066e973b790bcfa0ce80c13c95fb273c.ppt

- Количество слайдов: 14

Impact of Lehman Brothers bankruptcy on post-trade system in Japan 4 July, 2009 Dhaka, Bangladesh Japan Securities Depository Center, Inc.

IMPACT of Subprime Crisis and Lehman Brothers Bankruptcy on Asian Economies and Japan 2

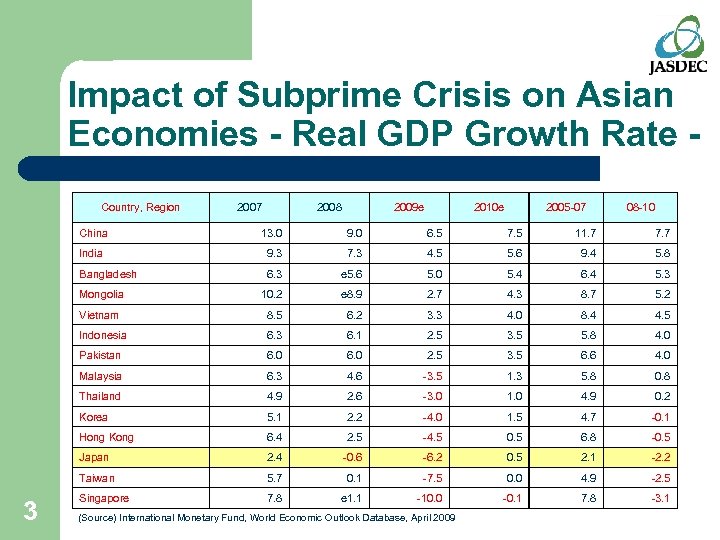

Impact of Subprime Crisis on Asian Economies - Real GDP Growth Rate Country, Region 2007 2008 2009 e 2010 e 2005 -07 08 -10 China 9. 0 6. 5 7. 5 11. 7 7. 7 India 9. 3 7. 3 4. 5 5. 6 9. 4 5. 8 Bangladesh 6. 3 e 5. 6 5. 0 5. 4 6. 4 5. 3 Mongolia 10. 2 e 8. 9 2. 7 4. 3 8. 7 5. 2 Vietnam 8. 5 6. 2 3. 3 4. 0 8. 4 4. 5 Indonesia 6. 3 6. 1 2. 5 3. 5 5. 8 4. 0 Pakistan 6. 0 2. 5 3. 5 6. 6 4. 0 Malaysia 6. 3 4. 6 -3. 5 1. 3 5. 8 0. 8 Thailand 4. 9 2. 6 -3. 0 1. 0 4. 9 0. 2 Korea 5. 1 2. 2 -4. 0 1. 5 4. 7 -0. 1 Hong Kong 6. 4 2. 5 -4. 5 0. 5 6. 8 -0. 5 Japan 2. 4 -0. 6 -6. 2 0. 5 2. 1 -2. 2 Taiwan 3 13. 0 5. 7 0. 1 -7. 5 0. 0 4. 9 -2. 5 Singapore 7. 8 e 1. 1 -10. 0 -0. 1 7. 8 -3. 1 (Source) International Monetary Fund, World Economic Outlook Database, April 2009

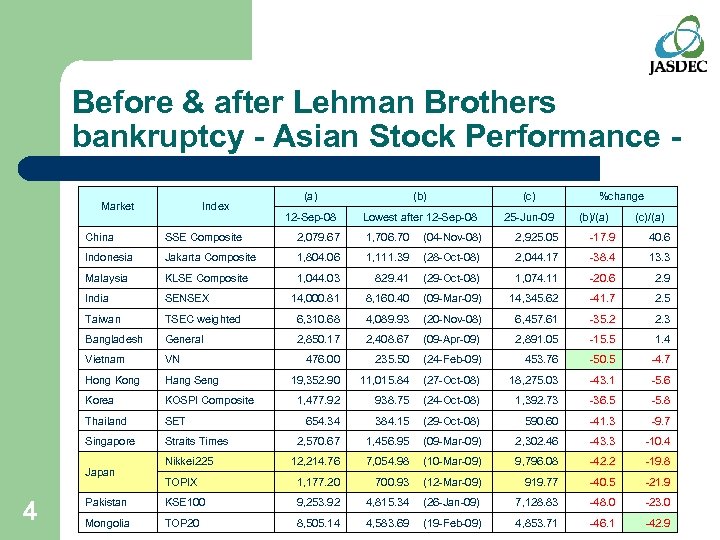

Before & after Lehman Brothers bankruptcy - Asian Stock Performance Market Index (a) (b) (c) 12 -Sep-08 Lowest after 12 -Sep-08 25 -Jun-09 %change (b)/(a) (c)/(a) China SSE Composite 2, 079. 67 1, 706. 70 (04 -Nov-08) 2, 925. 05 -17. 9 40. 6 Indonesia Jakarta Composite 1, 804. 06 1, 111. 39 (28 -Oct-08) 2, 044. 17 -38. 4 13. 3 Malaysia KLSE Composite 1, 044. 03 829. 41 (29 -Oct-08) 1, 074. 11 -20. 6 2. 9 India SENSEX 14, 000. 81 8, 160. 40 (09 -Mar-09) 14, 345. 62 -41. 7 2. 5 Taiwan TSEC weighted 6, 310. 68 4, 089. 93 (20 -Nov-08) 6, 457. 61 -35. 2 2. 3 Bangladesh General 2, 850. 17 2, 408. 67 (09 -Apr-09) 2, 891. 05 -15. 5 1. 4 Vietnam VN 476. 00 235. 50 (24 -Feb-09) 453. 76 -50. 5 -4. 7 Hong Kong Hang Seng 19, 352. 90 11, 015. 84 (27 -Oct-08) 18, 275. 03 -43. 1 -5. 6 Korea KOSPI Composite 1, 477. 92 938. 75 (24 -Oct-08) 1, 392. 73 -36. 5 -5. 8 Thailand SET 654. 34 384. 15 (29 -Oct-08) 590. 60 -41. 3 -9. 7 Singapore Straits Times 2, 570. 67 1, 456. 95 (09 -Mar-09) 2, 302. 46 -43. 3 -10. 4 12, 214. 76 7, 054. 98 (10 -Mar-09) 9, 796. 08 -42. 2 -19. 8 TOPIX 1, 177. 20 700. 93 (12 -Mar-09) 919. 77 -40. 5 -21. 9 Pakistan KSE 100 9, 253. 92 4, 815. 34 (26 -Jan-09) 7, 128. 83 -48. 0 -23. 0 Mongolia TOP 20 8, 505. 14 4, 583. 69 (19 -Feb-09) 4, 853. 71 -46. 1 -42. 9 Japan 4 Nikkei 225

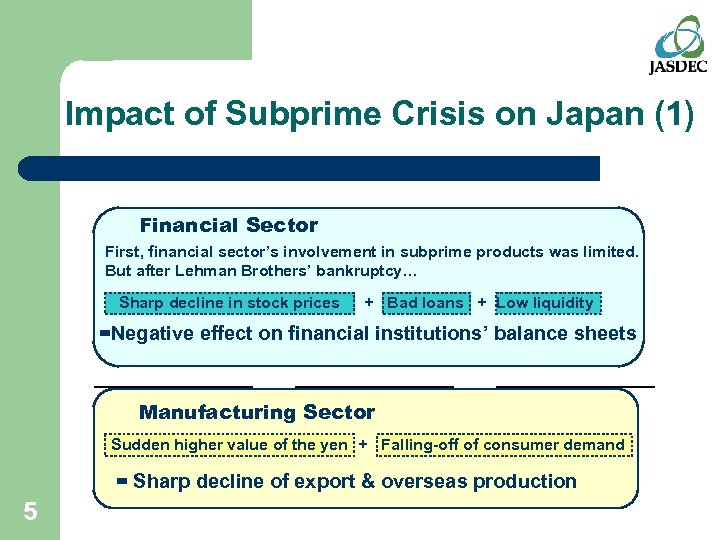

Impact of Subprime Crisis on Japan (1) Financial Sector First, financial sector’s involvement in subprime products was limited. But after Lehman Brothers’ bankruptcy… Sharp decline in stock prices + Bad loans + Low liquidity =Negative effect on financial institutions’ balance sheets Manufacturing Sector Sudden higher value of the yen + Falling-off of consumer demand = Sharp decline of export & overseas production 5

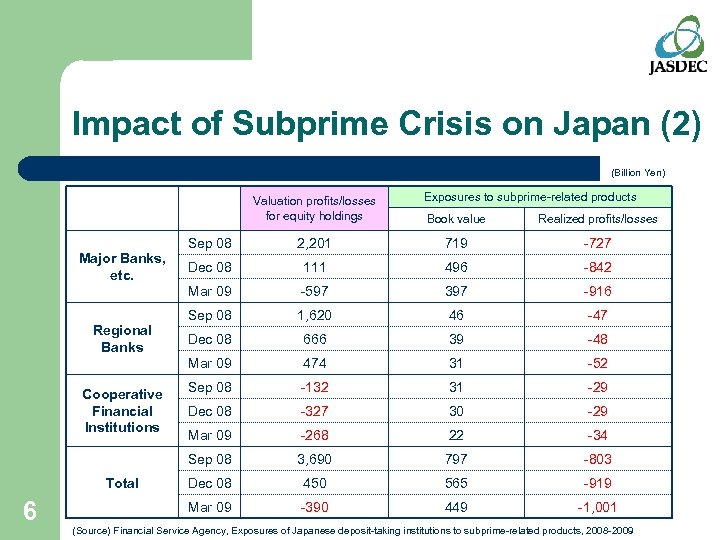

Impact of Subprime Crisis on Japan (2) (Billion Yen) Valuation profits/losses for equity holdings Exposures to subprime-related products Book value Realized profits/losses Cooperative Financial Institutions Total 6 719 -727 Dec 08 111 496 -842 Mar 09 -597 397 -916 Sep 08 1, 620 46 -47 Dec 08 666 39 -48 Mar 09 474 31 -52 Sep 08 -132 31 -29 Dec 08 -327 30 -29 Mar 09 -268 22 -34 3, 690 797 -803 Dec 08 450 565 -919 Mar 09 Regional Banks 2, 201 Sep 08 Major Banks, etc. Sep 08 -390 449 -1, 001 (Source) Financial Service Agency, Exposures of Japanese deposit-taking institutions to subprime-related products, 2008 -2009

IMPACT of Lehman Brothers Bankruptcy on the Post-trade system in Japan 7

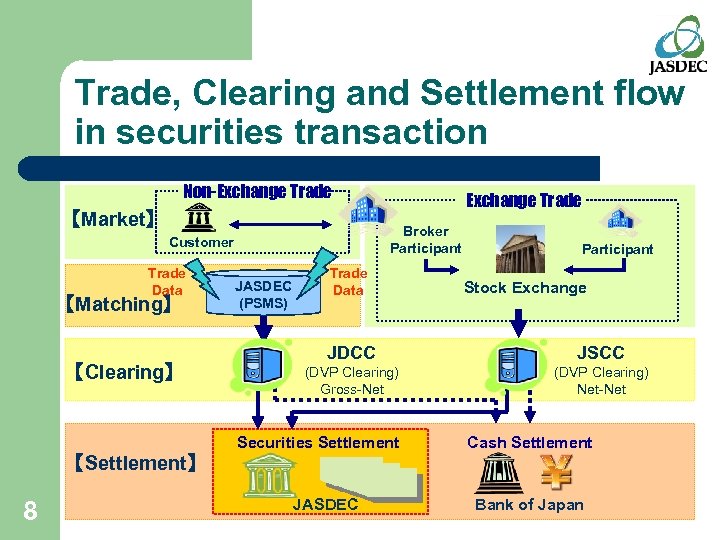

Trade, Clearing and Settlement flow in securities transaction Non-Exchange Trade 【Market】 Broker Participant Customer Trade Data 【Matching】 【Clearing】 Exchange Trade JASDEC (PSMS) Trade Data Participant Stock Exchange JDCC JSCC (DVP Clearing) Gross-Net (DVP Clearing) Net-Net Securities Settlement Cash Settlement 【Settlement】 8 JASDEC Bank of Japan

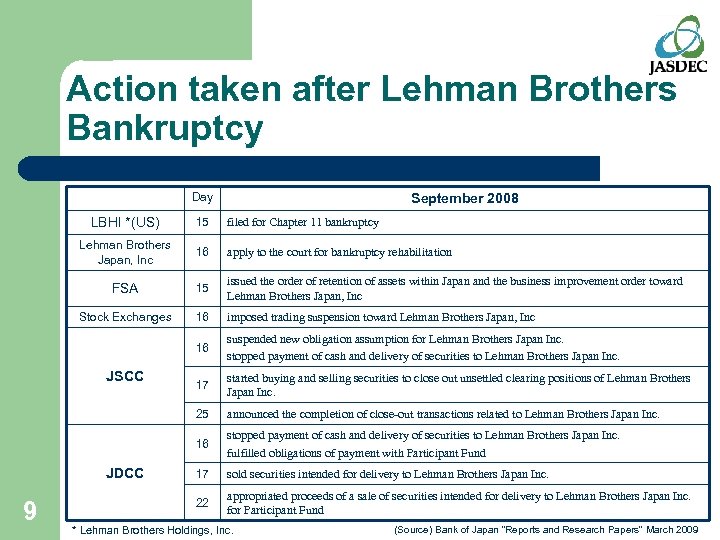

Action taken after Lehman Brothers Bankruptcy Day September 2008 LBHI *(US) 15 filed for Chapter 11 bankruptcy Lehman Brothers Japan, Inc 16 apply to the court for bankruptcy rehabilitation FSA 15 issued the order of retention of assets within Japan and the business improvement order toward Lehman Brothers Japan, Inc Stock Exchanges 16 imposed trading suspension toward Lehman Brothers Japan, Inc 16 suspended new obligation assumption for Lehman Brothers Japan Inc. stopped payment of cash and delivery of securities to Lehman Brothers Japan Inc. 17 started buying and selling securities to close out unsettled clearing positions of Lehman Brothers Japan Inc. 25 announced the completion of close-out transactions related to Lehman Brothers Japan Inc. 16 stopped payment of cash and delivery of securities to Lehman Brothers Japan Inc. fulfilled obligations of payment with Participant Fund 17 sold securities intended for delivery to Lehman Brothers Japan Inc. 22 appropriated proceeds of a sale of securities intended for delivery to Lehman Brothers Japan Inc. for Participant Fund JSCC JDCC 9 * Lehman Brothers Holdings, Inc. (Source) Bank of Japan “Reports and Research Papers” March 2009

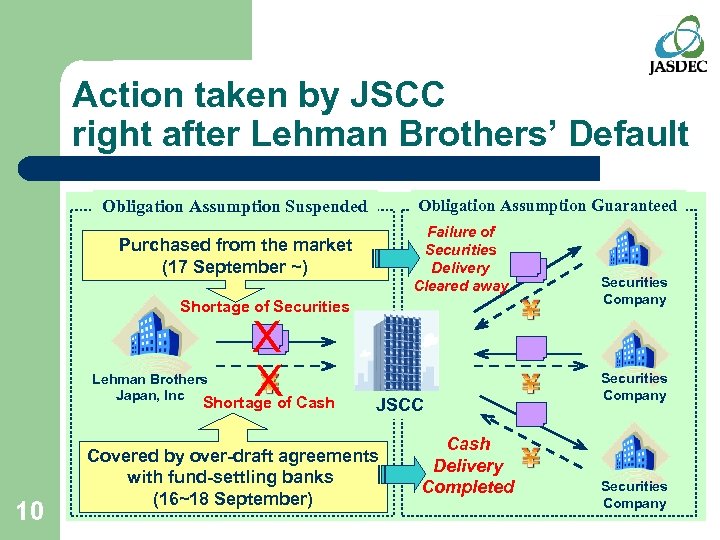

Action taken by JSCC right after Lehman Brothers’ Default Obligation Assumption Guaranteed Obligation Assumption Suspended Failure of Securities Delivery Cleared away Purchased from the market (17 September ~) Shortage of Securities Lehman Brothers Japan, Inc X X Shortage of Cash 10 JSCC Covered by over-draft agreements with fund-settling banks (16~18 September) Cash Delivery Completed Securities Company

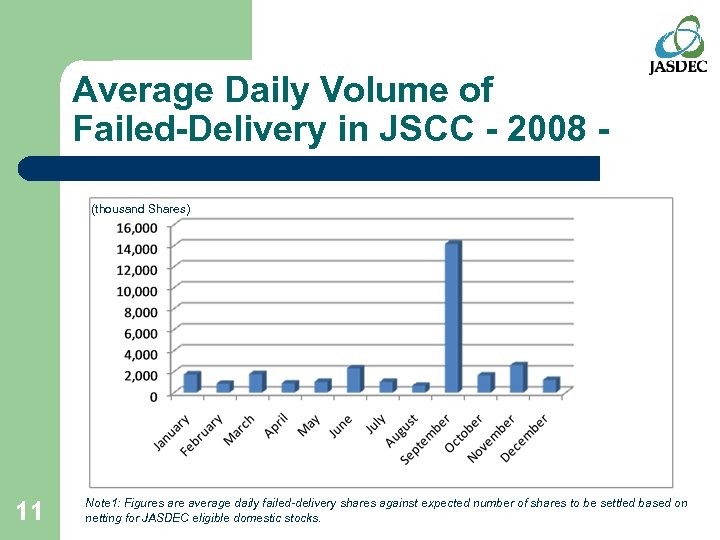

Average Daily Volume of Failed-Delivery in JSCC - 2008 (thousand Shares) 11 Note 1: Figures are average daily failed-delivery shares against expected number of shares to be settled based on netting for JASDEC eligible domestic stocks.

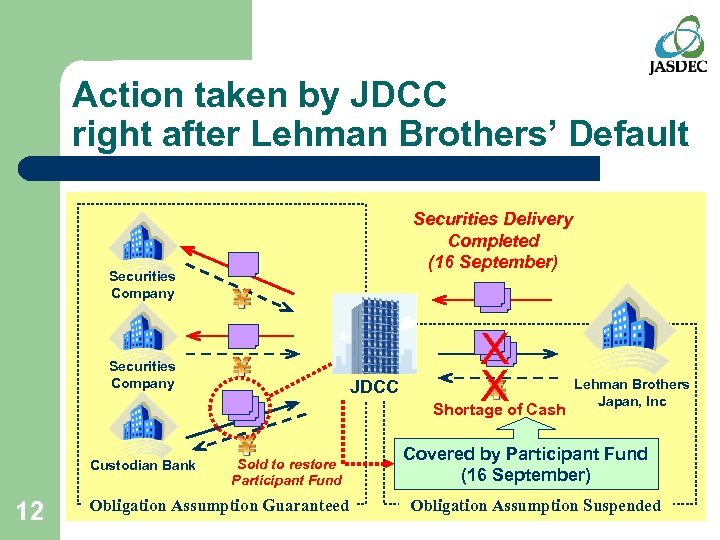

Action taken by JDCC right after Lehman Brothers’ Default Securities Delivery Completed (16 September) Securities Company JDCC X X Shortage of Cash Custodian Bank 12 Sold to restore Participant Fund Obligation Assumption Guaranteed Lehman Brothers Japan, Inc Covered by Participant Fund (16 September) Obligation Assumption Suspended

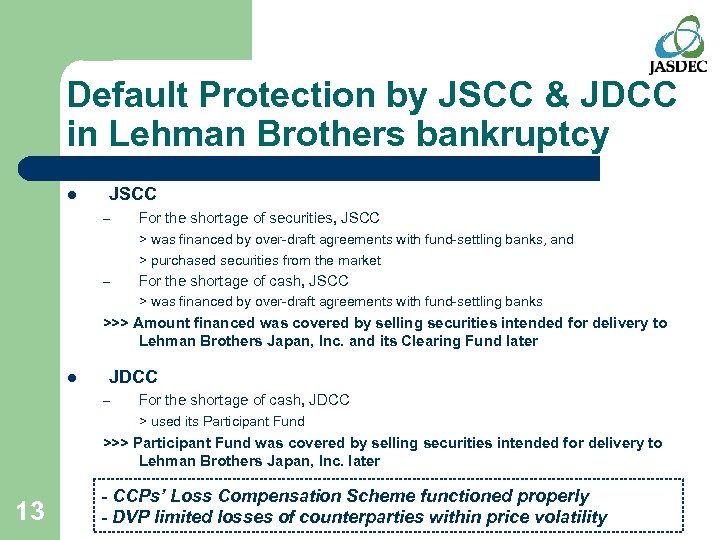

Default Protection by JSCC & JDCC in Lehman Brothers bankruptcy l JSCC – For the shortage of securities, JSCC > was financed by over-draft agreements with fund-settling banks, and > purchased securities from the market – For the shortage of cash, JSCC > was financed by over-draft agreements with fund-settling banks >>> Amount financed was covered by selling securities intended for delivery to Lehman Brothers Japan, Inc. and its Clearing Fund later l JDCC – For the shortage of cash, JDCC > used its Participant Fund >>> Participant Fund was covered by selling securities intended for delivery to Lehman Brothers Japan, Inc. later 13 - CCPs’ Loss Compensation Scheme functioned properly - DVP limited losses of counterparties within price volatility

For inquiries… Please contact: Naoko Watanabe International Department Japan Securities Depository Center, Inc. (n-watanabe@jasdec. com) 14

066e973b790bcfa0ce80c13c95fb273c.ppt