b5ea19ef9d58fb720dc4c8b1290cbd9e.ppt

- Количество слайдов: 72

I want it now! Why discount rates for losses show reverse direction and reverse magnitude effects David Hardisty, Kirstin Appelt, & Elke Weber Columbia University NSF SES-0345840 & SES-0820496 NIA 5 R 01 AG 027934 -02 1

I want it now! Why discount rates for losses show reverse direction and reverse magnitude effects David Hardisty, Kirstin Appelt, & Elke Weber Columbia University NSF SES-0345840 & SES-0820496 NIA 5 R 01 AG 027934 -02 1

Co-Authors Kirstin Appelt Elke Weber 2

Co-Authors Kirstin Appelt Elke Weber 2

Why study discounting? • Insufficient savings (Thaler & Benartzi, 2004) • Unhealthy behavior (Bickel et al. , 1999) • Depletion of environmental resources (Hendrickx et al. , 2001) • All involve myopic tradeoffs between immediate and future costs and benefits • Discounting the future means we want gains now and losses later 3

Why study discounting? • Insufficient savings (Thaler & Benartzi, 2004) • Unhealthy behavior (Bickel et al. , 1999) • Depletion of environmental resources (Hendrickx et al. , 2001) • All involve myopic tradeoffs between immediate and future costs and benefits • Discounting the future means we want gains now and losses later 3

Discounting “Anomalies” • Sign effect: losses discounted less (Thaler, 1981; Hardisty & Weber, 2009) • Magnitude effect: large outcomes discounted less (Thaler, 1981) • Direction effect: more discounting when you delay than when you accelerate (Loewenstein, 1988; Weber et al. , 2007) 4

Discounting “Anomalies” • Sign effect: losses discounted less (Thaler, 1981; Hardisty & Weber, 2009) • Magnitude effect: large outcomes discounted less (Thaler, 1981) • Direction effect: more discounting when you delay than when you accelerate (Loewenstein, 1988; Weber et al. , 2007) 4

Reversals • Direction and magnitude effects are eliminated or reversed for losses (Benzion et al. , 1989; Shelley, 1993) Unfortunately, forgotten. Why? • Don’t fit standard models • No process data 5

Reversals • Direction and magnitude effects are eliminated or reversed for losses (Benzion et al. , 1989; Shelley, 1993) Unfortunately, forgotten. Why? • Don’t fit standard models • No process data 5

Reconceptualizing Impatience • Impatience is “irrational” disutility of waiting – for gaining $100: I want it now – for losing $100: I want to get it out of the way now (Loewenstein, 1987) • Impatience is relatively insensitive to outcome magnitude (Benhabib et al. , 2007) • This explains the sign effect, magnitude effect, direction effect, and their interactions 6

Reconceptualizing Impatience • Impatience is “irrational” disutility of waiting – for gaining $100: I want it now – for losing $100: I want to get it out of the way now (Loewenstein, 1987) • Impatience is relatively insensitive to outcome magnitude (Benhabib et al. , 2007) • This explains the sign effect, magnitude effect, direction effect, and their interactions 6

Implications • For gains, impatience means more discounting • For losses, impatience means less discounting 7

Implications • For gains, impatience means more discounting • For losses, impatience means less discounting 7

Explaining the Sign Effect • Get $1, 000 now or $1, 000 next year? + uncertainty (Weber & Chapman, 2005; Epper et al. , 2009) + resource slack (Zauberman & Lynch, 2005) + interest on investment (e. g. , Franklin, 1784; Samuelson, 1937) + impatience (Laibson, 1997) high discount rate • Pay $1, 000 now or $1, 000 next year? +++ other factors - impatience lower discount rate 8

Explaining the Sign Effect • Get $1, 000 now or $1, 000 next year? + uncertainty (Weber & Chapman, 2005; Epper et al. , 2009) + resource slack (Zauberman & Lynch, 2005) + interest on investment (e. g. , Franklin, 1784; Samuelson, 1937) + impatience (Laibson, 1997) high discount rate • Pay $1, 000 now or $1, 000 next year? +++ other factors - impatience lower discount rate 8

Outline • Study 1: Sign, Magnitude, and Sign X Magnitude • Study 2: Sign, Direction, and Sign X Direction • Thought listings • National samples • Between-subjects designs 9

Outline • Study 1: Sign, Magnitude, and Sign X Magnitude • Study 2: Sign, Direction, and Sign X Direction • Thought listings • National samples • Between-subjects designs 9

Study 1 Sign X Magnitude 10

Study 1 Sign X Magnitude 10

Study 1: Participants • 199 US residents, recruited and run online – 76% female – Range of ages, education, & income • $8 compensation 11

Study 1: Participants • 199 US residents, recruited and run online – 76% female – Range of ages, education, & income • $8 compensation 11

Study 1: Gain Scenario • Imagine there was a legitimate error on your back taxes in your favor, and you will immediately receive $10 [$10, 000] from the government. • However, they are also giving you the option of receiving a different amount one year from now, instead. How much would the future amount need to be for you to choose it? 12

Study 1: Gain Scenario • Imagine there was a legitimate error on your back taxes in your favor, and you will immediately receive $10 [$10, 000] from the government. • However, they are also giving you the option of receiving a different amount one year from now, instead. How much would the future amount need to be for you to choose it? 12

Study 1: Loss Scenario • Imagine there was a legitimate error on your back taxes against you, and you must pay the government $10 [$10, 000] immediately • However, they are also giving you the option of paying a different amount one year from now, instead. How much would the future amount need to be for you to choose it? 13

Study 1: Loss Scenario • Imagine there was a legitimate error on your back taxes against you, and you must pay the government $10 [$10, 000] immediately • However, they are also giving you the option of paying a different amount one year from now, instead. How much would the future amount need to be for you to choose it? 13

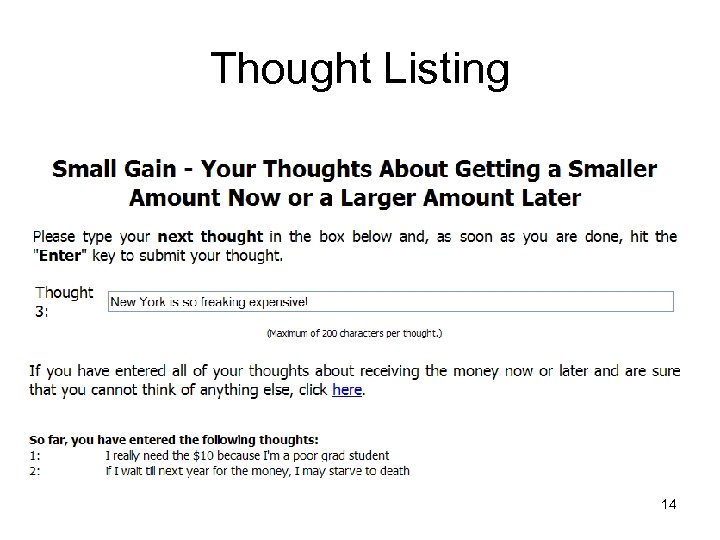

Thought Listing 14

Thought Listing 14

![Study 1: Choices [x] receive $10. 00 now [ ] receive $9. 00 one Study 1: Choices [x] receive $10. 00 now [ ] receive $9. 00 one](https://present5.com/presentation/b5ea19ef9d58fb720dc4c8b1290cbd9e/image-15.jpg) Study 1: Choices [x] receive $10. 00 now [ ] receive $9. 00 one year from now [x] receive $10. 00 now [ ] receive $10. 00 one year from now . . . [ ] receive $10. 00 now [x] receive $35. 00 one year from now 15

Study 1: Choices [x] receive $10. 00 now [ ] receive $9. 00 one year from now [x] receive $10. 00 now [ ] receive $10. 00 one year from now . . . [ ] receive $10. 00 now [x] receive $35. 00 one year from now 15

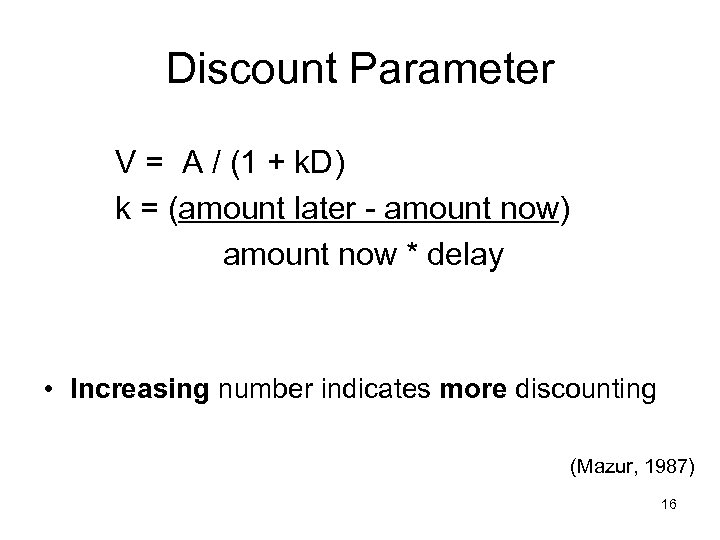

Discount Parameter V = A / (1 + k. D) k = (amount later - amount now) amount now * delay • Increasing number indicates more discounting (Mazur, 1987) 16

Discount Parameter V = A / (1 + k. D) k = (amount later - amount now) amount now * delay • Increasing number indicates more discounting (Mazur, 1987) 16

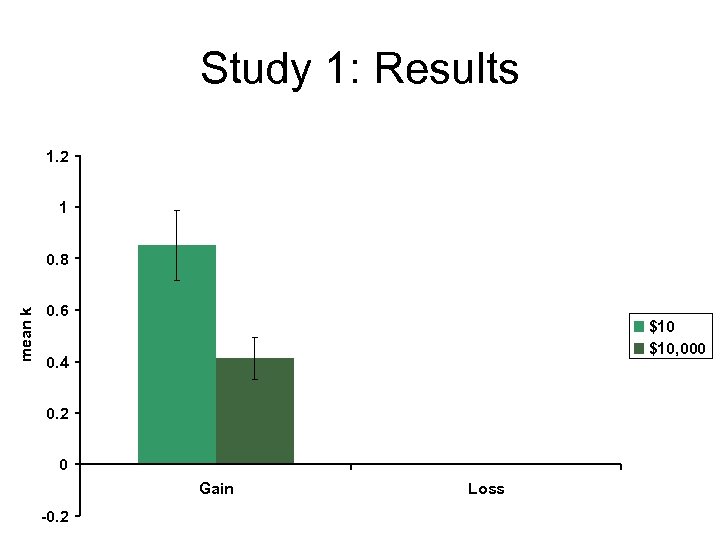

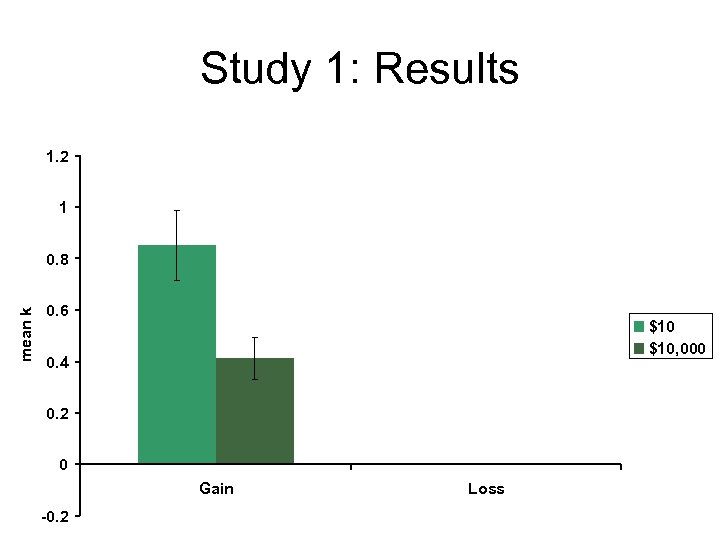

Study 1: Results 1. 2 1 mean k 0. 8 0. 6 $10, 000 0. 4 0. 2 0 Gain -0. 2 Loss

Study 1: Results 1. 2 1 mean k 0. 8 0. 6 $10, 000 0. 4 0. 2 0 Gain -0. 2 Loss

Explaining the Magnitude Effect for Gains • Impatience is insensitive to magnitude • Therefore, impatience has relatively less influence on large magnitude outcomes • Lower discount rates for larger magnitudes 18

Explaining the Magnitude Effect for Gains • Impatience is insensitive to magnitude • Therefore, impatience has relatively less influence on large magnitude outcomes • Lower discount rates for larger magnitudes 18

Study 1: Results 1. 2 1 mean k 0. 8 0. 6 $10, 000 0. 4 0. 2 0 Gain -0. 2 Loss

Study 1: Results 1. 2 1 mean k 0. 8 0. 6 $10, 000 0. 4 0. 2 0 Gain -0. 2 Loss

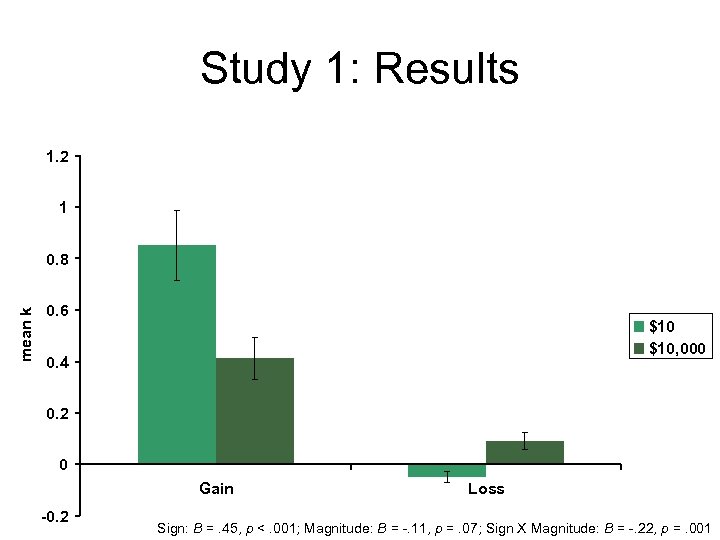

Study 1: Results 1. 2 1 mean k 0. 8 0. 6 $10, 000 0. 4 0. 2 0 Gain -0. 2 Loss Sign: B =. 45, p <. 001; Magnitude: B = -. 11, p =. 07; Sign X Magnitude: B = -. 22, p =. 001

Study 1: Results 1. 2 1 mean k 0. 8 0. 6 $10, 000 0. 4 0. 2 0 Gain -0. 2 Loss Sign: B =. 45, p <. 001; Magnitude: B = -. 11, p =. 07; Sign X Magnitude: B = -. 22, p =. 001

Explaining the Magnitude Effect for Losses • Impatience (to get it out of the way) is insensitive to magnitude • Therefore, impatience has relatively less influence on large magnitude outcomes • Higher discount rates for larger magnitudes 21

Explaining the Magnitude Effect for Losses • Impatience (to get it out of the way) is insensitive to magnitude • Therefore, impatience has relatively less influence on large magnitude outcomes • Higher discount rates for larger magnitudes 21

Thought Coding Six categories: • Future uncertainty • Expecting the money will be more useful now than in the future • Earning interest on investments • Other: what you ought to do (for example, “I should wait”) • Other: what you want (for example, “I want it now to get it over with”) • None of the above 22

Thought Coding Six categories: • Future uncertainty • Expecting the money will be more useful now than in the future • Earning interest on investments • Other: what you ought to do (for example, “I should wait”) • Other: what you want (for example, “I want it now to get it over with”) • None of the above 22

Thought Coding Six categories: • Future uncertainty • Expecting the money will be more useful now than in the future • Earning interest on investments • Other: what you ought to do (for example, “I should wait”) • Other: what you want (for example, “I want it now to get it over with”) • None of the above 23

Thought Coding Six categories: • Future uncertainty • Expecting the money will be more useful now than in the future • Earning interest on investments • Other: what you ought to do (for example, “I should wait”) • Other: what you want (for example, “I want it now to get it over with”) • None of the above 23

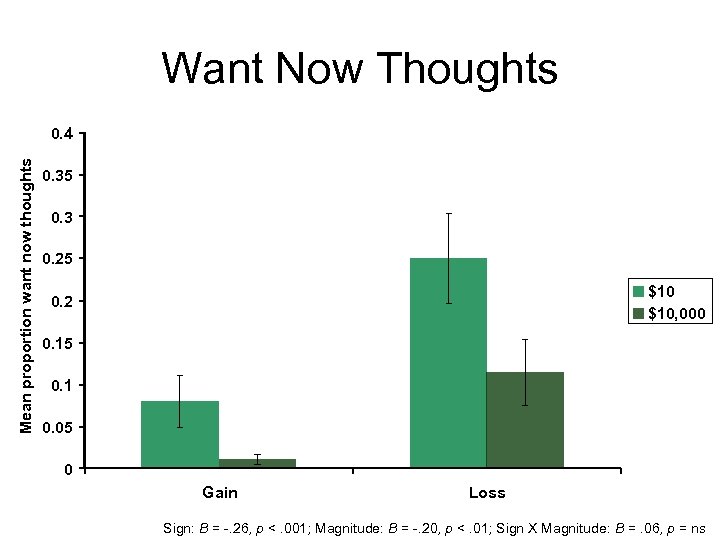

Want Now Thoughts Mean proportion want now thoughts 0. 4 0. 35 0. 3 0. 25 $10, 000 0. 2 0. 15 0. 1 0. 05 0 Gain Loss Sign: B = -. 26, p <. 001; Magnitude: B = -. 20, p <. 01; Sign X Magnitude: B =. 06, p = ns

Want Now Thoughts Mean proportion want now thoughts 0. 4 0. 35 0. 3 0. 25 $10, 000 0. 2 0. 15 0. 1 0. 05 0 Gain Loss Sign: B = -. 26, p <. 001; Magnitude: B = -. 20, p <. 01; Sign X Magnitude: B =. 06, p = ns

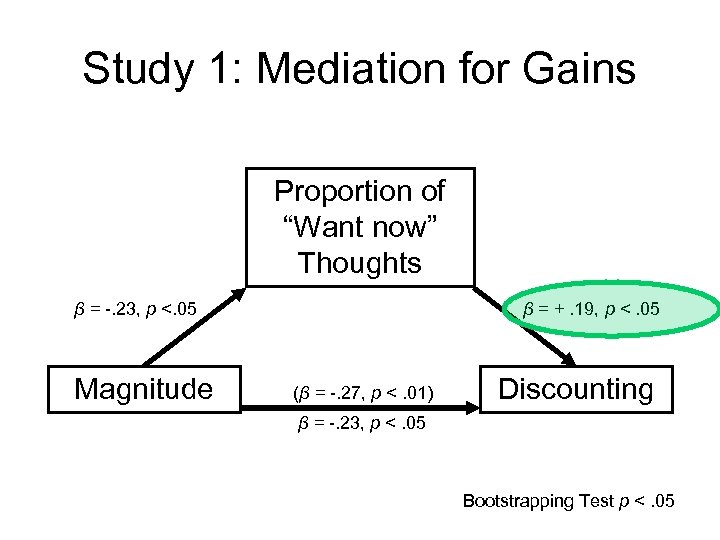

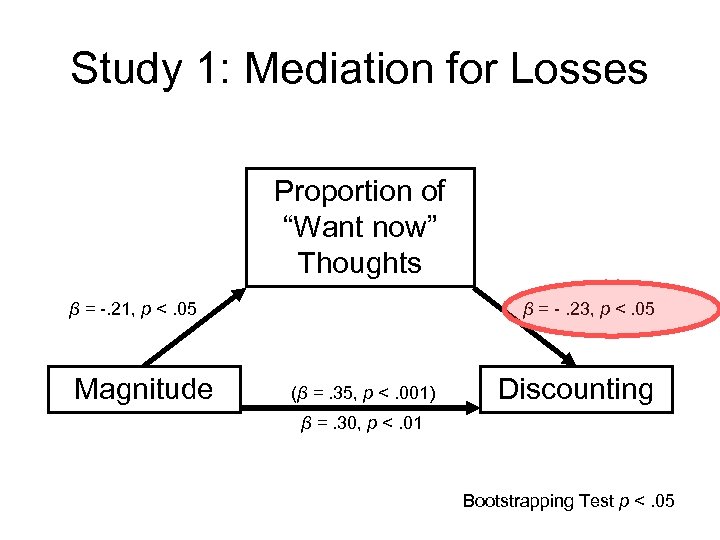

Process Summary • Gains: greater magnitude less impatience less discounting • Losses: greater magnitude less impatience more discounting 25

Process Summary • Gains: greater magnitude less impatience less discounting • Losses: greater magnitude less impatience more discounting 25

Study 1: Mediation for Gains Proportion of “Want now” Thoughts β = -. 23, p <. 05 Magnitude β = +. 19, p <. 05 (β = -. 27, p <. 01) Discounting β = -. 23, p <. 05 Bootstrapping Test p <. 05

Study 1: Mediation for Gains Proportion of “Want now” Thoughts β = -. 23, p <. 05 Magnitude β = +. 19, p <. 05 (β = -. 27, p <. 01) Discounting β = -. 23, p <. 05 Bootstrapping Test p <. 05

Study 1: Mediation for Losses Proportion of “Want now” Thoughts β = -. 21, p <. 05 Magnitude β = -. 23, p <. 05 (β =. 35, p <. 001) Discounting β =. 30, p <. 01 Bootstrapping Test p <. 05

Study 1: Mediation for Losses Proportion of “Want now” Thoughts β = -. 21, p <. 05 Magnitude β = -. 23, p <. 05 (β =. 35, p <. 001) Discounting β =. 30, p <. 01 Bootstrapping Test p <. 05

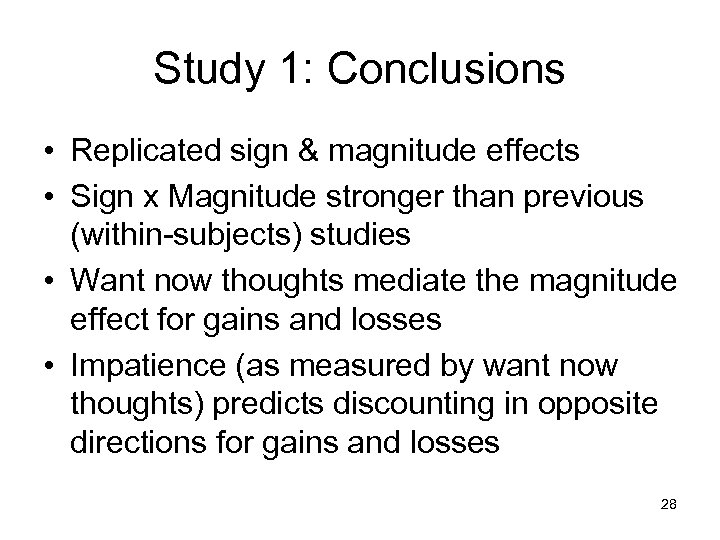

Study 1: Conclusions • Replicated sign & magnitude effects • Sign x Magnitude stronger than previous (within-subjects) studies • Want now thoughts mediate the magnitude effect for gains and losses • Impatience (as measured by want now thoughts) predicts discounting in opposite directions for gains and losses 28

Study 1: Conclusions • Replicated sign & magnitude effects • Sign x Magnitude stronger than previous (within-subjects) studies • Want now thoughts mediate the magnitude effect for gains and losses • Impatience (as measured by want now thoughts) predicts discounting in opposite directions for gains and losses 28

Study 2 Sign x Direction

Study 2 Sign x Direction

Direction Effect • Delay: default is today, with option to receive larger amount later • Accelerate: default is later, with option to receive smaller amount sooner • Greater discounting for delay than accelerate (Loewenstein, 1988) 30

Direction Effect • Delay: default is today, with option to receive larger amount later • Accelerate: default is later, with option to receive smaller amount sooner • Greater discounting for delay than accelerate (Loewenstein, 1988) 30

Explaining the Direction Effect • Creates a default for now or for later • People are initially biased in favor of the default option (Query Theory, Weber et al. , 2007) • Subsequent thoughts are influenced by this bias • Default predicts the order and balance of thoughts, which predict choices (Query Theory, Weber et al. , 2007) 31

Explaining the Direction Effect • Creates a default for now or for later • People are initially biased in favor of the default option (Query Theory, Weber et al. , 2007) • Subsequent thoughts are influenced by this bias • Default predicts the order and balance of thoughts, which predict choices (Query Theory, Weber et al. , 2007) 31

Explaining the Direction Effect • Creates a default for now or for later • People are initially biased in favor of the default option (Query Theory, Weber et al. , 2007) • Subsequent thoughts are influenced by this bias • Default predicts the order and balance of thoughts, which predict choices (Query Theory, Weber et al. , 2007) 32

Explaining the Direction Effect • Creates a default for now or for later • People are initially biased in favor of the default option (Query Theory, Weber et al. , 2007) • Subsequent thoughts are influenced by this bias • Default predicts the order and balance of thoughts, which predict choices (Query Theory, Weber et al. , 2007) 32

Explaining the Direction Effect • Creates a default for now or for later • People are initially biased in favor of the default option (Query Theory, Weber et al. , 2007) • Subsequent thoughts are influenced by this bias • Default predicts the order and balance of thoughts, which predict choices (Query Theory, Weber et al. , 2007) 33

Explaining the Direction Effect • Creates a default for now or for later • People are initially biased in favor of the default option (Query Theory, Weber et al. , 2007) • Subsequent thoughts are influenced by this bias • Default predicts the order and balance of thoughts, which predict choices (Query Theory, Weber et al. , 2007) 33

Reminder • For gains, impatience means greater discounting • For losses, impatience means lower discounting 34

Reminder • For gains, impatience means greater discounting • For losses, impatience means lower discounting 34

Study 2: Participants • 607 US residents – 75% women – Range of ages, education, & income • Same method as Study 1 35

Study 2: Participants • 607 US residents – 75% women – Range of ages, education, & income • Same method as Study 1 35

Study 2: Gain Scenarios • delay Imagine you have been selected to receive a $50 prize today. However, you also have the option of receiving a larger amount 3 months from now. • accelerate Imagine you have been selected to receive a $75 prize 3 months from today. However, you also have the option of receiving a smaller amount today. 36

Study 2: Gain Scenarios • delay Imagine you have been selected to receive a $50 prize today. However, you also have the option of receiving a larger amount 3 months from now. • accelerate Imagine you have been selected to receive a $75 prize 3 months from today. However, you also have the option of receiving a smaller amount today. 36

Study 2: Gain Scenarios • delay Imagine you have been selected to receive a $50 prize today. However, you also have the option of receiving a larger amount 3 months from now. • accelerate Imagine you have been selected to receive a $75 prize 3 months from today. However, you also have the option of receiving a smaller amount today. 37

Study 2: Gain Scenarios • delay Imagine you have been selected to receive a $50 prize today. However, you also have the option of receiving a larger amount 3 months from now. • accelerate Imagine you have been selected to receive a $75 prize 3 months from today. However, you also have the option of receiving a smaller amount today. 37

Study 2: Loss Scenarios • delay Imagine that you have been ticketed for a parking violation, and are required to pay $50 today. However, you also have the option of paying a larger amount 3 months from now. • accelerate Imagine that you have been ticketed for a parking violation, and are required to pay $75 3 months from today. However, you also have the option of paying a smaller amount today. 38

Study 2: Loss Scenarios • delay Imagine that you have been ticketed for a parking violation, and are required to pay $50 today. However, you also have the option of paying a larger amount 3 months from now. • accelerate Imagine that you have been ticketed for a parking violation, and are required to pay $75 3 months from today. However, you also have the option of paying a smaller amount today. 38

Study 2: Loss Scenarios • delay Imagine that you have been ticketed for a parking violation, and are required to pay $50 today. However, you also have the option of paying a larger amount 3 months from now. • accelerate Imagine that you have been ticketed for a parking violation, and are required to pay $75 3 months from today. However, you also have the option of paying a smaller amount today. 39

Study 2: Loss Scenarios • delay Imagine that you have been ticketed for a parking violation, and are required to pay $50 today. However, you also have the option of paying a larger amount 3 months from now. • accelerate Imagine that you have been ticketed for a parking violation, and are required to pay $75 3 months from today. However, you also have the option of paying a smaller amount today. 39

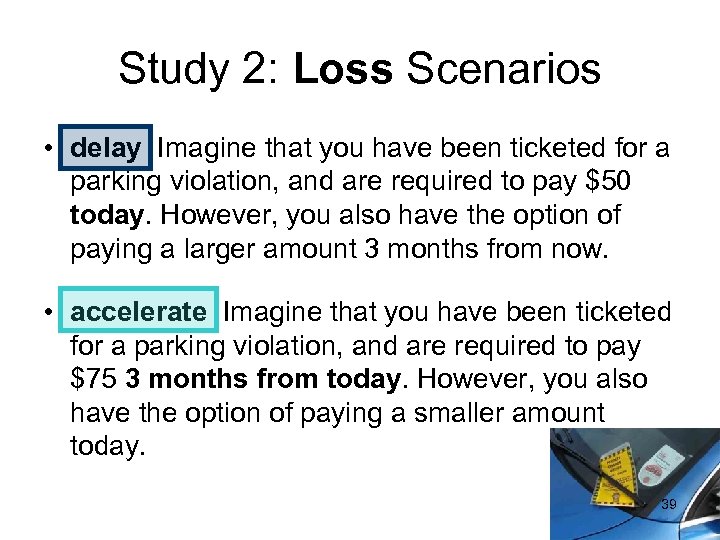

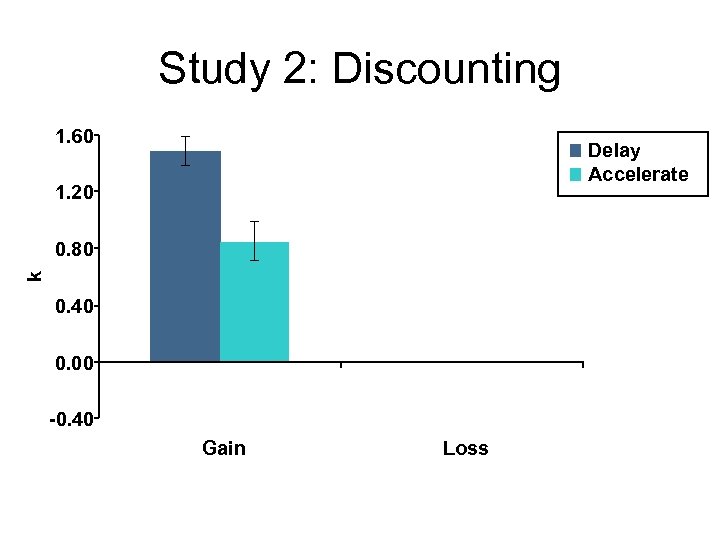

Study 2: Discounting 1. 60 Delay Accelerate 1. 20 k 0. 80 0. 40 0. 00 -0. 40 Gain Loss

Study 2: Discounting 1. 60 Delay Accelerate 1. 20 k 0. 80 0. 40 0. 00 -0. 40 Gain Loss

Study 2: Discounting 1. 60 Delay Accelerate 1. 20 k 0. 80 0. 40 0. 00 -0. 40 Gain Loss Sign: B =. 34, p <. 001 Direction: B =. 07, p =. 07 Sign X Direction: B = -. 32, p <. 001

Study 2: Discounting 1. 60 Delay Accelerate 1. 20 k 0. 80 0. 40 0. 00 -0. 40 Gain Loss Sign: B =. 34, p <. 001 Direction: B =. 07, p =. 07 Sign X Direction: B = -. 32, p <. 001

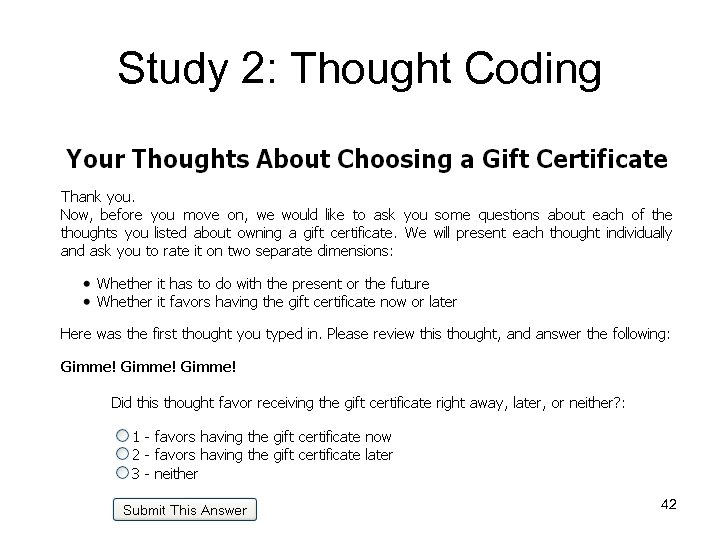

Study 2: Thought Coding 42

Study 2: Thought Coding 42

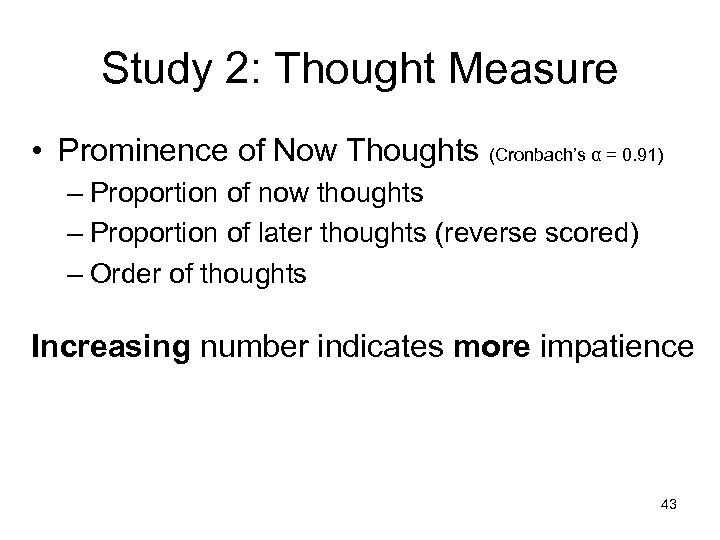

Study 2: Thought Measure • Prominence of Now Thoughts (Cronbach’s α = 0. 91) – Proportion of now thoughts – Proportion of later thoughts (reverse scored) – Order of thoughts Increasing number indicates more impatience 43

Study 2: Thought Measure • Prominence of Now Thoughts (Cronbach’s α = 0. 91) – Proportion of now thoughts – Proportion of later thoughts (reverse scored) – Order of thoughts Increasing number indicates more impatience 43

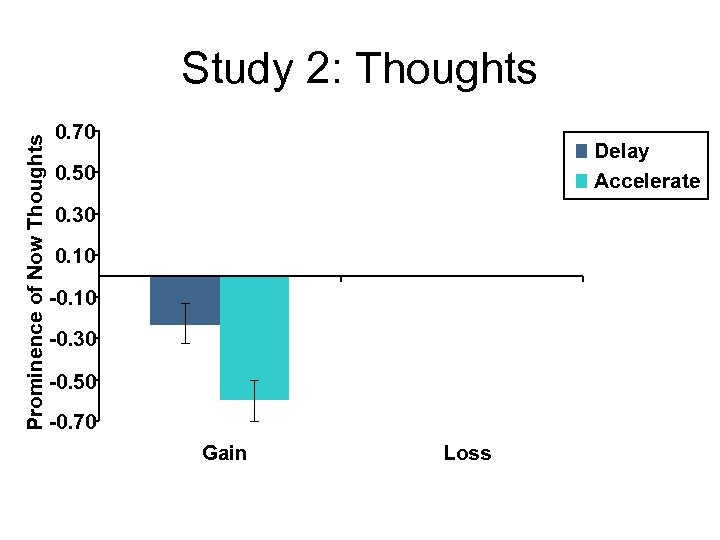

Prominence of Now Thoughts Study 2: Thoughts 0. 70 Delay Accelerate 0. 50 0. 30 0. 10 -0. 30 -0. 50 -0. 70 Gain Loss

Prominence of Now Thoughts Study 2: Thoughts 0. 70 Delay Accelerate 0. 50 0. 30 0. 10 -0. 30 -0. 50 -0. 70 Gain Loss

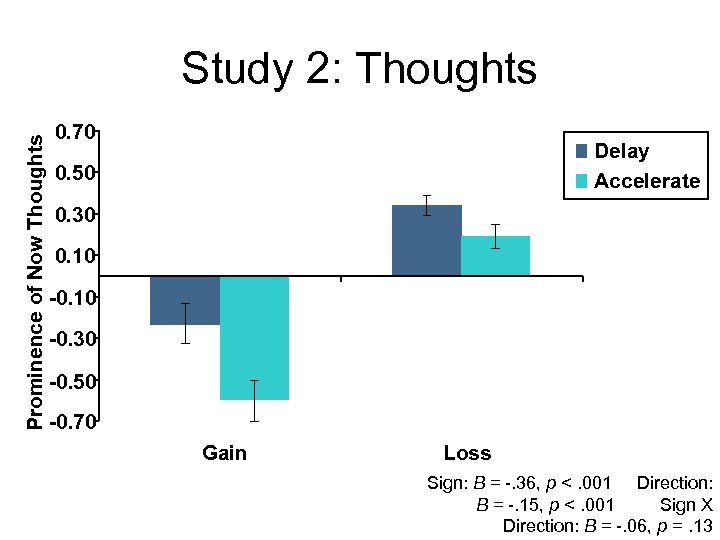

Prominence of Now Thoughts Study 2: Thoughts 0. 70 Delay Accelerate 0. 50 0. 30 0. 10 -0. 30 -0. 50 -0. 70 Gain Loss Sign: B = -. 36, p <. 001 Direction: B = -. 15, p <. 001 Sign X Direction: B = -. 06, p =. 13

Prominence of Now Thoughts Study 2: Thoughts 0. 70 Delay Accelerate 0. 50 0. 30 0. 10 -0. 30 -0. 50 -0. 70 Gain Loss Sign: B = -. 36, p <. 001 Direction: B = -. 15, p <. 001 Sign X Direction: B = -. 06, p =. 13

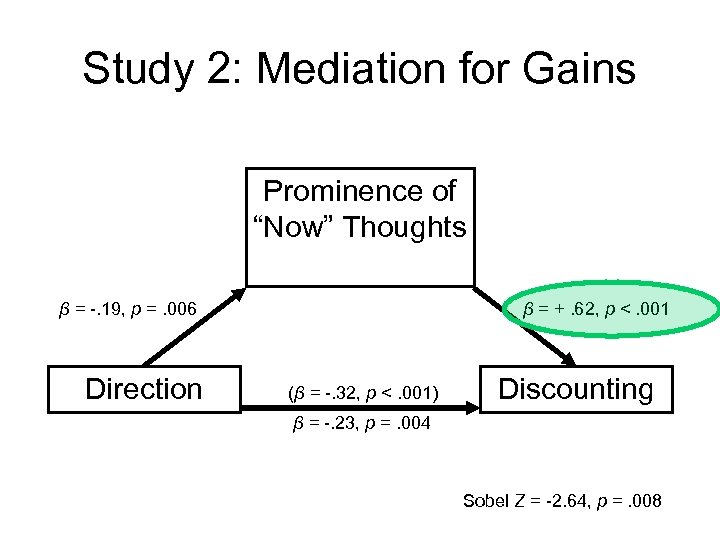

Study 2: Mediation for Gains Prominence of “Now” Thoughts β = -. 19, p =. 006 Direction β = +. 62, p <. 001 (β = -. 32, p <. 001) Discounting β = -. 23, p =. 004 Sobel Z = -2. 64, p =. 008

Study 2: Mediation for Gains Prominence of “Now” Thoughts β = -. 19, p =. 006 Direction β = +. 62, p <. 001 (β = -. 32, p <. 001) Discounting β = -. 23, p =. 004 Sobel Z = -2. 64, p =. 008

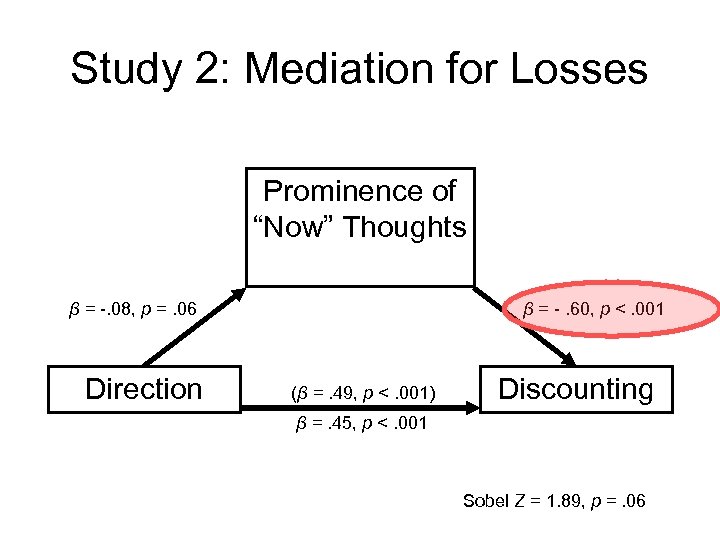

Study 2: Mediation for Losses Prominence of “Now” Thoughts β = -. 08, p =. 06 Direction β = -. 60, p <. 001 (β =. 49, p <. 001) Discounting β =. 45, p <. 001 Sobel Z = 1. 89, p =. 06

Study 2: Mediation for Losses Prominence of “Now” Thoughts β = -. 08, p =. 06 Direction β = -. 60, p <. 001 (β =. 49, p <. 001) Discounting β =. 45, p <. 001 Sobel Z = 1. 89, p =. 06

Study 2: Conclusions • Replicate sign, direction, Sign x Direction • Now thoughts mediate direction effect for gains and losses • Impatience (as measured by now thoughts) predicts discounting in opposite directions for gains and losses 48

Study 2: Conclusions • Replicate sign, direction, Sign x Direction • Now thoughts mediate direction effect for gains and losses • Impatience (as measured by now thoughts) predicts discounting in opposite directions for gains and losses 48

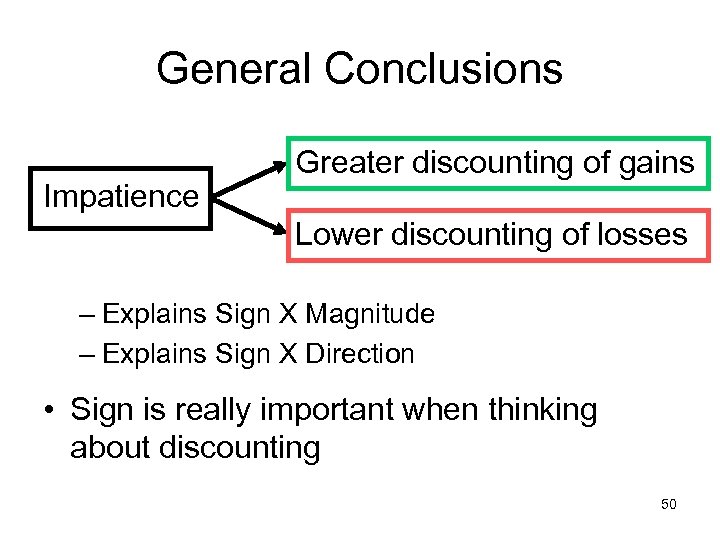

General Conclusions • Impatience is “irrational” disutility of waiting – I want gains now – I want to get losses out of the way now 49

General Conclusions • Impatience is “irrational” disutility of waiting – I want gains now – I want to get losses out of the way now 49

General Conclusions Impatience Greater discounting of gains Lower discounting of losses – Explains Sign X Magnitude – Explains Sign X Direction • Sign is really important when thinking about discounting 50

General Conclusions Impatience Greater discounting of gains Lower discounting of losses – Explains Sign X Magnitude – Explains Sign X Direction • Sign is really important when thinking about discounting 50

Thanks to. . . • The National Science Foundation: -03455840 & SES-0352062 SES • The National Institute on Aging: 5 R 01 AG 027934 -02 • The CRED and PAM labs 51

Thanks to. . . • The National Science Foundation: -03455840 & SES-0352062 SES • The National Institute on Aging: 5 R 01 AG 027934 -02 • The CRED and PAM labs 51

Thank You! www. davidhardisty. info www. kirstinappelt. com 52

Thank You! www. davidhardisty. info www. kirstinappelt. com 52

References (1) Benhabib, J. , Bisin, A. , & Schotter, A. (2007). Present-bias, quasi-hyperbolic discounting, and fixed costs. Working paper. New York University. Benzion, U. , Rapoport, A. , & Yagil, J. (1989). Discount rates inferred from decisions: An experimental study. Management Science, 35(3), 270 -284. Bickel, W. K. , Odum, A. L. , & Madden, G. J. (1999). Impulsivity and cigarette smoking: Delay discounting in current, never-, and ex-smokers. Psychopharmacology (Berlin), 146, 447 -454 Franklin, B. (1748). Advice to a young tradesman. Hardisty, D. J. , & Weber, E. U. (2009). Discounting future green: Money vs the environment. Journal of Experimental Psychology: General, 138(3), 329 -340. Hendrickx, L. , Poortinga, W. , van der Kooij, R. (2001). Temporal factors in resource dilemmas. Acta Psychologica, 108, 137 -154 Johnson, E. J. , Häubl, G. , & Keinan, A. (2007). Aspects of endowment: A query theory of value construction. Journal of Experimental Social Psychology: Learning, Memory and Cognition, 33(3), 461 -474. Laibson, D. (1997). Golden eggs and hyperbolic discounting. The Quarterly Journal of Economics, 112(2), 443 -477. Loewenstein, G. (1987). Anticipation and the valuation of delayed consumption. The Economic Journal, 97, 666 -684. Loewenstein, G. F. (1988). Frames of mind in intertemporal choice. Management 53 Science, 34(2), 200 -214.

References (1) Benhabib, J. , Bisin, A. , & Schotter, A. (2007). Present-bias, quasi-hyperbolic discounting, and fixed costs. Working paper. New York University. Benzion, U. , Rapoport, A. , & Yagil, J. (1989). Discount rates inferred from decisions: An experimental study. Management Science, 35(3), 270 -284. Bickel, W. K. , Odum, A. L. , & Madden, G. J. (1999). Impulsivity and cigarette smoking: Delay discounting in current, never-, and ex-smokers. Psychopharmacology (Berlin), 146, 447 -454 Franklin, B. (1748). Advice to a young tradesman. Hardisty, D. J. , & Weber, E. U. (2009). Discounting future green: Money vs the environment. Journal of Experimental Psychology: General, 138(3), 329 -340. Hendrickx, L. , Poortinga, W. , van der Kooij, R. (2001). Temporal factors in resource dilemmas. Acta Psychologica, 108, 137 -154 Johnson, E. J. , Häubl, G. , & Keinan, A. (2007). Aspects of endowment: A query theory of value construction. Journal of Experimental Social Psychology: Learning, Memory and Cognition, 33(3), 461 -474. Laibson, D. (1997). Golden eggs and hyperbolic discounting. The Quarterly Journal of Economics, 112(2), 443 -477. Loewenstein, G. (1987). Anticipation and the valuation of delayed consumption. The Economic Journal, 97, 666 -684. Loewenstein, G. F. (1988). Frames of mind in intertemporal choice. Management 53 Science, 34(2), 200 -214.

References (2) Samuelson, P. A. (1937). A note on the measurement of utility. A note on measurement of utility. The Review of Economic Studies, 4, 155 -161. Shelley, M. K. (1993). Outcome signs, questions frames and discount rates. Management Science, 39(7), 806 -815. Thaler, R. H. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8, 201 -207. Thaler, R. H. , & Benartzi, S. (2004). Save More Tomorrow™: Using behavioral economics to increase employee saving. Journal of Political Economy, 112, S 164 S 187. Weber, B. J. , & Chapman, G. B. (2005). The combined effects of risk and time on choice: Does uncertainty eliminate the immediacy effect? Does delay eliminate the certainty effect? Organizational Behavior and Human Decision Processes, 96, 104118. Weber, E. U. , Johnson, E. J. , Milch, K. F. , Chang, H. , Brodscholl, J. C. , & Goldstein, D. G. (2007). Asymmetric discounting in intertemporal choice: A Query Theory account. Psychological Science, 18(6), 516 -523. Zauberman, G. , & Lynch, J. J. G. (2005). Resource slack and propensity to discount delayed investments of time versus money. Journal of Experimental Psychology: General, 134(1), 23 -37. 54

References (2) Samuelson, P. A. (1937). A note on the measurement of utility. A note on measurement of utility. The Review of Economic Studies, 4, 155 -161. Shelley, M. K. (1993). Outcome signs, questions frames and discount rates. Management Science, 39(7), 806 -815. Thaler, R. H. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8, 201 -207. Thaler, R. H. , & Benartzi, S. (2004). Save More Tomorrow™: Using behavioral economics to increase employee saving. Journal of Political Economy, 112, S 164 S 187. Weber, B. J. , & Chapman, G. B. (2005). The combined effects of risk and time on choice: Does uncertainty eliminate the immediacy effect? Does delay eliminate the certainty effect? Organizational Behavior and Human Decision Processes, 96, 104118. Weber, E. U. , Johnson, E. J. , Milch, K. F. , Chang, H. , Brodscholl, J. C. , & Goldstein, D. G. (2007). Asymmetric discounting in intertemporal choice: A Query Theory account. Psychological Science, 18(6), 516 -523. Zauberman, G. , & Lynch, J. J. G. (2005). Resource slack and propensity to discount delayed investments of time versus money. Journal of Experimental Psychology: General, 134(1), 23 -37. 54

Bonus Slides! 55

Bonus Slides! 55

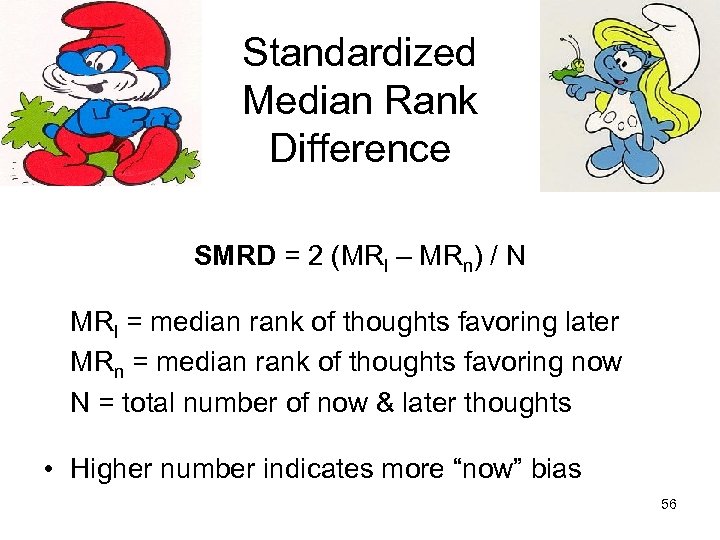

Standardized Median Rank Difference SMRD = 2 (MRl – MRn) / N MRl = median rank of thoughts favoring later MRn = median rank of thoughts favoring now N = total number of now & later thoughts • Higher number indicates more “now” bias 56

Standardized Median Rank Difference SMRD = 2 (MRl – MRn) / N MRl = median rank of thoughts favoring later MRn = median rank of thoughts favoring now N = total number of now & later thoughts • Higher number indicates more “now” bias 56

![Study 2: Delay Titration [ ] $50 gift certificate today [ ] $45 gift Study 2: Delay Titration [ ] $50 gift certificate today [ ] $45 gift](https://present5.com/presentation/b5ea19ef9d58fb720dc4c8b1290cbd9e/image-57.jpg) Study 2: Delay Titration [ ] $50 gift certificate today [ ] $45 gift certificate 3 months from today [ ] $50 gift certificate today [ ] $55 gift certificate 3 months from today [ ] $50 gift certificate today [ ] $60 gift certificate 3 months from today . . . [ ] $50 gift certificate today [ ] $90 gift certificate 3 months from today 57

Study 2: Delay Titration [ ] $50 gift certificate today [ ] $45 gift certificate 3 months from today [ ] $50 gift certificate today [ ] $55 gift certificate 3 months from today [ ] $50 gift certificate today [ ] $60 gift certificate 3 months from today . . . [ ] $50 gift certificate today [ ] $90 gift certificate 3 months from today 57

![Study 2: Accelerate Titration [ ] $75 gift certificate 3 months from today [ Study 2: Accelerate Titration [ ] $75 gift certificate 3 months from today [](https://present5.com/presentation/b5ea19ef9d58fb720dc4c8b1290cbd9e/image-58.jpg) Study 2: Accelerate Titration [ ] $75 gift certificate 3 months from today [ ] $85 gift certificate today [ ] $75 gift certificate 3 months from today [ ] $80 gift certificate today [ ] $75 gift certificate 3 months from today [ ] $70 gift certificate today … … [ ] $75 gift certificate 3 months from today [ ] $35 gift certificate today 58

Study 2: Accelerate Titration [ ] $75 gift certificate 3 months from today [ ] $85 gift certificate today [ ] $75 gift certificate 3 months from today [ ] $80 gift certificate today [ ] $75 gift certificate 3 months from today [ ] $70 gift certificate today … … [ ] $75 gift certificate 3 months from today [ ] $35 gift certificate today 58

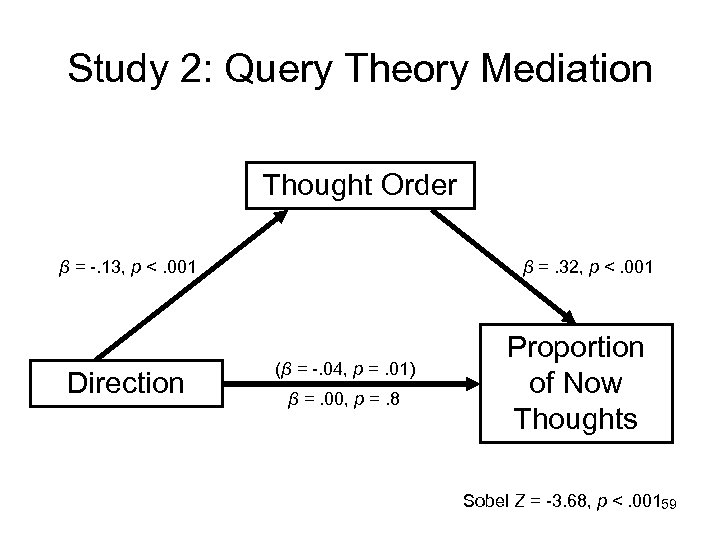

Study 2: Query Theory Mediation Thought Order β = -. 13, p <. 001 Direction β =. 32, p <. 001 (β = -. 04, p =. 01) β =. 00, p =. 8 Proportion of Now Thoughts Sobel Z = -3. 68, p <. 00159

Study 2: Query Theory Mediation Thought Order β = -. 13, p <. 001 Direction β =. 32, p <. 001 (β = -. 04, p =. 01) β =. 00, p =. 8 Proportion of Now Thoughts Sobel Z = -3. 68, p <. 00159

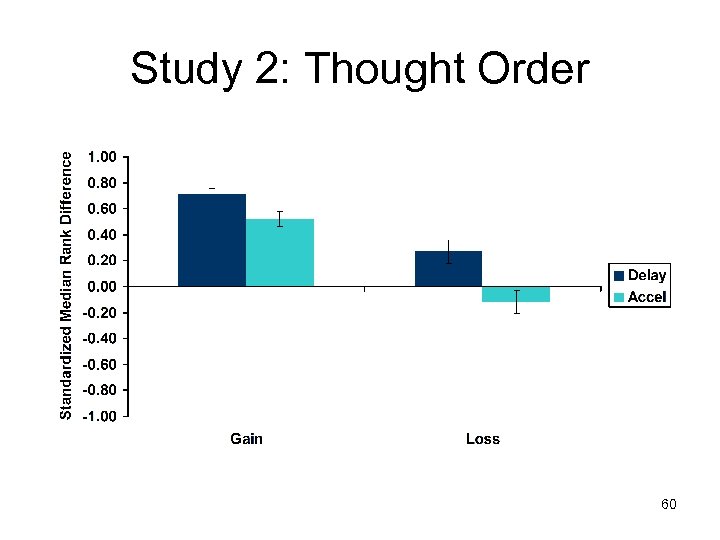

Study 2: Thought Order 60

Study 2: Thought Order 60

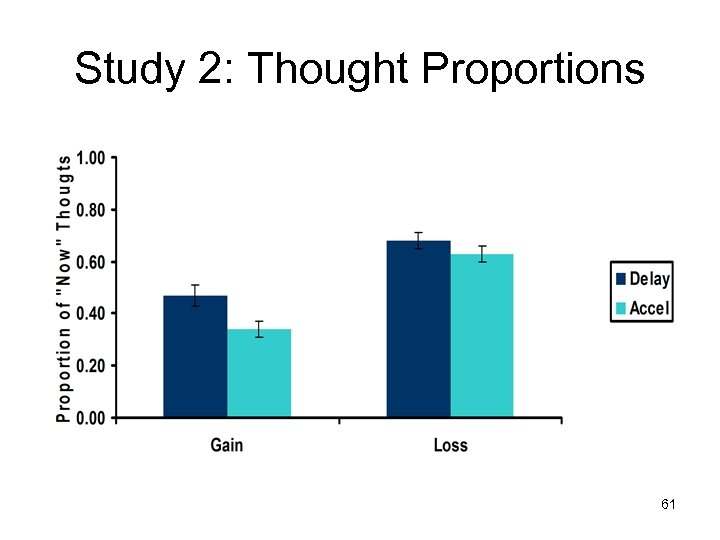

Study 2: Thought Proportions 61

Study 2: Thought Proportions 61

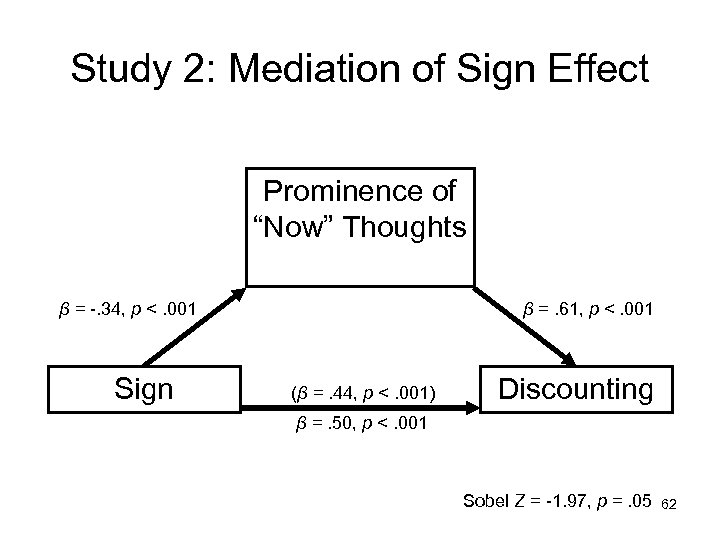

Study 2: Mediation of Sign Effect Prominence of “Now” Thoughts β = -. 34, p <. 001 Sign β =. 61, p <. 001 (β =. 44, p <. 001) Discounting β =. 50, p <. 001 Sobel Z = -1. 97, p =. 05 62

Study 2: Mediation of Sign Effect Prominence of “Now” Thoughts β = -. 34, p <. 001 Sign β =. 61, p <. 001 (β =. 44, p <. 001) Discounting β =. 50, p <. 001 Sobel Z = -1. 97, p =. 05 62

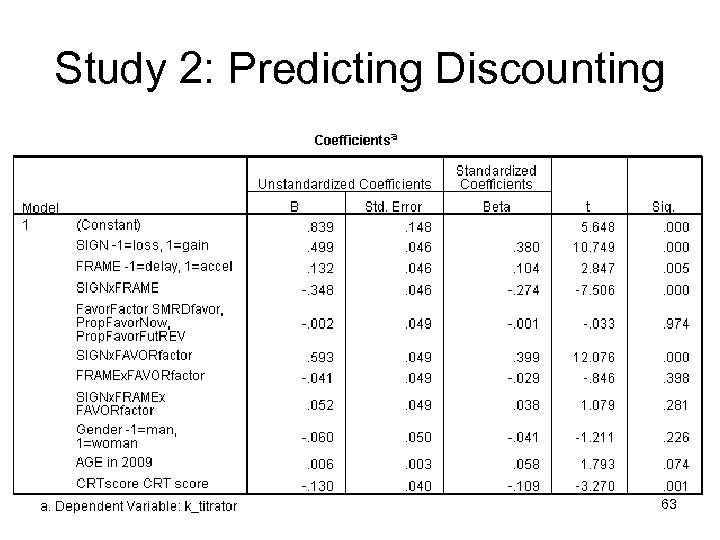

Study 2: Predicting Discounting 63

Study 2: Predicting Discounting 63

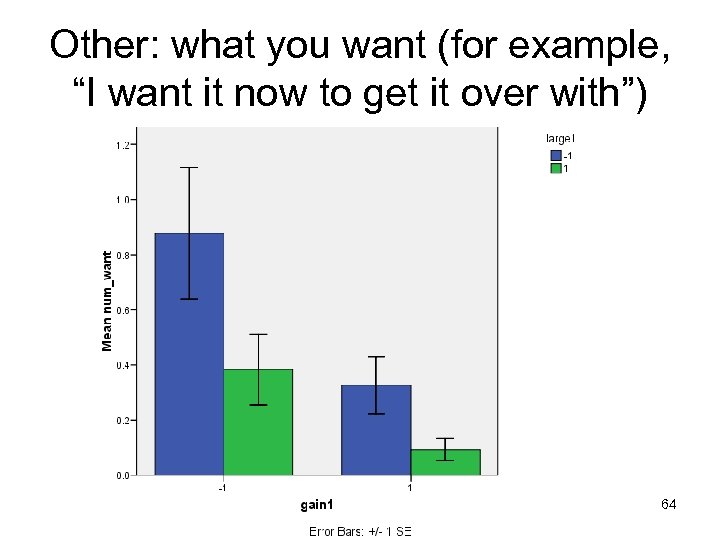

Other: what you want (for example, “I want it now to get it over with”) 64

Other: what you want (for example, “I want it now to get it over with”) 64

![Study 1: Small Gain Titration [ ] receive $10. 00 now [ ] receive Study 1: Small Gain Titration [ ] receive $10. 00 now [ ] receive](https://present5.com/presentation/b5ea19ef9d58fb720dc4c8b1290cbd9e/image-65.jpg) Study 1: Small Gain Titration [ ] receive $10. 00 now [ ] receive $9. 00 one year from now [ ] receive $10. 00 now [ ] receive $10. 50 one year from now [ ] receive $10. 00 now [ ] receive $11. 00 one year from now . . . [ ] receive $10. 00 now [ ] receive $35. 00 one year from now 65

Study 1: Small Gain Titration [ ] receive $10. 00 now [ ] receive $9. 00 one year from now [ ] receive $10. 00 now [ ] receive $10. 50 one year from now [ ] receive $10. 00 now [ ] receive $11. 00 one year from now . . . [ ] receive $10. 00 now [ ] receive $35. 00 one year from now 65

![Study 1: Choices [x] receive $10. 00 now [ ] receive $9. 00 one Study 1: Choices [x] receive $10. 00 now [ ] receive $9. 00 one](https://present5.com/presentation/b5ea19ef9d58fb720dc4c8b1290cbd9e/image-66.jpg) Study 1: Choices [x] receive $10. 00 now [ ] receive $9. 00 one year from now [x] receive $10. 00 now [ ] receive $10. 50 one year from now [ ] receive $10. 00 now [x] receive $11. 00 one year from now . . . [ ] receive $10. 00 now [x] receive $35. 00 one year from now Indifference point: $10 today = $10. 75 one year from today 66

Study 1: Choices [x] receive $10. 00 now [ ] receive $9. 00 one year from now [x] receive $10. 00 now [ ] receive $10. 50 one year from now [ ] receive $10. 00 now [x] receive $11. 00 one year from now . . . [ ] receive $10. 00 now [x] receive $35. 00 one year from now Indifference point: $10 today = $10. 75 one year from today 66

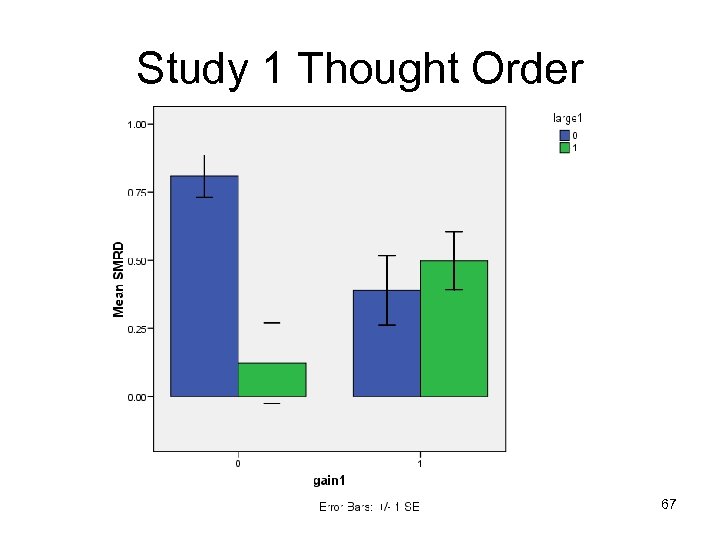

Study 1 Thought Order 67

Study 1 Thought Order 67

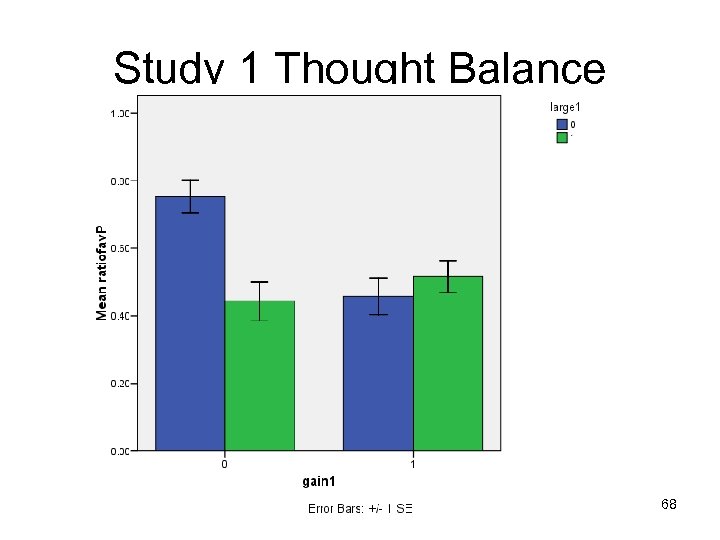

Study 1 Thought Balance 68

Study 1 Thought Balance 68

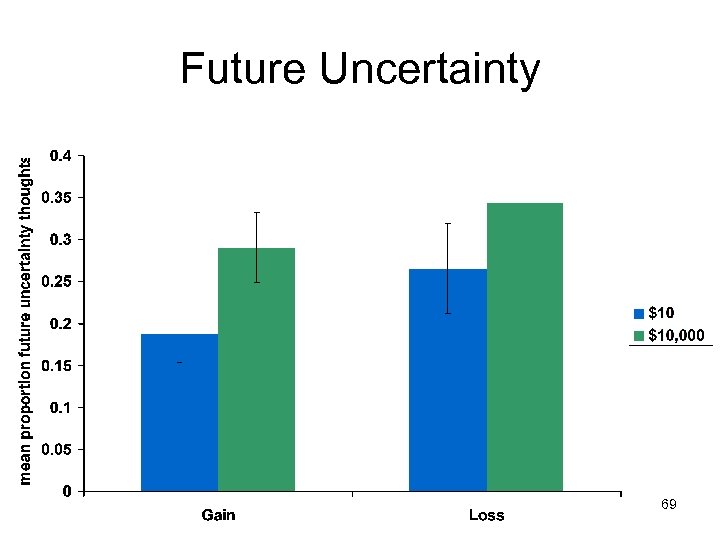

Future Uncertainty 69

Future Uncertainty 69

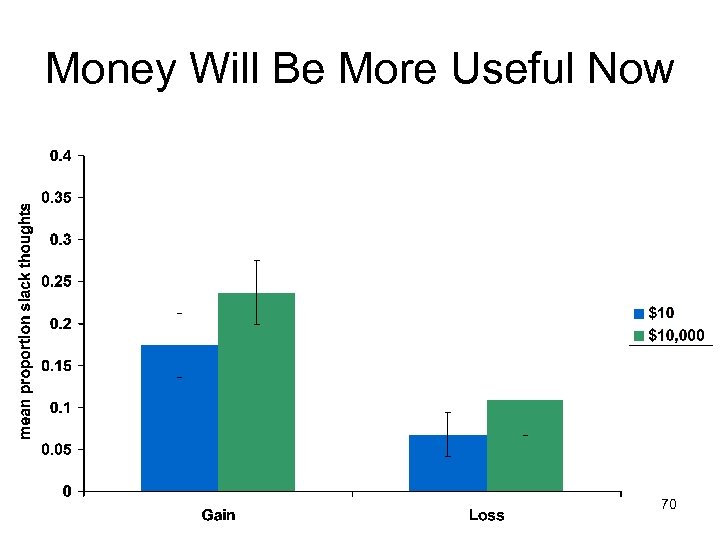

Money Will Be More Useful Now 70

Money Will Be More Useful Now 70

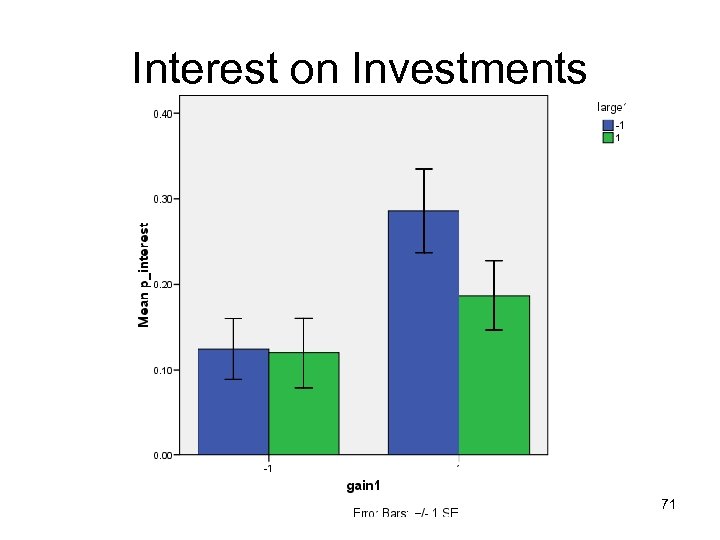

Interest on Investments 71

Interest on Investments 71

Supporting evidence that losses are different • In both studies, CRT & age predicted discounting of delay framed gains, but not delay framed losses 72

Supporting evidence that losses are different • In both studies, CRT & age predicted discounting of delay framed gains, but not delay framed losses 72