85ae28eb9ef540c66e47102204485598.ppt

- Количество слайдов: 23

Identifying Undervalued Companies Via Patent Analysis As a Means of Highlighting Merger/Acquisition Targets § Presented at: § National Meeting of the American Chemical Society San Diego, CA § April 3, 2001 § Presented by: § § § § Anthony Breitzman, VP/CTO Patrick Thomas, Research Analyst CHI Research, Inc. 10 White Horse Pike Haddon Heights, NJ 08035 www. chiresearch. com abreitz@chiresearch. com

Identifying Undervalued Companies Via Patent Analysis As a Means of Highlighting Merger/Acquisition Targets § Presented at: § National Meeting of the American Chemical Society San Diego, CA § April 3, 2001 § Presented by: § § § § Anthony Breitzman, VP/CTO Patrick Thomas, Research Analyst CHI Research, Inc. 10 White Horse Pike Haddon Heights, NJ 08035 www. chiresearch. com abreitz@chiresearch. com

Introduction Mergers and acquisitions take place for a variety of reasons, including strategic growth, expansion into new markets, or because the target company is attractively priced and contains know-how the suitor would like to obtain. In this presentation we will concentrate on the third issue; that is, the use of patent analysis in the valuation of companies. 3/17/2018

Introduction Mergers and acquisitions take place for a variety of reasons, including strategic growth, expansion into new markets, or because the target company is attractively priced and contains know-how the suitor would like to obtain. In this presentation we will concentrate on the third issue; that is, the use of patent analysis in the valuation of companies. 3/17/2018

Key Questions in Analyzing Mergers between Technology Based Companies 1. Does the merger make sense in technological terms? – Are the firms technologically compatible? – Does the merger fill a technological gap? 2. Are the financial terms of the merger appropriate? – Is the buying firm getting a fair price? – Is there a best target in terms of technology and price? Patent analysis can help frame both issues. 3/17/2018

Key Questions in Analyzing Mergers between Technology Based Companies 1. Does the merger make sense in technological terms? – Are the firms technologically compatible? – Does the merger fill a technological gap? 2. Are the financial terms of the merger appropriate? – Is the buying firm getting a fair price? – Is there a best target in terms of technology and price? Patent analysis can help frame both issues. 3/17/2018

Overview Slide 5: Introduction to patent analysis Slides 6 -9: Traditional uses of patent analysis in M&A Situations Slides 10 -22: Use of patent analysis in valuing companies 3/17/2018

Overview Slide 5: Introduction to patent analysis Slides 6 -9: Traditional uses of patent analysis in M&A Situations Slides 10 -22: Use of patent analysis in valuing companies 3/17/2018

Patent Analysis Basics § Patent and Patent Family counts can be used to measure the level of R&D activity. § Impact or value of R&D activity can be measured by weighting patent activity against patent indicators such as citation counts, number of equivalent documents, renewal decisions, science linkage, innovation speed, etc. For more on patent analysis see CHI Publication List: http: //www. chiresearch. com/pubs. htm papers 146, 113, 103 among others. 3/17/2018

Patent Analysis Basics § Patent and Patent Family counts can be used to measure the level of R&D activity. § Impact or value of R&D activity can be measured by weighting patent activity against patent indicators such as citation counts, number of equivalent documents, renewal decisions, science linkage, innovation speed, etc. For more on patent analysis see CHI Publication List: http: //www. chiresearch. com/pubs. htm papers 146, 113, 103 among others. 3/17/2018

Traditional Uses of Patent Analysis in M&A Situations § Targeting § Due Diligence § Technological Compatibility And now § Valuation 3/17/2018

Traditional Uses of Patent Analysis in M&A Situations § Targeting § Due Diligence § Technological Compatibility And now § Valuation 3/17/2018

Recent Targeting Examples § A large pharmaceutical company wishes to identify small biotech firms with strong genomics capabilities. § A South American cosmetics company wishes to manufacture anti-perspirants in Europe. Which European firms have the technological capabilities and might be viable acquisition targets? § A large semiconductor firm wants to invest in firms doing bioinformatics. Who has the best and are they for sale? 3/17/2018

Recent Targeting Examples § A large pharmaceutical company wishes to identify small biotech firms with strong genomics capabilities. § A South American cosmetics company wishes to manufacture anti-perspirants in Europe. Which European firms have the technological capabilities and might be viable acquisition targets? § A large semiconductor firm wants to invest in firms doing bioinformatics. Who has the best and are they for sale? 3/17/2018

Due-Diligence Examples § Is the firm everything it seems technologically? Are the key inventors still with the firm? We once did a duediligence analysis where the key inventor was moved to the parent company, before the sale of a subsidiary. § We once killed an acquisition of a hearing-aid company. The target had a strong sales network, but its technology was all analog while the competition was going digital. 3/17/2018

Due-Diligence Examples § Is the firm everything it seems technologically? Are the key inventors still with the firm? We once did a duediligence analysis where the key inventor was moved to the parent company, before the sale of a subsidiary. § We once killed an acquisition of a hearing-aid company. The target had a strong sales network, but its technology was all analog while the competition was going digital. 3/17/2018

Technological Compatibility Examples § Is the acquisition active in the same areas as the acquiring company? Does the firm fill a technological niche or gap that the acquiring company needs filled? § Recently we showed that the Glaxo-Smith. Kline merger was a good technological fit because both companies are active in largely the same treatment areas, but Glaxo would gain entry into a number of new areas. Also their strengths are complimentary. Smith. Kline would strengthen Glaxo’s weaker pharmaceutical technology, while Glaxo’s strong biotechnology and basic chemistry research would strengthen Smith. Kline’s weaker standing in those areas. 3/17/2018

Technological Compatibility Examples § Is the acquisition active in the same areas as the acquiring company? Does the firm fill a technological niche or gap that the acquiring company needs filled? § Recently we showed that the Glaxo-Smith. Kline merger was a good technological fit because both companies are active in largely the same treatment areas, but Glaxo would gain entry into a number of new areas. Also their strengths are complimentary. Smith. Kline would strengthen Glaxo’s weaker pharmaceutical technology, while Glaxo’s strong biotechnology and basic chemistry research would strengthen Smith. Kline’s weaker standing in those areas. 3/17/2018

Basic Idea of Valuation Methodology § Once a target or targets are identified, what is a reasonable price for that target? § Patent analysis can be used in the following way: 1. All players in the technology can be identified via patent activity. 2. A market-to-book value can be identified for the publicly traded subset. 3. Regression analysis can be used to correlate market-to-book values with patent impact indicators. 4. A target price is set based on where the target fits among its peers in patent indicators. 5. If the company is public, and its target price is above its actual price, than it is undervalued, and is a good buy. 3/17/2018

Basic Idea of Valuation Methodology § Once a target or targets are identified, what is a reasonable price for that target? § Patent analysis can be used in the following way: 1. All players in the technology can be identified via patent activity. 2. A market-to-book value can be identified for the publicly traded subset. 3. Regression analysis can be used to correlate market-to-book values with patent impact indicators. 4. A target price is set based on where the target fits among its peers in patent indicators. 5. If the company is public, and its target price is above its actual price, than it is undervalued, and is a good buy. 3/17/2018

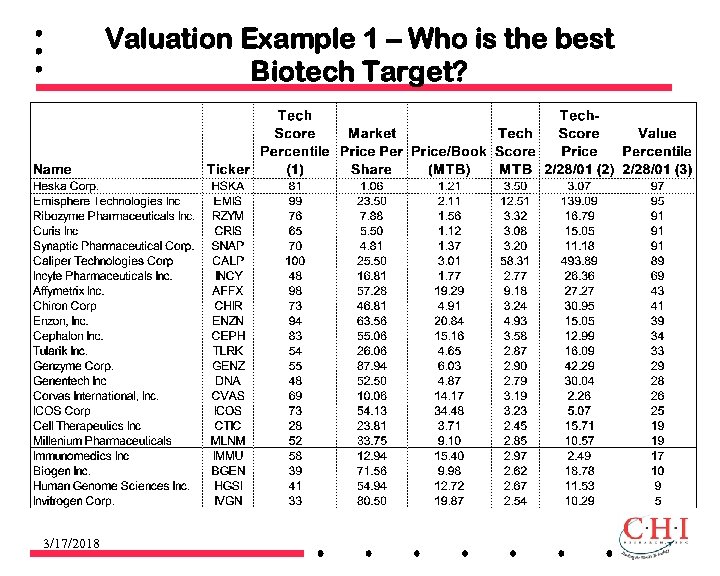

Valuation Example 1 – Who is the best Biotech Target? 3/17/2018

Valuation Example 1 – Who is the best Biotech Target? 3/17/2018

Footnotes to Previous Slide 1. Technology Score is a linear combination of various patent indicators. These are then percentile ranked by industry so that companies with a percentile score of 100 have the strongest technology indicators within the industry. 2. Regression analysis is used to determine the MTB level for a company with a particular tech. score within an industry. Once an MTB is determined, a price-per-share can be easily determined. 3. By comparing a company's actual price with its tech-score price, one can determine whether a company is over or under-valued in the market. 3/17/2018

Footnotes to Previous Slide 1. Technology Score is a linear combination of various patent indicators. These are then percentile ranked by industry so that companies with a percentile score of 100 have the strongest technology indicators within the industry. 2. Regression analysis is used to determine the MTB level for a company with a particular tech. score within an industry. Once an MTB is determined, a price-per-share can be easily determined. 3. By comparing a company's actual price with its tech-score price, one can determine whether a company is over or under-valued in the market. 3/17/2018

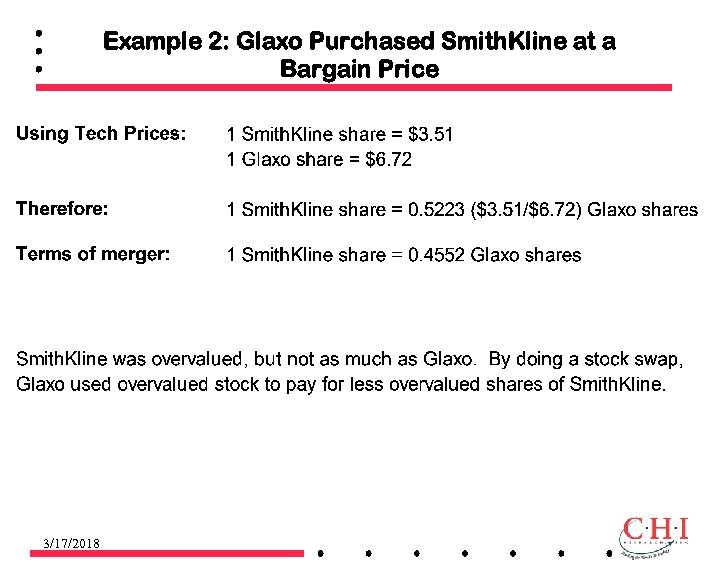

Example 2: Glaxo Purchased Smith. Kline at a Bargain Price 3/17/2018

Example 2: Glaxo Purchased Smith. Kline at a Bargain Price 3/17/2018

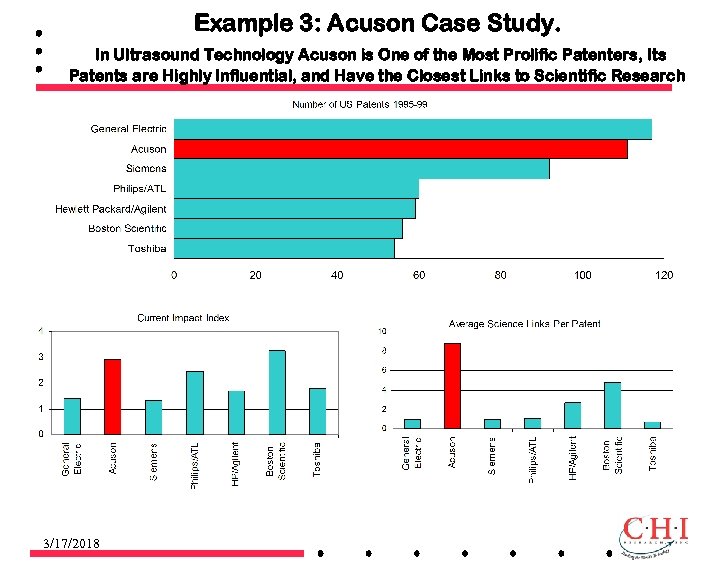

Example 3: Acuson Case Study. In Ultrasound Technology Acuson is One of the Most Prolific Patenters, Its Patents are Highly Influential, and Have the Closest Links to Scientific Research 3/17/2018

Example 3: Acuson Case Study. In Ultrasound Technology Acuson is One of the Most Prolific Patenters, Its Patents are Highly Influential, and Have the Closest Links to Scientific Research 3/17/2018

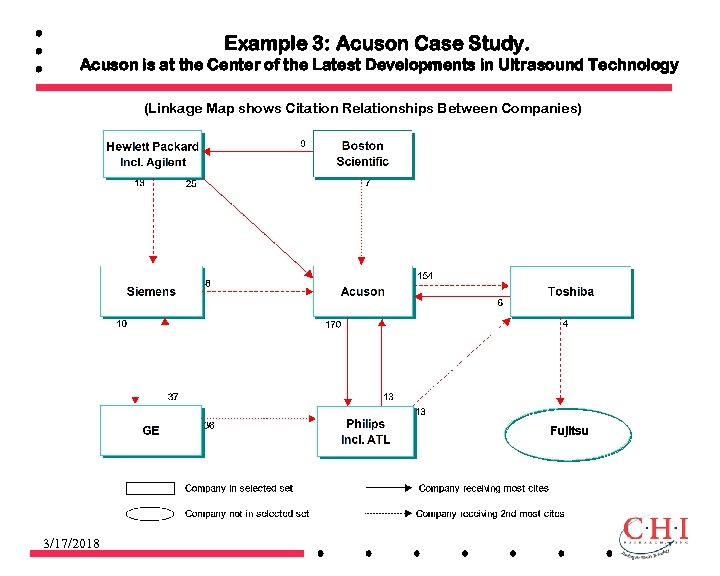

Example 3: Acuson Case Study. Acuson is at the Center of the Latest Developments in Ultrasound Technology (Linkage Map shows Citation Relationships Between Companies) 3/17/2018

Example 3: Acuson Case Study. Acuson is at the Center of the Latest Developments in Ultrasound Technology (Linkage Map shows Citation Relationships Between Companies) 3/17/2018

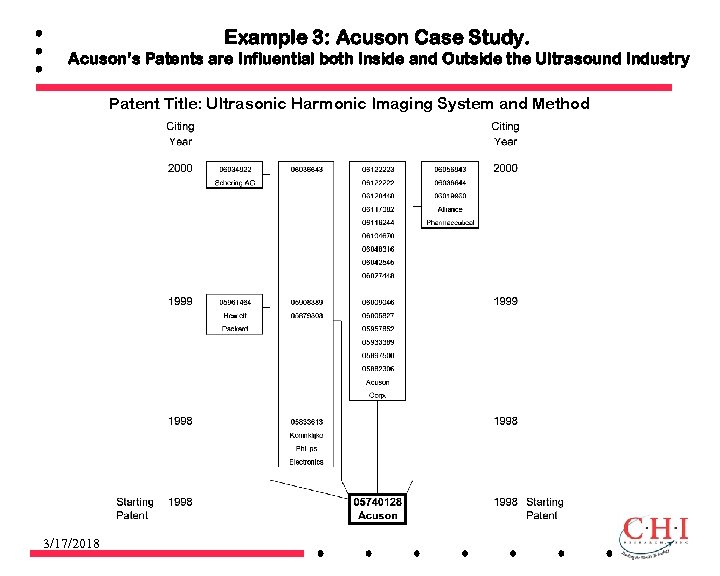

Example 3: Acuson Case Study. Acuson’s Patents are Influential both Inside and Outside the Ultrasound Industry Patent Title: Ultrasonic Harmonic Imaging System and Method 3/17/2018

Example 3: Acuson Case Study. Acuson’s Patents are Influential both Inside and Outside the Ultrasound Industry Patent Title: Ultrasonic Harmonic Imaging System and Method 3/17/2018

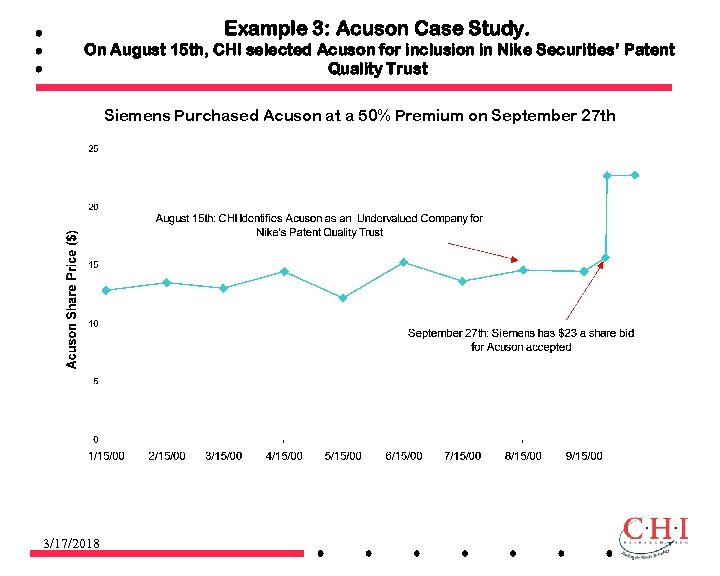

Example 3: Acuson Case Study. On August 15 th, CHI selected Acuson for inclusion in Nike Securities’ Patent Quality Trust Siemens Purchased Acuson at a 50% Premium on September 27 th 3/17/2018

Example 3: Acuson Case Study. On August 15 th, CHI selected Acuson for inclusion in Nike Securities’ Patent Quality Trust Siemens Purchased Acuson at a 50% Premium on September 27 th 3/17/2018

Example 3: Acuson Case Study. Key Facts § Patent analysis showed that Acuson’s ultrasound technology was very good relative to its peers. § Its stock price indicated it was undervalued relative to its industry and its technological quality. § The conclusion at the time (August 2000) was that Acuson was ripe for either a takeover or a substantial rise in stock price. 3/17/2018

Example 3: Acuson Case Study. Key Facts § Patent analysis showed that Acuson’s ultrasound technology was very good relative to its peers. § Its stock price indicated it was undervalued relative to its industry and its technological quality. § The conclusion at the time (August 2000) was that Acuson was ripe for either a takeover or a substantial rise in stock price. 3/17/2018

Can the Acuson Example be Generalized? § Yes. The method can and has been generalized to identify undervalued companies whose stocks should rise. § The method is the subject of a recently issued another pending patent. § The basic idea of the method is that once a company’s industry is identified, one can always tell 1) whether its patents are as good or better than its peers and 2) whether this is reflected in its stock price. 3/17/2018

Can the Acuson Example be Generalized? § Yes. The method can and has been generalized to identify undervalued companies whose stocks should rise. § The method is the subject of a recently issued another pending patent. § The basic idea of the method is that once a company’s industry is identified, one can always tell 1) whether its patents are as good or better than its peers and 2) whether this is reflected in its stock price. 3/17/2018

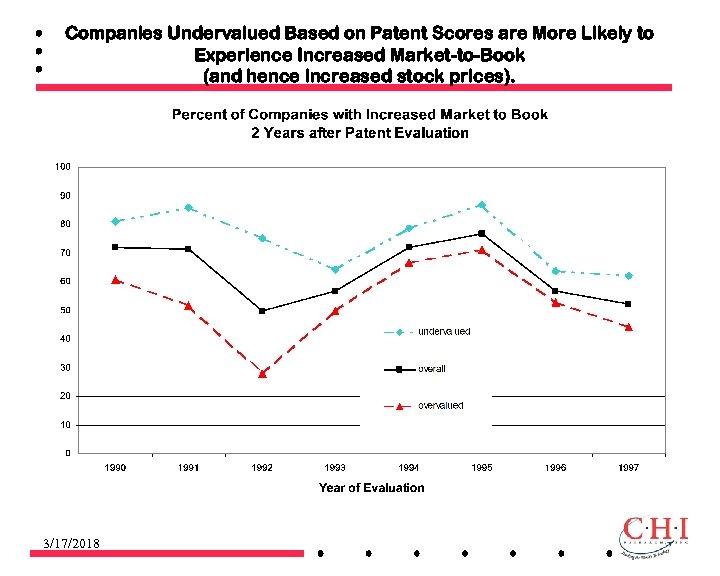

Companies Undervalued Based on Patent Scores are More Likely to Experience Increased Market-to-Book (and hence increased stock prices). 3/17/2018

Companies Undervalued Based on Patent Scores are More Likely to Experience Increased Market-to-Book (and hence increased stock prices). 3/17/2018

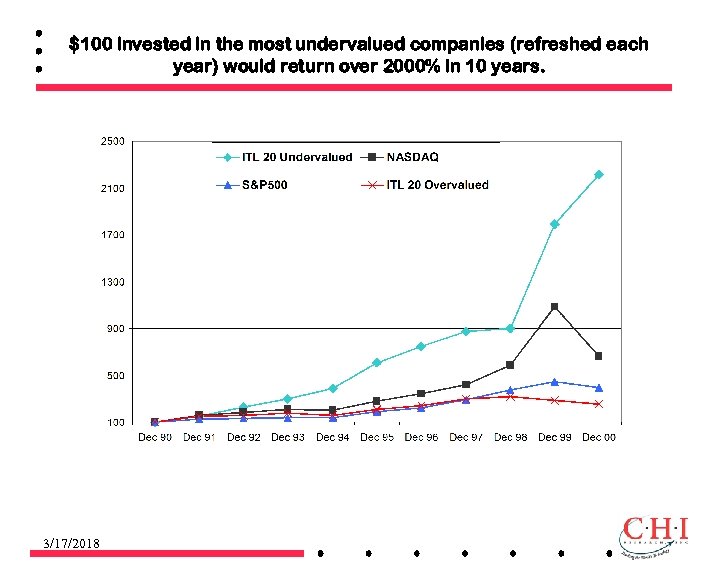

$100 invested in the most undervalued companies (refreshed each year) would return over 2000% in 10 years. 3/17/2018

$100 invested in the most undervalued companies (refreshed each year) would return over 2000% in 10 years. 3/17/2018

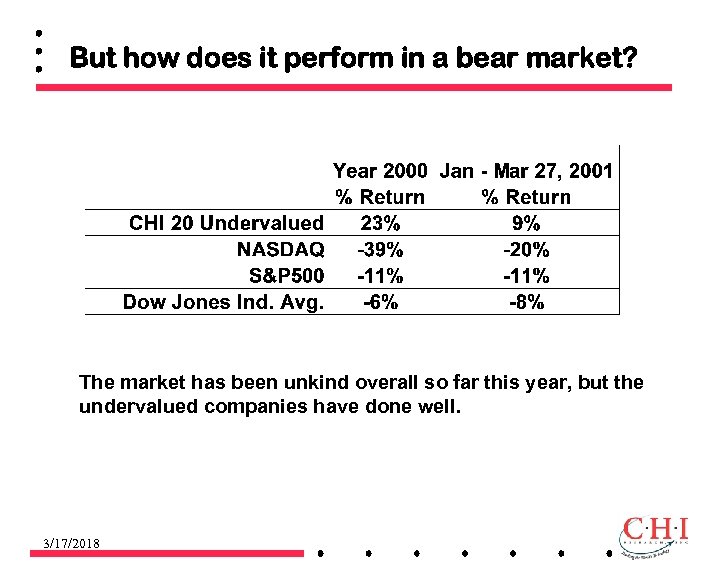

But how does it perform in a bear market? The market has been unkind overall so far this year, but the undervalued companies have done well. 3/17/2018

But how does it perform in a bear market? The market has been unkind overall so far this year, but the undervalued companies have done well. 3/17/2018

For More Information and Related Papers Visit: www. Chiresearch. com Or Contact: Tony Breitzman VP/CTO CHI Research, Inc. 10 White Horse Pike Haddon Heights, NJ 08035 Ph: 856. 546. 0600 Fax: 856. 546. 9633 E-mail: abreitz@chiresearch. com 3/17/2018

For More Information and Related Papers Visit: www. Chiresearch. com Or Contact: Tony Breitzman VP/CTO CHI Research, Inc. 10 White Horse Pike Haddon Heights, NJ 08035 Ph: 856. 546. 0600 Fax: 856. 546. 9633 E-mail: abreitz@chiresearch. com 3/17/2018