i 4: Where Philanthropy and For-Profit Investing in Israel Overlap to create sustainable social solutions Hila Dekel Michael Lustig November, 2015 1

i 4: Where Philanthropy and For-Profit Investing in Israel Overlap to create sustainable social solutions Hila Dekel Michael Lustig November, 2015 1

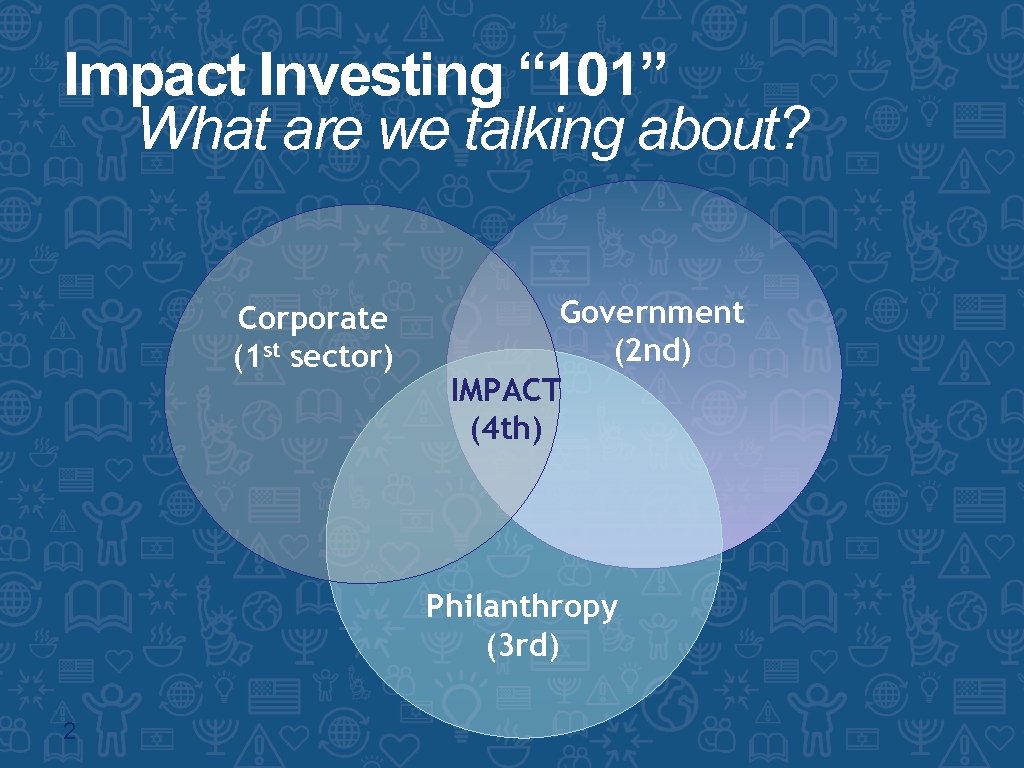

Impact Investing “ 101” What are we talking about? Corporate (1 st sector) Government (2 nd) IMPACT (4 th) Philanthropy (3 rd) 2

Impact Investing “ 101” What are we talking about? Corporate (1 st sector) Government (2 nd) IMPACT (4 th) Philanthropy (3 rd) 2

Example: Giga. Watt Global - Rwanda • Giga. Watt Global: Israel-Based Company • The Rwanda Project: 6% of the country’s power (8. 5 MW); only 15% of country is grid-connected • Economic (grid-parity) and Environmental impact • Social Impact: A piece of field revenue (pe’ah) covers the Medical expenses of an adjacent Youth Village (500 kids) for the next 25 years. 3

Example: Giga. Watt Global - Rwanda • Giga. Watt Global: Israel-Based Company • The Rwanda Project: 6% of the country’s power (8. 5 MW); only 15% of country is grid-connected • Economic (grid-parity) and Environmental impact • Social Impact: A piece of field revenue (pe’ah) covers the Medical expenses of an adjacent Youth Village (500 kids) for the next 25 years. 3

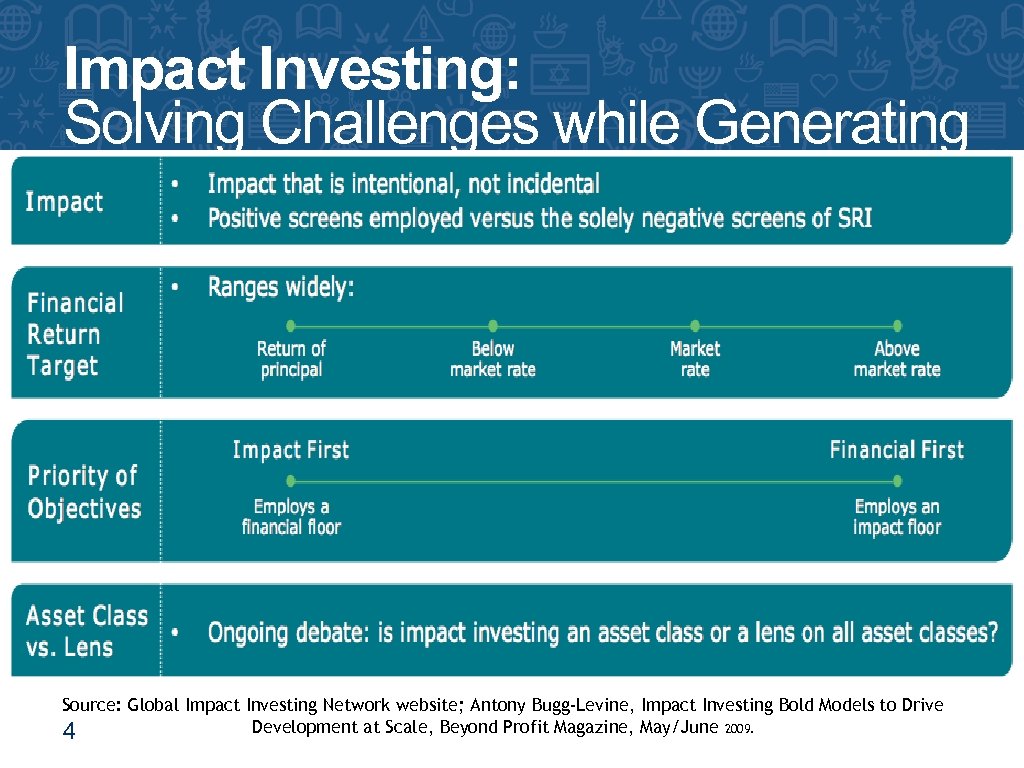

Impact Investing: Solving Challenges while Generating Profit • BULLET HEADER HERE • Bullet here • And here • No more than 5 lines please! • Let’s keep it clean. It forces clear thinking. • Cool? Great! Source: Global Impact Investing Network website; Antony Bugg-Levine, Impact Investing Bold Models to Drive Development at Scale, Beyond Profit Magazine, May/June 2009. 4

Impact Investing: Solving Challenges while Generating Profit • BULLET HEADER HERE • Bullet here • And here • No more than 5 lines please! • Let’s keep it clean. It forces clear thinking. • Cool? Great! Source: Global Impact Investing Network website; Antony Bugg-Levine, Impact Investing Bold Models to Drive Development at Scale, Beyond Profit Magazine, May/June 2009. 4

Creating the i 4 Committee • No pre-existing structure within UJAFederation of NY • Endowment - maximizing total return (no major concern for mission alignment) • Commissions – sole executors of mission related initiatives • i 4 as a cross-Commission initiative (Finance, allocating Commissions, FRD) 5

Creating the i 4 Committee • No pre-existing structure within UJAFederation of NY • Endowment - maximizing total return (no major concern for mission alignment) • Commissions – sole executors of mission related initiatives • i 4 as a cross-Commission initiative (Finance, allocating Commissions, FRD) 5

UJA-Federation’s first Impact Investment: The Yozma Fund • Tender Process from Government of Israel to create “social businesses” on issues of: Youth-at-risk Special needs Recovering addicts Released convicts Chronically unemployed Elderly Single parents 6

UJA-Federation’s first Impact Investment: The Yozma Fund • Tender Process from Government of Israel to create “social businesses” on issues of: Youth-at-risk Special needs Recovering addicts Released convicts Chronically unemployed Elderly Single parents 6

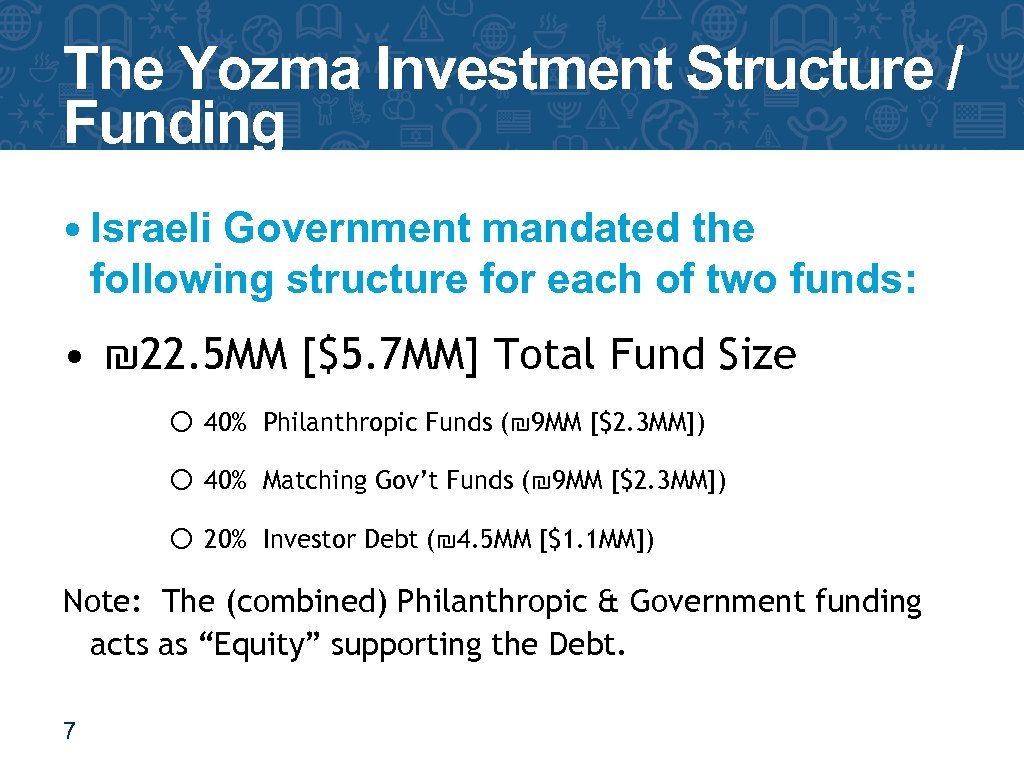

The Yozma Investment Structure / Funding • Israeli Government mandated the following structure for each of two funds: • ₪ 22. 5 MM [$5. 7 MM] Total Fund Size o 40% Philanthropic Funds (₪ 9 MM [$2. 3 MM]) o 40% Matching Gov’t Funds (₪ 9 MM [$2. 3 MM]) o 20% Investor Debt (₪ 4. 5 MM [$1. 1 MM]) Note: The (combined) Philanthropic & Government funding acts as “Equity” supporting the Debt. 7

The Yozma Investment Structure / Funding • Israeli Government mandated the following structure for each of two funds: • ₪ 22. 5 MM [$5. 7 MM] Total Fund Size o 40% Philanthropic Funds (₪ 9 MM [$2. 3 MM]) o 40% Matching Gov’t Funds (₪ 9 MM [$2. 3 MM]) o 20% Investor Debt (₪ 4. 5 MM [$1. 1 MM]) Note: The (combined) Philanthropic & Government funding acts as “Equity” supporting the Debt. 7

Existing Businesses of IVN & Dualis 8

Existing Businesses of IVN & Dualis 8

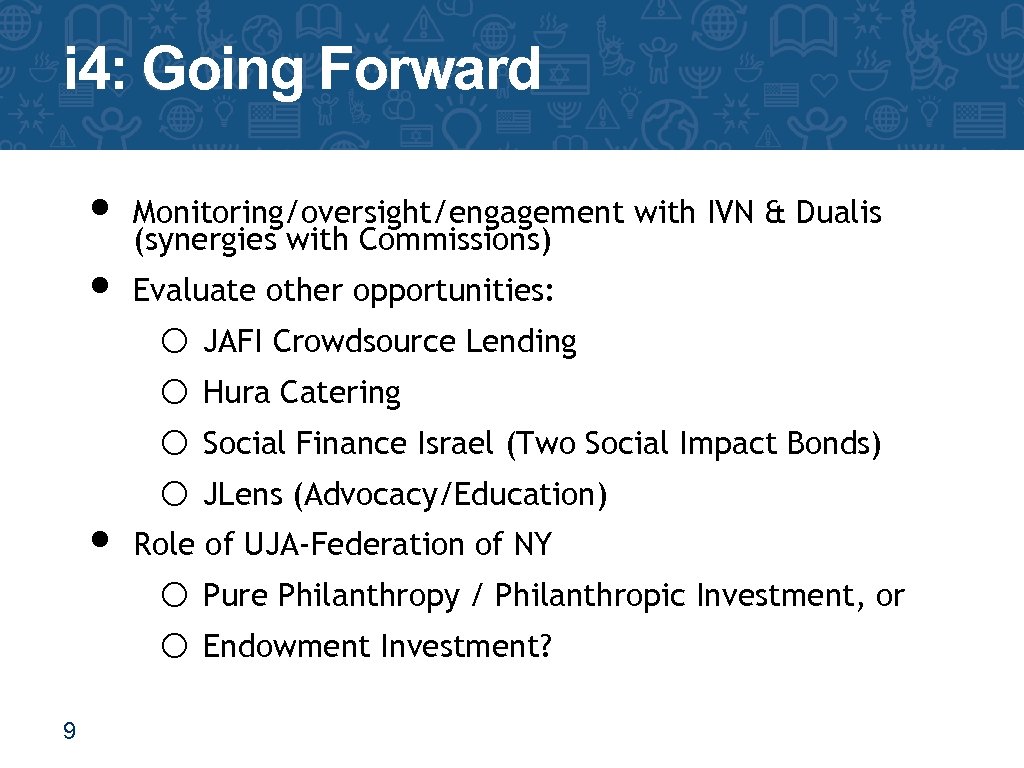

i 4: Going Forward • • • 9 Monitoring/oversight/engagement with IVN & Dualis (synergies with Commissions) Evaluate other opportunities: o JAFI Crowdsource Lending o Hura Catering o Social Finance Israel (Two Social Impact Bonds) o JLens (Advocacy/Education) Role of UJA-Federation of NY o Pure Philanthropy / Philanthropic Investment, or o Endowment Investment?

i 4: Going Forward • • • 9 Monitoring/oversight/engagement with IVN & Dualis (synergies with Commissions) Evaluate other opportunities: o JAFI Crowdsource Lending o Hura Catering o Social Finance Israel (Two Social Impact Bonds) o JLens (Advocacy/Education) Role of UJA-Federation of NY o Pure Philanthropy / Philanthropic Investment, or o Endowment Investment?

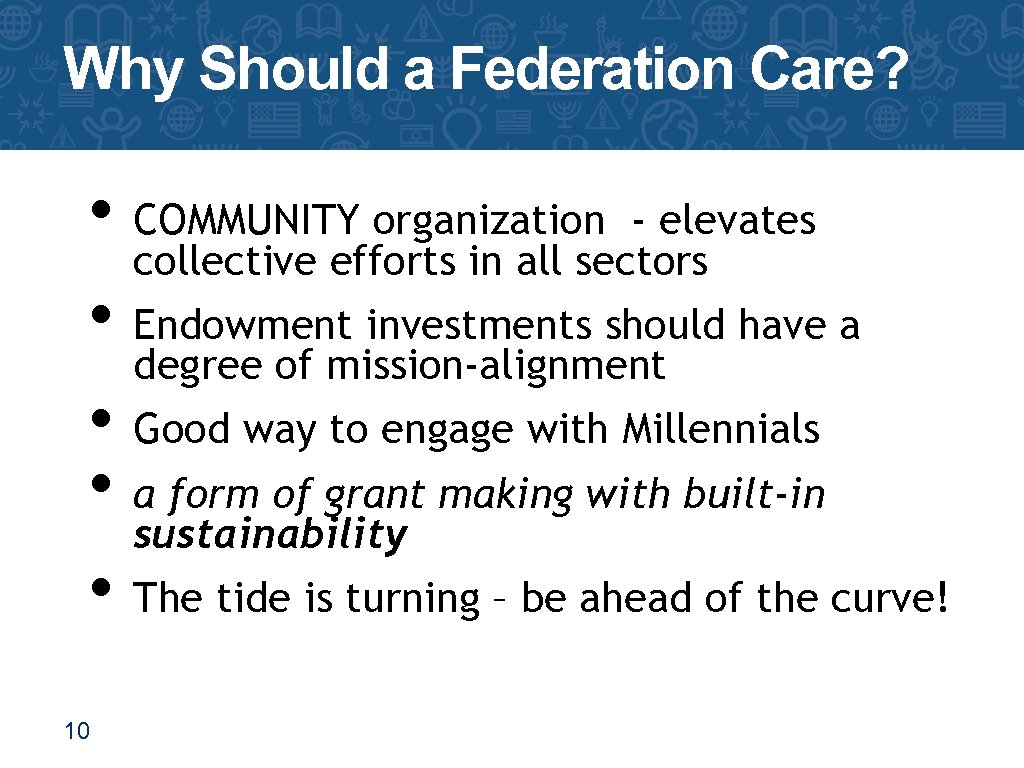

Why Should a Federation Care? • COMMUNITY organization - elevates collective efforts in all sectors • Endowment investments should have a degree of mission-alignment • Good way to engage with Millennials • a form of grant making with built-in sustainability • The tide is turning – be ahead of the curve! 10

Why Should a Federation Care? • COMMUNITY organization - elevates collective efforts in all sectors • Endowment investments should have a degree of mission-alignment • Good way to engage with Millennials • a form of grant making with built-in sustainability • The tide is turning – be ahead of the curve! 10