2a72b8211ca7b2bb330fd3373c06524b.ppt

- Количество слайдов: 36

Implementation and Applications of IFRS on Asset Impairment and Asset Held For Sale Vienna, March 14, 2006 By Thierry Bertrand, Partner, E&Y Olivier Lemaire, Partner, E&Y Renaud Breyer, Manager, E&Y 1

Implementation and Applications of IFRS on Asset Impairment and Asset Held For Sale Vienna, March 14, 2006 By Thierry Bertrand, Partner, E&Y Olivier Lemaire, Partner, E&Y Renaud Breyer, Manager, E&Y 1

Agenda A. Asset impairment • • • Refresh Indicators of impairment Recoverable amount Cash-generating units ( « CGUs » ) Impairment measurement First-time adoption issues B. Non current asset held for sale • • 2 Refresh Classification as held for sale Measurement Asset held for sale and discontinued operations !@#

Agenda A. Asset impairment • • • Refresh Indicators of impairment Recoverable amount Cash-generating units ( « CGUs » ) Impairment measurement First-time adoption issues B. Non current asset held for sale • • 2 Refresh Classification as held for sale Measurement Asset held for sale and discontinued operations !@#

Refresh – IAS 36 does not deal with the impairment of … • • • inventories assets arising from construction contracts deferred tax assets arising from employee benefits financial assets (other than subsidiaries, associates and joint ventures) • investment properties, if measured at fair value • biological assets related to agricultural activity, if measured at fair value less point-of-sale costs IAS 36 applies to all other assets including goodwill, intangible assets with undefinite useful live, intangible assets with finite useful life, tangible assets, … 3 !@#

Refresh – IAS 36 does not deal with the impairment of … • • • inventories assets arising from construction contracts deferred tax assets arising from employee benefits financial assets (other than subsidiaries, associates and joint ventures) • investment properties, if measured at fair value • biological assets related to agricultural activity, if measured at fair value less point-of-sale costs IAS 36 applies to all other assets including goodwill, intangible assets with undefinite useful live, intangible assets with finite useful life, tangible assets, … 3 !@#

Refresh - When is an impairment review necessary? • Companies need to consider, at each balance sheet date, whethere is any indication that an asset may be impaired – If there is, a full impairment review is needed to estimate the recoverable amount of the asset – Otherwise, no further action is required 4 !@#

Refresh - When is an impairment review necessary? • Companies need to consider, at each balance sheet date, whethere is any indication that an asset may be impaired – If there is, a full impairment review is needed to estimate the recoverable amount of the asset – Otherwise, no further action is required 4 !@#

Refresh - Indications of impairment – external • A significant decline in the asset’s market value • A significant adverse change in the technological, market, economic or regulatory environment in which the company operates • An increase in interest rates or other market rates of return that affect the return required on the company’s assets • The company’s reported net assets exceed its market capitalisation 5 !@#

Refresh - Indications of impairment – external • A significant decline in the asset’s market value • A significant adverse change in the technological, market, economic or regulatory environment in which the company operates • An increase in interest rates or other market rates of return that affect the return required on the company’s assets • The company’s reported net assets exceed its market capitalisation 5 !@#

Refresh - Indications of impairment – internal • Obsolescence or physical damage affecting the asset • Significant changes affecting the asset, such as plans to discontinue or restructure certain activities • Internal reporting systems showing or predicting poor performance from particular assets or business units 6 !@#

Refresh - Indications of impairment – internal • Obsolescence or physical damage affecting the asset • Significant changes affecting the asset, such as plans to discontinue or restructure certain activities • Internal reporting systems showing or predicting poor performance from particular assets or business units 6 !@#

Refresh - Impairment review • At the end of each annual reporting period, irrespective of whether any indication of potential impairment exists, an entity shall: – estimate the recoverable amount of intangible assets with an indefinite useful life or not yet available for use; however, the most recent detailed calculation of recoverable amount made in the preceding period may be used in the current period provided specific criteria are met – test goodwill acquired in a business combination for impairment 7 !@#

Refresh - Impairment review • At the end of each annual reporting period, irrespective of whether any indication of potential impairment exists, an entity shall: – estimate the recoverable amount of intangible assets with an indefinite useful life or not yet available for use; however, the most recent detailed calculation of recoverable amount made in the preceding period may be used in the current period provided specific criteria are met – test goodwill acquired in a business combination for impairment 7 !@#

Indicators of impairment Scenario 1 • Group A, a conglomerate operating in very diversified industries, has acquired Entity B in September 20 X 4. • Entity B specializes in performing technical inspections and surveys of ships. • As a result of the business combination, Group A has recognized a trademark and goodwill. • The trademark was fair valued using the royalty relief method. • The trademark is protected over a period of 20 years and can be renewed for an insignificant cost; therefore, it has an indefinite useful life. 8 !@#

Indicators of impairment Scenario 1 • Group A, a conglomerate operating in very diversified industries, has acquired Entity B in September 20 X 4. • Entity B specializes in performing technical inspections and surveys of ships. • As a result of the business combination, Group A has recognized a trademark and goodwill. • The trademark was fair valued using the royalty relief method. • The trademark is protected over a period of 20 years and can be renewed for an insignificant cost; therefore, it has an indefinite useful life. 8 !@#

Indicators of impairment Scenario 1 (Cont) • The goodwill arising on the acquisition of B remains allocated to Entity B, as a group of CGUs. • The CFO has decided to use the following as indicators of impairment: – Significant adverse changes in the regulatory environment in which Entity B operates – Significant decline in the budgeted cash flows – Significant decline of the market share 9 !@#

Indicators of impairment Scenario 1 (Cont) • The goodwill arising on the acquisition of B remains allocated to Entity B, as a group of CGUs. • The CFO has decided to use the following as indicators of impairment: – Significant adverse changes in the regulatory environment in which Entity B operates – Significant decline in the budgeted cash flows – Significant decline of the market share 9 !@#

Indicators of impairment Scenario 1 (Cont) • At the end of 20 X 5: the CFO looked at the above indicators and he decided there is no need to perform an impairment test due to the following: – The market share has slightly increased by 0. 8 % compared to prior year – No changes occurred in the regulatory environment in which the company operates – The budgeted cash flows reflect the increase in the market share and the steady growth of the shipping industry in which most of the company’s clients are operating. Question • No impairment test has been performed since September 20 X 4. Should we be concerned about this? 10 !@#

Indicators of impairment Scenario 1 (Cont) • At the end of 20 X 5: the CFO looked at the above indicators and he decided there is no need to perform an impairment test due to the following: – The market share has slightly increased by 0. 8 % compared to prior year – No changes occurred in the regulatory environment in which the company operates – The budgeted cash flows reflect the increase in the market share and the steady growth of the shipping industry in which most of the company’s clients are operating. Question • No impairment test has been performed since September 20 X 4. Should we be concerned about this? 10 !@#

Indicators of impairment Solution • The Group should perform an impairment test. According to IAS 36. 10, an entity shall test an intangible asset with indefinite useful life and the goodwill for impairment annually, irrespective of whethere is an indication of impairment. • In the case described, it means that although the circumstances point out that there is no need for an impairment test to be performed, the test should be performed anyway because the asset is not amortised. 11 !@#

Indicators of impairment Solution • The Group should perform an impairment test. According to IAS 36. 10, an entity shall test an intangible asset with indefinite useful life and the goodwill for impairment annually, irrespective of whethere is an indication of impairment. • In the case described, it means that although the circumstances point out that there is no need for an impairment test to be performed, the test should be performed anyway because the asset is not amortised. 11 !@#

Indicators of impairment Solution (Cont) • This impairment test may be performed at any time during the year, provided it is performed at the same time every year. • The impairment test for the brand may be performed at a different time than the test for goodwill, but for practical reasons it would be more relevant to perform both tests at the same time. 12 !@#

Indicators of impairment Solution (Cont) • This impairment test may be performed at any time during the year, provided it is performed at the same time every year. • The impairment test for the brand may be performed at a different time than the test for goodwill, but for practical reasons it would be more relevant to perform both tests at the same time. 12 !@#

Recoverable amount – definitions • The objective of the impairment test is to ensure that the carrying value of an asset is not greater that its recoverable amount – Recoverable amount is the higher of an asset’s net selling price and its value in use – Net selling price is the amount obtainable from the sale of an asset in an arm’s length transaction between knowledgeable, willing parties, less the costs of disposal – Value in use is the present value of estimated future cash flows expected to arise from the continuing use of an asset and its disposal at the end of its useful life 13 !@#

Recoverable amount – definitions • The objective of the impairment test is to ensure that the carrying value of an asset is not greater that its recoverable amount – Recoverable amount is the higher of an asset’s net selling price and its value in use – Net selling price is the amount obtainable from the sale of an asset in an arm’s length transaction between knowledgeable, willing parties, less the costs of disposal – Value in use is the present value of estimated future cash flows expected to arise from the continuing use of an asset and its disposal at the end of its useful life 13 !@#

Recoverable amount – Value in use test • • • 14 Identify ‘cash generating units’ Allocate assets to these units Forecast future cash flows for each unit Identify discount rate and discount the cash flows Compare resulting value in use with carrying value Write down as necessary to reflect any impairment loss thus identified !@#

Recoverable amount – Value in use test • • • 14 Identify ‘cash generating units’ Allocate assets to these units Forecast future cash flows for each unit Identify discount rate and discount the cash flows Compare resulting value in use with carrying value Write down as necessary to reflect any impairment loss thus identified !@#

Recoverable amount – Value in use • The following elements should be reflected in the calculation of an asset’s value in use: – an estimate of the future cash flows an entity expects to derive from the asset – the time value of money – expectations about possible variations in the amount and/or timing of those future cash flows – the price for bearing the uncertainty inherent in the asset – other factors, such as illiquidity The use of assumptions is an essential element of the expected cash flow method ! 15 !@#

Recoverable amount – Value in use • The following elements should be reflected in the calculation of an asset’s value in use: – an estimate of the future cash flows an entity expects to derive from the asset – the time value of money – expectations about possible variations in the amount and/or timing of those future cash flows – the price for bearing the uncertainty inherent in the asset – other factors, such as illiquidity The use of assumptions is an essential element of the expected cash flow method ! 15 !@#

Cash generating units • Defined as the smallest identifiable group of assets that generates cash flows from continuing use that are largely independent of the cash flows from other assets or groups of assets • Identification of units should be based on judgement, influenced by how they are monitored internally • Once chosen, units should be consistently defined thereafter unless there are good reasons for change 16 !@#

Cash generating units • Defined as the smallest identifiable group of assets that generates cash flows from continuing use that are largely independent of the cash flows from other assets or groups of assets • Identification of units should be based on judgement, influenced by how they are monitored internally • Once chosen, units should be consistently defined thereafter unless there are good reasons for change 16 !@#

Cash generating units • Determination is not conditioned upon existence of indicators of impairment • Judgement and very good knowledge of the industry and of the organisation of the company are required • Varying approaches in practice in various entities may be applied • Determination should be done at the lowest level possible • Independent cash inflows does not necessarily mean external cash inflows 17 !@#

Cash generating units • Determination is not conditioned upon existence of indicators of impairment • Judgement and very good knowledge of the industry and of the organisation of the company are required • Varying approaches in practice in various entities may be applied • Determination should be done at the lowest level possible • Independent cash inflows does not necessarily mean external cash inflows 17 !@#

Cash generating units – determination Scenario 1 • A tour operator owns three hotels of a similar class, offering the same facilities, near the beach at a large holiday resort. • These hotels are advertised as alternatives in the operator's brochure, at the same price. • Holidaymakers are frequently transferred from one to another and there is a central booking system for independent travelers. • The reporting system of the tour operator allows it to identify the cash flows generated by each of these hotels. Solution • The three hotels can be regarded as offering genuinely substitutable products by a sufficiently high proportion of potential guests and can be grouped together as a single cash-generating unit. The hotels are run as a single hotel on three sites. 18 !@#

Cash generating units – determination Scenario 1 • A tour operator owns three hotels of a similar class, offering the same facilities, near the beach at a large holiday resort. • These hotels are advertised as alternatives in the operator's brochure, at the same price. • Holidaymakers are frequently transferred from one to another and there is a central booking system for independent travelers. • The reporting system of the tour operator allows it to identify the cash flows generated by each of these hotels. Solution • The three hotels can be regarded as offering genuinely substitutable products by a sufficiently high proportion of potential guests and can be grouped together as a single cash-generating unit. The hotels are run as a single hotel on three sites. 18 !@#

Cash generating units – determination (cont’d) Scenario 2 • A luxury-clothing producer M owns three stores in the same city (although in different neighbourhoods) and 20 stores in other cities. • All stores are managed in the same way and all stores purchase from the same factory owned by M. Pricing, advertising, marketing and human resources policies (except for hiring specific sales staff) are managed centrally by M. • The management does not have any intention to sell any of these stores because of their strategic location. • Frequent transfers of products take place between the three stores in order to satisfy customers’ demands and the customers have no preferences between the three stores as long as they find the product they want in any of them. Solution • It is likely that the cash inflows generated by one store alone are not independent of the cash inflows generated by the other stores located in the same city. Therefore, we may consider that a clothing retailer with an established brand name would be justified in treating its three stores in same city as a single CGU. 19 !@#

Cash generating units – determination (cont’d) Scenario 2 • A luxury-clothing producer M owns three stores in the same city (although in different neighbourhoods) and 20 stores in other cities. • All stores are managed in the same way and all stores purchase from the same factory owned by M. Pricing, advertising, marketing and human resources policies (except for hiring specific sales staff) are managed centrally by M. • The management does not have any intention to sell any of these stores because of their strategic location. • Frequent transfers of products take place between the three stores in order to satisfy customers’ demands and the customers have no preferences between the three stores as long as they find the product they want in any of them. Solution • It is likely that the cash inflows generated by one store alone are not independent of the cash inflows generated by the other stores located in the same city. Therefore, we may consider that a clothing retailer with an established brand name would be justified in treating its three stores in same city as a single CGU. 19 !@#

Cash generating units – determination (cont’d) Scenario 3 • A gas industry company has a certain number of customer contracts for whose fulfilment it uses several gas fields located in the same geographical area. • The gas fields are not dedicated to a particular contract. • The company is using the same distribution network (pipelines, etc) for all the gas fields. • The gas field that will be the delivery source will depend on the company’s centralised allocation decision. Solution • The three gas fields represent a cash-generating unit 20 !@#

Cash generating units – determination (cont’d) Scenario 3 • A gas industry company has a certain number of customer contracts for whose fulfilment it uses several gas fields located in the same geographical area. • The gas fields are not dedicated to a particular contract. • The company is using the same distribution network (pipelines, etc) for all the gas fields. • The gas field that will be the delivery source will depend on the company’s centralised allocation decision. Solution • The three gas fields represent a cash-generating unit 20 !@#

Cash generating units – Allocation • Attribute all identifiable assets and liabilities to the appropriate cash generating units – Exclude tax assets and liabilities, interest – bearing debt, and other items relating wholly to financing • For items, such as corporate assets and goodwill, that cannot be allocated or apportioned to individual cash generating units, a second value in use test at a higher level of aggregation may be needed • Ensure that the allocation of carrying values is done on the same basis 21 !@#

Cash generating units – Allocation • Attribute all identifiable assets and liabilities to the appropriate cash generating units – Exclude tax assets and liabilities, interest – bearing debt, and other items relating wholly to financing • For items, such as corporate assets and goodwill, that cannot be allocated or apportioned to individual cash generating units, a second value in use test at a higher level of aggregation may be needed • Ensure that the allocation of carrying values is done on the same basis 21 !@#

Cash generating units – Allocation • Goodwill should be tested for impairment as part of the impairment testing the CGU to which it relates (annually and whenever there is an indication that it may be impaired) • The carrying amount of goodwill should be allocated to each of the smallest CGU to which a portion of that carrying amount can be allocated on a “reasonable and consistent basis” – Allocation is consistent with the lowest level at which management monitors the return on investment – The CGU cannot be larger than a segment based either on primary or secondary reporting format 22 !@#

Cash generating units – Allocation • Goodwill should be tested for impairment as part of the impairment testing the CGU to which it relates (annually and whenever there is an indication that it may be impaired) • The carrying amount of goodwill should be allocated to each of the smallest CGU to which a portion of that carrying amount can be allocated on a “reasonable and consistent basis” – Allocation is consistent with the lowest level at which management monitors the return on investment – The CGU cannot be larger than a segment based either on primary or secondary reporting format 22 !@#

Impairment measurement Forecast cash flows should: • Include all the relevant cash flows of that particular asset or cash generating unit • Reflect the asset or unit in its present state • Exclude cash flows relating to tax and financing • Be consistent with up-to-date budgets and plans • Beyond the period covered by budgets, assume only steady state or declining growth 23 !@#

Impairment measurement Forecast cash flows should: • Include all the relevant cash flows of that particular asset or cash generating unit • Reflect the asset or unit in its present state • Exclude cash flows relating to tax and financing • Be consistent with up-to-date budgets and plans • Beyond the period covered by budgets, assume only steady state or declining growth 23 !@#

Impairment measurement (cont’d) Discount rate should be: • The current market rate appropriate for the risks specific to the asset or cash generating unit • Pre-tax • Consistent with the forecast’s treatment of inflation • Determined after considering – – 24 The company’s weighted average cost of capital The company’s incremental borrowing rate Other market borrowing rates The adjustments needed to reflect different risks !@#

Impairment measurement (cont’d) Discount rate should be: • The current market rate appropriate for the risks specific to the asset or cash generating unit • Pre-tax • Consistent with the forecast’s treatment of inflation • Determined after considering – – 24 The company’s weighted average cost of capital The company’s incremental borrowing rate Other market borrowing rates The adjustments needed to reflect different risks !@#

Impairment measurement – individual assets • If the carrying amount of an asset exceeds its recoverable amount, it should be written down – The reduction in value – the impairment loss – is normally expensed in the income statement – If the asset had been revalued, the impairment loss is treated as a revaluation decrease – An asset should not be written down below zero unless it is required to recognise a liability under another standard – The new carrying amount forms the basis for future depreciation and revised deferred tax balances 25 !@#

Impairment measurement – individual assets • If the carrying amount of an asset exceeds its recoverable amount, it should be written down – The reduction in value – the impairment loss – is normally expensed in the income statement – If the asset had been revalued, the impairment loss is treated as a revaluation decrease – An asset should not be written down below zero unless it is required to recognise a liability under another standard – The new carrying amount forms the basis for future depreciation and revised deferred tax balances 25 !@#

Impairment measurement – cash generating units • The impairment loss should be allocated: – First to any goodwill in the unit – Then, on a pro rata basis, against the other assets in the unit, but not so as to write down any below the highest of • its net selling price (if determinable) • its value in use (if determinable) • Zero – Any amount remaining unallocated should only be treated as a liability if required by another standard 26 !@#

Impairment measurement – cash generating units • The impairment loss should be allocated: – First to any goodwill in the unit – Then, on a pro rata basis, against the other assets in the unit, but not so as to write down any below the highest of • its net selling price (if determinable) • its value in use (if determinable) • Zero – Any amount remaining unallocated should only be treated as a liability if required by another standard 26 !@#

Impairment measurement – Reversal of an impairment loss • In subsequent periods, companies should look for indications that an impairment loss has reversed – – – Increase in an asset’s market value Favourable changes in the company’s environment Decreases in interest rates/other rates of return Favourable changes within the company Improved performance of the asset • If these exist, the recoverable amount should be re-estimated, and the loss reversed if appropriate 27 !@#

Impairment measurement – Reversal of an impairment loss • In subsequent periods, companies should look for indications that an impairment loss has reversed – – – Increase in an asset’s market value Favourable changes in the company’s environment Decreases in interest rates/other rates of return Favourable changes within the company Improved performance of the asset • If these exist, the recoverable amount should be re-estimated, and the loss reversed if appropriate 27 !@#

Impairment measurement – Reversal of an impairment loss • The reversal is limited to the amount that brings the asset back to the carrying amount it would now be stated as if no loss had been recognised • The reversal is credited to the income statement, or treated as a revaluation increase for revalued assets • In a cash generating unit, it should be allocated pro rata to assets other than goodwill to restore them to their previous amounts, only if – The loss was caused by a specific external event of an exceptional nature that will not recur, and – That specific event has now been reversed • The reversal of the impairment loss recognised for goodwill is prohibited 28 !@#

Impairment measurement – Reversal of an impairment loss • The reversal is limited to the amount that brings the asset back to the carrying amount it would now be stated as if no loss had been recognised • The reversal is credited to the income statement, or treated as a revaluation increase for revalued assets • In a cash generating unit, it should be allocated pro rata to assets other than goodwill to restore them to their previous amounts, only if – The loss was caused by a specific external event of an exceptional nature that will not recur, and – That specific event has now been reversed • The reversal of the impairment loss recognised for goodwill is prohibited 28 !@#

First-time adoption issues Impacts of IAS 36 on financial reporting: • As IAS 36 prescribes very precise indicators for triggering impairment tests, entities will probably have to perform such tests more frequently than under previous GAAP. • The lower-level aggregation of assets may lead to the recognition of impairment losses that do not arise under existing local GAAP. • IAS 1 requires that all amortization amounts and impairment losses are reported under results from continuing operations in the income statement. • IAS 36 prescribes numerous disclosures relating to the impairment of assets, even if they are of confidential nature 29 !@#

First-time adoption issues Impacts of IAS 36 on financial reporting: • As IAS 36 prescribes very precise indicators for triggering impairment tests, entities will probably have to perform such tests more frequently than under previous GAAP. • The lower-level aggregation of assets may lead to the recognition of impairment losses that do not arise under existing local GAAP. • IAS 1 requires that all amortization amounts and impairment losses are reported under results from continuing operations in the income statement. • IAS 36 prescribes numerous disclosures relating to the impairment of assets, even if they are of confidential nature 29 !@#

First-time adoption issues (cont’d) • Except for goodwill, first-time adopters have the benefit of a number of exemptions from the requirement of full restatement of opening IFRS balance sheet, in particular the fair value as deemed cost for fixed assets. • Impairment test is required if there is any indication that an asset is impaired. If a first-time adopter recognise or reverse any impairment losses, it should disclose detailed information. 30 !@#

First-time adoption issues (cont’d) • Except for goodwill, first-time adopters have the benefit of a number of exemptions from the requirement of full restatement of opening IFRS balance sheet, in particular the fair value as deemed cost for fixed assets. • Impairment test is required if there is any indication that an asset is impaired. If a first-time adopter recognise or reverse any impairment losses, it should disclose detailed information. 30 !@#

Refresh – Classification as held for sale • A non current asset is classified as held for sale if its carrying amount will be recovered principally through a sale transaction rather than through continuing use • It must be available for immediate sale, and sale must be highly probable, which requires that – – – management is committed to a plan to sell it an active programme to fulfil the plan has been started it must be being marketed at a reasonable price a completed sale within a year must be expected significant changes to the plan must be unlikely • Non current asset held for sale is different from assets to be abandoned 31 !@#

Refresh – Classification as held for sale • A non current asset is classified as held for sale if its carrying amount will be recovered principally through a sale transaction rather than through continuing use • It must be available for immediate sale, and sale must be highly probable, which requires that – – – management is committed to a plan to sell it an active programme to fulfil the plan has been started it must be being marketed at a reasonable price a completed sale within a year must be expected significant changes to the plan must be unlikely • Non current asset held for sale is different from assets to be abandoned 31 !@#

Classification as Held for Sale – Scenario • Good Group acquires through foreclosure a property comprising land buildings that it intends to sell. • After the renovations are completed and the property is classified as held for sale but before a firm purchase commitment is obtained, Good Group becomes aware of environmental damage requiring remediation. The Good Group still intends to sell the property immediately after the remediation is completed. Question: • Did Good Group corrrectly classify the property as held for sale? Answer • No, Good Group did not correctly classify the property. Even if Good Group still intends to sell the property after the remediation is completed, Good Group does not have the ability to transfer the property to a buyer until after the remediation is completed. The delay in the timing of the transfer of the property imposed by others before a firm purchase commitment is obtained demonstrates that the property is not available for immediate sale (different requirements could apply if this happened after a firm commitment is obtained). The criterion of IFRS 5. 7 has not been met. The property should be reclassified as held and used. 32 !@#

Classification as Held for Sale – Scenario • Good Group acquires through foreclosure a property comprising land buildings that it intends to sell. • After the renovations are completed and the property is classified as held for sale but before a firm purchase commitment is obtained, Good Group becomes aware of environmental damage requiring remediation. The Good Group still intends to sell the property immediately after the remediation is completed. Question: • Did Good Group corrrectly classify the property as held for sale? Answer • No, Good Group did not correctly classify the property. Even if Good Group still intends to sell the property after the remediation is completed, Good Group does not have the ability to transfer the property to a buyer until after the remediation is completed. The delay in the timing of the transfer of the property imposed by others before a firm purchase commitment is obtained demonstrates that the property is not available for immediate sale (different requirements could apply if this happened after a firm commitment is obtained). The criterion of IFRS 5. 7 has not been met. The property should be reclassified as held and used. 32 !@#

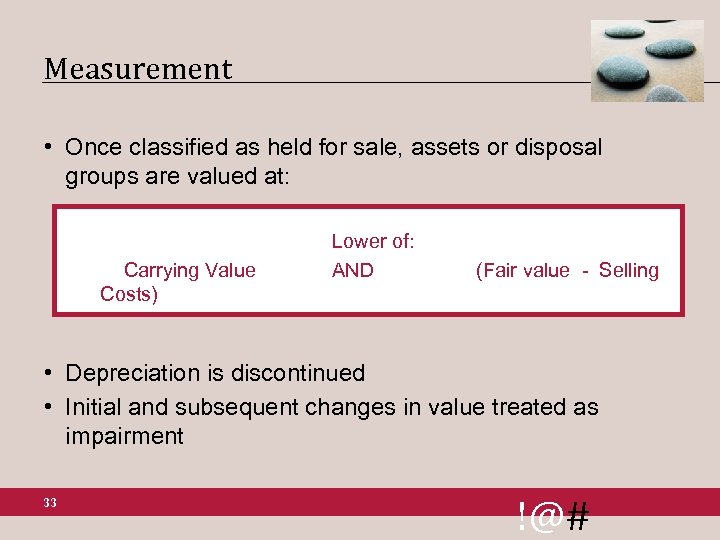

Measurement • Once classified as held for sale, assets or disposal groups are valued at: Carrying Value Costs) Lower of: AND (Fair value - Selling • Depreciation is discontinued • Initial and subsequent changes in value treated as impairment 33 !@#

Measurement • Once classified as held for sale, assets or disposal groups are valued at: Carrying Value Costs) Lower of: AND (Fair value - Selling • Depreciation is discontinued • Initial and subsequent changes in value treated as impairment 33 !@#

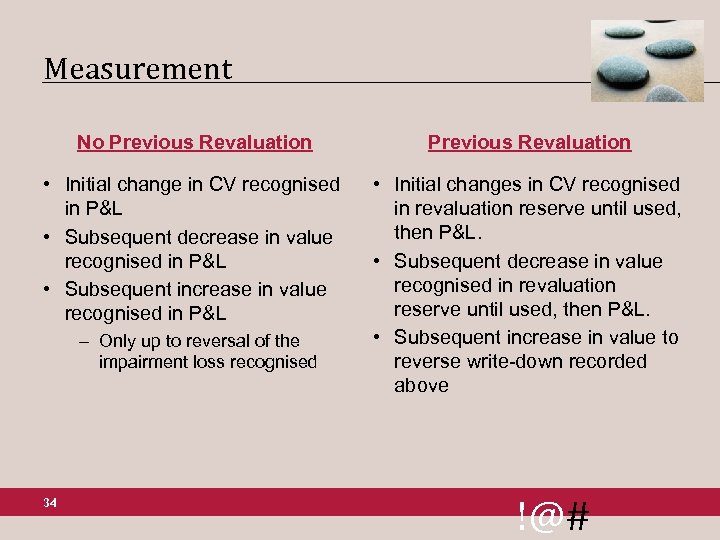

Measurement No Previous Revaluation • Initial change in CV recognised in P&L • Subsequent decrease in value recognised in P&L • Subsequent increase in value recognised in P&L • Initial changes in CV recognised in revaluation reserve until used, then P&L. • Subsequent decrease in value recognised in revaluation reserve until used, then P&L. • Subsequent increase in value to reverse write-down recorded above – Only up to reversal of the impairment loss recognised 34 !@#

Measurement No Previous Revaluation • Initial change in CV recognised in P&L • Subsequent decrease in value recognised in P&L • Subsequent increase in value recognised in P&L • Initial changes in CV recognised in revaluation reserve until used, then P&L. • Subsequent decrease in value recognised in revaluation reserve until used, then P&L. • Subsequent increase in value to reverse write-down recorded above – Only up to reversal of the impairment loss recognised 34 !@#

Assets Held for Sale and Discontinued Operations An asset held for sale should not be confused with a discontinued operation that is a component of an entity that either has been disposed of, or is classified as held for sale, and (a) represents a separate major line of business or geographical area of operations; (b) is part of a single co-ordinated plan to dispose of a separate major line of business or geographical area of operations; or (c) is a subsidiary acquired exclusively with a view to resale. In such case, the company would present the income statement of the discontinued operation in one single line in the consolidated income statement. 35 !@#

Assets Held for Sale and Discontinued Operations An asset held for sale should not be confused with a discontinued operation that is a component of an entity that either has been disposed of, or is classified as held for sale, and (a) represents a separate major line of business or geographical area of operations; (b) is part of a single co-ordinated plan to dispose of a separate major line of business or geographical area of operations; or (c) is a subsidiary acquired exclusively with a view to resale. In such case, the company would present the income statement of the discontinued operation in one single line in the consolidated income statement. 35 !@#

Q&A 36 !@#

Q&A 36 !@#