73d1512490c709ba24fafe3c1dc88f3d.ppt

- Количество слайдов: 28

IBSA and the Aerospace Industry in Brazil Mario Marconini South-South Economic Cooperation: Exploring IBSA (India-Brazil. South Africa) Initiative Johannesburg, 28 June 2006 Marconini IBSA Aerospace Joburg 28. 06

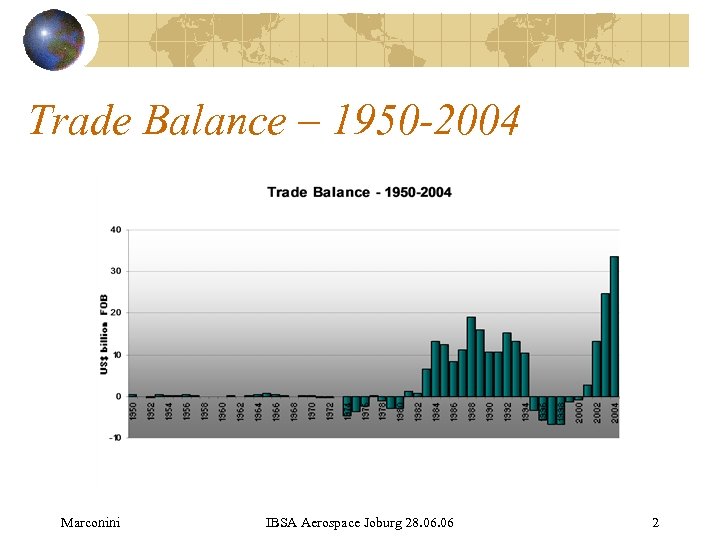

Trade Balance – 1950 -2004 Marconini IBSA Aerospace Joburg 28. 06 2

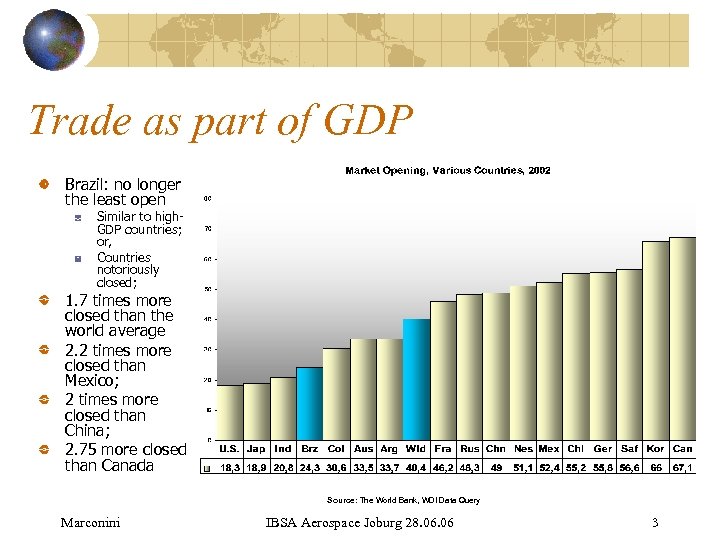

Trade as part of GDP Brazil: no longer the least open Similar to high. GDP countries; or, Countries notoriously closed; 1. 7 times more closed than the world average 2. 2 times more closed than Mexico; 2 times more closed than China; 2. 75 more closed than Canada Source: The World Bank, WDI Data Query Marconini IBSA Aerospace Joburg 28. 06 3

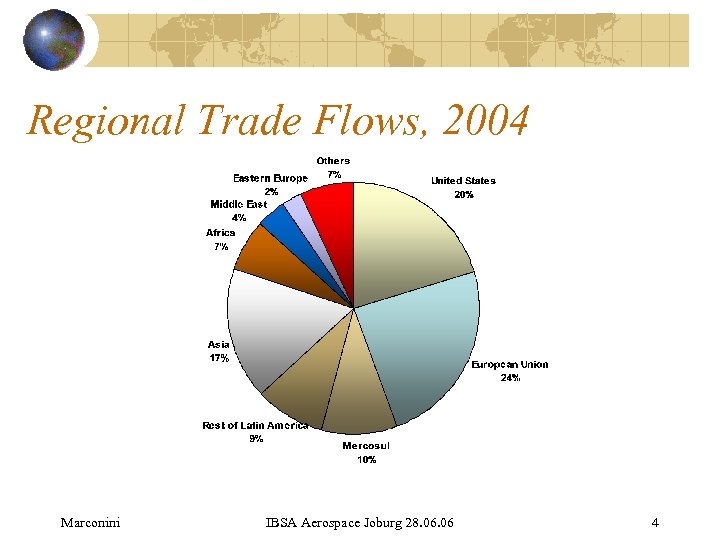

Regional Trade Flows, 2004 Marconini IBSA Aerospace Joburg 28. 06 4

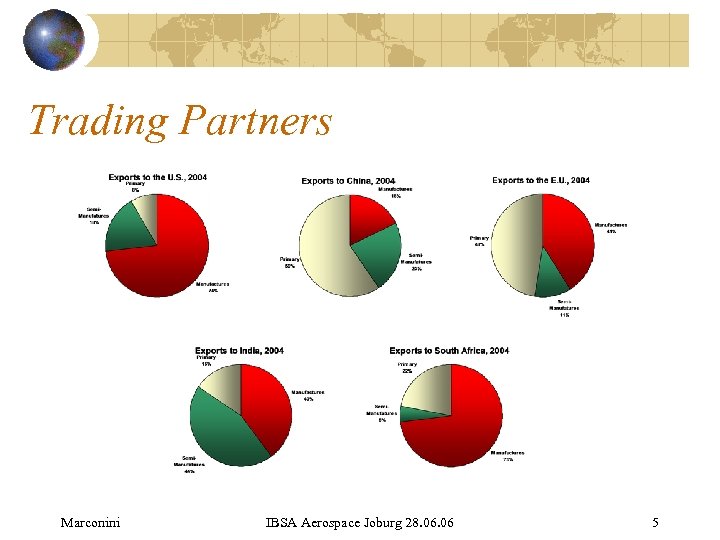

Trading Partners Marconini IBSA Aerospace Joburg 28. 06 5

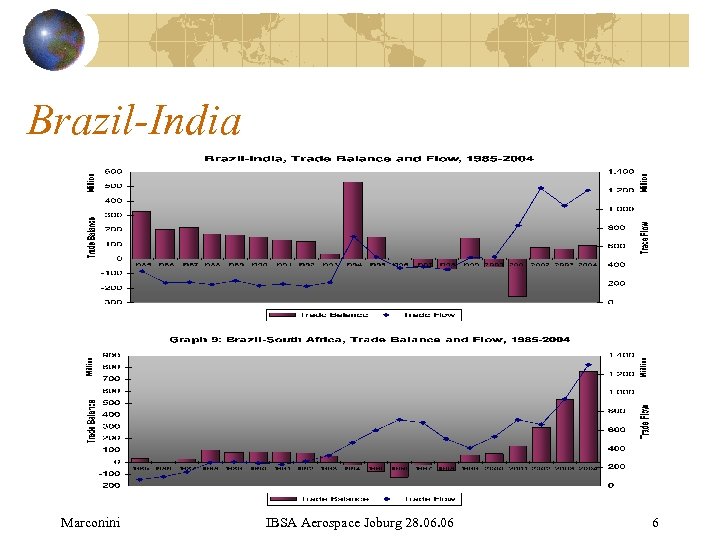

Brazil-India Marconini IBSA Aerospace Joburg 28. 06 6

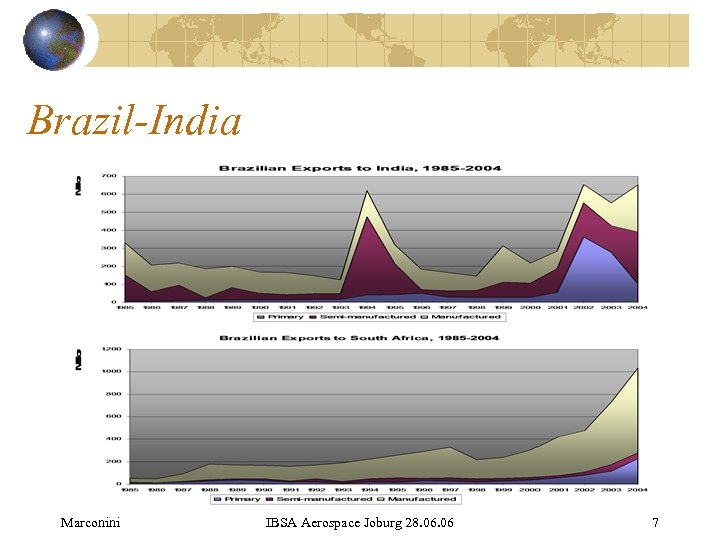

Brazil-India Marconini IBSA Aerospace Joburg 28. 06 7

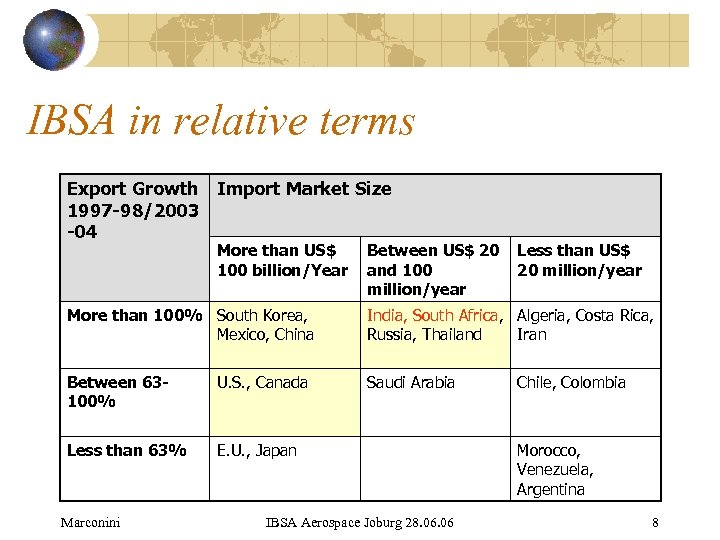

IBSA in relative terms Export Growth Import Market Size 1997 -98/2003 -04 More than US$ 100 billion/Year Between US$ 20 and 100 million/year Less than US$ 20 million/year More than 100% South Korea, Mexico, China India, South Africa, Algeria, Costa Rica, Russia, Thailand Iran Between 63100% U. S. , Canada Saudi Arabia Less than 63% E. U. , Japan Marconini IBSA Aerospace Joburg 28. 06 Chile, Colombia Morocco, Venezuela, Argentina 8

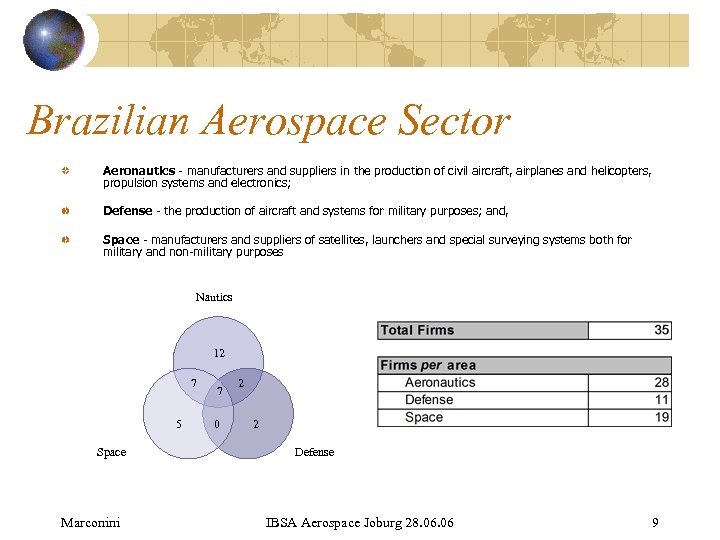

Brazilian Aerospace Sector Aeronautics - manufacturers and suppliers in the production of civil aircraft, airplanes and helicopters, propulsion systems and electronics; Defense - the production of aircraft and systems for military purposes; and, Space - manufacturers and suppliers of satellites, launchers and special surveying systems both for military and non-military purposes Nautics 12 7 5 Space Marconini 7 0 2 2 Defense IBSA Aerospace Joburg 28. 06 9

Brazilian Aerospace Sector One of most dynamic sectors Direct relationship with national security; High technological linkages and spillovers; One of the country's main exporters; and, Productivity levels and growth perspectives. Marconini IBSA Aerospace Joburg 28. 06 10

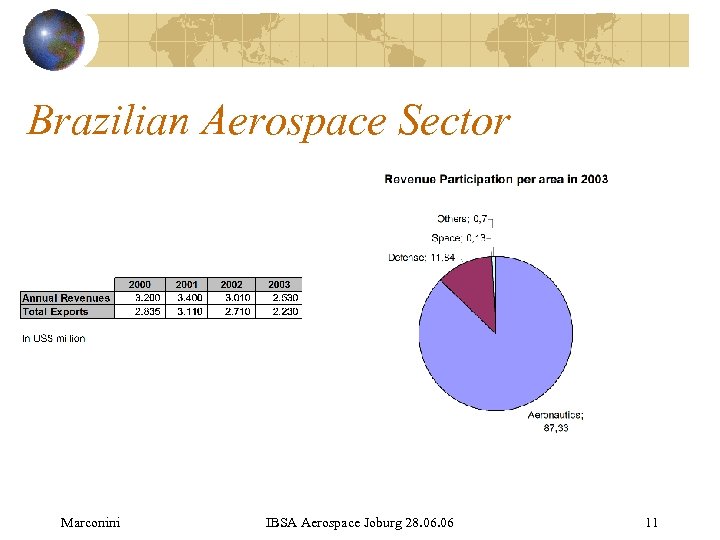

Brazilian Aerospace Sector Marconini IBSA Aerospace Joburg 28. 06 11

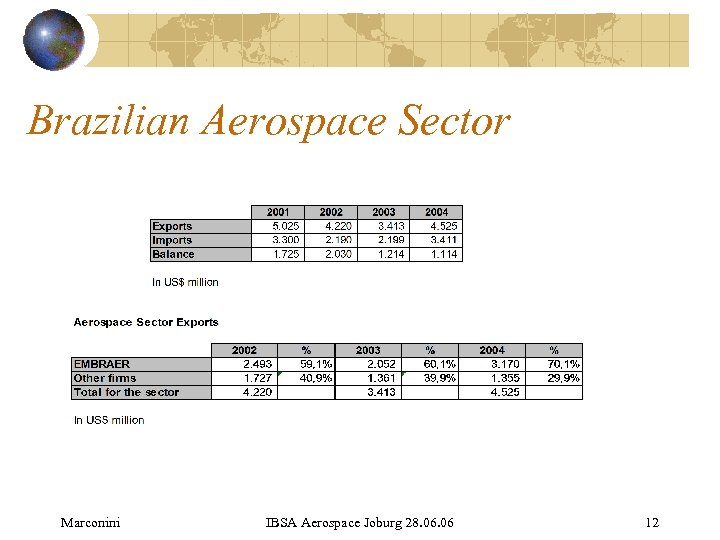

Brazilian Aerospace Sector Marconini IBSA Aerospace Joburg 28. 06 12

Brazilian Aerospace Sector 1941 1945 1946 1947 1950 1954 1969 1971 1975 1979 1983 1990 1994 Marconini – – – – Ministry of Aeronautics Idea of a Aeronautical Technological Center (CTA) Organizational Commission Military Engineering in Rio transferred to São José dos Campos First ITA class CTA created, also Research and Development Institute (IPD) Embraer created as state-company Bandeirante and air force contracts start Embraer first export: Uruguayan Air Force Embraer: presence in the U. S. Embraer: presence in Europe Embraer major financial crisis; downsize 13 to 9. 9 K employees Privatization of Embraer IBSA Aerospace Joburg 28. 06 13

The Embraer Phenomenon Empresa Brasileira de Aeronáutica 13, 000 direct, 3, 000 indirect of 18, 000 jobs 80% of aerospatial MSMEs’ revenues Virtually all integrated with Embraer chain 11 service suppliers formed a venture Embraer and partners in aeronautics and defense Only space: Orbisat and Orbital Multi in helicopters: Helibras Marconini IBSA Aerospace Joburg 28. 06 14

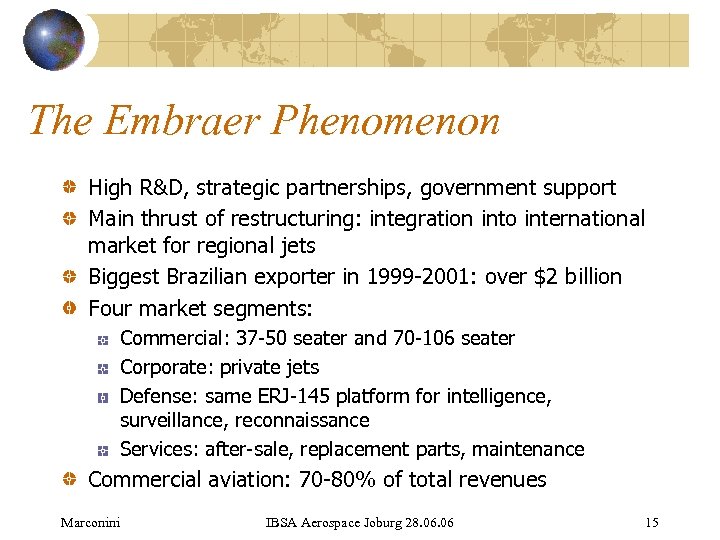

The Embraer Phenomenon High R&D, strategic partnerships, government support Main thrust of restructuring: integration into international market for regional jets Biggest Brazilian exporter in 1999 -2001: over $2 billion Four market segments: Commercial: 37 -50 seater and 70 -106 seater Corporate: private jets Defense: same ERJ-145 platform for intelligence, surveillance, reconnaissance Services: after-sale, replacement parts, maintenance Commercial aviation: 70 -80% of total revenues Marconini IBSA Aerospace Joburg 28. 06 15

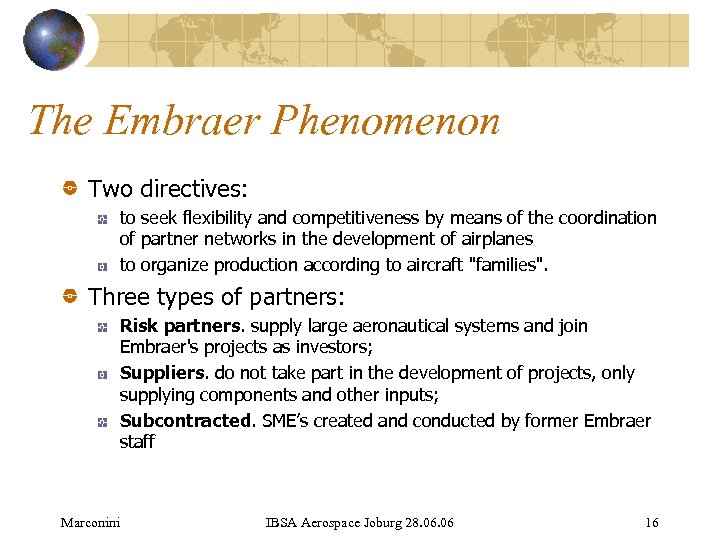

The Embraer Phenomenon Two directives: to seek flexibility and competitiveness by means of the coordination of partner networks in the development of airplanes to organize production according to aircraft "families". Three types of partners: Risk partners. supply large aeronautical systems and join Embraer's projects as investors; Suppliers. do not take part in the development of projects, only supplying components and other inputs; Subcontracted. SME’s created and conducted by former Embraer staff Marconini IBSA Aerospace Joburg 28. 06 16

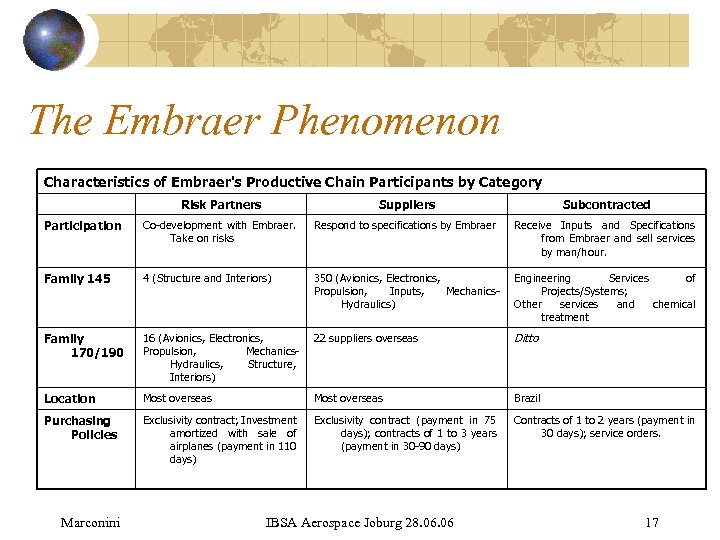

The Embraer Phenomenon Characteristics of Embraer's Productive Chain Participants by Category Risk Partners Suppliers Subcontracted Participation Co-development with Embraer. Take on risks Respond to specifications by Embraer Receive Inputs and Specifications from Embraer and sell services by man/hour. Family 145 4 (Structure and Interiors) 350 (Avionics, Electronics, Propulsion, Inputs, Mechanics. Hydraulics) Engineering Services of Projects/Systems; Other services and chemical treatment Family 170/190 16 (Avionics, Electronics, Propulsion, Mechanics. Hydraulics, Structure, Interiors) 22 suppliers overseas Ditto Location Most overseas Brazil Purchasing Policies Exclusivity contract; Investment amortized with sale of airplanes (payment in 110 days) Exclusivity contract (payment in 75 days); contracts of 1 to 3 years (payment in 30 -90 days) Contracts of 1 to 2 years (payment in 30 days); service orders. Marconini IBSA Aerospace Joburg 28. 06 17

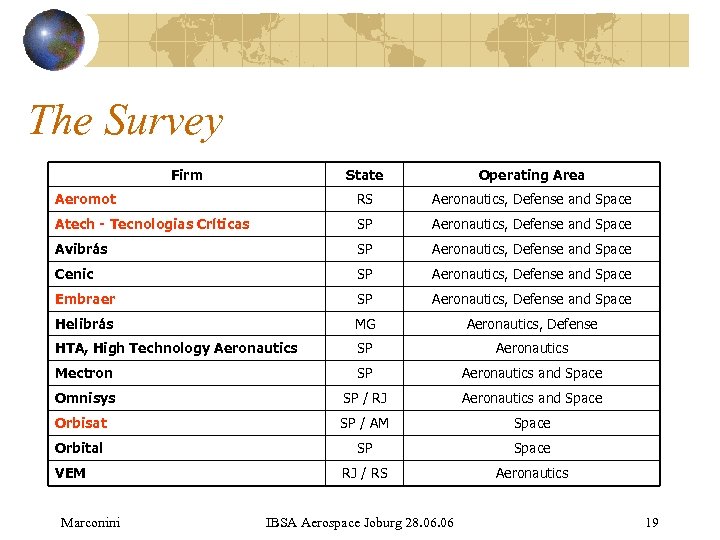

The Survey Second semester of 2005 12 firms contacted Distrust with the project Additional information and clarifications Linkage of project to government Sources of financing for the research Recourse to high technology Economic relevance: Embraer alone Marconini IBSA Aerospace Joburg 28. 06 18

The Survey Firm State Operating Area Aeromot RS Aeronautics, Defense and Space Atech - Tecnologias Críticas SP Aeronautics, Defense and Space Avibrás SP Aeronautics, Defense and Space Cenic SP Aeronautics, Defense and Space Embraer SP Aeronautics, Defense and Space Helibrás MG Aeronautics, Defense HTA, High Technology Aeronautics SP Aeronautics Mectron SP Aeronautics and Space Omnisys SP / RJ Aeronautics and Space Orbisat SP / AM Space Orbital SP Space RJ / RS Aeronautics VEM Marconini IBSA Aerospace Joburg 28. 06 19

Survey Findings: General Positive impression re: industry future Need to attract world-class suppliers Space less developed than India or China Develop indigenous technology ½ traded with India or South Africa Exports: dynamic developed markets Imports: quality of products Supplying firms: need for certification Marconini IBSA Aerospace Joburg 28. 06 20

Survey Findings: General Aviation systems: oligopolies Alternatives in India and Russia Little prospecting yet ¾ never heard of IBSA ¼ heard of it but highly skeptical anyway Embraer: exports to both Aeromot: sales to S. A. but not India Orbisat: sales to S. A. but not India None see significant increase in IBSA business Marconini IBSA Aerospace Joburg 28. 06 21

South-South Cooperation ½ – cooperation projects China – CIBERS satellite Russia – satellite launchers ½ – France and Germany ¼ - knew of India project ½ – considered infeasible with IBSA Embraer already has global network Better to have productive chain at home Marconini IBSA Aerospace Joburg 28. 06 22

South-South Cooperation Space sector Interest with India: satellite manufacture, launching technology, optical radars, image sensors, launching vehicles. Interest with South Africa: military aircraf parts G-20 type of grouping on subsidies Technical barriers, not a problem Exception: emissions and noise in E. U. IBSA for bargaining technology transfer Financing crucial: government could help to provide level playing field Country Image: Embraer’s effect Marconini IBSA Aerospace Joburg 28. 06 23

Capabilities Embraer: long-haul market would be a "suicide“ Significant political incentives Radars, detection of oil spots in S. A. ocean Political blockage: Brazilian government crucial Lack of funding, interest, priority Orbisat: Radars in Embraer’s aircrafts Market access, doing business in India Difficult to comprehend, decision-making hierarchies, corruption Infrastructure: governmental support, unavailable funds R&D: deficient in geostationary satellites and launchers Lack of investment in higher education High interest rates and short loan duration Embraer: distances and freight not important Technical requirements and high values and quantities, very important Orbisat: effective partnership with India: satellites and radars Lost to Israel in India due to lack of presence and contacts in Indian government Marconini IBSA Aerospace Joburg 28. 06 24

Value Addition ¼ - aircraft “from the South” Long-haul – segmented, highly competitive, well established, highly oligopolized (4 multis) R&D – only element of IBSA cooperation Market agreements, joint research, technological swaps Only in defense and space – not aeronautics Marconini IBSA Aerospace Joburg 28. 06 25

Government Involvement Skepticism Do internationally what has not been done internally Yet, Project in defense and space Financing at competitive rates and durations Nationalization of segments Intermediaries with foreign governments Stimulate small enterprises in specific projects Create special entity or regulatory agencies Presidential visits: events, fairs and commercial visits, more beneficial Marconini IBSA Aerospace Joburg 28. 06 26

Threats ¼ ¾ ½ ½ ½ Marconini - IBSA IBSA cannot improve bargaining cannot replace the developed cooperation – improbable technology transfer feasible technology transfer irrelevant IBSA Aerospace Joburg 28. 06 27

Ten Conclusions 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Brazil’s sector integrated into the world Little to gain in aeronautics Cooperation only in defense and space Long-haul is really a “long-haul” shot India seen as very difficult for firms Skepticism re. government initiatives Better to nationalize world-class production Government can support and mediate IBSA cannot change the developed IBSA cannot replace the developed Marconini IBSA Aerospace Joburg 28. 06 28

73d1512490c709ba24fafe3c1dc88f3d.ppt