68cf6c5d963db3edf26790e58ae0702e.ppt

- Количество слайдов: 19

® IBM Software Group Workplace, Portal & Collaboration Market overview Christina Mavromatis

IBM Software Group Agenda § The Portfolio §Market opportunity §Our positioning §Market trends §North Region priorities 2

IBM Software Group The Portfolio 3

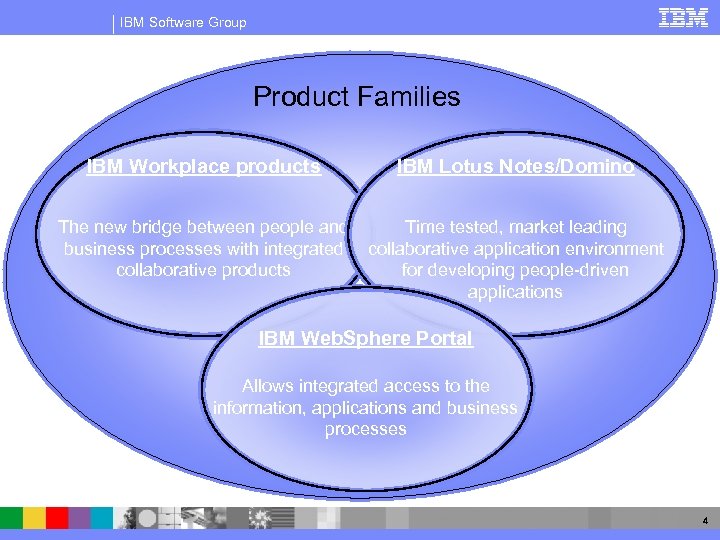

IBM Software Group Product Families IBM Workplace products IBM Lotus Notes/Domino The new bridge between people and business processes with integrated collaborative products Time tested, market leading collaborative application environment for developing people-driven applications IBM Web. Sphere Portal Allows integrated access to the information, applications and business processes 4

IBM Software Group Marketplace Assessment 5

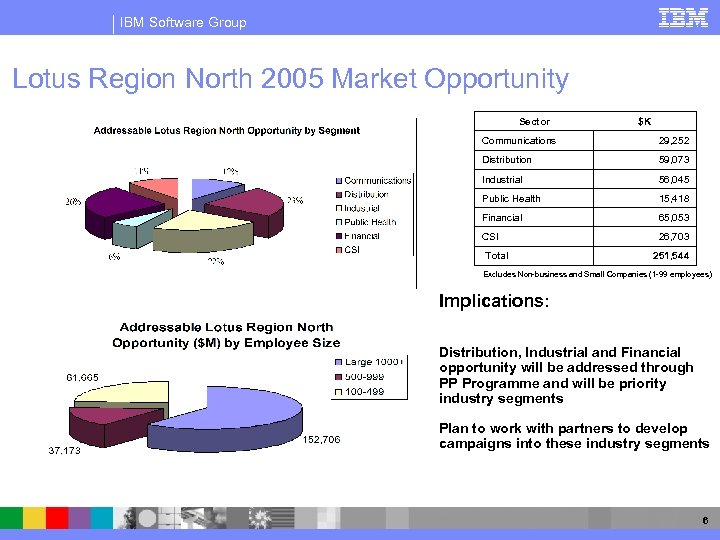

IBM Software Group Lotus Region North 2005 Market Opportunity Sector $K Communications 29, 252 Distribution 59, 073 Industrial 56, 045 Public Health 15, 418 Financial 65, 053 CSI 26, 703 Total 251, 544 Excludes Non-business and Small Companies (1 -99 employees) Implications: Distribution, Industrial and Financial opportunity will be addressed through PP Programme and will be priority industry segments Plan to work with partners to develop campaigns into these industry segments 6

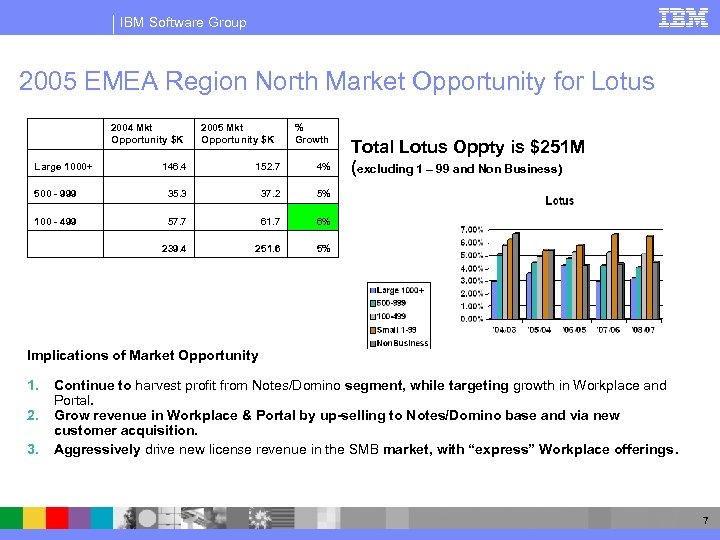

IBM Software Group 2005 EMEA Region North Market Opportunity for Lotus 2004 Mkt Opportunity $K Large 1000+ 2005 Mkt Opportunity $K % Growth 146. 4 152. 7 4% 500 - 999 35. 3 37. 2 5% 100 - 499 57. 7 61. 7 6% 239. 4 251. 6 Total Lotus Oppty is $251 M (excluding 1 – 99 and Non Business) 5% Implications of Market Opportunity 1. 2. 3. Continue to harvest profit from Notes/Domino segment, while targeting growth in Workplace and Portal. Grow revenue in Workplace & Portal by up-selling to Notes/Domino base and via new customer acquisition. Aggressively drive new license revenue in the SMB market, with “express” Workplace offerings. 7

IBM Software Group Our positioning 8

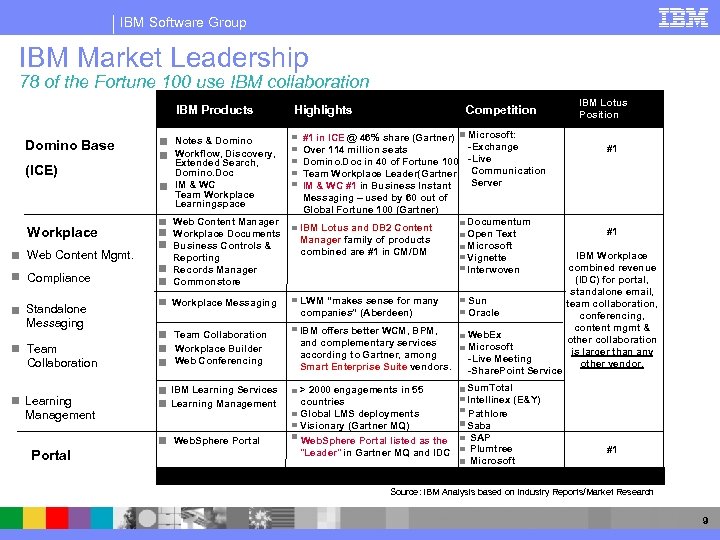

IBM Software Group IBM Market Leadership 78 of the Fortune 100 use IBM collaboration IBM Products Domino Base (ICE) Workplace Web Content Mgmt. Compliance Standalone Messaging Team Collaboration Learning Management Notes & Domino Web Content Manager Workplace Documents Business Controls & Reporting Records Manager Commonstore Competition #1 in ICE @ 46% share (Gartner) Over 114 million seats Domino. Doc in 40 of Fortune 100 Team Workplace Leader(Gartner) IM & WC #1 in Business Instant Messaging – used by 60 out of Global Fortune 100 (Gartner) Workflow, Discovery, Extended Search, Domino. Doc IM & WC Team Workplace Learningspace Microsoft: -Exchange -Live Communication Server Documentum Open Text Microsoft Vignette Interwoven IBM Lotus and DB 2 Content Manager family of products combined are #1 in CM/DM Workplace Messaging LWM “makes sense for many companies” (Aberdeen) Sun Oracle Team Collaboration Workplace Builder Web Conferencing IBM offers better WCM, BPM, and complementary services according to Gartner, among Smart Enterprise Suite vendors. Web. Ex Microsoft -Live Meeting -Share. Point Service > 2000 engagements in 55 countries Global LMS deployments Visionary (Gartner MQ) Web. Sphere Portal listed as the "Leader" in Gartner MQ and IDC Sum. Total Intellinex (E&Y) Pathlore Saba SAP Plumtree Microsoft IBM Learning Services Learning Management Web. Sphere Portal Highlights IBM Lotus Position #1 #1 IBM Workplace combined revenue (IDC) for portal, standalone email, team collaboration, conferencing, content mgmt & other collaboration is larger than any other vendor. #1 Source: IBM Analysis based on Industry Reports/Market Research 9

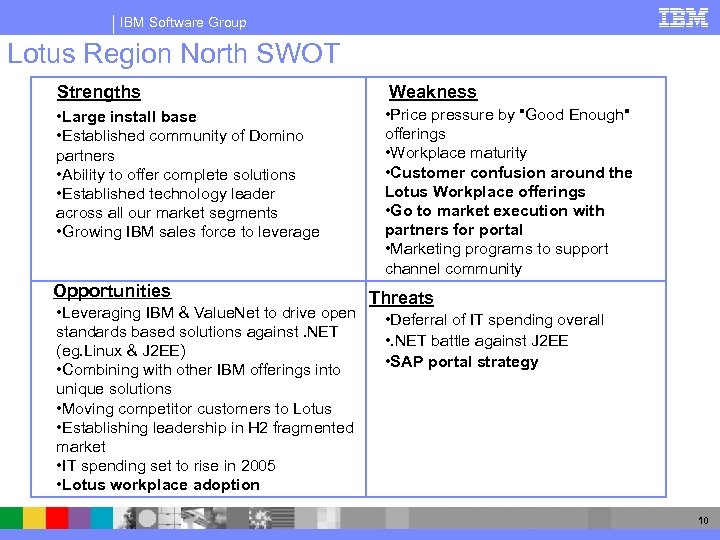

IBM Software Group Lotus Region North SWOT Strengths Weakness • Large install base • Established community of Domino partners • Ability to offer complete solutions • Established technology leader across all our market segments • Growing IBM sales force to leverage • Price pressure by "Good Enough" offerings • Workplace maturity • Customer confusion around the Lotus Workplace offerings • Go to market execution with partners for portal • Marketing programs to support channel community Opportunities • Leveraging IBM & Value. Net to drive open standards based solutions against. NET (eg. Linux & J 2 EE) • Combining with other IBM offerings into unique solutions • Moving competitor customers to Lotus • Establishing leadership in H 2 fragmented market • IT spending set to rise in 2005 • Lotus workplace adoption Threats • Deferral of IT spending overall • . NET battle against J 2 EE • SAP portal strategy 10

IBM Software Group Market Trends 11

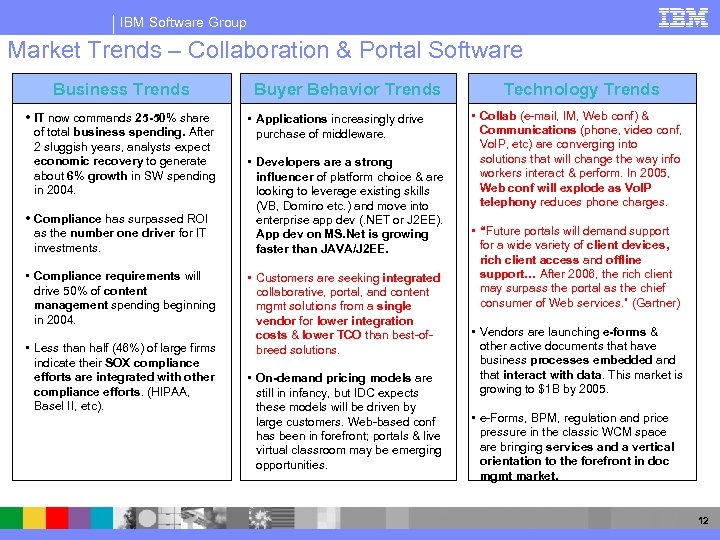

IBM Software Group Market Trends – Collaboration & Portal Software Business Trends • IT now commands 25 -50% share of total business spending. After 2 sluggish years, analysts expect economic recovery to generate about 6% growth in SW spending in 2004. • Compliance has surpassed ROI as the number one driver for IT investments. • Compliance requirements will drive 50% of content management spending beginning in 2004. • Less than half (46%) of large firms indicate their SOX compliance efforts are integrated with other compliance efforts. (HIPAA, Basel II, etc). Buyer Behavior Trends • Applications increasingly drive purchase of middleware. • Developers are a strong influencer of platform choice & are looking to leverage existing skills (VB, Domino etc. ) and move into enterprise app dev (. NET or J 2 EE). App dev on MS. Net is growing faster than JAVA/J 2 EE. • Customers are seeking integrated collaborative, portal, and content mgmt solutions from a single vendor for lower integration costs & lower TCO than best-ofbreed solutions. • On-demand pricing models are still in infancy, but IDC expects these models will be driven by large customers. Web-based conf has been in forefront; portals & live virtual classroom may be emerging opportunities. Technology Trends • Collab (e-mail, IM, Web conf) & Communications (phone, video conf, Vo. IP, etc) are converging into solutions that will change the way info workers interact & perform. In 2005, Web conf will explode as Vo. IP telephony reduces phone charges. • “Future portals will demand support for a wide variety of client devices, rich client access and offline support… After 2006, the rich client may surpass the portal as the chief consumer of Web services. ” (Gartner) • Vendors are launching e-forms & other active documents that have business processes embedded and that interact with data. This market is growing to $1 B by 2005. • e-Forms, BPM, regulation and price pressure in the classic WCM space are bringing services and a vertical orientation to the forefront in doc mgmt market. Source: Multiple analyst reports synthesized by the Lotus Market Intelligence team 12

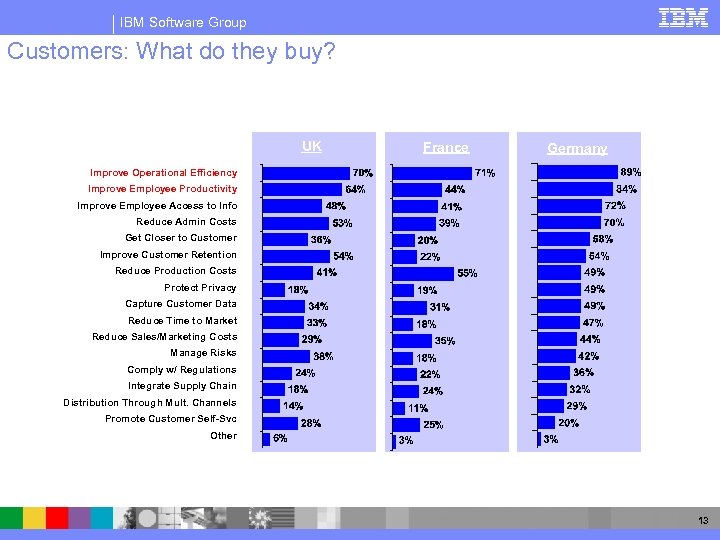

IBM Software Group Customers: What do they buy? UK France Germany Improve Operational Efficiency Improve Employee Productivity Improve Employee Access to Info Reduce Admin Costs Get Closer to Customer Improve Customer Retention Reduce Production Costs Protect Privacy Capture Customer Data Reduce Time to Market Reduce Sales/Marketing Costs Manage Risks Comply w/ Regulations Integrate Supply Chain Distribution Through Mult. Channels Promote Customer Self-Svc Other 13

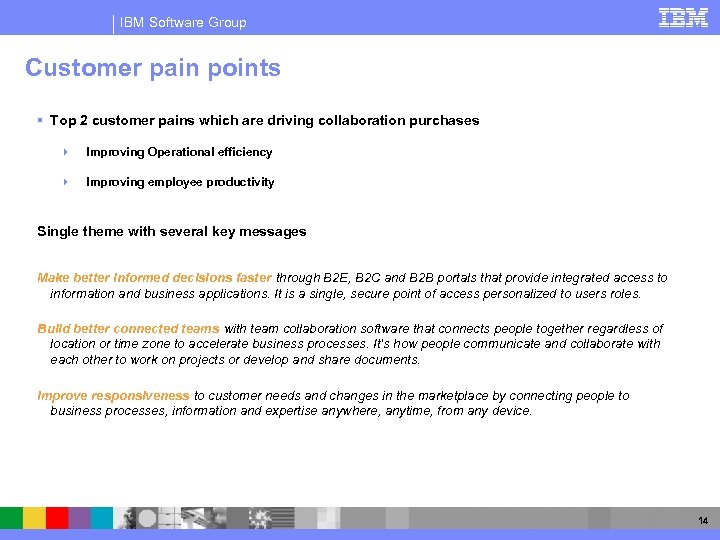

IBM Software Group Customer pain points § Top 2 customer pains which are driving collaboration purchases 4 Improving Operational efficiency 4 Improving employee productivity Single theme with several key messages Make better informed decisions faster through B 2 E, B 2 C and B 2 B portals that provide integrated access to information and business applications. It is a single, secure point of access personalized to users roles. Build better connected teams with team collaboration software that connects people together regardless of location or time zone to accelerate business processes. It’s how people communicate and collaborate with each other to work on projects or develop and share documents. Improve responsiveness to customer needs and changes in the marketplace by connecting people to business processes, information and expertise anywhere, anytime, from any device. 14

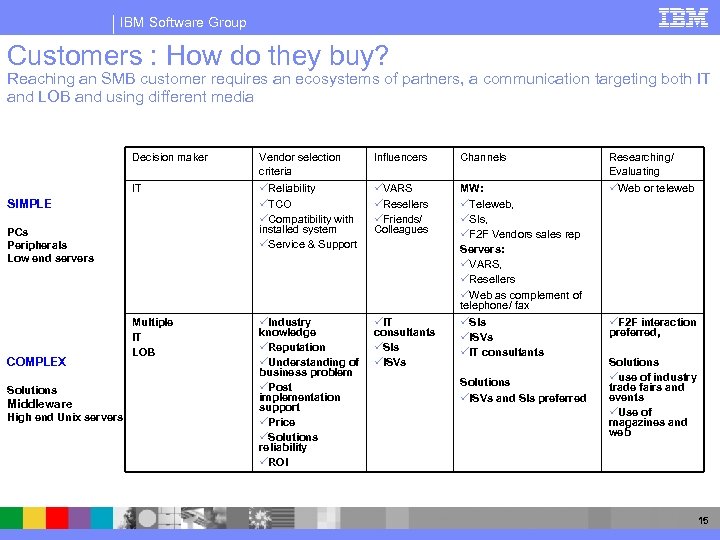

IBM Software Group Customers : How do they buy? Reaching an SMB customer requires an ecosystems of partners, a communication targeting both IT and LOB and using different media Decision maker Vendor selection criteria Influencers Channels Researching/ Evaluating IT üReliability üTCO üCompatibility with installed system üService & Support üVARS üResellers üFriends/ Colleagues MW: üTeleweb, üSIs, üF 2 F Vendors sales rep Servers: üVARS, üResellers üWeb as complement of telephone/ fax üWeb or teleweb Multiple IT LOB üIndustry knowledge üReputation üUnderstanding of business problem üPost implementation support üPrice üSolutions reliability üROI üIT consultants üSIs üISVs üIT consultants üF 2 F interaction preferred, Solutions üuse of industry trade fairs and events üUse of magazines and web SIMPLE PCs Peripherals Low end servers COMPLEX Solutions Middleware High end Unix servers Solutions üISVs and SIs preferred 15

IBM Software Group North Region Priorities 16

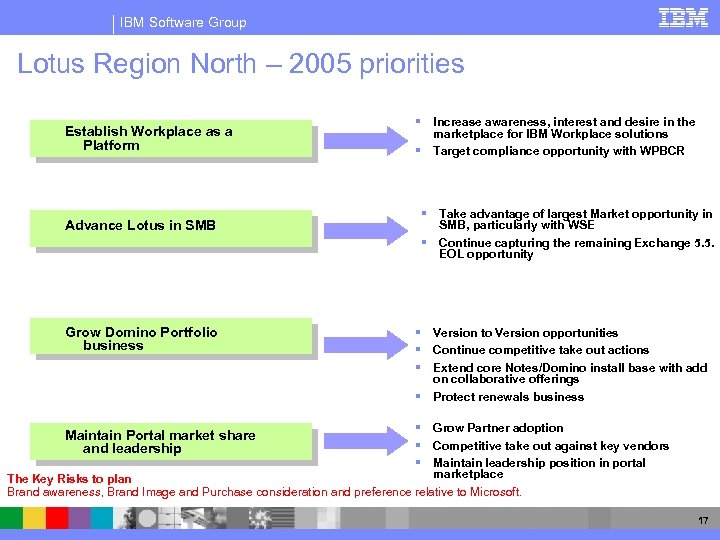

IBM Software Group Lotus Region North – 2005 priorities Establish Workplace as a Platform § Increase awareness, interest and desire in the marketplace for IBM Workplace solutions Target compliance opportunity with WPBCR § § Advance Lotus in SMB § Grow Domino Portfolio business § § Take advantage of largest Market opportunity in SMB, particularly with WSE Continue capturing the remaining Exchange 5. 5. EOL opportunity Version to Version opportunities Continue competitive take out actions Extend core Notes/Domino install base with add on collaborative offerings Protect renewals business § § § Grow Partner adoption Competitive take out against key vendors Maintain leadership position in portal marketplace The Key Risks to plan Brand awareness, Brand Image and Purchase consideration and preference relative to Microsoft. Maintain Portal market share and leadership 17

IBM Software Group Brand Plan Key product priorities § Workplace § Portal § Domino Growth opportunities/focus areas § Crush Microsoft § Workplace Services Express § SMB Key enablers of success § Awareness & Enablement ……. . so what is Marketing doing? ? Demand Gen is critical …. but so is enablement & creating awareness! 18

IBM Software Group Thank you! 19

68cf6c5d963db3edf26790e58ae0702e.ppt