0b11e9e8f1bb11abf15d640d17e102b4.ppt

- Количество слайдов: 14

Implementation of Basel II Trends and Experience from the West European Banking Sector Dr. Robert Wagner – Bearing. Point XVth International Banking Congress Saint-Petersburg, June 8 th 2006

Bearing. Point provides management & technology consulting services globally as well as in Russia Bearing. Point Global Clients & Business Management and Technology Consultants Bearing. Point Russia B e a r in g P o in t l l Bearing. Point, Inc. is a listed company (NYSE: BE) with global headquarters in Mc. Lean, Virginia Founded in 2002 after the acquisition of 17 former KPMG Consulting and Andersen practices Today over 17. 000 employees with an average of 12 years experience in 155 offices in 40 countries Over 50 alliance partners l l 100+ professionals – approximately a half of them are certified consultants 90% of consultants have experience in project implementation in Russia and around the Globe (at least 2 finished projects) l About $3. 4 bn net revenue in 2004 l Over 2, 100 clients (750 of the Fortune 2000) l Regular engagements at 98% our Top-100 -clients l National and international framework contracts with key clients l 90% of our clients confirm their satisfaction in working with us © 2006 Bearing. Point – Page 1

Our FS Risk Management Group has vast experience in implementing Basel II Risk management experts n n n Risk IT experts . Credit Risk Operational Risk Market Risk Regulatory Reporting Business Process Design n n Data Warehouse EAI, SOA Standard components IT Security Programme Delivery B e a r in g P o in t Risk Management Core Team (Basel II / Risk IT) 230 experts worldwide 130 experts in Europe n We started work on Basel II in 2000 with leading German banks n We assisted many local, regional and international banks with their Basel II program n We worked on Basel II engagements across EMEA, the US and ASPAC n We own a portfolio of assets and tools that we use in our assignments, including our Basel II Solution Abacus/Da. Vinci © 2006 Bearing. Point – Page 2

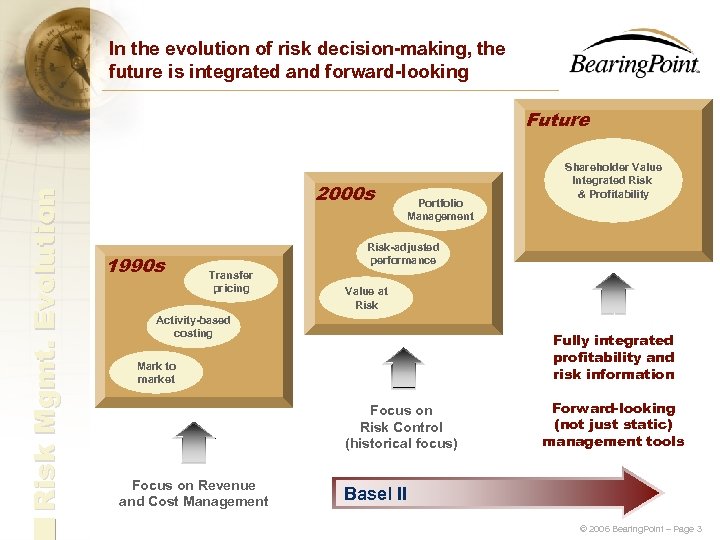

In the evolution of risk decision-making, the future is integrated and forward-looking Risk Mgmt. Evolution Future 2000 s 1990 s Portfolio Management Shareholder Value Integrated Risk & Profitability Risk-adjusted performance Transfer pricing Value at Risk Activity-based costing Fully integrated profitability and risk information Mark to market Focus on Risk Control (historical focus) Focus on Revenue and Cost Management Forward-looking (not just static) management tools Basel II © 2006 Bearing. Point – Page 3

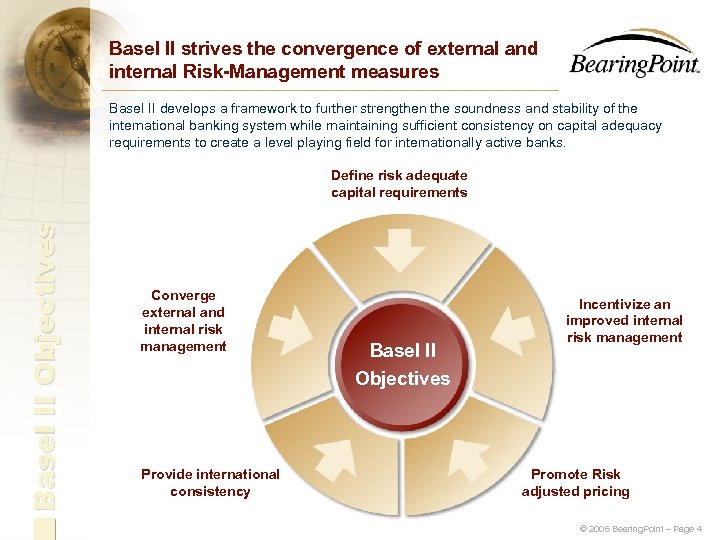

Basel II strives the convergence of external and internal Risk-Management measures Basel II develops a framework to further strengthen the soundness and stability of the international banking system while maintaining sufficient consistency on capital adequacy requirements to create a level playing field for internationally active banks. B a s e l I I Ob je c t iv e s Define risk adequate capital requirements Converge external and internal risk management Provide international consistency Basel II Objectives Incentivize an improved internal risk management Promote Risk adjusted pricing © 2006 Bearing. Point – Page 4

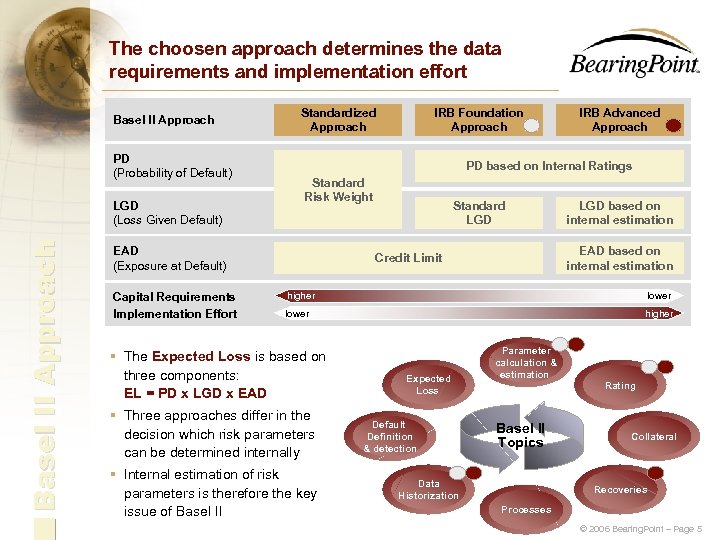

The choosen approach determines the data requirements and implementation effort Basel II Approach PD (Probability of Default) B a s e l II A p p r o a c h LGD (Loss Given Default) Standardized Approach IRB Advanced Approach PD based on Internal Ratings Standard Risk Weight EAD (Exposure at Default) Capital Requirements Implementation Effort IRB Foundation Approach Standard LGD based on internal estimation EAD based on internal estimation Credit Limit higher lower higher § The Expected Loss is based on three components: EL = PD x LGD x EAD § Three approaches differ in the decision which risk parameters can be determined internally § Internal estimation of risk parameters is therefore the key issue of Basel II Expected Loss Default Definition & detection Parameter calculation & estimation Basel II Topics Data Historization Rating Collateral Recoveries Processes © 2006 Bearing. Point – Page 5

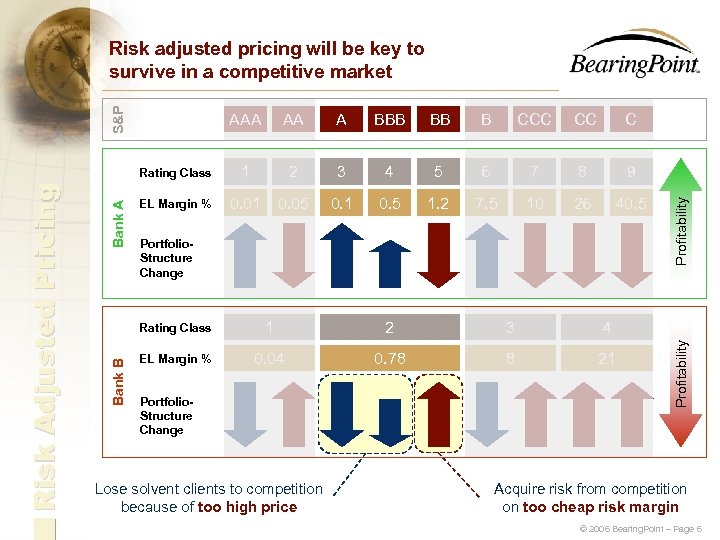

S&P Risk adjusted pricing will be key to survive in a competitive market BBB BB B CCC CC C 1 2 3 4 5 6 7 8 9 EL Margin % 0. 01 0. 05 0. 1 0. 5 1. 2 7. 5 10 26 40. 5 Portfolio. Structure Change Bank B Rating Class 1 2 3 4 EL Margin % 0. 04 0. 78 8 21 Profitability A Portfolio. Structure Change Lose solvent clients to competition because of too high price Profitability Bank A AA Rating Class R is k A d ju s t e d P r ic in g AAA Acquire risk from competition on too cheap risk margin © 2006 Bearing. Point – Page 6

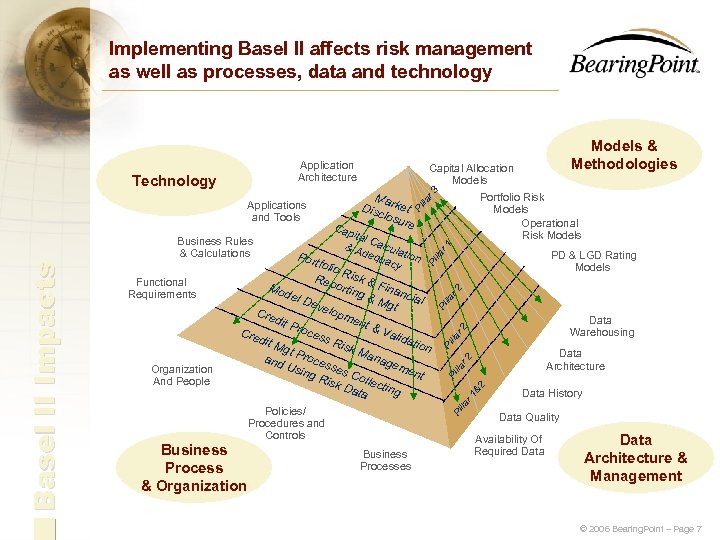

Implementing Basel II affects risk management as well as processes, data and technology Application Architecture lla r 3 r 1 lla r 2 lla Pi r 2 Data Warehousing lla r 2 Data Architecture &2 r 1 Data History lla Rep Risk & F ortin Mod g & inancia el D l Mgt eve lopm Cre dit P ent &V roce Cre alid ss R dit M atio isk n gt P Man roce and age Usin sses men Col g. R t l isk Dat ecting a Pi Policies/ Procedures and Controls Business Process & Organization PD & LGD Rating Models lla Organization And People Cap ital C & A alcula deq t Por uac ion tfoli y o Pi Functional Requirements Portfolio Risk Models Operational Risk Models Pi Basel II Impacts Business Rules & Calculations Ma Disc rket losu re Pi Applications and Tools Capital Allocation Models Pi Technology Models & Methodologies Business Processes Data Quality Availability Of Required Data Architecture & Management © 2006 Bearing. Point – Page 7

Estimation and use of internal parameters require extensive historical data Required time series for risk parameters in the advanced approach for implementation by 2007: 97 98 99 00 01 02 03 04 05 06 07 08 09 Rating (3 years) BCS: PD (5 years) BCS: EAD (5 years) D a t a His t o r y BCS: LGD (5 years) Retail: (5 years) PD, LGD, EL, EAD/CCF Required time series for estimation Transition period of 3 years Minimum additional time to retrieve useful data for calculating parameter figure BCS: Banks, Corporates, Sovereigns § For later introduction of IRB approach the data collection should start as early as possible § Developing the data retrograde is difficult and costly © 2006 Bearing. Point – Page 8

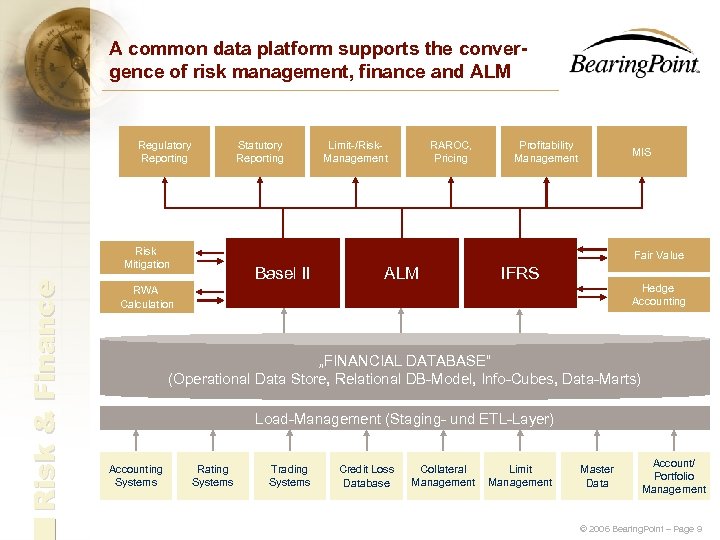

A common data platform supports the convergence of risk management, finance and ALM Regulatory Reporting Statutory Reporting R is k & F in a n c e Risk Mitigation Limit-/Risk. Management RAROC, Pricing Profitability Management MIS Fair Value Basel II ALM IFRS Hedge Accounting RWA Calculation „FINANCIAL DATABASE“ (Operational Data Store, Relational DB-Model, Info-Cubes, Data-Marts) Load-Management (Staging- und ETL-Layer) Accounting Systems Rating Systems Trading Systems Credit Loss Database Collateral Management Limit Management Master Data Account/ Portfolio Management © 2006 Bearing. Point – Page 9

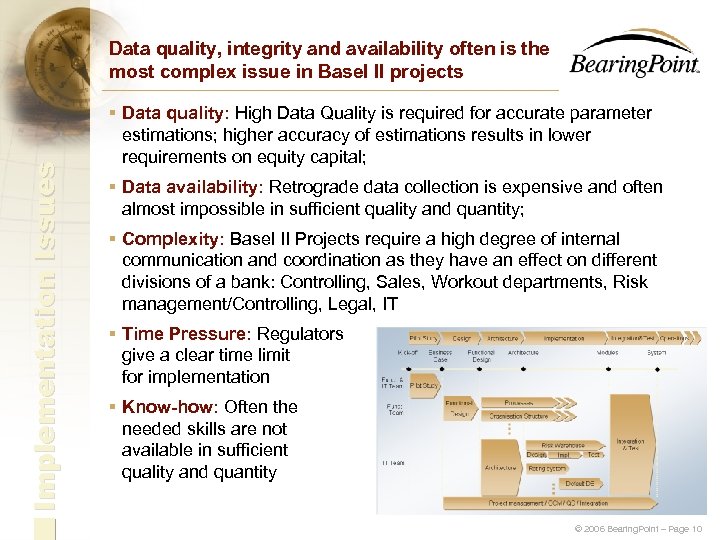

Implementation Issues Data quality, integrity and availability often is the most complex issue in Basel II projects § Data quality: High Data Quality is required for accurate parameter estimations; higher accuracy of estimations results in lower requirements on equity capital; § Data availability: Retrograde data collection is expensive and often almost impossible in sufficient quality and quantity; § Complexity: Basel II Projects require a high degree of internal communication and coordination as they have an effect on different divisions of a bank: Controlling, Sales, Workout departments, Risk management/Controlling, Legal, IT § Time Pressure: Regulators give a clear time limit for implementation § Know-how: Often the needed skills are not available in sufficient quality and quantity © 2006 Bearing. Point – Page 10

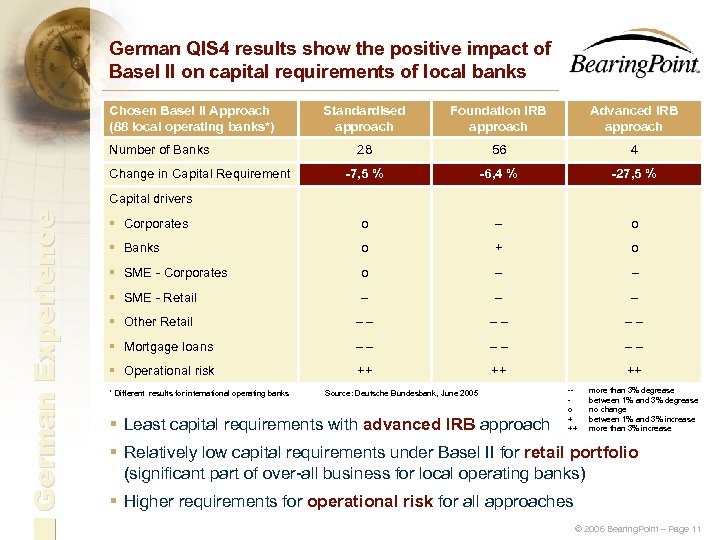

German QIS 4 results show the positive impact of Basel II on capital requirements of local banks Chosen Basel II Approach (88 local operating banks*) Standardised approach Foundation IRB approach Advanced IRB approach 28 56 4 -7, 5 % -6, 4 % -27, 5 % § Corporates o – o § Banks o + o § SME - Corporates o – – § SME - Retail – – – § Other Retail –– –– –– § Mortgage loans –– –– –– § Operational risk ++ ++ ++ Number of Banks Change in Capital Requirement German Experience Capital drivers * Different results for international operating banks Source: Deutsche Bundesbank, June 2005 § Least capital requirements with advanced IRB approach -o + ++ more than 3% degrease between 1% and 3% degrease no change between 1% and 3% increase more than 3% increase § Relatively low capital requirements under Basel II for retail portfolio (significant part of over-all business for local operating banks) § Higher requirements for operational risk for all approaches © 2006 Bearing. Point – Page 11

Key Success Factors in Basel II implementation projects 1. Agree on the right strategy regarding the different approaches and asset classes 2. Involve all affected departments at an early stage Lessons Learned 3. Ensure that all business units (regional subsidiaries, branches, etc. ) are able to support the chosen Basel II approach 4. Enforce IT & business departments to work together seamlessly 5. Create a flexible and expandable data architecture 6. Start with historical data collection as soon as possible 7. Consider regulatory, risk management, ALM and accounting aspects as interconnected 8. Choose an experienced partner … . . . like Bearing. Point © 2006 Bearing. Point – Page 12

Contact Information Thank you for your attention! Dr. Robert Wagner Managing Director Olof-Palme-Straße 31 60439 Frankfurt/Main Germany www. bearingpoint. com Tel. : +49. 69. 13022. 1331 Fax: +49. 69. 13022. 1471 Mobile: +49. 172. 621. 2623 robert. wagner@bearingpoint. com Thomas Stuemer General Director Bolshaya Ordynka 40 119017 Moscow Russia www. bearingpoint. com Tel. : +7. 495. 937. 4466 Fax: +7. 495. 937. 4467 Mobile: +7. 495. 139. 9398 thomas. stuemer@bearingpoint. com © Copyright Bearing. Point Gmb. H, Frankfurt/Main, 2006 Alle Rechte vorbehalten. Der Inhalt dieses Dokuments unterliegt dem Urheberrecht. Veränderungen, Kürzungen, Erweiterungen und Ergänzungen bedürfen der vorherigen schriftlichen Einwilligung durch Bearing. Point Gmb. H, Frankfurt/Main. Jede Vervielfältigung ist nur zum persönlichen Gebrauch gestattet und nur unter der Bedingung, dass dieser Urheberrechtsvermerk beim Vervielfältigen auf dem Dokument selbst erhalten bleibt. Jede Veröffentlichung oder jede Übersetzung bedarf der vorherigen schriftlichen Einwilligung durch Bearing. Point Gmb. H, Frankfurt/Main. Gewerbliche Nutzung oder Nutzung zu Schulungs-zwecken durch Dritte bedarf ebenfalls der vorherigen schriftlichen Einwilligung durch Bearing. Point Gmb. H, Frankfurt/Main. © 2006 Bearing. Point – Page 13

0b11e9e8f1bb11abf15d640d17e102b4.ppt