37101dc3b418199e92be3284191f0b6d.ppt

- Количество слайдов: 19

III COLÓQUIO INTERNACIONAL SOBRE SEGUROS E FUNDOS DE PENSÕES July 7 th, 2004 Denis Duverne Member of AXA Management Board Chief Financial Officer

The Future of the Insurance Business : Challenges and Perspectives Lisbonne- Denis Duverne - 07/07/04 - Page 2

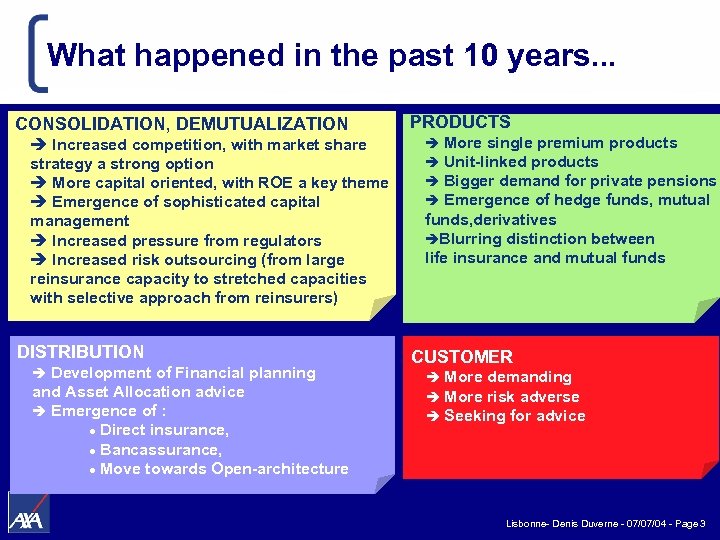

What happened in the past 10 years. . . CONSOLIDATION, DEMUTUALIZATION è Increased competition, with market share strategy a strong option è More capital oriented, with ROE a key theme è Emergence of sophisticated capital management è Increased pressure from regulators è Increased risk outsourcing (from large reinsurance capacity to stretched capacities with selective approach from reinsurers) DISTRIBUTION Development of Financial planning and Asset Allocation advice è Emergence of : l Direct insurance, l Bancassurance, l Move towards Open-architecture è PRODUCTS More single premium products Unit-linked products Bigger demand for private pensions Emergence of hedge funds, mutual funds, derivatives èBlurring distinction between life insurance and mutual funds è è CUSTOMER è è è More demanding More risk adverse Seeking for advice Lisbonne- Denis Duverne - 07/07/04 - Page 3

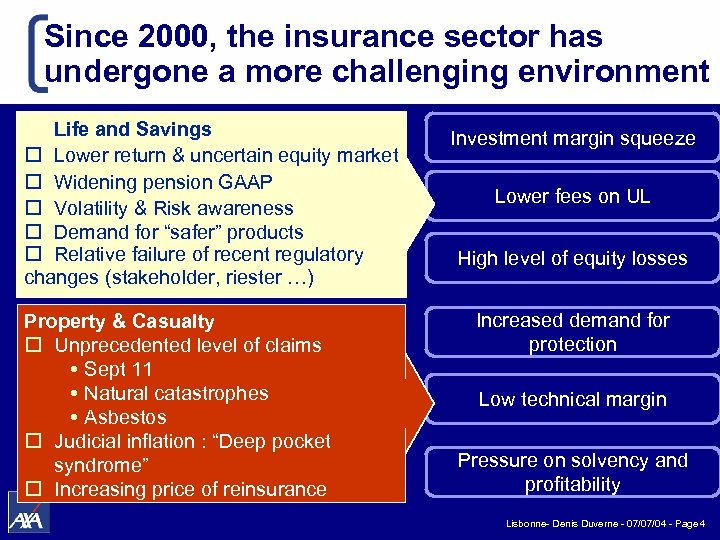

Since 2000, the insurance sector has undergone a more challenging environment Life and Savings o Lower return & uncertain equity market o Widening pension GAAP o Volatility & Risk awareness o Demand for “safer” products o Relative failure of recent regulatory changes (stakeholder, riester …) Property & Casualty o Unprecedented level of claims Sept 11 Natural catastrophes Asbestos o Judicial inflation : “Deep pocket syndrome” o Increasing price of reinsurance Investment margin squeeze Lower fees on UL High level of equity losses Increased demand for protection Low technical margin Pressure on solvency and profitability Lisbonne- Denis Duverne - 07/07/04 - Page 4

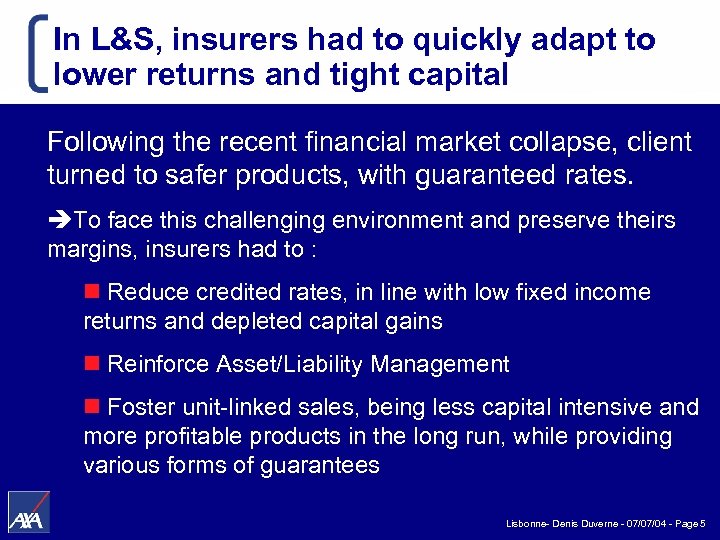

In L&S, insurers had to quickly adapt to lower returns and tight capital Following the recent financial market collapse, client turned to safer products, with guaranteed rates. èTo face this challenging environment and preserve theirs margins, insurers had to : n Reduce credited rates, in line with low fixed income returns and depleted capital gains n Reinforce Asset/Liability Management n Foster unit-linked sales, being less capital intensive and more profitable products in the long run, while providing various forms of guarantees Lisbonne- Denis Duverne - 07/07/04 - Page 5

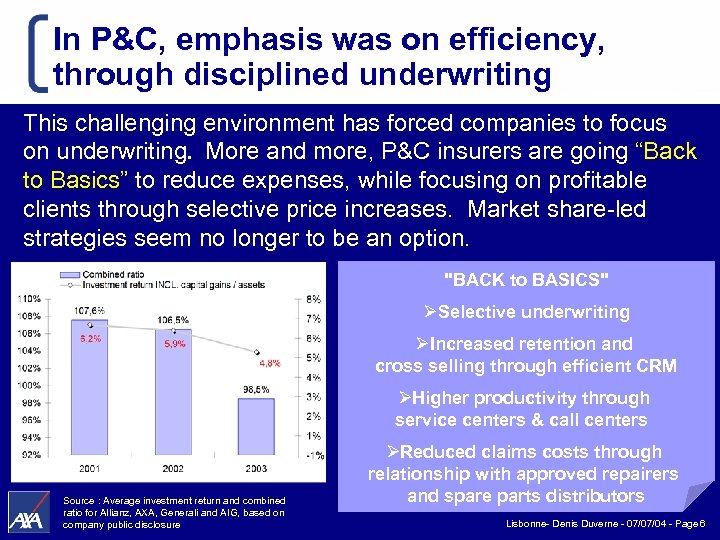

In P&C, emphasis was on efficiency, through disciplined underwriting This challenging environment has forced companies to focus on underwriting. More and more, P&C insurers are going “Back to Basics” to reduce expenses, while focusing on profitable clients through selective price increases. Market share-led strategies seem no longer to be an option. "BACK to BASICS" ØSelective underwriting ØIncreased retention and cross selling through efficient CRM ØHigher productivity through service centers & call centers Source : Average investment return and combined ratio for Allianz, AXA, Generali and AIG, based on company public disclosure ØReduced claims costs through relationship with approved repairers and spare parts distributors Lisbonne- Denis Duverne - 07/07/04 - Page 6

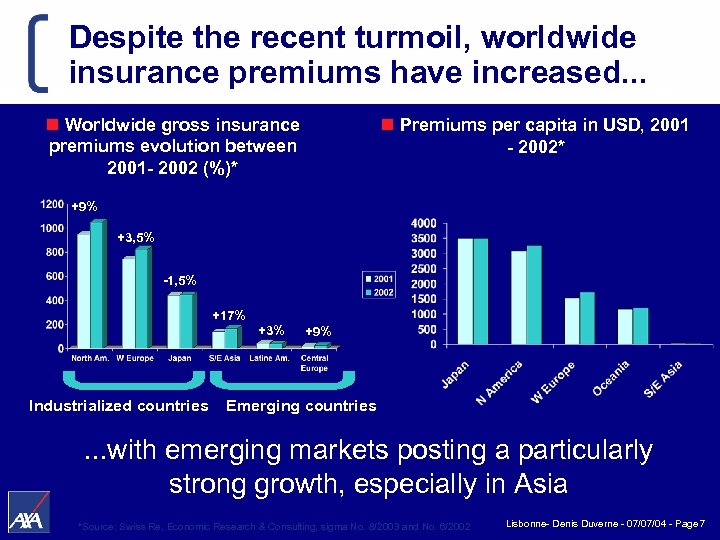

Despite the recent turmoil, worldwide insurance premiums have increased. . . n Worldwide gross insurance premiums evolution between 2001 - 2002 (%)* n Premiums per capita in USD, 2001 - 2002* +9% +3, 5% -1, 5% +17% +3% Industrialized countries +9% Emerging countries . . . with emerging markets posting a particularly strong growth, especially in Asia *Source: Swiss Re, Economic Research & Consulting, sigma No. 8/2003 and No. 6/2002 Lisbonne- Denis Duverne - 07/07/04 - Page 7

Future and challenges for the insurance sector ? To remain attractive, the insurance sector has to grow profitably while satifying client needs… n What future in terms of growth? n What future in terms of distribution ? n What future in terms of offer ? n What future in terms of margins ? n What future in terms of required capital ? Lisbonne- Denis Duverne - 07/07/04 - Page 8

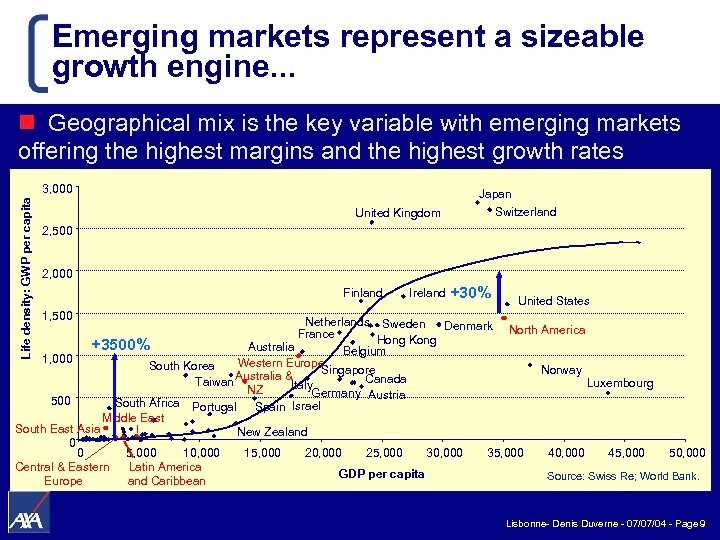

Emerging markets represent a sizeable growth engine. . . n Geographical mix is the key variable with emerging markets offering the highest margins and the highest growth rates Life density: GWP per capita 3, 000 Japan Switzerland United Kingdom 2, 500 2, 000 Finland Ireland +30% United States 1, 500 Netherlands Sweden Denmark North America France Hong Kong +3500% Australia Belgium 1, 000 Western Europe South Korea Singapore Norway Australia & Canada Taiwan Luxembourg Italy NZ Germany Austria 500 South Africa Portugal Spain Israel Middle East South East Asia New Zealand 0 0 5, 000 10, 000 15, 000 20, 000 25, 000 30, 000 35, 000 40, 000 45, 000 50, 000 Central & Eastern Latin America GDP per capita Source: Swiss Re; World Bank. Europe and Caribbean Lisbonne- Denis Duverne - 07/07/04 - Page 9

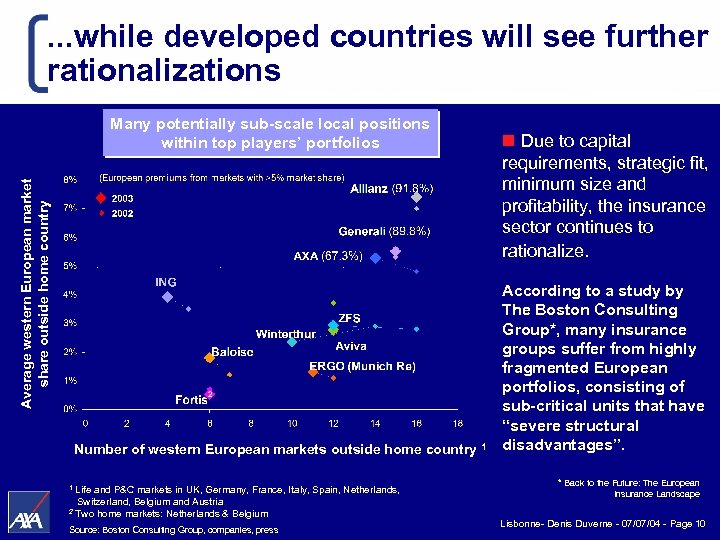

. . . while developed countries will see further rationalizations Many potentially sub-scale local positions within top players’ portfolios Average western European market share outside home country n Due to capital requirements, strategic fit, minimum size and profitability, the insurance sector continues to rationalize. Number of western European markets outside home country Life and P&C markets in UK, Germany, France, Italy, Spain, Netherlands, Switzerland, Belgium and Austria 2 Two home markets: Netherlands & Belgium 1 Source: Boston Consulting Group, companies, press 1 According to a study by The Boston Consulting Group*, many insurance groups suffer from highly fragmented European portfolios, consisting of sub-critical units that have “severe structural disadvantages”. * Back to the Future: The European Insurance Landscape Lisbonne- Denis Duverne - 07/07/04 - Page 10

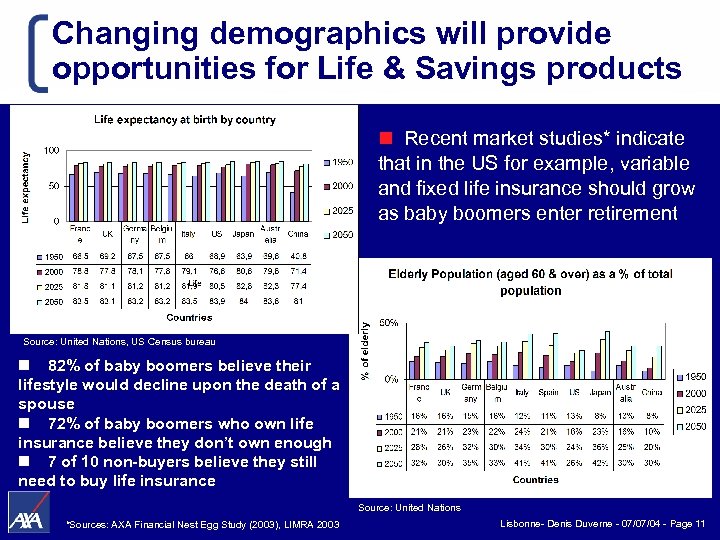

Changing demographics will provide opportunities for Life & Savings products n Recent market studies* indicate that in the US for example, variable and fixed life insurance should grow as baby boomers enter retirement Source: United Nations, US Census bureau n 82% of baby boomers believe their lifestyle would decline upon the death of a spouse n 72% of baby boomers who own life insurance believe they don’t own enough n 7 of 10 non-buyers believe they still need to buy life insurance Source: United Nations *Sources: AXA Financial Nest Egg Study (2003), LIMRA 2003 Lisbonne- Denis Duverne - 07/07/04 - Page 11

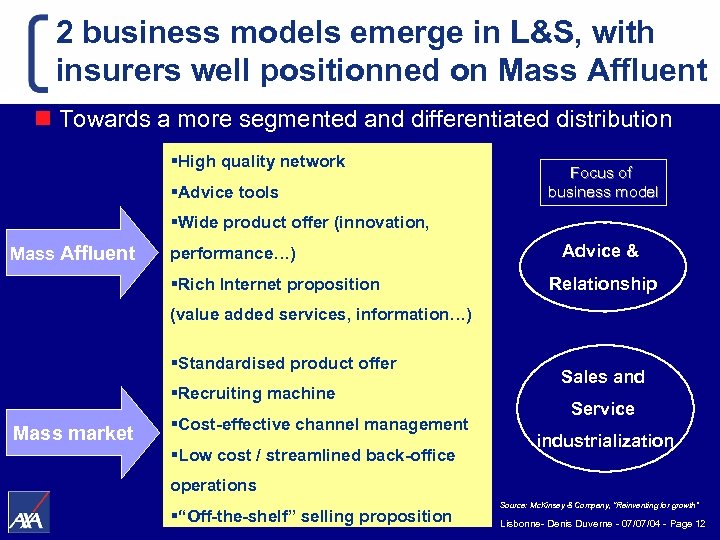

2 business models emerge in L&S, with insurers well positionned on Mass Affluent n Towards a more segmented and differentiated distribution §High quality network §Advice tools Focus of business model §Wide product offer (innovation, Mass Affluent performance…) §Rich Internet proposition Advice & Relationship (value added services, information…) §Standardised product offer §Recruiting machine Mass market §Cost-effective channel management §Low cost / streamlined back-office Sales and Service industrialization operations §“Off-the-shelf” selling proposition Source: Mc. Kinsey & Company, “Reinventing for growth” Lisbonne- Denis Duverne - 07/07/04 - Page 12

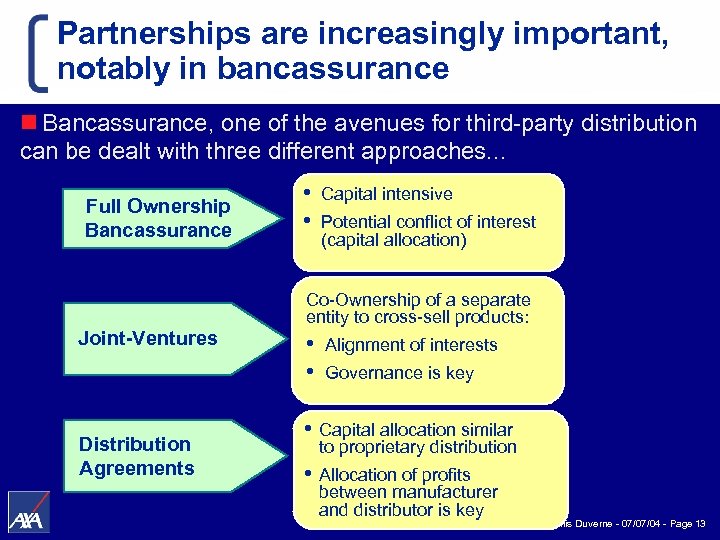

Partnerships are increasingly important, notably in bancassurance n Bancassurance, one of the avenues for third-party distribution can be dealt with three different approaches. . . Full Ownership Bancassurance • • Capital intensive Potential conflict of interest (capital allocation) Co-Ownership of a separate entity to cross-sell products: Joint-Ventures Distribution Agreements • • Alignment of interests Governance is key • Capital allocation similar to proprietary distribution • Allocation of profits between manufacturer and distributor is key Lisbonne- Denis Duverne - 07/07/04 - Page 13

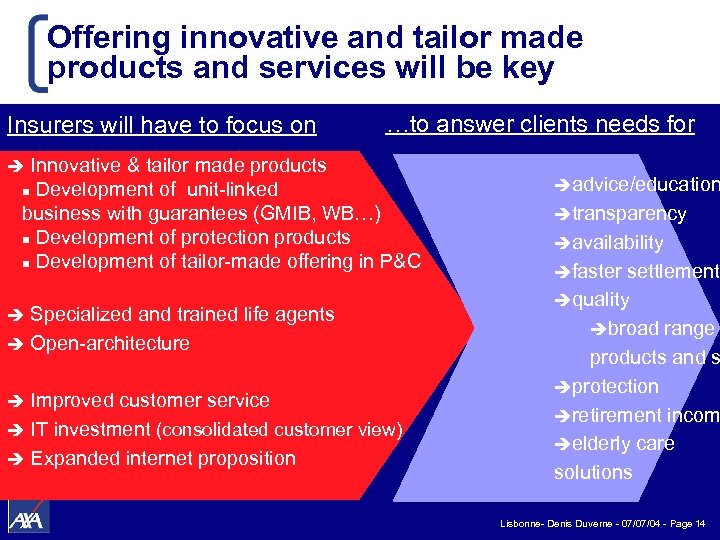

Offering innovative and tailor made products and services will be key Insurers will have to focus on …to answer clients needs for Innovative & tailor made products n Development of unit-linked business with guarantees (GMIB, WB…) n Development of protection products n Development of tailor-made offering in P&C è Specialized and trained life agents è Open-architecture è Improved customer service è IT investment (consolidated customer view) è Expanded internet proposition è èadvice/education ètransparency èavailability èfaster settlements èquality èbroad range products and s èprotection èretirement incom èelderly care solutions Lisbonne- Denis Duverne - 07/07/04 - Page 14

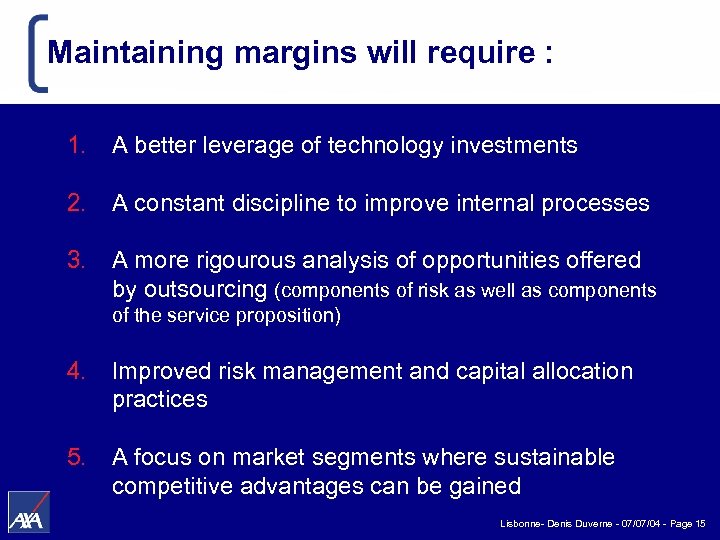

Maintaining margins will require : 1. A better leverage of technology investments 2. A constant discipline to improve internal processes 3. A more rigourous analysis of opportunities offered by outsourcing (components of risk as well as components of the service proposition) 4. Improved risk management and capital allocation practices 5. A focus on market segments where sustainable competitive advantages can be gained Lisbonne- Denis Duverne - 07/07/04 - Page 15

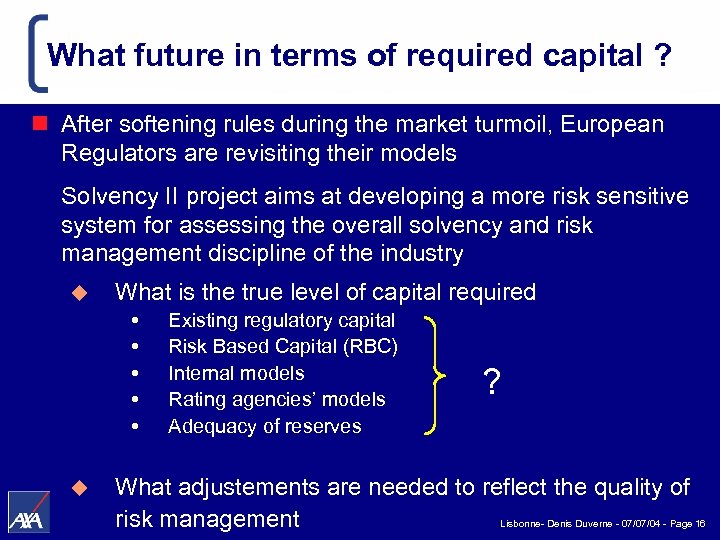

What future in terms of required capital ? n After softening rules during the market turmoil, European Regulators are revisiting their models Solvency II project aims at developing a more risk sensitive system for assessing the overall solvency and risk management discipline of the industry u What is the true level of capital required u Existing regulatory capital Risk Based Capital (RBC) Internal models Rating agencies’ models Adequacy of reserves ? What adjustements are needed to reflect the quality of risk management Lisbonne- Denis Duverne - 07/07/04 - Page 16

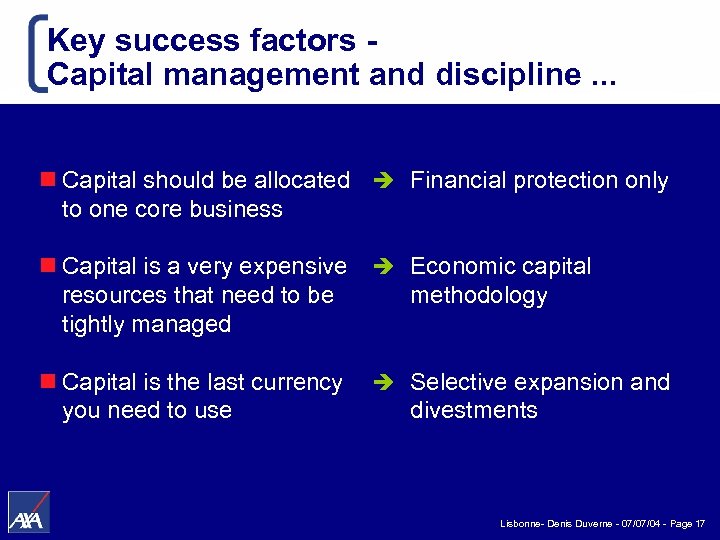

Key success factors Capital management and discipline. . . n Capital should be allocated è Financial protection only to one core business n Capital is a very expensive resources that need to be tightly managed è Economic capital n Capital is the last currency you need to use è Selective expansion and methodology divestments Lisbonne- Denis Duverne - 07/07/04 - Page 17

Conclusion 1. Insurance will remain a growth business 2. Thanks to a reduced capitalization and improved risk management practices, future cycles should be less pronounced 3. The unbundling of the various components of the value proposition will be key to the future success of insurance companies Lisbonne- Denis Duverne - 07/07/04 - Page 18

Thank you

37101dc3b418199e92be3284191f0b6d.ppt