847365a19f130c1b40d3fa48513dd97d.ppt

- Количество слайдов: 70

IDENTITY THEFT What is Identity Theft?

IDENTITY THEFT What is Identity Theft?

A Legal Definition “A fraud committed or attempted using the identifying information of another person without authority. ”

A Legal Definition “A fraud committed or attempted using the identifying information of another person without authority. ”

Scope of Identity Theft n In 2004, there were almost 250, 000 ID theft complaints and victims spent nearly 250 million hours trying to sort out bogus accounts and set their credit records straight n Credit Card Fraud – 28% n Phone/utilities Fraud – 19% n Bank Fraud – 18%

Scope of Identity Theft n In 2004, there were almost 250, 000 ID theft complaints and victims spent nearly 250 million hours trying to sort out bogus accounts and set their credit records straight n Credit Card Fraud – 28% n Phone/utilities Fraud – 19% n Bank Fraud – 18%

Scope of Identity Theft In 2004, merchandise and services obtained as a result of ID Theft exceeded $52 billion n In 2005, an estimated 10 million Americans became victims of Identity Theft. On average, a victim spent $500. 00 and 30 hours resolving the problem n

Scope of Identity Theft In 2004, merchandise and services obtained as a result of ID Theft exceeded $52 billion n In 2005, an estimated 10 million Americans became victims of Identity Theft. On average, a victim spent $500. 00 and 30 hours resolving the problem n

Scope of Identity Theft n In 2004, plastic card losses were $17 million n In 2005, plastic card losses are expected to be approximately $35 million

Scope of Identity Theft n In 2004, plastic card losses were $17 million n In 2005, plastic card losses are expected to be approximately $35 million

Common Types of Identity Theft or Financial Fraud n n n n Unauthorized transactions on existing accounts (e. g. , unauthorized charges on a credit card or checks on a checking account) – often more easily corrected than others Make purchases on your credit card and have the statements sent to a different address Takeover of existing accounts (e. g. , prolonged use or emptying of a financial account) Creation of new accounts Establish wireless service Open an account in your name and write bad checks on that account File for bankruptcy under your name Get identification, such as Driver’s License made with their picture and your name

Common Types of Identity Theft or Financial Fraud n n n n Unauthorized transactions on existing accounts (e. g. , unauthorized charges on a credit card or checks on a checking account) – often more easily corrected than others Make purchases on your credit card and have the statements sent to a different address Takeover of existing accounts (e. g. , prolonged use or emptying of a financial account) Creation of new accounts Establish wireless service Open an account in your name and write bad checks on that account File for bankruptcy under your name Get identification, such as Driver’s License made with their picture and your name

Warning Signs n n n n A financial institution may call if a transaction seems out of the ordinary You may see unauthorized charges on a credit card or checking account statement Credit card statements don’t arrive Bills arrive for something you didn’t request You may see an account that you did not open on your credit report Suspicious inquiries on your credit report Suddenly denied credit You may get a call from a collection agency asking why you have not paid a bill

Warning Signs n n n n A financial institution may call if a transaction seems out of the ordinary You may see unauthorized charges on a credit card or checking account statement Credit card statements don’t arrive Bills arrive for something you didn’t request You may see an account that you did not open on your credit report Suspicious inquiries on your credit report Suddenly denied credit You may get a call from a collection agency asking why you have not paid a bill

Identity Thieves Look For: n n n n Name Address Date of Birth Social Security Number Driver’s license number Mother’s maiden name Account numbers Card expiration dates n n n Internet passwords Personal identification numbers User Ids for online account access Security codes from the back of credit and debit cards Other identifying information

Identity Thieves Look For: n n n n Name Address Date of Birth Social Security Number Driver’s license number Mother’s maiden name Account numbers Card expiration dates n n n Internet passwords Personal identification numbers User Ids for online account access Security codes from the back of credit and debit cards Other identifying information

How Your Identity Can Be Stolen n n n Loss or theft of your wallet, purse, or credit card Mail theft Skimming information from the magnetic strip on credit or debit cards “Dumpster diving” through the trash “Shoulder surfing, ” looking over your shoulder when you are entering a PIN or password Stealing records or information on the job Bribing an employee who has access to records

How Your Identity Can Be Stolen n n n Loss or theft of your wallet, purse, or credit card Mail theft Skimming information from the magnetic strip on credit or debit cards “Dumpster diving” through the trash “Shoulder surfing, ” looking over your shoulder when you are entering a PIN or password Stealing records or information on the job Bribing an employee who has access to records

How Your Identity Can Be Stolen n n Hacking records Conning information out of employees Steal your credit reports by abusing their employee’s authorized access to them, or by posing as someone who may have a legal right to access your report (landlord, employer) Steal personal information found in your home

How Your Identity Can Be Stolen n n Hacking records Conning information out of employees Steal your credit reports by abusing their employee’s authorized access to them, or by posing as someone who may have a legal right to access your report (landlord, employer) Steal personal information found in your home

How Your Identity Can be Stolen n n n Eavesdropping Impersonation Scam phone calls where a stranger asks for personal or financial information Pretexting – by posing as legitimate companies and claiming you have a problem with your account Computer hacking “Phishing” e-mails Spyware

How Your Identity Can be Stolen n n n Eavesdropping Impersonation Scam phone calls where a stranger asks for personal or financial information Pretexting – by posing as legitimate companies and claiming you have a problem with your account Computer hacking “Phishing” e-mails Spyware

TELEMARKETING FRAUD n How Can I Tell if it’s Fraud? n n n High-pressure sales tactics Insistence on an immediate decision The offer sounds too good to be true A request for your credit card number for any purpose other than to make a purchase An offer to send someone to your home or office to pick up the money, or some other method to get your funds more quickly

TELEMARKETING FRAUD n How Can I Tell if it’s Fraud? n n n High-pressure sales tactics Insistence on an immediate decision The offer sounds too good to be true A request for your credit card number for any purpose other than to make a purchase An offer to send someone to your home or office to pick up the money, or some other method to get your funds more quickly

TELEMARKETING FRAUD A statement that something is “free, ” followed by a requirement that you pay for something n An investment that is “without risk” n Unwillingness to provide written information or references that you can contact n A suggestion that you should make a purchase or investment on the basis of “trust” n

TELEMARKETING FRAUD A statement that something is “free, ” followed by a requirement that you pay for something n An investment that is “without risk” n Unwillingness to provide written information or references that you can contact n A suggestion that you should make a purchase or investment on the basis of “trust” n

TELEMARKETING FRAUD n Ways to Avoid Becoming a Victim: Don’t allow yourself to be pushed into a hurried decision n Always request written information, by mail, about the product, service, investment or charity and about the organization that’s offering it n Don’t make any investment or purchase you don’t fully understand n

TELEMARKETING FRAUD n Ways to Avoid Becoming a Victim: Don’t allow yourself to be pushed into a hurried decision n Always request written information, by mail, about the product, service, investment or charity and about the organization that’s offering it n Don’t make any investment or purchase you don’t fully understand n

TELEMARKETING FRAUD n n Ask with what state or federal agencies the firm is registered Check out the company or organization If an investment or major purchase is involved, request that information also be sent to your accountant, financial adviser, banker, or attorney for evaluation and an opinion Ask what recourse you would have if you make a purchase and aren’t satisfied

TELEMARKETING FRAUD n n Ask with what state or federal agencies the firm is registered Check out the company or organization If an investment or major purchase is involved, request that information also be sent to your accountant, financial adviser, banker, or attorney for evaluation and an opinion Ask what recourse you would have if you make a purchase and aren’t satisfied

TELEMARKETING FRAUD Beware of testimonials that you may have no way of verifying n Don’t provide personal financial information over the phone unless you are absolutely certain the caller has a bona fide need to know n If necessary, hang up the phone n

TELEMARKETING FRAUD Beware of testimonials that you may have no way of verifying n Don’t provide personal financial information over the phone unless you are absolutely certain the caller has a bona fide need to know n If necessary, hang up the phone n

DO NOT CALL LIST n National Do Not Call Registry n n www. donotcall. gov Effective for 5 Years Free Texas No Call Registry n n www. texasnocall. com Effective for 3 Years Free online registration Nominal fee for automated registration or registration by mail

DO NOT CALL LIST n National Do Not Call Registry n n www. donotcall. gov Effective for 5 Years Free Texas No Call Registry n n www. texasnocall. com Effective for 3 Years Free online registration Nominal fee for automated registration or registration by mail

Phishing n n Seek to obtain the same kind of information that any ID thief wants May mimic: n Financial Institutions n Government agencies n Computer software companies n E-Commerce sites n Other legitimate business May ask you to go to a Web site to verify and enter your personal information May contain a link that takes you to a Web site that looks just like your financial institution’s

Phishing n n Seek to obtain the same kind of information that any ID thief wants May mimic: n Financial Institutions n Government agencies n Computer software companies n E-Commerce sites n Other legitimate business May ask you to go to a Web site to verify and enter your personal information May contain a link that takes you to a Web site that looks just like your financial institution’s

Phishing and Spyware Phishing (continued) n n At the fake Web site, crooks copy, or “spoof, ” graphics from real Web sites The message may include an excuse (e. g. , the bank is undergoing a computer upgrade), or sound urgent or intimidating (e. g. , you will lose access to your account if you don’t provide the information promptly) Spyware software: n n Monitors your online activity and diverts information while you are using legitimate Web sites May be installed on your computer when you visit deceptive Web sites, download seemingly innocent games or other software, or open e-mails that may have spyware attached

Phishing and Spyware Phishing (continued) n n At the fake Web site, crooks copy, or “spoof, ” graphics from real Web sites The message may include an excuse (e. g. , the bank is undergoing a computer upgrade), or sound urgent or intimidating (e. g. , you will lose access to your account if you don’t provide the information promptly) Spyware software: n n Monitors your online activity and diverts information while you are using legitimate Web sites May be installed on your computer when you visit deceptive Web sites, download seemingly innocent games or other software, or open e-mails that may have spyware attached

Protect Yourself from Phishing n n n Update your browsers, spam filters, anti-virus and anti-spyware software regularly Use parental controls Visit a Web site by typing the Web address – or URL – into your Web browser yourself, not by clicking a link

Protect Yourself from Phishing n n n Update your browsers, spam filters, anti-virus and anti-spyware software regularly Use parental controls Visit a Web site by typing the Web address – or URL – into your Web browser yourself, not by clicking a link

Phishing and Spyware n n Look for the “s” in “https” when engaging in financial transactions because it indicates scrambling or encryption of the communication (don’t just copy a link that appears to have an “s” in “https”) Look for the lock icon in the lower right corner of the screen when engaging in financial or other sensitive transactions because the lock signifies an encrypted session (Spoofed phishing sites may have fake locks, so beware)

Phishing and Spyware n n Look for the “s” in “https” when engaging in financial transactions because it indicates scrambling or encryption of the communication (don’t just copy a link that appears to have an “s” in “https”) Look for the lock icon in the lower right corner of the screen when engaging in financial or other sensitive transactions because the lock signifies an encrypted session (Spoofed phishing sites may have fake locks, so beware)

Phishing and Spyware n More information on Phishing is available at: www. Secret. Service. gov n www. Antiphishing. org n www. FTC. gov n

Phishing and Spyware n More information on Phishing is available at: www. Secret. Service. gov n www. Antiphishing. org n www. FTC. gov n

Spyware n n n Use anti-spyware software Set parental controls Keep current with other software updates and patches

Spyware n n n Use anti-spyware software Set parental controls Keep current with other software updates and patches

On-Line Safety n n Protect your computer like you would protect your personal information Turn it off when you walk away from the computer so that no one else can gain access while you are not there Use a firewall Make sure that your operating system and software updated on a frequent basis (keep patches current)

On-Line Safety n n Protect your computer like you would protect your personal information Turn it off when you walk away from the computer so that no one else can gain access while you are not there Use a firewall Make sure that your operating system and software updated on a frequent basis (keep patches current)

On-Line Safety n n Make sure that you have anti-spam software – many phishing attacks come as a result of spam Use strong passwords n n n Words or numbers that are not easy to guess Use a combination of numbers, letters, and other characters Do not use the same password for every account. Consider changing your passwords periodically

On-Line Safety n n Make sure that you have anti-spam software – many phishing attacks come as a result of spam Use strong passwords n n n Words or numbers that are not easy to guess Use a combination of numbers, letters, and other characters Do not use the same password for every account. Consider changing your passwords periodically

On-Line Safety n n n Know the Web address – or “URL” – of the Web site that you are going to visit Read and learn how the Web site is going to protect and use your personal information Clean your hard drive before you dispose of an old computer

On-Line Safety n n n Know the Web address – or “URL” – of the Web site that you are going to visit Read and learn how the Web site is going to protect and use your personal information Clean your hard drive before you dispose of an old computer

FRAUDULENT CHECK TRANSACATIONS n If your personal checks are stolen: n n n To prevent retailers from accepting the stolen checks, call: n n n Close the account Ask your financial institution to notify Chex. Systems, Inc. Tele. Check at 1 -800 -710 -9898 or 1 -800 -927 -0188 Certegy, Inc. at 1 -800 -437 -5120 To find out if an identity thief has been passing bad checks in your name, call: n SCAN: 1 -800 -262 -7771

FRAUDULENT CHECK TRANSACATIONS n If your personal checks are stolen: n n n To prevent retailers from accepting the stolen checks, call: n n n Close the account Ask your financial institution to notify Chex. Systems, Inc. Tele. Check at 1 -800 -710 -9898 or 1 -800 -927 -0188 Certegy, Inc. at 1 -800 -437 -5120 To find out if an identity thief has been passing bad checks in your name, call: n SCAN: 1 -800 -262 -7771

FRAUDULENT NEW ACCOUNTS n Problems opening a new account? Contact Chex. Systems, Inc. at: Chex. Systems, Inc. n Attn: Consumer Relations n 7805 Hudson Road, Suite 100 n Woodbury, MN 55125 n 1 -800 -428 -9623 n Fax: 602 -659 -2197 n www. chexhelp. com n

FRAUDULENT NEW ACCOUNTS n Problems opening a new account? Contact Chex. Systems, Inc. at: Chex. Systems, Inc. n Attn: Consumer Relations n 7805 Hudson Road, Suite 100 n Woodbury, MN 55125 n 1 -800 -428 -9623 n Fax: 602 -659 -2197 n www. chexhelp. com n

What is FTWCCU doing to Fight Back? n n n Developing and implementing new technologies to improve online and physical security of information and communication Complying with new regulatory requirements and enhancing procedures to prevent, find and fight Identity Theft Educating consumers about how to protect themselves n See FTWCCU Home Page at www. ftwccu. org

What is FTWCCU doing to Fight Back? n n n Developing and implementing new technologies to improve online and physical security of information and communication Complying with new regulatory requirements and enhancing procedures to prevent, find and fight Identity Theft Educating consumers about how to protect themselves n See FTWCCU Home Page at www. ftwccu. org

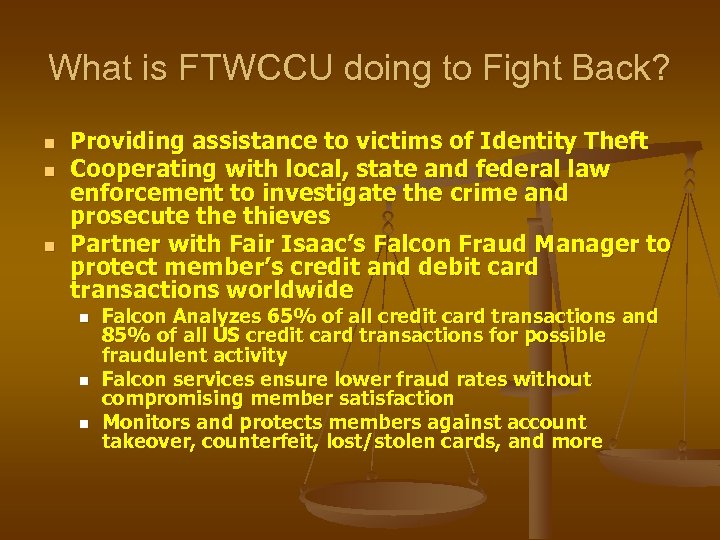

What is FTWCCU doing to Fight Back? n n n Providing assistance to victims of Identity Theft Cooperating with local, state and federal law enforcement to investigate the crime and prosecute thieves Partner with Fair Isaac’s Falcon Fraud Manager to protect member’s credit and debit card transactions worldwide n n n Falcon Analyzes 65% of all credit card transactions and 85% of all US credit card transactions for possible fraudulent activity Falcon services ensure lower fraud rates without compromising member satisfaction Monitors and protects members against account takeover, counterfeit, lost/stolen cards, and more

What is FTWCCU doing to Fight Back? n n n Providing assistance to victims of Identity Theft Cooperating with local, state and federal law enforcement to investigate the crime and prosecute thieves Partner with Fair Isaac’s Falcon Fraud Manager to protect member’s credit and debit card transactions worldwide n n n Falcon Analyzes 65% of all credit card transactions and 85% of all US credit card transactions for possible fraudulent activity Falcon services ensure lower fraud rates without compromising member satisfaction Monitors and protects members against account takeover, counterfeit, lost/stolen cards, and more

Protect Your Information n n Do not leave a lot of financial records lying around your house for prying eyes to see Do not keep information that you don’t need in your purse or wallet Do not leave credit or debit card receipts at the ATM, gas pump, or anywhere else Do not keep personal identification numbers attached to credit, debit, or ATM cards

Protect Your Information n n Do not leave a lot of financial records lying around your house for prying eyes to see Do not keep information that you don’t need in your purse or wallet Do not leave credit or debit card receipts at the ATM, gas pump, or anywhere else Do not keep personal identification numbers attached to credit, debit, or ATM cards

Protect Your Information n n Shred personal records or get rid of them as effectively as possible Beware of giving information to anyone over the phone or Internet unless you initiate the contact Remember that your bank or credit card issuers already have your account numbers, PINs, access codes, passwords, Social Security numbers and other information they need. They won’t phone or e-mail you to ask for it Protect your mail – send and receive it safely

Protect Your Information n n Shred personal records or get rid of them as effectively as possible Beware of giving information to anyone over the phone or Internet unless you initiate the contact Remember that your bank or credit card issuers already have your account numbers, PINs, access codes, passwords, Social Security numbers and other information they need. They won’t phone or e-mail you to ask for it Protect your mail – send and receive it safely

Protect Your Social Security Number n n Do not carry around your Social Security number Do not give the number to others just because a merchant or someone else says he or she needs it Ask questions before deciding whether to give it out – Why is it needed? How will it be protected? Remember, financial institutions will need your Social Security number – for tax reporting and other identifying purposes

Protect Your Social Security Number n n Do not carry around your Social Security number Do not give the number to others just because a merchant or someone else says he or she needs it Ask questions before deciding whether to give it out – Why is it needed? How will it be protected? Remember, financial institutions will need your Social Security number – for tax reporting and other identifying purposes

Income Tax-Related Identity Theft n n n Your Social Security number can be used by identity thieves to file a false tax return and get a refund using your name Your Social Security number could be used by someone to get a job and report income that you didn’t know about If you do not prepare your own income tax return, be very careful in choosing a tax preparer

Income Tax-Related Identity Theft n n n Your Social Security number can be used by identity thieves to file a false tax return and get a refund using your name Your Social Security number could be used by someone to get a job and report income that you didn’t know about If you do not prepare your own income tax return, be very careful in choosing a tax preparer

Income Tax-Related Identity Theft n n If you receive a notice from the IRS that leads you to believe someone may have used your Social Security number fraudulently, respond immediately either by phone or in writing as directed in that notice IRS tax examiners will work with you and other agencies such as the Social Security Administration to help resolve these problems www. irs. gov 1 -877 -777 -4778

Income Tax-Related Identity Theft n n If you receive a notice from the IRS that leads you to believe someone may have used your Social Security number fraudulently, respond immediately either by phone or in writing as directed in that notice IRS tax examiners will work with you and other agencies such as the Social Security Administration to help resolve these problems www. irs. gov 1 -877 -777 -4778

Avoid Mail Theft n n Mailboxes are vulnerable because they have no locks and are located at the end of a drive or walkway, or at the curbside Identity thieves know that unsecured mail boxes may contain easy and valuable pickings for them because the mail may include: n n n n n Credit cards Credit card statements Bank checks Credit card convenience checks Insurance policies Mortgage documents Driver’s licenses Other material with important information

Avoid Mail Theft n n Mailboxes are vulnerable because they have no locks and are located at the end of a drive or walkway, or at the curbside Identity thieves know that unsecured mail boxes may contain easy and valuable pickings for them because the mail may include: n n n n n Credit cards Credit card statements Bank checks Credit card convenience checks Insurance policies Mortgage documents Driver’s licenses Other material with important information

Secure Your Mail n n n n Take your incoming mail out of the mailbox as soon as possible Consider getting a mail box with a lock or using a Post Office box Put your outgoing mail in a blue, United States Postal Service collection box on a street corner; or Hand it to your letter carrier directly; or Bring it to the Post Office If you put it in your mailbox, remember that putting the red flag up alerts the thieves as well as the mail carrier that there is outgoing mail If you think you are an identity theft victim and the mail is involved, contact www. usps. com/postalinspectors

Secure Your Mail n n n n Take your incoming mail out of the mailbox as soon as possible Consider getting a mail box with a lock or using a Post Office box Put your outgoing mail in a blue, United States Postal Service collection box on a street corner; or Hand it to your letter carrier directly; or Bring it to the Post Office If you put it in your mailbox, remember that putting the red flag up alerts the thieves as well as the mail carrier that there is outgoing mail If you think you are an identity theft victim and the mail is involved, contact www. usps. com/postalinspectors

Steps to Catch Identity Thieves n n Monitor your online financial accounts frequently Promptly review your other financial statements, credit card statements, and other bills Quickly call the financial institution or company if you see anything suspicious and follow up in writing Sign your new credit and debit cards promptly

Steps to Catch Identity Thieves n n Monitor your online financial accounts frequently Promptly review your other financial statements, credit card statements, and other bills Quickly call the financial institution or company if you see anything suspicious and follow up in writing Sign your new credit and debit cards promptly

What To Do If You Are, or Think You May Be A Victim n n n “Must Do” List – Act Quickly Use the “Chart Your Course of Action” form (page 11 in “Take Charge: Fighting Back Against Identity Theft” material http: //www. ftc. gov/bcp/edu/pubs/consumer/idt heft/idt 04. pdf) Contact the financial institutions or the companies where the information about you has been misused and let them know that you’re a victim of Identity Theft Close accounts that you know, or believe, have been tampered with or opened fraudulently

What To Do If You Are, or Think You May Be A Victim n n n “Must Do” List – Act Quickly Use the “Chart Your Course of Action” form (page 11 in “Take Charge: Fighting Back Against Identity Theft” material http: //www. ftc. gov/bcp/edu/pubs/consumer/idt heft/idt 04. pdf) Contact the financial institutions or the companies where the information about you has been misused and let them know that you’re a victim of Identity Theft Close accounts that you know, or believe, have been tampered with or opened fraudulently

What To Do If You Are, or Think You May Be A Victim n Fraudulent Electronic Withdrawals The Electronic Fund Transfer Act protects consumers for fraudulent ATM, debit or credit card withdrawals; or any other electronic debit or credit transaction n You have 60 days from the time the statement was sent to you to report discrepancies in writing n

What To Do If You Are, or Think You May Be A Victim n Fraudulent Electronic Withdrawals The Electronic Fund Transfer Act protects consumers for fraudulent ATM, debit or credit card withdrawals; or any other electronic debit or credit transaction n You have 60 days from the time the statement was sent to you to report discrepancies in writing n

What To Do If You Are, or Think You May Be A Victim n Lost or stolen ATM card Loss is limited to $50 if reported within 2 business days of discovery of loss n If after 2 business days, but within 60 days after discrepancy appears on your statement, loss could be up to $500 of what thief withdraws n If more than 60 days after loss, you are responsible for loss of all unauthorized funds n

What To Do If You Are, or Think You May Be A Victim n Lost or stolen ATM card Loss is limited to $50 if reported within 2 business days of discovery of loss n If after 2 business days, but within 60 days after discrepancy appears on your statement, loss could be up to $500 of what thief withdraws n If more than 60 days after loss, you are responsible for loss of all unauthorized funds n

What To Do If You Are, or Think You May Be A Victim n Credit Card Fraudulent Charges n n Write to the creditor at the address given for “billing inquiries, ” NOT the address for sending your payments (See sample letter on page 20 – “Take Charge” document Send your letter within 60 days after the first billing containing the error was mailed to you. n If the billing address was changed by the identity thief and you didn’t receive the bill, your dispute letter still must reach the creditor within 60 days of when the creditor would have mailed the bill

What To Do If You Are, or Think You May Be A Victim n Credit Card Fraudulent Charges n n Write to the creditor at the address given for “billing inquiries, ” NOT the address for sending your payments (See sample letter on page 20 – “Take Charge” document Send your letter within 60 days after the first billing containing the error was mailed to you. n If the billing address was changed by the identity thief and you didn’t receive the bill, your dispute letter still must reach the creditor within 60 days of when the creditor would have mailed the bill

What To Do If You Are, or Think You May Be A Victim n n n Send your letter by certified mail and request a return receipt. Include copies of the police report Keep original police report and copies of letter and supporting documentation The creditor must acknowledge your complaint in writing within 30 days after receiving it The creditor must resolve the dispute within two billing cycles (but no more than 90 days) after receiving your letter

What To Do If You Are, or Think You May Be A Victim n n n Send your letter by certified mail and request a return receipt. Include copies of the police report Keep original police report and copies of letter and supporting documentation The creditor must acknowledge your complaint in writing within 30 days after receiving it The creditor must resolve the dispute within two billing cycles (but no more than 90 days) after receiving your letter

Contact a Financial Institution n n They will investigate the circumstances They should take the suspect charges off the account, pending investigation They will reissue cards, PINs, access codes and passwords, and close accounts, as necessary They need a written report of what you are claiming

Contact a Financial Institution n n They will investigate the circumstances They should take the suspect charges off the account, pending investigation They will reissue cards, PINs, access codes and passwords, and close accounts, as necessary They need a written report of what you are claiming

Where to Find Help n n If not satisfied with the way the financial institution is handling your complaint you may contact the agency that oversees them If not sure which agency oversees your financial institution, refer to pages 15 -17 in “Take Charge” manual for specific agency web addresses and phone numbers.

Where to Find Help n n If not satisfied with the way the financial institution is handling your complaint you may contact the agency that oversees them If not sure which agency oversees your financial institution, refer to pages 15 -17 in “Take Charge” manual for specific agency web addresses and phone numbers.

Contact the Credit Bureaus n n n Contact the credit bureaus immediately when you find out you are a victim of Identity Theft to place a fraud alert in your credit report You also may want to contact the credit bureaus to place a fraud alert if you feel like you may become a victim of Identity Theft (e. g. , your wallet containing identifying information has been stolen) The fraud alert on your credit file signals to would -be creditors to do extra verification before they grant credit in your name

Contact the Credit Bureaus n n n Contact the credit bureaus immediately when you find out you are a victim of Identity Theft to place a fraud alert in your credit report You also may want to contact the credit bureaus to place a fraud alert if you feel like you may become a victim of Identity Theft (e. g. , your wallet containing identifying information has been stolen) The fraud alert on your credit file signals to would -be creditors to do extra verification before they grant credit in your name

Contact the Credit Bureaus n n n You only need to notify one of the three nationwide credit bureaus; it will notify the other two to place a fraud alert Carefully review your credit reports to make sure that there are no fraudulent accounts opened in your name or other errors After the fraud alert is in place, the credit bureaus will also make available to you a free copy of your credit report

Contact the Credit Bureaus n n n You only need to notify one of the three nationwide credit bureaus; it will notify the other two to place a fraud alert Carefully review your credit reports to make sure that there are no fraudulent accounts opened in your name or other errors After the fraud alert is in place, the credit bureaus will also make available to you a free copy of your credit report

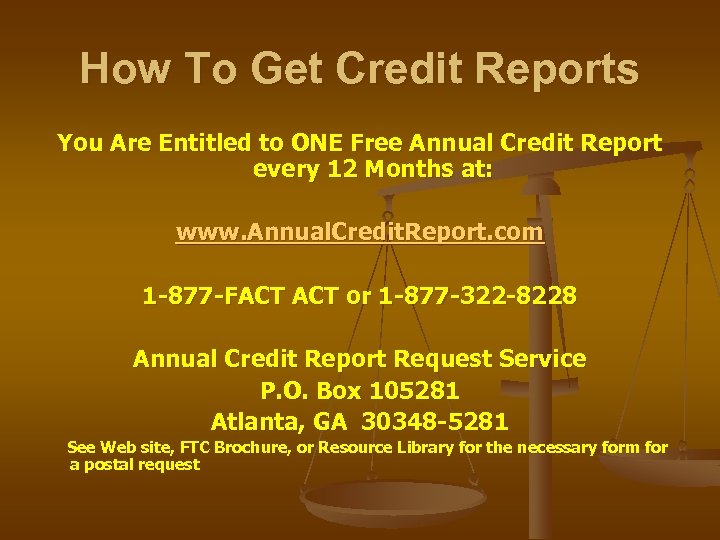

How To Get Credit Reports You Are Entitled to ONE Free Annual Credit Report every 12 Months at: www. Annual. Credit. Report. com 1 -877 -FACT or 1 -877 -322 -8228 Annual Credit Report Request Service P. O. Box 105281 Atlanta, GA 30348 -5281 See Web site, FTC Brochure, or Resource Library for the necessary form for a postal request

How To Get Credit Reports You Are Entitled to ONE Free Annual Credit Report every 12 Months at: www. Annual. Credit. Report. com 1 -877 -FACT or 1 -877 -322 -8228 Annual Credit Report Request Service P. O. Box 105281 Atlanta, GA 30348 -5281 See Web site, FTC Brochure, or Resource Library for the necessary form for a postal request

What You Can Do To Protect Yourself

What You Can Do To Protect Yourself

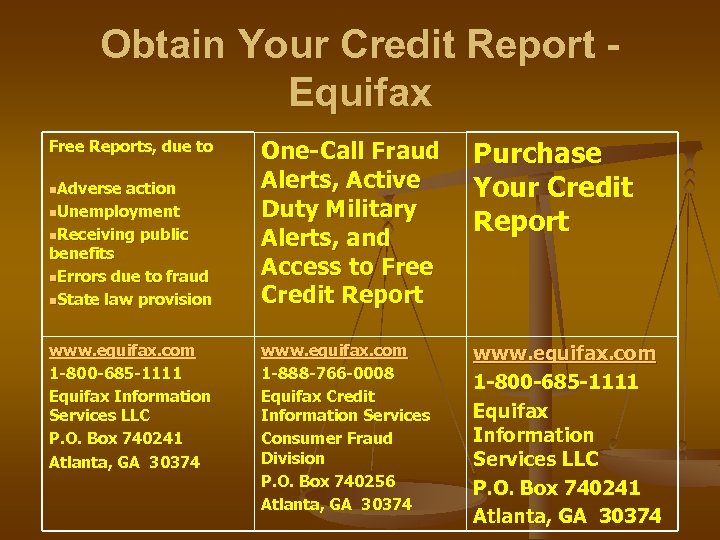

Obtain Your Credit Report Equifax Free Reports, due to n. Adverse action n. Unemployment n. Receiving public benefits n. Errors due to fraud n. State law provision www. equifax. com 1 -800 -685 -1111 Equifax Information Services LLC P. O. Box 740241 Atlanta, GA 30374 One-Call Fraud Alerts, Active Duty Military Alerts, and Access to Free Credit Report Purchase Your Credit Report www. equifax. com 1 -888 -766 -0008 Equifax Credit Information Services Consumer Fraud Division P. O. Box 740256 Atlanta, GA 30374 www. equifax. com 1 -800 -685 -1111 Equifax Information Services LLC P. O. Box 740241 Atlanta, GA 30374

Obtain Your Credit Report Equifax Free Reports, due to n. Adverse action n. Unemployment n. Receiving public benefits n. Errors due to fraud n. State law provision www. equifax. com 1 -800 -685 -1111 Equifax Information Services LLC P. O. Box 740241 Atlanta, GA 30374 One-Call Fraud Alerts, Active Duty Military Alerts, and Access to Free Credit Report Purchase Your Credit Report www. equifax. com 1 -888 -766 -0008 Equifax Credit Information Services Consumer Fraud Division P. O. Box 740256 Atlanta, GA 30374 www. equifax. com 1 -800 -685 -1111 Equifax Information Services LLC P. O. Box 740241 Atlanta, GA 30374

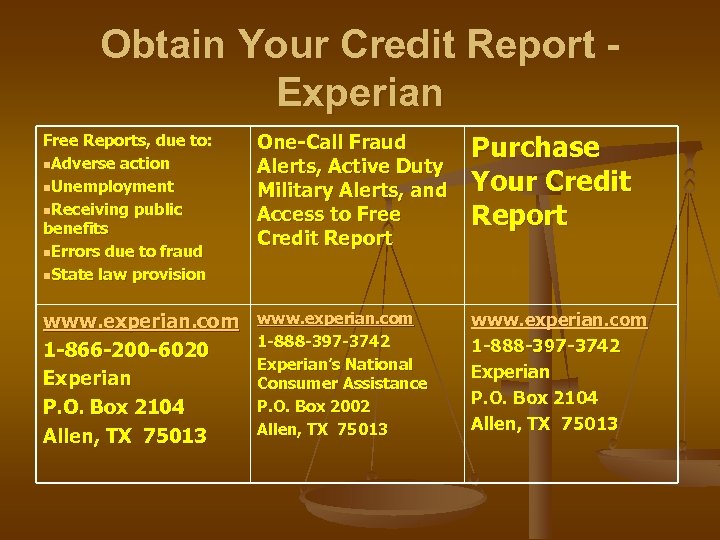

Obtain Your Credit Report Experian Free Reports, due to: n. Adverse action n. Unemployment n. Receiving public benefits n. Errors due to fraud n. State law provision One-Call Fraud Alerts, Active Duty Military Alerts, and Access to Free Credit Report Purchase Your Credit Report www. experian. com 1 -866 -200 -6020 Experian P. O. Box 2104 Allen, TX 75013 www. experian. com 1 -888 -397 -3742 Experian’s National Consumer Assistance P. O. Box 2002 Allen, TX 75013 www. experian. com 1 -888 -397 -3742 Experian P. O. Box 2104 Allen, TX 75013

Obtain Your Credit Report Experian Free Reports, due to: n. Adverse action n. Unemployment n. Receiving public benefits n. Errors due to fraud n. State law provision One-Call Fraud Alerts, Active Duty Military Alerts, and Access to Free Credit Report Purchase Your Credit Report www. experian. com 1 -866 -200 -6020 Experian P. O. Box 2104 Allen, TX 75013 www. experian. com 1 -888 -397 -3742 Experian’s National Consumer Assistance P. O. Box 2002 Allen, TX 75013 www. experian. com 1 -888 -397 -3742 Experian P. O. Box 2104 Allen, TX 75013

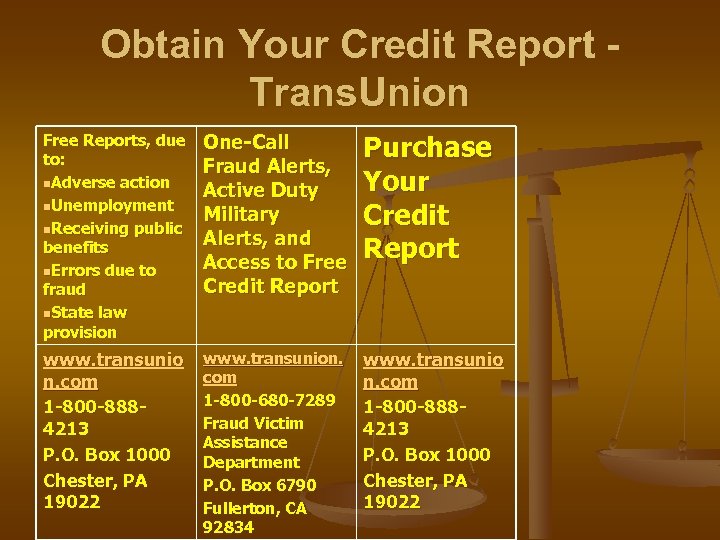

Obtain Your Credit Report Trans. Union Free Reports, due to: n. Adverse action n. Unemployment n. Receiving public benefits n. Errors due to fraud n. State law provision One-Call Fraud Alerts, Active Duty Military Alerts, and Access to Free Credit Report Purchase Your Credit Report www. transunio n. com 1 -800 -8884213 P. O. Box 1000 Chester, PA 19022 www. transunion. com 1 -800 -680 -7289 Fraud Victim Assistance Department P. O. Box 6790 Fullerton, CA 92834 www. transunio n. com 1 -800 -8884213 P. O. Box 1000 Chester, PA 19022

Obtain Your Credit Report Trans. Union Free Reports, due to: n. Adverse action n. Unemployment n. Receiving public benefits n. Errors due to fraud n. State law provision One-Call Fraud Alerts, Active Duty Military Alerts, and Access to Free Credit Report Purchase Your Credit Report www. transunio n. com 1 -800 -8884213 P. O. Box 1000 Chester, PA 19022 www. transunion. com 1 -800 -680 -7289 Fraud Victim Assistance Department P. O. Box 6790 Fullerton, CA 92834 www. transunio n. com 1 -800 -8884213 P. O. Box 1000 Chester, PA 19022

How To Get Credit Reports n Other conditions under which you can request a free report from any credit bureau: n n If you are unemployed and seeking employment If you receive public welfare assistance, or If you believe information in your credit file is incorrect due to fraud Request a free report for these reasons from any consumer reporting agency by contacting them directly

How To Get Credit Reports n Other conditions under which you can request a free report from any credit bureau: n n If you are unemployed and seeking employment If you receive public welfare assistance, or If you believe information in your credit file is incorrect due to fraud Request a free report for these reasons from any consumer reporting agency by contacting them directly

Adverse Action Notices n n If your application for credit or insurance is denied, the company that denied the application based in whole or in part on information contained in a credit report must provide an adverse action notice The notice will tell you how you can request a free credit report from the appropriate credit bureau You can buy your credit report at any time You can subscribe to credit monitoring services

Adverse Action Notices n n If your application for credit or insurance is denied, the company that denied the application based in whole or in part on information contained in a credit report must provide an adverse action notice The notice will tell you how you can request a free credit report from the appropriate credit bureau You can buy your credit report at any time You can subscribe to credit monitoring services

Fraud Alerts n n Initial Alert Extended Alert – refer to page 6 in “Take Charge” material

Fraud Alerts n n Initial Alert Extended Alert – refer to page 6 in “Take Charge” material

Fraud Alert Contact Information n www. equifax. com – 1 -888 -766 -0008 n www. experian. com – 1 -888 -397 -3742 n www. transunion. com – 1 -800 -680 -7289

Fraud Alert Contact Information n www. equifax. com – 1 -888 -766 -0008 n www. experian. com – 1 -888 -397 -3742 n www. transunion. com – 1 -800 -680 -7289

Contact Law Enforcement n n File a police report with the local police or sheriff to document your situation Be persistent. Consider contacting State or Federal law enforcement, if necessary Provide any evidence you may have when you contact the police Get a copy of your police report to establish that you are a victim of a crime and to help you repair your credit record

Contact Law Enforcement n n File a police report with the local police or sheriff to document your situation Be persistent. Consider contacting State or Federal law enforcement, if necessary Provide any evidence you may have when you contact the police Get a copy of your police report to establish that you are a victim of a crime and to help you repair your credit record

Contact Law Enforcement n n Proving You’re a Victim – refer to page 8 “Take Charge” material Criminal Violations – refer to pages 20 – 21 “Take Charge” material

Contact Law Enforcement n n Proving You’re a Victim – refer to page 8 “Take Charge” material Criminal Violations – refer to pages 20 – 21 “Take Charge” material

Contact the FTC n The Federal Trade Commission has a wealth of information for consumers who find themselves victimized by Identify Theft – www. consumer. gov/idtheft n n Consumer Response Center, Federal Trade Commission, 600 Pennsylvania Ave. , NW, Washington, DC 20580 The FTC shares collected data with 1400 law enforcement agencies around the country. To report the crime by phone, call 1 -877 -IDTHEFT

Contact the FTC n The Federal Trade Commission has a wealth of information for consumers who find themselves victimized by Identify Theft – www. consumer. gov/idtheft n n Consumer Response Center, Federal Trade Commission, 600 Pennsylvania Ave. , NW, Washington, DC 20580 The FTC shares collected data with 1400 law enforcement agencies around the country. To report the crime by phone, call 1 -877 -IDTHEFT

OTHER CONTACTS n Federal Trade Commission n n Internal Revenue Service n n www. onguardonline. gov www. ftc. gov/idtheft 1 -877 -IDTHEFT (438 -4338) www. irs. gov/individuals/index. html www. irs. gov/individuals/article/0, , id=136324, 00. html U. S. Department of Justice n n www. usdoj. gov/criminal/fraud/text/idtheft. html

OTHER CONTACTS n Federal Trade Commission n n Internal Revenue Service n n www. onguardonline. gov www. ftc. gov/idtheft 1 -877 -IDTHEFT (438 -4338) www. irs. gov/individuals/index. html www. irs. gov/individuals/article/0, , id=136324, 00. html U. S. Department of Justice n n www. usdoj. gov/criminal/fraud/text/idtheft. html

OTHER CONTACTS n U. S. Postal Inspection Service n n U. S. Secret Service n n www. usps. com/postalinspectors www. lookstoogoodtobetrue. com/ Offer FREE Fraud-Prevention DVDs www. secretservice. gov/faq. shtml#identity U. S. Social Security Administration n n www. ssa. gov www. socialsecurity. gov/pubs/10064. html

OTHER CONTACTS n U. S. Postal Inspection Service n n U. S. Secret Service n n www. usps. com/postalinspectors www. lookstoogoodtobetrue. com/ Offer FREE Fraud-Prevention DVDs www. secretservice. gov/faq. shtml#identity U. S. Social Security Administration n n www. ssa. gov www. socialsecurity. gov/pubs/10064. html

OTHER CONTACTS n U. S. Treasury Department n n n www. treas. gov/offices/domesticfinance/financial-institution/cip/identitytheft. shtml Refer to pages 22 – 25 in the “Take Charge: Fight Back Against Identity Theft” materials for contact agencies for other types of Identity Theft Fraud.

OTHER CONTACTS n U. S. Treasury Department n n n www. treas. gov/offices/domesticfinance/financial-institution/cip/identitytheft. shtml Refer to pages 22 – 25 in the “Take Charge: Fight Back Against Identity Theft” materials for contact agencies for other types of Identity Theft Fraud.

Bankruptcy Fraud n If someone has filed bankruptcy in your name, you must write to the U. S. Trustee in the region where the bankruptcy was filed. (Refer to page 17, “Take Charge” materials)

Bankruptcy Fraud n If someone has filed bankruptcy in your name, you must write to the U. S. Trustee in the region where the bankruptcy was filed. (Refer to page 17, “Take Charge” materials)

Debt Collection n Sometimes people find out that they are a victim of Identity Theft when they are contacted by a debt collector Ascertain the details about the debt and the collector (i. e. , who is calling and the nature of the debt) Determine the company that referred the debt to the debt collector

Debt Collection n Sometimes people find out that they are a victim of Identity Theft when they are contacted by a debt collector Ascertain the details about the debt and the collector (i. e. , who is calling and the nature of the debt) Determine the company that referred the debt to the debt collector

Debt Collection n Contact both the debt collector and the company on whose behalf they are collecting and dispute the account You will probably have to send them a copy of the police report Document that they have resolved the debt and that you are no longer being held liable for the account on which they are trying to collect

Debt Collection n Contact both the debt collector and the company on whose behalf they are collecting and dispute the account You will probably have to send them a copy of the police report Document that they have resolved the debt and that you are no longer being held liable for the account on which they are trying to collect

Stop Debt Collector Contact n n Write letter to collection agency Send collection agency letter of explanation. Include copy of police report and supporting documents n Refer to pages 21 -22 of “Take Charge” material for more information

Stop Debt Collector Contact n n Write letter to collection agency Send collection agency letter of explanation. Include copy of police report and supporting documents n Refer to pages 21 -22 of “Take Charge” material for more information

Tips for Identity Theft Victims n n Keep good records (e. g. , the names and telephone numbers of the people you talk to, summaries of conversations, documentary evidence of the crime) Consider using the FTC’s standard affidavit and sample form letters for contacting credit reporting agencies, available at: www. consumer. gov/idtheft Filing the police report also allows you to block the identity theft accounts in your credit report, and makes it easier to get documents used to open the fraudulent identity theft accounts The police report will support your request for the 7 -year fraud alert available to proven victims

Tips for Identity Theft Victims n n Keep good records (e. g. , the names and telephone numbers of the people you talk to, summaries of conversations, documentary evidence of the crime) Consider using the FTC’s standard affidavit and sample form letters for contacting credit reporting agencies, available at: www. consumer. gov/idtheft Filing the police report also allows you to block the identity theft accounts in your credit report, and makes it easier to get documents used to open the fraudulent identity theft accounts The police report will support your request for the 7 -year fraud alert available to proven victims

Identity Theft Movies

Identity Theft Movies