29e6bfb65b12f32ab7416aa3094685b3.ppt

- Количество слайдов: 34

Hypercompetition Hypercompetitive Rivalries Richard D’Aveni and Robert Gunther

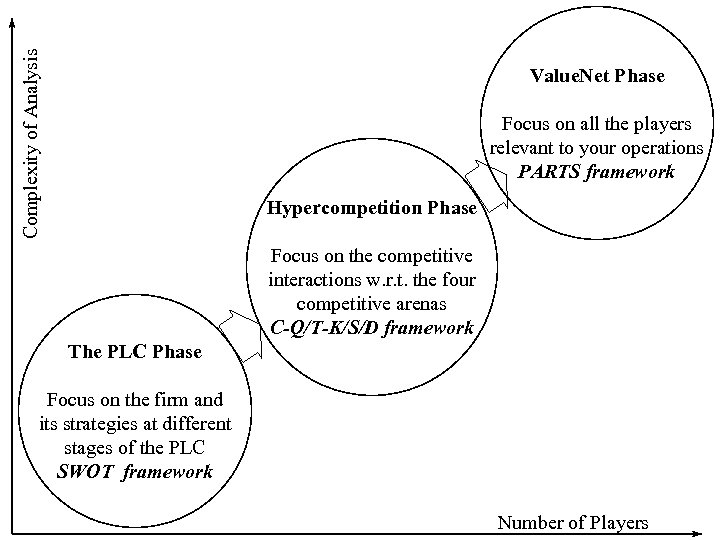

Complexity of Analysis Value. Net Phase Focus on all the players relevant to your operations PARTS framework Hypercompetition Phase Focus on the competitive interactions w. r. t. the four competitive arenas C-Q/T-K/S/D framework The PLC Phase Focus on the firm and its strategies at different stages of the PLC SWOT framework Number of Players

Limitations of traditional view A key limitation of all the above strategies is that it ignores the dynamics of competition in the marketplace. While the issue of foremost importance for the company is the customer, D’Aveni notes that competitive interaction among firms typically goes through six stages

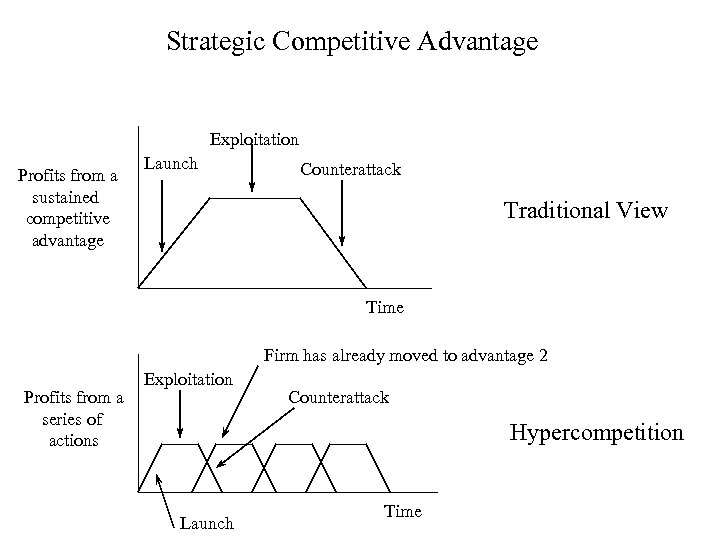

Strategic Competitive Advantage Exploitation Profits from a sustained competitive advantage Launch Counterattack Traditional View Time Firm has already moved to advantage 2 Profits from a series of actions Exploitation Counterattack Hypercompetition Launch Time

DEC • DEC in minicomputers. The company posted a 31% average growth rate from 1977 to 1982 by focusing on the minicomputer. The company clung so tenaciously to its advantage in minicomputer technology that it failed to develop a strong position in the emerging markets for minicomputers and PCs. As CEO Ken Olsen commented in 1984 (Businessweek), “We had 6 PCs in-house that we could have launched in the late 70 s. But we were selling so many (VAX minis), it would have been immoral to chase a new market. ”

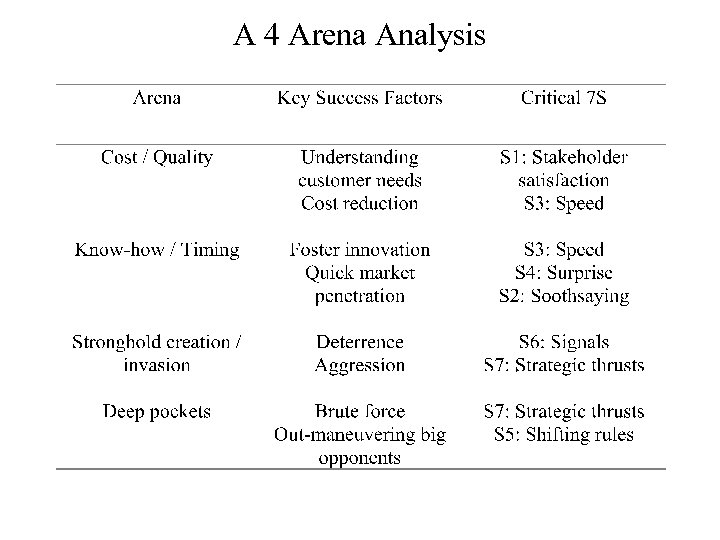

Hypercompetition Four arenas of competition • Cost & Quality (C-Q) • Timing and know-how (T-K) • Strongholds (S) • Deep pockets (D)

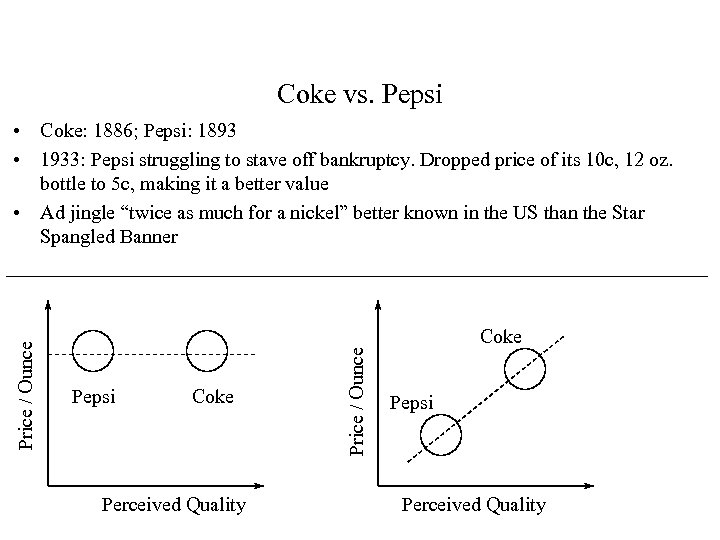

Coke vs. Pepsi Coke Perceived Quality Price / Ounce • Coke: 1886; Pepsi: 1893 • 1933: Pepsi struggling to stave off bankruptcy. Dropped price of its 10 c, 12 oz. bottle to 5 c, making it a better value • Ad jingle “twice as much for a nickel” better known in the US than the Star Spangled Banner Coke Pepsi Perceived Quality

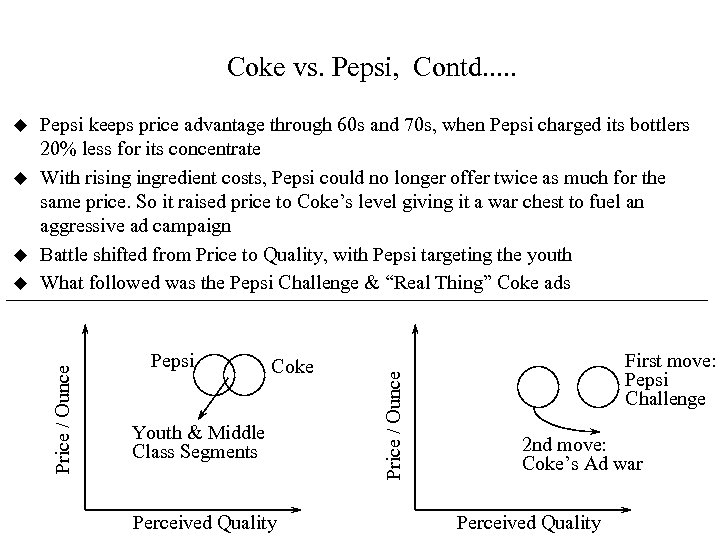

Coke vs. Pepsi, Contd. . . u u Pepsi Coke Youth & Middle Class Segments Perceived Quality Price / Ounce u Pepsi keeps price advantage through 60 s and 70 s, when Pepsi charged its bottlers 20% less for its concentrate With rising ingredient costs, Pepsi could no longer offer twice as much for the same price. So it raised price to Coke’s level giving it a war chest to fuel an aggressive ad campaign Battle shifted from Price to Quality, with Pepsi targeting the youth What followed was the Pepsi Challenge & “Real Thing” Coke ads Price / Ounce u First move: Pepsi Challenge 2 nd move: Coke’s Ad war Perceived Quality

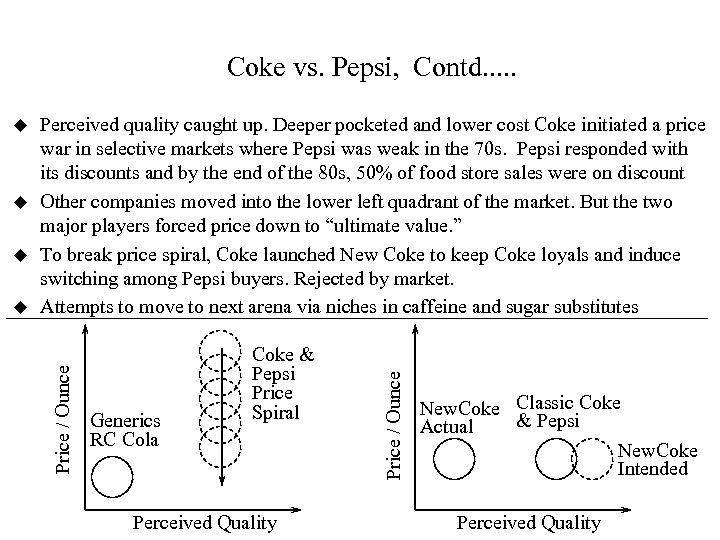

Coke vs. Pepsi, Contd. . . u u Generics RC Cola Coke & Pepsi Price Spiral Perceived Quality Price / Ounce u Perceived quality caught up. Deeper pocketed and lower cost Coke initiated a price war in selective markets where Pepsi was weak in the 70 s. Pepsi responded with its discounts and by the end of the 80 s, 50% of food store sales were on discount Other companies moved into the lower left quadrant of the market. But the two major players forced price down to “ultimate value. ” To break price spiral, Coke launched New Coke to keep Coke loyals and induce switching among Pepsi buyers. Rejected by market. Attempts to move to next arena via niches in caffeine and sugar substitutes Price / Ounce u New. Coke Classic Coke & Pepsi Actual New. Coke Intended Perceived Quality

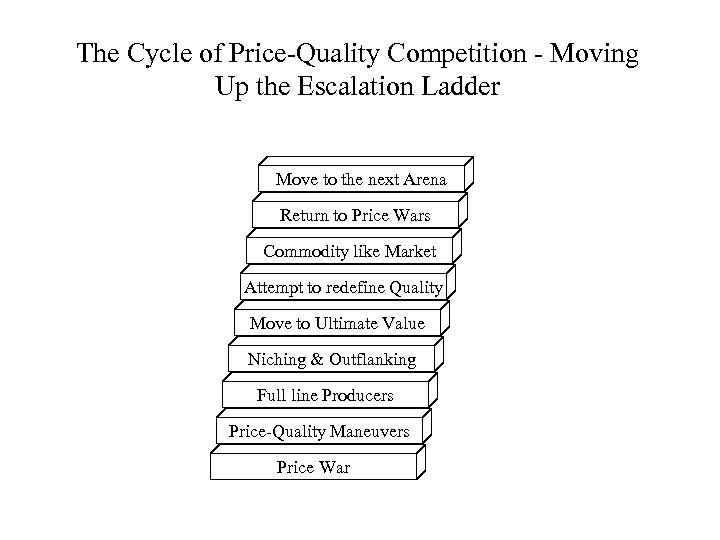

The Cycle of Price-Quality Competition - Moving Up the Escalation Ladder Move to the next Arena Return to Price Wars Commodity like Market Attempt to redefine Quality Move to Ultimate Value Niching & Outflanking Full line Producers Price-Quality Maneuvers Price War

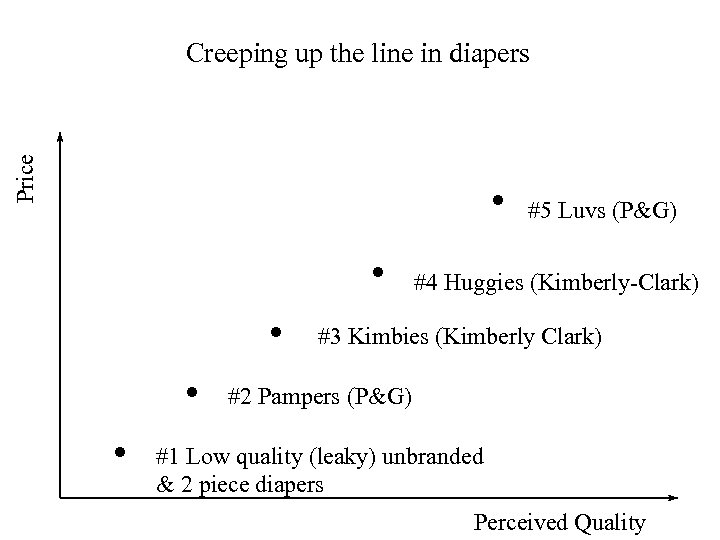

Price Creeping up the line in diapers . . . #5 Luvs (P&G) #4 Huggies (Kimberly-Clark) #3 Kimbies (Kimberly Clark) #2 Pampers (P&G) #1 Low quality (leaky) unbranded & 2 piece diapers Perceived Quality

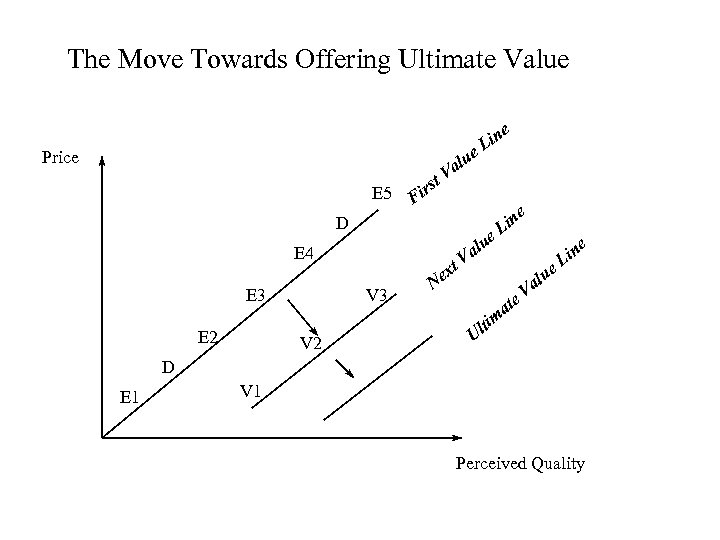

The Move Towards Offering Ultimate Value e e Price E 5 alu V t irs F e D E 4 E 3 E 2 V 3 V 2 n Li N t ex e lu a n Li e V ate m lti U alu e n Li V D E 1 V 1 Perceived Quality

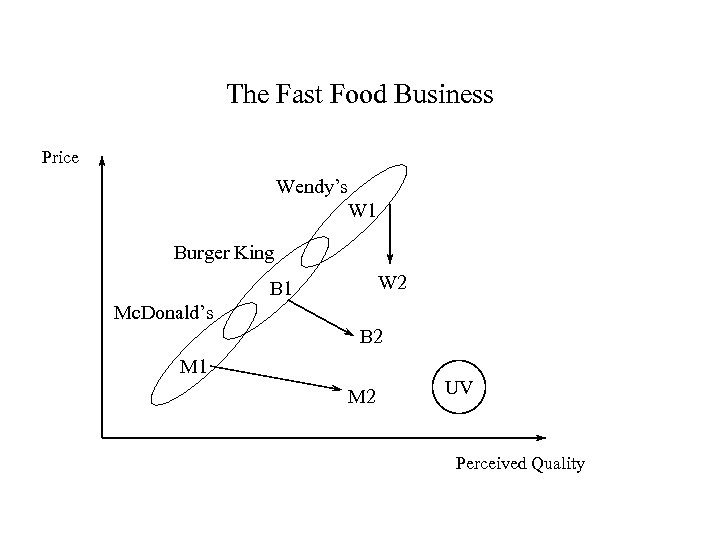

The Fast Food Business Price Wendy’s W 1 Burger King W 2 B 1 Mc. Donald’s B 2 M 1 M 2 UV Perceived Quality

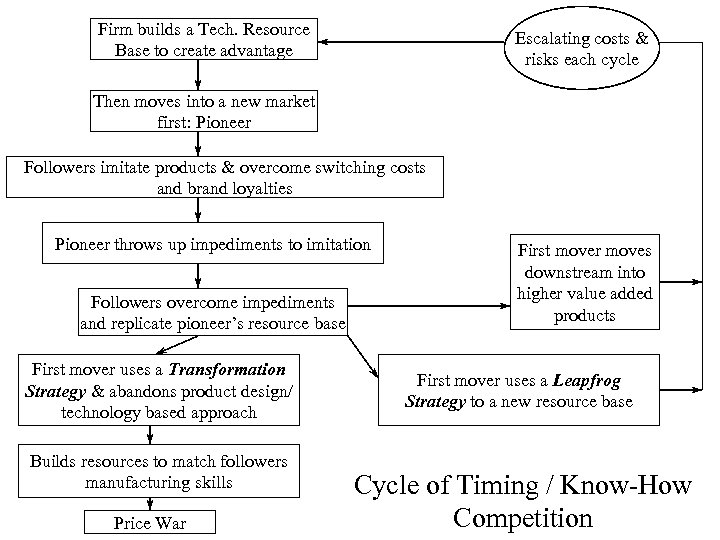

Firm builds a Tech. Resource Base to create advantage Escalating costs & risks each cycle Then moves into a new market first: Pioneer Followers imitate products & overcome switching costs and brand loyalties Pioneer throws up impediments to imitation Followers overcome impediments and replicate pioneer’s resource base First mover uses a Transformation Strategy & abandons product design/ technology based approach Builds resources to match followers manufacturing skills Price War First mover moves downstream into higher value added products First mover uses a Leapfrog Strategy to a new resource base Cycle of Timing / Know-How Competition

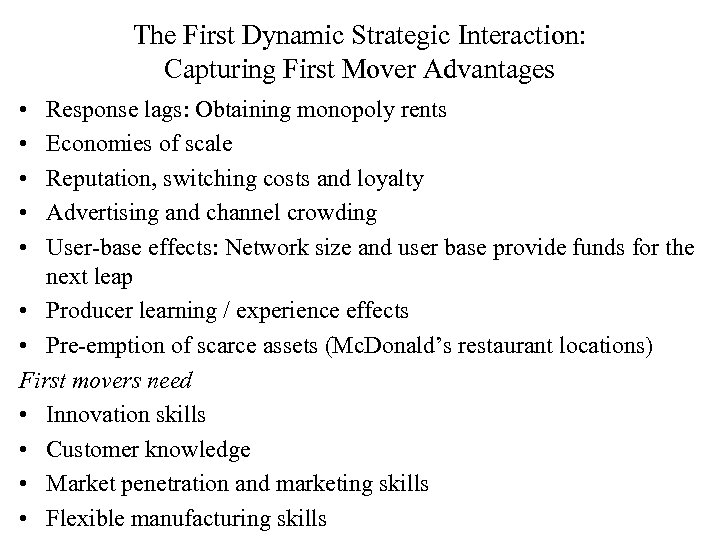

The First Dynamic Strategic Interaction: Capturing First Mover Advantages • • • Response lags: Obtaining monopoly rents Economies of scale Reputation, switching costs and loyalty Advertising and channel crowding User-base effects: Network size and user base provide funds for the next leap • Producer learning / experience effects • Pre-emption of scarce assets (Mc. Donald’s restaurant locations) First movers need • Innovation skills • Customer knowledge • Market penetration and marketing skills • Flexible manufacturing skills

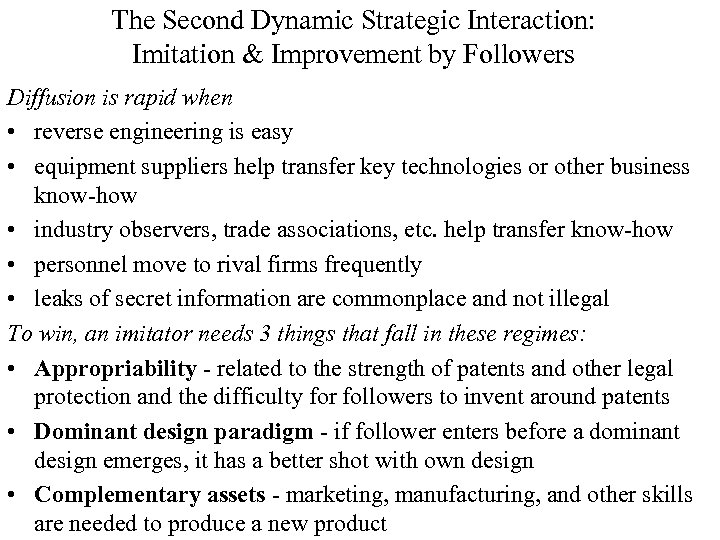

The Second Dynamic Strategic Interaction: Imitation & Improvement by Followers Diffusion is rapid when • reverse engineering is easy • equipment suppliers help transfer key technologies or other business know-how • industry observers, trade associations, etc. help transfer know-how • personnel move to rival firms frequently • leaks of secret information are commonplace and not illegal To win, an imitator needs 3 things that fall in these regimes: • Appropriability - related to the strength of patents and other legal protection and the difficulty for followers to invent around patents • Dominant design paradigm - if follower enters before a dominant design emerges, it has a better shot with own design • Complementary assets - marketing, manufacturing, and other skills are needed to produce a new product

The Second Dynamic Strategic Interaction: Imitation & Improvement by Followers Follower strategies work best when the first mover is unable to keep up with demand (Adidas & Nike - no fortressing), is not satisfying all segments of consumers or all varieties of needs ( flanking) or has a design flaw that can be corrected (aspirin vs. buffered aspirin) • Pure imitation strategy • Adding bells & whistles • P&G - Crest (basic toothpaste); Lever - Close. Up (+freshen breath and whiten teeth) and Aim (gel + fluoride protection); Beecham - Aqua. Fresh (fights cavities + freshens breath + whitens teeth) • Stripping down: Niche airlines • Flanking products • Reconceptualized products: Mobike from inexpensive transport to vehicle for fun and recreation to a status symbol • Risk reduction: warranties, free samples, etc. • Compatible products

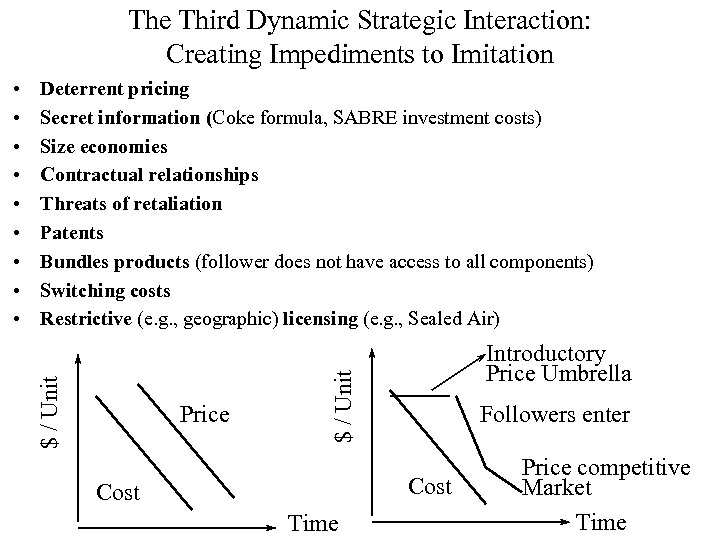

The Third Dynamic Strategic Interaction: Creating Impediments to Imitation Deterrent pricing Secret information (Coke formula, SABRE investment costs) Size economies Contractual relationships Threats of retaliation Patents Bundles products (follower does not have access to all components) Switching costs Restrictive (e. g. , geographic) licensing (e. g. , Sealed Air) Price Introductory Price Umbrella $ / Unit • • • Followers enter Cost Time Price competitive Market Time

The Fourth Dynamic Strategic Interaction: Overcoming the Impediments • Deterrent pricing: No problem if the follower is resource rich; Process innovations • Secret information: Reverse engineering, experimentation (private label colas) • Size economies: Process innovations; build scale in one geographic area and expand (Japanese auto builders); No problem if growth exceeds first mover’s capacity • Contractual relationships: New supplier, vertical integration • Threats of retaliation: Some may not be credible if innovator also loses • Patents: Increase imitation costs only by 11% • Bundled products: Joint ventures, vertical integration • Switching costs: Advertising, promotions, etc. ; may make market more attractive as follower can reap the benefits once in

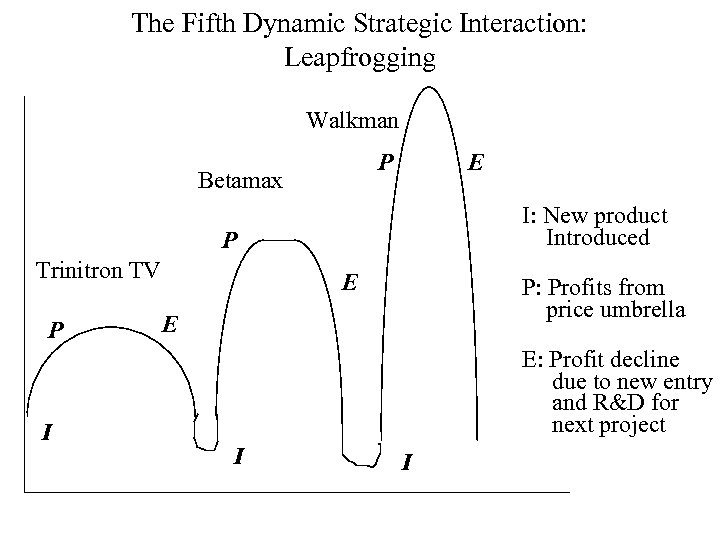

The Fifth Dynamic Strategic Interaction: Transformation or Leapfrogging • Transformation strategy • Compaq - from a premium priced innovator to a low cost manufacturer • Leapfrogging strategy • Cyrix introduced the 486 clone in 18 months, compared to the standard 3 to 4 year industry cycle. And produced it at 4% of Intel’s initial investment. For a while also hoped to leapfrog Intel • P&G and Ultra thin diapers in Japan • Mc. Donald’s leapfrogged over competition by reconceptualizing itself as a restaurant - not just a place for burgers

The Fifth Dynamic Strategic Interaction: Leapfrogging Walkman P Betamax E I: New product Introduced P Trinitron TV P I E P: Profits from price umbrella E E: Profit decline due to new entry and R&D for next project I I

The Sixth Dynamic Strategic Interaction: Downstream Vertical Integration • Sony entered the software side of the entertainment business with Columbia Pictures - but imitated by Matsushita • Intel and motherboards • Problem is that it ties up resources that could fruitfully be committed to building the company’s core businesses

Strongholds and Entry Barriers Maxwell house was dominant in the East Coast market and Folgers was strong in the West Coast. After being acquired by P&G, Folgers entered the Cleveland market to increase its eastern penetration. Maxwell countered by attacking Folgers’ stronghold; lowering prices and increasing ad expenditures in Kansas city. Maxwell also introduced a “fighting brand” called Horizon which was similar to Folgers in taste and in packaging. Folgers then escalated by entering Pittsburgh. Maxwell responded by entering Dallas with reduced prices. The battle continued until the market was no longer two coastal segments but one national battleground

Strongholds and Entry Barriers BIC revolutionized the disposable ballpoint pen with its mass merchandising skills Gillette entered the market for disposable pens (Paper. Mate), overcoming entry barriers (access to distribution channels, economies of scale in advertising, brand equity, etc. ) by using its own considerable skills in mass merchandising. So BIC counter- attacked by entering Gillette’s stronghold, disposable razors - giving rise to multi -market competition.

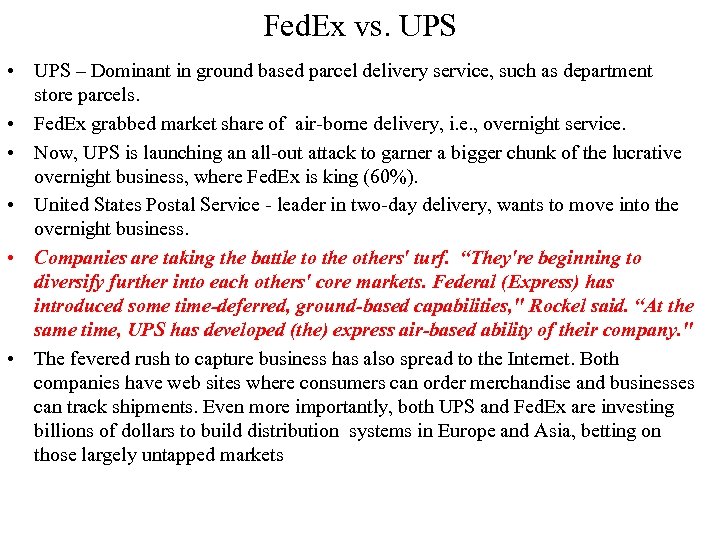

Fed. Ex vs. UPS • UPS – Dominant in ground based parcel delivery service, such as department store parcels. • Fed. Ex grabbed market share of air-borne delivery, i. e. , overnight service. • Now, UPS is launching an all-out attack to garner a bigger chunk of the lucrative overnight business, where Fed. Ex is king (60%). • United States Postal Service - leader in two-day delivery, wants to move into the overnight business. • Companies are taking the battle to the others' turf. “They're beginning to diversify further into each others' core markets. Federal (Express) has introduced some time-deferred, ground-based capabilities, " Rockel said. “At the same time, UPS has developed (the) express air-based ability of their company. " • The fevered rush to capture business has also spread to the Internet. Both companies have web sites where consumers can order merchandise and businesses can track shipments. Even more importantly, both UPS and Fed. Ex are investing billions of dollars to build distribution systems in Europe and Asia, betting on those largely untapped markets

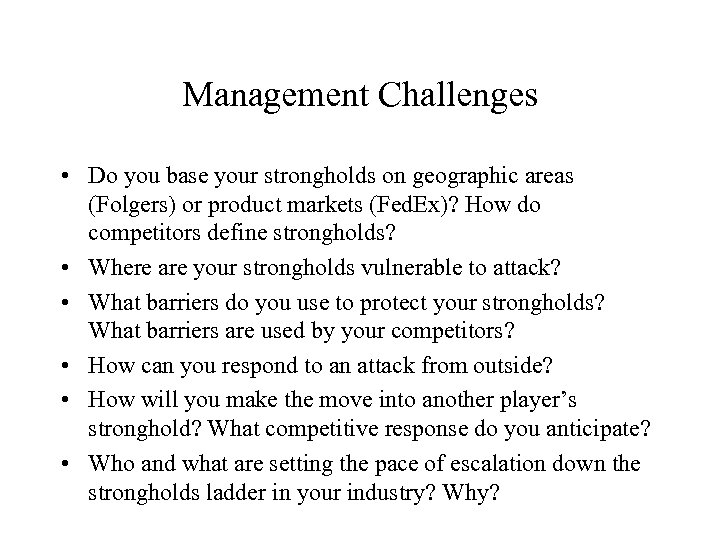

Management Challenges • Do you base your strongholds on geographic areas (Folgers) or product markets (Fed. Ex)? How do competitors define strongholds? • Where are your strongholds vulnerable to attack? • What barriers do you use to protect your strongholds? What barriers are used by your competitors? • How can you respond to an attack from outside? • How will you make the move into another player’s stronghold? What competitive response do you anticipate? • Who and what are setting the pace of escalation down the strongholds ladder in your industry? Why?

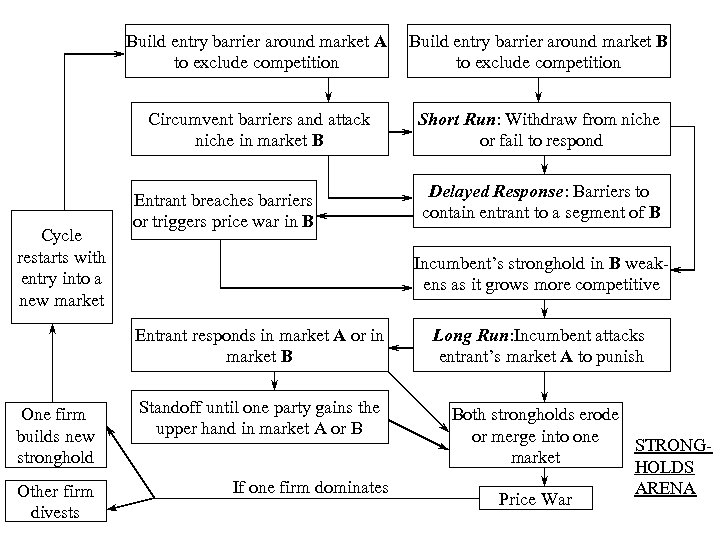

Build entry barrier around market A to exclude competition Circumvent barriers and attack niche in market B Cycle restarts with entry into a new market Build entry barrier around market B to exclude competition Short Run: Withdraw from niche or fail to respond Entrant breaches barriers or triggers price war in B Incumbent’s stronghold in B weakens as it grows more competitive Entrant responds in market A or in market B One firm builds new stronghold Other firm divests Delayed Response: Barriers to contain entrant to a segment of B Standoff until one party gains the upper hand in market A or B If one firm dominates Long Run: Incumbent attacks entrant’s market A to punish Both strongholds erode or merge into one STRONGmarket HOLDS ARENA Price War

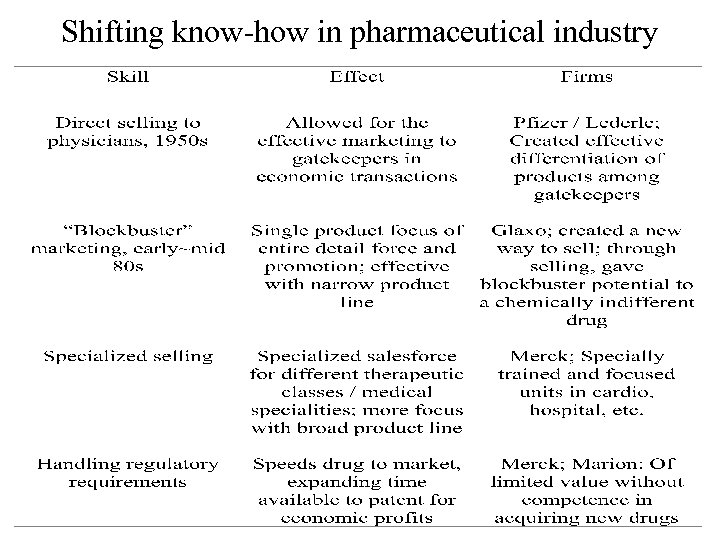

Shifting know-how in pharmaceutical industry

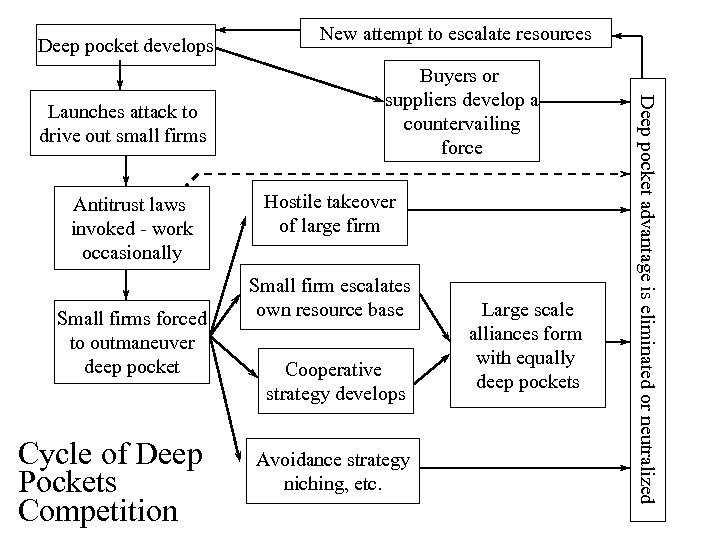

Deep pocket develops Antitrust laws invoked - work occasionally Small firms forced to outmaneuver deep pocket Cycle of Deep Pockets Competition Buyers or suppliers develop a countervailing force Hostile takeover of large firm Small firm escalates own resource base Cooperative strategy develops Avoidance strategy niching, etc. Large scale alliances form with equally deep pockets Deep pocket advantage is eliminated or neutralized Launches attack to drive out small firms New attempt to escalate resources

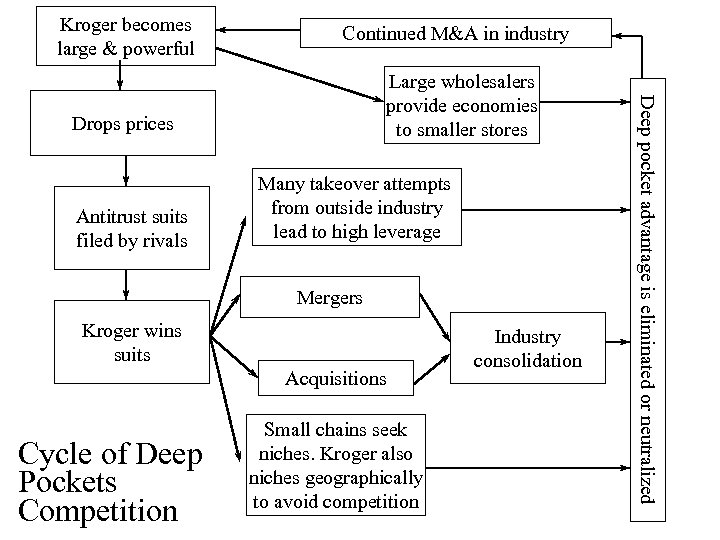

Kroger becomes large & powerful Continued M&A in industry Drops prices Antitrust suits filed by rivals Many takeover attempts from outside industry lead to high leverage Mergers Kroger wins suits Acquisitions Cycle of Deep Pockets Competition Small chains seek niches. Kroger also niches geographically to avoid competition Industry consolidation Deep pocket advantage is eliminated or neutralized Large wholesalers provide economies to smaller stores

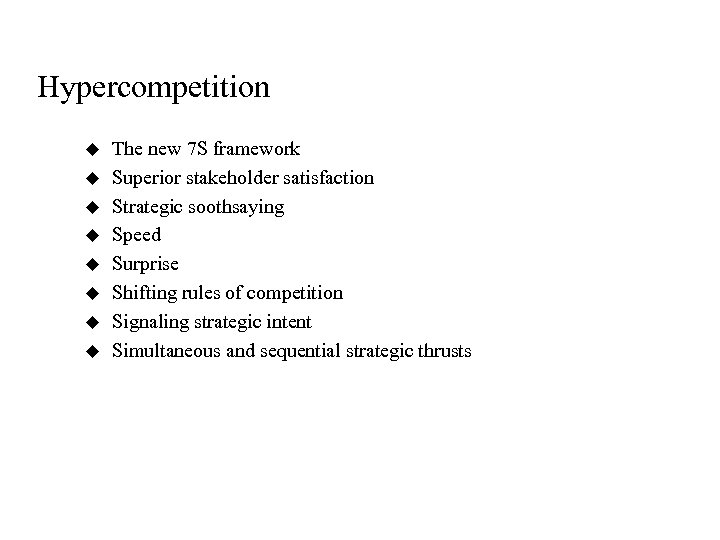

Hypercompetition u u u u The new 7 S framework Superior stakeholder satisfaction Strategic soothsaying Speed Surprise Shifting rules of competition Signaling strategic intent Simultaneous and sequential strategic thrusts

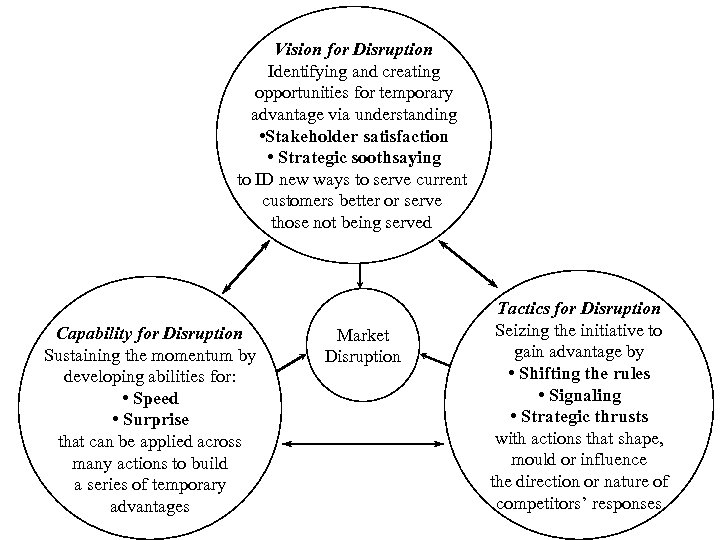

Vision for Disruption Identifying and creating opportunities for temporary advantage via understanding • Stakeholder satisfaction • Strategic soothsaying to ID new ways to serve current customers better or serve those not being served Capability for Disruption Sustaining the momentum by developing abilities for: • Speed • Surprise that can be applied across many actions to build a series of temporary advantages Market Disruption Tactics for Disruption Seizing the initiative to gain advantage by • Shifting the rules • Signaling • Strategic thrusts with actions that shape, mould or influence the direction or nature of competitors’ responses

A 4 Arena Analysis

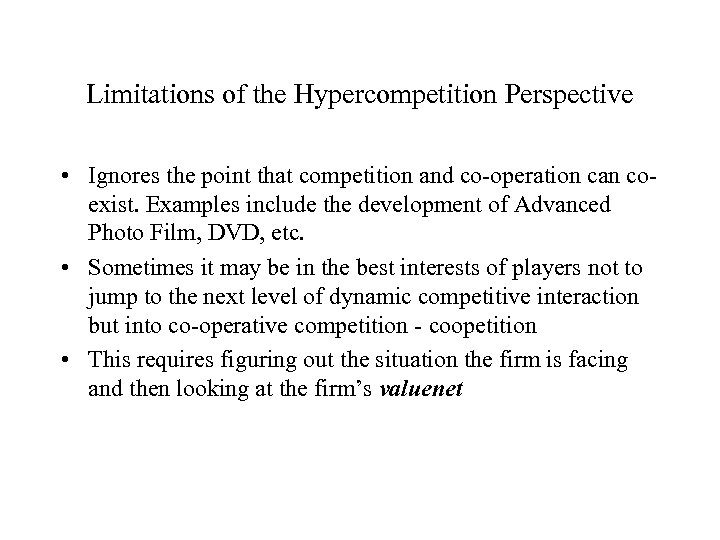

Limitations of the Hypercompetition Perspective • Ignores the point that competition and co-operation can coexist. Examples include the development of Advanced Photo Film, DVD, etc. • Sometimes it may be in the best interests of players not to jump to the next level of dynamic competitive interaction but into co-operative competition - coopetition • This requires figuring out the situation the firm is facing and then looking at the firm’s valuenet

29e6bfb65b12f32ab7416aa3094685b3.ppt