af0e336b2d1db72d58d74911dfdd634a.ppt

- Количество слайдов: 35

Impacts of the Financial Tsunami on the Hong Kong Economy Government Economist 3 November 2008 1

Impacts of the Financial Tsunami on the Hong Kong Economy Government Economist 3 November 2008 1

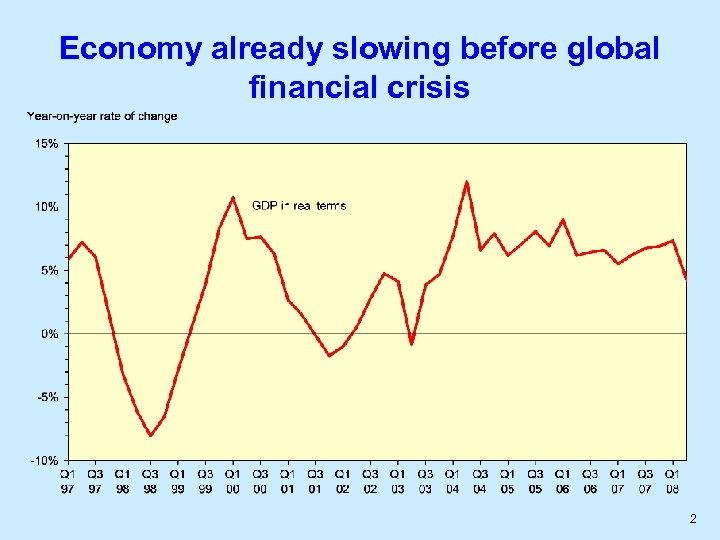

Economy already slowing before global financial crisis 2

Economy already slowing before global financial crisis 2

Global financial crisis adding significant downside risks to HK economy • Global financial crisis mutated into synchronised downturn • Financial markets under exceptional stress credit conditions unusually tight • Key risk facing advanced economies is downward spiral between asset prices and real economy, leading to prolonged slump • Increasing impact on Asia in coming quarters 3

Global financial crisis adding significant downside risks to HK economy • Global financial crisis mutated into synchronised downturn • Financial markets under exceptional stress credit conditions unusually tight • Key risk facing advanced economies is downward spiral between asset prices and real economy, leading to prolonged slump • Increasing impact on Asia in coming quarters 3

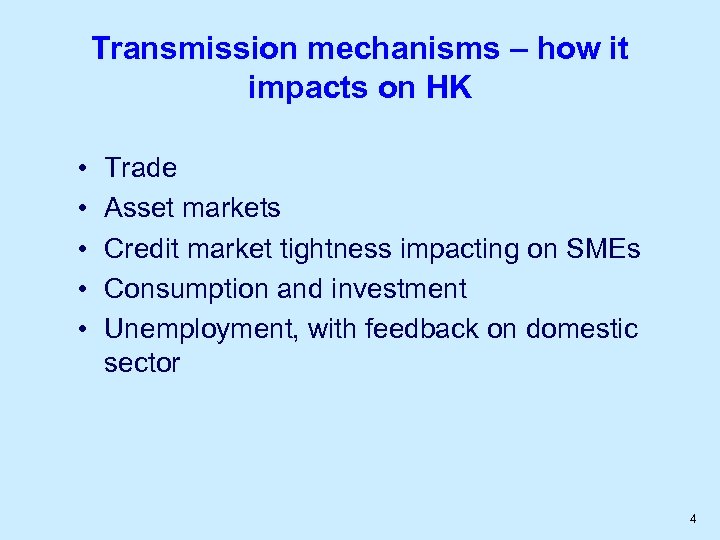

Transmission mechanisms – how it impacts on HK • • • Trade Asset markets Credit market tightness impacting on SMEs Consumption and investment Unemployment, with feedback on domestic sector 4

Transmission mechanisms – how it impacts on HK • • • Trade Asset markets Credit market tightness impacting on SMEs Consumption and investment Unemployment, with feedback on domestic sector 4

Impact on trade 5

Impact on trade 5

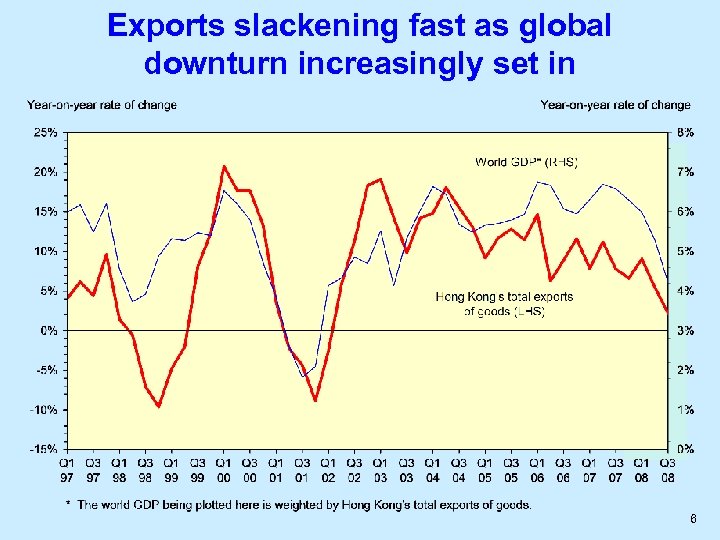

Exports slackening fast as global downturn increasingly set in 6

Exports slackening fast as global downturn increasingly set in 6

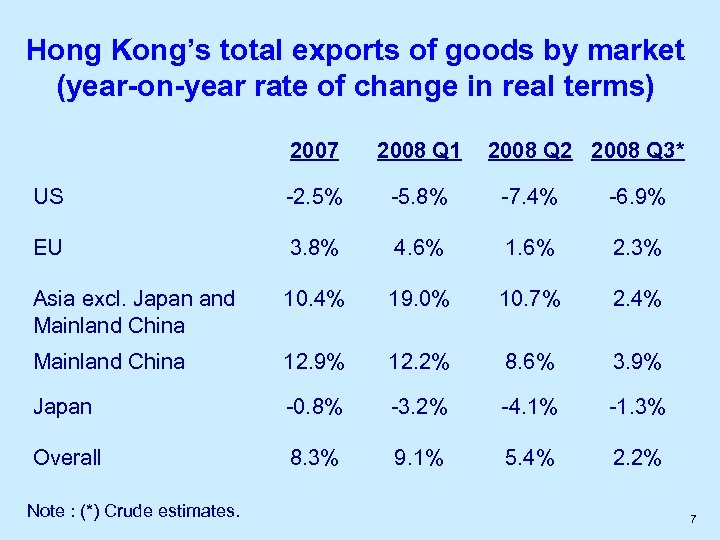

Hong Kong’s total exports of goods by market (year-on-year rate of change in real terms) 2007 2008 Q 1 US -2. 5% -5. 8% -7. 4% -6. 9% EU 3. 8% 4. 6% 1. 6% 2. 3% Asia excl. Japan and Mainland China 10. 4% 19. 0% 10. 7% 2. 4% Mainland China 12. 9% 12. 2% 8. 6% 3. 9% Japan -0. 8% -3. 2% -4. 1% -1. 3% Overall 8. 3% 9. 1% 5. 4% 2. 2% Note : (*) Crude estimates. 2008 Q 2 2008 Q 3* 7

Hong Kong’s total exports of goods by market (year-on-year rate of change in real terms) 2007 2008 Q 1 US -2. 5% -5. 8% -7. 4% -6. 9% EU 3. 8% 4. 6% 1. 6% 2. 3% Asia excl. Japan and Mainland China 10. 4% 19. 0% 10. 7% 2. 4% Mainland China 12. 9% 12. 2% 8. 6% 3. 9% Japan -0. 8% -3. 2% -4. 1% -1. 3% Overall 8. 3% 9. 1% 5. 4% 2. 2% Note : (*) Crude estimates. 2008 Q 2 2008 Q 3* 7

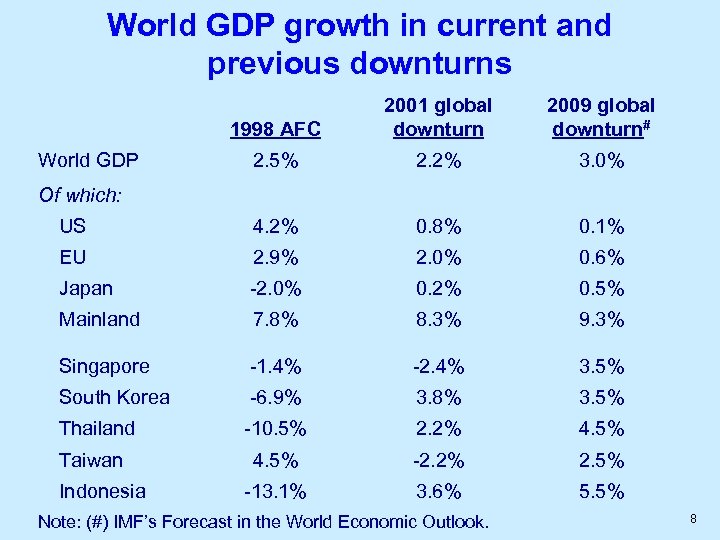

World GDP growth in current and previous downturns 1998 AFC 2001 global downturn 2009 global downturn# 2. 5% 2. 2% 3. 0% US 4. 2% 0. 8% 0. 1% EU 2. 9% 2. 0% 0. 6% Japan -2. 0% 0. 2% 0. 5% Mainland 7. 8% 8. 3% 9. 3% Singapore -1. 4% -2. 4% 3. 5% South Korea -6. 9% 3. 8% 3. 5% Thailand -10. 5% 2. 2% 4. 5% -2. 2% 2. 5% -13. 1% 3. 6% 5. 5% World GDP Of which: Taiwan Indonesia Note: (#) IMF’s Forecast in the World Economic Outlook. 8

World GDP growth in current and previous downturns 1998 AFC 2001 global downturn 2009 global downturn# 2. 5% 2. 2% 3. 0% US 4. 2% 0. 8% 0. 1% EU 2. 9% 2. 0% 0. 6% Japan -2. 0% 0. 2% 0. 5% Mainland 7. 8% 8. 3% 9. 3% Singapore -1. 4% -2. 4% 3. 5% South Korea -6. 9% 3. 8% 3. 5% Thailand -10. 5% 2. 2% 4. 5% -2. 2% 2. 5% -13. 1% 3. 6% 5. 5% World GDP Of which: Taiwan Indonesia Note: (#) IMF’s Forecast in the World Economic Outlook. 8

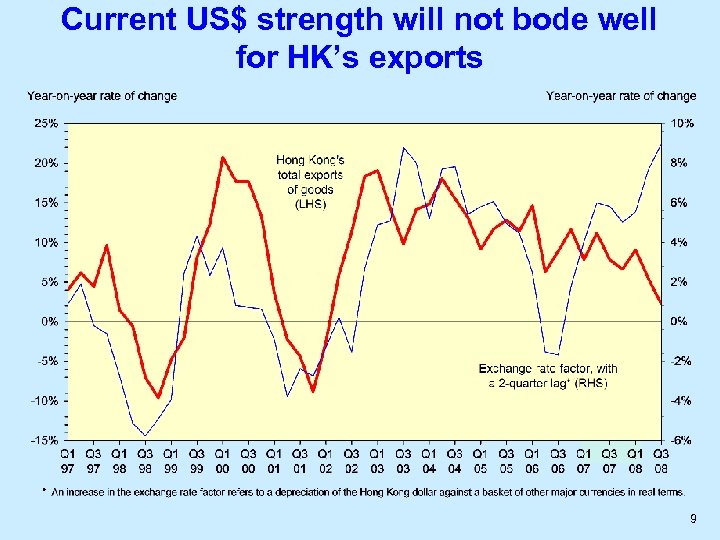

Current US$ strength will not bode well for HK’s exports 9

Current US$ strength will not bode well for HK’s exports 9

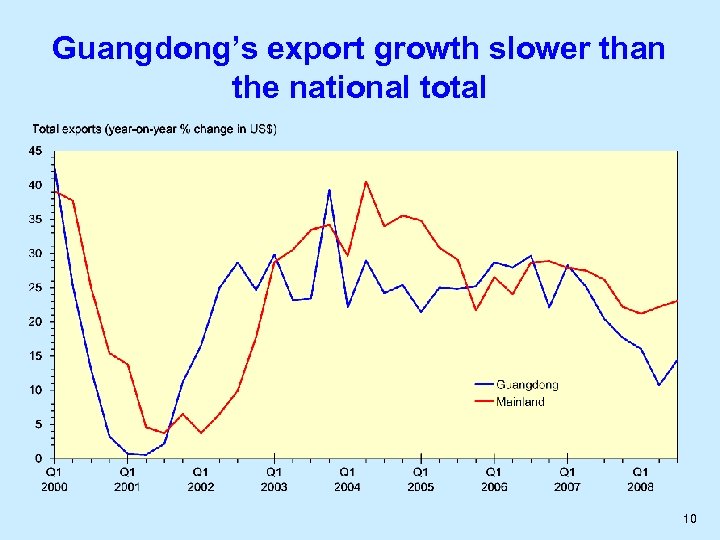

Guangdong’s export growth slower than the national total 10

Guangdong’s export growth slower than the national total 10

Impact on asset markets and domestic demand 11

Impact on asset markets and domestic demand 11

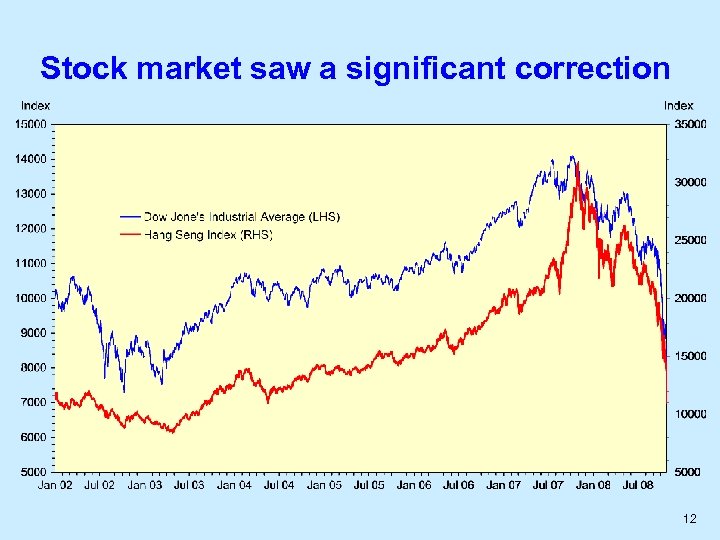

Stock market saw a significant correction 12

Stock market saw a significant correction 12

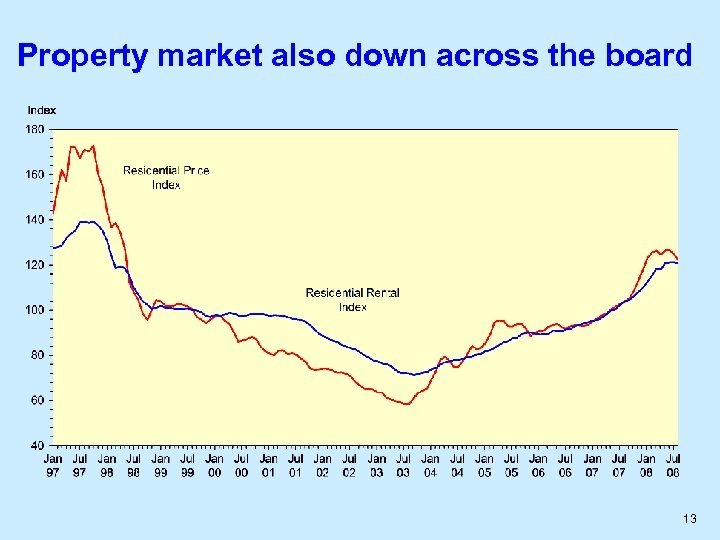

Property market also down across the board 13

Property market also down across the board 13

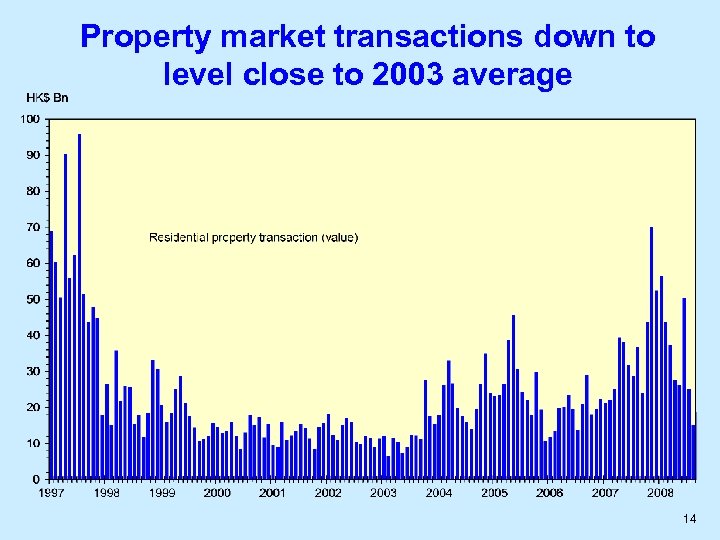

Property market transactions down to level close to 2003 average 14

Property market transactions down to level close to 2003 average 14

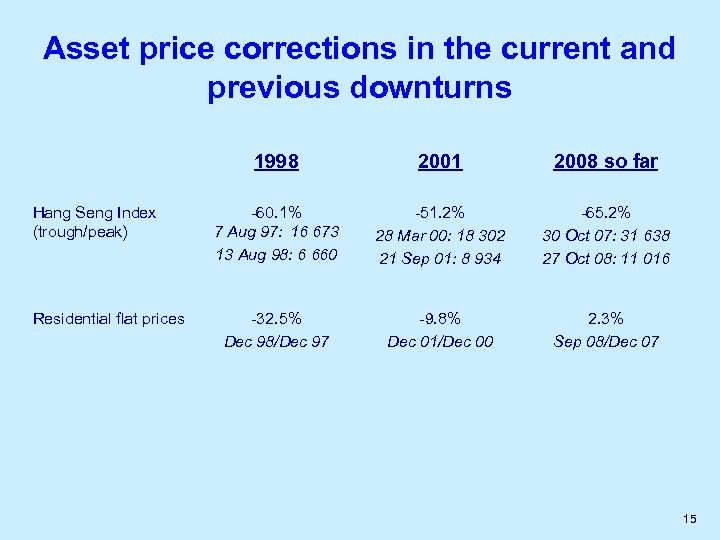

Asset price corrections in the current and previous downturns 1998 Hang Seng Index (trough/peak) Residential flat prices 2001 2008 so far -60. 1% 7 Aug 97: 16 673 13 Aug 98: 6 660 -51. 2% 28 Mar 00: 18 302 21 Sep 01: 8 934 -65. 2% 30 Oct 07: 31 638 27 Oct 08: 11 016 -32. 5% Dec 98/Dec 97 -9. 8% Dec 01/Dec 00 2. 3% Sep 08/Dec 07 15

Asset price corrections in the current and previous downturns 1998 Hang Seng Index (trough/peak) Residential flat prices 2001 2008 so far -60. 1% 7 Aug 97: 16 673 13 Aug 98: 6 660 -51. 2% 28 Mar 00: 18 302 21 Sep 01: 8 934 -65. 2% 30 Oct 07: 31 638 27 Oct 08: 11 016 -32. 5% Dec 98/Dec 97 -9. 8% Dec 01/Dec 00 2. 3% Sep 08/Dec 07 15

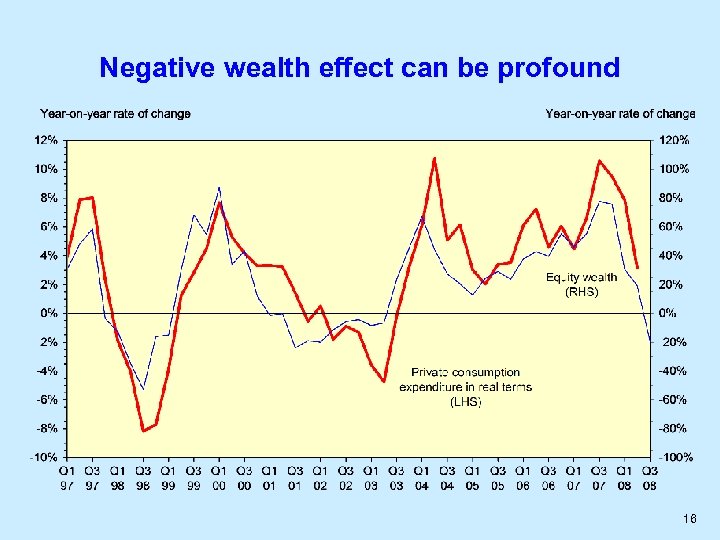

Negative wealth effect can be profound 16

Negative wealth effect can be profound 16

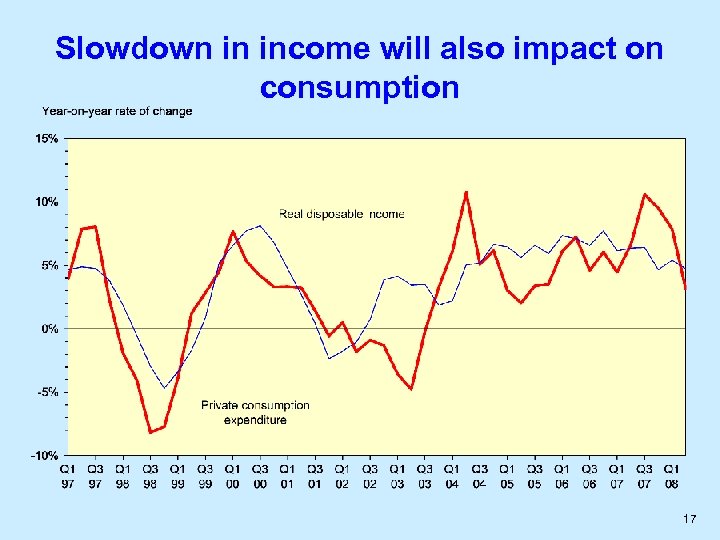

Slowdown in income will also impact on consumption 17

Slowdown in income will also impact on consumption 17

Impact on Businesses 18

Impact on Businesses 18

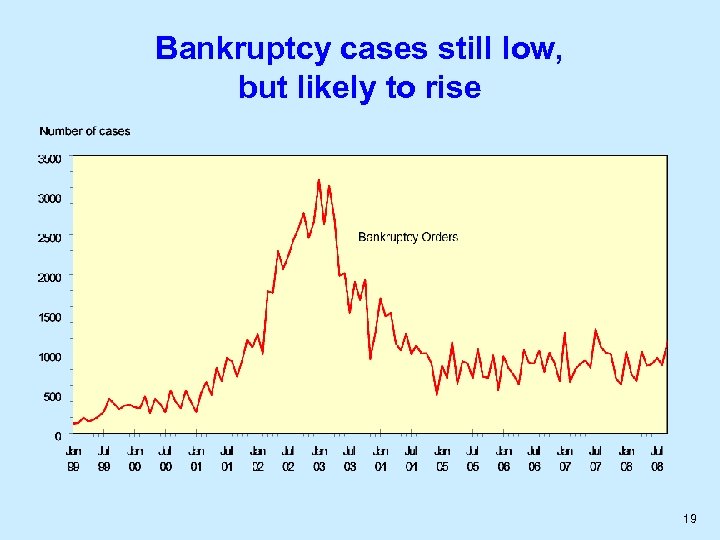

Bankruptcy cases still low, but likely to rise 19

Bankruptcy cases still low, but likely to rise 19

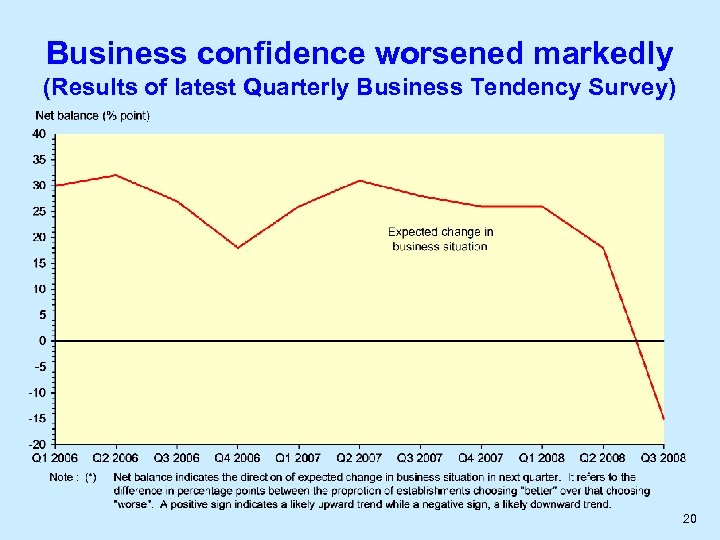

Business confidence worsened markedly (Results of latest Quarterly Business Tendency Survey) 20

Business confidence worsened markedly (Results of latest Quarterly Business Tendency Survey) 20

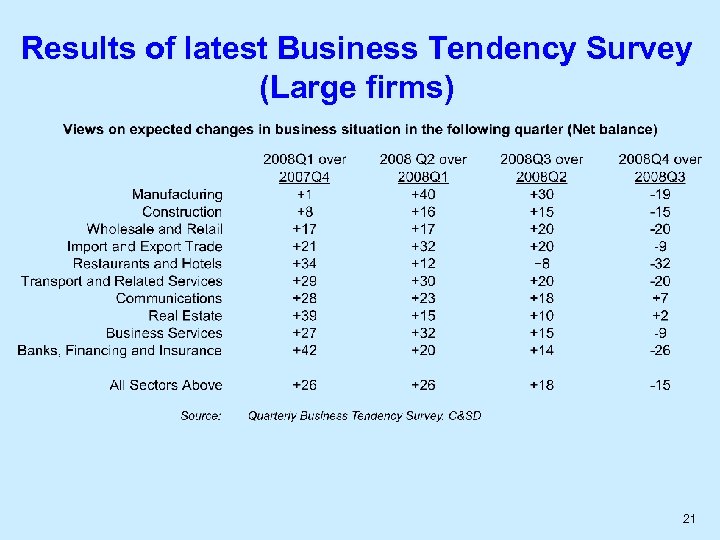

Results of latest Business Tendency Survey (Large firms) 21

Results of latest Business Tendency Survey (Large firms) 21

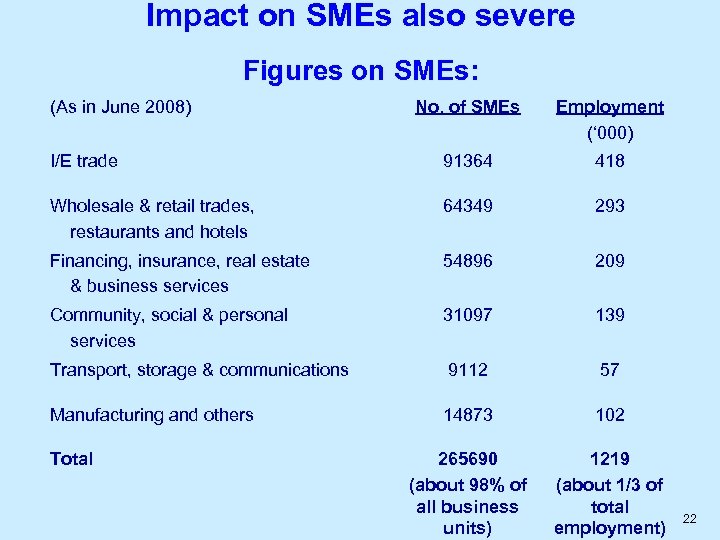

Impact on SMEs also severe Figures on SMEs: (As in June 2008) No. of SMEs Employment (‘ 000) I/E trade 91364 418 Wholesale & retail trades, restaurants and hotels 64349 293 Financing, insurance, real estate & business services 54896 209 Community, social & personal services 31097 139 Transport, storage & communications 9112 57 Manufacturing and others 14873 102 265690 (about 98% of all business units) 1219 (about 1/3 of total employment) Total 22

Impact on SMEs also severe Figures on SMEs: (As in June 2008) No. of SMEs Employment (‘ 000) I/E trade 91364 418 Wholesale & retail trades, restaurants and hotels 64349 293 Financing, insurance, real estate & business services 54896 209 Community, social & personal services 31097 139 Transport, storage & communications 9112 57 Manufacturing and others 14873 102 265690 (about 98% of all business units) 1219 (about 1/3 of total employment) Total 22

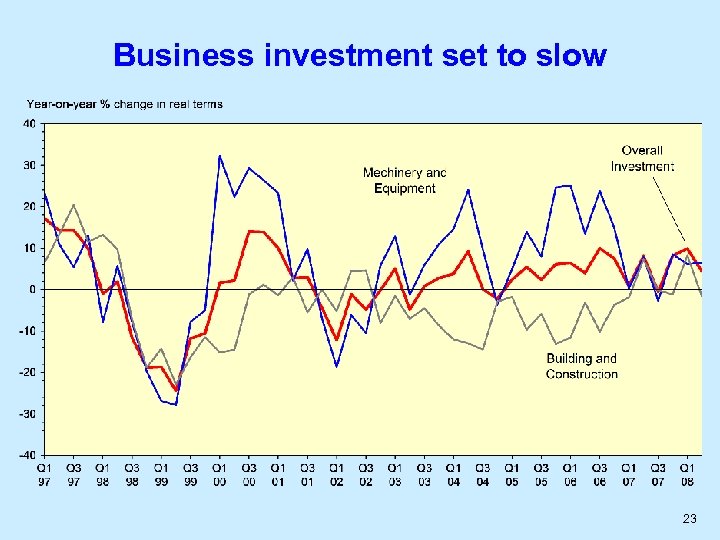

Business investment set to slow 23

Business investment set to slow 23

Impact on labour market 24

Impact on labour market 24

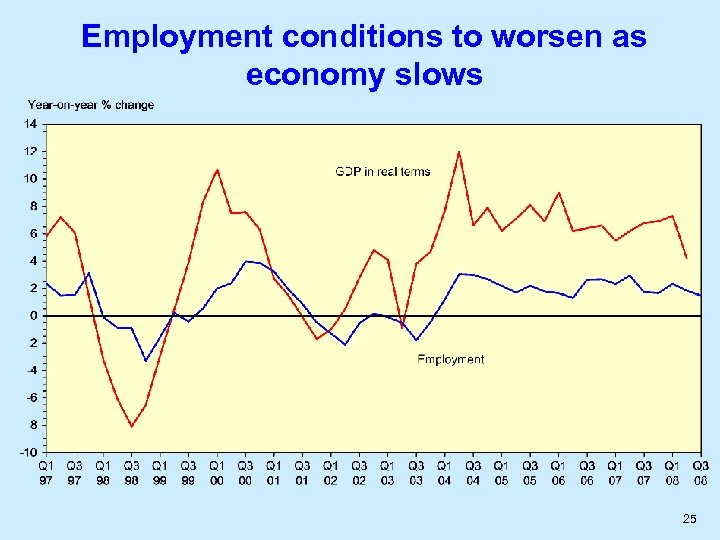

Employment conditions to worsen as economy slows 25

Employment conditions to worsen as economy slows 25

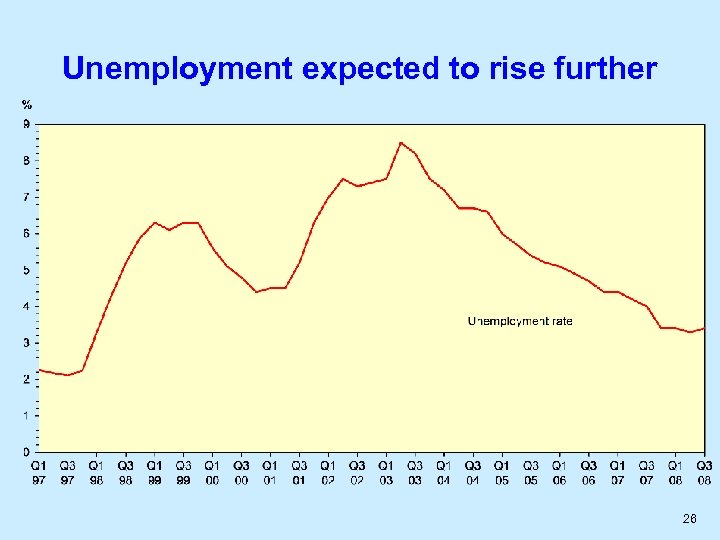

Unemployment expected to rise further 26

Unemployment expected to rise further 26

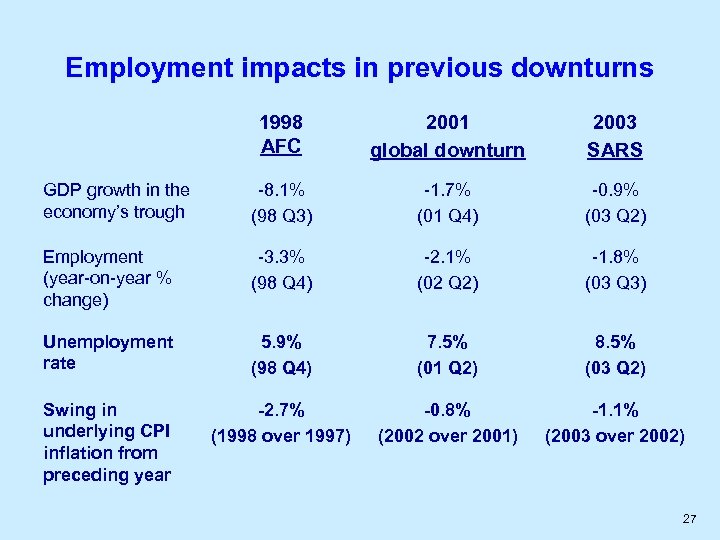

Employment impacts in previous downturns 1998 AFC 2001 global downturn 2003 SARS GDP growth in the economy’s trough -8. 1% (98 Q 3) -1. 7% (01 Q 4) -0. 9% (03 Q 2) Employment (year-on-year % change) -3. 3% (98 Q 4) -2. 1% (02 Q 2) -1. 8% (03 Q 3) Unemployment rate 5. 9% (98 Q 4) 7. 5% (01 Q 2) 8. 5% (03 Q 2) Swing in underlying CPI inflation from preceding year -2. 7% (1998 over 1997) -0. 8% (2002 over 2001) -1. 1% (2003 over 2002) 27

Employment impacts in previous downturns 1998 AFC 2001 global downturn 2003 SARS GDP growth in the economy’s trough -8. 1% (98 Q 3) -1. 7% (01 Q 4) -0. 9% (03 Q 2) Employment (year-on-year % change) -3. 3% (98 Q 4) -2. 1% (02 Q 2) -1. 8% (03 Q 3) Unemployment rate 5. 9% (98 Q 4) 7. 5% (01 Q 2) 8. 5% (03 Q 2) Swing in underlying CPI inflation from preceding year -2. 7% (1998 over 1997) -0. 8% (2002 over 2001) -1. 1% (2003 over 2002) 27

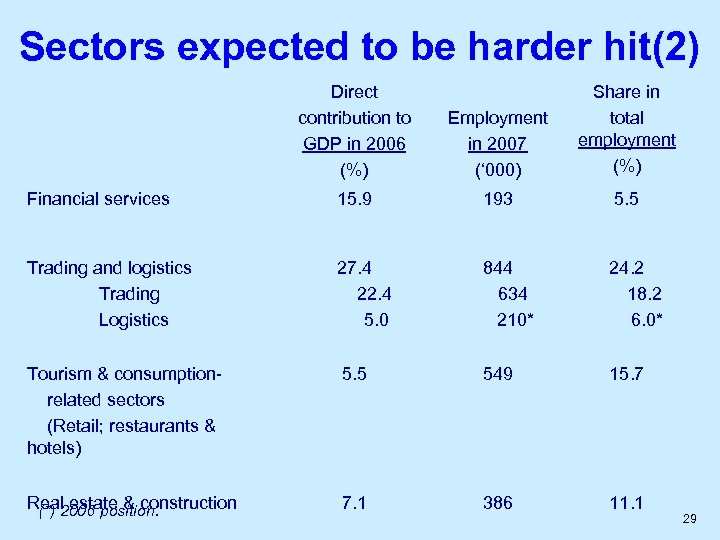

Sectors expected to be harder hit(1) • Financial services • Trading and logistics • Tourism and consumption-related • Real estate and construction 28

Sectors expected to be harder hit(1) • Financial services • Trading and logistics • Tourism and consumption-related • Real estate and construction 28

Sectors expected to be harder hit(2) Direct contribution to GDP in 2006 (%) Employment in 2007 (‘ 000) Share in total employment (%) Financial services 15. 9 193 5. 5 Trading and logistics Trading Logistics 27. 4 22. 4 5. 0 844 634 210* 24. 2 18. 2 6. 0* Tourism & consumptionrelated sectors (Retail; restaurants & hotels) 5. 5 549 15. 7 Real estate & construction (*) 2006 position. 7. 1 386 11. 1 29

Sectors expected to be harder hit(2) Direct contribution to GDP in 2006 (%) Employment in 2007 (‘ 000) Share in total employment (%) Financial services 15. 9 193 5. 5 Trading and logistics Trading Logistics 27. 4 22. 4 5. 0 844 634 210* 24. 2 18. 2 6. 0* Tourism & consumptionrelated sectors (Retail; restaurants & hotels) 5. 5 549 15. 7 Real estate & construction (*) 2006 position. 7. 1 386 11. 1 29

Wide range of uncertainties ahead 30

Wide range of uncertainties ahead 30

HK’s economic slowdown will be more severe if: • Global financial market meltdown • Global downturn degenerated into prolonged and severe slump; and Asia moving into recession • US$ continues to strengthen • China's exports slow markedly • Property market suffers continued fall-off 31

HK’s economic slowdown will be more severe if: • Global financial market meltdown • Global downturn degenerated into prolonged and severe slump; and Asia moving into recession • US$ continues to strengthen • China's exports slow markedly • Property market suffers continued fall-off 31

Factors that may cushion HK against a severe slowdown : • Global concerted efforts to prevent systemic crisis from spreading further • Global financial markets stabilise • CPG’s support for Hong Kong: Premier Wen’s recent remarks • China maintains reasonably strong momentum, especially in trade • Interest rates hold stable or move down • US$ to reverse trend • Infrastructure projects can speed up 32

Factors that may cushion HK against a severe slowdown : • Global concerted efforts to prevent systemic crisis from spreading further • Global financial markets stabilise • CPG’s support for Hong Kong: Premier Wen’s recent remarks • China maintains reasonably strong momentum, especially in trade • Interest rates hold stable or move down • US$ to reverse trend • Infrastructure projects can speed up 32

Short-term economic outlook • GDP growth likely to slow down further in Q 4; earlier forecast of 4 -5% for 2008 difficult to attain • Economic conditions will worsen further in early 2009; prospect of turnaround in H 2 2009 still highly uncertain • Unemployment rate looks set to rise further, more visibly in 2009 • Inflation likely to ease as pressures from local and external sources recede significantly 33

Short-term economic outlook • GDP growth likely to slow down further in Q 4; earlier forecast of 4 -5% for 2008 difficult to attain • Economic conditions will worsen further in early 2009; prospect of turnaround in H 2 2009 still highly uncertain • Unemployment rate looks set to rise further, more visibly in 2009 • Inflation likely to ease as pressures from local and external sources recede significantly 33

Overall • Global financial crisis will inflict major shocks on HK economy via various channels • HK's strong fundamentals mean speedy recovery once global situation turns for better • But short term outlook inevitably much dimmer; risk of recession in 2009 now higher • Remain alert to risk of potentially more damaging impact from global crisis • Need to get prepared for difficult period ahead 34

Overall • Global financial crisis will inflict major shocks on HK economy via various channels • HK's strong fundamentals mean speedy recovery once global situation turns for better • But short term outlook inevitably much dimmer; risk of recession in 2009 now higher • Remain alert to risk of potentially more damaging impact from global crisis • Need to get prepared for difficult period ahead 34

END 35

END 35