82aa05ea520c7fc1661a30c98b022d2d.ppt

- Количество слайдов: 15

Impact of a GM Bankruptcy • • • GMSSPP or GMPSP 401(K) Promark Income Fund Pension Plan Pension Benefit Guarantee Corporation Can I rollover all or part of my pension plan and 401(K) to an IRA? • What can I do with after tax assets in my 401(K) • How can I access assets from my 401(K) or IRA penalty free before age 59 ½ • Defensive actions to consider

GMSSPP or GMPSP 401(k) • Amounts invested in a 401(k) plan by a participant constitute assets of the 401(k) retirement plan and are held in trust for the benefit of the participant. • These investment assets do NOT belong to the plan sponsor and are segregated and separate from the plan sponsor’s assets. • Under current law, participants’ assets are NOT at risk of being determined to be property of a General Motors bankruptcy estate.

Promark Income Fund • What is Promark Income Fund? – A bank maintained collective investment fund managed by General Motors Trust Bank with a stable value investment strategy. • GMTB is an indirect wholly owned subsidiary of General Motors and a GM Bankruptcy should not affect GMTB’s ability to serve as manager of the fund. – The fund invests in investment grade and non-investment grade fixed income securities (9/08) • 35. 6% Corporate, 25. 8% Mortgage Backed, 20. 5% Government, 11. 5% High Yield, 5. 7% Short term – Insured by wrap contracts issued by several highly rated insurance companies. (AA by S&P) • Aegon, ING, Pacific Life – For more information refer to GM PSP and GM SSPP Prospectus

Pension Plan • Will bankruptcy affect my pension? – Much more complex than 401(k) issue – It is possible that GM Bankruptcy will have no current affect of on the pension plan. – Pension plan could continue to operate through bankruptcy proceedings and could continue to be an obligation of a post-bankruptcy GM. – In some cases, bankrupt companies do choose to terminate their pension plans as part of their reorganization.

Pension Plan Funding • Funding of Pension Plan according to GM filing with the SEC on 2/18/09 – Combined U. S. pension assets dropped to $84. 2 billion on 12/31/08 compared to $104. 1 billion at end of 2007. Funding levels dropped from 124% to 87%. • Market correction (GM pension 26% equities) • Early Retirement Buy outs – Hourly pension now $55. 5 billion and 83% funded – Salaried pension now $28. 7 billion and 95% funded – May have to seek additional financial support in 2013 and 2014 if funding conditions don’t improve

Pension Plan • Termination of Pension Plans – Terminated plans don’t necessarily mean terminated benefits for participants. – Many current retirees and near retirees may see no changes in their benefits IF GM did terminate their pension plan. – Termination of the plan means turning over its operation to the Pension Benefit Guaranty Corporation (PBGC)

Pension Benefit Guaranty Corp. • Created by Employee Retirement Income Security Act (ERISA) of 1974. • Protects the retirement income of 44. 1 million American workers in 30, 330 private sector defined benefit pension plans. • PBGS is NOT funded by general tax revenues. • PBGC collects insurance premiums from employers, earns money from investments, and receives funds from pension plans it takes over.

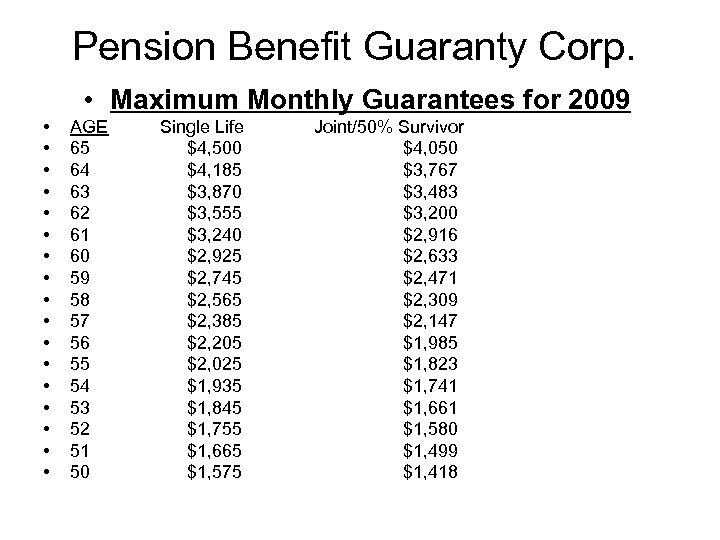

Pension Benefit Guaranty Corp. • If your plan ends without sufficient money to pay all benefits, PBGC will pay you the benefit provided by your plan up to the limits provided by law. • Now pays monthly retirement benefits to about 683, 000 retirees in 3, 595 pension plans that ended. • The maximum pension benefit guaranteed by PBGC is set by law and adjusted yearly. • For plans ended in 2009, workers who retire at age 65 can receive up to $4, 500 per month ($54, 000 yr. ) Single life annuity or $4, 050 per month ($48, 600 yr. ) Joint and 50% Survivor Annuity. The guarantee is lower for those who retire early. The guarantee increase for those who retire after age 65. • For additional information- www. pbgc. gov

Pension Benefit Guaranty Corp. • Maximum Monthly Guarantees for 2009 • • • • • AGE 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 50 Single Life $4, 500 $4, 185 $3, 870 $3, 555 $3, 240 $2, 925 $2, 745 $2, 565 $2, 385 $2, 205 $2, 025 $1, 935 $1, 845 $1, 755 $1, 665 $1, 575 Joint/50% Survivor $4, 050 $3, 767 $3, 483 $3, 200 $2, 916 $2, 633 $2, 471 $2, 309 $2, 147 $1, 985 $1, 823 $1, 741 $1, 661 $1, 580 $1, 499 $1, 418

Pension Benefit Guaranty Corp. • In a recent interview, the acting director of the PBGC Vince Snowbarger noted that GM is not expected to terminate its pension plan in bankruptcy. • Uncertainties of bankruptcy makes the issue of pension plan termination a very volatile and fluid situation.

Can I rollover all or part of my pension plan and 401(K) to an IRA? • Pension Plan – Active Salaried Employees • Your Part B contributions only • Will reduce monthly benefit – Employees who have severed service • Order pension projection for: – Single life annuity and 65% survivor benefit – Lump sum option – Pension Protection Act and IRS regulations impose restrictions on accelerated payments (Lump Sum Distributions) when funding levels fall below 80%. • As of 12/31/08 GM Hourly pension funding level was 83% and Salaried pension plan was 95% funded. • Delphi pension no longer allows lump sum distributions

What can I do with after tax assets in my 401(K) • Available penalty and income tax free for emergency cash reserves. • Rollover to tax free Roth IRA in 2010.

How can I access assets from my 401(K) or IRA penalty free before age 59 1/2 • 401(k) Age 55 Rule • IRA 72 (t) Rule

Defensive actions to consider • Build up emergency cash reserves in FDIC insured money mkt, savings, or CD’s. • Pay down short term debt. • Review your current mortgage rate and if appropriate, refinance to new lower rate 30 yr. fixed mortgage. • Rebalance 401(K) and other investments to more moderate allocation. • Update your retirement plan – Review current holdings to assess age 55 rule, 72(t), and after tax assets. – Pension alternatives

Actions to Consider • Update your financial plan to adjust for: – – Lower pension benefits Higher health care cost Higher taxes Longer life expectancy • Increase retirement savings – – – 401(k) & new Roth 401(k) IRA’s and Roth IRA’s Tax Deferred Variable Annuities with living and death benefits Separately Managed Accounts REIT’s • Delay retirement or work part time for a few years

82aa05ea520c7fc1661a30c98b022d2d.ppt