f95e798e2fbadba1a5263f08e1e865fc.ppt

- Количество слайдов: 35

ILLINOIS STATE BAR ASSOCIATION Law Ed Series Real Estate Law Section Council “REAL ESTATE LAW UPDATE ” Wednesday, September 15, 1999, Eastland Suites Conference Center, Bloomington, Il. l Thursday, September 23, 1999, First Chicago Center, Chicago, Il. l 1

ILLINOIS INSTITUTE OF CONTINUING LEGAL EDUCATION “A PRACTICAL APPROACH TO MORTGAGE LIENS ON REAL ESTATE” STEVEN B. BASHAW, Moderator Mc. Bride Baker & Coles, Chicago & Oak Brook Terrace, Illinois 2

Types of Mortgages: l l Specific, consensual liens Practical Approach: Lien priority distinction Two vs. Three party instruments Equitable Mortgages: When a deed is a mortgage and other problems – Harney v. Colwell, (1 st Dist. 1942) 324 Ill, App. 173, 41 N. E. 2 d 123) 3

Types of Mortgages: l Purchase Money Mortgage Priority over prior liens against grantee to extent of purchase debt Application of Busse, (1 st Dist. 1984) 124 Ill. App. 3 d 433, 464 N. E. 2 d 561. Bank of Homewood, (1 st Dist. 1964) 48 Ill. App. 2 d 316, 199 N. E. 2 d 293. 4

MORTGAGE LIEN PRIORITY “Prior in time (perfection) is prior in right” l Firstmark Standard Life Insurance v. Superior Bank, FSB, (1 st Dist. 1995) 271 Ill. App. 2 d 435, 649 N. E. 2 d 465 l Subject to real estate taxes, special assessments and mechanic’s liens l EXCEPTIONS: l Statutory: Recording laws & mechanic’s liens l Case Law: Purchase money mortgage rules l Contract: Subordination clauses l 5

ENFORCEABILITY & LIMITATIONS An action to foreclose mortgage: 10 yrs after right of action accrues 735 ILCS 5/13 -115 Lorocque v. Baker, (2 nd Dist. 1938) 295 Ill. App. 1, 14 N. E. 2 d 502. 6

ENFORCEABILITY & LIMITATIONS Statute of Limitations on mortgage: 20 years from date of last payment 735 ILCS 5/13 -116 Livingston v. Meyers, (1955) 6 Ill. 2 d 325, 129 N. E. 2 d 12 7

ENFORCEABILITY & LIMITATIONS No Maturity Date: 30 years from date of instrument 735 ILCS 5/13 -116 Zuls v. Bowen, (1 st Dist. 1053) 351 Ill. App. 492, 115 N. E. 2 d 577. 8

TITLE vs LIEN THEORY l l ISSUE: Rights of possession: Title theory = immediate possession; Lien theory = adjudication Illinois = Intermediary estate by case law 9

TITLE vs LIEN THEORY l ILLINOIS MORTGAGE FORECLOSURE LAW; 735 ILCS 5/15 -1701 – Distinction between residential vs. nonresidential up to expiration of redemption Residential presumption mortgagor will continue in possession until at least judgment l Non-Residential presumption mortgagee will obtain possession IF the mortgage documents provide and a reasonable probability of ultimately prevailing l 10

TITLE vs LIEN THEORY – Post Redemption 735 ILCS 5/15 -1701(c)(2): “rent” @ lesser of interest under the mortgage or fmv rental – A Lease subordinate to mortgage shall not be automatically terminated 735 ILCS 5/15 -1504(3)(T); 735 ILCS 5/1508(g) Kell/Lehr & Associates v. O’Brien, (2 nd Dist. 1990), 194 Ill. App. 3 d 380, 551 N. E. 2 d 419 - prepaid rent – Mortgagee is entitled to designate Receiver: 735 ILCS 5/15 -1702(b) – Priority Mortgagee is entitled to priority in all matters relating to possession: 735 ILCS 11 5/15/1702(c)

ENFORCEMENT OF PRIORITY l The Practical approach ALWAYS considers priority of lien: Foreclosure of priority lien extinguishes subordinate liens; l Baldi v. Chicago Title, (1 st Dist. 1983), 113 Ill. App. 3 d 29, 446 N. E. 2 d 1205 and Orloff v. Petak, (3 rd Dist. 1992), 224 Ill. App. 3 d 638, 587 N. E. 2 d 37. l 12

ENFORCEMENT OF PRIORITY A lien’s priority CAN be affected (i. e. . , altered) in litigation Mid-America Federal Savings v. Liberty Bank, (2 nd Dist. 1990) 562 N. E. 2 d 1188; priority position prejudiced by failure to participate in judgment 13

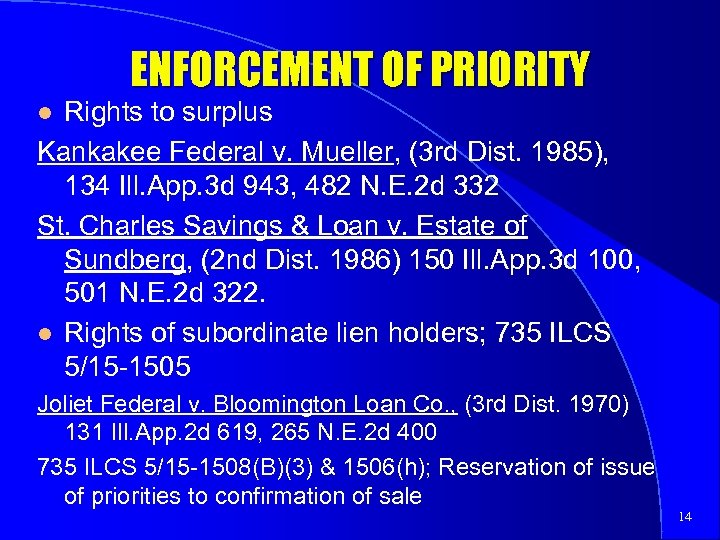

ENFORCEMENT OF PRIORITY Rights to surplus Kankakee Federal v. Mueller, (3 rd Dist. 1985), 134 Ill. App. 3 d 943, 482 N. E. 2 d 332 St. Charles Savings & Loan v. Estate of Sundberg, (2 nd Dist. 1986) 150 Ill. App. 3 d 100, 501 N. E. 2 d 322. l Rights of subordinate lien holders; 735 ILCS 5/15 -1505 l Joliet Federal v. Bloomington Loan Co. , (3 rd Dist. 1970) 131 Ill. App. 2 d 619, 265 N. E. 2 d 400 735 ILCS 5/15 -1508(B)(3) & 1506(h); Reservation of issue of priorities to confirmation of sale 14

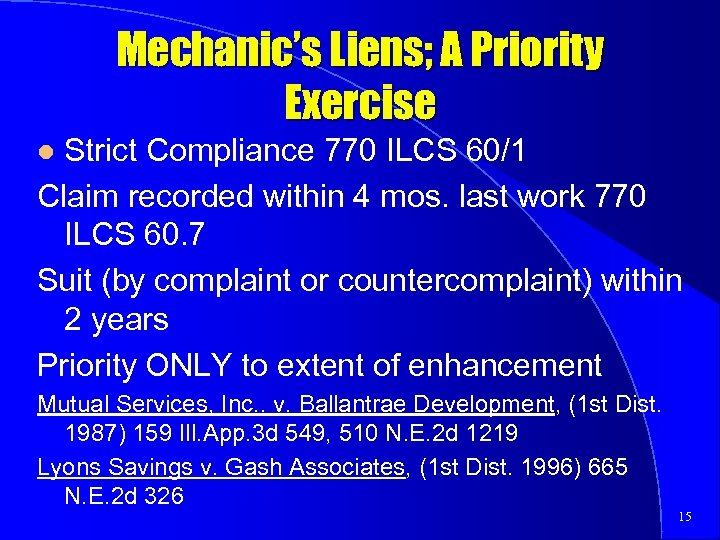

Mechanic’s Liens; A Priority Exercise Strict Compliance 770 ILCS 60/1 Claim recorded within 4 mos. last work 770 ILCS 60. 7 Suit (by complaint or countercomplaint) within 2 years Priority ONLY to extent of enhancement l Mutual Services, Inc. . v. Ballantrae Development, (1 st Dist. 1987) 159 Ill. App. 3 d 549, 510 N. E. 2 d 1219 Lyons Savings v. Gash Associates, (1 st Dist. 1996) 665 N. E. 2 d 326 15

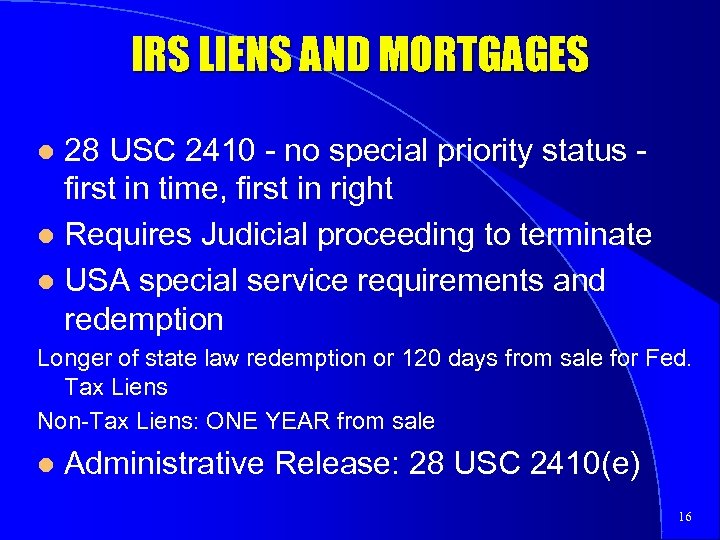

IRS LIENS AND MORTGAGES 28 USC 2410 - no special priority status first in time, first in right l Requires Judicial proceeding to terminate l USA special service requirements and redemption l Longer of state law redemption or 120 days from sale for Fed. Tax Liens Non-Tax Liens: ONE YEAR from sale l Administrative Release: 28 USC 2410(e) 16

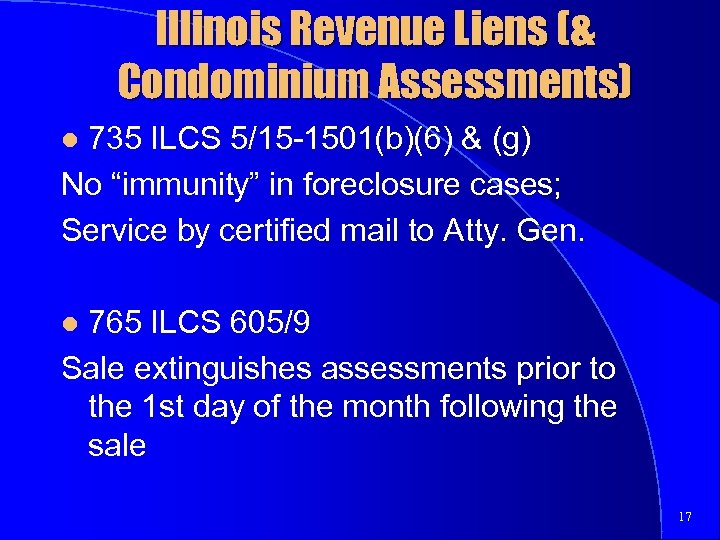

Illinois Revenue Liens (& Condominium Assessments) 735 ILCS 5/15 -1501(b)(6) & (g) No “immunity” in foreclosure cases; Service by certified mail to Atty. Gen. l 765 ILCS 605/9 Sale extinguishes assessments prior to the 1 st day of the month following the sale l 17

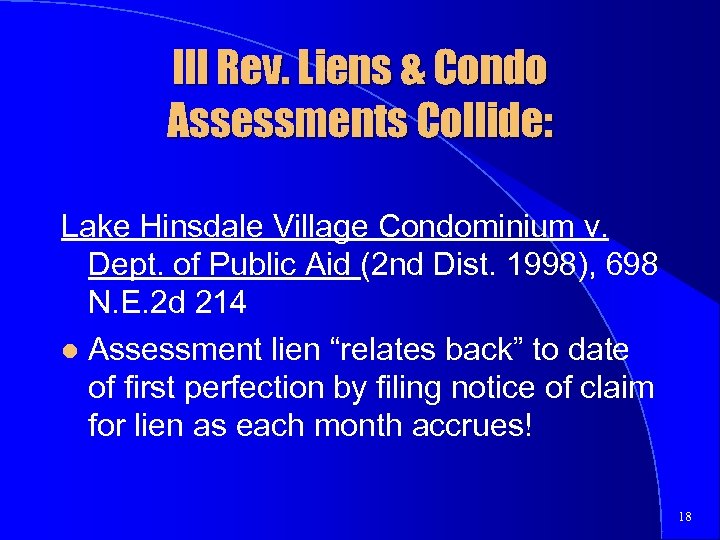

Ill Rev. Liens & Condo Assessments Collide: Lake Hinsdale Village Condominium v. Dept. of Public Aid (2 nd Dist. 1998), 698 N. E. 2 d 214 l Assessment lien “relates back” to date of first perfection by filing notice of claim for lien as each month accrues! 18

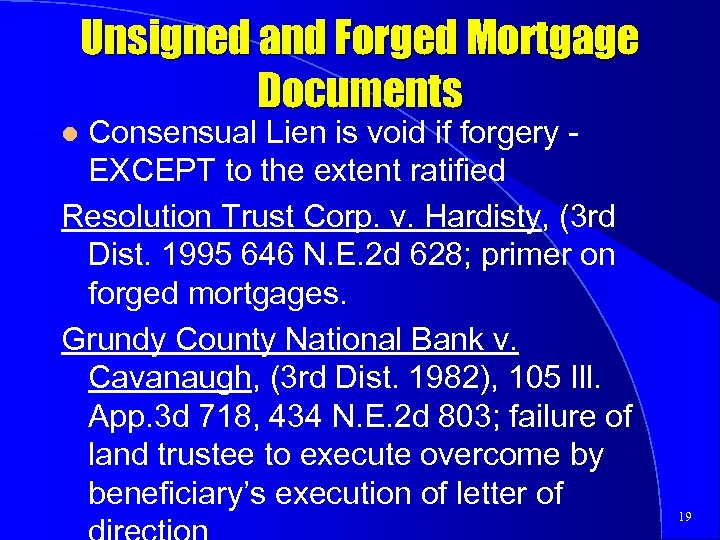

Unsigned and Forged Mortgage Documents Consensual Lien is void if forgery EXCEPT to the extent ratified Resolution Trust Corp. v. Hardisty, (3 rd Dist. 1995 646 N. E. 2 d 628; primer on forged mortgages. Grundy County National Bank v. Cavanaugh, (3 rd Dist. 1982), 105 Ill. App. 3 d 718, 434 N. E. 2 d 803; failure of land trustee to execute overcome by beneficiary’s execution of letter of l 19

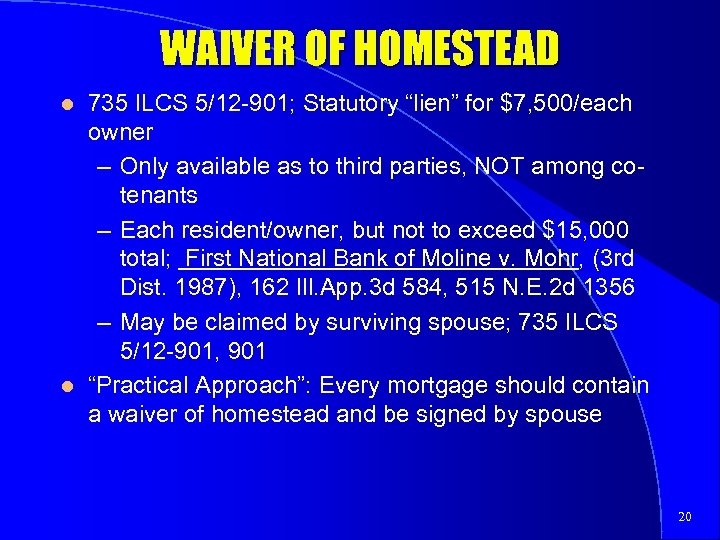

WAIVER OF HOMESTEAD l l 735 ILCS 5/12 -901; Statutory “lien” for $7, 500/each owner – Only available as to third parties, NOT among cotenants – Each resident/owner, but not to exceed $15, 000 total; First National Bank of Moline v. Mohr, (3 rd Dist. 1987), 162 Ill. App. 3 d 584, 515 N. E. 2 d 1356 – May be claimed by surviving spouse; 735 ILCS 5/12 -901, 901 “Practical Approach”: Every mortgage should contain a waiver of homestead and be signed by spouse 20

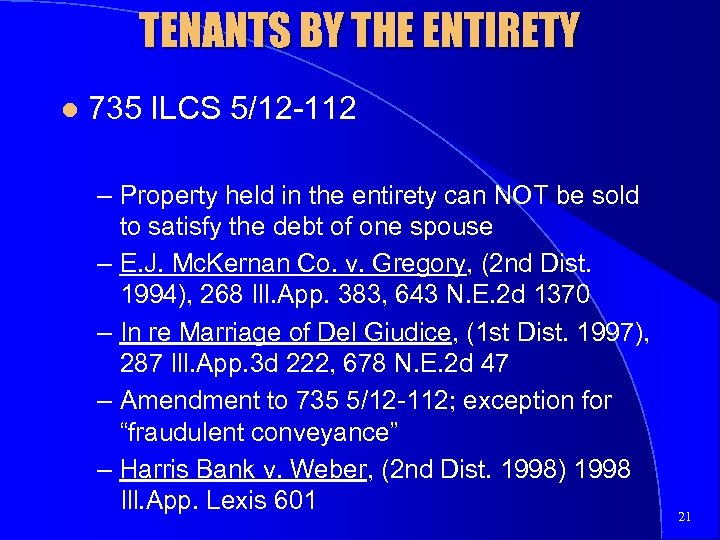

TENANTS BY THE ENTIRETY l 735 ILCS 5/12 -112 – Property held in the entirety can NOT be sold to satisfy the debt of one spouse – E. J. Mc. Kernan Co. v. Gregory, (2 nd Dist. 1994), 268 Ill. App. 383, 643 N. E. 2 d 1370 – In re Marriage of Del Giudice, (1 st Dist. 1997), 287 Ill. App. 3 d 222, 678 N. E. 2 d 47 – Amendment to 735 5/12 -112; exception for “fraudulent conveyance” – Harris Bank v. Weber, (2 nd Dist. 1998) 1998 Ill. App. Lexis 601 21

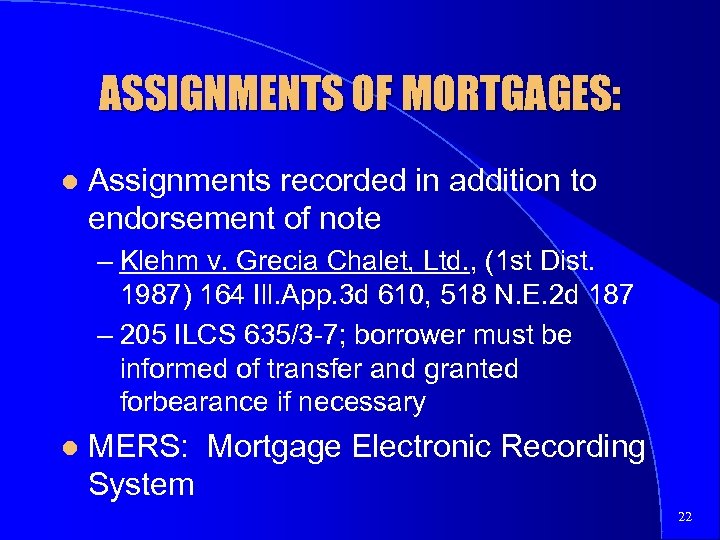

ASSIGNMENTS OF MORTGAGES: l Assignments recorded in addition to endorsement of note – Klehm v. Grecia Chalet, Ltd. , (1 st Dist. 1987) 164 Ill. App. 3 d 610, 518 N. E. 2 d 187 – 205 ILCS 635/3 -7; borrower must be informed of transfer and granted forbearance if necessary l MERS: Mortgage Electronic Recording System 22

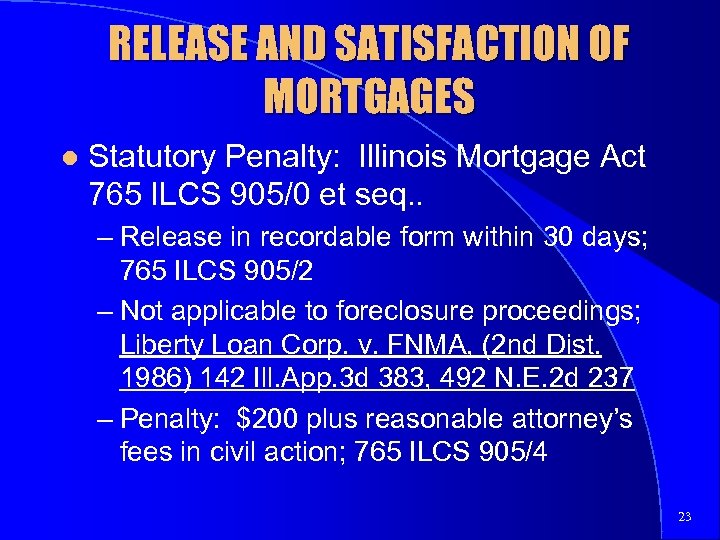

RELEASE AND SATISFACTION OF MORTGAGES l Statutory Penalty: Illinois Mortgage Act 765 ILCS 905/0 et seq. . – Release in recordable form within 30 days; 765 ILCS 905/2 – Not applicable to foreclosure proceedings; Liberty Loan Corp. v. FNMA, (2 nd Dist. 1986) 142 Ill. App. 3 d 383, 492 N. E. 2 d 237 – Penalty: $200 plus reasonable attorney’s fees in civil action; 765 ILCS 905/4 23

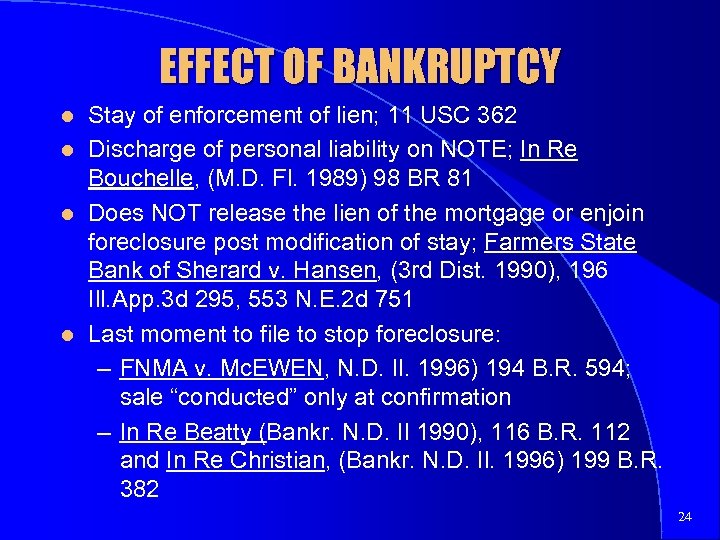

EFFECT OF BANKRUPTCY l l Stay of enforcement of lien; 11 USC 362 Discharge of personal liability on NOTE; In Re Bouchelle, (M. D. Fl. 1989) 98 BR 81 Does NOT release the lien of the mortgage or enjoin foreclosure post modification of stay; Farmers State Bank of Sherard v. Hansen, (3 rd Dist. 1990), 196 Ill. App. 3 d 295, 553 N. E. 2 d 751 Last moment to file to stop foreclosure: – FNMA v. Mc. EWEN, N. D. Il. 1996) 194 B. R. 594; sale “conducted” only at confirmation – In Re Beatty (Bankr. N. D. Il 1990), 116 B. R. 112 and In Re Christian, (Bankr. N. D. Il. 1996) 199 B. R. 382 24

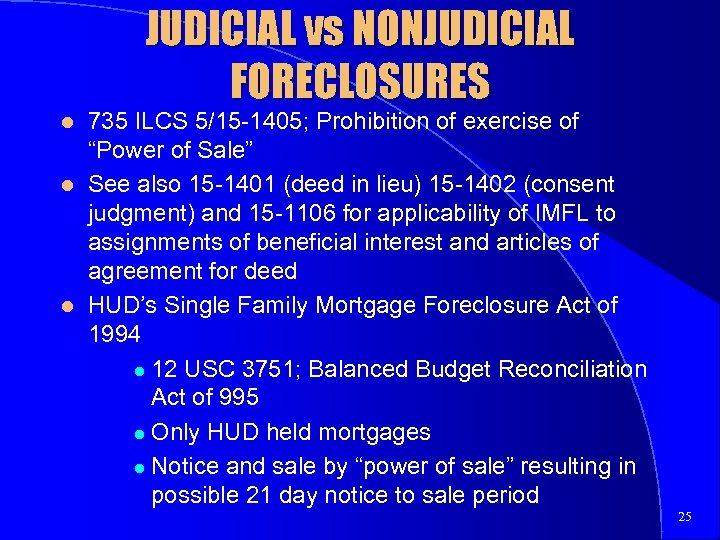

JUDICIAL vs NONJUDICIAL FORECLOSURES l l l 735 ILCS 5/15 -1405; Prohibition of exercise of “Power of Sale” See also 15 -1401 (deed in lieu) 15 -1402 (consent judgment) and 15 -1106 for applicability of IMFL to assignments of beneficial interest and articles of agreement for deed HUD’s Single Family Mortgage Foreclosure Act of 1994 l 12 USC 3751; Balanced Budget Reconciliation Act of 995 l Only HUD held mortgages l Notice and sale by “power of sale” resulting in possible 21 day notice to sale period 25

DEFICIENCIES, SURPLUS & ENTITLEMENT Created at Confirmation of Report of Sale; 735 ILCS 5/15 -1508 l Deficiency: l – Heritage Standard Bank v. Heritage Standard Bank, (2 nd Dist. 1986) 149 Ill. App. 3 d 563, 500 N. E. 2 d 60 – State Bank of Antioch v. Nelson, (2 nd Dist. 1985) 132 Ill. App. 3 d 120, 477 N. E. 2 d 77 26

DEFICIENCIES, SURPLUS & ENTITLEMENT l Surplus: – Application: 735 ILCS 5/15 -1512 Reasonable expense of sale l Expenses of maintaining the premises l satisfaction of claims in order of priority as adjudicated l Surplus to be held until further order of court l – Hart v. Wingart, (1876) 83 Ill. 282 – Kankakee Federal v. Mueller, (3 rd Dist. 1985), 134 Ill. App. 3 d 943, 482 N. E. 2 d 332 – St. Charles Savings & Loan v. Estate of Sundberg, (2 nd Dist. 1986) 150 Ill. App. 3 d 100, 501 N. E. 2 d 322. 27

Emerging Surplus & Lien Law Members Equity Credit Union v. Duefel, (3 rd Dist. 1998) 692 N. E, 2 d 865; Buyers take subject to outstanding debts vs. “marshalling asset” theory l BCGS, LLC v. Jaster, (2 nd Dist. 1998) 700 N. E. 2 d 1075; foreclosure extinguishes all liens over which court had jurisdiction in favor of bidder; even husband of owner! l 28

ALTERNATIVE DISPUTE RESOLUTION & MORTGAGE LIENS: l DEED IN LIEU OF FORECLOSURE – 735 ILCS 5/15 -1401 – Voluntary – Presumed quid pro quo: conveyance for release of liability – Olney Trust Bank v. Pitts, (5 th Dist. 1990), 200 Ill. App. 3 d 917, 528 N. E. 2 d 398. 29

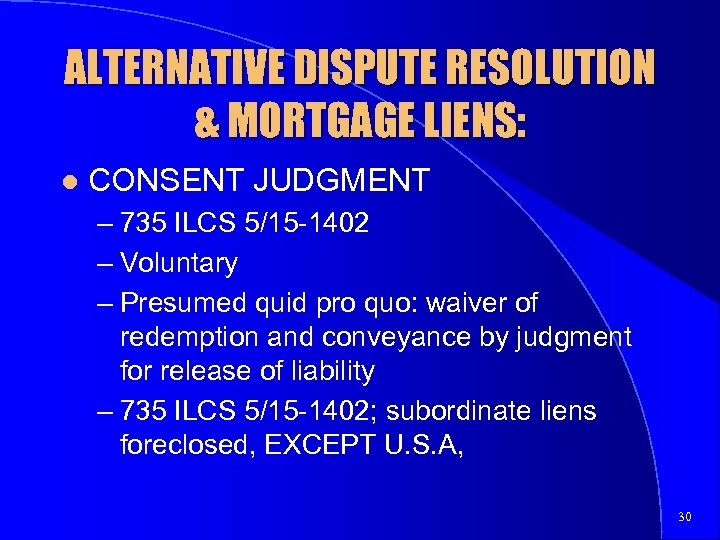

ALTERNATIVE DISPUTE RESOLUTION & MORTGAGE LIENS: l CONSENT JUDGMENT – 735 ILCS 5/15 -1402 – Voluntary – Presumed quid pro quo: waiver of redemption and conveyance by judgment for release of liability – 735 ILCS 5/15 -1402; subordinate liens foreclosed, EXCEPT U. S. A, 30

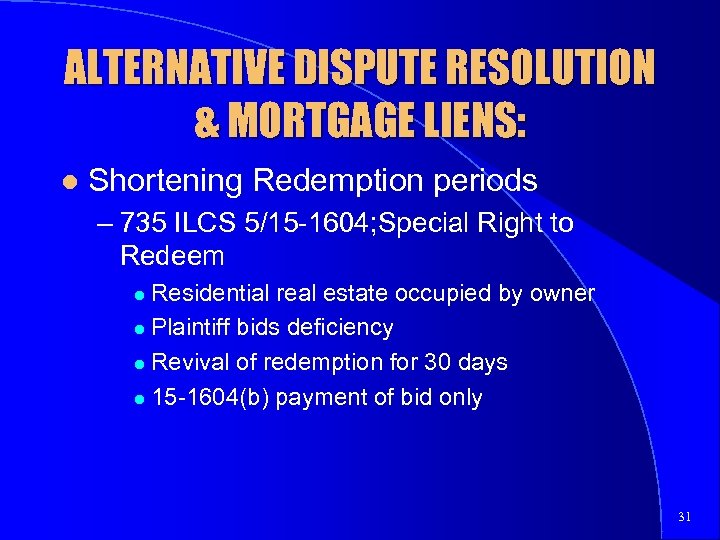

ALTERNATIVE DISPUTE RESOLUTION & MORTGAGE LIENS: l Shortening Redemption periods – 735 ILCS 5/15 -1604; Special Right to Redeem Residential real estate occupied by owner l Plaintiff bids deficiency l Revival of redemption for 30 days l 15 -1604(b) payment of bid only l 31

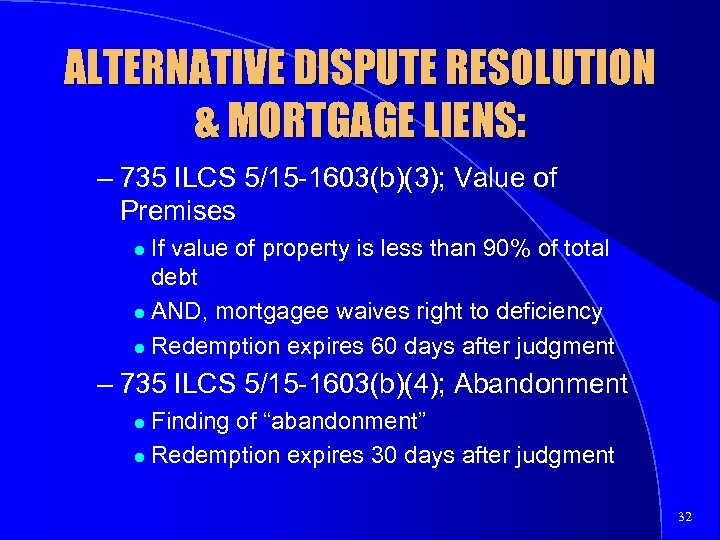

ALTERNATIVE DISPUTE RESOLUTION & MORTGAGE LIENS: – 735 ILCS 5/15 -1603(b)(3); Value of Premises If value of property is less than 90% of total debt l AND, mortgagee waives right to deficiency l Redemption expires 60 days after judgment l – 735 ILCS 5/15 -1603(b)(4); Abandonment Finding of “abandonment” l Redemption expires 30 days after judgment l 32

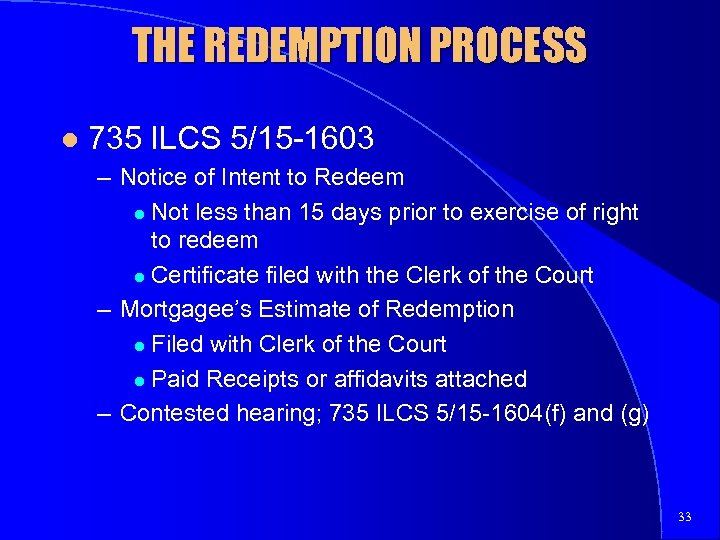

THE REDEMPTION PROCESS l 735 ILCS 5/15 -1603 – Notice of Intent to Redeem l Not less than 15 days prior to exercise of right to redeem l Certificate filed with the Clerk of the Court – Mortgagee’s Estimate of Redemption l Filed with Clerk of the Court l Paid Receipts or affidavits attached – Contested hearing; 735 ILCS 5/15 -1604(f) and (g) 33

The “Practical Side” to Redemption: l Fleet Mortgage v. Deal, (1 st Dist. 1997), 287 Ill. App. 3 d 385, 678 N. E. 2 d 35 l Commercial Credit v. Espinosa, (1 st Dist. 1997), ___ Ill. App. 3 d __, 689 N. E. 2 d 282 34

That’s All! l Thanks for attending! We hope you have enjoyed this presentation. If you have questions, please feel free to ask. We’re happy to help. l For a detailed listing of the upcoming CLE schedule visit our web site at http: //www/illinoiscle. com 35

f95e798e2fbadba1a5263f08e1e865fc.ppt