I n v e s t o r - P r e s e n t a t i o n J a n u a r y 2 0 0 2 1

I n v e s t o r - P r e s e n t a t i o n J a n u a r y 2 0 0 2 1

Table of Contents < Executive Summary < Investment Highlights in brief < Art Market Overview – Art is an Asset – Art 100 -Index vs. Conventional Investments – < CAPITAL “Art Compass” – Art Market Outlooks – Problems of an Investment in Art – The < Fund as Problem Solution < Fund Policy < SOLON Art Fund: Structure & Function – Management Company – Executive Bios – < Strategic Partner: KWB Kunstwertbrief AG – Asset Management Policy: Diversification in 3 Dimensions – Strategy Descriptions – Chance/Risk/Time-Profile of the Portfolio < Investment < Legal Set-up – Initialisation of the Fund – Ongoing Capital Acquisition and Valuation – Profit Participation and Redemption of Shares – Management Remuneration and Subsequent < Costs – Terms & Conditions < Disclaimer < Contact 2

Table of Contents < Executive Summary < Investment Highlights in brief < Art Market Overview – Art is an Asset – Art 100 -Index vs. Conventional Investments – < CAPITAL “Art Compass” – Art Market Outlooks – Problems of an Investment in Art – The < Fund as Problem Solution < Fund Policy < SOLON Art Fund: Structure & Function – Management Company – Executive Bios – < Strategic Partner: KWB Kunstwertbrief AG – Asset Management Policy: Diversification in 3 Dimensions – Strategy Descriptions – Chance/Risk/Time-Profile of the Portfolio < Investment < Legal Set-up – Initialisation of the Fund – Ongoing Capital Acquisition and Valuation – Profit Participation and Redemption of Shares – Management Remuneration and Subsequent < Costs – Terms & Conditions < Disclaimer < Contact 2

Executive Summary 3

Executive Summary 3

Investment Highlights (1) < Art has not only immaterial value – combining a real estate-like substantial character with mobility and an impressive long-term yield of 10% p. a. on average, art has also an economic dimension. Executive Summary < Because of its slow cycles and its low correlation with the stock market, the fine art market is an attractive target for a portfolio addition in terms of an alternative investment. < But the fragmentation, inefficiency, intransparency and illiquidity of the art market are a tremendous hurdle for individual invest-ments in fine art, and considering the high price levels, diversifi-cation is only possible with assets of several million dollars. < SOLON Art Fund will offer a solution – with a minimum capital employment of only 100, 000 US$, long-term and value-oriented investors can get access to an attractive and strictly diversified portfolio of artworks. 4

Investment Highlights (1) < Art has not only immaterial value – combining a real estate-like substantial character with mobility and an impressive long-term yield of 10% p. a. on average, art has also an economic dimension. Executive Summary < Because of its slow cycles and its low correlation with the stock market, the fine art market is an attractive target for a portfolio addition in terms of an alternative investment. < But the fragmentation, inefficiency, intransparency and illiquidity of the art market are a tremendous hurdle for individual invest-ments in fine art, and considering the high price levels, diversifi-cation is only possible with assets of several million dollars. < SOLON Art Fund will offer a solution – with a minimum capital employment of only 100, 000 US$, long-term and value-oriented investors can get access to an attractive and strictly diversified portfolio of artworks. 4

Investment Highlights (2) < SOLON Art Fund is the first art fund to establish an asset management policy which strictly follows the principles of Modern Portfolio Theory: a wide horizontal and vertical diversification monitored by an experienced management team showing complementary strengths – will result in an optimal chance/risk profile. Executive Summary < Combining different trading and asset management strategies, SOLON Art Fund will be able to show performance in every market phase which leads to a realistic target yield of 12 to 17% on average (over seven to ten years). < Exhibitions, merchandising and leasing are not only additional revenue sources, but also an exclusive emotional and social benefit for the fund’s investors. < 5 mn US$ are projected as basic capitalisation for the fund set-up; early investors will get special conditions. 5

Investment Highlights (2) < SOLON Art Fund is the first art fund to establish an asset management policy which strictly follows the principles of Modern Portfolio Theory: a wide horizontal and vertical diversification monitored by an experienced management team showing complementary strengths – will result in an optimal chance/risk profile. Executive Summary < Combining different trading and asset management strategies, SOLON Art Fund will be able to show performance in every market phase which leads to a realistic target yield of 12 to 17% on average (over seven to ten years). < Exhibitions, merchandising and leasing are not only additional revenue sources, but also an exclusive emotional and social benefit for the fund’s investors. < 5 mn US$ are projected as basic capitalisation for the fund set-up; early investors will get special conditions. 5

Art Market 6

Art Market 6

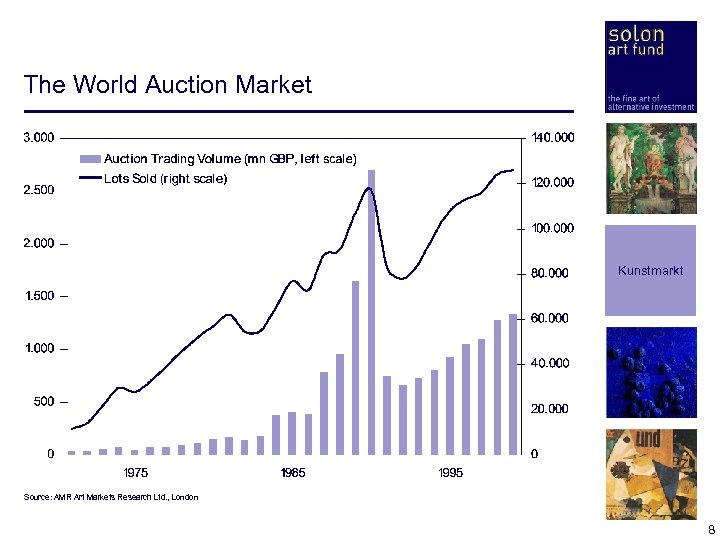

Art Market Overview < Annual volume of around 70 bn US$ < Even conservative estimations assume the total volume for fine art trading to be between < 50 and 100 bn US$ per year. Detailed figures are only available for the auction market: Sotheby’s and Christies, the two market leaders, show a yearly turnover of 2. 3 bn US$ each; numerous smaller auction houses report trading volumes of less than 250 mn US$ (e. g. Phillips: 225 mn US$, Bonham‘s 70 mn US$). < Private transactions are most important < However, the auction scene only represents a small part of the art market; most of the < deals – especially in the premium segment – are operated by galleries, art consultants < and private transactions (“C 2 C”). Art Market < Fragmentation of supply and demand < The most important players on the art market are: resellers and professional art dealers < (driven by economic interest), collectors (driven by passion), museums (build up collections and never act on the sell side) and corporates (using art for marketing and image purposes). < Market development: boom – crash – stability < After the boom during the late 80’s had been brining an enormous increase of the trading < volume, the market had a terrible break-down when the debt financing-induced speculation bubble burst in the crash of 1990/91. But the art market actors have learned from the past – after some years of recovery, the market now shows stability and moderate, continous gains. 7

Art Market Overview < Annual volume of around 70 bn US$ < Even conservative estimations assume the total volume for fine art trading to be between < 50 and 100 bn US$ per year. Detailed figures are only available for the auction market: Sotheby’s and Christies, the two market leaders, show a yearly turnover of 2. 3 bn US$ each; numerous smaller auction houses report trading volumes of less than 250 mn US$ (e. g. Phillips: 225 mn US$, Bonham‘s 70 mn US$). < Private transactions are most important < However, the auction scene only represents a small part of the art market; most of the < deals – especially in the premium segment – are operated by galleries, art consultants < and private transactions (“C 2 C”). Art Market < Fragmentation of supply and demand < The most important players on the art market are: resellers and professional art dealers < (driven by economic interest), collectors (driven by passion), museums (build up collections and never act on the sell side) and corporates (using art for marketing and image purposes). < Market development: boom – crash – stability < After the boom during the late 80’s had been brining an enormous increase of the trading < volume, the market had a terrible break-down when the debt financing-induced speculation bubble burst in the crash of 1990/91. But the art market actors have learned from the past – after some years of recovery, the market now shows stability and moderate, continous gains. 7

The World Auction Market Kunstmarkt Source: AMR Art Markets Research Ltd. , London 8

The World Auction Market Kunstmarkt Source: AMR Art Markets Research Ltd. , London 8

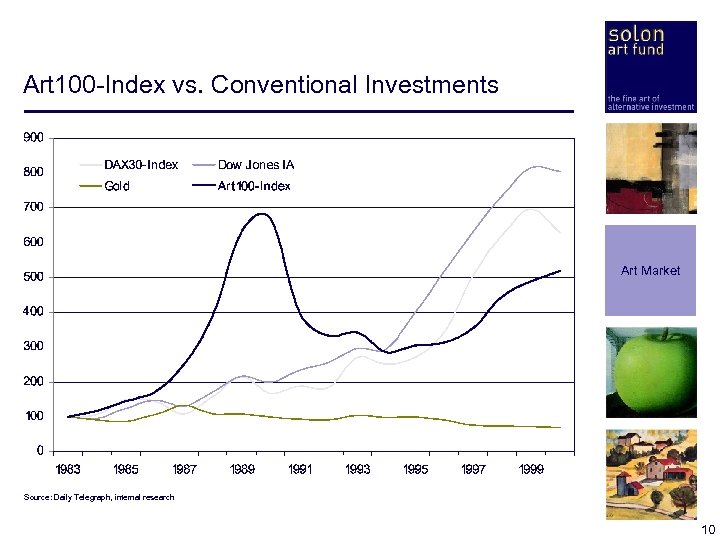

Art is an Asset < The real estate-like value character of art < Art is one of the oldest methods of capital saving – like real estate, fine art is immune to < inflation, with the additional advantage of mobility. Especially in antique times and in the < Netherlands of the 17 th century, art was of special importance. < Prices will increase continuously < On the one hand, the supply with high-grade artworks is limited and will be hold on a < stable level by the buying activity of museums and by destruction. On the other hand, < increasing prosperity brings additional buyers so that, on a long-term basis, the prices < increase continuously. Art Market < Long-term yields of 10% and more are possible < < During the last 20 years, an art investment brought an average yield of more than 10% p. a. , based on the “Daily Telegraph Art 100 Index” observing the prices for the world’s 100 most Important artists. With a combination of intelligent investment and trading strategies, there is even more potential – but only in case of consequent selection and a long - term investment horizon. < Low volatility < < Because of its specific features, the art market moves in slow and long-term cycles. In consequence, the volatility of the art market is significantly lower than the up and down on The financial markets which makes art an attractive portfolio addition in terms of an alternative investment. 9

Art is an Asset < The real estate-like value character of art < Art is one of the oldest methods of capital saving – like real estate, fine art is immune to < inflation, with the additional advantage of mobility. Especially in antique times and in the < Netherlands of the 17 th century, art was of special importance. < Prices will increase continuously < On the one hand, the supply with high-grade artworks is limited and will be hold on a < stable level by the buying activity of museums and by destruction. On the other hand, < increasing prosperity brings additional buyers so that, on a long-term basis, the prices < increase continuously. Art Market < Long-term yields of 10% and more are possible < < During the last 20 years, an art investment brought an average yield of more than 10% p. a. , based on the “Daily Telegraph Art 100 Index” observing the prices for the world’s 100 most Important artists. With a combination of intelligent investment and trading strategies, there is even more potential – but only in case of consequent selection and a long - term investment horizon. < Low volatility < < Because of its specific features, the art market moves in slow and long-term cycles. In consequence, the volatility of the art market is significantly lower than the up and down on The financial markets which makes art an attractive portfolio addition in terms of an alternative investment. 9

Art 100 -Index vs. Conventional Investments Art Market Source: Daily Telegraph, internal research 10

Art 100 -Index vs. Conventional Investments Art Market Source: Daily Telegraph, internal research 10

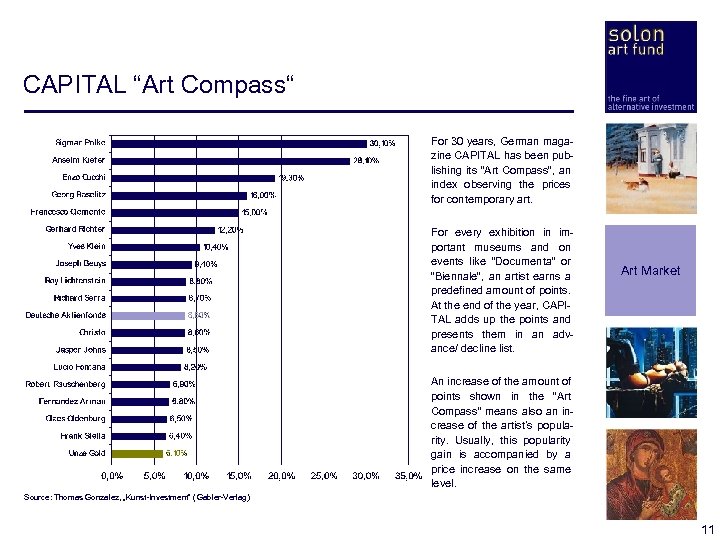

CAPITAL “Art Compass“ For 30 years, German magazine CAPITAL has been publishing its “Art Compass”, an index observing the prices for contemporary art. For every exhibition in important museums and on events like “Documenta” or “Biennale”, an artist earns a predefined amount of points. At the end of the year, CAPITAL adds up the points and presents them in an advance/ decline list. Art Market An increase of the amount of points shown in the “Art Compass” means also an increase of the artist’s popularity. Usually, this popularity gain is accompanied by a price increase on the same level. Source: Thomas Gonzalez, „Kunst-Investment“ ( Gabler-Verlag) 11

CAPITAL “Art Compass“ For 30 years, German magazine CAPITAL has been publishing its “Art Compass”, an index observing the prices for contemporary art. For every exhibition in important museums and on events like “Documenta” or “Biennale”, an artist earns a predefined amount of points. At the end of the year, CAPITAL adds up the points and presents them in an advance/ decline list. Art Market An increase of the amount of points shown in the “Art Compass” means also an increase of the artist’s popularity. Usually, this popularity gain is accompanied by a price increase on the same level. Source: Thomas Gonzalez, „Kunst-Investment“ ( Gabler-Verlag) 11

Outlook: Time to Invest has Come < Current situation: “selective hausse“ < At the moment, the art market shows a best-case scenario, a “selective hausse”. New auction records are only achieved by artists and artworks of the “first row” while it is difficult to find buyers for objects of minor quality levels. A new speculation bubble can’t be noticed so that the market actors seem to have learned from the crash of 1990/91. Moreover, the introduction of the Euro also influences the art market – artworks can be used as vehicle for an anonymous exchange of cash money. < First half of 2002 will bring good opportunities for buyers < < Art Market In the 2 nd Quarter of 2002, this special impact will clear off. In addition, some of the art Portfolios which have only been built up under the motivation of the currency exchange in Europe will be liquidated – with time pressure and acceptance for limited losses. This situation with high short-term supply will offer vast opportunities to buy high-quality artworks at good conditions. < Weak stock markets are an additional chance < < < For the art market, the ongoing weakness of the world’s stock markets and the political uncertainties could be an additional driver: On the one hand, more and more people will realize the value character of an art investment which brings additional demand. And on the other hand, former “New Economy millionaires” who have been buying some premium artworks could be forced to bring them back to the market in order to get new liquidity for other projects. 12

Outlook: Time to Invest has Come < Current situation: “selective hausse“ < At the moment, the art market shows a best-case scenario, a “selective hausse”. New auction records are only achieved by artists and artworks of the “first row” while it is difficult to find buyers for objects of minor quality levels. A new speculation bubble can’t be noticed so that the market actors seem to have learned from the crash of 1990/91. Moreover, the introduction of the Euro also influences the art market – artworks can be used as vehicle for an anonymous exchange of cash money. < First half of 2002 will bring good opportunities for buyers < < Art Market In the 2 nd Quarter of 2002, this special impact will clear off. In addition, some of the art Portfolios which have only been built up under the motivation of the currency exchange in Europe will be liquidated – with time pressure and acceptance for limited losses. This situation with high short-term supply will offer vast opportunities to buy high-quality artworks at good conditions. < Weak stock markets are an additional chance < < < For the art market, the ongoing weakness of the world’s stock markets and the political uncertainties could be an additional driver: On the one hand, more and more people will realize the value character of an art investment which brings additional demand. And on the other hand, former “New Economy millionaires” who have been buying some premium artworks could be forced to bring them back to the market in order to get new liquidity for other projects. 12

Problems of an Investment in Art < Heterogeneity < Nearly every high-quality artwork is unique; quality levels are difficult to define. Any < attempt of standardisation (like it is done for stocks or bonds) is difficult. < Knowledge < Authenticity and provenance of an artwork and the position an artwork has in the artist’s < whole oeuvre are important parameters for the valuation. But the expert knowledge needed for this information is scattered all over the world and difficult to access. Art Market < Intransparency of supply and prices < Illiquidity is one terrible result of this lack of transparency. Buying and selling art is much < more difficult than dealing with real estate, and credits on art are hard to get. Moreover, < the illiquidity effect is even enforced by high transaction costs. < High prices are a hurdle for diversification < Really high-quality artworks usually have prices of 50, 000 US$ upwards. Calculating with < an art portfolio representing 5% of total individual assets, this means that even with a < fortune of 2 mn US$ diversification is impossible. 13

Problems of an Investment in Art < Heterogeneity < Nearly every high-quality artwork is unique; quality levels are difficult to define. Any < attempt of standardisation (like it is done for stocks or bonds) is difficult. < Knowledge < Authenticity and provenance of an artwork and the position an artwork has in the artist’s < whole oeuvre are important parameters for the valuation. But the expert knowledge needed for this information is scattered all over the world and difficult to access. Art Market < Intransparency of supply and prices < Illiquidity is one terrible result of this lack of transparency. Buying and selling art is much < more difficult than dealing with real estate, and credits on art are hard to get. Moreover, < the illiquidity effect is even enforced by high transaction costs. < High prices are a hurdle for diversification < Really high-quality artworks usually have prices of 50, 000 US$ upwards. Calculating with < an art portfolio representing 5% of total individual assets, this means that even with a < fortune of 2 mn US$ diversification is impossible. 13

The Art Fund: Solution for Investors < Art market experience < An experienced management is responsible for the selection of attractive artworks, for < administration and for sale – accompanied and supported by a world-wide network of art < experts and strategic partners which can only be established by an institution like a fund. < “Money is power” – especially in the art business < With the investors’ money the art fund has the financial power to act and negotiate on a < strong basis which will facilitate buying and selling and help to get the best prices. Thus, < the fund is using the inefficiency of the art market for its own purpose and gain. Art Market < Diversification brings risk reduction < With a fund volume of 5 mn US$ upwards, investments can be diversified into different < objects and strategies so that market and selection risks can be reduced to a minimum. < Liquidity < While single artworks are unique, the fund’s shares are standard good. Thus, investment < and disinvestment is possible much easier, faster and more efficient. < Taxation advantages < Using certain options of company structuring, both the fund itself and the individual investor might profit from taxation advantages which could not be offered by other investment opportunities. 14

The Art Fund: Solution for Investors < Art market experience < An experienced management is responsible for the selection of attractive artworks, for < administration and for sale – accompanied and supported by a world-wide network of art < experts and strategic partners which can only be established by an institution like a fund. < “Money is power” – especially in the art business < With the investors’ money the art fund has the financial power to act and negotiate on a < strong basis which will facilitate buying and selling and help to get the best prices. Thus, < the fund is using the inefficiency of the art market for its own purpose and gain. Art Market < Diversification brings risk reduction < With a fund volume of 5 mn US$ upwards, investments can be diversified into different < objects and strategies so that market and selection risks can be reduced to a minimum. < Liquidity < While single artworks are unique, the fund’s shares are standard good. Thus, investment < and disinvestment is possible much easier, faster and more efficient. < Taxation advantages < Using certain options of company structuring, both the fund itself and the individual investor might profit from taxation advantages which could not be offered by other investment opportunities. 14

Fund Policy 15

Fund Policy 15

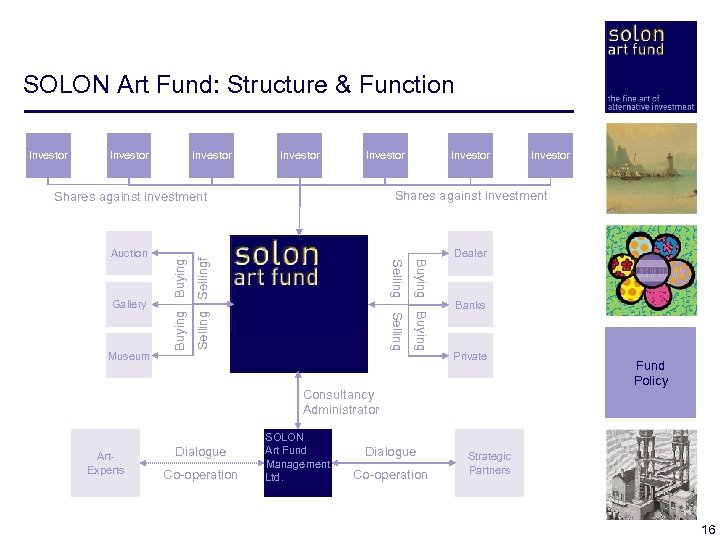

SOLON Art Fund: Structure & Function Investor Investor Dealer Selling Museum Selling Gallery Sellingf Auction Buying Shares against investment Banks Private Consultancy Administrator Art. Experts Dialogue Co-operation SOLON Art Fund Management Ltd. Dialogue Co-operation Fund Policy Strategic Partners 16

SOLON Art Fund: Structure & Function Investor Investor Dealer Selling Museum Selling Gallery Sellingf Auction Buying Shares against investment Banks Private Consultancy Administrator Art. Experts Dialogue Co-operation SOLON Art Fund Management Ltd. Dialogue Co-operation Fund Policy Strategic Partners 16

The Management Company < Asset management and administration < The management of the fund’s assets will be exclusively done by SOLON Art Fund Management Ltd. This management company defines the principles of the fund policy, decides on purchase and sale of artworks, is responsible for balancing and administration and represents the fund towards third parties. Remuneration of the management company will follow a two-step-model: an agio to be paid by the investor at time of an engagement in the fund a management fee related to the fund’s performance. < Management team with complementary strengths < The three initiators of the project will also be owners of SOLON Art Fund Management Ltd. < and directors of the SOLON Art Fund: Reiner Opoku, Wolfgang Roth und Michael Poetter – < a management team with complementary strengths, combining internationality and longterm experience in every economical sector which is important for the fund. An expansion of the management team will take place in accordance with the increase of the fund’s volume. Fund Policy < Einbindung eines strategischen Partners geplant < < < During 2002, the initiators will try to find a strategic partner for joining the management company. Preferred partners are financial institutions who could support the marketing and the capital acquisition so that the fund will reach its target volume (50 mn US$) as soon as possible in order to be able to participate in the whole potential which is offered by the current market situation. 17

The Management Company < Asset management and administration < The management of the fund’s assets will be exclusively done by SOLON Art Fund Management Ltd. This management company defines the principles of the fund policy, decides on purchase and sale of artworks, is responsible for balancing and administration and represents the fund towards third parties. Remuneration of the management company will follow a two-step-model: an agio to be paid by the investor at time of an engagement in the fund a management fee related to the fund’s performance. < Management team with complementary strengths < The three initiators of the project will also be owners of SOLON Art Fund Management Ltd. < and directors of the SOLON Art Fund: Reiner Opoku, Wolfgang Roth und Michael Poetter – < a management team with complementary strengths, combining internationality and longterm experience in every economical sector which is important for the fund. An expansion of the management team will take place in accordance with the increase of the fund’s volume. Fund Policy < Einbindung eines strategischen Partners geplant < < < During 2002, the initiators will try to find a strategic partner for joining the management company. Preferred partners are financial institutions who could support the marketing and the capital acquisition so that the fund will reach its target volume (50 mn US$) as soon as possible in order to be able to participate in the whole potential which is offered by the current market situation. 17

Management: Reiner Opoku, CEO < Dealer for contemporary art R. Opoku < Reiner Opoku, coming from Cologne, has been professional art dealer < for nearly 20 years. His focus lies on works of artists like Warhol, < Richter, Polke, Twombly and Kippenberger as well as on several newcomers of the 80’s and 90’s (Avantgarde). < Founder of “Kunsthaus“ in Cologne < As Founder and former Managing Partner (1996 -2000) of “Kunsthaus” < in Cologne, Opoku has succeeded inspiring broad masses for the purchase of high-quality art. On 600 square meters, “Kunsthaus” – European-wide an innovation - offers paintings, drawings, prints, sculptures and photos of numerous artists of all epochs, combined with exhibitions and merchandising shops. < Wertvolle Kontakte durch Kuratorentätigkeit < Between 1983 and 1996, Opoku has been manager and curator for various European and American artists, among them J. G. Dokoupil, < Donald Baechler, Martin Kippenberger, Sigmar Polke und Rosemarie < Trockel. Thereby as well as by his activity as Sales Director Asia for < the Benedikt Taschen publishing house he orders apart from extensive market expert's assessment over valuable international contacts, both into the art scene and to media and social opinion leaders. Fund Policy 18

Management: Reiner Opoku, CEO < Dealer for contemporary art R. Opoku < Reiner Opoku, coming from Cologne, has been professional art dealer < for nearly 20 years. His focus lies on works of artists like Warhol, < Richter, Polke, Twombly and Kippenberger as well as on several newcomers of the 80’s and 90’s (Avantgarde). < Founder of “Kunsthaus“ in Cologne < As Founder and former Managing Partner (1996 -2000) of “Kunsthaus” < in Cologne, Opoku has succeeded inspiring broad masses for the purchase of high-quality art. On 600 square meters, “Kunsthaus” – European-wide an innovation - offers paintings, drawings, prints, sculptures and photos of numerous artists of all epochs, combined with exhibitions and merchandising shops. < Wertvolle Kontakte durch Kuratorentätigkeit < Between 1983 and 1996, Opoku has been manager and curator for various European and American artists, among them J. G. Dokoupil, < Donald Baechler, Martin Kippenberger, Sigmar Polke und Rosemarie < Trockel. Thereby as well as by his activity as Sales Director Asia for < the Benedikt Taschen publishing house he orders apart from extensive market expert's assessment over valuable international contacts, both into the art scene and to media and social opinion leaders. Fund Policy 18

Management: Wolfgang Roth, COO < Expert for classical modern art W. Roth < Wolfgang Roth is internationally active as art dealer for more than 25 < years. His special attention hereby applies to the German Expressionism (and here to the artist movement “Die Brücke”) as well as to the < works of the classical modern art. < Scientific Studies < After his boarding school time, spent in Geneva / Carouge, Roth was < student to the Columbia University, New York (the USA). Graduated as < Bacchelor of Arts and Master of Commerce / Art, he has a wide-spread art-historical knowledge which is a crucial base for successful < trades with high-quality art. < Chartermember of Sotheby‘s Online < < < Fund Policy The fact that Roth‘s expert knowledge is internationally in demand Could also illustrated by his activity as Chartermember of Sotheby‘s Online. Here, he participated actively in the initiation of the Internet branch of the world largest auction house (launched in 1999). At same time, he got the chance to further develop his personal art specialist network. This benefits now also SOLON Art Fund where Roth is responsible for purchase and valuation. 19

Management: Wolfgang Roth, COO < Expert for classical modern art W. Roth < Wolfgang Roth is internationally active as art dealer for more than 25 < years. His special attention hereby applies to the German Expressionism (and here to the artist movement “Die Brücke”) as well as to the < works of the classical modern art. < Scientific Studies < After his boarding school time, spent in Geneva / Carouge, Roth was < student to the Columbia University, New York (the USA). Graduated as < Bacchelor of Arts and Master of Commerce / Art, he has a wide-spread art-historical knowledge which is a crucial base for successful < trades with high-quality art. < Chartermember of Sotheby‘s Online < < < Fund Policy The fact that Roth‘s expert knowledge is internationally in demand Could also illustrated by his activity as Chartermember of Sotheby‘s Online. Here, he participated actively in the initiation of the Internet branch of the world largest auction house (launched in 1999). At same time, he got the chance to further develop his personal art specialist network. This benefits now also SOLON Art Fund where Roth is responsible for purchase and valuation. 19

Initiator: Michael Poetter < 25 years of business development experience M. Poetter < During the 25 years of his career as independent entrepreneur, Michael Poetter, graduated in economy, has been developing and transferring a whole number of innovative business models. His experience thereby reaches from start ups over the initialisation of international joint ventures up to the structuring of complex transactions under integration of major companies (e. g. Formula One sponsorship deal Mc. Laren / Mercedes-Benz / Reemtsma). < Focussed on media, events and marketing < The emphasis of its activity was particularly on event marketing and < the media business. Among other things, Poetter has been shareholder in and managing director of “Variété Wintergarten“, Berlin Ticket Gmb. H and Radio Concept Gmb. H (Radio Energy 91, 7 in Hamburg) as well as advisor to VIVA music television and co-initiator of pop. KOMM, a successful music fair. Fund Policy < Responsible for investor relations < As initiator of SOLON Art Fund, Poetter will be responsible for the definition of new business concepts and for investor acquisition and < communication. Moreover, his society contacts are of high importance < for the organization of Sales Events. 20

Initiator: Michael Poetter < 25 years of business development experience M. Poetter < During the 25 years of his career as independent entrepreneur, Michael Poetter, graduated in economy, has been developing and transferring a whole number of innovative business models. His experience thereby reaches from start ups over the initialisation of international joint ventures up to the structuring of complex transactions under integration of major companies (e. g. Formula One sponsorship deal Mc. Laren / Mercedes-Benz / Reemtsma). < Focussed on media, events and marketing < The emphasis of its activity was particularly on event marketing and < the media business. Among other things, Poetter has been shareholder in and managing director of “Variété Wintergarten“, Berlin Ticket Gmb. H and Radio Concept Gmb. H (Radio Energy 91, 7 in Hamburg) as well as advisor to VIVA music television and co-initiator of pop. KOMM, a successful music fair. Fund Policy < Responsible for investor relations < As initiator of SOLON Art Fund, Poetter will be responsible for the definition of new business concepts and for investor acquisition and < communication. Moreover, his society contacts are of high importance < for the organization of Sales Events. 20

Strategic Partner: KWB Kunstwertbrief AG < Certifying the market value of art < < With its international expert network and based on a proprietary estimation scheme, KWB AG offers certificates about the long-term market value of artworks. This service becomes revolutionary thereby that the company is responsible for the certified prices , i. e. in the form of long-term purchase warranties. Thus, even credits on artworks are possible, together with KWB‘s banking partners. www. kunstwertbrief. com < Access to know-how, artworks and clients < Through the partnership with KWB AG, SOLON Art Fund gets access to a unique know- how pool within the area of art investment. Moreover, KWB‘s client base (professional < Dealers and private collectors) which is settled exclusively in the premium segment, can < be both source for good purchases and target group for sales. < Long-term security for the fund’s assets SOLON Art Fund intends to get so-called “Kunstwertbriefe“ for most of the art objects held by the fund – notarially authenticated purchase warranties with 11 years of run time whose valuation should be at least the fund‘s purchase price. Thus, on the one hand the fund‘s assets are protected completely from losses, on the other hand the investor receives the unique certainty that the decisions of the management are checked again by an institution which is really independent due to its economic self-interest. With support of < KWB AG, SOLON Art Fund could also get bank financings for its art objects in order to < leverage its own working capital. < < Fund Police 21

Strategic Partner: KWB Kunstwertbrief AG < Certifying the market value of art < < With its international expert network and based on a proprietary estimation scheme, KWB AG offers certificates about the long-term market value of artworks. This service becomes revolutionary thereby that the company is responsible for the certified prices , i. e. in the form of long-term purchase warranties. Thus, even credits on artworks are possible, together with KWB‘s banking partners. www. kunstwertbrief. com < Access to know-how, artworks and clients < Through the partnership with KWB AG, SOLON Art Fund gets access to a unique know- how pool within the area of art investment. Moreover, KWB‘s client base (professional < Dealers and private collectors) which is settled exclusively in the premium segment, can < be both source for good purchases and target group for sales. < Long-term security for the fund’s assets SOLON Art Fund intends to get so-called “Kunstwertbriefe“ for most of the art objects held by the fund – notarially authenticated purchase warranties with 11 years of run time whose valuation should be at least the fund‘s purchase price. Thus, on the one hand the fund‘s assets are protected completely from losses, on the other hand the investor receives the unique certainty that the decisions of the management are checked again by an institution which is really independent due to its economic self-interest. With support of < KWB AG, SOLON Art Fund could also get bank financings for its art objects in order to < leverage its own working capital. < < Fund Police 21

Asset Allocation: Diversification in 3 Dimensions < Modern Portfolio Theory as basic principle < The most important difference between SOLON Art Fund and its competitives will be its < Clear orientation at the principles of Modern Portfolio Theory. Basic statement of this < method is that an optimal net yield/risk structure can be attained only by balanced diversification. Therefore, SOLON Art Fund aims at a broad investment policy combining different temporal horizons, object classes and revenue streams in an intelligent manner. < Diversification level 1: temporal horizons < SOLON Art Fund is neither an art dealing company nor another pure investment trust. < Therefore both short term-speculative positions and stocks, where the long-term value is < in the center of attention, will be structured. < Diversification level 2: object classes < Huge accumulation risks are a substantial reason for the failure of many art funds. This is < why SOLON Art Fund won‘t concentrate on only a few object classes but will bundle attractive artworks from all promising epochs of the 20 th (and 21 st) century. Fund Policy < Diversification level 3: revenue streams < The purchase and sale of artworks is the most important income source for SOLON Art < Fund, but not the only one. With exhibitions, merchandising, leasing, project pre-financings and venture capital, the fund has also additional revenue streams. 22

Asset Allocation: Diversification in 3 Dimensions < Modern Portfolio Theory as basic principle < The most important difference between SOLON Art Fund and its competitives will be its < Clear orientation at the principles of Modern Portfolio Theory. Basic statement of this < method is that an optimal net yield/risk structure can be attained only by balanced diversification. Therefore, SOLON Art Fund aims at a broad investment policy combining different temporal horizons, object classes and revenue streams in an intelligent manner. < Diversification level 1: temporal horizons < SOLON Art Fund is neither an art dealing company nor another pure investment trust. < Therefore both short term-speculative positions and stocks, where the long-term value is < in the center of attention, will be structured. < Diversification level 2: object classes < Huge accumulation risks are a substantial reason for the failure of many art funds. This is < why SOLON Art Fund won‘t concentrate on only a few object classes but will bundle attractive artworks from all promising epochs of the 20 th (and 21 st) century. Fund Policy < Diversification level 3: revenue streams < The purchase and sale of artworks is the most important income source for SOLON Art < Fund, but not the only one. With exhibitions, merchandising, leasing, project pre-financings and venture capital, the fund has also additional revenue streams. 22

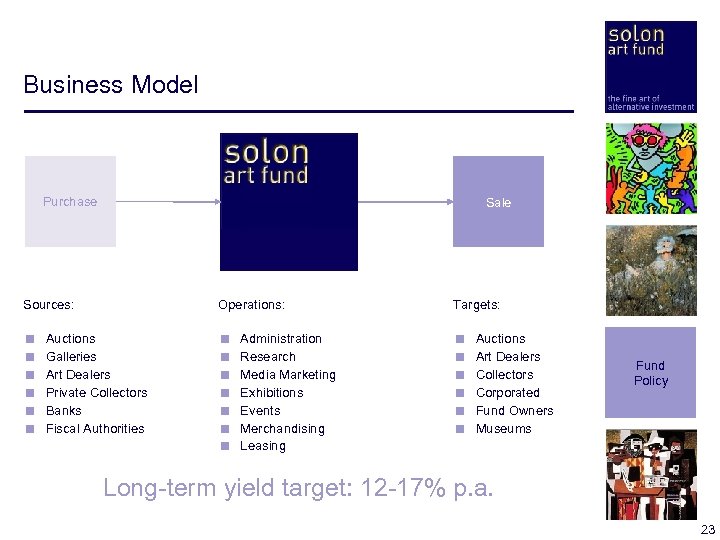

Business Model Purchase Sale Sources: < < < Operations: Auctions Galleries Art Dealers Private Collectors Banks Fiscal Authorities < < < < Administration Research Media Marketing Exhibitions Events Merchandising Leasing Targets: < < < Auctions Art Dealers Collectors Corporated Fund Owners Museums Fund Policy Long-term yield target: 12 -17% p. a. 23

Business Model Purchase Sale Sources: < < < Operations: Auctions Galleries Art Dealers Private Collectors Banks Fiscal Authorities < < < < Administration Research Media Marketing Exhibitions Events Merchandising Leasing Targets: < < < Auctions Art Dealers Collectors Corporated Fund Owners Museums Fund Policy Long-term yield target: 12 -17% p. a. 23

The “Buy & Hold“ Strategy < Long-term “blue chip” portfolio < < < One part of the fund‘s assets will be invested into selected, favourably acquired works of established artists. Similar to shares of large companies, these „blue chips“ of the art market (e. g. Kirchner, Rothko, Rauschenberg, Warhol, F ontana, Beuys or Richter) will show a moderate, but constant increases in value, while the downside exposure is very low. < Permanent marketing is possible < < < This strategy presupposes an internal time horizon between 5 and 10 years. Differently than bonds or shares, art objects bring no current yields, but a creative marketing allows to generate additional income during the holding period. In view of the popularity of the acquired objects, attractive exhibitions can be organized at small expenditure. A further source of yield is leasing – enterprises or privates can borrow the fund‘s artworks against fee and insurance, whereby the owners of the fund enjoy preferred conditions. < Leverage will reduce capital freeze < < < Fund Policy Nevertheless this strategy naturally causes a high capital freeze. However, this effect can be reduced by crediting the artworks with support of the bank network of the co-operation partner KWB AG. Without impairing the large marketing potentials, these loans – handed out at conditions comparable to real estate loans – can reach 60% of the market value. This influx of funds can be used again in alternative strategies. 24

The “Buy & Hold“ Strategy < Long-term “blue chip” portfolio < < < One part of the fund‘s assets will be invested into selected, favourably acquired works of established artists. Similar to shares of large companies, these „blue chips“ of the art market (e. g. Kirchner, Rothko, Rauschenberg, Warhol, F ontana, Beuys or Richter) will show a moderate, but constant increases in value, while the downside exposure is very low. < Permanent marketing is possible < < < This strategy presupposes an internal time horizon between 5 and 10 years. Differently than bonds or shares, art objects bring no current yields, but a creative marketing allows to generate additional income during the holding period. In view of the popularity of the acquired objects, attractive exhibitions can be organized at small expenditure. A further source of yield is leasing – enterprises or privates can borrow the fund‘s artworks against fee and insurance, whereby the owners of the fund enjoy preferred conditions. < Leverage will reduce capital freeze < < < Fund Policy Nevertheless this strategy naturally causes a high capital freeze. However, this effect can be reduced by crediting the artworks with support of the bank network of the co-operation partner KWB AG. Without impairing the large marketing potentials, these loans – handed out at conditions comparable to real estate loans – can reach 60% of the market value. This influx of funds can be used again in alternative strategies. 24

The „Newcomer“ Strategy < Young artists promise superproportional yields < There are numerous young artists who could already draw a certain attention on themselves by exhibitions and publications, but who are nevertheless still waiting for the ultimate break-through. SOLON Art Fund will also get engaged in this segment and build up stocks with several works of such promising artists. Because of lowest entrance prices, a multiplication of the capital assigned is possible if these artists succeed on the market < after a while. < Dispersion minimizes selection risks < Even if SOLON Art Fund can rely on the competence of its network as well as on the < particular experiences of Reiner Opoku in terms of selecting these talents, naturally certain uncertainties remain. However, this risk can be reduced by consistent dispersion, < Which again only a fund can ensure. Similar to the venture capital business, only one or < two out of a portfolio of ten artists need to achieve a „break-through“ in order to make the < overall strategy a successful investment. Yields of several hundred percent are possible; < prerequisite is a long-term engagement horizon of 7 to 12 years. Fund Policy < Intensive integration of partners < < The success of this strategy is also determined by intensive networking. The ongoing establishment of an artist means not only financial expense (exhibitions, catalogues), but also requires the interconnection of galleries, collectors and – above all – media. Such project partnerships are started up and continuously monitored by SOLON Art Fund. 25

The „Newcomer“ Strategy < Young artists promise superproportional yields < There are numerous young artists who could already draw a certain attention on themselves by exhibitions and publications, but who are nevertheless still waiting for the ultimate break-through. SOLON Art Fund will also get engaged in this segment and build up stocks with several works of such promising artists. Because of lowest entrance prices, a multiplication of the capital assigned is possible if these artists succeed on the market < after a while. < Dispersion minimizes selection risks < Even if SOLON Art Fund can rely on the competence of its network as well as on the < particular experiences of Reiner Opoku in terms of selecting these talents, naturally certain uncertainties remain. However, this risk can be reduced by consistent dispersion, < Which again only a fund can ensure. Similar to the venture capital business, only one or < two out of a portfolio of ten artists need to achieve a „break-through“ in order to make the < overall strategy a successful investment. Yields of several hundred percent are possible; < prerequisite is a long-term engagement horizon of 7 to 12 years. Fund Policy < Intensive integration of partners < < The success of this strategy is also determined by intensive networking. The ongoing establishment of an artist means not only financial expense (exhibitions, catalogues), but also requires the interconnection of galleries, collectors and – above all – media. Such project partnerships are started up and continuously monitored by SOLON Art Fund. 25

The “Arbitrage“ Strategy < Turning inefficiency into profit < This strategy uses the well-known inefficiency and intransparency of the art market in the < sense of a commercial stock. Again and again you can notice that for example a painting of < a Spanish artist is to be sold over an Italian auction house, although no appropriate demand is available there. This is an opportunity to purchase at favorable prices and to reoffer the object in a better environment or to sell it in a private transaction a few months < later. Both works of established artists and objects from the „second row“ could be interesting for this strategy. < Short-term capital freeze provides rapid yields < After deduction of transaction costs, the net yield expectation for this strategy is approximately 15 to 30%. This is clearly fewer than with other strategies, but the time horizon and the capital freeze duration are also substantially shorter with only 2 to 12 months. Beyond that the “Arbitrage“ strategy is an vehicle with which the fund can already prove first yields briefly after its launch. Fund Policy < Active observation of the markets is a prerequisite < A very precise observation of the markets, above all a permanent screening of auction < catalogues, is the decisive prerequisite for a functioning arbitrage business. On the one < Hand the fund management has already developed suitable mechanisms for this observation, on the other hand the co-operation network is also helpful: The fund will get immediate notice of purchase opportunities resulting from clients rejected by KWB AG. 26

The “Arbitrage“ Strategy < Turning inefficiency into profit < This strategy uses the well-known inefficiency and intransparency of the art market in the < sense of a commercial stock. Again and again you can notice that for example a painting of < a Spanish artist is to be sold over an Italian auction house, although no appropriate demand is available there. This is an opportunity to purchase at favorable prices and to reoffer the object in a better environment or to sell it in a private transaction a few months < later. Both works of established artists and objects from the „second row“ could be interesting for this strategy. < Short-term capital freeze provides rapid yields < After deduction of transaction costs, the net yield expectation for this strategy is approximately 15 to 30%. This is clearly fewer than with other strategies, but the time horizon and the capital freeze duration are also substantially shorter with only 2 to 12 months. Beyond that the “Arbitrage“ strategy is an vehicle with which the fund can already prove first yields briefly after its launch. Fund Policy < Active observation of the markets is a prerequisite < A very precise observation of the markets, above all a permanent screening of auction < catalogues, is the decisive prerequisite for a functioning arbitrage business. On the one < Hand the fund management has already developed suitable mechanisms for this observation, on the other hand the co-operation network is also helpful: The fund will get immediate notice of purchase opportunities resulting from clients rejected by KWB AG. 26

The “Liquidation“ Strategy < Market placement of large private collections < < < Particularly in Europe the next 20 years will be an epoch of inheriting. Especially in the middle class often considerable art possession is bequeathed. In many cases the inherits will try to liquidate these objects quickly, e. g. because of inheritance taxes or personal taste. But an individual sale is difficult for amateurs. Thus, SOLON Art Fund can offer its services and take over the whole collection in the context of a block trade. < Financial structuring with partners and revenue sharing < < Usually, the purchase volume will exceed the financial power of the fund, at least during the first years - the liquidation strategy is only one of several business models for the fund and it would be a contradiction to the diversification principle to invest all liquidity into one project. But together with partners like KWB AG, whose art banking know-how and net-work enables loans on art, this gap can be closed. One option could be an immediate pur-chase rate, set below the market price, combined with a revenue sharing model: SOLON Art Fund gets an exclusive sales mandate for a pre-defined period (for good reason two to three years) and the excess of proceeds is divided up between the fund and the inherits. Fund Policy < Service is also useful for banks and fiscal authorities < Potential targets for the “Liquidation” strategy are not only private collections, but also < stocks of banks (from distressed credits) or fiscal authorities (customs, fiscal investiga-tion, fiscal enforcement). SOLON Art Fund will always be able to make a more attractive offer than the large auction houses. 27

The “Liquidation“ Strategy < Market placement of large private collections < < < Particularly in Europe the next 20 years will be an epoch of inheriting. Especially in the middle class often considerable art possession is bequeathed. In many cases the inherits will try to liquidate these objects quickly, e. g. because of inheritance taxes or personal taste. But an individual sale is difficult for amateurs. Thus, SOLON Art Fund can offer its services and take over the whole collection in the context of a block trade. < Financial structuring with partners and revenue sharing < < Usually, the purchase volume will exceed the financial power of the fund, at least during the first years - the liquidation strategy is only one of several business models for the fund and it would be a contradiction to the diversification principle to invest all liquidity into one project. But together with partners like KWB AG, whose art banking know-how and net-work enables loans on art, this gap can be closed. One option could be an immediate pur-chase rate, set below the market price, combined with a revenue sharing model: SOLON Art Fund gets an exclusive sales mandate for a pre-defined period (for good reason two to three years) and the excess of proceeds is divided up between the fund and the inherits. Fund Policy < Service is also useful for banks and fiscal authorities < Potential targets for the “Liquidation” strategy are not only private collections, but also < stocks of banks (from distressed credits) or fiscal authorities (customs, fiscal investiga-tion, fiscal enforcement). SOLON Art Fund will always be able to make a more attractive offer than the large auction houses. 27

The “Venture Capital“ Strategy < Incubator for new business ideas < Due to its networking with all other market players, SOLON Art Fund will almost automatically develop new business ideas, which have a strong art market reference, but which are not core business of the fund however. In such situations, the fund takes over an incu-bator role – the idea will be evaluated to a plausible, independent and profitable business model, suitable management for the new entity will be acquired and, together with stra-tegic partners and financial investors, a joint venture will be initialised. < Gains by shareholding < The fund will keep a long-term shareholding in these spin-offs - usually with a strategic < proportion of 25, 1 % - so that a further diversification level is introduced. In future times, < the complete spin-off of these activities into a newly established “art venture capital fund“ is conceivable. Of course, the owners of this fund will directly profit of the initialisation of such a project. < First starting point: “Encrypted Art“ < < < Fund Policy Under the label “Encrypted Art“ the fund initiators already have developed a first business Model that is to be pursued in sense of the “Venture Capital“ strategy after a successful establishment of the fund. This project concerns a software based on artificial intelligence which independently detects underestimations or overestimations of art objects on base of all available transaction data so that it would be a killer application for the “Arbitrage“ strategy. 28

The “Venture Capital“ Strategy < Incubator for new business ideas < Due to its networking with all other market players, SOLON Art Fund will almost automatically develop new business ideas, which have a strong art market reference, but which are not core business of the fund however. In such situations, the fund takes over an incu-bator role – the idea will be evaluated to a plausible, independent and profitable business model, suitable management for the new entity will be acquired and, together with stra-tegic partners and financial investors, a joint venture will be initialised. < Gains by shareholding < The fund will keep a long-term shareholding in these spin-offs - usually with a strategic < proportion of 25, 1 % - so that a further diversification level is introduced. In future times, < the complete spin-off of these activities into a newly established “art venture capital fund“ is conceivable. Of course, the owners of this fund will directly profit of the initialisation of such a project. < First starting point: “Encrypted Art“ < < < Fund Policy Under the label “Encrypted Art“ the fund initiators already have developed a first business Model that is to be pursued in sense of the “Venture Capital“ strategy after a successful establishment of the fund. This project concerns a software based on artificial intelligence which independently detects underestimations or overestimations of art objects on base of all available transaction data so that it would be a killer application for the “Arbitrage“ strategy. 28

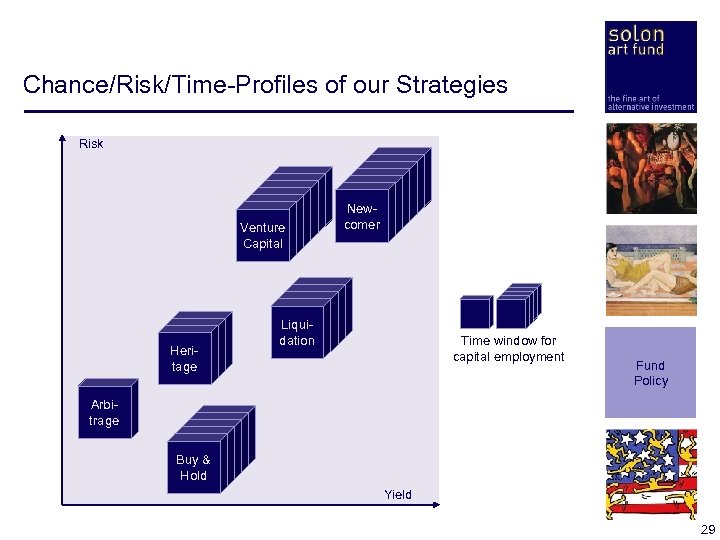

Chance/Risk/Time-Profiles of our Strategies Risk Arbitrage Venture Capital Heritage Arbitrage Newcomer Liquidation Time window for capital employment Fund Policy Arbitrage Buy & Hold Yield 29

Chance/Risk/Time-Profiles of our Strategies Risk Arbitrage Venture Capital Heritage Arbitrage Newcomer Liquidation Time window for capital employment Fund Policy Arbitrage Buy & Hold Yield 29

Investment Story < Participation in a professionally administrated art portfolio with a unique chance/risk profile, based on consistent diversification and intelligent Networking. < Prospect of high long-term net yields which are independent of the fluctuations of the financial markets (genuine alternative investment for portfolio admixture). < Security of the investment by the long-term substance and value character of high-quality artworks. < Preferred conditions for acquisition or leasing of art objects from the fund assets in order to explore also the emotional yield of fine art. Fund Policy < Access to an exclusive international circle of acquaintances from economics and society (events and journeys, which will be offered only to the shareholders of the fund). 30

Investment Story < Participation in a professionally administrated art portfolio with a unique chance/risk profile, based on consistent diversification and intelligent Networking. < Prospect of high long-term net yields which are independent of the fluctuations of the financial markets (genuine alternative investment for portfolio admixture). < Security of the investment by the long-term substance and value character of high-quality artworks. < Preferred conditions for acquisition or leasing of art objects from the fund assets in order to explore also the emotional yield of fine art. Fund Policy < Access to an exclusive international circle of acquaintances from economics and society (events and journeys, which will be offered only to the shareholders of the fund). 30

Investment 31

Investment 31

Legal Set-up < Structure will be fixed in accordance with first investors It is planned to determine the legal set-up of SOLON Art Fund in close coordination with the initial investors which is a further advantage of an early commitment. Nevertheless, it is already clear that a) the fund will not be located in Germany and that b) there has to be defined a structure under which the administration of the fund‘s assets by an external management company is possible and which opens the occasion to redeem the shares < after some years. < < < Option A: Offshore-construction < < < One option is the installation of an offshore construction following the same mechanisms which are pursued also by most hedge funds. Major advantage of this solution would be that areas such as Aruba, Curacao or BVI provide effective administrative structures and low taxation so that the liquidity of the fund (and thus its financial power) is not weakened by additional deliveries. Problematic however is the tax treatment of the yields in the country of the investor. < Option B: US company < < < Alternatively conceivable is the establishment of a US company for the fund. Here, the yields gained by the fund would be subject to a tax liability, but under certain conditions the increases in value generated on the side of the investor are tax free. Additionally, this option offers the advantage of a possible stock market listing of the fund which could be interesting under the aspects of liquidity and marketing. Investment 32

Legal Set-up < Structure will be fixed in accordance with first investors It is planned to determine the legal set-up of SOLON Art Fund in close coordination with the initial investors which is a further advantage of an early commitment. Nevertheless, it is already clear that a) the fund will not be located in Germany and that b) there has to be defined a structure under which the administration of the fund‘s assets by an external management company is possible and which opens the occasion to redeem the shares < after some years. < < < Option A: Offshore-construction < < < One option is the installation of an offshore construction following the same mechanisms which are pursued also by most hedge funds. Major advantage of this solution would be that areas such as Aruba, Curacao or BVI provide effective administrative structures and low taxation so that the liquidity of the fund (and thus its financial power) is not weakened by additional deliveries. Problematic however is the tax treatment of the yields in the country of the investor. < Option B: US company < < < Alternatively conceivable is the establishment of a US company for the fund. Here, the yields gained by the fund would be subject to a tax liability, but under certain conditions the increases in value generated on the side of the investor are tax free. Additionally, this option offers the advantage of a possible stock market listing of the fund which could be interesting under the aspects of liquidity and marketing. Investment 32

Initialisation of the Fund < Signing of preliminary agreements with potential investors < < Target of the pre-marketing phase which is organized by SOLON Art Fund at the moment is to sign preliminary agreements, in which potential investors make a commitment to pay in the capital needed for the establishment of the fund (under the basic conditions stated in this presentation) < Set-up of the fund only with commitments of at least 5 mn US$ < < < These preliminary agreements are closed under the delaying condition that the initiators succeed in catching up commitments from different investors over a deposit of altogether at least 5 mn US$ until April 30 th, 2002. With a lower starting volume, the fixed cost of the fund structure would be in a misrelation to the business opportunities. Beyond that the investment policy of SOLON Art Fund which is aligned to diversification requires a certain minimum capitalization. < Reduced agio for initial investors < The initial investors are integrated actively into the set-up process of the fund and will < receive effective shares in relation to their deposit. Additionally to the deposited nominal < amount, an agio of 3, 25% of the total investment is due which is to be paid to the management company. This agio will be used for covering of the administrative expense. Investors, who enter the fund only after its establishment, will be charged with an agio of 5%, so that there is an additional incentive for early commitments. Investment 33

Initialisation of the Fund < Signing of preliminary agreements with potential investors < < Target of the pre-marketing phase which is organized by SOLON Art Fund at the moment is to sign preliminary agreements, in which potential investors make a commitment to pay in the capital needed for the establishment of the fund (under the basic conditions stated in this presentation) < Set-up of the fund only with commitments of at least 5 mn US$ < < < These preliminary agreements are closed under the delaying condition that the initiators succeed in catching up commitments from different investors over a deposit of altogether at least 5 mn US$ until April 30 th, 2002. With a lower starting volume, the fixed cost of the fund structure would be in a misrelation to the business opportunities. Beyond that the investment policy of SOLON Art Fund which is aligned to diversification requires a certain minimum capitalization. < Reduced agio for initial investors < The initial investors are integrated actively into the set-up process of the fund and will < receive effective shares in relation to their deposit. Additionally to the deposited nominal < amount, an agio of 3, 25% of the total investment is due which is to be paid to the management company. This agio will be used for covering of the administrative expense. Investors, who enter the fund only after its establishment, will be charged with an agio of 5%, so that there is an additional incentive for early commitments. Investment 33

Ongoing Capital Acquisition & Valuation < Immediate start of investment activities < As soon as the legal structures are finished (this process usually takes about three weeks) < and the investors‘ fundings are paid in, the management company will immediately initiate < the investment activities of the fund. < Ongoing issue of shares (targeted fund volume: 50 mn US$) < The investment activity will be accompanied by a permanent placement of further fund < proportions, based on international management roadshows with institutional and private < investors. The issue of new fund shares takes place on the basis of the Net Asset Value < (NAV) stated in the last quarterly report, plus an agio of 5%. < Conservative NAV calculation < < < < The fund‘s Net Asset Value will be the sum of the asset positions, i. e. the cash money and the book value of artworks and equity investments. It is important to notice that the book value will never be more than the entrance price (plus transaction costs). The fund won‘t do any appreciations, an increase of the NAV only takes place when artworks are sold at a price which is higher than the book value or when the fund generates other income. As the fund will only show and report “real performance“, there will be no significant increase of the NAV during the first 12 months after the launch. < Audited quarterly reports Investment < Every quarterly reports and NAV calculations will be checked by an external auditor. The < fund‘s shareholders will periodically receive Income Statements and MDA‘s. 34

Ongoing Capital Acquisition & Valuation < Immediate start of investment activities < As soon as the legal structures are finished (this process usually takes about three weeks) < and the investors‘ fundings are paid in, the management company will immediately initiate < the investment activities of the fund. < Ongoing issue of shares (targeted fund volume: 50 mn US$) < The investment activity will be accompanied by a permanent placement of further fund < proportions, based on international management roadshows with institutional and private < investors. The issue of new fund shares takes place on the basis of the Net Asset Value < (NAV) stated in the last quarterly report, plus an agio of 5%. < Conservative NAV calculation < < < < The fund‘s Net Asset Value will be the sum of the asset positions, i. e. the cash money and the book value of artworks and equity investments. It is important to notice that the book value will never be more than the entrance price (plus transaction costs). The fund won‘t do any appreciations, an increase of the NAV only takes place when artworks are sold at a price which is higher than the book value or when the fund generates other income. As the fund will only show and report “real performance“, there will be no significant increase of the NAV during the first 12 months after the launch. < Audited quarterly reports Investment < Every quarterly reports and NAV calculations will be checked by an external auditor. The < fund‘s shareholders will periodically receive Income Statements and MDA‘s. 34

Profit Participation & Redemption of Shares < Accumulation of all yields < < < In order to strengthen the financial power of the fund – a substantial determinant of its economic success – also from inside out, no yield payments are intended. All yields will be accumulated and thus carry for an increase of the Net Asset Value. This means, that the an effective profit taking by the investor is only possible by selling shares of the fund or by redemption. < Investment makes sense only under long-term aspects < < < As already follows from the explanation of the asset management strategies of the fund, an investment into SOLON Art Fund only makes sense with a sufficiently long time horizon. This should be at least 7 years, since only after this time the results of all strategies flow into in the Net Asset Value. In order to underline this long-term aspect and to avoid loads of the fund‘s liquidity caused by potential discharges, the redemption of shares in the fund is impossible within the first three years after establishment of the fund. < Redemption will be possible quarterly (starting in the 4 th year) < < < Starting from the fourth year after establishment of the fund, the shares can be returned at their current Net Asset Value proportion. The redemption demand has to be announced By the investor three months in advance. For the case of possible discharges the fund will reproach an appropriate liquid reserve. During the three-year waiting period shares could be sold “over the counter“ to other prospective customers; under certain circumstances however also the possibility of a lending exists. Investment 35

Profit Participation & Redemption of Shares < Accumulation of all yields < < < In order to strengthen the financial power of the fund – a substantial determinant of its economic success – also from inside out, no yield payments are intended. All yields will be accumulated and thus carry for an increase of the Net Asset Value. This means, that the an effective profit taking by the investor is only possible by selling shares of the fund or by redemption. < Investment makes sense only under long-term aspects < < < As already follows from the explanation of the asset management strategies of the fund, an investment into SOLON Art Fund only makes sense with a sufficiently long time horizon. This should be at least 7 years, since only after this time the results of all strategies flow into in the Net Asset Value. In order to underline this long-term aspect and to avoid loads of the fund‘s liquidity caused by potential discharges, the redemption of shares in the fund is impossible within the first three years after establishment of the fund. < Redemption will be possible quarterly (starting in the 4 th year) < < < Starting from the fourth year after establishment of the fund, the shares can be returned at their current Net Asset Value proportion. The redemption demand has to be announced By the investor three months in advance. For the case of possible discharges the fund will reproach an appropriate liquid reserve. During the three-year waiting period shares could be sold “over the counter“ to other prospective customers; under certain circumstances however also the possibility of a lending exists. Investment 35

Management Remuneration & Subsequent Costs < Agio 5% (for initial investors 3, 25%) < Management fee 0, 5% per quarter (= 2% p. a. ) < < This fee represents the basic remuneration of the management company. At the end of each quarter, the management company will charge the fund with 0, 5% of the Net Asset Value as it is proven in the Income Statements. This remuneration takes place only if the fund was invested to at least 50% of the accumulated capital influxes at the deadline. < Performance fee 25% < Beyond that the management company receives a performance fee of 25% of the achieved < increase in value. This fee will also be charged quarterly. Basis for the calculation of the < performance fee is the increase of the Net Asset Value during the preceded quarter, settled over new capital influxes. < Costs of bookkeeping & audit: about 2% p. a. < At the end of each quarter, the fund will also have to pay the cost for the administration of < the fund company, the audit of the Income Statements and the determination of the Net < Asset Value. The exact amount depends on the business volume and the capitalization of < the fund; under normal corcumstances, these administrative cost should not exceed an < annual average of about 2% of the Net Asset Value however. Investment 36

Management Remuneration & Subsequent Costs < Agio 5% (for initial investors 3, 25%) < Management fee 0, 5% per quarter (= 2% p. a. ) < < This fee represents the basic remuneration of the management company. At the end of each quarter, the management company will charge the fund with 0, 5% of the Net Asset Value as it is proven in the Income Statements. This remuneration takes place only if the fund was invested to at least 50% of the accumulated capital influxes at the deadline. < Performance fee 25% < Beyond that the management company receives a performance fee of 25% of the achieved < increase in value. This fee will also be charged quarterly. Basis for the calculation of the < performance fee is the increase of the Net Asset Value during the preceded quarter, settled over new capital influxes. < Costs of bookkeeping & audit: about 2% p. a. < At the end of each quarter, the fund will also have to pay the cost for the administration of < the fund company, the audit of the Income Statements and the determination of the Net < Asset Value. The exact amount depends on the business volume and the capitalization of < the fund; under normal corcumstances, these administrative cost should not exceed an < annual average of about 2% of the Net Asset Value however. Investment 36

Terms & Conditions < Investment Target: SOLON Art Fund (unlimited trading and investment trust for artworks) < Type of Investment: Share purchase / co-foundation < Domicile: to be fixed < Fund Management: SOLON Art Fund Management, Ltd. < Minimum Investment: 500. 000 US$ plus 3, 25% Agio (initially) < Management Fee: 0, 5% p. q. plus 25% performance fee < Yield Payments: none (accumulation) < NAV Determination: quarterly (according to book values) < Redemption of Shares: quarterly (after 3 years)on NAV basis Investment 37

Terms & Conditions < Investment Target: SOLON Art Fund (unlimited trading and investment trust for artworks) < Type of Investment: Share purchase / co-foundation < Domicile: to be fixed < Fund Management: SOLON Art Fund Management, Ltd. < Minimum Investment: 500. 000 US$ plus 3, 25% Agio (initially) < Management Fee: 0, 5% p. q. plus 25% performance fee < Yield Payments: none (accumulation) < NAV Determination: quarterly (according to book values) < Redemption of Shares: quarterly (after 3 years)on NAV basis Investment 37

Disclaimer In accordance with the undisclosure agreement signed between the initiators of the SOLON Art Fund project (Reiner Opoku, Wolfgang Roth, Michael Poetter) and the recipient of this memorandum, the content of this documentation is to be treated strictly confidentially. Each offence against this obligation is civilly pursued. In all other respects it is pointed out that the use or utilization of this document for every other purpose than the purposes named in the undisclosure agreement represents an abusive use and possibly also a violation of the copyrights of the initiators. Moreover, the recipient should notice that the purpose of this memorandum is only the general information concerning the business idea presented herein. This memorandum does not represent a request to purchase or sell securities or equity investments. Exclusive and single basis for a potential capital commitments of the recipient in the SOLON Art Fund project is either an official offering circular or a detailed investment contract bet-ween the investor on the one hand the initiators or a legal entity created by them for this purpose on the other hand. If the recipient should have to accept losses caused by a capital commitment in the described project, any liability and responsibility of the initiators or a legal entity represented by them is categorically impossible as far as it refers to thi memorandum. Since the project described herein is still in the planning phase, all detail specifications and labels have a purely indicative character. All information after best knowledge and certainty, but without any guarantee. Investment 38

Disclaimer In accordance with the undisclosure agreement signed between the initiators of the SOLON Art Fund project (Reiner Opoku, Wolfgang Roth, Michael Poetter) and the recipient of this memorandum, the content of this documentation is to be treated strictly confidentially. Each offence against this obligation is civilly pursued. In all other respects it is pointed out that the use or utilization of this document for every other purpose than the purposes named in the undisclosure agreement represents an abusive use and possibly also a violation of the copyrights of the initiators. Moreover, the recipient should notice that the purpose of this memorandum is only the general information concerning the business idea presented herein. This memorandum does not represent a request to purchase or sell securities or equity investments. Exclusive and single basis for a potential capital commitments of the recipient in the SOLON Art Fund project is either an official offering circular or a detailed investment contract bet-ween the investor on the one hand the initiators or a legal entity created by them for this purpose on the other hand. If the recipient should have to accept losses caused by a capital commitment in the described project, any liability and responsibility of the initiators or a legal entity represented by them is categorically impossible as far as it refers to thi memorandum. Since the project described herein is still in the planning phase, all detail specifications and labels have a purely indicative character. All information after best knowledge and certainty, but without any guarantee. Investment 38

SOLON Art Fund Project c/0 Michael Poetter Uhlandstraße 175 D-10719 Berlin / Germany Tel. +49 (0)30 88 47 01 -0 Fax +49 (0)30 88 47 01 -13 e. Mail cobeho@aol. com 39

SOLON Art Fund Project c/0 Michael Poetter Uhlandstraße 175 D-10719 Berlin / Germany Tel. +49 (0)30 88 47 01 -0 Fax +49 (0)30 88 47 01 -13 e. Mail cobeho@aol. com 39