f8ea71c8829786ca03ca49fc09ba1f40.ppt

- Количество слайдов: 20

IIM – MBA 2006 Future of Grow for the Long Run or Die ? Group : Tiphaine Lalonde, Adeeb Munim, Jean-Paul Nicolet, John Soltana

Once Upon a Time, On 1984 & called it created a company on his own image with 1000 $ Found “The One Thing” and did stick to it …. . the “Direct Model”. Incarnated it in the « Soul of Dell » …. . & could sell PC & Servers … & Earn Profits for years while PC giants, IBM, Compaq, … were in lose. AFTER 20 years, Dell built a 60 Billion fortune ! He understood to live one needs to Grow for Long Run otherwise face Death BUT, but since 5 Quarters he could not Grow …. How many quarters separate Dell from DEATH ? Or could EVOLVE to SURVIVE … Or REINVENT its future and LIVE …… ALICE, Alice from your Wonderland … Could you see FUTURE OF DELL ?

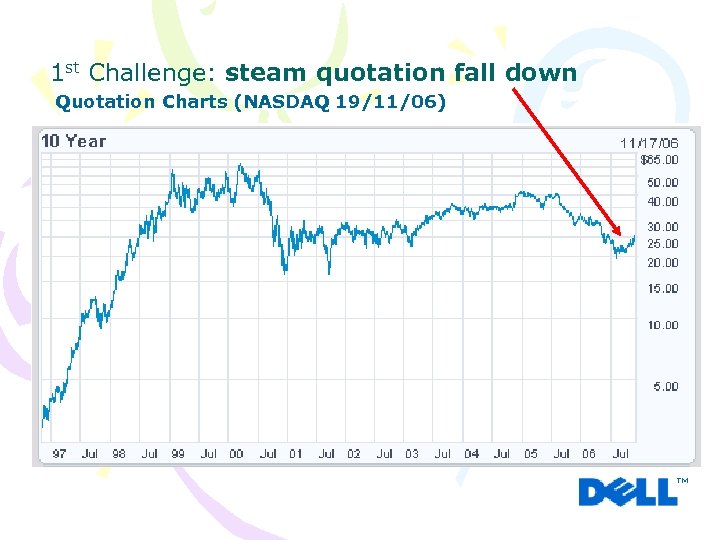

1 st Challenge: steam quotation fall down Quotation Charts (NASDAQ 19/11/06)

Signs of the stake 1. Quotation lost 40 % of value (43 US$ to 24 US$) since 1 year 2. Investor analysts doubt on Dell’s Recovery 1. 2. Short term: Missed Financial Targets since > 1 year Mid/long term: how to increase sales from 60 to 80 Billion $ by 2009 ?

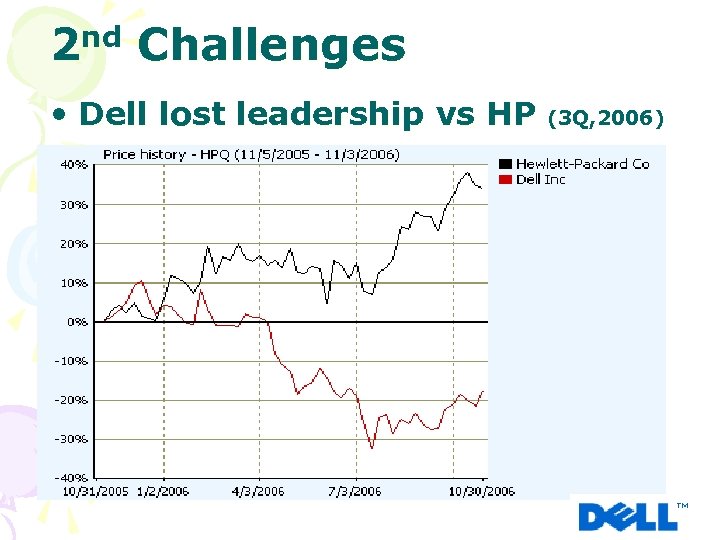

2 nd Challenges • Dell lost leadership vs HP (3 Q, 2006)

Signs of the stake 3. Lost top leadership in worldwide PC sales After 3 years of leadership: HP = 17. 23% vs DELL = 17. 18% 4. Revenue growth - 6% On PC Desktop (core product) -1% on all product segments

II. What is Dell’s Singularity? “The direct model has become the backbone of our company, and the greatest tool in its growth”, Michael Dell

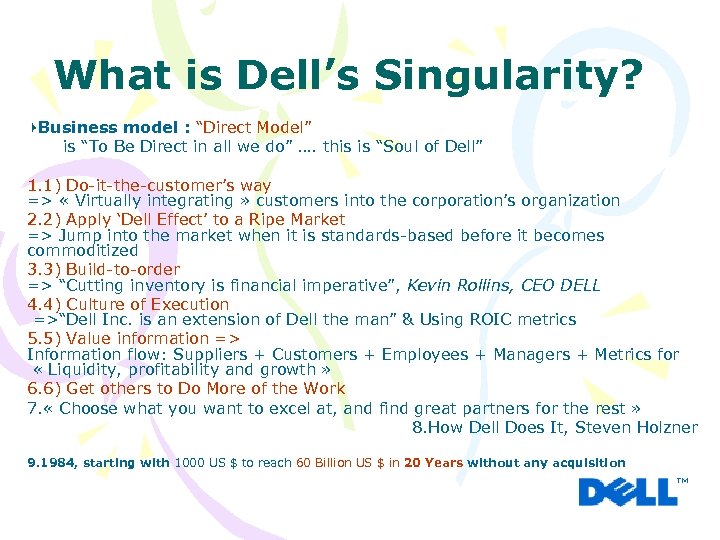

What is Dell’s Singularity? Business model : “Direct Model” is “To Be Direct in all we do” …. this is “Soul of Dell” 1. 1) Do-it-the-customer’s way => « Virtually integrating » customers into the corporation’s organization 2. 2) Apply ‘Dell Effect’ to a Ripe Market => Jump into the market when it is standards-based before it becomes commoditized 3. 3) Build-to-order => “Cutting inventory is financial imperative”, Kevin Rollins, CEO DELL 4. 4) Culture of Execution =>“Dell Inc. is an extension of Dell the man” & Using ROIC metrics 5. 5) Value information => Information flow: Suppliers + Customers + Employees + Managers + Metrics for « Liquidity, profitability and growth » 6. 6) Get others to Do More of the Work 7. « Choose what you want to excel at, and find great partners for the rest » 8. How Dell Does It, Steven Holzner 9. 1984, starting with 1000 US $ to reach 60 Billion US $ in 20 Years without any acquisition

Products 35% 15. 2% Enhanced Services 10 % 26. 3 % 3. 5 %

Market segments • Home & home office • Small business • Medium and Large Business • Government, Education & Healthcare

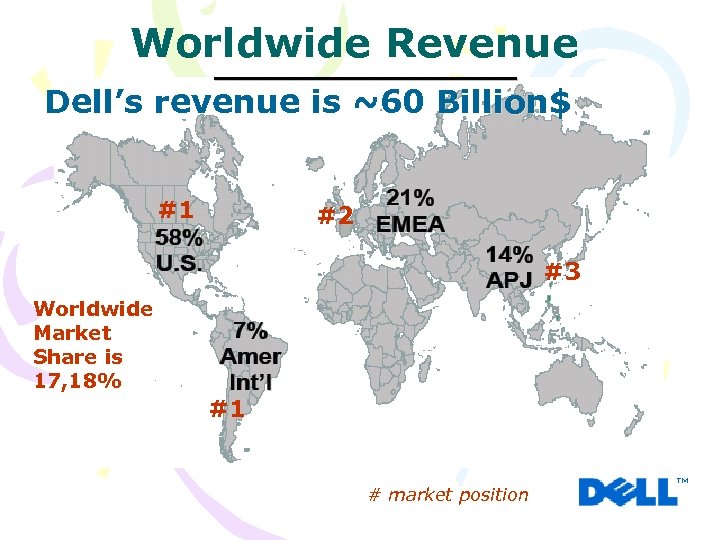

Worldwide Revenue Dell’s revenue is ~60 Billion$ #1 #2 #3 Worldwide Market Share is 17, 18% #1 # market position

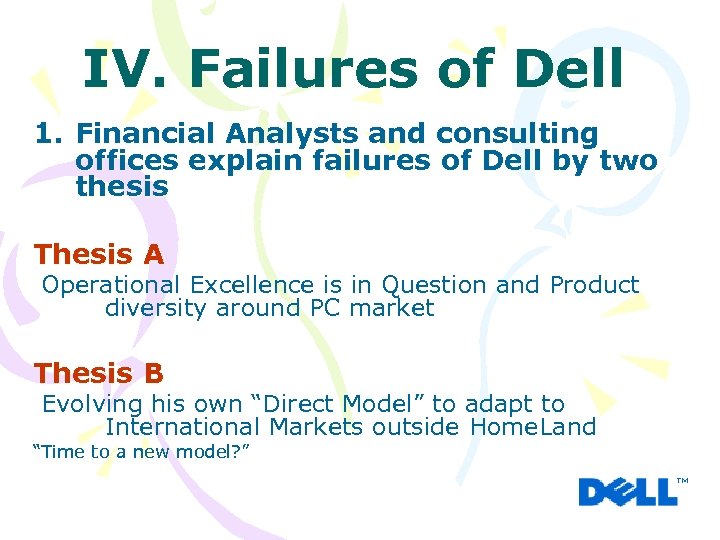

IV. Failures of Dell 1. Financial Analysts and consulting offices explain failures of Dell by two thesis Thesis A Operational Excellence is in Question and Product diversity around PC market Thesis B Evolving his own “Direct Model” to adapt to International Markets outside Home. Land “Time to a new model? ”

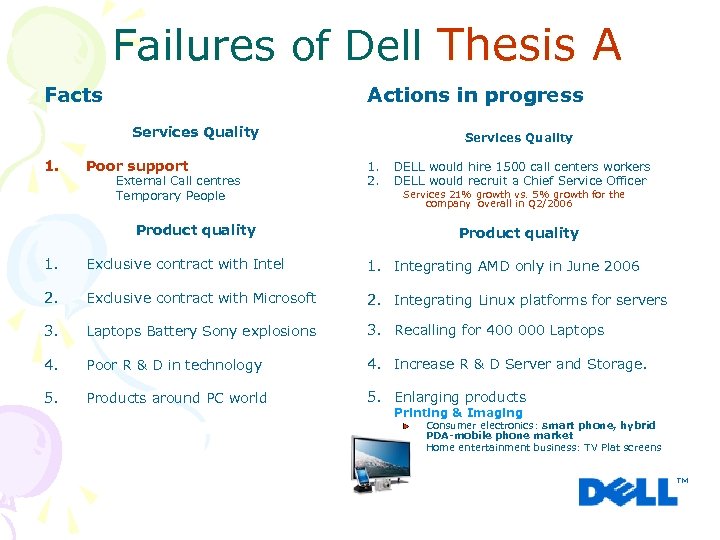

Failures of Dell Thesis A Facts Actions in progress Services Quality 1. Poor support External Call centres Temporary People Product quality Services Quality 1. 2. DELL would hire 1500 call centers workers DELL would recruit a Chief Service Officer Services 21% growth vs. 5% growth for the company overall in Q 2/2006 Product quality 1. Exclusive contract with Intel 1. Integrating AMD only in June 2006 2. Exclusive contract with Microsoft 2. Integrating Linux platforms for servers 3. Laptops Battery Sony explosions 3. Recalling for 400 000 Laptops 4. Poor R & D in technology 4. Increase R & D Server and Storage. 5. Products around PC world 5. Enlarging products Printing & Imaging Consumer electronics: smart phone, hybrid PDA-mobile phone market Home entertainment business: TV Plat screens

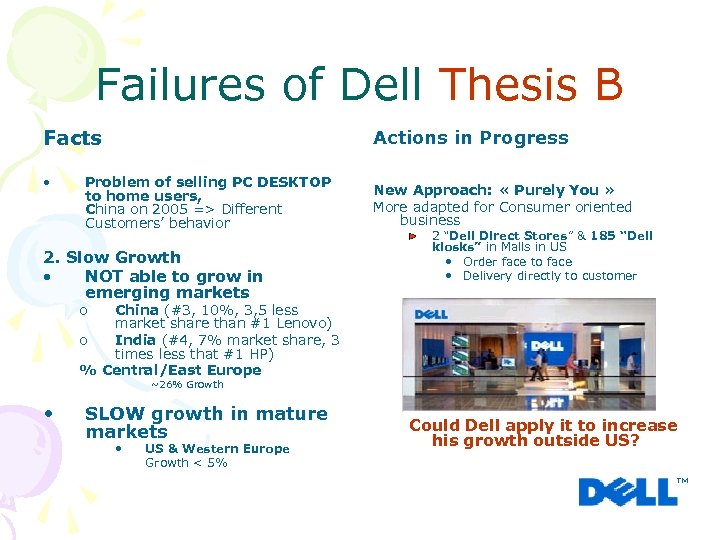

Failures of Dell Thesis B Facts • Actions in Progress Problem of selling PC DESKTOP to home users, China on 2005 => Different Customers’ behavior 2. Slow Growth • NOT able to grow in emerging markets New Approach: « Purely You » More adapted for Consumer oriented business 2 “Dell Direct Stores” & 185 “Dell kiosks” in Malls in US • Order face to face • Delivery directly to customer o China (#3, 10%, 3, 5 less market share than #1 Lenovo) o India (#4, 7% market share, 3 times less that #1 HP) % Central/East Europe ~26% Growth • SLOW growth in mature markets • US & Western Europe Growth < 5% Could Dell apply it to increase his growth outside US?

VI. How to grow ? Future of

How to Grow ? 1. • Extending the “Direct Model” area Dell is in “Trial & Error” strategy to extend toward near neighboring markets to PC Business Consumer Electronics -> Home Entertainment 2. • • Exporting the “Direct Model” to new markets and New Value proposal to other products outside the PC Business to Services rather than products

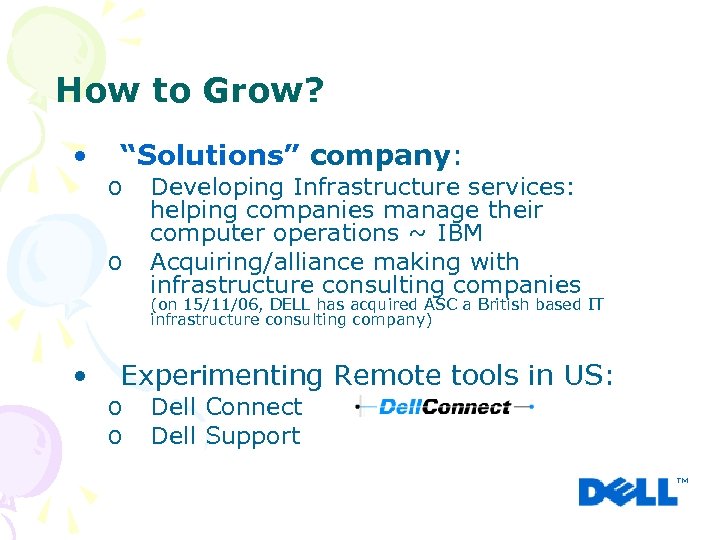

How to Grow? • “Solutions” company: o o Developing Infrastructure services: helping companies manage their computer operations ~ IBM Acquiring/alliance making with infrastructure consulting companies (on 15/11/06, DELL has acquired ASC a British based IT infrastructure consulting company) • Experimenting Remote tools in US: o o Dell Connect Dell Support

How to grow ? “Direct Model” 1. Evolving the “Direct Model” itself Example: “Dell Direct stores” Blended approach: Face to face + virtual Would this permit Dell to grow in mature and emerging markets? 2. Product innovation + Customer Relation Innovation 3. Jumping into the market in • Innovation phase rather than Standardization phase OR • Commodity phase, finding the Anamorphous 4. Grow through acquisitions

Future of Scenario A Could Dell Change without Changing ? Scenario B Could DELL reinvent its own future in DELL 2. 0 ? Have The “Second” Thing? Or the “One Thing” for second time ?

Future of Could Dell compete for the FUTURE rather than competing for the NEAR FUTURE ?

f8ea71c8829786ca03ca49fc09ba1f40.ppt