1119bd7e6559cfbdf2720dcf0d9abcb9.ppt

- Количество слайдов: 23

Important Notice The following presentation has been developed and approved for use by authorized producers and agents of the insurers of American General Life Companies. This presentation must be used with the accompanying narrative notes which are included in the presentation. You must take the following steps to access these notes: 1. Save the presentation to your laptop or PC 2. Open the saved presentation; then click the “View” option in your menu bar in the upper left corner of your screen 3. From the “View” drop down, click “Notes Page” This will open the presentation with the narrative notes at the bottom of each slide. When making the presentation, these notes must be used without modification. Please contact your American General Life Companies representative with additional questions. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 1

December 2012 AG Secure Lifetime GUL ® Providing “Optionality” an unbeatable package of guarantees and flexibility FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC

AG Secure Lifetime GUL® Building Guaranteed Cash Value Earlier • AG Secure Lifetime GUL generates guaranteed cash sooner—as early as policy year 10 AG Secure Lifetime GUL • Cash value is only part of the story— we remain committed to offering highly competitive GUL premiums • Our ongoing commitment to the universal life market has brought great innovation in 100% guaranteed UL • AG Secure Lifetime GUL® • AG Secure Survivor GUL® FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 3

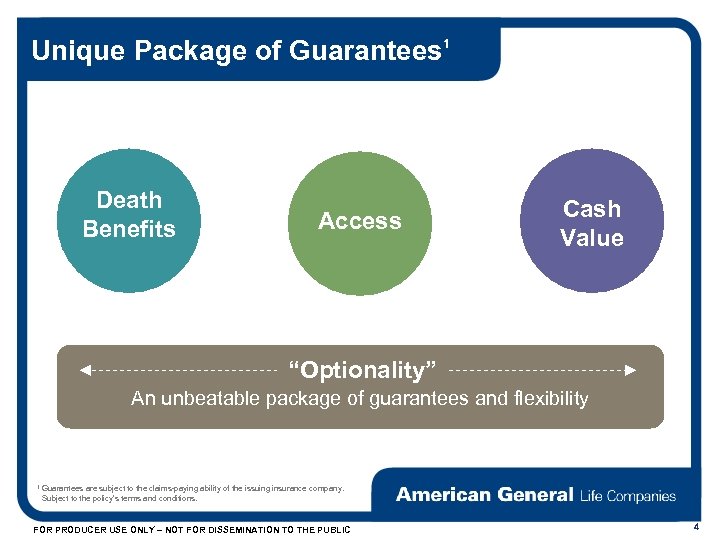

Unique Package of Guarantees 1 Death Benefits Access Cash Value “Optionality” An unbeatable package of guarantees and flexibility 1 Guarantees are subject to the claims-paying ability of the issuing insurance company. Subject to the policy’s terms and conditions. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 4

What is ‘Optionality? ’ • Select Guarantee Period and Select Premium Funding Period • Pro-rata adjustments with no loss of guarantees and no surrender charges on Cash Value withdrawals • Guaranteed Cash Value beginning as early as year 10 Guaranteed Death Benefit Guaranteed Premium FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 5

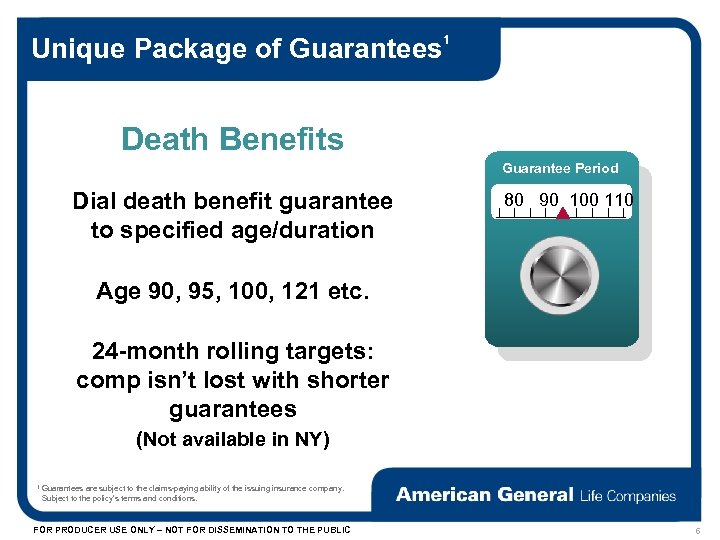

Unique Package of Guarantees 1 Death Benefits Guarantee Period Dial death benefit guarantee to specified age/duration 80 90 100 110 Age 90, 95, 100, 121 etc. 24 -month rolling targets: comp isn’t lost with shorter guarantees (Not available in NY) 1 Guarantees are subject to the claims-paying ability of the issuing insurance company. Subject to the policy’s terms and conditions. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 6

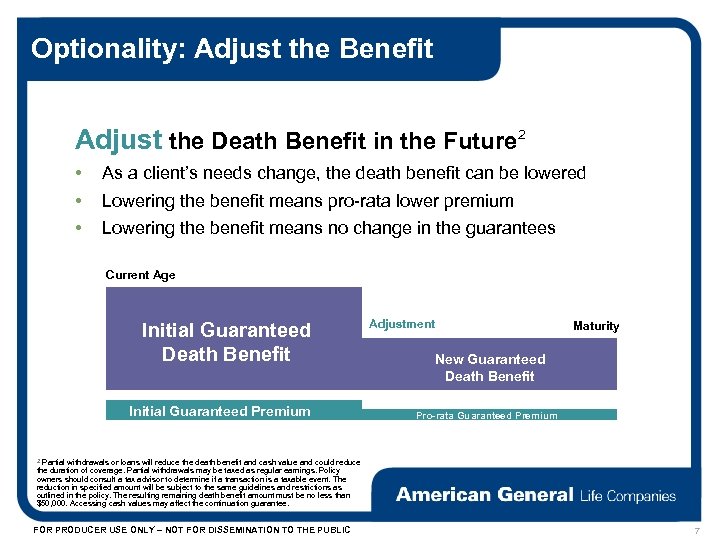

Optionality: Adjust the Benefit Adjust the Death Benefit in the Future 2 • • • As a client’s needs change, the death benefit can be lowered Lowering the benefit means pro-rata lower premium Lowering the benefit means no change in the guarantees Current Age Initial Guaranteed Death Benefit Initial Guaranteed Premium Adjustment Maturity New Guaranteed Death Benefit Pro-rata Guaranteed Premium Partial withdrawals or loans will reduce the death benefit and cash value and could reduce the duration of coverage. Partial withdrawals may be taxed as regular earnings. Policy owners should consult a tax advisor to determine if a transaction is a taxable event. The reduction in specified amount will be subject to the same guidelines and restrictions as outlined in the policy. The resulting remaining death benefit amount must be no less than $50, 000. Accessing cash values may affect the continuation guarantee. 2 FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 7

Unique Package of Guarantees Access 2 Access cash value & preserve proportional guarantees Enhances future flexibility and choice as needs change Unique among GUL products Uncommon flexibility to respond to life’s changing needs Partial withdrawals or loans will reduce the death benefit and cash value and could reduce the duration of coverage. Partial withdrawals may be taxed as regular earnings. Policy owners should consult a tax advisor to determine if a transaction is a taxable event. The reduction in specified amount will be subject to the same guidelines and restrictions as outlined in the policy. The resulting remaining death benefit amount must be no less than $50, 000. Accessing cash values may affect the continuation guarantee. 2 FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 8

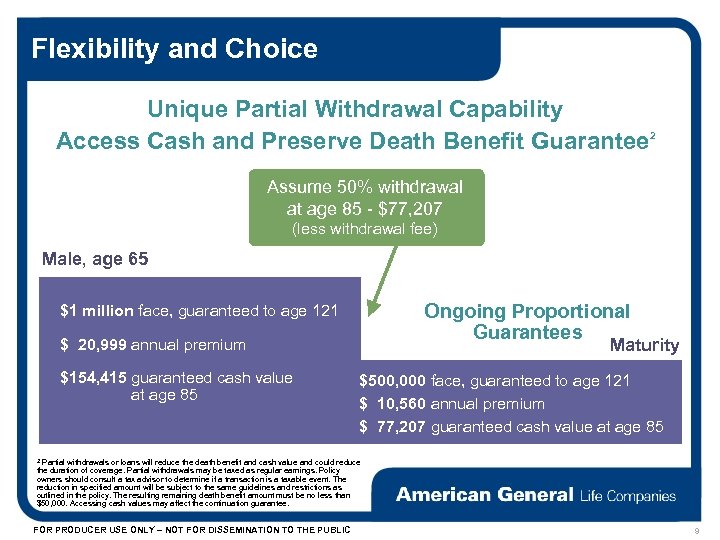

Flexibility and Choice Unique Partial Withdrawal Capability Access Cash and Preserve Death Benefit Guarantee 2 Assume 50% withdrawal at age 85 - $77, 207 (less withdrawal fee) Male, age 65 Ongoing Proportional Guarantees $1 million face, guaranteed to age 121 $ 20, 999 annual premium $154, 415 guaranteed cash value at age 85 Maturity $500, 000 face, guaranteed to age 121 $ 10, 560 annual premium $ 77, 207 guaranteed cash value at age 85 Partial withdrawals or loans will reduce the death benefit and cash value and could reduce the duration of coverage. Partial withdrawals may be taxed as regular earnings. Policy owners should consult a tax advisor to determine if a transaction is a taxable event. The reduction in specified amount will be subject to the same guidelines and restrictions as outlined in the policy. The resulting remaining death benefit amount must be no less than $50, 000. Accessing cash values may affect the continuation guarantee. 2 FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 9

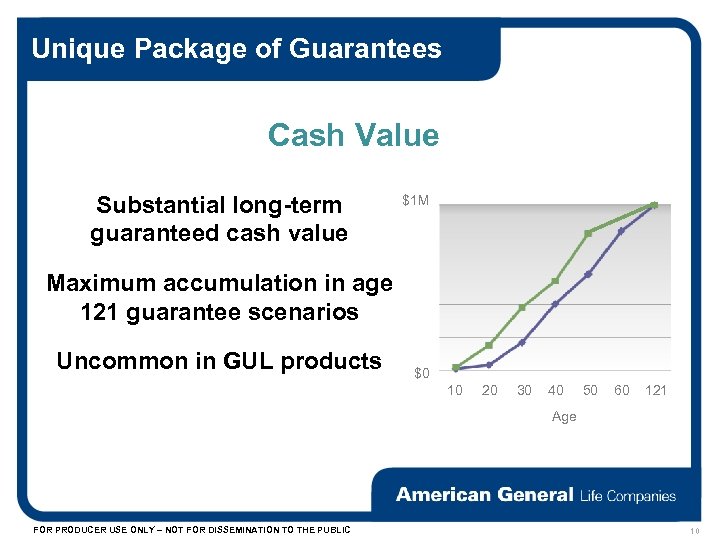

Unique Package of Guarantees Cash Value Substantial long-term guaranteed cash value $1 M Maximum accumulation in age 121 guarantee scenarios Uncommon in GUL products $0 10 20 30 40 50 60 121 Age FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 10

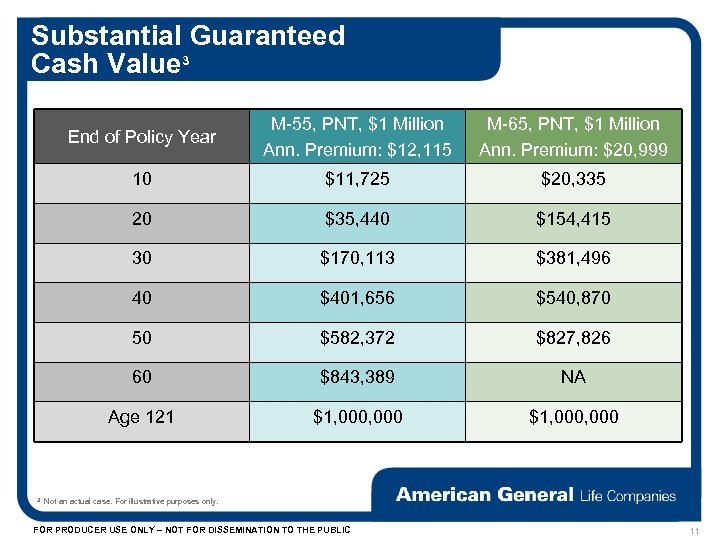

Substantial Guaranteed Cash Value 3 End of Policy Year M-65, PNT, $1 Million Ann. Premium: $20, 999 10 $11, 725 $20, 335 20 $35, 440 $154, 415 30 $170, 113 $381, 496 40 $401, 656 $540, 870 50 $582, 372 $827, 826 60 $843, 389 NA Age 121 3 M-55, PNT, $1 Million Ann. Premium: $12, 115 $1, 000, 000 Not an actual case. For illustrative purposes only. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 11

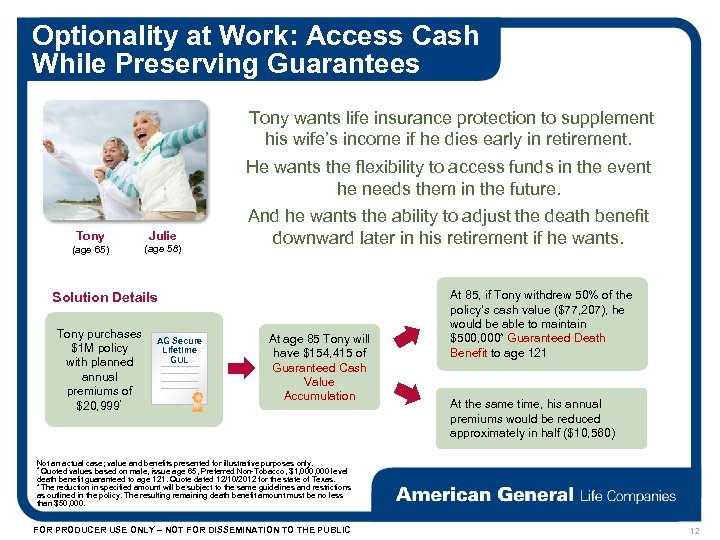

Optionality at Work: Access Cash While Preserving Guarantees Tony wants life insurance protection to supplement his wife’s income if he dies early in retirement. He wants the flexibility to access funds in the event he needs them in the future. Tony Julie (age 65) (age 58) And he wants the ability to adjust the death benefit downward later in his retirement if he wants. Solution Details Tony purchases $1 M policy with planned annual premiums of $20, 999* AG Secure Lifetime GUL At age 85 Tony will have $154, 415 of Guaranteed Cash Value Accumulation At 85, if Tony withdrew 50% of the policy’s cash value ($77, 207), he would be able to maintain $500, 000^ Guaranteed Death Benefit to age 121 At the same time, his annual premiums would be reduced approximately in half ($10, 560) Not an actual case; value and benefits presented for illustrative purposes only. * Quoted values based on male, issue age 65, Preferred Non-Tobacco, $1, 000 level death benefit guaranteed to age 121. Quote dated 12/10/2012 for the state of Texas. ^ The reduction in specified amount will be subject to the same guidelines and restrictions as outlined in the policy. The resulting remaining death benefit amount must be no less than $50, 000. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 12

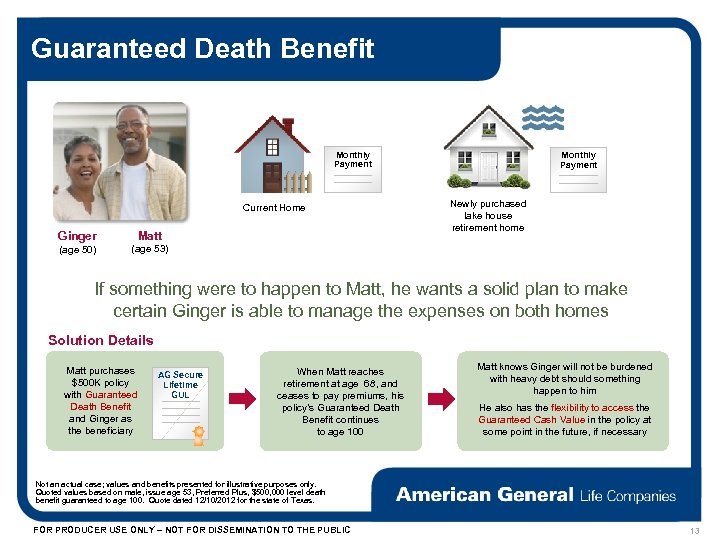

Guaranteed Death Benefit Monthly Payment Current Home Ginger Matt (age 50) Monthly Payment Newly purchased lake house retirement home (age 53) If something were to happen to Matt, he wants a solid plan to make certain Ginger is able to manage the expenses on both homes Solution Details Matt purchases $500 K policy with Guaranteed Death Benefit and Ginger as the beneficiary AG Secure Lifetime GUL When Matt reaches retirement at age 68, and ceases to pay premiums, his policy’s Guaranteed Death Benefit continues to age 100 Matt knows Ginger will not be burdened with heavy debt should something happen to him He also has the flexibility to access the Guaranteed Cash Value in the policy at some point in the future, if necessary Not an actual case; values and benefits presented for illustrative purposes only. Quoted values based on male, issue age 53, Preferred Plus, $500, 000 level death benefit guaranteed to age 100. Quote dated 12/10/2012 for the state of Texas. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 13

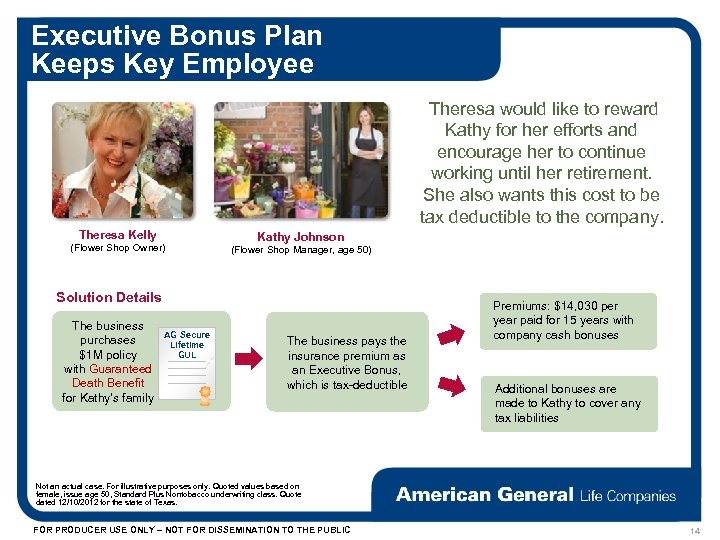

Executive Bonus Plan Keeps Key Employee Theresa would like to reward Kathy for her efforts and encourage her to continue working until her retirement. She also wants this cost to be tax deductible to the company. Theresa Kelly (Flower Shop Owner) Kathy Johnson (Flower Shop Manager, age 50) Solution Details The business purchases $1 M policy with Guaranteed Death Benefit for Kathy’s family AG Secure Lifetime GUL The business pays the insurance premium as an Executive Bonus, which is tax-deductible Premiums: $14, 030 per year paid for 15 years with company cash bonuses Additional bonuses are made to Kathy to cover any tax liabilities Not an actual case. For illustrative purposes only. Quoted values based on female, issue age 50, Standard Plus Nontobacco underwriting class. Quote dated 12/10/2012 for the state of Texas. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 14

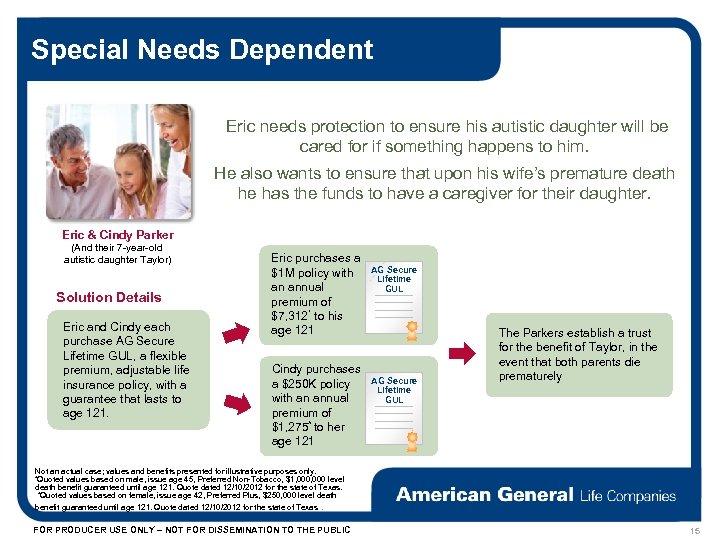

Special Needs Dependent Eric needs protection to ensure his autistic daughter will be cared for if something happens to him. He also wants to ensure that upon his wife’s premature death he has the funds to have a caregiver for their daughter. Eric & Cindy Parker (And their 7 -year-old autistic daughter Taylor) Solution Details Eric and Cindy each purchase AG Secure Lifetime GUL, a flexible premium, adjustable life insurance policy, with a guarantee that lasts to age 121. Eric purchases a $1 M policy with an annual premium of $7, 312* to his age 121 Cindy purchases a $250 K policy with an annual premium of $1, 275^ to her age 121 AG Secure Lifetime GUL The Parkers establish a trust for the benefit of Taylor, in the event that both parents die prematurely Not an actual case; values and benefits presented for illustrative purposes only. *Quoted values based on male, issue age 45, Preferred Non-Tobacco, $1, 000 level death benefit guaranteed until age 121. Quote dated 12/10/2012 for the state of Texas. ^Quoted values based on female, issue age 42, Preferred Plus, $250, 000 level death benefit guaranteed until age 121. Quote dated 12/10/2012 for the state of Texas. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 15

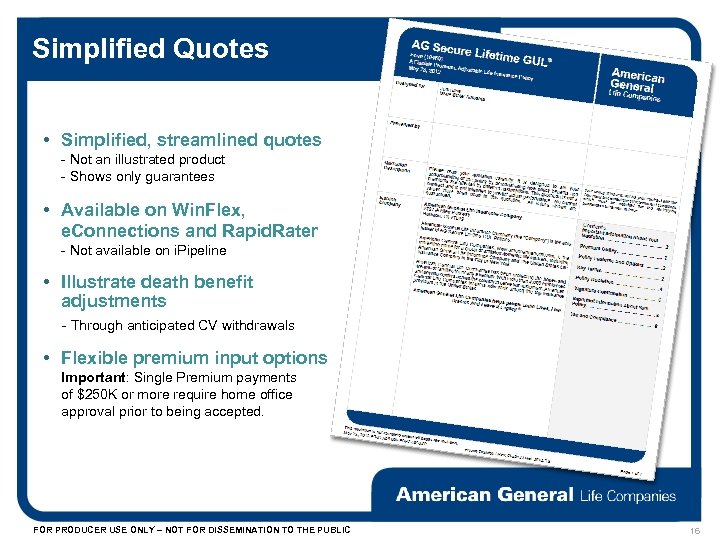

Simplified Quotes • Simplified, streamlined quotes - Not an illustrated product - Shows only guarantees • Available on Win. Flex, e. Connections and Rapid. Rater - Not available on i. Pipeline • Illustrate death benefit adjustments - Through anticipated CV withdrawals • Flexible premium input options Important: Single Premium payments of $250 K or more require home office approval prior to being accepted. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 16

A Suite of Quoting and Illustration Tools e. Connections Desktop for user friendly solutions with dedicated support Rapid. Rater for easy and accessible quotes on our guaranteed universal insurance and term products Life. Launch landing page for easy access to desktop versions of our popular rate quote and illustration tools NEW - AG Rapid Rater on Mobile Win. Flex Web for American General products on familiar industry tool Providing quoting and illustration tools – Where, when and how you need them FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 17

Time Saving Portfolio of Technology Solutions AG Quick Ticket® is a simple online process to submit cases – on a computer or tablet – at NO COST to you! FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 18

Consumer Friendly Processing Helps Maintain Guarantees Late Payments • Premiums received within 28 -day window after due date credited as if received on due date for maintaining no-lapse guarantee 1035 Exchanges • 1035 exchange funds will be treated as if received on issue date for maintaining no-lapse guarantee Internal revenue Code Section 1035 and associated rules are complex in nature. The policy owner may incur surrender charges from the previous policy, be subject to new sales and surrender charges and other limitations with the new policy. It is highly recommended that the policy owner consult a tax advisor prior to exchanging a policy. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 19

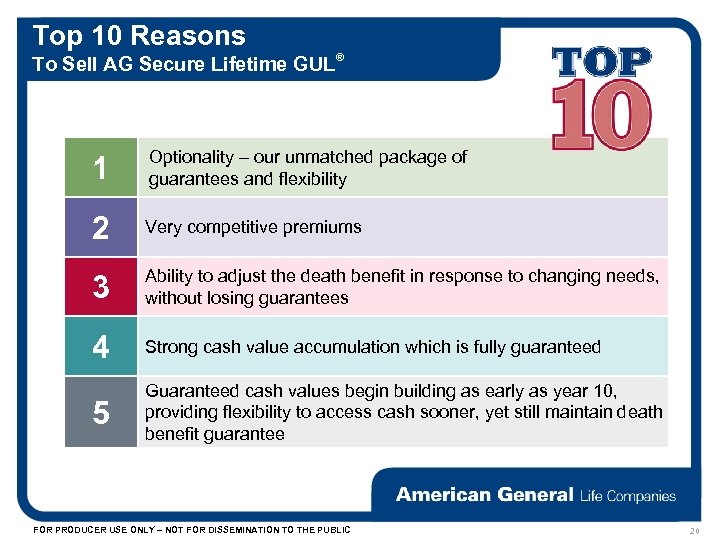

Top 10 Reasons To Sell AG Secure Lifetime GUL® 1 Optionality – our unmatched package of guarantees and flexibility 2 Very competitive premiums 3 Ability to adjust the death benefit in response to changing needs, without losing guarantees 4 Strong cash value accumulation which is fully guaranteed 5 Guaranteed cash values begin building as early as year 10, providing flexibility to access cash sooner, yet still maintain death benefit guarantee FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 20

Top 10 Reasons To Sell AG Secure Lifetime GUL® 6 Highly competitive compensation with 24 -month rolling targets (except in New York) 7 Client-friendly, easy-to-read Win. Flex and e. Connections Desktop quotes, rather than complicated illustrations 8 Quotes-on-the-go, with American General’s Rapid Pater on Mobile app for i. Phone and Android 9 Submit cases faster, get paid quicker with industry-leading AG Quick Ticket® 10 Consumer friendly processing preserves guarantees in the event of late premium payments FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 21

Questions? For additional information, please contact your American General Life Companies representative or visit our producer Web site at http: //e. Station. americangeneral. com Sales Desk can be reached at 1 -800 -677 -3311 FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 22

Important Information Policies issued by: American General Life Insurance Company 2727 -A Allen Parkway, Houston, TX 77019 AG Secure Lifetime GUL® Policy Form Number 10460; ICC-10460; AG Secure Survivor GUL Policy Form Number 11239, ICC-11239 The United States Life Insurance Company in the City of New York One World Financial Center, 200 Liberty Street, New York 10281 AG Secure Lifetime GUL® Policy Form Number 10460 N The underwriting risks, financial and contractual obligations and support functions associated with the policies issued by American General Life Insurance Company (AGL) and The Unites States Life Insurance Company in the City of New York (US Life) are the issuing insurer’s responsibility. American General Life Companies, www. americangeneral. com, is the marketing name for the insurance companies and affiliates comprising the domestic life operations of American International Group, Inc. , including AGL and US Life. Guarantees are subject to the claims-paying ability of the issuing insurance company. Policies and riders not available in all states. US Life is authorized to conduct insurance business in the state of New York. These product specifications are not intended to be all-inclusive of product information. State variations may apply. Please refer to the policy for complete details. Important: Prior to soliciting business, be certain that you are appropriately licensed and appointed with the insurer and that the product has been approved for sale by the insurer in that state. If uncertain, contact your American General Life Companies representative for assistance. © 2012. All rights reserved. FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC 23

1119bd7e6559cfbdf2720dcf0d9abcb9.ppt