Return u/s 27 for the Month of September/second quarter of Next FY to which rectification pertains is filed Or CA MAYUR R PAREKH FCA/DISA(ICAI) ØAnnual Return for the concerned FY to which rectification pertains is filed. 51

Returns Section 27 (Return ) q It shall include both details of inward supply and outward supply besides other details q A registered taxable person shall not be allowed to furnish return for tax period if valid return for any previous tax period is not furnished. q Due date of payment is linked to due date of return u/s 27. q If tax due as per return is not paid in full, return shall not be regarded as Valid Return for allowing input tax credit to counter party. q Filing of Nil Return is also mandatory. q Errors in return filed for a particular period can be rectified in the return to be filed for the month/quarter during which such erros/ommissions are discovered. q No rectification in return is permitted if there is change in liability due to scrutiny, audit, inspection or enforcement activity by tax authorities. q No rectification will be permitted after the earlier of following events Ø Return u/s 27 for the Month of September/second quarter of Next FY to which rectification pertains is filed Or CA MAYUR R PAREKH FCA/DISA(ICAI) ØAnnual Return for the concerned FY to which rectification pertains is filed. 51

Returns Section 27 A – First Return q Applicable to new Assessee or even to existing migrated tax payer? ? q Return shall contain particulars of outward supplies ( from the date on which he becomes liable to register till the end of the month in which registration is granted. ) q Return shall contain particulars of inward supplies ( from the date of registration till the end of the month in which registration is granted. CA MAYUR R PAREKH FCA/DISA(ICAI) 52

Returns Section 27 A – First Return q Applicable to new Assessee or even to existing migrated tax payer? ? q Return shall contain particulars of outward supplies ( from the date on which he becomes liable to register till the end of the month in which registration is granted. ) q Return shall contain particulars of inward supplies ( from the date of registration till the end of the month in which registration is granted. CA MAYUR R PAREKH FCA/DISA(ICAI) 52

Returns Section 29 (Matching of Input Tax Credit) q Details of inward supplies shall be matched with corresponding outward supplies for the same or any preceding tax period. q Also with additional duty of customs paid u/s 3 of the Customs Tariff Act, 1975. q Matched items of inward supplies as above subject to section 16 (provisions of ITC) will be accepted and communicated to the recipient. q Unmatched entires [ i. e. where claim of ITC in inward supply details is higher than the tax declared by the supplier for the same supply or where outward supply is not declared by the supplier] – Discrepancies shall be communicated to both. q Duplication of ITC claims shall also be identified and communicated If unmatched entry is not reflected by supplier in his return for the month in which discrepancy was communicated – It shall be added to tax liability of recipient in the return for the month succeeding the month in which discrepancy is communicated. q Interest shall be payable by recipient on such additions from date of availment till the corresponding additions are made as above. Re- Credit of ITC and Interest available if supplier rectifies his return within specified time period. [ Credit of Interest shall be limited to interest paid by the Supplier] CA MAYUR R PAREKH FCA/DISA(ICAI) 53

Returns Section 29 (Matching of Input Tax Credit) q Details of inward supplies shall be matched with corresponding outward supplies for the same or any preceding tax period. q Also with additional duty of customs paid u/s 3 of the Customs Tariff Act, 1975. q Matched items of inward supplies as above subject to section 16 (provisions of ITC) will be accepted and communicated to the recipient. q Unmatched entires [ i. e. where claim of ITC in inward supply details is higher than the tax declared by the supplier for the same supply or where outward supply is not declared by the supplier] – Discrepancies shall be communicated to both. q Duplication of ITC claims shall also be identified and communicated If unmatched entry is not reflected by supplier in his return for the month in which discrepancy was communicated – It shall be added to tax liability of recipient in the return for the month succeeding the month in which discrepancy is communicated. q Interest shall be payable by recipient on such additions from date of availment till the corresponding additions are made as above. Re- Credit of ITC and Interest available if supplier rectifies his return within specified time period. [ Credit of Interest shall be limited to interest paid by the Supplier] CA MAYUR R PAREKH FCA/DISA(ICAI) 53

Returns Section 29 A (Matching of reduction in output tax liability) q Deals with details of credit note relating to outward supplies furnished by the supplier. q Matching of Outward Supply details (GSTR-1 ? ? ) with details of corresponding inward supplies shown by recipient in his valid return (GSTR-3) q Matched Entries will be accepted and such acceptance shall be communicated to recipient. q Unmatched entires [ i. e. where reduction in outward tax liability w. r. t. outward supply is higher than the reduction in ITC claim by recipient for the same supply or where corresponding credit note is not declared by the recipient] – Discrepancies shall be communicated to both. q Duplication of claims for reduction in output tax liability shall also be identified and communicated q If unmatched entry is not reflected by recipient in his return for the month in which discrepancy was communicated – It shall be added to tax liability of supplier in the return for the month succeeding the month in which discrepancy is communicated. Interest shall be payable by supplier on such additions from date of claim of reduction till the corresponding additions are made as above. q Re- Credit of claim and Interest available if receiver rectifies his return within specified time period. [ Credit of Interest shall be limited to interest paid by the CA MAYUR R PAREKH FCA/DISA(ICAI) 54

Returns Section 29 A (Matching of reduction in output tax liability) q Deals with details of credit note relating to outward supplies furnished by the supplier. q Matching of Outward Supply details (GSTR-1 ? ? ) with details of corresponding inward supplies shown by recipient in his valid return (GSTR-3) q Matched Entries will be accepted and such acceptance shall be communicated to recipient. q Unmatched entires [ i. e. where reduction in outward tax liability w. r. t. outward supply is higher than the reduction in ITC claim by recipient for the same supply or where corresponding credit note is not declared by the recipient] – Discrepancies shall be communicated to both. q Duplication of claims for reduction in output tax liability shall also be identified and communicated q If unmatched entry is not reflected by recipient in his return for the month in which discrepancy was communicated – It shall be added to tax liability of supplier in the return for the month succeeding the month in which discrepancy is communicated. Interest shall be payable by supplier on such additions from date of claim of reduction till the corresponding additions are made as above. q Re- Credit of claim and Interest available if receiver rectifies his return within specified time period. [ Credit of Interest shall be limited to interest paid by the CA MAYUR R PAREKH FCA/DISA(ICAI) 54

Returns Annual Return – Section 30 q To be filed by every taxable person other than Ø ISD Ø Composition Dealer Ø Deductor of TDS u/s 37 Ø A Casual Taxable Person Ø A non-resident Taxable Person q Audited Accounts and a Reconciliation Statement (supplies as per returns vis-à-vis supplies as per audited financial statements) to be furnished along with return CA MAYUR R PAREKH FCA/DISA(ICAI) 55

Returns Annual Return – Section 30 q To be filed by every taxable person other than Ø ISD Ø Composition Dealer Ø Deductor of TDS u/s 37 Ø A Casual Taxable Person Ø A non-resident Taxable Person q Audited Accounts and a Reconciliation Statement (supplies as per returns vis-à-vis supplies as per audited financial statements) to be furnished along with return CA MAYUR R PAREKH FCA/DISA(ICAI) 55

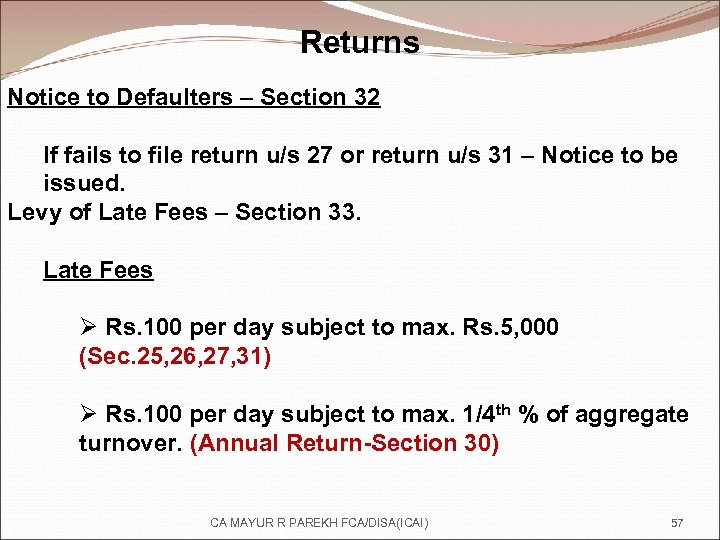

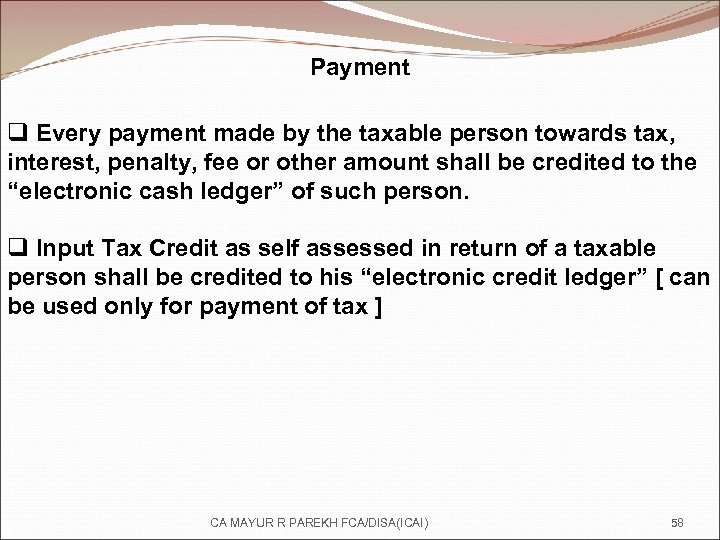

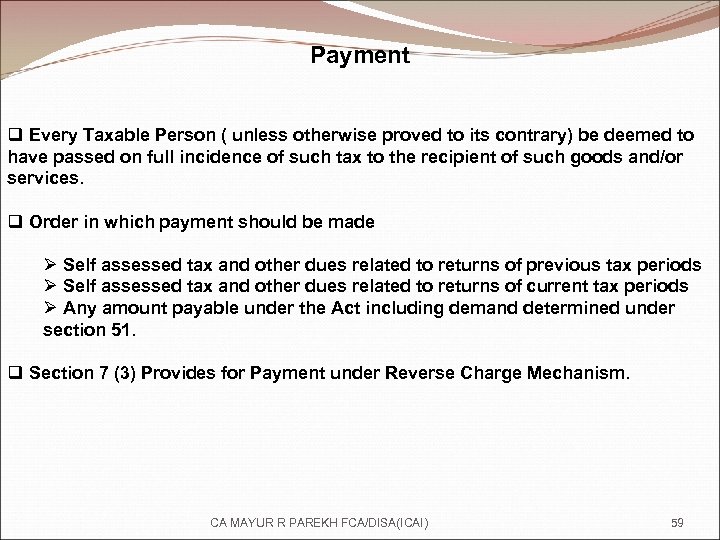

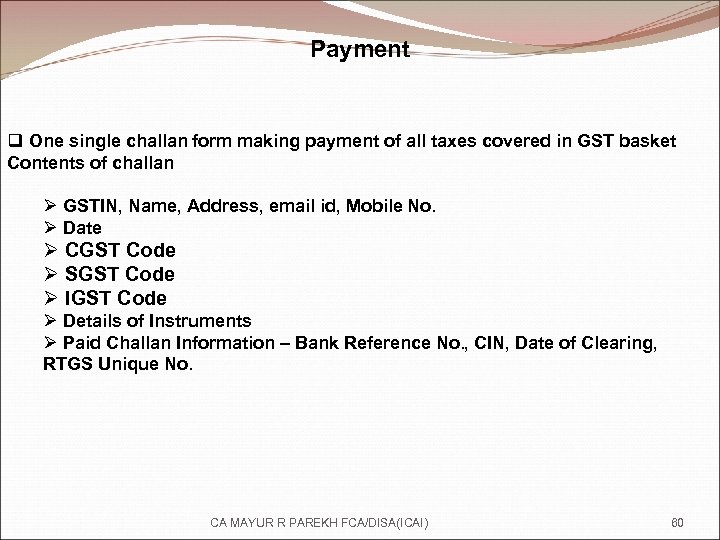

Returns Section 31 – Final Return q To be filed by persons who apply for cancellation of registration. q Final return to be filed before later of the following events Ø 3 months from date of cancellation or Ø Date of cancellation order. CA MAYUR R PAREKH FCA/DISA(ICAI) 56