221825715917d3d334e07b02d49b4b6a.ppt

- Количество слайдов: 22

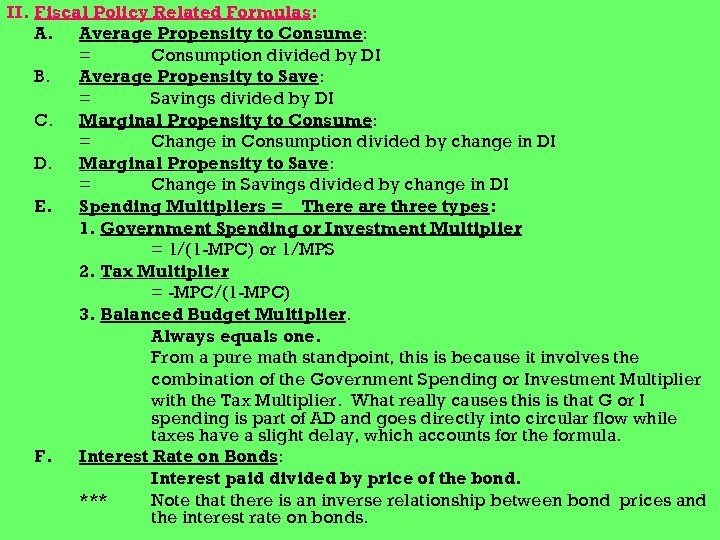

II. Fiscal Policy Related Formulas: A. Average Propensity to Consume: = Consumption divided by DI B. Average Propensity to Save: = Savings divided by DI C. Marginal Propensity to Consume: = Change in Consumption divided by change in DI D. Marginal Propensity to Save: = Change in Savings divided by change in DI E. Spending Multipliers = There are three types: 1. Government Spending or Investment Multiplier = 1/(1 -MPC) or 1/MPS 2. Tax Multiplier = -MPC/(1 -MPC) 3. Balanced Budget Multiplier. Always equals one. From a pure math standpoint, this is because it involves the combination of the Government Spending or Investment Multiplier with the Tax Multiplier. What really causes this is that G or I spending is part of AD and goes directly into circular flow while taxes have a slight delay, which accounts for the formula. F. Interest Rate on Bonds: Interest paid divided by price of the bond. *** Note that there is an inverse relationship between bond prices and the interest rate on bonds.

II. Fiscal Policy Related Formulas: A. Average Propensity to Consume: = Consumption divided by DI B. Average Propensity to Save: = Savings divided by DI C. Marginal Propensity to Consume: = Change in Consumption divided by change in DI D. Marginal Propensity to Save: = Change in Savings divided by change in DI E. Spending Multipliers = There are three types: 1. Government Spending or Investment Multiplier = 1/(1 -MPC) or 1/MPS 2. Tax Multiplier = -MPC/(1 -MPC) 3. Balanced Budget Multiplier. Always equals one. From a pure math standpoint, this is because it involves the combination of the Government Spending or Investment Multiplier with the Tax Multiplier. What really causes this is that G or I spending is part of AD and goes directly into circular flow while taxes have a slight delay, which accounts for the formula. F. Interest Rate on Bonds: Interest paid divided by price of the bond. *** Note that there is an inverse relationship between bond prices and the interest rate on bonds.

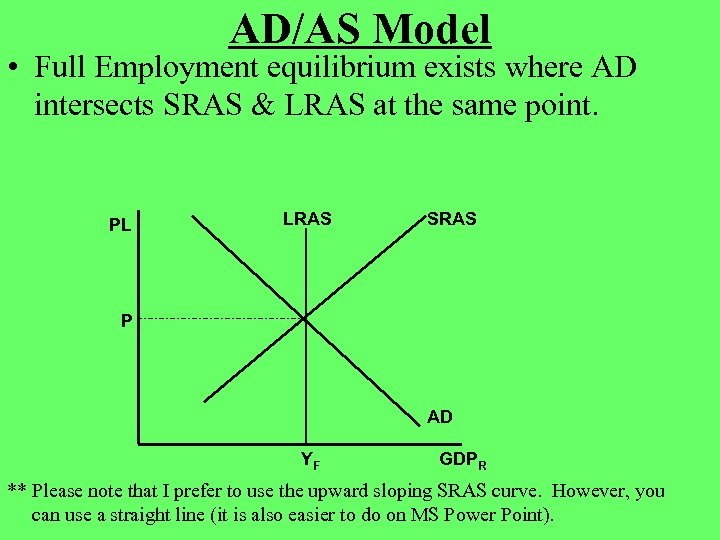

AD/AS Model • Full Employment equilibrium exists where AD intersects SRAS & LRAS at the same point. PL LRAS SRAS P AD YF GDPR ** Please note that I prefer to use the upward sloping SRAS curve. However, you can use a straight line (it is also easier to do on MS Power Point).

AD/AS Model • Full Employment equilibrium exists where AD intersects SRAS & LRAS at the same point. PL LRAS SRAS P AD YF GDPR ** Please note that I prefer to use the upward sloping SRAS curve. However, you can use a straight line (it is also easier to do on MS Power Point).

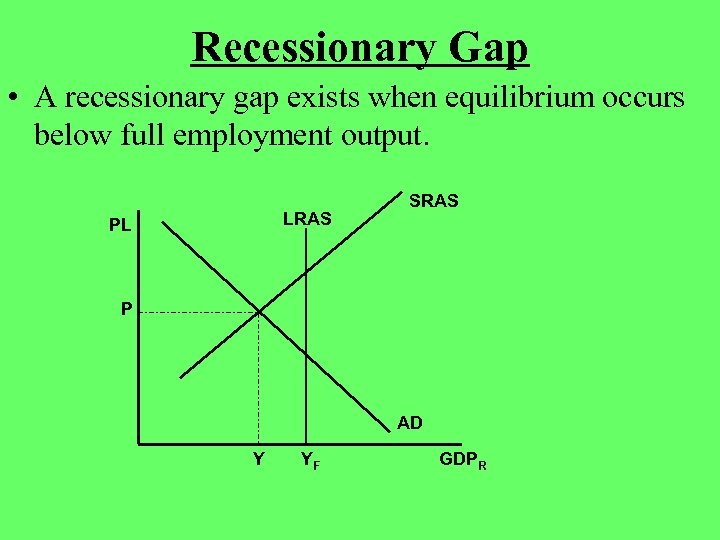

Recessionary Gap • A recessionary gap exists when equilibrium occurs below full employment output. LRAS PL SRAS P AD Y YF GDPR

Recessionary Gap • A recessionary gap exists when equilibrium occurs below full employment output. LRAS PL SRAS P AD Y YF GDPR

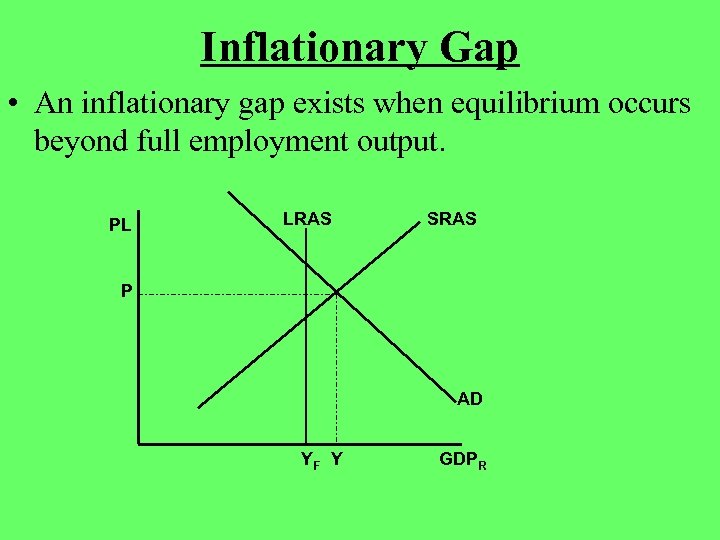

Inflationary Gap • An inflationary gap exists when equilibrium occurs beyond full employment output. PL LRAS SRAS P AD YF Y GDPR

Inflationary Gap • An inflationary gap exists when equilibrium occurs beyond full employment output. PL LRAS SRAS P AD YF Y GDPR

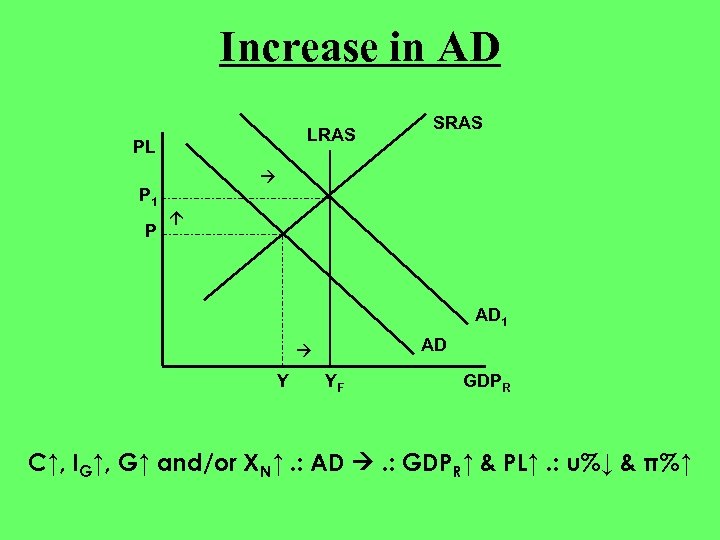

Increase in AD LRAS PL P 1 P SRAS AD 1 AD Y YF GDPR C↑, IG↑, G↑ and/or XN↑. : AD . : GDPR↑ & PL↑. : u%↓ & π%↑

Increase in AD LRAS PL P 1 P SRAS AD 1 AD Y YF GDPR C↑, IG↑, G↑ and/or XN↑. : AD . : GDPR↑ & PL↑. : u%↓ & π%↑

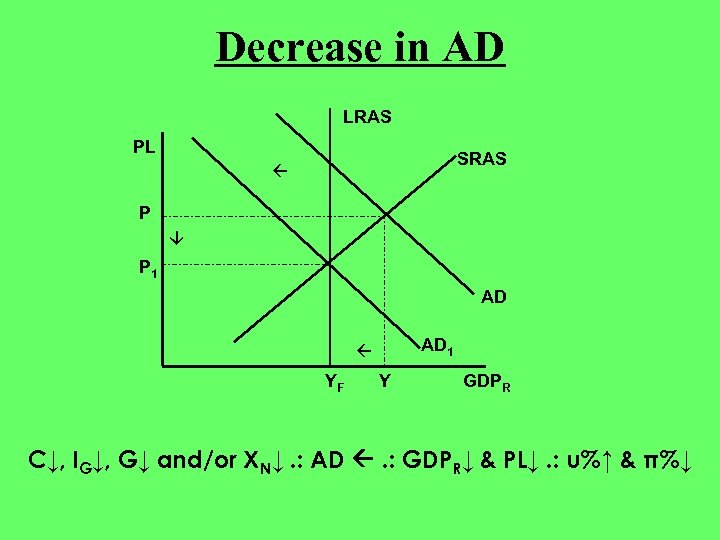

Decrease in AD LRAS PL SRAS P P 1 AD AD 1 YF Y GDPR C↓, IG↓, G↓ and/or XN↓. : AD . : GDPR↓ & PL↓. : u%↑ & π%↓

Decrease in AD LRAS PL SRAS P P 1 AD AD 1 YF Y GDPR C↓, IG↓, G↓ and/or XN↓. : AD . : GDPR↓ & PL↓. : u%↑ & π%↓

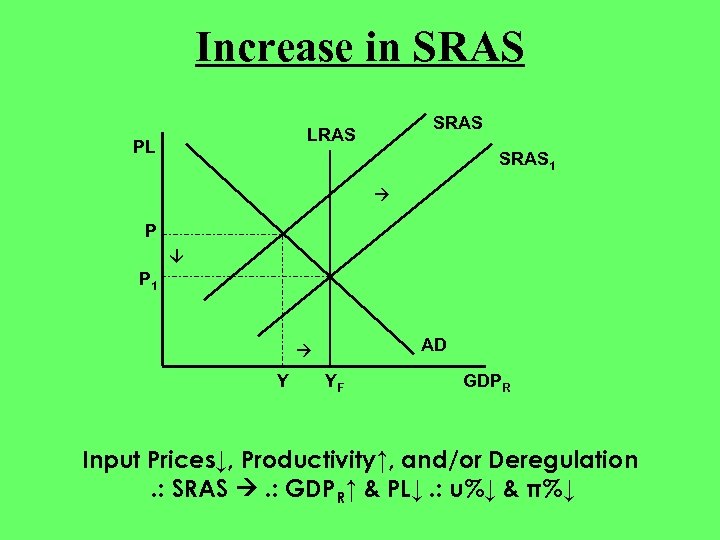

Increase in SRAS LRAS PL SRAS 1 P P 1 AD Y YF GDPR Input Prices↓, Productivity↑, and/or Deregulation. : SRAS . : GDPR↑ & PL↓. : u%↓ & π%↓

Increase in SRAS LRAS PL SRAS 1 P P 1 AD Y YF GDPR Input Prices↓, Productivity↑, and/or Deregulation. : SRAS . : GDPR↑ & PL↓. : u%↓ & π%↓

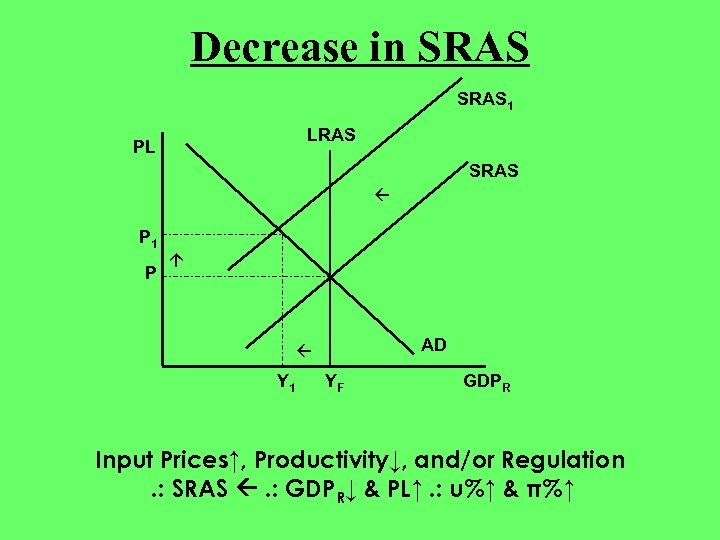

Decrease in SRAS 1 LRAS PL SRAS P P 1 AD Y 1 YF GDPR Input Prices↑, Productivity↓, and/or Regulation. : SRAS . : GDPR↓ & PL↑. : u%↑ & π%↑

Decrease in SRAS 1 LRAS PL SRAS P P 1 AD Y 1 YF GDPR Input Prices↑, Productivity↓, and/or Regulation. : SRAS . : GDPR↓ & PL↑. : u%↑ & π%↑

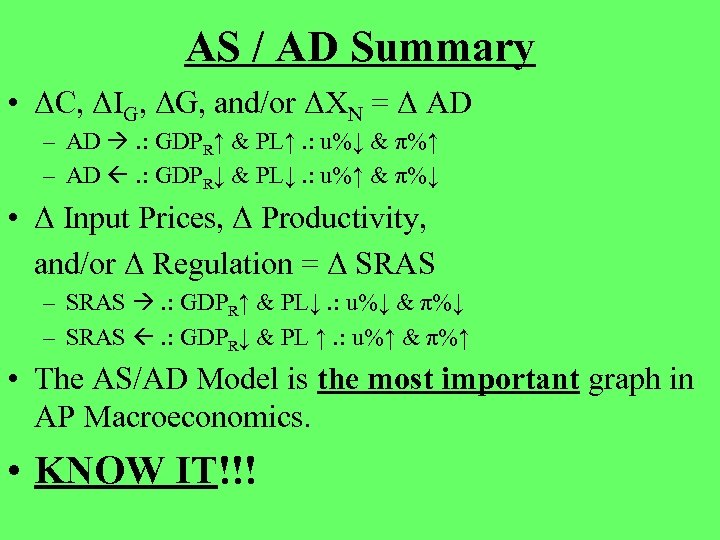

AS / AD Summary • ΔC, ΔIG, ΔG, and/or ΔXN = Δ AD – AD . : GDPR↑ & PL↑. : u%↓ & π%↑ – AD . : GDPR↓ & PL↓. : u%↑ & π%↓ • Δ Input Prices, Δ Productivity, and/or Δ Regulation = Δ SRAS – SRAS . : GDPR↑ & PL↓. : u%↓ & π%↓ – SRAS . : GDPR↓ & PL ↑. : u%↑ & π%↑ • The AS/AD Model is the most important graph in AP Macroeconomics. • KNOW IT!!!

AS / AD Summary • ΔC, ΔIG, ΔG, and/or ΔXN = Δ AD – AD . : GDPR↑ & PL↑. : u%↓ & π%↑ – AD . : GDPR↓ & PL↓. : u%↑ & π%↓ • Δ Input Prices, Δ Productivity, and/or Δ Regulation = Δ SRAS – SRAS . : GDPR↑ & PL↓. : u%↓ & π%↓ – SRAS . : GDPR↓ & PL ↑. : u%↑ & π%↑ • The AS/AD Model is the most important graph in AP Macroeconomics. • KNOW IT!!!

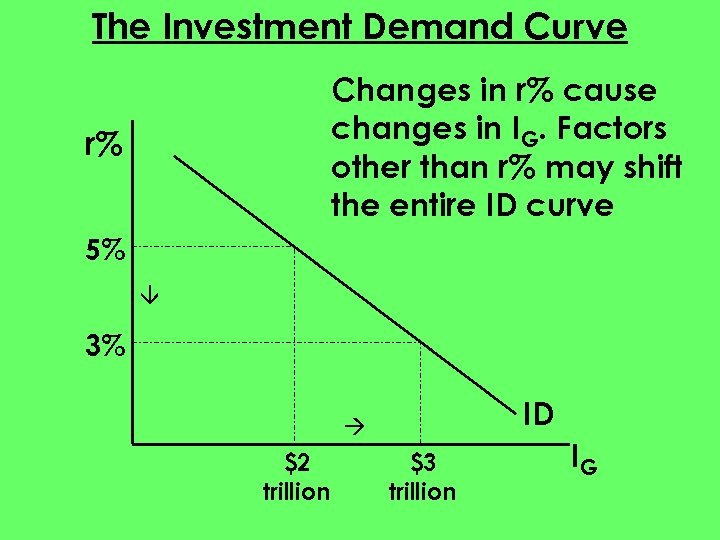

The Investment Demand Curve Changes in r% cause changes in IG. Factors other than r% may shift the entire ID curve r% 5% 3% ID $2 trillion $3 trillion IG

The Investment Demand Curve Changes in r% cause changes in IG. Factors other than r% may shift the entire ID curve r% 5% 3% ID $2 trillion $3 trillion IG

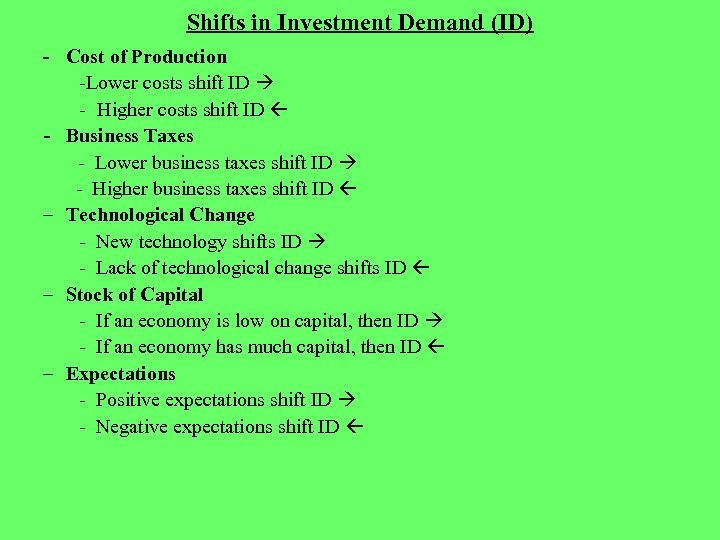

Shifts in Investment Demand (ID) - Cost of Production -Lower costs shift ID - Higher costs shift ID - Business Taxes - Lower business taxes shift ID - Higher business taxes shift ID – Technological Change - New technology shifts ID - Lack of technological change shifts ID – Stock of Capital - If an economy is low on capital, then ID - If an economy has much capital, then ID – Expectations - Positive expectations shift ID - Negative expectations shift ID

Shifts in Investment Demand (ID) - Cost of Production -Lower costs shift ID - Higher costs shift ID - Business Taxes - Lower business taxes shift ID - Higher business taxes shift ID – Technological Change - New technology shifts ID - Lack of technological change shifts ID – Stock of Capital - If an economy is low on capital, then ID - If an economy has much capital, then ID – Expectations - Positive expectations shift ID - Negative expectations shift ID

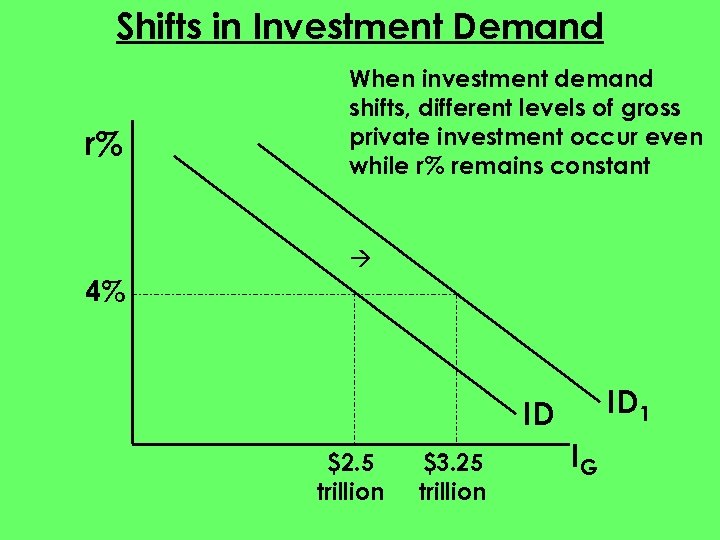

Shifts in Investment Demand r% When investment demand shifts, different levels of gross private investment occur even while r% remains constant 4% ID 1 ID $2. 5 trillion $3. 25 trillion IG

Shifts in Investment Demand r% When investment demand shifts, different levels of gross private investment occur even while r% remains constant 4% ID 1 ID $2. 5 trillion $3. 25 trillion IG

Loanable Funds Market The Loanable Funds Market graph’s primary use is for Fiscal Policy, especially when the government uses deficit spending to fight recession. It might also be used when the government buys back bonds from the public to reduce the national debt.

Loanable Funds Market The Loanable Funds Market graph’s primary use is for Fiscal Policy, especially when the government uses deficit spending to fight recession. It might also be used when the government buys back bonds from the public to reduce the national debt.

Thoughts on Loanable Funds • Loanable funds market determines the real interest rate (r%). • Loanable funds market relates saving and borrowing. • Changes in saving and borrowing create changes in loanable funds and therefore the r% changes. • When government does fiscal policy it will affect the loanable funds market. • Changes in the real interest rate (r%) will affect Gross Private Investment

Thoughts on Loanable Funds • Loanable funds market determines the real interest rate (r%). • Loanable funds market relates saving and borrowing. • Changes in saving and borrowing create changes in loanable funds and therefore the r% changes. • When government does fiscal policy it will affect the loanable funds market. • Changes in the real interest rate (r%) will affect Gross Private Investment

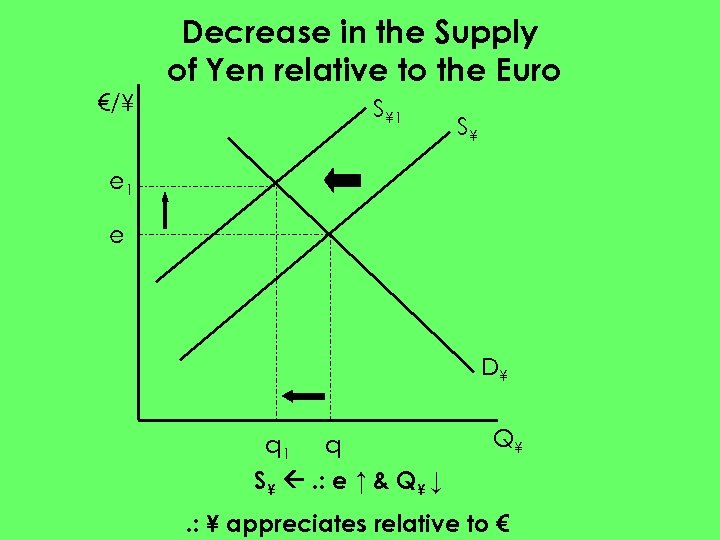

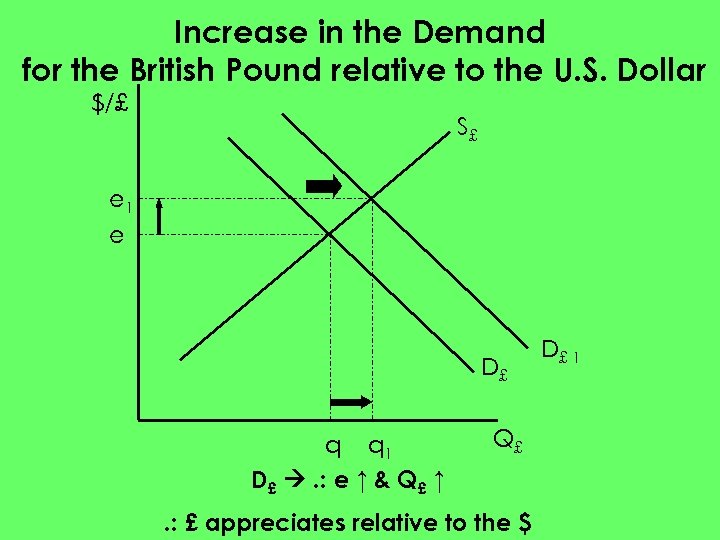

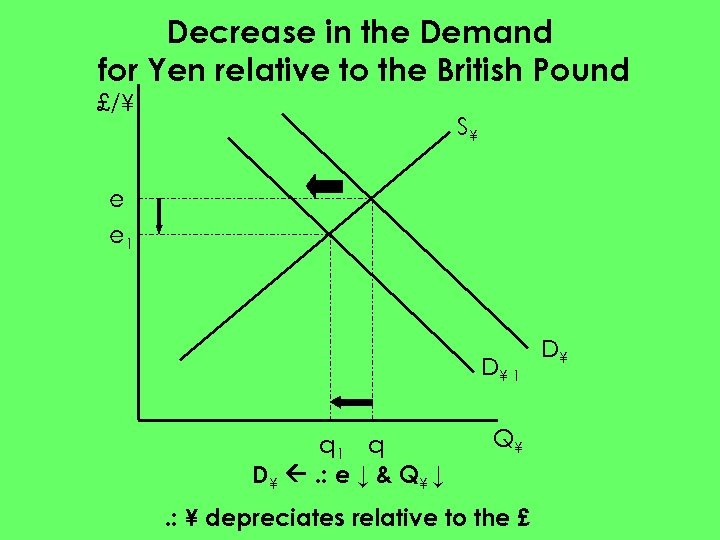

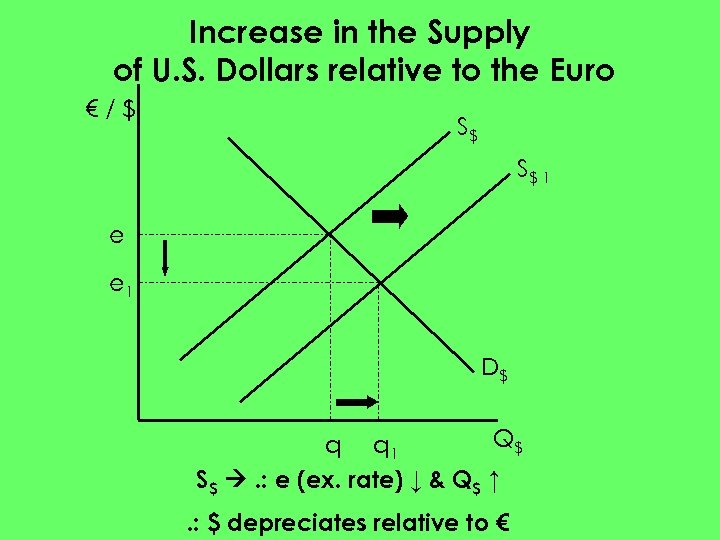

Changes in Exchange Rates • Exchange rates (e) are a function of the supply and demand for currency. – An increase in the supply of a currency will decrease the exchange rate of a currency – A decrease in supply of a currency will increase the exchange rate of a currency – An increase in demand for a currency will increase the exchange rate of a currency – A decrease in demand for a currency will decrease the exchange rate of a currency

Changes in Exchange Rates • Exchange rates (e) are a function of the supply and demand for currency. – An increase in the supply of a currency will decrease the exchange rate of a currency – A decrease in supply of a currency will increase the exchange rate of a currency – An increase in demand for a currency will increase the exchange rate of a currency – A decrease in demand for a currency will decrease the exchange rate of a currency

Appreciation and Depreciation • Appreciation of a currency occurs when the exchange rate of that currency increases (e↑) • Depreciation of a currency occurs when the exchange rate of that currency decreases (e↓) – Ex. If German tourists flock to America to go shopping, then the supply of Euros will increase and the demand for Dollars will increase. This will cause the Euro to depreciate and the dollar to appreciate.

Appreciation and Depreciation • Appreciation of a currency occurs when the exchange rate of that currency increases (e↑) • Depreciation of a currency occurs when the exchange rate of that currency decreases (e↓) – Ex. If German tourists flock to America to go shopping, then the supply of Euros will increase and the demand for Dollars will increase. This will cause the Euro to depreciate and the dollar to appreciate.

€/¥ Decrease in the Supply of Yen relative to the Euro S¥ 1 S¥ e 1 e D¥ q 1 q S¥ . : e ↑ & Q¥ ↓ Q¥ . : ¥ appreciates relative to €

€/¥ Decrease in the Supply of Yen relative to the Euro S¥ 1 S¥ e 1 e D¥ q 1 q S¥ . : e ↑ & Q¥ ↓ Q¥ . : ¥ appreciates relative to €

Increase in the Demand for the British Pound relative to the U. S. Dollar $/£ S£ e 1 e D£ q q 1 D£ . : e ↑ & Q£ ↑ Q£ . : £ appreciates relative to the $ D£ 1

Increase in the Demand for the British Pound relative to the U. S. Dollar $/£ S£ e 1 e D£ q q 1 D£ . : e ↑ & Q£ ↑ Q£ . : £ appreciates relative to the $ D£ 1

Decrease in the Demand for Yen relative to the British Pound £/¥ S¥ e e 1 D¥ 1 q D¥ . : e ↓ & Q¥ ↓ Q¥ . : ¥ depreciates relative to the £ D¥

Decrease in the Demand for Yen relative to the British Pound £/¥ S¥ e e 1 D¥ 1 q D¥ . : e ↓ & Q¥ ↓ Q¥ . : ¥ depreciates relative to the £ D¥

Increase in the Supply of U. S. Dollars relative to the Euro €/$ S$ S$ 1 e e 1 D$ Q$ q q 1 S$ . : e (ex. rate) ↓ & Q$ ↑. : $ depreciates relative to €

Increase in the Supply of U. S. Dollars relative to the Euro €/$ S$ S$ 1 e e 1 D$ Q$ q q 1 S$ . : e (ex. rate) ↓ & Q$ ↑. : $ depreciates relative to €

Exchange Rate Determinants • Consumer Tastes – Ex. a preference for Japanese goods creates an increase in the supply of dollars in the currency exchange market which leads to depreciation of the Dollar and an appreciation of Yen • Relative Income – Ex. If Mexico’s economy is strong and the U. S. economy is in recession, then Mexicans will buy more American goods, increasing the demand for the Dollar, causing the Dollar to appreciate and the Peso to depreciate •

Exchange Rate Determinants • Consumer Tastes – Ex. a preference for Japanese goods creates an increase in the supply of dollars in the currency exchange market which leads to depreciation of the Dollar and an appreciation of Yen • Relative Income – Ex. If Mexico’s economy is strong and the U. S. economy is in recession, then Mexicans will buy more American goods, increasing the demand for the Dollar, causing the Dollar to appreciate and the Peso to depreciate •

Exchange Rate Determinants (continued) • Relative Price Level Ex. If the price level is higher in Canada than in the United States, then American goods are relatively cheaper than Canadian goods, thus Canadians will import more American goods causing the U. S. Dollar to appreciate and the Canadian Dollar to depreciate. • Speculation – Ex. If U. S. investors expect that Swiss interest rates will climb in the future, then Americans will demand Swiss Francs in order to earn the higher rates of return in Switzerland. This will cause the Dollar to depreciate and the Swiss Franc to appreciate

Exchange Rate Determinants (continued) • Relative Price Level Ex. If the price level is higher in Canada than in the United States, then American goods are relatively cheaper than Canadian goods, thus Canadians will import more American goods causing the U. S. Dollar to appreciate and the Canadian Dollar to depreciate. • Speculation – Ex. If U. S. investors expect that Swiss interest rates will climb in the future, then Americans will demand Swiss Francs in order to earn the higher rates of return in Switzerland. This will cause the Dollar to depreciate and the Swiss Franc to appreciate