5dcf061f664b744003d3b5a0c5875e10.ppt

- Количество слайдов: 79

ILS Vendor Landscape Companies and Products Marshall Breeding Director for Innovative Technologies and Research Vanderbilt University http: //staffweb. library. vanderbilt. edu/breeding http: //www. librarytechnology. org/ Library and Archives Canada December 7, 2007

Business Trends A look at the companies involved in library automation and related technologies

Business Landscape § Library Journal Automated System Marketplace: § An Industry redefined (April 1, 2007) § An increasingly consolidated industry § VC and Private Equity playing a stronger role then ever before § Moving out of a previous phase of fragmentation where many companies expend energies producing decreasingly differentiated systems in a limited marketplace § Narrowing of product options § Open Source opportunities rise to challenge stranglehold of traditional commercial model

Other Business Factors § Level of innovation falls below expectations § Companies struggle to keep up with ILS enhancements and R&D for new innovations. § Pressure within companies to reduce costs, increase revenue § Pressure from libraries for more innovative products

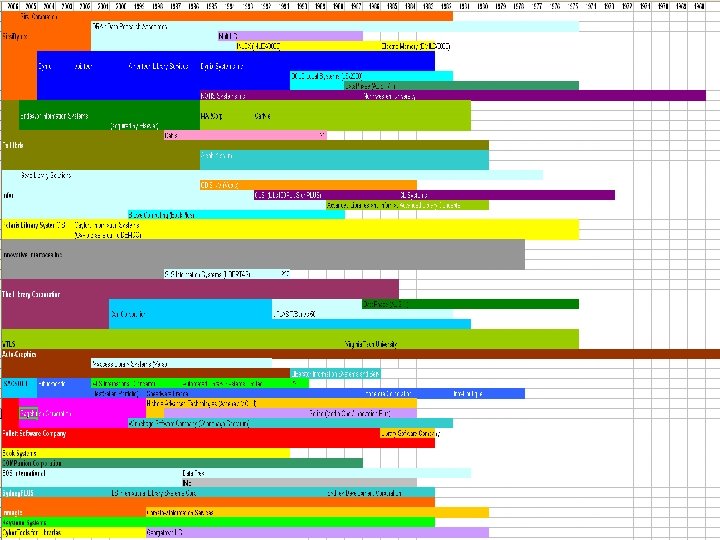

Library Automation M&A History

Why worry about who owns the Industry? § Some of the most important decisions that affect the options available to libraries are made in the corporate board room. § Increased control by financial interests of private equity and venture capital firms § Recent industry events driven by external corporate decisions; § Market success and technological advantages don’t necessarily drive business decisions

Investor owned companies § Sirsi. Dynix -> Vista Equity Partners (Recently bought out Seaport Capital + Hicks Muse/HM Capital) § Ex Libris -> Francisco Partners (recently bought out VC’s) § Endeavor -> Francisco Partners (recently bought out Elsevier) § Infor (was Extensity, was Geac) -> Golden Gate § Polaris -> Croydon Company § formerly part of Gaylord Bros (acquired by Demco)

Public companies: § Auto-Graphics § De-listed from SEC reporting requirements § Was OTC: AUGR now Pink Sheets: AUGR

Founder / Family owned companies § Innovative Interfaces § 100% ownership by Jerry Kline following 2001 buy-out of partner Steve Silberstien § The Library Corporation § Owned by Annette Murphy family § VTLS – tech spin-off from Virginia Tech, wholly owned by Vinod Chachra § These companies not under the control of external financial interests

Impact of Ownership § Long term vs short tem interests § Decision makers in tune with the needs of the customer base? § Ability to understand libraries as business customers § Serving non-profit organizations quite different § It’s possible to operate a profitable company and stay true to the interest of library as customer

Revenue sources § New ILS sales § Maintenance support § 15% purchase cost annually with inflation adjustments § Non-ILS software § Library Services

Diverse Business Activities § Many ways to expand business in ways that leverage library automation expertise: § Non-ILS software: link resolvers, federated search, ERM, portal/alternative Web interfaces § Retrospective conversion services § RFID or AMH § Network Consulting Services § Content products § Imaging services

Business Development Strategy § Essential to understand the strategic business plans of the company § § § Long term growth? Short term profits? Growth through M&A Organic growth by attracting new customer libraries Positioning for sale? § Get past press releases and spin and look closely at the corporate behavior.

Libraries Demand choice § Current market narrowing options § Consolidation working toward monopoly? § Many companies currently prosper in the library automation industry § Room for niche players § Domination by a large monopoly unlikely to be accepted by library community § Monopoly would be subverted by Open Source or other cooperative movement

The Chopping Block § § § Horizon 8. 0 (Mar 2007) Horizon 7. x (Mar 2007) ENCompass (Jan 2006) Link. Finder. Plus (Jan 2006) Taos (Dec 2001) NOTIS Horizon (Jun 1994)

Legacy Phase out § § § § § DRA Classic Dynix Classic Multi. LIS INLEX/3000 Advance PLUS VTLS Classic NOTIS PC Systems: Winnebago Spectrum, Follett Circ Plus, Athena, Concourse

Status of current ILS Products § Most ILS products from commercial vendors mature § None less than a decade old § Approaching end of life cycle? § Evolved systems § No success in launching new systems § Horizon 8. 0 § Taos

Current Vintage § § ALEPH 500 Unicorn Millennium Virtua 1996 1982 1995 § § § Voyager Carl Polaris Koha Library. Solution Evergreen 1995 1982 1997 1999 1997 2004

ILS Migration Trends § Few voluntary lateral migrations § Forced Migrations § Vendor abandonment § Need to move from legacy systems § Exit from bad marriages with vendors § Exit from bad marriages with consortia § It’s never been harder to justify investments in ILS

Products surrounding the ILS § Need for products focused on electronic content and user experience § Next-gen interfaces § Federated search § Linking § Electronic Resource Management

An age of less integrated systems § Core ILS supplemented by: § Open. URL Link Resolvers § Metasearch / Federated Search § Electronic Resource Management § Next Generation Library Interfaces

No longer an ILS-centric industry § Portion of revenues derived from core ILS products diminishing relative to other library tech products § Many companies and organizations that don’t offer an ILS are involved in library automation: § OCLC § Cambridge / Bowker § Web. Feat § Muse Global

Library Automation Companies

Sirsi. Dynix § Highly consolidated company § Sirsi Corp, Dynix, DRA, Multi. LIS, INLEX/300, Docutec, OCLC Local Systems, Data. Phase, Electric Memory, NOTIS Systems § Largest in the industry § ~$125 revenue § Owned by Vista Equity Partners § Previously supported by VC: Seaport Capital, Hicks Muse) § Consolidated company working toward consolidating and integrating products and business units.

Corporate Strategy § Single ILS strategy based on Unicorn (Feb 2007) § Move toward Saas (Software as a Service) § Abandoned development of Horizon 8. 0 / 7 x § Reduction in Force § Phase out higher earning staff § Single HQ? Provo?

Unicorn / Symphony § § § § Server component written in C C-ISAM pre-relational database structure Oracle version available BRS fulltext search engine Unicode implementation problematic Robust API Perl used for reports and system administration

Workflows § Latest version of staff client § Recently translated from C to Java § Few gains in functionality § Slower performance § Necessary to get to Unicode given choice of C development environment

Rooms § Launched as the company’s strategic portal product in 2004 § Limited market interest in academic libraries § Some use by public libraries § Strongest interest in K-12 School arena § Does not fit within the current expectations for next-gen interfaces

Challenges § Poor reputation among library community § Lack of trust due to abrupt abandonment of Horizon § 8. 0 and 7. x versions § Expect some decrease in overall customer base § Stimulated Open Source movement § Unicorn/Symphony perceived as old technology

Product strategies § Continually slow in creating new products § No electronic resource management product § Remarkets Serials Solutions § Abandoned local development of ERM for both Unicorn and Horizon § § No Linking product – OEM Serials Solution No Next Generation Interface § Recent agreement with Brainware (another Vista portfolio company)

Strengths § Large company § Customer support infrastructure

Ex Libris Profile § Global provider of software to Academic Libraries § Largest in the academic market, Third largest overall § Owned by Francisco Partners § Acquired Endeavor in Nov 2006 § Strong focus on non-ILS products: § SFX – Meta. Lib – Verde – Digi. Tool – Primo § Continues to support and develop ALEPH and Voyager

Ex Libris Corporate History § Founded in 1980 to create automation software for the library of Hebrew University in Jerusalem § Automated Library Expandable Program – Aleph 100 § Aleph Yissum was a technology transfer spin-off of HUJ § Acquired Dabis July 1997 (German ILS vendor) § Ex Libris formed in 1986 to market ALEPH § Aleph Yissum and Ex Libris merged in 1995 § 1999 VC investments by Tamar Technologies and Walden Israel § Azriel Morag exits Aug 2005 § Failed IPO in Sept 2005 § Acquisition by Francisco Partners in Jul 2006 for $62 million § Acquisition of Endeavor in Nov 2006

Francisco Partners § § Private Equity Firm $5 Billion Technology focused companies Looks for synergies in portfolio companies

Corporate Strategy § Assemble company capable of dominating academic market § Internal software development – avoid OEM approach for strategic products § Investments in development § Aggressive pricing (? ) § Lower development costs in Israel

ALEPH 500 § Current flagship ILS § Designed for large complex libraries § Rich functionality § Reputation for being difficult to implement § Evolved system – parts of the system still in COBOL § Large Academic § British Library

Product Strategy § Products for libraries in higher education § Strength in products for managing electronic content § SFX, Meta. Lib, Verde § Recent effort to develop Primo as a nextgeneration discovery and delivery platform. Will serve as a front-end for all products

Innovative Interfaces § Founded by Jerry Kline and Steve Silberstein § Kline bought out Silberstein in 2000 § Some bank debt to finance the transition which has is paid off. § Company wholly owned by Jerry Kline § No involvement with VC or Private equity § No recent involvement in M&A § Acquired SLS in 1997

Product Strategy § Evolutionary Product strategy § Innopac -> Millennium beginning in 1995 § Millennium was one of the first library automation systems to use Java. Employed only on the client side. Server remains in C. § Millennium as core technology § Encore, Right. Results, Research. Pro § Early to market in new product areas: § § § Electronic Resource Management Institutional Repository platform Next-generation interface

Corporate Strategy § § § Strong revenues to support R&D Relies on internal software development Avoids OEM approach for strategic products § Defiant resistance to VC and Private Equity investment/control

Company Strengths § Large and growing customer base § Continues to make new sales in a difficult ILS market § Ability to perform rapid software development § First to market in Electronic Resource Management § Remarkable response to Encore

Company Challenges § § § Reputation for closed systems Aggressive pricing Perceived by many of its library customers as rigid § Ability to resist buyout offers

VTLS § Wholly owned by Vinod Chachra. Virgina Tech initially had equity that has been sold to Chachra. § VTLS developed Circulation System in min 1970’s when Chachra was VP for IT § Technology transfer spin-off from Virginia Tech University in 1985 § Pioneer in library automation systems

Virtua § Initially introduced in 1995 § Current technologies: § RDBMS, Unicode, 3 -tier client/server architecture § Early ILS implementation of FRBR

Virtua Success / failures § Univ of Kansas – signed in 1996 > Voyager 1998 § State Library of Queensland – signed in 1998 > Voyager 2002 § New York University signed June 2004 > ALEPH Nov 2007 § University of Oxford signed June 2005. Implementation problematic; go/no-go decision planned for Dec 2007

Oxford University § § § Selected Virtua in June 2005 ILS for 100 libraries Contract included creation of custom software for Oxford’s closed stack retrieval process.

Lost opportunities § Lost most of its North American customer base § In the 1980 s VTLS was a major supplier of automations software for public and academic libraries in North America § Failed to transition customers from VTLS classic § Slow adoption of Virtua

VERIFY Electronic Resource Management § Signed Tri-College Library Consortium of Bryn Mawr, Haverford and Swarthmore Colleges as development partner in 2005 § Following unsuccessful implementation Tri-College has begun to implement Ex Libris Verde

VITAL Institutional Repository § Built on open source Fedora platform § Major contracts in Australia (Arrow consortium)

VTLS Challenges § Damaged reputation in the marketplace due to failed system implementations § Virtua is aging rapidly – resources to revitalize development? § Ripe for acquisition? § Continues to announce new sales: most are low-value international contracts § Overextended resources on NYU & Oxford

VTLS Strengths § § § Strong international presence Solid implementation of Unicode Strong re-sellers. Eg: i. Group

OCLC in the ILS arena? § Increasingly overlapped with library automation activities § World. Cat Local recently announced § Penetrating deeper into local libraries § Library-owned cooperative on a buying binge of automation companies: § § § Openly Informatics Fretwell-Downing Informatics Sisis Informationssysteme PICA (now 100%) Di. Me. Ma (CONTENTdm) § ILS companies concerned about competing with a nonprofit with enormous resources and the ability to shift costs.

Cambridge Information Group / Bowker § Serials Solutions § Syndetic Solutions § Electronic Resource Management § Federated Search § E-Journals data § Aqua. Browser § Next-gen Interface

Product and Technology Trends

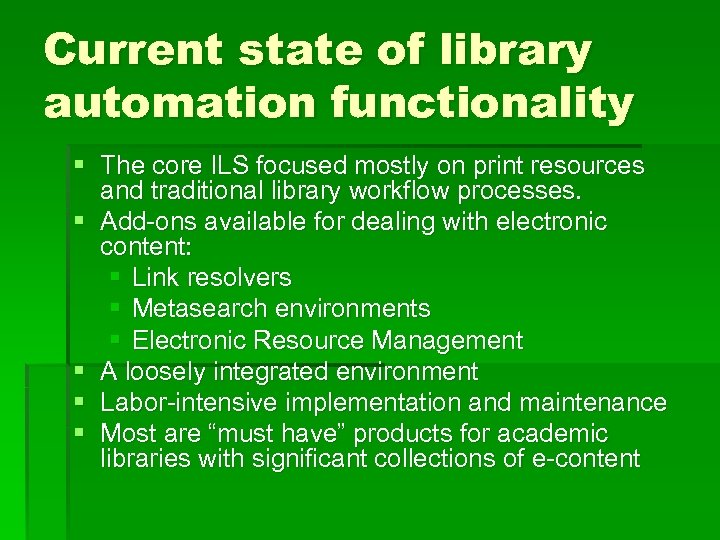

Current state of library automation functionality § The core ILS focused mostly on print resources and traditional library workflow processes. § Add-ons available for dealing with electronic content: § Link resolvers § Metasearch environments § Electronic Resource Management § A loosely integrated environment § Labor-intensive implementation and maintenance § Most are “must have” products for academic libraries with significant collections of e-content

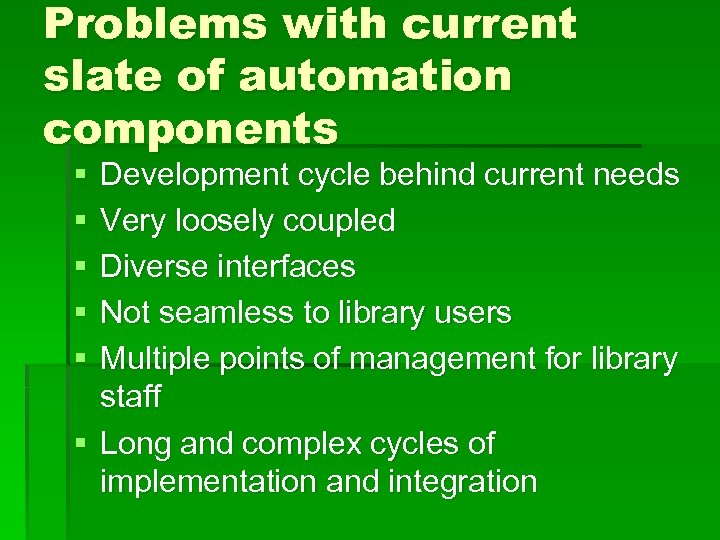

Problems with current slate of automation components § § § Development cycle behind current needs Very loosely coupled Diverse interfaces Not seamless to library users Multiple points of management for library staff § Long and complex cycles of implementation and integration

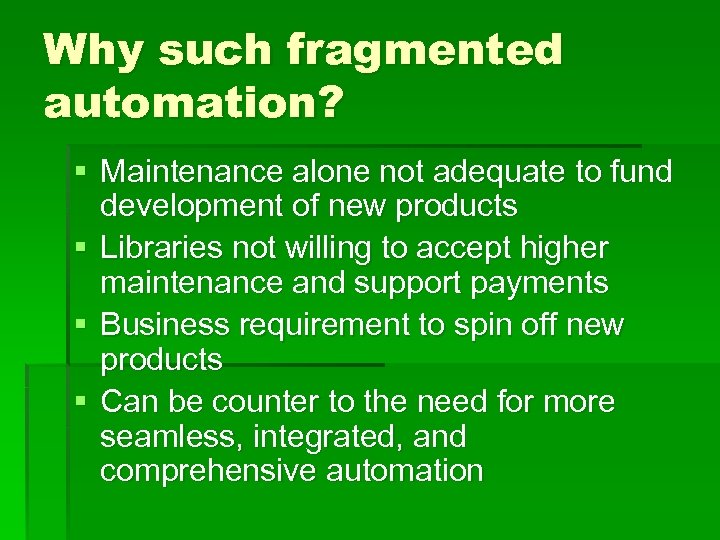

Why such fragmented automation? § Maintenance alone not adequate to fund development of new products § Libraries not willing to accept higher maintenance and support payments § Business requirement to spin off new products § Can be counter to the need for more seamless, integrated, and comprehensive automation

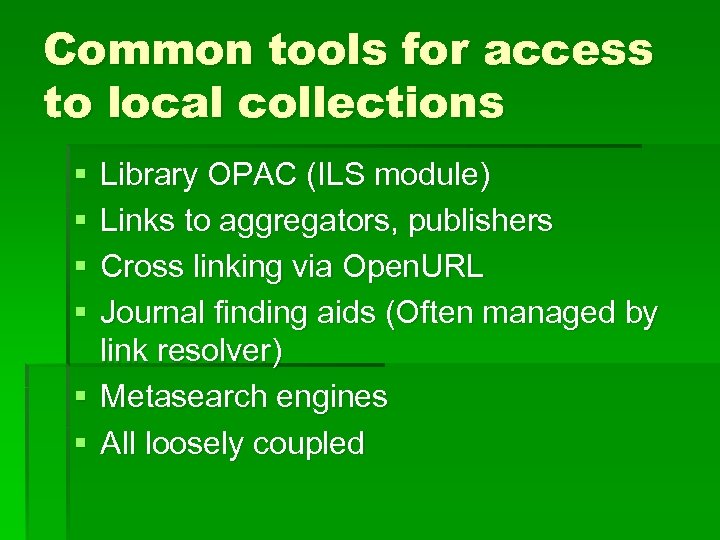

Common tools for access to local collections § § Library OPAC (ILS module) Links to aggregators, publishers Cross linking via Open. URL Journal finding aids (Often managed by link resolver) § Metasearch engines § All loosely coupled

Library OPAC § Evolved from card catalogs and continues to be bound by the constraints of that legacy. § Complex and rich in features § Interfaces often do not compare favorably with alternatives available on the Web § Print materials becoming a smaller component of the library’s overall collections.

Redefinition of library catalogs and interfaces § Traditional notions of the library catalog are being questioned § It’s no longer enough to provide a catalog limited to print resources § Digital resources cannot be an afterthought § Forcing users to use different interfaces depending on type of content becoming less tenable § Libraries working toward consolidated search environments that give equal footing to digital and print resources

The best Library OPAC?

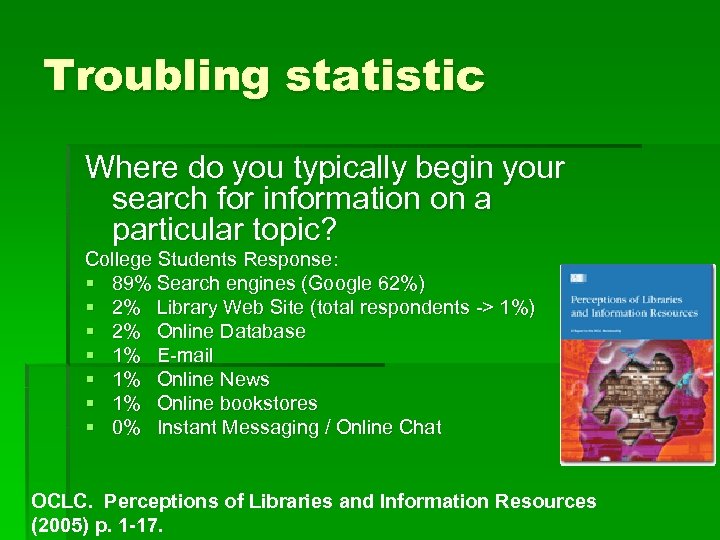

Troubling statistic Where do you typically begin your search for information on a particular topic? College Students Response: § 89% Search engines (Google 62%) § 2% Library Web Site (total respondents -> 1%) § 2% Online Database § 1% E-mail § 1% Online News § 1% Online bookstores § 0% Instant Messaging / Online Chat OCLC. Perceptions of Libraries and Information Resources (2005) p. 1 -17.

Change underway § Widespread dissatisfaction with most of the current OPACs. Many efforts toward nextgeneration catalogs and interfaces. § Movement among libraries to break out of the current mold of library catalogs and offer new interfaces better suited to the expectations of library users. § Decoupling of the front-end interface from the back-end library automation system.

Toward compelling library interfaces § Urgent need for libraries to offer interfaces their users will like to use § Move out of the 1990’s § Powerful search capabilities in tune with how the Web works today § User expectations set by other Web destination

The holy grail § A single point of entry into all the content and services offered by the library § Print + Electronic § Local + Remote § Locally metadata created Content

Comprehensive Search Service § More like OAI § Open Archives Initiative § Consolidated search services based on and data gathered in advance § Problems of scale diminished § Problems of cooperation persist

Web 2. 0 influence § A more social and collaborative approach § Web Tools and technology that foster collaboration § Blogs, wiki, blogs, tagging, social bookmarking, user rating, user reviews § Web services – important infrastructure § XML APIs § AJAX (asynchronous Java. Script and XML)

Interface expectations § Millennial gen library users are well acclimated to the Web and like it. § Used to relevancy ranking § § § The “good stuff” should be listed first Users tend not to delve deep into a result list Good relevancy requires a sophisticated approach, including objective matching criteria supplemented by popularity and relatedness factors.

Interface expectations (cont…) § Very rapid response. Users have a low tolerance for slow systems § Rich visual information: book jacket images, rating scores, etc. § Let users drill down through the result set incrementally narrowing the field § Faceted Browsing § Drill-down vs up-front Boolean or “Advanced Search” § gives the users clues about the number of hits in each sub topic. § Navigational Bread crumbs § Ratings and rankings

Appropriate organizational structures § § LCSH vs FAST Full MARC vs Dublin Core or MODS Discipline-specific thesauri or ontologies “tags”

Current Next-Gen catalog products

Common characteristics § Decoupled interface Mass export of catalog data Alternative search engine Alternative interface

Endeca Guided Navigation § North Carolina State University http: //www. lib. ncsu. edu/catalog/ § Mc. Master University http: //libcat. mcmaster. ca/ § Phoenix Public Library http: //www. phoenixpubliclibrary. org/ § Florida Center for Library Automation http: //catalog. fcla. edu/ux. jsp

Aqua. Browser Library § Queens Borough Public Library § http: //aqua. queenslibrary. org/

Ex Libris Primo § Vanderbilt University http: //alphasearch. library. vanderbilt. edu § University of Minnesota http: //prime 2. oit. umn. edu: 1701/primo_library/li bweb/action/search. do? vid=TWINCITIES § University of Iowa http: //smartsearch. uiowa. edu/

Encore from Innovative Interfaces § Nashville Public Library http: //nplencore. library. nashville. org/iii/encore/app § Scottsdale Public Library http: //encore. scottsdaleaz. gov/iii/encore/app § Yale University Lillian Goldman Law Library http: //encore. law. yale. edu/iii/encore/app

VUFind – Villanova University Based on Apache Solr search toolkit http: //www. vufind. org/

OCLC Worldcat Local § OCLC Worldcat customized for local library catalog § Relies on hooks into ILS for local services § University of Washington Libraries http: //uwashington. worldcat. org/ § University of California Melvyl Catalog

Questions and Discussion

5dcf061f664b744003d3b5a0c5875e10.ppt