94e5982843006e902fa21f78ec3569ab.ppt

- Количество слайдов: 32

*

If you owned a business, what areas do you need to keep track of? Businesses must complete a number of documents before transferring the information to accounts. Can you name some of these documents?

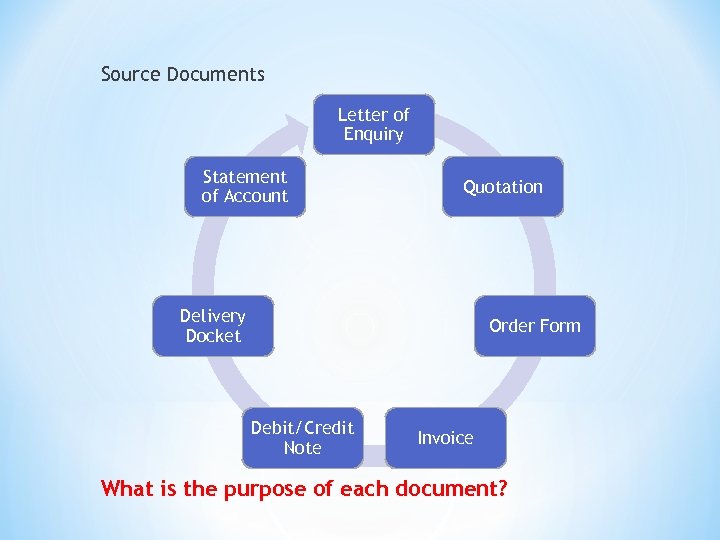

Source Documents Letter of Enquiry Statement of Account Quotation Delivery Docket Order Form Debit/Credit Note Invoice What is the purpose of each document?

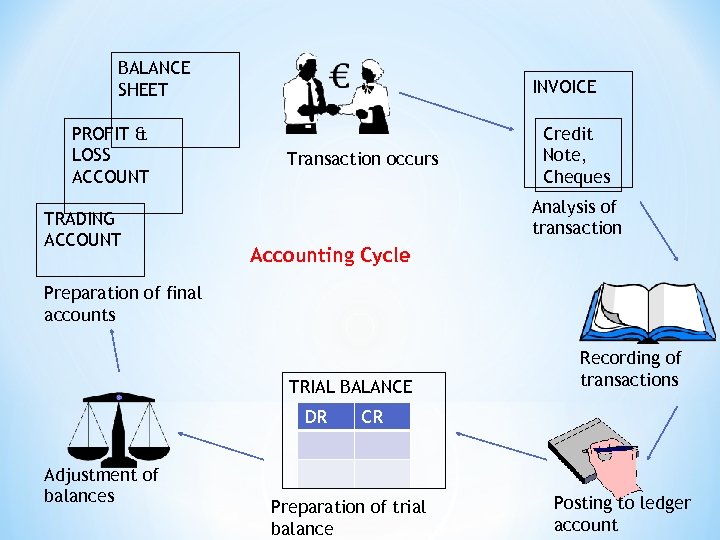

BALANCE SHEET PROFIT & LOSS ACCOUNT TRADING ACCOUNT INVOICE Transaction occurs Credit Note, Cheques Analysis of transaction Accounting Cycle Preparation of final accounts TRIAL BALANCE DR Adjustment of balances Recording of transactions CR Preparation of trial balance Posting to ledger account

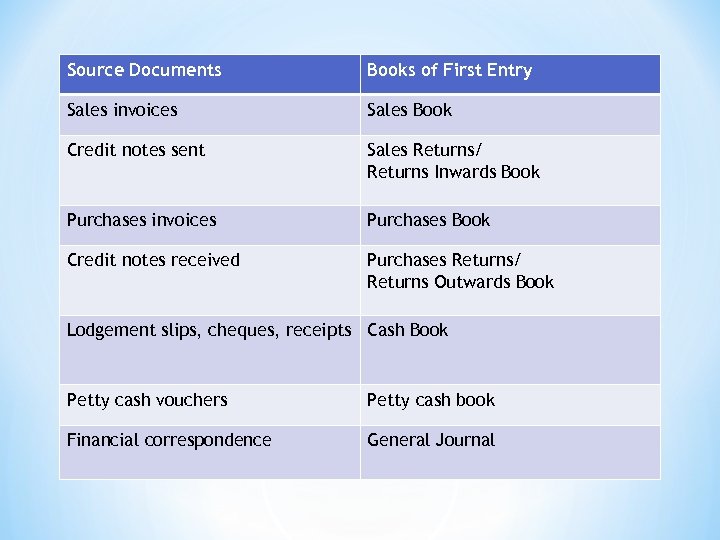

Source Documents Books of First Entry Sales invoices Sales Book Credit notes sent Sales Returns/ Returns Inwards Book Purchases invoices Purchases Book Credit notes received Purchases Returns/ Returns Outwards Book Lodgement slips, cheques, receipts Cash Book Petty cash vouchers Petty cash book Financial correspondence General Journal

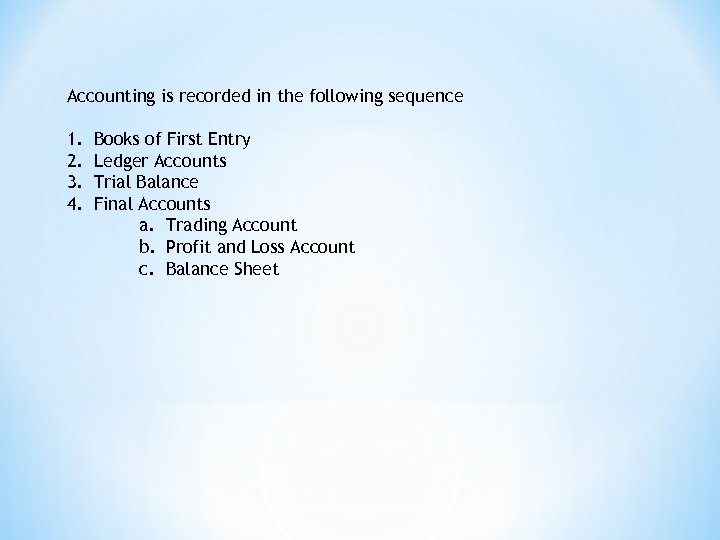

Accounting is recorded in the following sequence 1. 2. 3. 4. Books of First Entry Ledger Accounts Trial Balance Final Accounts a. Trading Account b. Profit and Loss Account c. Balance Sheet

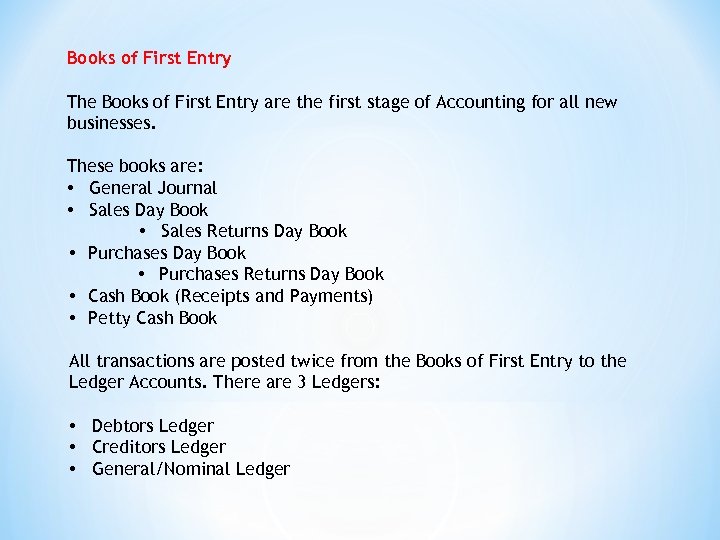

Books of First Entry The Books of First Entry are the first stage of Accounting for all new businesses. These books are: • General Journal • Sales Day Book • Sales Returns Day Book • Purchases Returns Day Book • Cash Book (Receipts and Payments) • Petty Cash Book All transactions are posted twice from the Books of First Entry to the Ledger Accounts. There are 3 Ledgers: • Debtors Ledger • Creditors Ledger • General/Nominal Ledger

Class/Group Discussion Goods/items can be bought or sold on credit or by cash? What does buying on CREDIT mean?

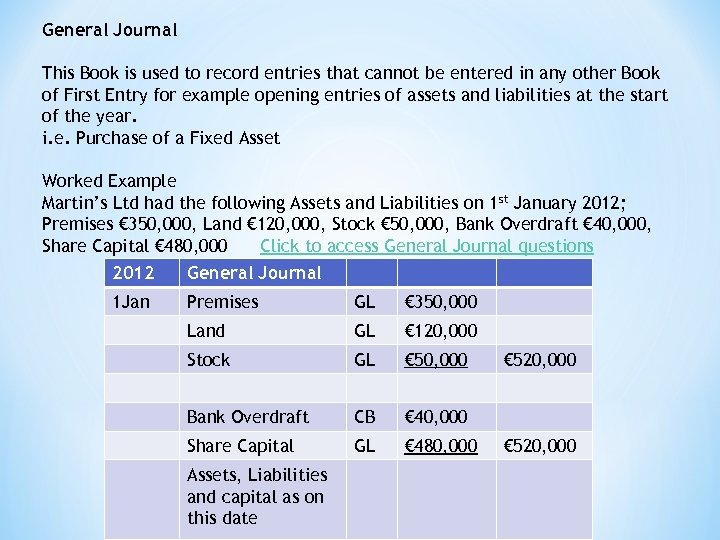

General Journal This Book is used to record entries that cannot be entered in any other Book of First Entry for example opening entries of assets and liabilities at the start of the year. i. e. Purchase of a Fixed Asset Worked Example Martin’s Ltd had the following Assets and Liabilities on 1 st January 2012; Premises € 350, 000, Land € 120, 000, Stock € 50, 000, Bank Overdraft € 40, 000, Share Capital € 480, 000 Click to access General Journal questions 2012 General Journal 1 Jan Premises GL € 350, 000 Land GL € 120, 000 Stock GL € 50, 000 Bank Overdraft CB € 40, 000 Share Capital GL € 480, 000 Assets, Liabilities and capital as on this date € 520, 000

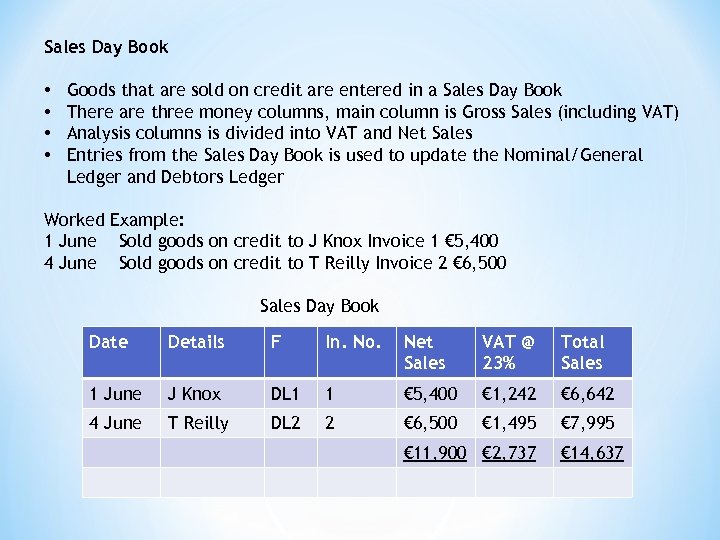

Sales Day Book • • Goods that are sold on credit are entered in a Sales Day Book There are three money columns, main column is Gross Sales (including VAT) Analysis columns is divided into VAT and Net Sales Entries from the Sales Day Book is used to update the Nominal/General Ledger and Debtors Ledger Worked Example: 1 June Sold goods on credit to J Knox Invoice 1 € 5, 400 4 June Sold goods on credit to T Reilly Invoice 2 € 6, 500 Sales Day Book Date Details F In. No. Net Sales VAT @ 23% Total Sales 1 June J Knox DL 1 1 € 5, 400 € 1, 242 € 6, 642 4 June T Reilly DL 2 2 € 6, 500 € 1, 495 € 7, 995 € 11, 900 € 2, 737 € 14, 637

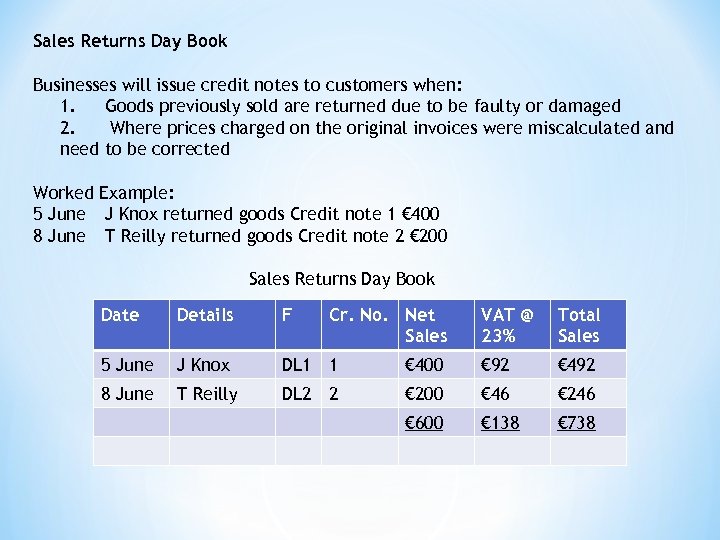

Sales Returns Day Book Businesses will issue credit notes to customers when: 1. Goods previously sold are returned due to be faulty or damaged 2. Where prices charged on the original invoices were miscalculated and need to be corrected Worked Example: 5 June J Knox returned goods Credit note 1 € 400 8 June T Reilly returned goods Credit note 2 € 200 Sales Returns Day Book Date Details F Cr. No. Net Sales 5 June J Knox DL 1 1 8 June T Reilly DL 2 2 VAT @ 23% Total Sales € 400 € 92 € 492 € 200 € 46 € 246 € 600 € 138 € 738

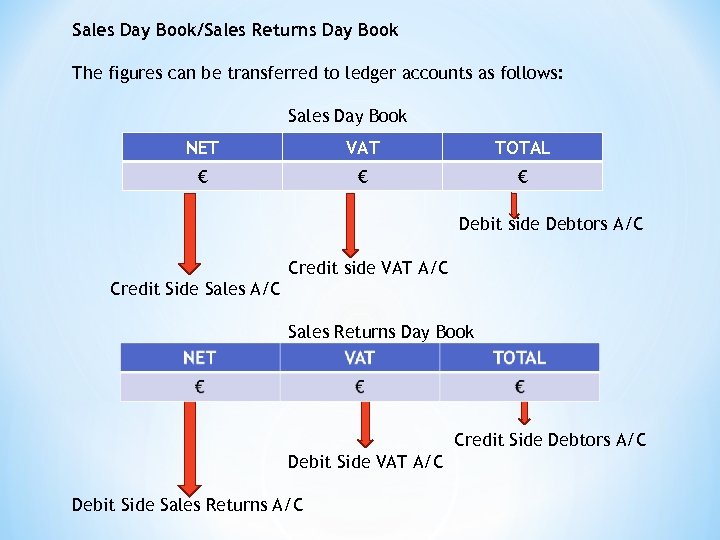

Sales Day Book/Sales Returns Day Book The figures can be transferred to ledger accounts as follows: Sales Day Book NET VAT TOTAL € € € Debit side Debtors A/C Credit side VAT A/C Credit Side Sales A/C Sales Returns Day Book Credit Side Debtors A/C Debit Side VAT A/C Debit Side Sales Returns A/C

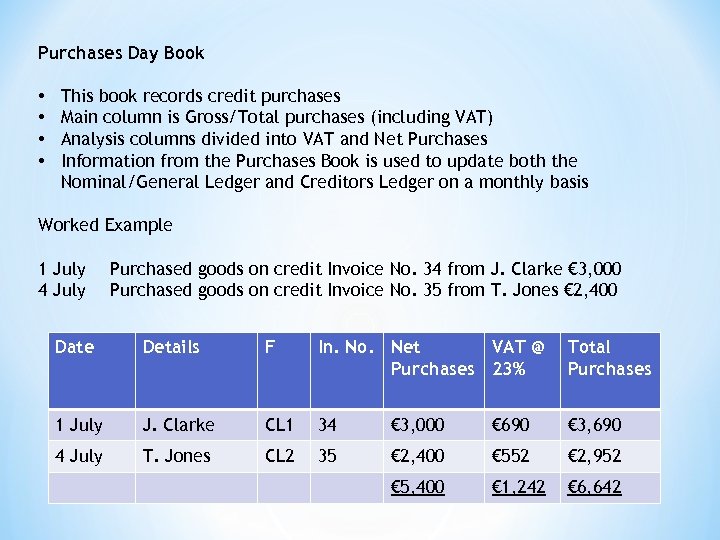

Purchases Day Book • • This book records credit purchases Main column is Gross/Total purchases (including VAT) Analysis columns divided into VAT and Net Purchases Information from the Purchases Book is used to update both the Nominal/General Ledger and Creditors Ledger on a monthly basis Worked Example 1 July 4 July Purchased goods on credit Invoice No. 34 from J. Clarke € 3, 000 Purchased goods on credit Invoice No. 35 from T. Jones € 2, 400 Date Details F In. No. Net VAT @ Purchases 23% Total Purchases 1 July J. Clarke CL 1 34 € 3, 000 € 690 € 3, 690 4 July T. Jones CL 2 35 € 2, 400 € 552 € 2, 952 € 5, 400 € 1, 242 € 6, 642

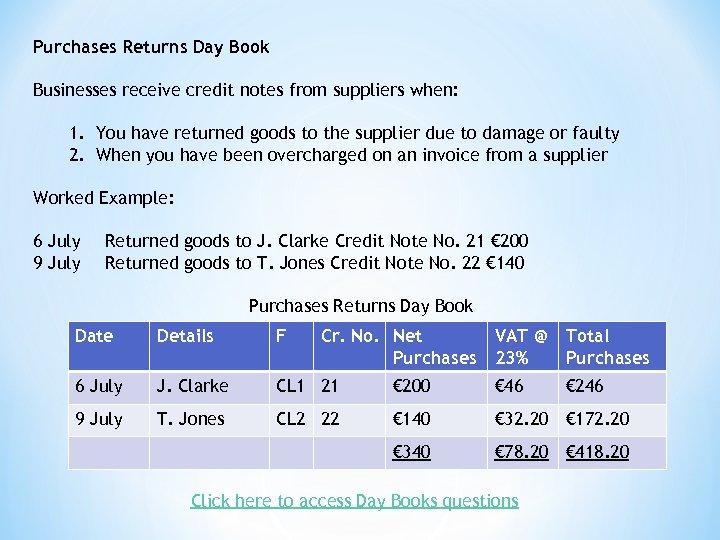

Purchases Returns Day Book Businesses receive credit notes from suppliers when: 1. You have returned goods to the supplier due to damage or faulty 2. When you have been overcharged on an invoice from a supplier Worked Example: 6 July 9 July Returned goods to J. Clarke Credit Note No. 21 € 200 Returned goods to T. Jones Credit Note No. 22 € 140 Purchases Returns Day Book Date Details F Cr. No. Net VAT @ Purchases 23% 6 July J. Clarke CL 1 21 € 200 € 46 9 July T. Jones CL 2 22 € 140 € 32. 20 € 172. 20 € 340 € 78. 20 € 418. 20 Click here to access Day Books questions Total Purchases € 246

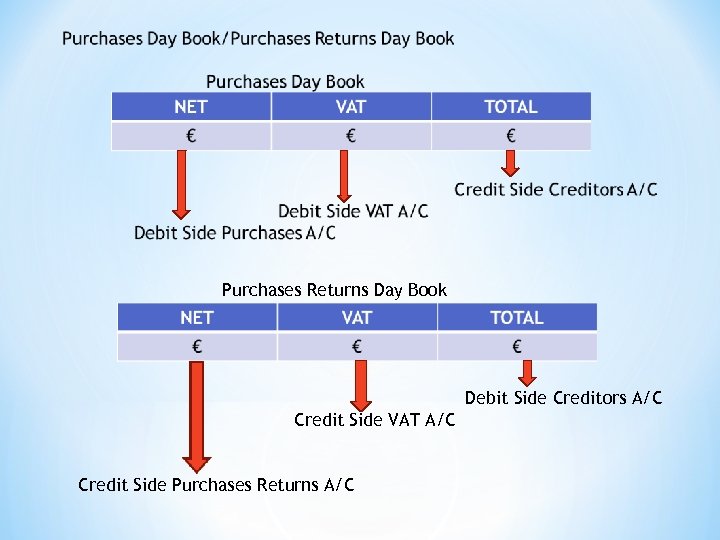

Purchases Returns Day Book Debit Side Creditors A/C Credit Side VAT A/C Credit Side Purchases Returns A/C

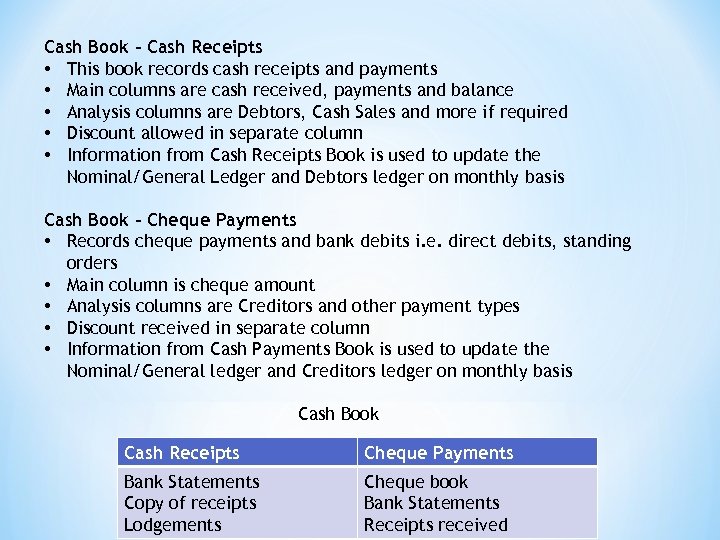

Cash Book – Cash Receipts • This book records cash receipts and payments • Main columns are cash received, payments and balance • Analysis columns are Debtors, Cash Sales and more if required • Discount allowed in separate column • Information from Cash Receipts Book is used to update the Nominal/General Ledger and Debtors ledger on monthly basis Cash Book – Cheque Payments • Records cheque payments and bank debits i. e. direct debits, standing orders • Main column is cheque amount • Analysis columns are Creditors and other payment types • Discount received in separate column • Information from Cash Payments Book is used to update the Nominal/General ledger and Creditors ledger on monthly basis Cash Book Cash Receipts Cheque Payments Bank Statements Copy of receipts Lodgements Cheque book Bank Statements Receipts received

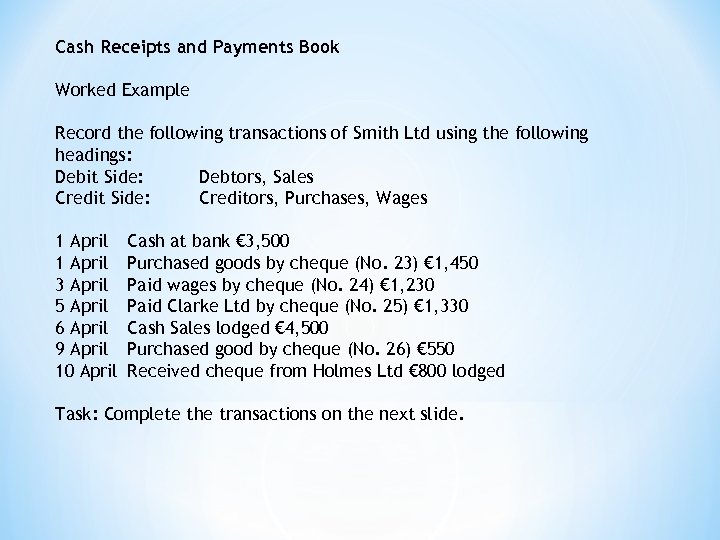

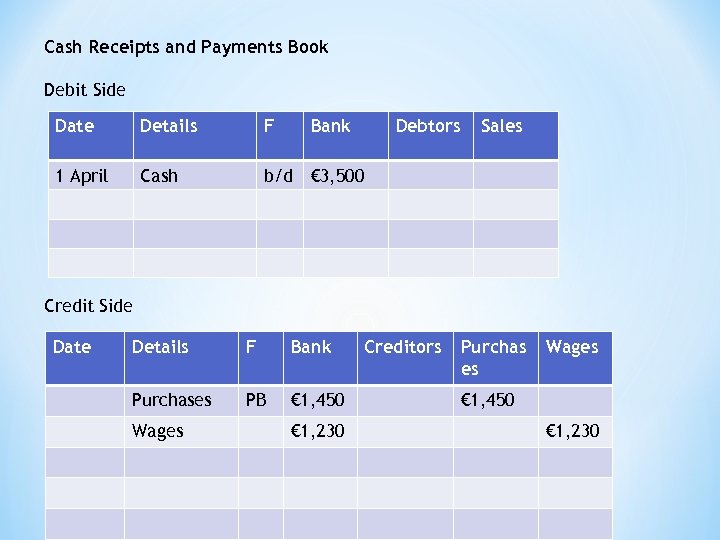

Cash Receipts and Payments Book Worked Example Record the following transactions of Smith Ltd using the following headings: Debit Side: Debtors, Sales Credit Side: Creditors, Purchases, Wages 1 April 3 April 5 April 6 April 9 April 10 April Cash at bank € 3, 500 Purchased goods by cheque (No. 23) € 1, 450 Paid wages by cheque (No. 24) € 1, 230 Paid Clarke Ltd by cheque (No. 25) € 1, 330 Cash Sales lodged € 4, 500 Purchased good by cheque (No. 26) € 550 Received cheque from Holmes Ltd € 800 lodged Task: Complete the transactions on the next slide.

Cash Receipts and Payments Book Debit Side Date Details F Bank Debtors 1 April Cash Sales b/d € 3, 500 Credit Side Date Details F Bank Purchases PB € 1, 450 Wages € 1, 230 Creditors Purchas es Wages € 1, 450 € 1, 230

PETTY CASH BOOK What is Petty Cash Book used for? What is a float? Name some items that belong in a Petty Cash Book?

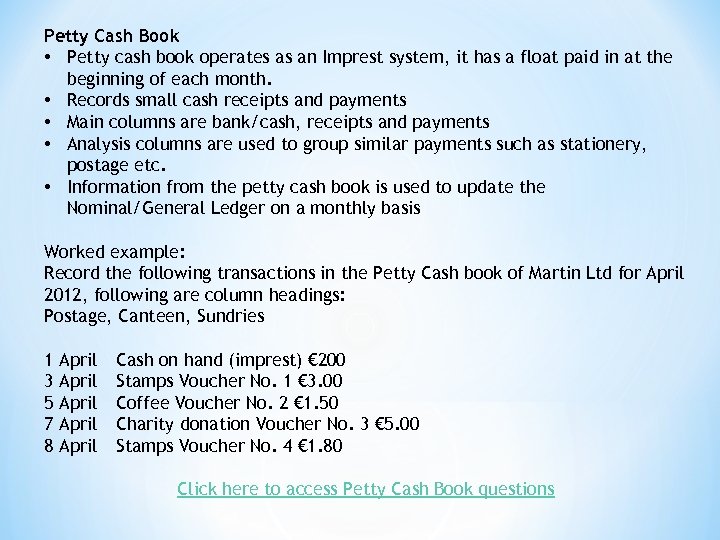

Petty Cash Book • Petty cash book operates as an Imprest system, it has a float paid in at the beginning of each month. • Records small cash receipts and payments • Main columns are bank/cash, receipts and payments • Analysis columns are used to group similar payments such as stationery, postage etc. • Information from the petty cash book is used to update the Nominal/General Ledger on a monthly basis Worked example: Record the following transactions in the Petty Cash book of Martin Ltd for April 2012, following are column headings: Postage, Canteen, Sundries 1 3 5 7 8 April April Cash on hand (imprest) € 200 Stamps Voucher No. 1 € 3. 00 Coffee Voucher No. 2 € 1. 50 Charity donation Voucher No. 3 € 5. 00 Stamps Voucher No. 4 € 1. 80 Click here to access Petty Cash Book questions

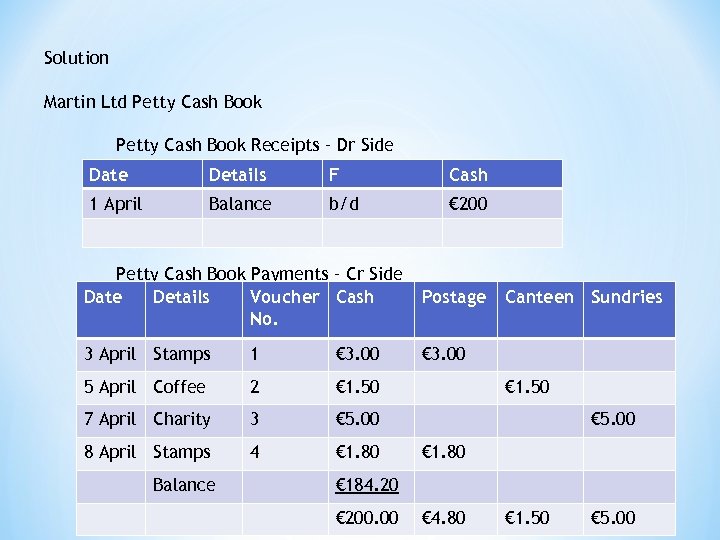

Solution Martin Ltd Petty Cash Book Receipts – Dr Side Date Details F Cash 1 April Balance b/d € 200 Petty Cash Book Payments – Cr Side Date Details Voucher Cash No. Postage 3 April Stamps 1 € 3. 00 5 April Coffee 2 € 1. 50 7 April Charity 3 € 5. 00 8 April Stamps 4 € 1. 80 Balance Canteen Sundries € 1. 50 € 5. 00 € 1. 80 € 184. 20 € 200. 00 € 4. 80 € 1. 50 € 5. 00

Ledger Accounts Sales Day Book, Sales Returns Day Book, Purchases Day Book and Purchases Returns Day book entries are transferred to the Ledger accounts: Debtors Ledger: these are the accounts of debtors or customer i. e. people who owe the business money. Creditors Ledger: these are the accounts of creditors or suppliers i. e. people the business owe money to.

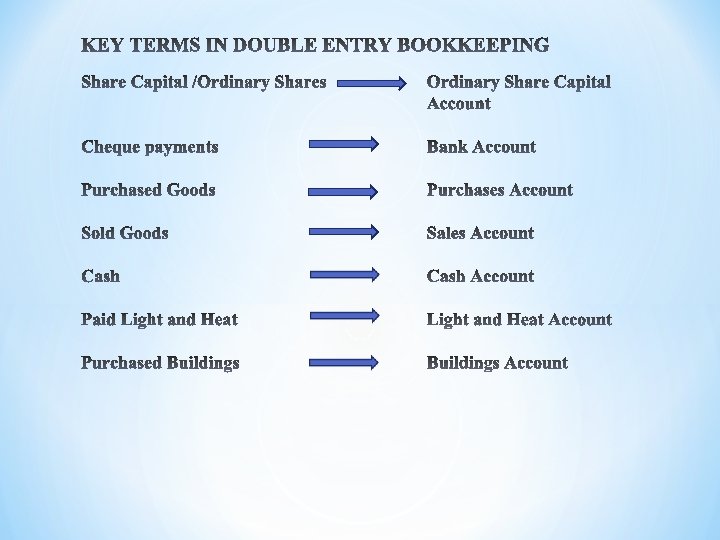

Double-entry Bookkeeping system • In your study of double entry so far, every accounting entry is based on the double-entry principle. There are two aspects to every transaction. The basic rule is: • DEBIT – Assets and Expenses • CREDIT – Liabilities and Revenue If a business wanted to reduce an asset or an expense – entry on the credit side of asset or expense account. If a business wanted to reduce a liability or revenue – entry on the debit side of the liability or income account. It follows that if all the debit and credits are entered correctly in the ledger at the end of the accounting period the totals of the debits will equal the totals of the credits. These balances are listed in a Trial Balance.

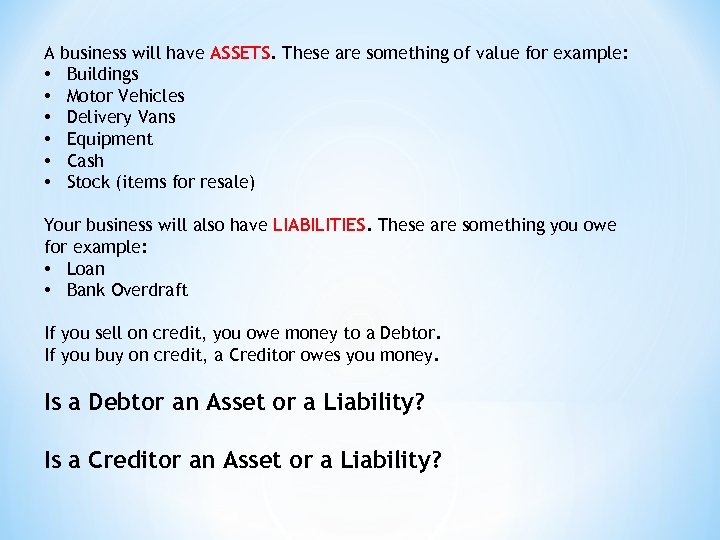

A • • • business will have ASSETS. These are something of value for example: Buildings Motor Vehicles Delivery Vans Equipment Cash Stock (items for resale) Your business will also have LIABILITIES. These are something you owe for example: • Loan • Bank Overdraft If you sell on credit, you owe money to a Debtor. If you buy on credit, a Creditor owes you money. Is a Debtor an Asset or a Liability? Is a Creditor an Asset or a Liability?

Discussion When a business is starting up it requires Capital and this money is lodged in the Bank. Which of the underlined words is the ASSET and which is the LIABILITY? Explain why?

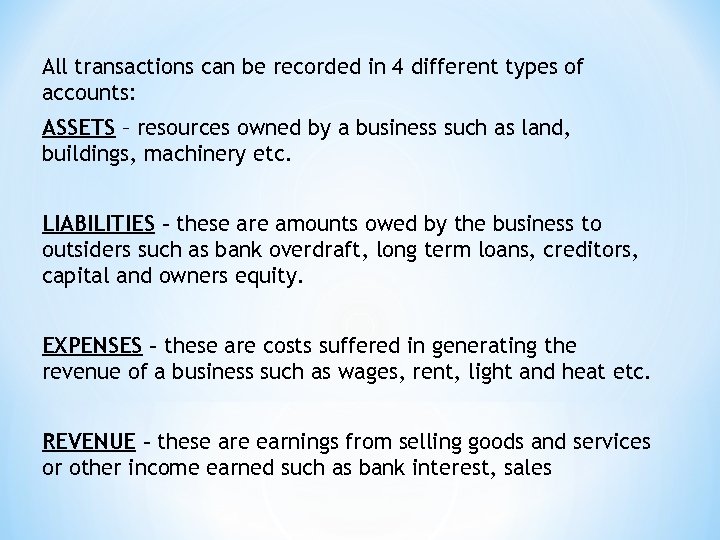

All transactions can be recorded in 4 different types of accounts: ASSETS – resources owned by a business such as land, buildings, machinery etc. LIABILITIES – these are amounts owed by the business to outsiders such as bank overdraft, long term loans, creditors, capital and owners equity. EXPENSES – these are costs suffered in generating the revenue of a business such as wages, rent, light and heat etc. REVENUE – these are earnings from selling goods and services or other income earned such as bank interest, sales

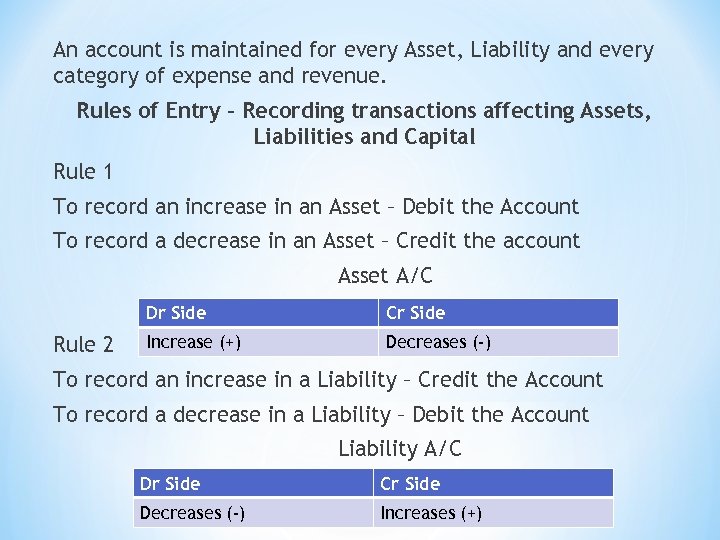

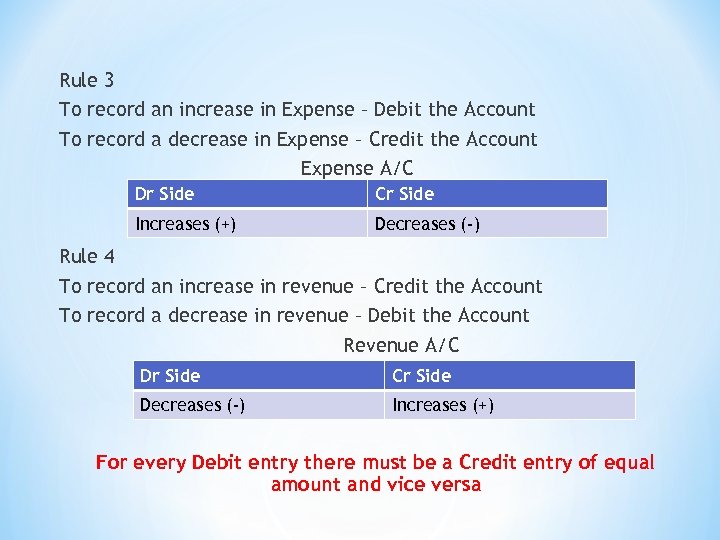

An account is maintained for every Asset, Liability and every category of expense and revenue. Rules of Entry – Recording transactions affecting Assets, Liabilities and Capital Rule 1 To record an increase in an Asset – Debit the Account To record a decrease in an Asset – Credit the account Asset A/C Dr Side Rule 2 Cr Side Increase (+) Decreases (-) To record an increase in a Liability – Credit the Account To record a decrease in a Liability – Debit the Account Liability A/C Dr Side Cr Side Decreases (-) Increases (+)

Rule 3 To record an increase in Expense – Debit the Account To record a decrease in Expense – Credit the Account Expense A/C Dr Side Cr Side Increases (+) Decreases (-) Rule 4 To record an increase in revenue – Credit the Account To record a decrease in revenue – Debit the Account Revenue A/C Dr Side Cr Side Decreases (-) Increases (+) For every Debit entry there must be a Credit entry of equal amount and vice versa

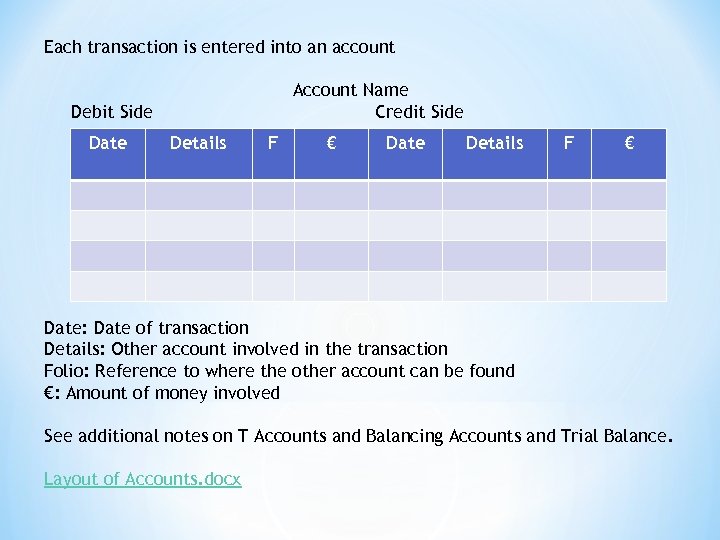

Each transaction is entered into an account Account Name Credit Side Debit Side Date Details F € Date: Date of transaction Details: Other account involved in the transaction Folio: Reference to where the other account can be found €: Amount of money involved See additional notes on T Accounts and Balancing Accounts and Trial Balance. Layout of Accounts. docx

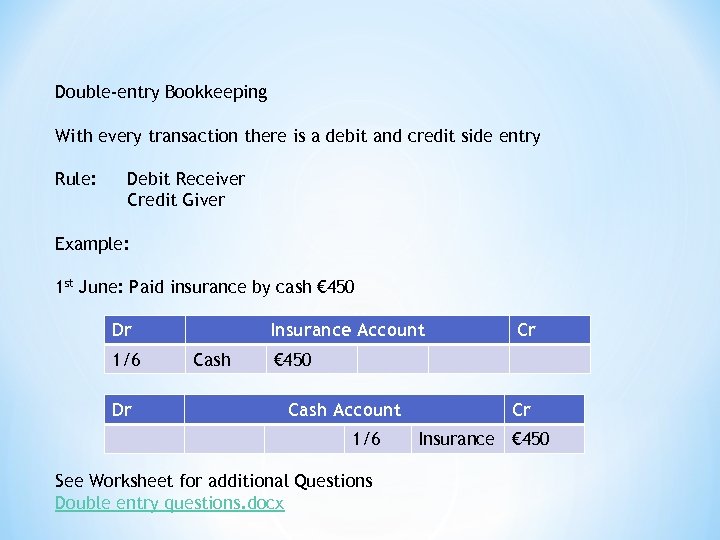

Double-entry Bookkeeping With every transaction there is a debit and credit side entry Rule: Debit Receiver Credit Giver Example: 1 st June: Paid insurance by cash € 450 Dr 1/6 Dr Insurance Account Cash Cr € 450 Cash Account 1/6 See Worksheet for additional Questions Double entry questions. docx Cr Insurance € 450

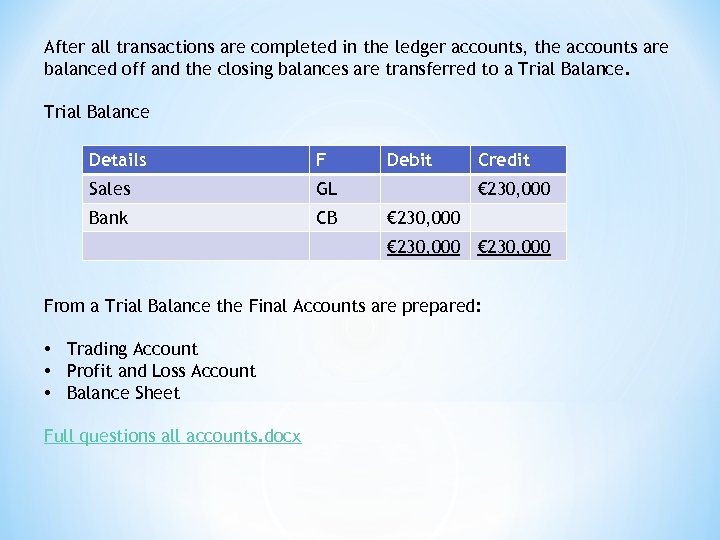

After all transactions are completed in the ledger accounts, the accounts are balanced off and the closing balances are transferred to a Trial Balance Details F Sales GL Bank CB Debit Credit € 230, 000 From a Trial Balance the Final Accounts are prepared: • Trading Account • Profit and Loss Account • Balance Sheet Full questions all accounts. docx

94e5982843006e902fa21f78ec3569ab.ppt