1019b413823bac84b26d9831fc2d9287.ppt

- Количество слайдов: 45

Immigration and Tax Compliance on Payments to Nonresident Aliens University of Arizona Financial Services Office Tax Compliance

Immigration and Tax Compliance on Payments to Nonresident Aliens University of Arizona Financial Services Office Tax Compliance

Part I Immigration Compliance 2

Part I Immigration Compliance 2

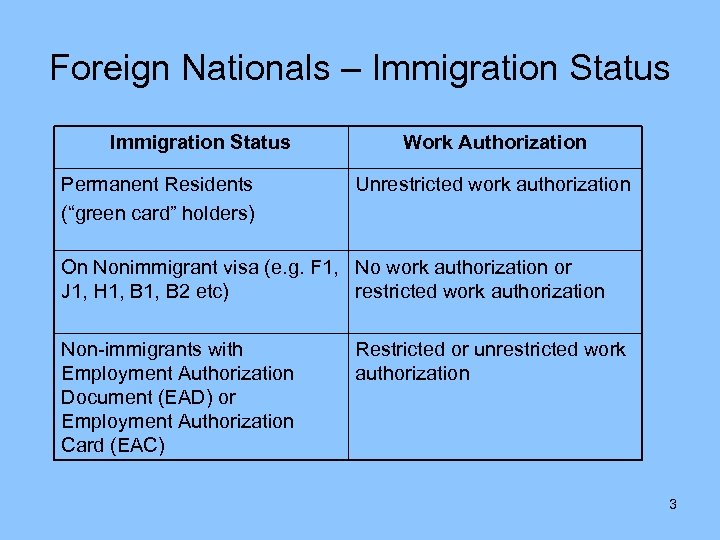

Foreign Nationals – Immigration Status Permanent Residents (“green card” holders) Work Authorization Unrestricted work authorization On Nonimmigrant visa (e. g. F 1, No work authorization or J 1, H 1, B 2 etc) restricted work authorization Non-immigrants with Employment Authorization Document (EAD) or Employment Authorization Card (EAC) Restricted or unrestricted work authorization 3

Foreign Nationals – Immigration Status Permanent Residents (“green card” holders) Work Authorization Unrestricted work authorization On Nonimmigrant visa (e. g. F 1, No work authorization or J 1, H 1, B 2 etc) restricted work authorization Non-immigrants with Employment Authorization Document (EAD) or Employment Authorization Card (EAC) Restricted or unrestricted work authorization 3

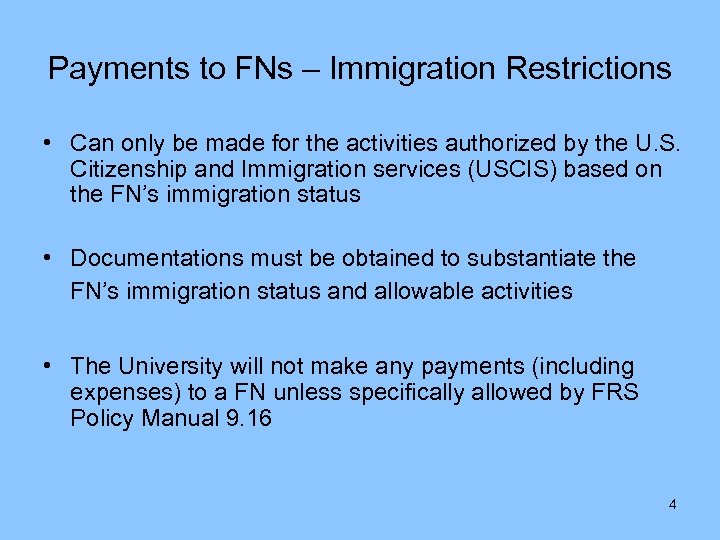

Payments to FNs – Immigration Restrictions • Can only be made for the activities authorized by the U. S. Citizenship and Immigration services (USCIS) based on the FN’s immigration status • Documentations must be obtained to substantiate the FN’s immigration status and allowable activities • The University will not make any payments (including expenses) to a FN unless specifically allowed by FRS Policy Manual 9. 16 4

Payments to FNs – Immigration Restrictions • Can only be made for the activities authorized by the U. S. Citizenship and Immigration services (USCIS) based on the FN’s immigration status • Documentations must be obtained to substantiate the FN’s immigration status and allowable activities • The University will not make any payments (including expenses) to a FN unless specifically allowed by FRS Policy Manual 9. 16 4

Questions to ask Before you check 9. 16 policy, you need to know about the FNs: • Visa type • Sponsor of the visa (UA, another institution, or no sponsor) • Activities of the FN • Payment type – reimbursement of expenses? Fee for services? “Stipend”? 5

Questions to ask Before you check 9. 16 policy, you need to know about the FNs: • Visa type • Sponsor of the visa (UA, another institution, or no sponsor) • Activities of the FN • Payment type – reimbursement of expenses? Fee for services? “Stipend”? 5

Typical Allowable Payments to Non-immigrants • B 1, B 2, WB, WT – do not need visa sponsor, can be paid an honorarium and associated expenses for usual academic activities, subject to restrictions (the 9 -5 -6 rules) • F 1 and J 1 students: sponsored by the educational institution that they are attending. Generally only allowed to be compensated by the sponsor for services. Allowed to receive non-service scholarship from institutions other than the sponsor • J-1 non-students (scholars, researchers) may be paid for services and related expenses by sponsoring institution, and by another institution only if approved by the sponsoring institution (RO letter required) • H 1, O 1, TN: employment-based, only allowed to be paid for services by the employer (sponsor). May be allowed to be reimbursed business expenses by another institution for academic activities which is an integral part of their employment 6

Typical Allowable Payments to Non-immigrants • B 1, B 2, WB, WT – do not need visa sponsor, can be paid an honorarium and associated expenses for usual academic activities, subject to restrictions (the 9 -5 -6 rules) • F 1 and J 1 students: sponsored by the educational institution that they are attending. Generally only allowed to be compensated by the sponsor for services. Allowed to receive non-service scholarship from institutions other than the sponsor • J-1 non-students (scholars, researchers) may be paid for services and related expenses by sponsoring institution, and by another institution only if approved by the sponsoring institution (RO letter required) • H 1, O 1, TN: employment-based, only allowed to be paid for services by the employer (sponsor). May be allowed to be reimbursed business expenses by another institution for academic activities which is an integral part of their employment 6

General Immigration Documentation Required • Passport (photo page) • Visa stamp/sticker • I-94 (front and back)-must be obtained before the FN departs from the US • Other (as applicable): I-20 for F 1 DS 2019 for J-1 I-797 Approval Notice for H 1, O 1, TN, and P 7

General Immigration Documentation Required • Passport (photo page) • Visa stamp/sticker • I-94 (front and back)-must be obtained before the FN departs from the US • Other (as applicable): I-20 for F 1 DS 2019 for J-1 I-797 Approval Notice for H 1, O 1, TN, and P 7

PASSPORT 8

PASSPORT 8

Visa and I-94 • A visa allows a FN to travel to the United States as far as the port of entry (airport or land border crossing) and ask the immigration officer to allow the FN to enter the country. • I-94 is also called Arrival/Departure Record, is the small white card given to the FN at the port of entry to the US. This form is very important since it officially determines how long an FN can remain in the US under a specific nonimmigrant status. • A FN cannot re-enter the US with a expired visa. However, as long as the FN stays in the US, and the I-94 is valid, the expired visa does not matter 9

Visa and I-94 • A visa allows a FN to travel to the United States as far as the port of entry (airport or land border crossing) and ask the immigration officer to allow the FN to enter the country. • I-94 is also called Arrival/Departure Record, is the small white card given to the FN at the port of entry to the US. This form is very important since it officially determines how long an FN can remain in the US under a specific nonimmigrant status. • A FN cannot re-enter the US with a expired visa. However, as long as the FN stays in the US, and the I-94 is valid, the expired visa does not matter 9

10

10

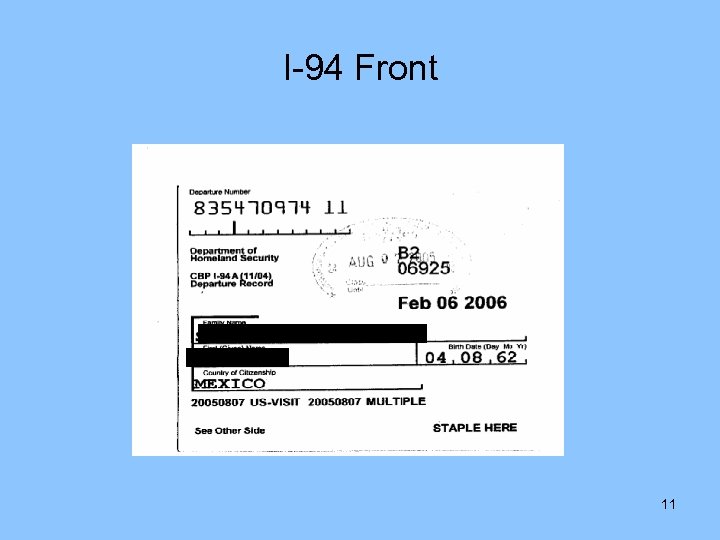

I-94 Front 11

I-94 Front 11

I-94 Back

I-94 Back

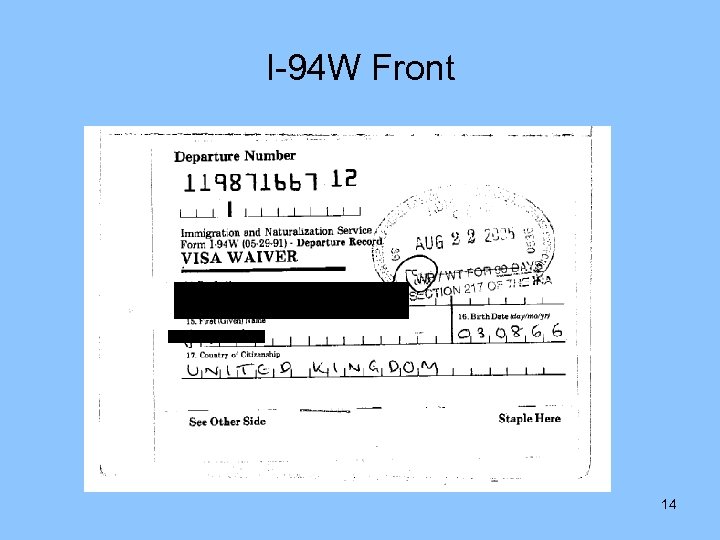

Visa Waiver For FNs from a country participates in the Visa Waiver Program. • They don’t need a visa to enter the US for a visit lasts no more than 90 days • They are issued an I-94 W (small green card) with the WB (Waiver for Business) or WT (Waiver for Tourist) stamp • Authorized activities and document requirements for WB are similar to B 1, for WT are similar to B 2 13

Visa Waiver For FNs from a country participates in the Visa Waiver Program. • They don’t need a visa to enter the US for a visit lasts no more than 90 days • They are issued an I-94 W (small green card) with the WB (Waiver for Business) or WT (Waiver for Tourist) stamp • Authorized activities and document requirements for WB are similar to B 1, for WT are similar to B 2 13

I-94 W Front 14

I-94 W Front 14

I-94 W Back 15

I-94 W Back 15

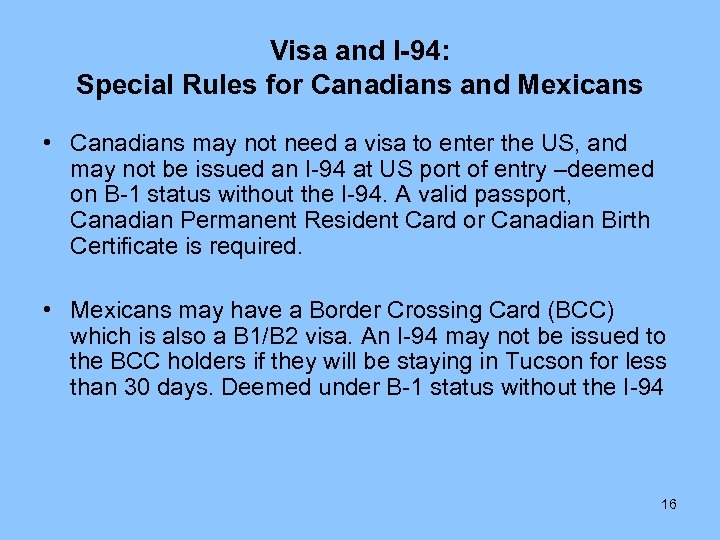

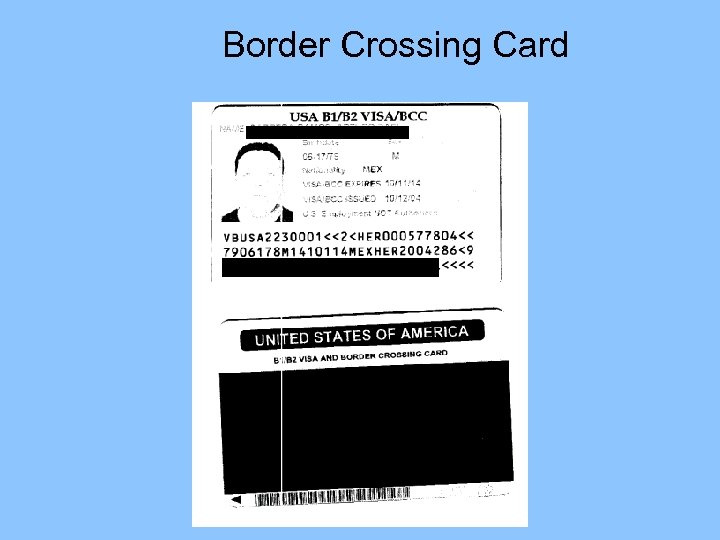

Visa and I-94: Special Rules for Canadians and Mexicans • Canadians may not need a visa to enter the US, and may not be issued an I-94 at US port of entry –deemed on B-1 status without the I-94. A valid passport, Canadian Permanent Resident Card or Canadian Birth Certificate is required. • Mexicans may have a Border Crossing Card (BCC) which is also a B 1/B 2 visa. An I-94 may not be issued to the BCC holders if they will be staying in Tucson for less than 30 days. Deemed under B-1 status without the I-94 16

Visa and I-94: Special Rules for Canadians and Mexicans • Canadians may not need a visa to enter the US, and may not be issued an I-94 at US port of entry –deemed on B-1 status without the I-94. A valid passport, Canadian Permanent Resident Card or Canadian Birth Certificate is required. • Mexicans may have a Border Crossing Card (BCC) which is also a B 1/B 2 visa. An I-94 may not be issued to the BCC holders if they will be staying in Tucson for less than 30 days. Deemed under B-1 status without the I-94 16

Border Crossing Card

Border Crossing Card

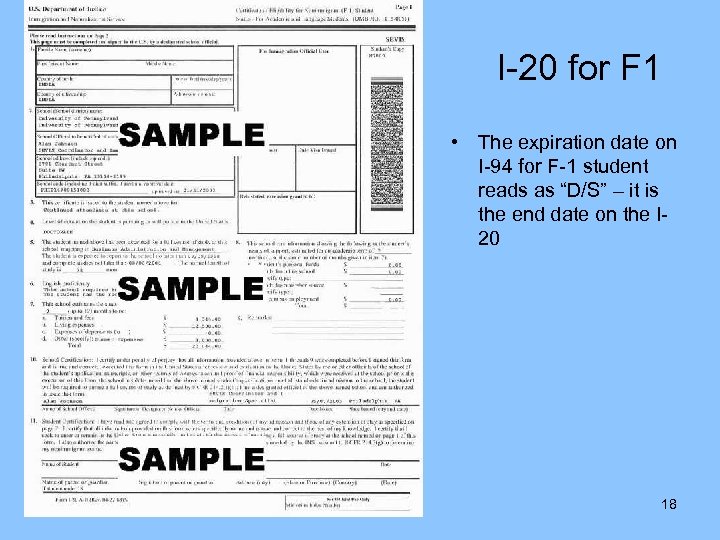

I-20 for F 1 • The expiration date on I-94 for F-1 student reads as “D/S” – it is the end date on the I 20 18

I-20 for F 1 • The expiration date on I-94 for F-1 student reads as “D/S” – it is the end date on the I 20 18

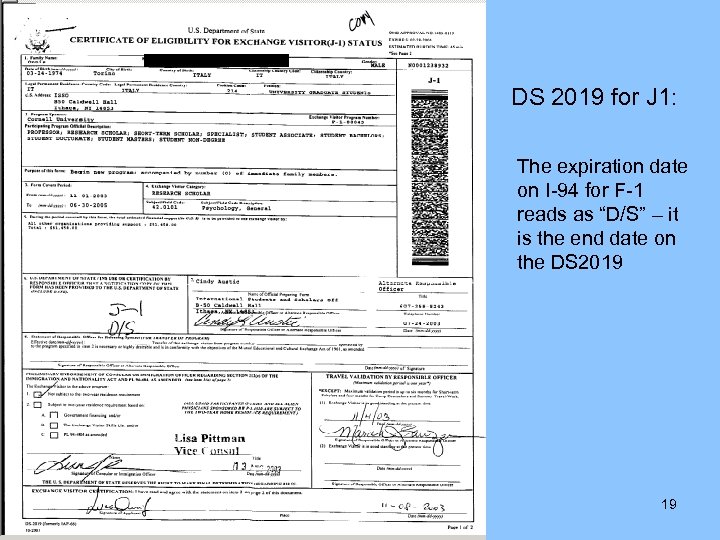

DS 2019 for J 1: The expiration date on I-94 for F-1 reads as “D/S” – it is the end date on the DS 2019 19

DS 2019 for J 1: The expiration date on I-94 for F-1 reads as “D/S” – it is the end date on the DS 2019 19

Permanent Residents: You can ask if the FNs are PR, however it is not appropriate to request a copy of their green card, unless they provide it voluntarily. Treat them as a US citizen for documentation purpose. 20

Permanent Residents: You can ask if the FNs are PR, however it is not appropriate to request a copy of their green card, unless they provide it voluntarily. Treat them as a US citizen for documentation purpose. 20

FNs with EAD or EAC • An non-immigrant may obtain the EAD/EAC under different immigration status. For example: F-1 under OPT (Optional Practical Training), J-2 (spouse of J-1 student and J-1 nonstudent) Non-immigrant who has applied for permanent residency and under AOS (“Adjustment of Status”) • Must read the card to see if there is any restriction If the EAD/EAC holder is under OPT, the holder is still under F-1 student status even the student has graduated. It is required to verify that the employment/self-employment is in the field of the student’s study and is appropriate to the level of education (indicated on the last page of the I-20). 21

FNs with EAD or EAC • An non-immigrant may obtain the EAD/EAC under different immigration status. For example: F-1 under OPT (Optional Practical Training), J-2 (spouse of J-1 student and J-1 nonstudent) Non-immigrant who has applied for permanent residency and under AOS (“Adjustment of Status”) • Must read the card to see if there is any restriction If the EAD/EAC holder is under OPT, the holder is still under F-1 student status even the student has graduated. It is required to verify that the employment/self-employment is in the field of the student’s study and is appropriate to the level of education (indicated on the last page of the I-20). 21

Part II Ta x Compliance 22

Part II Ta x Compliance 22

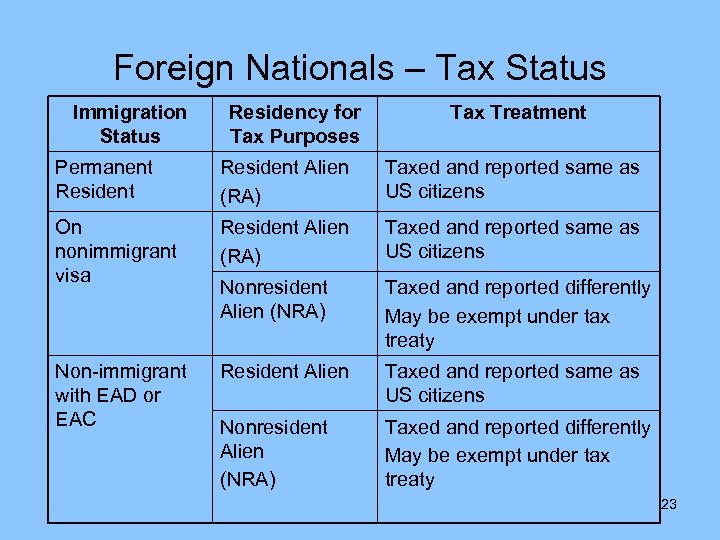

Foreign Nationals – Tax Status Immigration Status Residency for Tax Purposes Tax Treatment Permanent Resident Alien (RA) Taxed and reported same as US citizens On nonimmigrant visa Resident Alien (RA) Taxed and reported same as US citizens Nonresident Alien (NRA) Taxed and reported differently May be exempt under tax treaty Non-immigrant with EAD or EAC Resident Alien Taxed and reported same as US citizens Nonresident Alien (NRA) Taxed and reported differently May be exempt under tax treaty 23

Foreign Nationals – Tax Status Immigration Status Residency for Tax Purposes Tax Treatment Permanent Resident Alien (RA) Taxed and reported same as US citizens On nonimmigrant visa Resident Alien (RA) Taxed and reported same as US citizens Nonresident Alien (NRA) Taxed and reported differently May be exempt under tax treaty Non-immigrant with EAD or EAC Resident Alien Taxed and reported same as US citizens Nonresident Alien (NRA) Taxed and reported differently May be exempt under tax treaty 23

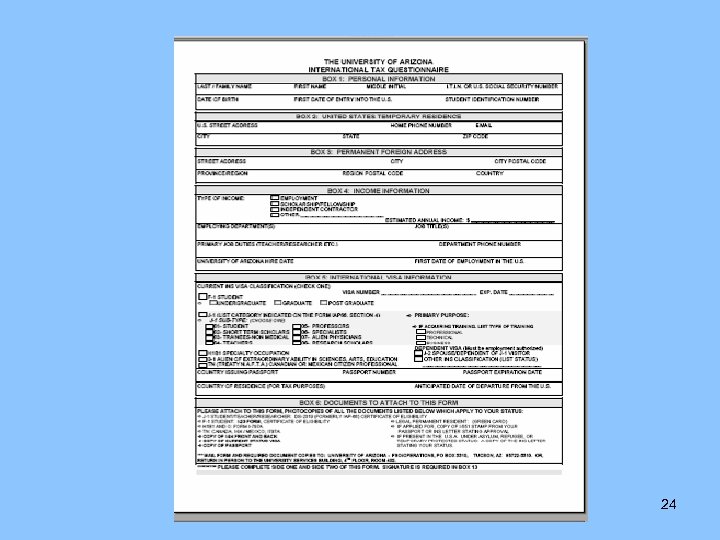

24

24

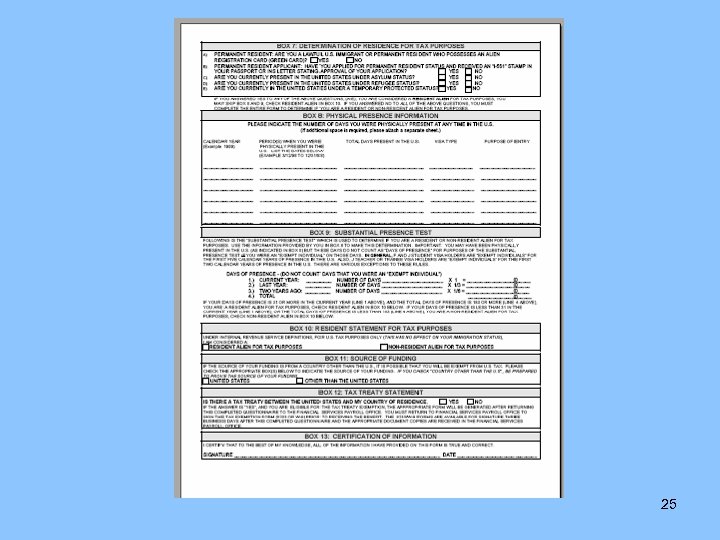

25

25

Nonresident Alien Tax Compliance System - Glacier The University has introduced a web-based tax compliance system called Glacier. It is used to • Determine tax residency status • Determine tax treatment for reportable income • Prepare applicable tax documents for eligible FNs to apply for tax treaty exemption • Tracks the tax residency status and tax treaty exemptions (dollar amount limit, time limit etc) 26

Nonresident Alien Tax Compliance System - Glacier The University has introduced a web-based tax compliance system called Glacier. It is used to • Determine tax residency status • Determine tax treatment for reportable income • Prepare applicable tax documents for eligible FNs to apply for tax treaty exemption • Tracks the tax residency status and tax treaty exemptions (dollar amount limit, time limit etc) 26

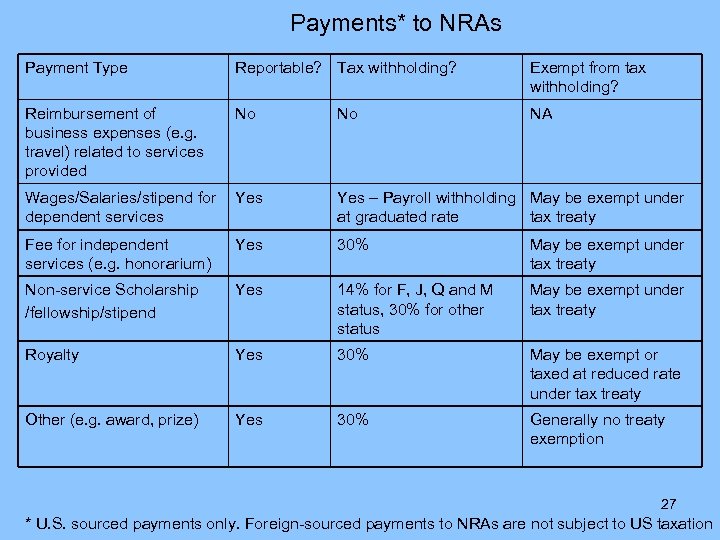

Payments* to NRAs Payment Type Reportable? Tax withholding? Exempt from tax withholding? Reimbursement of business expenses (e. g. travel) related to services provided No No NA Wages/Salaries/stipend for dependent services Yes – Payroll withholding May be exempt under at graduated rate tax treaty Fee for independent services (e. g. honorarium) Yes 30% May be exempt under tax treaty Non-service Scholarship /fellowship/stipend Yes 14% for F, J, Q and M status, 30% for other status May be exempt under tax treaty Royalty Yes 30% May be exempt or taxed at reduced rate under tax treaty Other (e. g. award, prize) Yes 30% Generally no treaty exemption 27 * U. S. sourced payments only. Foreign-sourced payments to NRAs are not subject to US taxation

Payments* to NRAs Payment Type Reportable? Tax withholding? Exempt from tax withholding? Reimbursement of business expenses (e. g. travel) related to services provided No No NA Wages/Salaries/stipend for dependent services Yes – Payroll withholding May be exempt under at graduated rate tax treaty Fee for independent services (e. g. honorarium) Yes 30% May be exempt under tax treaty Non-service Scholarship /fellowship/stipend Yes 14% for F, J, Q and M status, 30% for other status May be exempt under tax treaty Royalty Yes 30% May be exempt or taxed at reduced rate under tax treaty Other (e. g. award, prize) Yes 30% Generally no treaty exemption 27 * U. S. sourced payments only. Foreign-sourced payments to NRAs are not subject to US taxation

US Taxpayer Identification Number (TIN) Required for Reportable Payment • US Social Security Number Card, or • Individual Taxpayer Identification Number (ITIN) Notice issued by the IRS • If the FN fails to the TIN (SSN or ITIN), payment cannot be paid without a statement “Verification of Request for US Taxpayer Identification Number”, signed by the FN • The FN does not qualify for treaty benefit without a US TIN • Be careful that Canadian SSN is also a 9 digit number that can be easily confused with US SSN 28

US Taxpayer Identification Number (TIN) Required for Reportable Payment • US Social Security Number Card, or • Individual Taxpayer Identification Number (ITIN) Notice issued by the IRS • If the FN fails to the TIN (SSN or ITIN), payment cannot be paid without a statement “Verification of Request for US Taxpayer Identification Number”, signed by the FN • The FN does not qualify for treaty benefit without a US TIN • Be careful that Canadian SSN is also a 9 digit number that can be easily confused with US SSN 28

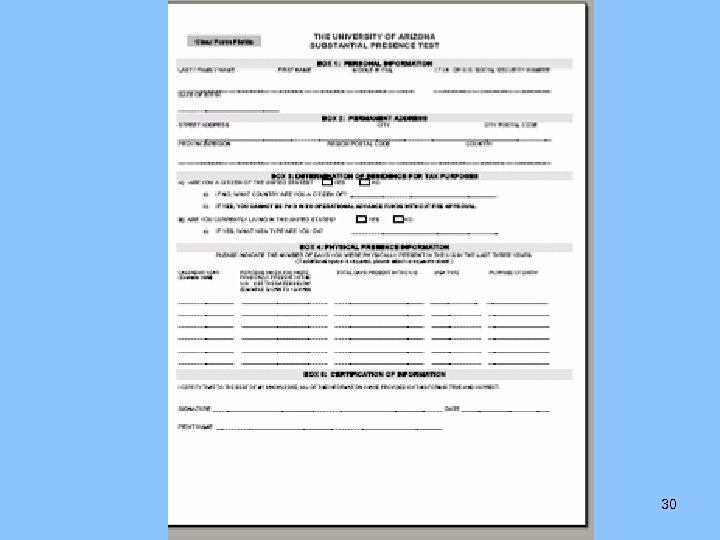

Payment for Services Performed by FNs Outside the US • Not subject to US Immigration regulation • Foreign-sourced income to the FNs – not subject to US taxation if the FNs are NRAs for tax purposes • FN submits a Substantial Presence Test Form to A/P prior to the service to determine his/her tax residency status • If the FN qualifies as NRA, payment is not reportable, not taxable • If the FN qualifies as RA, the payment is reportable/taxable in the same way as the payment made to a US citizen 29

Payment for Services Performed by FNs Outside the US • Not subject to US Immigration regulation • Foreign-sourced income to the FNs – not subject to US taxation if the FNs are NRAs for tax purposes • FN submits a Substantial Presence Test Form to A/P prior to the service to determine his/her tax residency status • If the FN qualifies as NRA, payment is not reportable, not taxable • If the FN qualifies as RA, the payment is reportable/taxable in the same way as the payment made to a US citizen 29

SUBSTANTIAL PRESENCE TEST FORM 30

SUBSTANTIAL PRESENCE TEST FORM 30

Payment of Foreign-sourced Scholarship • Foreign-sourced scholarship payment is not subject to US tax reporting or withholding • Scholarship is foreign-sourced if The academic activities take place outside the US, OR The payor of the scholarship is located outside the U. S. Ø Documentation must be provided to substantiate the foreign source. 31

Payment of Foreign-sourced Scholarship • Foreign-sourced scholarship payment is not subject to US tax reporting or withholding • Scholarship is foreign-sourced if The academic activities take place outside the US, OR The payor of the scholarship is located outside the U. S. Ø Documentation must be provided to substantiate the foreign source. 31

Tax Treaty Benefits for NRAs • A taxable payment to the NRA may be exempt from US taxation or taxed at a reduced rate based on the Income Tax Treaty between the US and the FN’s country of residence for tax purposes • The NRA must meet certain criteria in order to qualify for the treaty benefit • A US TIN (SSN or ITIN) must be provided by the FN in order to claim the treaty benefit • Appropriate tax form must be completed to apply for the treaty benefit (e. g. Form 8233 for compensation, W 8 BEN for scholarship and royalty) • There are 14 days processing time for payment with treaty claims on Form 8233 – must be sent to the IRS for acceptance 32

Tax Treaty Benefits for NRAs • A taxable payment to the NRA may be exempt from US taxation or taxed at a reduced rate based on the Income Tax Treaty between the US and the FN’s country of residence for tax purposes • The NRA must meet certain criteria in order to qualify for the treaty benefit • A US TIN (SSN or ITIN) must be provided by the FN in order to claim the treaty benefit • Appropriate tax form must be completed to apply for the treaty benefit (e. g. Form 8233 for compensation, W 8 BEN for scholarship and royalty) • There are 14 days processing time for payment with treaty claims on Form 8233 – must be sent to the IRS for acceptance 32

Part III Typical Payments to Nonresident Aliens 33

Part III Typical Payments to Nonresident Aliens 33

Honorarium and Associated Expenses • FNs on nonimmigrant visa who are allowed to be paid an honorarium and associated expenses include B 1/WB, B 2/WT, BCC, if honorarium rules are met • J-1 sponsored by another institution is allowed to paid an honorarium and associated expenses if approved by his/her visa sponsoring institution (RO letter required) • EAD or EAC holders may be paid an honorarium and associated expenses as self-employed 34

Honorarium and Associated Expenses • FNs on nonimmigrant visa who are allowed to be paid an honorarium and associated expenses include B 1/WB, B 2/WT, BCC, if honorarium rules are met • J-1 sponsored by another institution is allowed to paid an honorarium and associated expenses if approved by his/her visa sponsoring institution (RO letter required) • EAD or EAC holders may be paid an honorarium and associated expenses as self-employed 34

Honorarium Rules for B 1/B 2/WT/WB Status • only usual academic activities (such as lecturing, teaching, sharing knowledge, attending meetings of boards and committees) are allowed • Honorarium must from no more than 5 institutions within a six month period for usual academic activities lasted for no more than 9 days (9 -5 -6 rule) A Statement stating that the FN meets the 9 -5 -6 rules is required in addition to the regular immigration documents 35

Honorarium Rules for B 1/B 2/WT/WB Status • only usual academic activities (such as lecturing, teaching, sharing knowledge, attending meetings of boards and committees) are allowed • Honorarium must from no more than 5 institutions within a six month period for usual academic activities lasted for no more than 9 days (9 -5 -6 rule) A Statement stating that the FN meets the 9 -5 -6 rules is required in addition to the regular immigration documents 35

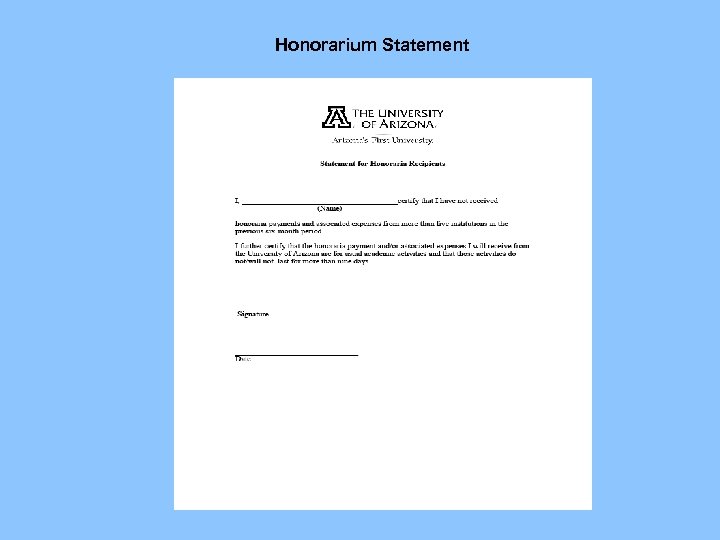

Honorarium Statement

Honorarium Statement

9 -5 -6 Rules • The 9 -5 -6 rule does not apply to FNs under B 1/WB status if only reimbursing expenses associated with the usual academic activities. However, the rule does apply to B 2/WT status even only expenses are reimbursed (no honorarium) • Only the days when the FN engages in the academic activities during the visit are counted against the 9 days • The 9 days is the time limit for each visit • The 5 times are counted per visit, even with the same institution • Expenses for the days that are not counted against the 9 days are reimbursable if they are reasonably related to the honorarium activities 37

9 -5 -6 Rules • The 9 -5 -6 rule does not apply to FNs under B 1/WB status if only reimbursing expenses associated with the usual academic activities. However, the rule does apply to B 2/WT status even only expenses are reimbursed (no honorarium) • Only the days when the FN engages in the academic activities during the visit are counted against the 9 days • The 9 days is the time limit for each visit • The 5 times are counted per visit, even with the same institution • Expenses for the days that are not counted against the 9 days are reimbursable if they are reasonably related to the honorarium activities 37

Example of 9 -5 -6 Rules • A B-1 visitor is on campus to work on a research project with a UA faculty member. The visitor arrives on Day 1 and departs on Day 14. Day 1 is Sunday. He works from Day 2 to Day 6, and Day 9 to D Day 12. He rests on Day 7 Day 8 (weekend), and Day 13. Although he is here for 14 days, he works for only 9 days, so he meets the 9 -day rule. Expenses for Day 1, Day 7 and Day 8 and Day 14 (departure day) are reasonably related to his academic activities during this visit. We need further information for Day 13 to determine if there is a valid business reason for him to stay for one more day at the University's cost (e. g. flight delayed to Day 14 due to weather). 38

Example of 9 -5 -6 Rules • A B-1 visitor is on campus to work on a research project with a UA faculty member. The visitor arrives on Day 1 and departs on Day 14. Day 1 is Sunday. He works from Day 2 to Day 6, and Day 9 to D Day 12. He rests on Day 7 Day 8 (weekend), and Day 13. Although he is here for 14 days, he works for only 9 days, so he meets the 9 -day rule. Expenses for Day 1, Day 7 and Day 8 and Day 14 (departure day) are reasonably related to his academic activities during this visit. We need further information for Day 13 to determine if there is a valid business reason for him to stay for one more day at the University's cost (e. g. flight delayed to Day 14 due to weather). 38

Payment to J-1 sponsored by another Institution • Other than the regular immigration documents, the J-1 (sponsored by another institution) must obtain a RO letter from his sponsoring institution authorizing his activities at UA. The Letter must be signed by the RO (Responsible Officer), usually is the one who signed his DS 2019. • With the authorization by the RO, the J-1 can be reimbursed business expenses and paid a fee for services 39

Payment to J-1 sponsored by another Institution • Other than the regular immigration documents, the J-1 (sponsored by another institution) must obtain a RO letter from his sponsoring institution authorizing his activities at UA. The Letter must be signed by the RO (Responsible Officer), usually is the one who signed his DS 2019. • With the authorization by the RO, the J-1 can be reimbursed business expenses and paid a fee for services 39

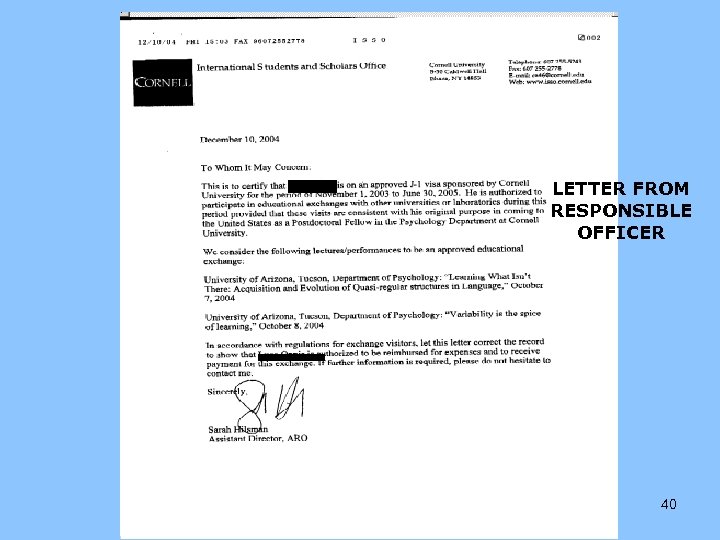

LETTER FROM THE RESPONSI BLE OFFICER LETTER FROM RESPONSIBLE OFFICER 40

LETTER FROM THE RESPONSI BLE OFFICER LETTER FROM RESPONSIBLE OFFICER 40

H 1, O 1 and TN professors/researchers sponsored by another institution • Expenses related to the usual academic activities are allowed to be reimbursed to the H 1, O 1 and TN professors/researchers sponsored by another institution • Any payment represents fee for services (e. g. honorarium) is not allowed to be paid to the FNs • If paying a fee for services provided by these FNs, must be approved by the FNs’ sponsoring institution, so the payment will be paid to the sponsoring institution 41

H 1, O 1 and TN professors/researchers sponsored by another institution • Expenses related to the usual academic activities are allowed to be reimbursed to the H 1, O 1 and TN professors/researchers sponsored by another institution • Any payment represents fee for services (e. g. honorarium) is not allowed to be paid to the FNs • If paying a fee for services provided by these FNs, must be approved by the FNs’ sponsoring institution, so the payment will be paid to the sponsoring institution 41

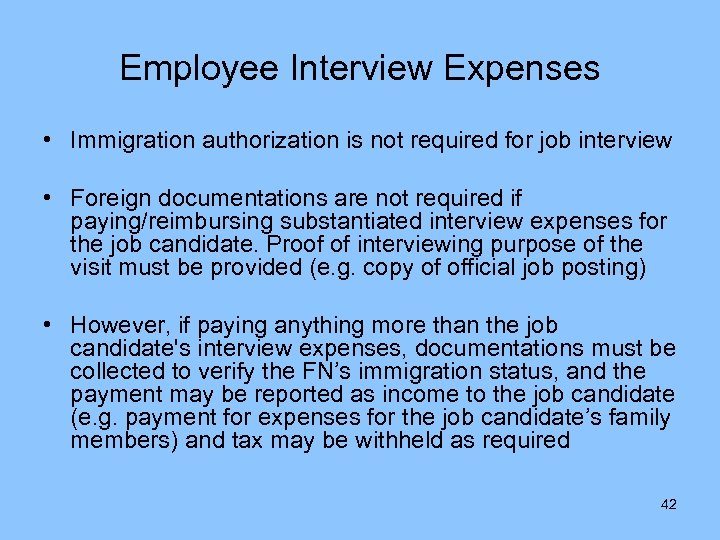

Employee Interview Expenses • Immigration authorization is not required for job interview • Foreign documentations are not required if paying/reimbursing substantiated interview expenses for the job candidate. Proof of interviewing purpose of the visit must be provided (e. g. copy of official job posting) • However, if paying anything more than the job candidate's interview expenses, documentations must be collected to verify the FN’s immigration status, and the payment may be reported as income to the job candidate (e. g. payment for expenses for the job candidate’s family members) and tax may be withheld as required 42

Employee Interview Expenses • Immigration authorization is not required for job interview • Foreign documentations are not required if paying/reimbursing substantiated interview expenses for the job candidate. Proof of interviewing purpose of the visit must be provided (e. g. copy of official job posting) • However, if paying anything more than the job candidate's interview expenses, documentations must be collected to verify the FN’s immigration status, and the payment may be reported as income to the job candidate (e. g. payment for expenses for the job candidate’s family members) and tax may be withheld as required 42

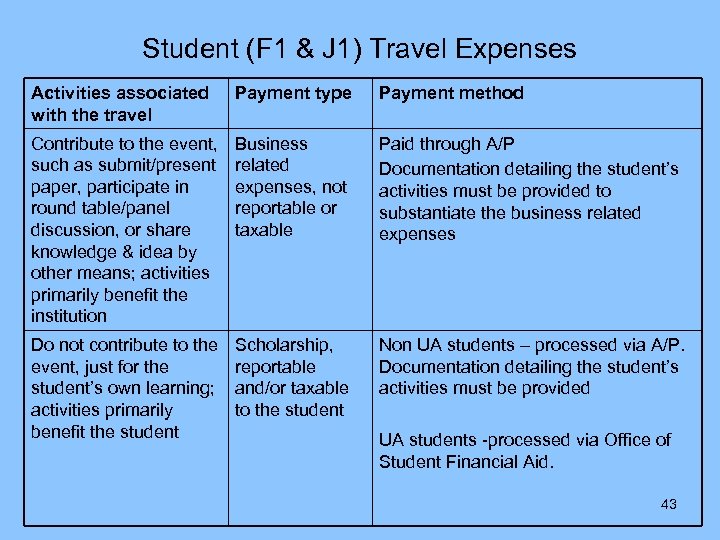

Student (F 1 & J 1) Travel Expenses Activities associated with the travel Payment type Payment method Contribute to the event, such as submit/present paper, participate in round table/panel discussion, or share knowledge & idea by other means; activities primarily benefit the institution Business related expenses, not reportable or taxable Paid through A/P Documentation detailing the student’s activities must be provided to substantiate the business related expenses Do not contribute to the event, just for the student’s own learning; activities primarily benefit the student Scholarship, reportable and/or taxable to the student Non UA students – processed via A/P. Documentation detailing the student’s activities must be provided UA students -processed via Office of Student Financial Aid. 43

Student (F 1 & J 1) Travel Expenses Activities associated with the travel Payment type Payment method Contribute to the event, such as submit/present paper, participate in round table/panel discussion, or share knowledge & idea by other means; activities primarily benefit the institution Business related expenses, not reportable or taxable Paid through A/P Documentation detailing the student’s activities must be provided to substantiate the business related expenses Do not contribute to the event, just for the student’s own learning; activities primarily benefit the student Scholarship, reportable and/or taxable to the student Non UA students – processed via A/P. Documentation detailing the student’s activities must be provided UA students -processed via Office of Student Financial Aid. 43

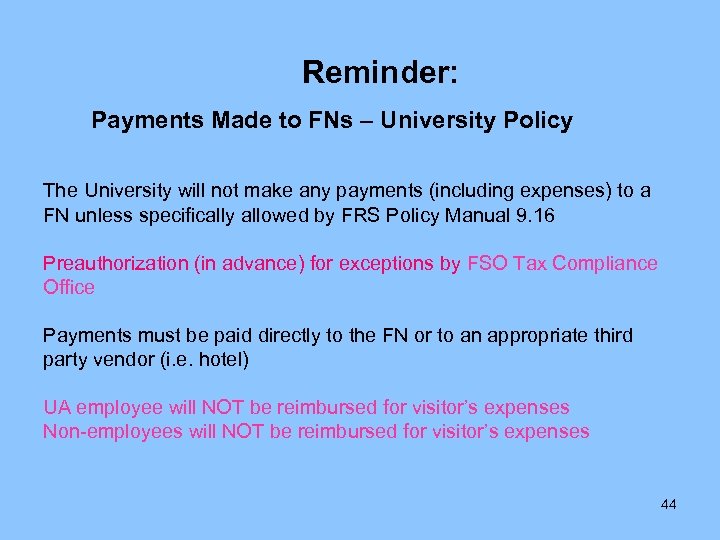

Reminder: Payments Made to FNs – University Policy The University will not make any payments (including expenses) to a FN unless specifically allowed by FRS Policy Manual 9. 16 Preauthorization (in advance) for exceptions by FSO Tax Compliance Office Payments must be paid directly to the FN or to an appropriate third party vendor (i. e. hotel) UA employee will NOT be reimbursed for visitor’s expenses Non-employees will NOT be reimbursed for visitor’s expenses 44

Reminder: Payments Made to FNs – University Policy The University will not make any payments (including expenses) to a FN unless specifically allowed by FRS Policy Manual 9. 16 Preauthorization (in advance) for exceptions by FSO Tax Compliance Office Payments must be paid directly to the FN or to an appropriate third party vendor (i. e. hotel) UA employee will NOT be reimbursed for visitor’s expenses Non-employees will NOT be reimbursed for visitor’s expenses 44

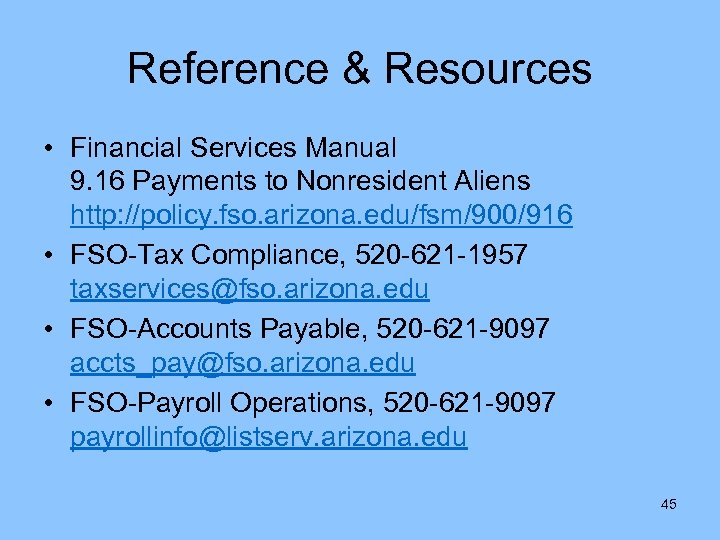

Reference & Resources • Financial Services Manual 9. 16 Payments to Nonresident Aliens http: //policy. fso. arizona. edu/fsm/900/916 • FSO-Tax Compliance, 520 -621 -1957 taxservices@fso. arizona. edu • FSO-Accounts Payable, 520 -621 -9097 accts_pay@fso. arizona. edu • FSO-Payroll Operations, 520 -621 -9097 payrollinfo@listserv. arizona. edu 45

Reference & Resources • Financial Services Manual 9. 16 Payments to Nonresident Aliens http: //policy. fso. arizona. edu/fsm/900/916 • FSO-Tax Compliance, 520 -621 -1957 taxservices@fso. arizona. edu • FSO-Accounts Payable, 520 -621 -9097 accts_pay@fso. arizona. edu • FSO-Payroll Operations, 520 -621 -9097 payrollinfo@listserv. arizona. edu 45