38d166fa15a01293c8f7e508e697af8c.ppt

- Количество слайдов: 39

Importance of State and Local Tax Planning n Various Types of Taxes Levied on Business n n Various Business Transactions Subject to Taxation n n Review Table 1. 1 Review Illustration 1. 1 Disparity of Tax Rates Across Jurisdictions n Tax Liabilities Among Multiple Jurisdictions n “Today’s entrepreneurs and managers thus must be well versed in the basics of state and local tax planning…”

Importance of State and Local Tax Planning n Various Types of Taxes Levied on Business n n Various Business Transactions Subject to Taxation n n Review Table 1. 1 Review Illustration 1. 1 Disparity of Tax Rates Across Jurisdictions n Tax Liabilities Among Multiple Jurisdictions n “Today’s entrepreneurs and managers thus must be well versed in the basics of state and local tax planning…”

Types of Taxes n Corporate Income and Franchise Taxes n n Simplified Formula: [(Federal taxable income +/- state adjustments) X State rate] – State Credits and Estimated Taxes Key Issues n n n When is a business subject to a state’s taxing jurisdiction? How should the corporation split income in a multistate operation? Compliance Procedures and Tax Controversies are some what similar to Federal. n n n 4 year statute of limitations. Amendments filed 90 days of Federal Amendment Appeals process less friendly than federal, use regular courts rather than tax court.

Types of Taxes n Corporate Income and Franchise Taxes n n Simplified Formula: [(Federal taxable income +/- state adjustments) X State rate] – State Credits and Estimated Taxes Key Issues n n n When is a business subject to a state’s taxing jurisdiction? How should the corporation split income in a multistate operation? Compliance Procedures and Tax Controversies are some what similar to Federal. n n n 4 year statute of limitations. Amendments filed 90 days of Federal Amendment Appeals process less friendly than federal, use regular courts rather than tax court.

Individual Income Taxes n Residency n n Calculation of base n n Resident—Physically present in the state for other than a temporary or transitory purpose. Taxed on world wide income. Non Resident—An individual who is not a resident. Taxed only on income sourced within the state. Part year resident—A resident who moves into (out of the state) during the tax year. Taxed on income received while a resident. Starts with Federal Taxable Income or AGI, adjustments, tax rates and credits similar to corporate formula Sourcing of Income n Generally sourced where earned. n n n Rents—By jurisdiction where the property is located Royalties—Where the intangible is being used Services—Where the service is rendered.

Individual Income Taxes n Residency n n Calculation of base n n Resident—Physically present in the state for other than a temporary or transitory purpose. Taxed on world wide income. Non Resident—An individual who is not a resident. Taxed only on income sourced within the state. Part year resident—A resident who moves into (out of the state) during the tax year. Taxed on income received while a resident. Starts with Federal Taxable Income or AGI, adjustments, tax rates and credits similar to corporate formula Sourcing of Income n Generally sourced where earned. n n n Rents—By jurisdiction where the property is located Royalties—Where the intangible is being used Services—Where the service is rendered.

Flow Through Entities n n n Generally not taxed on the state level Resident partners/shareholders taxed on their distributive share of income regardless of jurisdiction Non resident partners/shareholders taxed (1) in the state of their residence and (2) in the state where the income is earned. The state of residence generally allows a credit for taxes paid to another state. Non resident partners/shareholders are often permitted to file a composite (group) return. Many states have withholding or other arrangements to collect taxes owed from non-residents.

Flow Through Entities n n n Generally not taxed on the state level Resident partners/shareholders taxed on their distributive share of income regardless of jurisdiction Non resident partners/shareholders taxed (1) in the state of their residence and (2) in the state where the income is earned. The state of residence generally allows a credit for taxes paid to another state. Non resident partners/shareholders are often permitted to file a composite (group) return. Many states have withholding or other arrangements to collect taxes owed from non-residents.

Sales and Use Taxes n n Imposed on the Consumer Rates set at the state level; cities and counties may levy an additional tax. Based on a percentage of purchase price. Definitions are very important n n n Certain types of sales are exempt Tax rate depends on the nature of the product sold. Definitions determine the difference between products and services.

Sales and Use Taxes n n Imposed on the Consumer Rates set at the state level; cities and counties may levy an additional tax. Based on a percentage of purchase price. Definitions are very important n n n Certain types of sales are exempt Tax rate depends on the nature of the product sold. Definitions determine the difference between products and services.

Property Taxes n n n Assessed against realty, in many settings also personalty Local government assesses the tax in most cases. Valuation methods, tax rates and Assessment dates vary

Property Taxes n n n Assessed against realty, in many settings also personalty Local government assesses the tax in most cases. Valuation methods, tax rates and Assessment dates vary

Other Taxes n n Payroll (unemployment compensation) and excise taxes—very important Capital stock taxes License taxes—important Estate (Inheritance) and Gift Taxes n n n Estate tax structure was generally uniform until 2001, not varies considerably Gift taxes are rare Additional Taxes n n n Transfer Tax Incorporation Severance Telecommunications Tourism Highway Use

Other Taxes n n Payroll (unemployment compensation) and excise taxes—very important Capital stock taxes License taxes—important Estate (Inheritance) and Gift Taxes n n n Estate tax structure was generally uniform until 2001, not varies considerably Gift taxes are rare Additional Taxes n n n Transfer Tax Incorporation Severance Telecommunications Tourism Highway Use

Sources of Law n U. S. Constitution n n State Constitutions Legislative Law Sources n n Statutes are the highest authority Administrative Law Sources n n Jurisdiction and Nexus are important issues. See next slide. Commerce Clause Due Process State revenue agency administers the law. The agency issues regulations and rulings, letter rulings. Counties and cities assess and collect property taxes Specialized agencies collect capital stock taxes, employment taxes, and public utility taxes. Judicial Law Sources n n Only bind states over which the court has jurisdiction. Trial, intermediate appellate, and final appeal courts--> US Supreme Court

Sources of Law n U. S. Constitution n n State Constitutions Legislative Law Sources n n Statutes are the highest authority Administrative Law Sources n n Jurisdiction and Nexus are important issues. See next slide. Commerce Clause Due Process State revenue agency administers the law. The agency issues regulations and rulings, letter rulings. Counties and cities assess and collect property taxes Specialized agencies collect capital stock taxes, employment taxes, and public utility taxes. Judicial Law Sources n n Only bind states over which the court has jurisdiction. Trial, intermediate appellate, and final appeal courts--> US Supreme Court

Multistate Law Sources n Multistate Tax Commission n Encourages states to adopt tax laws that apply to multistate and multinational enterprises Over ½ of the states are full or associate members of MTC UDITPA n n n “Seeks to properly and consistently determine the state and local tax liability of multistate taxpayers. Applies primarily to apportionment methods. Most states have adopted UDITPA in whole or in part.

Multistate Law Sources n Multistate Tax Commission n Encourages states to adopt tax laws that apply to multistate and multinational enterprises Over ½ of the states are full or associate members of MTC UDITPA n n n “Seeks to properly and consistently determine the state and local tax liability of multistate taxpayers. Applies primarily to apportionment methods. Most states have adopted UDITPA in whole or in part.

Generic State and Local Tax Planning Strategies n n n Shifting and Splitting (Examples 1. 1 & 1. 3) Location (Example 1. 4) Transformation (Example 1. 6) Timing (Example 1. 7) Apportionment (Example 1. 10)

Generic State and Local Tax Planning Strategies n n n Shifting and Splitting (Examples 1. 1 & 1. 3) Location (Example 1. 4) Transformation (Example 1. 6) Timing (Example 1. 7) Apportionment (Example 1. 10)

State and Local Tax Research n n n Scanning the changing state and local tax environment for (1) non tax changes in the business environment and (2) changes in tax rates and tax credits Tax Management in Action 1. 1 Web Sites Appendix A

State and Local Tax Research n n n Scanning the changing state and local tax environment for (1) non tax changes in the business environment and (2) changes in tax rates and tax credits Tax Management in Action 1. 1 Web Sites Appendix A

Corporate Income/Franchise Tax n n Effective and Statutory Rates (Table 3. 1) Nexus n n n Definition and judicial history differs from sales tax Four tests for franchise tax purposes. Domestic corporations have nexus with state of incorporation; foreign corporations must meet the nexus rules.

Corporate Income/Franchise Tax n n Effective and Statutory Rates (Table 3. 1) Nexus n n n Definition and judicial history differs from sales tax Four tests for franchise tax purposes. Domestic corporations have nexus with state of incorporation; foreign corporations must meet the nexus rules.

Definitions n Jurisdiction n A State’s Power to Impose a Tax n Nexus n A Taxpayer’s Contact with a State

Definitions n Jurisdiction n A State’s Power to Impose a Tax n Nexus n A Taxpayer’s Contact with a State

Elements of Public Law 86 -272 If a seller from state B has only the following business activities in state A: n Solicitation n By an employee or representative n Of orders for tangible personal property n Sent outside the state for approval, and n Filed by shipment or delivery from a point outside the state. Then the seller from state B owes no income tax to state A.

Elements of Public Law 86 -272 If a seller from state B has only the following business activities in state A: n Solicitation n By an employee or representative n Of orders for tangible personal property n Sent outside the state for approval, and n Filed by shipment or delivery from a point outside the state. Then the seller from state B owes no income tax to state A.

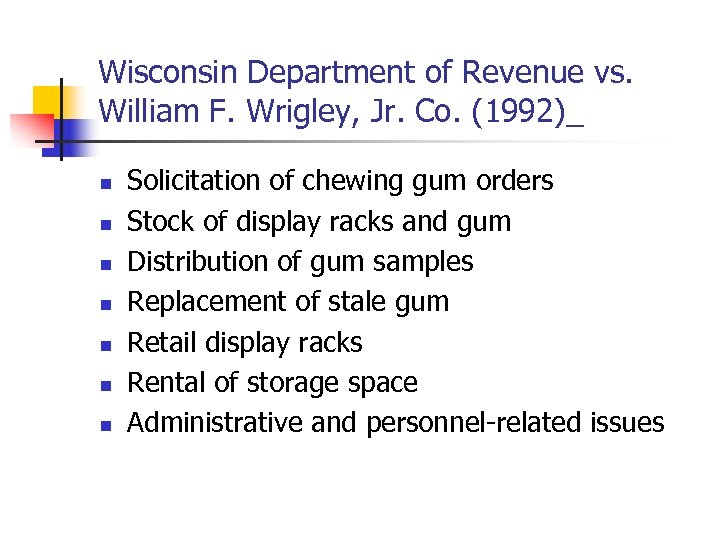

Wisconsin Department of Revenue vs. William F. Wrigley, Jr. Co. (1992)_ n n n n Solicitation of chewing gum orders Stock of display racks and gum Distribution of gum samples Replacement of stale gum Retail display racks Rental of storage space Administrative and personnel-related issues

Wisconsin Department of Revenue vs. William F. Wrigley, Jr. Co. (1992)_ n n n n Solicitation of chewing gum orders Stock of display racks and gum Distribution of gum samples Replacement of stale gum Retail display racks Rental of storage space Administrative and personnel-related issues

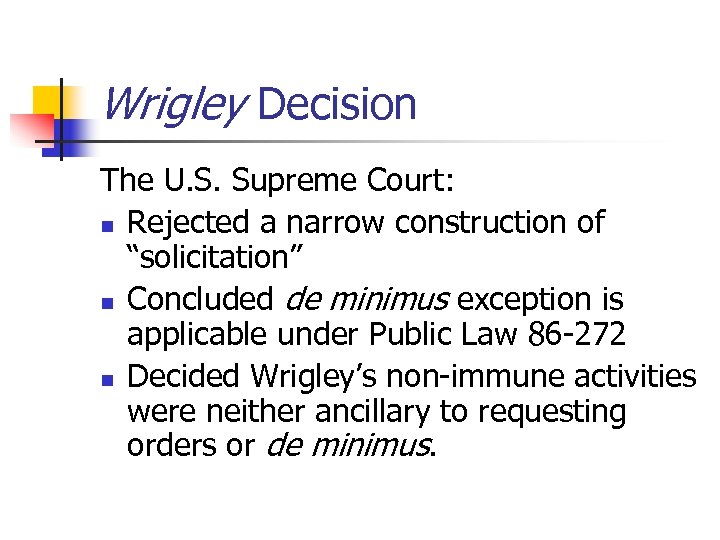

Wrigley Decision The U. S. Supreme Court: n Rejected a narrow construction of “solicitation” n Concluded de minimus exception is applicable under Public Law 86 -272 n Decided Wrigley’s non-immune activities were neither ancillary to requesting orders or de minimus.

Wrigley Decision The U. S. Supreme Court: n Rejected a narrow construction of “solicitation” n Concluded de minimus exception is applicable under Public Law 86 -272 n Decided Wrigley’s non-immune activities were neither ancillary to requesting orders or de minimus.

Wrigley Decision The U. S. Supreme Court: n Rejected a narrow construction of “solicitation” n Concluded de minimus exception is applicable under Public Law 86 -272 n Decided Wrigley’s non-immune activities were neither ancillary to requesting orders or de minimus.

Wrigley Decision The U. S. Supreme Court: n Rejected a narrow construction of “solicitation” n Concluded de minimus exception is applicable under Public Law 86 -272 n Decided Wrigley’s non-immune activities were neither ancillary to requesting orders or de minimus.

Multistate Tax Commission— Interpretation of PL 86 -272 n n n Only solicitation to sell personal property is protected Intangibles are not protected Sale or delivery and their solicitation are not protected unless it is either: n n n Ancillary to solicitation From the protected list In-state activity limited to solicitation (exceptions; de minimus and independent contractor activities)

Multistate Tax Commission— Interpretation of PL 86 -272 n n n Only solicitation to sell personal property is protected Intangibles are not protected Sale or delivery and their solicitation are not protected unless it is either: n n n Ancillary to solicitation From the protected list In-state activity limited to solicitation (exceptions; de minimus and independent contractor activities)

Multistate Tax Commission— Interpretation of PL 86 -272 n n n Only solicitation to sell personal property is protected Intangibles are not protected Sale or delivery and their solicitation are not protected unless it is either: n n n Ancillary to solicitation From the protected list In-state activity limited to solicitation (exceptions; de minimus and independent contractor activities)

Multistate Tax Commission— Interpretation of PL 86 -272 n n n Only solicitation to sell personal property is protected Intangibles are not protected Sale or delivery and their solicitation are not protected unless it is either: n n n Ancillary to solicitation From the protected list In-state activity limited to solicitation (exceptions; de minimus and independent contractor activities)

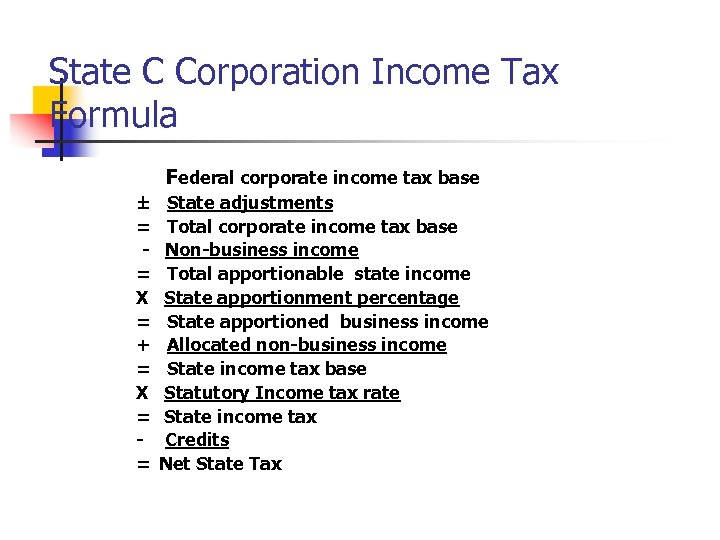

State C Corporation Income Tax Formula Federal corporate income tax base ± = = X = + = X = = State adjustments Total corporate income tax base Non-business income Total apportionable state income State apportionment percentage State apportioned business income Allocated non-business income State income tax base Statutory Income tax rate State income tax Credits Net State Tax

State C Corporation Income Tax Formula Federal corporate income tax base ± = = X = + = X = = State adjustments Total corporate income tax base Non-business income Total apportionable state income State apportionment percentage State apportioned business income Allocated non-business income State income tax base Statutory Income tax rate State income tax Credits Net State Tax

State C Corporation Income Tax Formula Federal corporate income tax base ± = = X = + = X = = State adjustments Total corporate income tax base Non-business income Total apportionable state income State apportionment percentage State apportioned business income Allocated non-business income State income tax base Statutory Income tax rate State income tax Credits Net State Tax

State C Corporation Income Tax Formula Federal corporate income tax base ± = = X = + = X = = State adjustments Total corporate income tax base Non-business income Total apportionable state income State apportionment percentage State apportioned business income Allocated non-business income State income tax base Statutory Income tax rate State income tax Credits Net State Tax

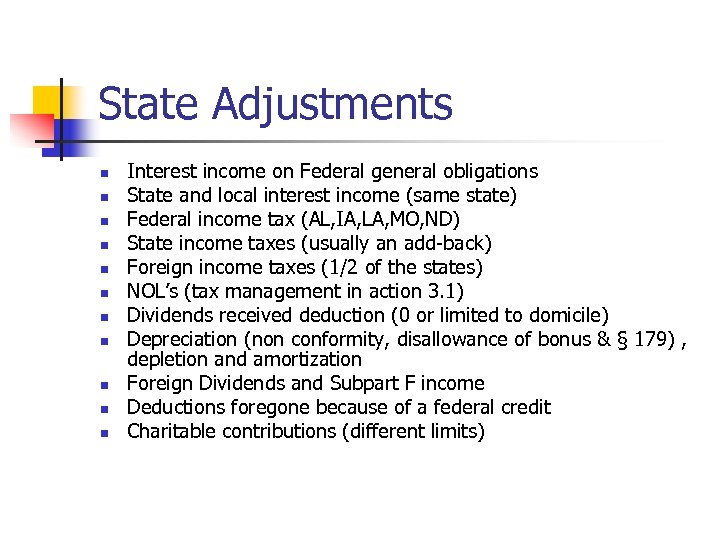

State Adjustments n n n Interest income on Federal general obligations State and local interest income (same state) Federal income tax (AL, IA, LA, MO, ND) State income taxes (usually an add-back) Foreign income taxes (1/2 of the states) NOL’s (tax management in action 3. 1) Dividends received deduction (0 or limited to domicile) Depreciation (non conformity, disallowance of bonus & § 179) , depletion and amortization Foreign Dividends and Subpart F income Deductions foregone because of a federal credit Charitable contributions (different limits)

State Adjustments n n n Interest income on Federal general obligations State and local interest income (same state) Federal income tax (AL, IA, LA, MO, ND) State income taxes (usually an add-back) Foreign income taxes (1/2 of the states) NOL’s (tax management in action 3. 1) Dividends received deduction (0 or limited to domicile) Depreciation (non conformity, disallowance of bonus & § 179) , depletion and amortization Foreign Dividends and Subpart F income Deductions foregone because of a federal credit Charitable contributions (different limits)

Business v. Non-business Income n Business income—apportioned n n Transactional test—”transactions and activities in the regular course of the tax payer’s trade or business” Functional test—”acquisition, management, and disposition of the property constitute integral parts of the regular trade or business. ” MTC Compact examples Non-business income—allocated n Example 3. 6

Business v. Non-business Income n Business income—apportioned n n Transactional test—”transactions and activities in the regular course of the tax payer’s trade or business” Functional test—”acquisition, management, and disposition of the property constitute integral parts of the regular trade or business. ” MTC Compact examples Non-business income—allocated n Example 3. 6

Allocating Non-business Income n Non-business income sourced to a particular state n n n Examples 3. 7 & 3. 8 Table 3. 2 Shannon Properties—business and nonbusiness income components

Allocating Non-business Income n Non-business income sourced to a particular state n n n Examples 3. 7 & 3. 8 Table 3. 2 Shannon Properties—business and nonbusiness income components

Apportionment Rules for Business Income n Taxable in Another State n n Net income tax Franchise tax measured by net income Franchise tax for privilege of doing business Corporate stock tax in another state

Apportionment Rules for Business Income n Taxable in Another State n n Net income tax Franchise tax measured by net income Franchise tax for privilege of doing business Corporate stock tax in another state

Apportionment Rules for Business Income--Continued n Unitary Taxation n Generally states west of Mississippi river. Tax management in action 3. 3 provides a list of unitary and separate reporting states. Combined returns available n Similar to consolidated returns but with foreign affiliates n Business income partitioned among the jurisdictions in which the group operates based on a rough approximation of the companies’ presence there. n Usually uses a three factor formula: sales, property and payroll. n States only apportion the business income of a unitary business or part of a multistate business that constitutes a unitary business (all activities of a single business entity) n Parts of the same groups of companies—whether incorporated or not—are usually considered unitary if they are consolidated for GAAP purposes. n Review Example 3. 10

Apportionment Rules for Business Income--Continued n Unitary Taxation n Generally states west of Mississippi river. Tax management in action 3. 3 provides a list of unitary and separate reporting states. Combined returns available n Similar to consolidated returns but with foreign affiliates n Business income partitioned among the jurisdictions in which the group operates based on a rough approximation of the companies’ presence there. n Usually uses a three factor formula: sales, property and payroll. n States only apportion the business income of a unitary business or part of a multistate business that constitutes a unitary business (all activities of a single business entity) n Parts of the same groups of companies—whether incorporated or not—are usually considered unitary if they are consolidated for GAAP purposes. n Review Example 3. 10

Apportionment Rules for Business Income--Continued n Separate Accounting n n n Each corporation doing business in a state files a separate return even if it a member of a group that files a federal consolidated return. However states do allow consolidated returns for corporations domiciled in that state and in some instances foreign corporations that are members of an domestic affiliated group. Review Tax Management in Action 3. 4 & footnotes

Apportionment Rules for Business Income--Continued n Separate Accounting n n n Each corporation doing business in a state files a separate return even if it a member of a group that files a federal consolidated return. However states do allow consolidated returns for corporations domiciled in that state and in some instances foreign corporations that are members of an domestic affiliated group. Review Tax Management in Action 3. 4 & footnotes

Three-Factor Apportionment Formula n Table 3. 3 Apportionment Factor Weighting by State n n Review IA & MN apportionment factors Property Factor n n n n Property included if it is owned or rented and used by the taxpayer during the tax period. Usually does not include intangibles Mobile property is sourced to each state based on a ratio of either time spent or miles traveled. Property in transit is sourced to the buyer’s destination state. Owned property is generally valued at original cost usually averaged at the beginning and end of the year. The net rental cost of the property rented for the year multiplied by eights becomes the property factor component. Businesses may reduce state income taxes by shifting property or payroll to a low income tax state. Citibank example.

Three-Factor Apportionment Formula n Table 3. 3 Apportionment Factor Weighting by State n n Review IA & MN apportionment factors Property Factor n n n n Property included if it is owned or rented and used by the taxpayer during the tax period. Usually does not include intangibles Mobile property is sourced to each state based on a ratio of either time spent or miles traveled. Property in transit is sourced to the buyer’s destination state. Owned property is generally valued at original cost usually averaged at the beginning and end of the year. The net rental cost of the property rented for the year multiplied by eights becomes the property factor component. Businesses may reduce state income taxes by shifting property or payroll to a low income tax state. Citibank example.

Apportionment Rules for Business Income--Continued n Payroll Factor n n Exclude payroll related to non-business income Payroll Sourcing Rules (employee services within state) n n n Source wages to the state where a majority of the services are performed, if only incidental services are performed outside the state. If the services outside the state are more than incidental sources wages to the state that is the base of operations for the employee If the employee has no base of operations, source wages to the state from which the employer exercises direction and control, but only as long as some services are performed in that state. If the employee’s wages cannot be sources under the first three criteria, use state of residence. Payroll Formula: Payroll nexus state/Total compensation everywhere n Planning: Locate management in states that do not include executive compensation in the payroll factor.

Apportionment Rules for Business Income--Continued n Payroll Factor n n Exclude payroll related to non-business income Payroll Sourcing Rules (employee services within state) n n n Source wages to the state where a majority of the services are performed, if only incidental services are performed outside the state. If the services outside the state are more than incidental sources wages to the state that is the base of operations for the employee If the employee has no base of operations, source wages to the state from which the employer exercises direction and control, but only as long as some services are performed in that state. If the employee’s wages cannot be sources under the first three criteria, use state of residence. Payroll Formula: Payroll nexus state/Total compensation everywhere n Planning: Locate management in states that do not include executive compensation in the payroll factor.

Apportionment Rules for Business Income--Continued n Sales Factor n All gross receipts from transactions and activities conducted in the regular course of the taxpayer’s business. n n n Gross receipts = gross sales – returns and all. + interest charges + service charges + federal and state excise (sales) taxes + commissions + rental income + royalties + proceeds from disposition of tangible and intangible assets (business income) Non business income is excluded Sales of a significant asset are included

Apportionment Rules for Business Income--Continued n Sales Factor n All gross receipts from transactions and activities conducted in the regular course of the taxpayer’s business. n n n Gross receipts = gross sales – returns and all. + interest charges + service charges + federal and state excise (sales) taxes + commissions + rental income + royalties + proceeds from disposition of tangible and intangible assets (business income) Non business income is excluded Sales of a significant asset are included

Apportionment Rules for Business Income--Continued n Sourcing Rules for Sales n Tangible Personal Property n n n Sourced at state of destination State of origin for purchaser is US government or taxpayer is not taxed at state of destination (throwback rule) Review Table 3. 4, Throwback rule creates “nowhere states’ Planning technique—create warehouse or production facility in a state that does not have throwback rule Double throwback rule applied in some states for drop shipments Foreign sales—general rule is if purchaser pay income tax in foreign country, sale is foreign source

Apportionment Rules for Business Income--Continued n Sourcing Rules for Sales n Tangible Personal Property n n n Sourced at state of destination State of origin for purchaser is US government or taxpayer is not taxed at state of destination (throwback rule) Review Table 3. 4, Throwback rule creates “nowhere states’ Planning technique—create warehouse or production facility in a state that does not have throwback rule Double throwback rule applied in some states for drop shipments Foreign sales—general rule is if purchaser pay income tax in foreign country, sale is foreign source

Apportionment Rules for Business Income--Continued n Receipts Other Than Tangible Personal Property n n n Includes employee services, rentals, licensing or other use of intangible personal property Sourced to location of income producing activity If activity takes place in more than one state, apportionment is based on the cost of performance.

Apportionment Rules for Business Income--Continued n Receipts Other Than Tangible Personal Property n n n Includes employee services, rentals, licensing or other use of intangible personal property Sourced to location of income producing activity If activity takes place in more than one state, apportionment is based on the cost of performance.

Apportionment and Consolidated or Combined Tax Returns n Combined Returns n n Mandatory Includes the pooled information of the corporation and other members of the unitary group Members of the unitary group are treated as a single corporate entity for purposes of apportionment. The combined factor is applied to the unitary group’s combined income Consolidated Returns in a Unitary State n n The Unitary group and the affiliated corporations may be the same. However, a consolidated group may include corporations that are not members of the same unitary group. To apportion income the group may use one of two methods: n Separate method—company by company basis n Consolidated method apportions the groups aggregate income.

Apportionment and Consolidated or Combined Tax Returns n Combined Returns n n Mandatory Includes the pooled information of the corporation and other members of the unitary group Members of the unitary group are treated as a single corporate entity for purposes of apportionment. The combined factor is applied to the unitary group’s combined income Consolidated Returns in a Unitary State n n The Unitary group and the affiliated corporations may be the same. However, a consolidated group may include corporations that are not members of the same unitary group. To apportion income the group may use one of two methods: n Separate method—company by company basis n Consolidated method apportions the groups aggregate income.

Combined Returns: Sales Factor Sourcing and the Throwback Rule n The separate entity approach n n Each unitary group member’s sales are subjected to the throwback rules before the numerator of the group’s combined sales factor is determined. The unitary approach n n All sales into the state are sourced to it regardless of the status of the members. Sales into other states that would be thrown back are not thrown back if any member of the unitary group is taxable in the other state.

Combined Returns: Sales Factor Sourcing and the Throwback Rule n The separate entity approach n n Each unitary group member’s sales are subjected to the throwback rules before the numerator of the group’s combined sales factor is determined. The unitary approach n n All sales into the state are sourced to it regardless of the status of the members. Sales into other states that would be thrown back are not thrown back if any member of the unitary group is taxable in the other state.

Combined Returns and Unitary Taxation n What constitutes a unitary business? n The three unities test n n The functional integration test n n Contributions to income result from functional integration, centralization of management, and economies of scale. Contribution dependency test n n Unity of ownership Unity of operation Unity of centralized executive force and system of operation The member makes a contribution to, or depends on, l other members of the unitary group. / Multistate Compact Unitary Business Regulations Unitary Checklists (TMA 3. 5) Worldwide Unitary Business n n Water’s edge unitary group—domestic corporations and foreign corporations with more than 20% of their activity in the U. S. Water’s edge election available in many unitary states

Combined Returns and Unitary Taxation n What constitutes a unitary business? n The three unities test n n The functional integration test n n Contributions to income result from functional integration, centralization of management, and economies of scale. Contribution dependency test n n Unity of ownership Unity of operation Unity of centralized executive force and system of operation The member makes a contribution to, or depends on, l other members of the unitary group. / Multistate Compact Unitary Business Regulations Unitary Checklists (TMA 3. 5) Worldwide Unitary Business n n Water’s edge unitary group—domestic corporations and foreign corporations with more than 20% of their activity in the U. S. Water’s edge election available in many unitary states

Apportionment and Consolidated or Combined Tax Returns--Continued n Consolidated Returns n n n Voluntary Pools the operations of affiliated corporations operating in a non-unitary state or non-unitary corporations operating in a unitary state. Beneficial if affiliates having NOL’s are combined with profitable affiliates Used in both unitary and non unitary states. A group of affiliated corporations that files a consolidated return is called a consolidated group.

Apportionment and Consolidated or Combined Tax Returns--Continued n Consolidated Returns n n n Voluntary Pools the operations of affiliated corporations operating in a non-unitary state or non-unitary corporations operating in a unitary state. Beneficial if affiliates having NOL’s are combined with profitable affiliates Used in both unitary and non unitary states. A group of affiliated corporations that files a consolidated return is called a consolidated group.

Alternative Apportionment Formulas n Single factor sales n n Two Factor Election n n Detrimental to out-of state business Used in Iowa/Texas Missouri election Colorado, Hawaii Industry specific formulas n Railroads, Financial Institutions, Radio, TV broadcasting

Alternative Apportionment Formulas n Single factor sales n n Two Factor Election n n Detrimental to out-of state business Used in Iowa/Texas Missouri election Colorado, Hawaii Industry specific formulas n Railroads, Financial Institutions, Radio, TV broadcasting

Taxation of Flow-Through Entities n Partnerships n For corporate partners n n n Partnership must separate business and non-business income based on the relationship between the asset-yielding income and the partnership income. The partner must then also separate business and nonbusiness income based on the relationship between the partnership’s business and the corporate partner’s business Apportionment Methods for corporations n n On the partnership level—allocated to the specific partner Flow through methods—flows through to the corporation and is combined with other corporate activities. Corporate level—stand alone factors are multiplied by the distributive share of partnership income Example 3. 32

Taxation of Flow-Through Entities n Partnerships n For corporate partners n n n Partnership must separate business and non-business income based on the relationship between the asset-yielding income and the partnership income. The partner must then also separate business and nonbusiness income based on the relationship between the partnership’s business and the corporate partner’s business Apportionment Methods for corporations n n On the partnership level—allocated to the specific partner Flow through methods—flows through to the corporation and is combined with other corporate activities. Corporate level—stand alone factors are multiplied by the distributive share of partnership income Example 3. 32

Taxation of Flow-Through Entities n Limited Liability Companies n n n Florida, Texas and Pennsylvania tax as corporations Can use check the box regulations to elect flow through status (partnership, Subchapter S or in some cases proprietorship) Subchapter S Corporations n Not taxed in most states, five states have a “toll charge”

Taxation of Flow-Through Entities n Limited Liability Companies n n n Florida, Texas and Pennsylvania tax as corporations Can use check the box regulations to elect flow through status (partnership, Subchapter S or in some cases proprietorship) Subchapter S Corporations n Not taxed in most states, five states have a “toll charge”