3a3b593c621efda7563249a1c7ac54a6.ppt

- Количество слайдов: 61

Hungry for Business Growth? Manage your strategic risks and facilitate success SRM 003 By Martin Berthiaume, risk manager Amy Hutchens, compliance officer Recording of this session via any media type is strictly prohibited. Page 1

• Martin Berthiaume Director general, Telus security solution, M. Berthiaume owns a bachelor’s degree in actuarial science and has worked in information technology and in risk management for the benefit of different major Canadian businesses such as Bell Canada, Taleo (AKA Recruitsoft) and many significant Canadian insurance companies. Leading Enode as its funder and CEO for ten years, he brought to the market the GRC solution Sherpa and provided its customers with consulting services at the enterprise level and in information security and technology. In april 2014, Telus acquired Enode, since then M. Berthiaume is now part of the Telus security solution management team where he helps managers understand the importance of communicating and managing risk efficiently as a key factor to insure business sustainability, making it possible to grow the organisation’s appetite for risk. TELUS (TSX: T, NYSE: TU) is Canada’s fastest-growing national telecommunications company, with $11. 4 billion in annual revenue and 13. 3 million customer connections, including 7. 8 million wireless subscribers. Recording of this session via any media type is strictly prohibited. Page 2

• Amy E. Hutchens, JD, CCEP President, CLEAResources. com Ms. Hutchens is certified CCEP and currently serves as President of CLEAResources, LLC, which serves as a corporate resource for Compliance, Legal, Ethics, and Risk. She has developed, implemented, and managed all aspects of compliance programs including assessing risk, drafting policies, training employees, developing codes of conduct, and establishing monitoring and investigative protocols to maximize value and effectiveness in compliance and ethics programs. Recording of this session via any media type is strictly prohibited. Page 3

What to Expect This session will highlight the value of taking strategic risks in order to win the game. • Attendees will understand the importance of mapping business environment and business skills • Attendees will be able to differentiate between risk avoidance and opportunity reward • Attendees should aspire to deploy an enterprise risk strategy that will not promote fear but rather aim for new opportunity, value generation AND risk mitigation. Recording of this session via any media type is strictly prohibited. Page 4

Presentation Plan • Analogy: Driven to Win • Covering the basis • Applied risk analysis and the Ethics of Business Risks • Looking at risk through your strategic objectives • Performing your risk assessment • Take aways Martin Berthiaume Amy E. Hutchens Martin Berthiaume Recording of this session via any media type is strictly prohibited. Page 5

Driven to WIN Recording of this session via any media type is strictly prohibited. Page 6

Recording of this session via any media type is strictly prohibited. Page 7

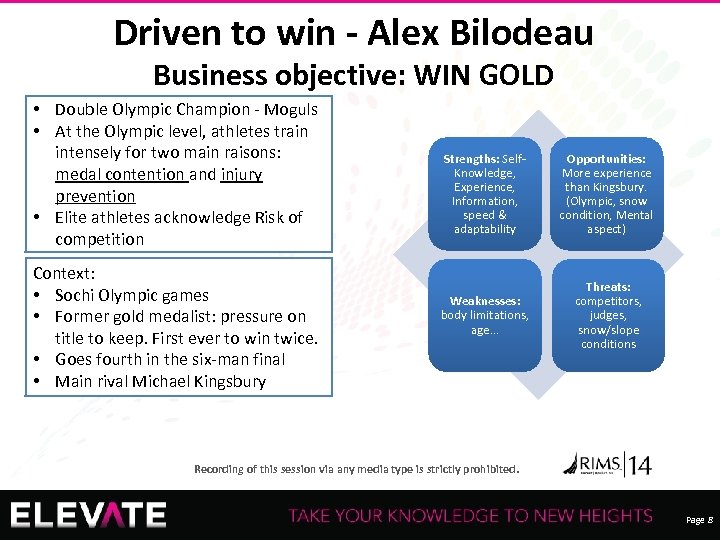

Driven to win - Alex Bilodeau Business objective: WIN GOLD • Double Olympic Champion - Moguls • At the Olympic level, athletes train intensely for two main raisons: medal contention and injury prevention • Elite athletes acknowledge Risk of competition Context: • Sochi Olympic games • Former gold medalist: pressure on title to keep. First ever to win twice. • Goes fourth in the six-man final • Main rival Michael Kingsbury Strengths: Self. Knowledge, Experience, Information, speed & adaptability Opportunities: More experience than Kingsbury. (Olympic, snow condition, Mental aspect) Weaknesses: body limitations, age… Threats: competitors, judges, snow/slope conditions Recording of this session via any media type is strictly prohibited. Page 8

Success and risk work together Success Risk Recording of this session via any media type is strictly prohibited. Page 9

Covering the basis Definitions Recording of this session via any media type is strictly prohibited. Page 10

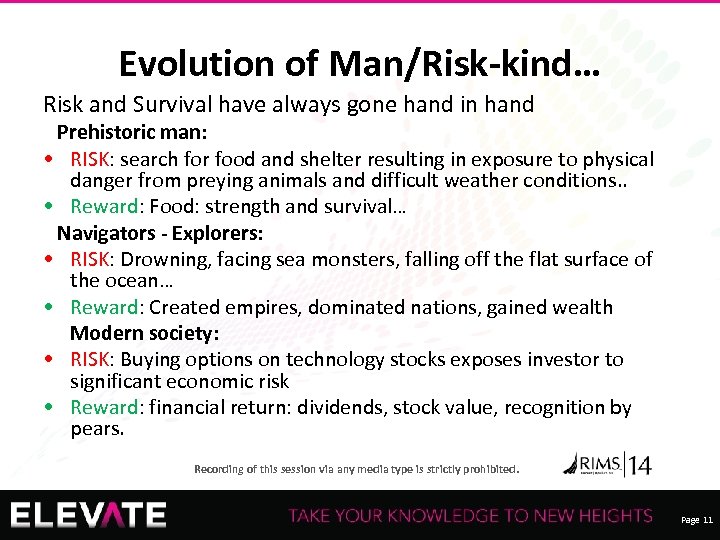

Evolution of Man/Risk-kind… Risk and Survival have always gone hand in hand Prehistoric man: • RISK: search for food and shelter resulting in exposure to physical danger from preying animals and difficult weather conditions. . • Reward: Food: strength and survival… Navigators - Explorers: • RISK: Drowning, facing sea monsters, falling off the flat surface of the ocean… • Reward: Created empires, dominated nations, gained wealth Modern society: • RISK: Buying options on technology stocks exposes investor to significant economic risk • Reward: financial return: dividends, stock value, recognition by pears. Recording of this session via any media type is strictly prohibited. Page 11

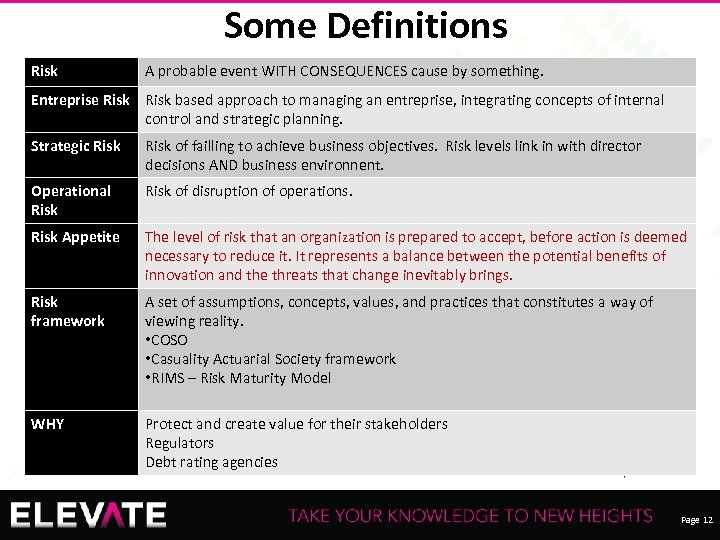

Some Definitions Risk A probable event WITH CONSEQUENCES cause by something. Entreprise Risk based approach to managing an entreprise, integrating concepts of internal control and strategic planning. Strategic Risk of failling to achieve business objectives. Risk levels link in with director decisions AND business environnent. Operational Risk of disruption of operations. Risk Appetite The level of risk that an organization is prepared to accept, before action is deemed necessary to reduce it. It represents a balance between the potential benefits of innovation and the threats that change inevitably brings. Risk framework A set of assumptions, concepts, values, and practices that constitutes a way of viewing reality. • COSO • Casuality Actuarial Society framework • RIMS – Risk Maturity Model WHY Protect and create value for their stakeholders Regulators Debt rating agencies Recording of this session via any media type is strictly prohibited. Page 12

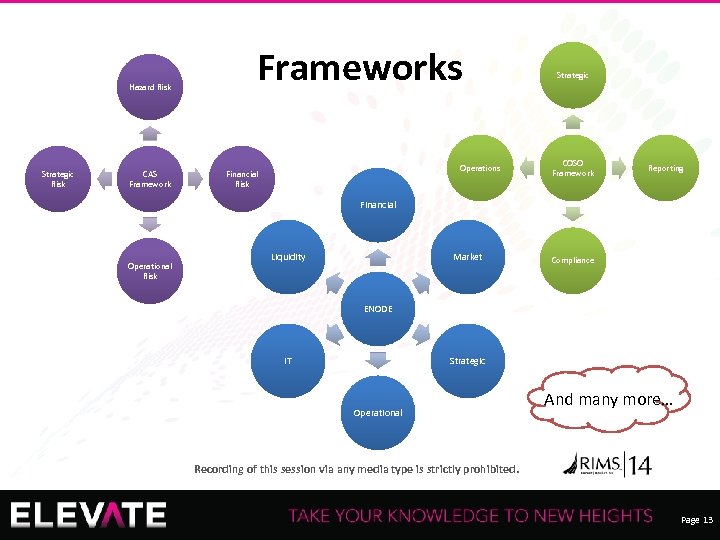

Hazard Risk Strategic Risk CAS Frameworks Operations Financial Risk Strategic COSO Framework Reporting Financial Operational Risk Liquidity Market Compliance ENODE IT Strategic Operational And many more… Recording of this session via any media type is strictly prohibited. Page 13

Let’s use this definition of RISK Even if there is little consensus about risk definition, we will start with this Chinese expression: These Chinese characters combine the notions of danger (crisis) and opportunity, representing the downside and the upside of risk. Limit the frequency and impact of events negatively influencing the current state of affairs -Current state -Avoid losses How much risk one is willing to take to create value. -Sport -Innovation -Stocks Recording of this session via any media type is strictly prohibited. Page 14

Covering the basis Today’s assessments Recording of this session via any media type is strictly prohibited. Page 15

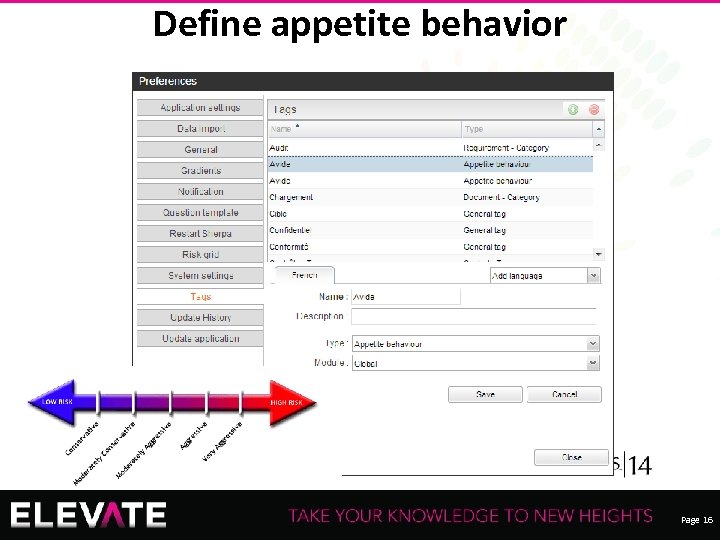

Define appetite behavior Recording of this session via any media type is strictly prohibited. Page 16

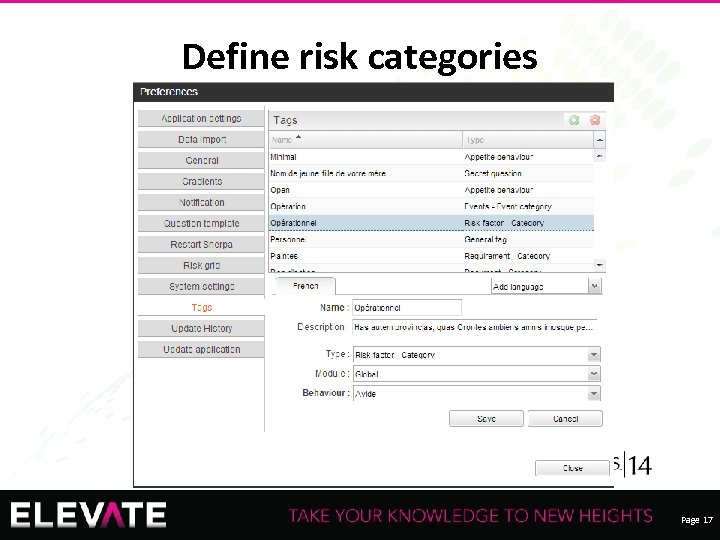

Define risk categories Recording of this session via any media type is strictly prohibited. Page 17

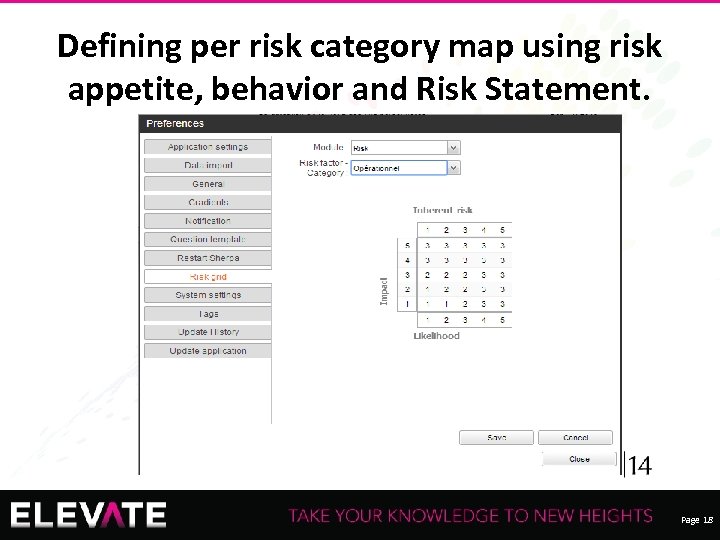

Defining per risk category map using risk appetite, behavior and Risk Statement. Recording of this session via any media type is strictly prohibited. Page 18

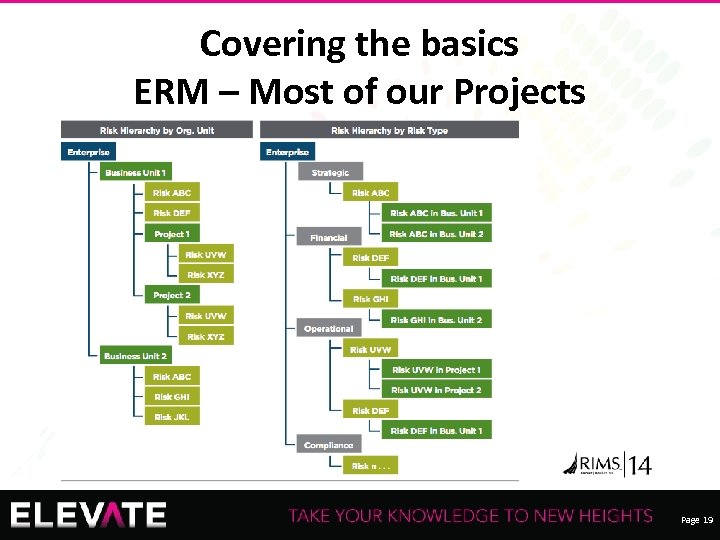

Covering the basics ERM – Most of our Projects Recording of this session via any media type is strictly prohibited. Page 19

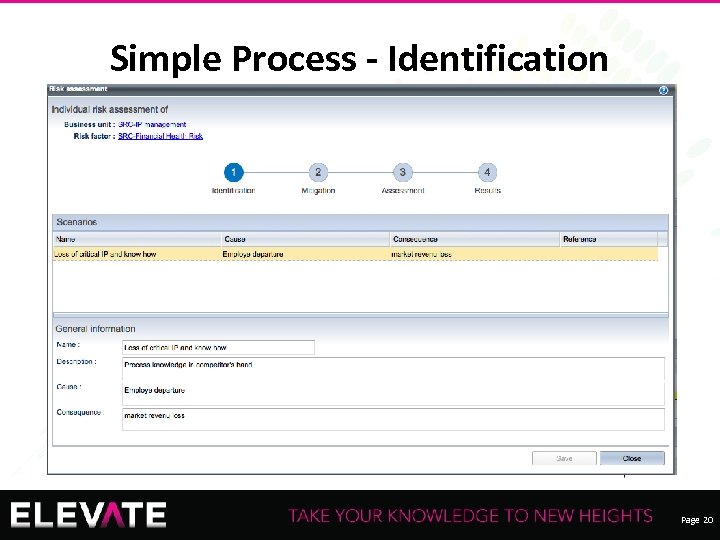

Simple Process - Identification Recording of this session via any media type is strictly prohibited. Page 20

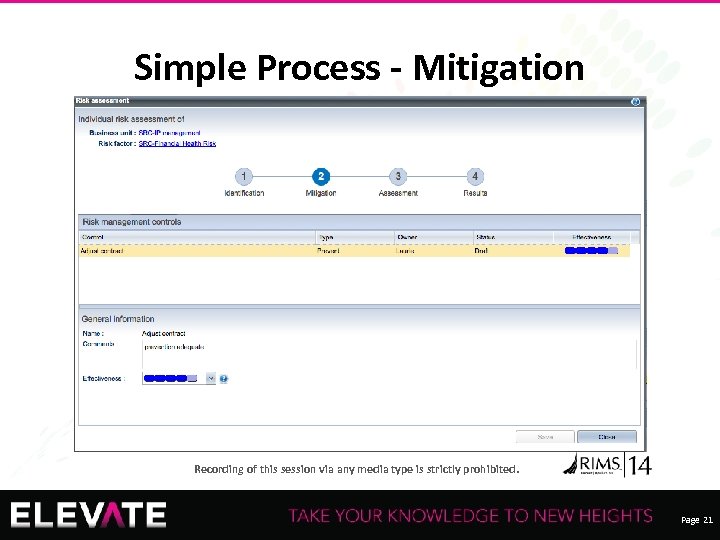

Simple Process - Mitigation Recording of this session via any media type is strictly prohibited. Page 21

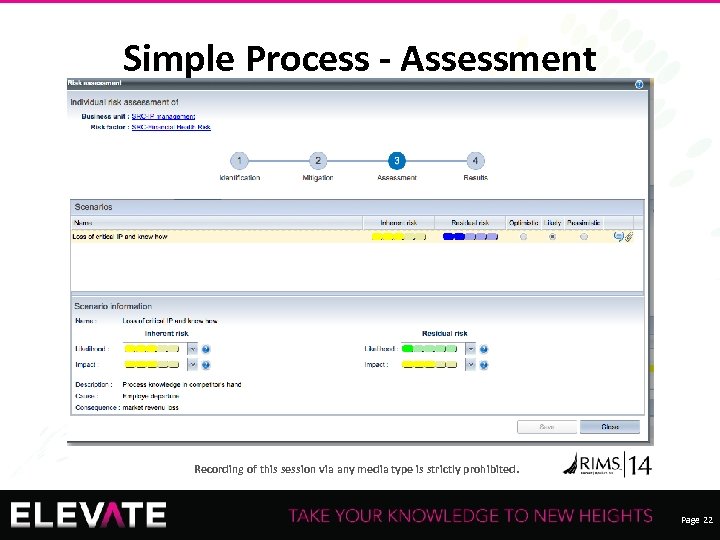

Simple Process - Assessment Recording of this session via any media type is strictly prohibited. Page 22

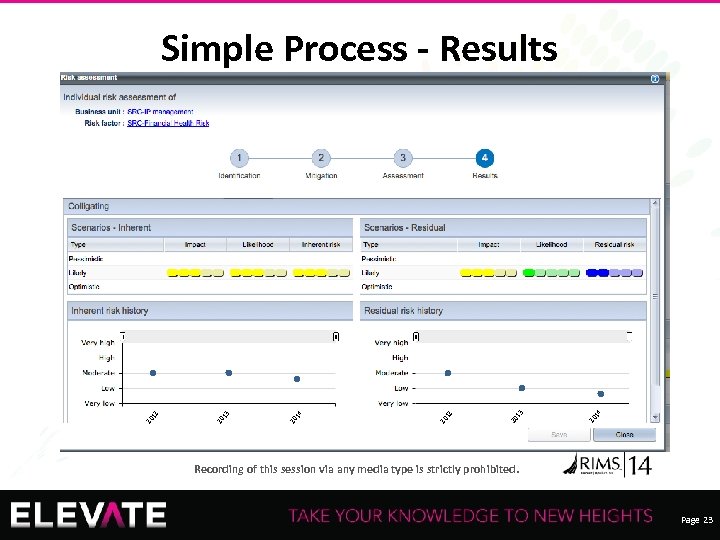

14 20 13 20 12 20 14 20 13 20 20 12 Simple Process - Results Recording of this session via any media type is strictly prohibited. Page 23

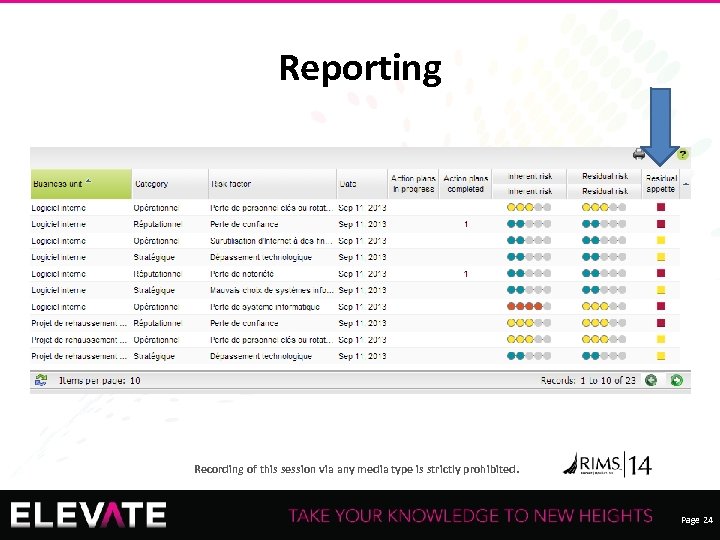

Reporting Recording of this session via any media type is strictly prohibited. Page 24

What WE DO ! Most of the time… Risk Behavior – Risk Statement ! Risk assessment ! Risk avoidance ! Reporting ! Planning the mitigation ! IS THAT ENOUGH ? Recording of this session via any media type is strictly prohibited. Page 25

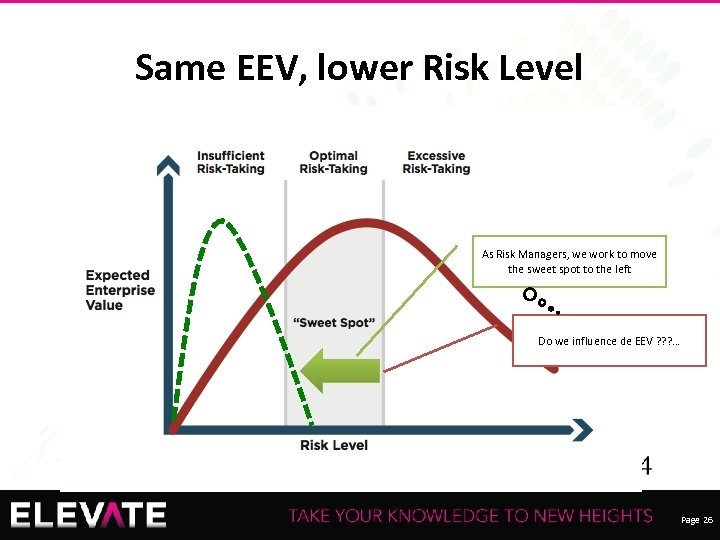

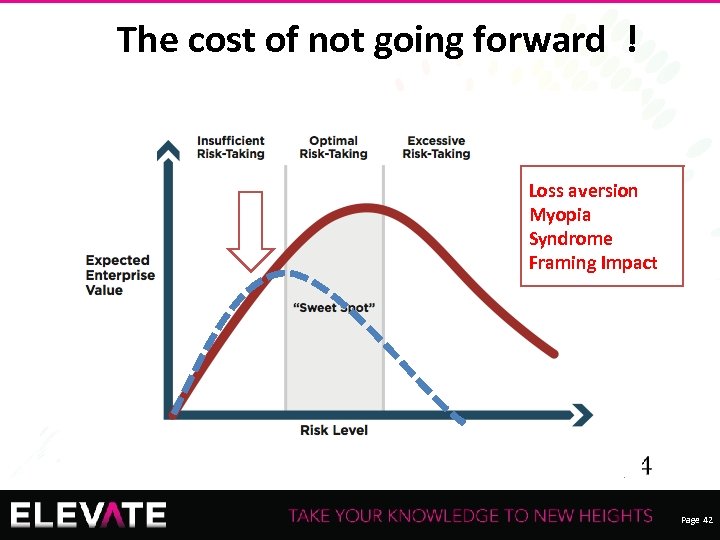

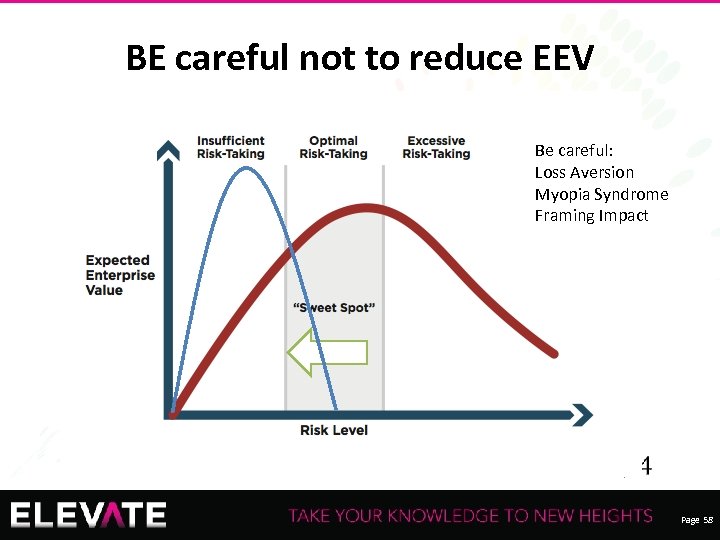

Same EEV, lower Risk Level As Risk Managers, we work to move the sweet spot to the left Do we influence de EEV ? ? ? … Recording of this session via any media type is strictly prohibited. Page 26

Facts… Individuals are far more affected by loss than equivalent gain : Loss aversion The loss aversion worsens with frequent monitoring: Myopia syndrome The choices that people make when presented with risky options will depend on the presentation: Framing impact Recording of this session via any media type is strictly prohibited. Page 27

Does Risk Management creates value? We believe there is too much of a focus on risk mitigation and not enough attention paid to managing risk for reward Recording of this session via any media type is strictly prohibited. Page 28

Applied risk analysis and the Ethics of Business Risks Recording of this session via any media type is strictly prohibited. Page 29

Use case 1 Getting ready for the BAR exam – do you spend time on improving weakness? Recording of this session via any media type is strictly prohibited. Page 30

Use case 2 Two workplace hypotheticals – analysis of difference btw risk taking to avoid negative, risk taking to gain bigger reward – ethical side of risk Recording of this session via any media type is strictly prohibited. Page 31

Looking at Risk through your strategic objectives Recording of this session via any media type is strictly prohibited. Page 32

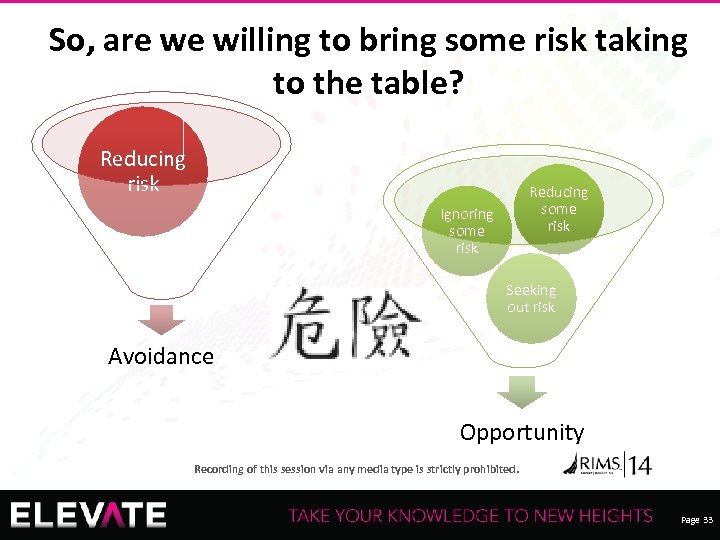

So, are we willing to bring some risk taking to the table? Reducing risk Reducing some risk Ignoring some risk Seeking out risk Avoidance Opportunity Recording of this session via any media type is strictly prohibited. Page 33

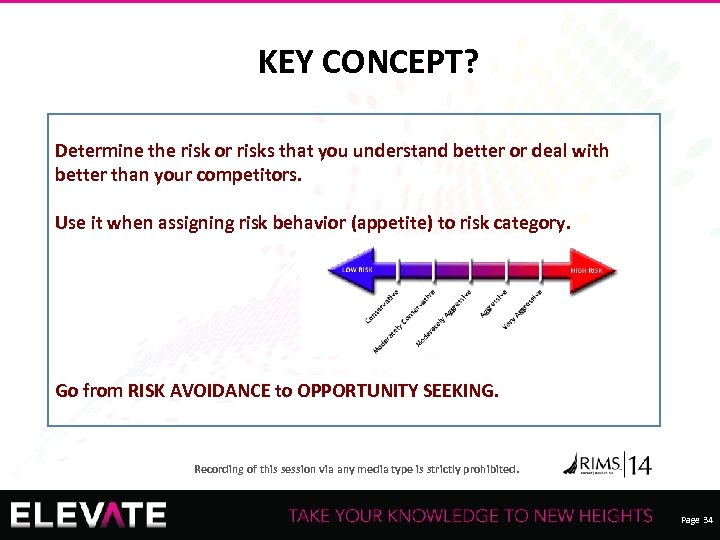

KEY CONCEPT? Determine the risk or risks that you understand better or deal with better than your competitors. Use it when assigning risk behavior (appetite) to risk category. Go from RISK AVOIDANCE to OPPORTUNITY SEEKING. Recording of this session via any media type is strictly prohibited. Page 34

Looking at risk through your strategic objectives • Assign a risk behavior to objectives and projects • What to do with your SWOT analysis • What is the cost of not going forward for fear of risk? • What are the key indicators Recording of this session via any media type is strictly prohibited. Page 35

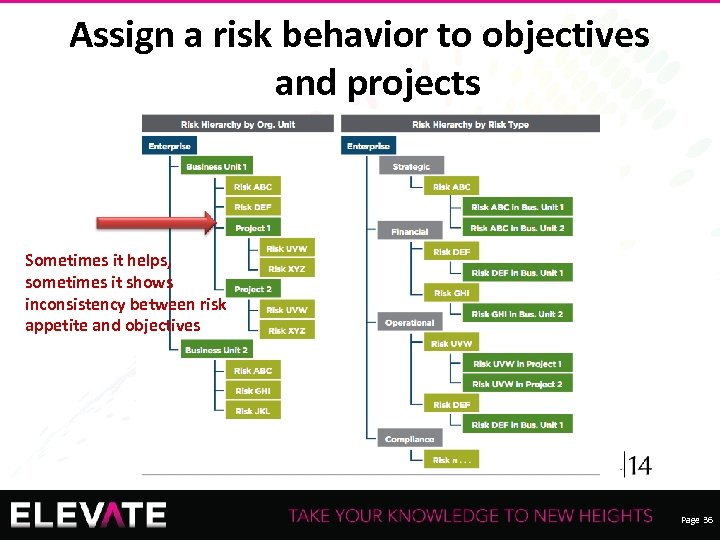

Assign a risk behavior to objectives and projects Sometimes it helps, sometimes it shows inconsistency between risk appetite and objectives Recording of this session via any media type is strictly prohibited. Page 36

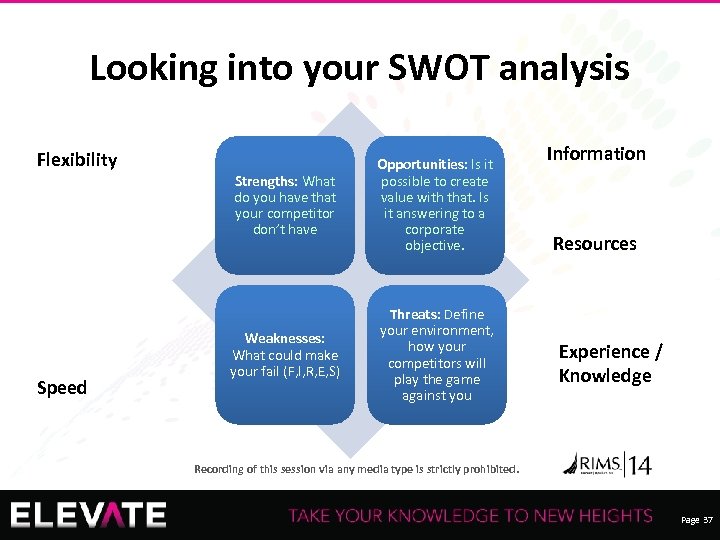

Looking into your SWOT analysis Flexibility Speed Strengths: What do you have that your competitor don’t have Opportunities: Is it possible to create value with that. Is it answering to a corporate objective. Weaknesses: What could make your fail (F, I, R, E, S) Threats: Define your environment, how your competitors will play the game against you Information Resources Experience / Knowledge Recording of this session via any media type is strictly prohibited. Page 37

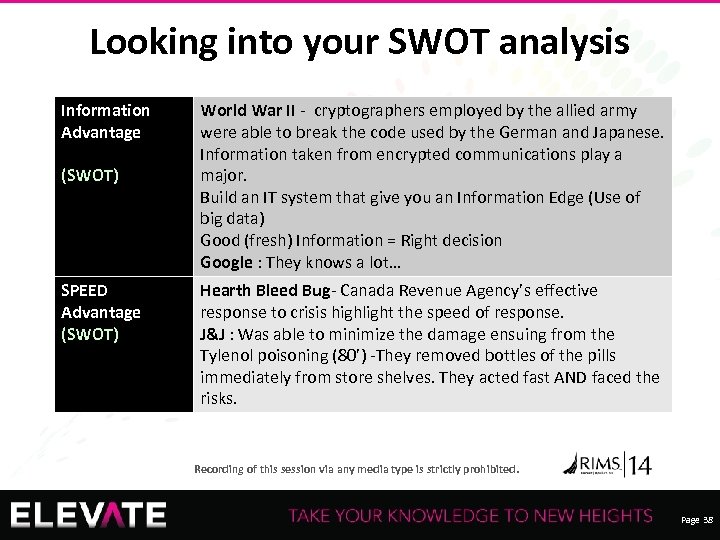

Looking into your SWOT analysis Information Advantage (SWOT) SPEED Advantage (SWOT) World War II - cryptographers employed by the allied army were able to break the code used by the German and Japanese. Information taken from encrypted communications play a major. Build an IT system that give you an Information Edge (Use of big data) Good (fresh) Information = Right decision Google : They knows a lot… Hearth Bleed Bug- Canada Revenue Agency’s effective response to crisis highlight the speed of response. J&J : Was able to minimize the damage ensuing from the Tylenol poisoning (80’) -They removed bottles of the pills immediately from store shelves. They acted fast AND faced the risks. Recording of this session via any media type is strictly prohibited. Page 38

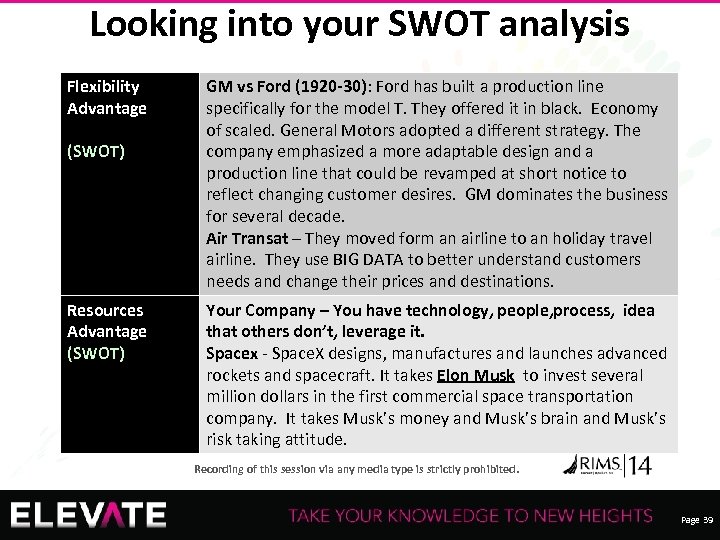

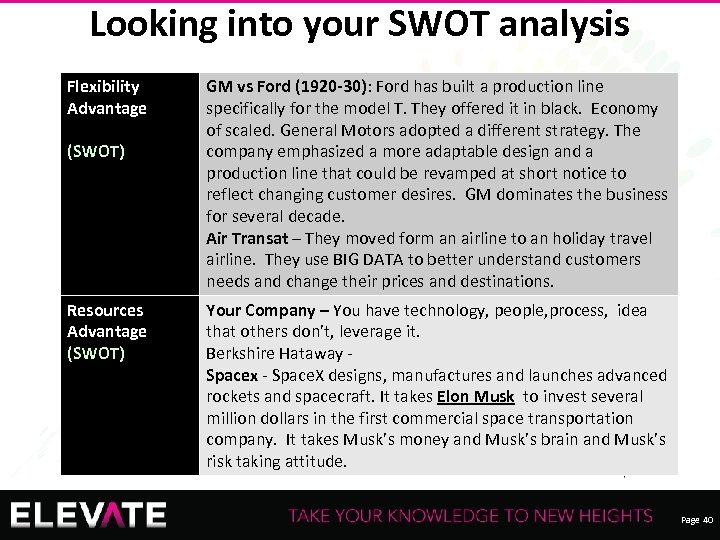

Looking into your SWOT analysis Flexibility Advantage (SWOT) Resources Advantage (SWOT) GM vs Ford (1920 -30): Ford has built a production line specifically for the model T. They offered it in black. Economy of scaled. General Motors adopted a different strategy. The company emphasized a more adaptable design and a production line that could be revamped at short notice to reflect changing customer desires. GM dominates the business for several decade. Air Transat – They moved form an airline to an holiday travel airline. They use BIG DATA to better understand customers needs and change their prices and destinations. Your Company – You have technology, people, process, idea that others don’t, leverage it. Spacex - Space. X designs, manufactures and launches advanced rockets and spacecraft. It takes Elon Musk to invest several million dollars in the first commercial space transportation company. It takes Musk’s money and Musk’s brain and Musk’s risk taking attitude. Recording of this session via any media type is strictly prohibited. Page 39

Looking into your SWOT analysis Flexibility Advantage (SWOT) Resources Advantage (SWOT) GM vs Ford (1920 -30): Ford has built a production line specifically for the model T. They offered it in black. Economy of scaled. General Motors adopted a different strategy. The company emphasized a more adaptable design and a production line that could be revamped at short notice to reflect changing customer desires. GM dominates the business for several decade. Air Transat – They moved form an airline to an holiday travel airline. They use BIG DATA to better understand customers needs and change their prices and destinations. Your Company – You have technology, people, process, idea that others don’t, leverage it. Berkshire Hataway - Spacex - Space. X designs, manufactures and launches advanced rockets and spacecraft. It takes Elon Musk to invest several million dollars in the first commercial space transportation company. It takes Musk’s money and Musk’s brain and Musk’s risk taking attitude. Recording of this session via any media type is strictly prohibited. Page 40

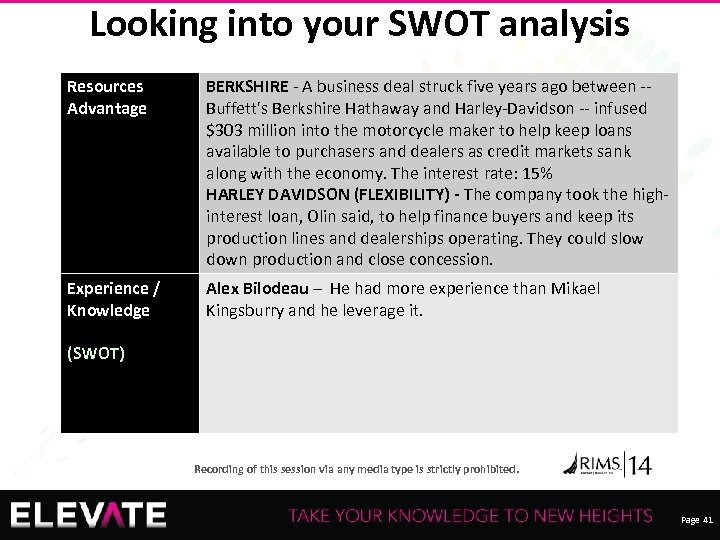

Looking into your SWOT analysis Resources Advantage BERKSHIRE - A business deal struck five years ago between -- Buffett's Berkshire Hathaway and Harley-Davidson -- infused $303 million into the motorcycle maker to help keep loans available to purchasers and dealers as credit markets sank along with the economy. The interest rate: 15% HARLEY DAVIDSON (FLEXIBILITY) - The company took the highinterest loan, Olin said, to help finance buyers and keep its production lines and dealerships operating. They could slow down production and close concession. Experience / Knowledge Alex Bilodeau – He had more experience than Mikael Kingsburry and he leverage it. (SWOT) Recording of this session via any media type is strictly prohibited. Page 41

The cost of not going forward ! Loss aversion Myopia Syndrome Framing Impact Recording of this session via any media type is strictly prohibited. Page 42

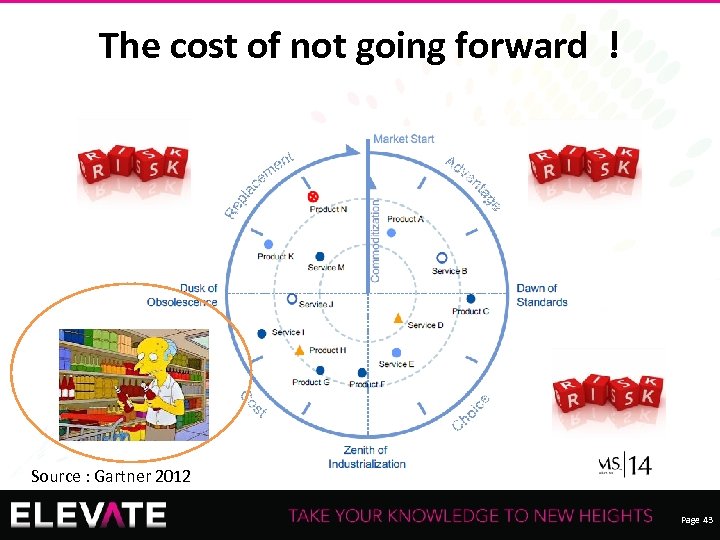

The cost of not going forward ! Source : Gartner 2012 Recording of this session via any media type is strictly prohibited. Page 43

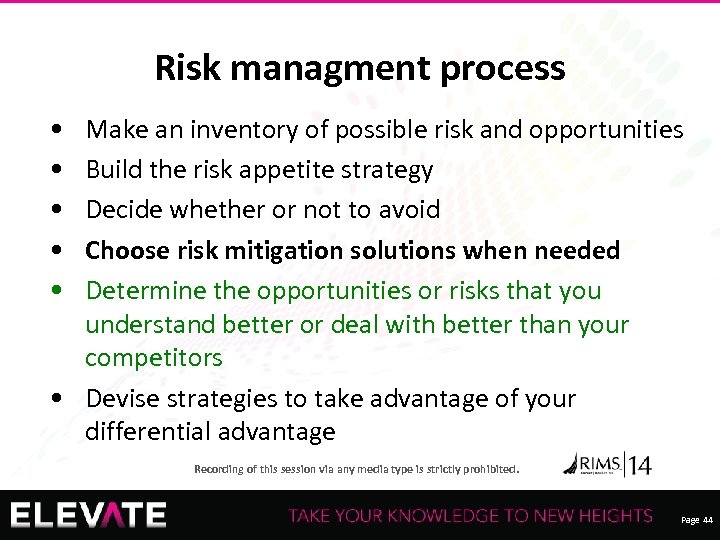

Risk managment process • • • Make an inventory of possible risk and opportunities Build the risk appetite strategy Decide whether or not to avoid Choose risk mitigation solutions when needed Determine the opportunities or risks that you understand better or deal with better than your competitors • Devise strategies to take advantage of your differential advantage Recording of this session via any media type is strictly prohibited. Page 44

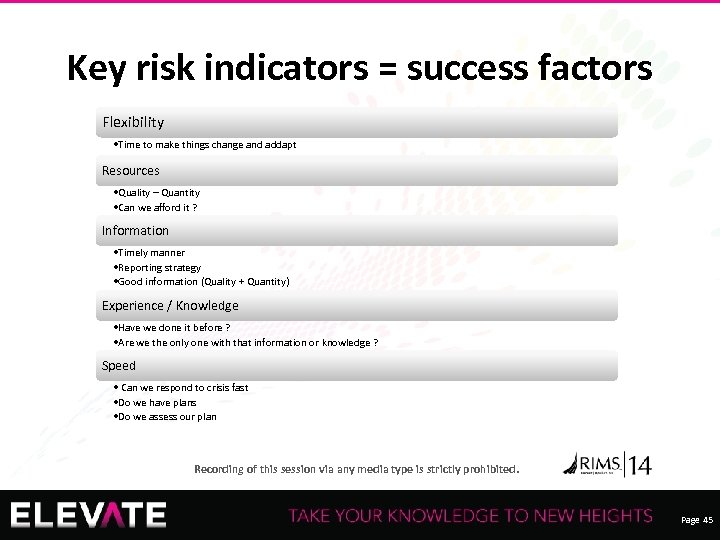

Key risk indicators = success factors Flexibility • Time to make things change and addapt Resources • Quality – Quantity • Can we afford it ? Information • Timely manner • Reporting strategy • Good information (Quality + Quantity) Experience / Knowledge • Have we done it before ? • Are we the only one with that information or knowledge ? Speed • Can we respond to crisis fast • Do we have plans • Do we assess our plan Recording of this session via any media type is strictly prohibited. Page 45

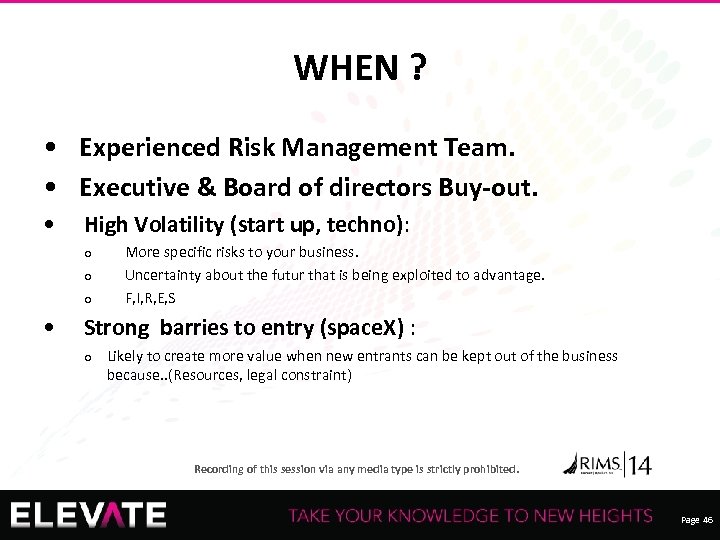

WHEN ? • Experienced Risk Management Team. • Executive & Board of directors Buy-out. • High Volatility (start up, techno): o o o • More specific risks to your business. Uncertainty about the futur that is being exploited to advantage. F, I, R, E, S Strong barries to entry (space. X) : o Likely to create more value when new entrants can be kept out of the business because. . (Resources, legal constraint) Recording of this session via any media type is strictly prohibited. Page 46

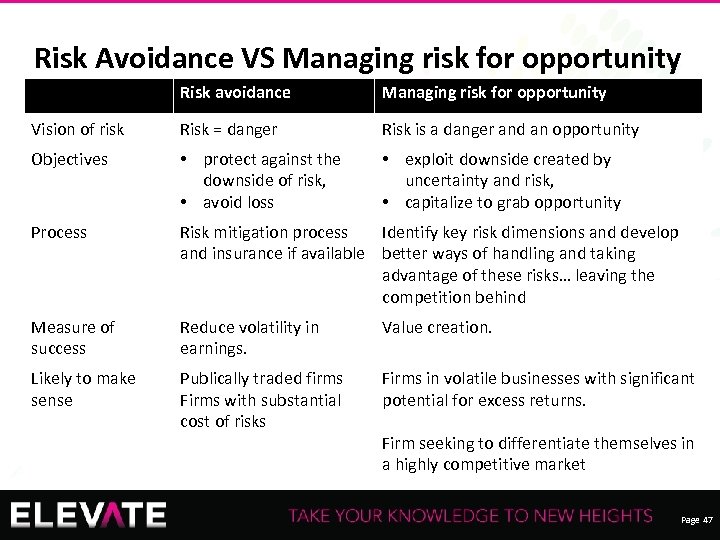

Risk Avoidance VS Managing risk for opportunity Risk avoidance Managing risk for opportunity Vision of risk Risk = danger Risk is a danger and an opportunity Objectives • protect against the downside of risk, • avoid loss • exploit downside created by uncertainty and risk, • capitalize to grab opportunity Process Risk mitigation process Identify key risk dimensions and develop and insurance if available better ways of handling and taking advantage of these risks… leaving the competition behind Measure of success Reduce volatility in earnings. Likely to make sense Publically traded firms Firms with substantial cost of risks Value creation. Firms in volatile businesses with significant potential for excess returns. Firm seeking to differentiate themselves in a highly competitive market Recording of this session via any media type is strictly prohibited. Page 47

PERFORMING YOUR RISK ASSESSMENT Recording of this session via any media type is strictly prohibited. Page 48

Risk Assessment Best Practices How do we get them accomplished? • • Decide whether to use external help Define the scope of the risk assessment Identify stakeholders – who has the information you need? Identify decision-makers - who will be making decisions at key decision points? GC, Compliance Officer, other? • Engage leadership – get the authority you need • Decide on degree of formality and complexity Recording of this session via any media type is strictly prohibited. 49 Page 49

Risk Assessment Best Practices How do we get them accomplished? Gathering information: Surveys/questionnaires Interviews Data collection: hotline stats, internal discipline stats, past compliance issues, enforcement trends, “chatter” in marketplace, political changes/implications q Quantifying risks: probability and impact q Use disagreement as a springboard to educate: if some think a risk is “very high” and others think its “very low” - explore q • • • Recording of this session via any media type is strictly prohibited. 50 Page 50

Risk Assessment Best Practices Tools & Techniques: • KISS “keep it simple, stupid” • For probability: consider industry history, company history, enforcement trends • For impact: consider financial impact, workforce impact, reputational impact, market share loss, degree of board or senior management involvement • For surveys: consider using online free survey services Recording of this session via any media type is strictly prohibited. 51 Page 51

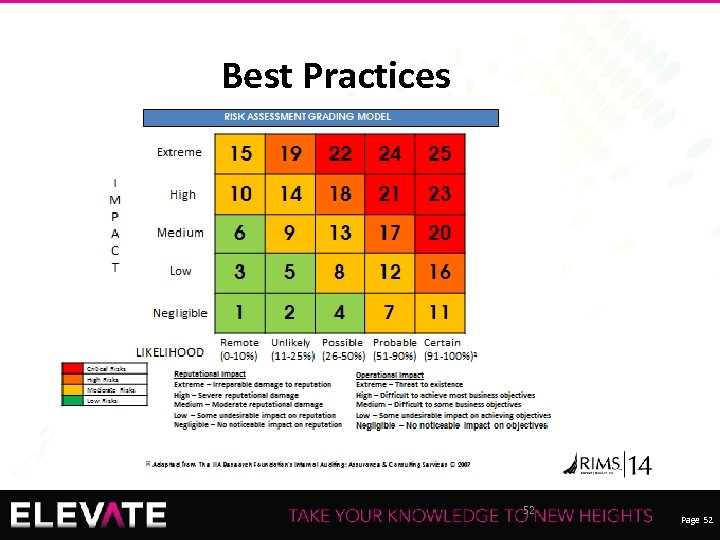

Best Practices Recording of this session via any media type is strictly prohibited. 52 Page 52

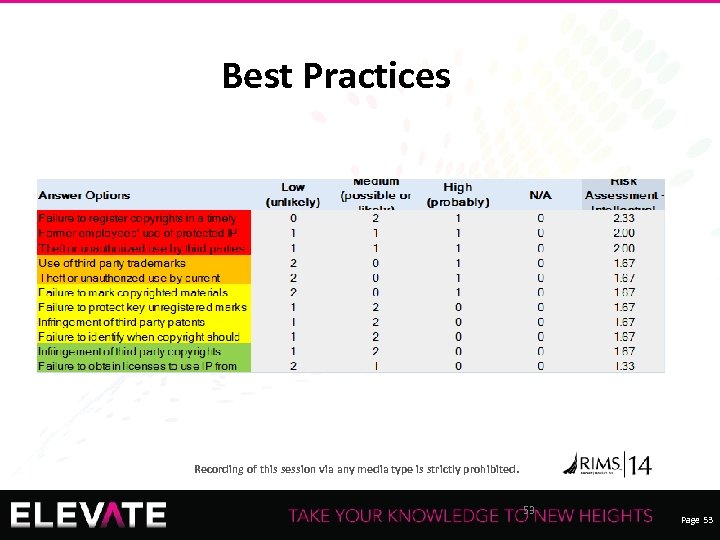

Best Practices Recording of this session via any media type is strictly prohibited. 53 Page 53

Risk Assessment Best Practices What do we do with the results? • Who do we share the results with? – CEO/Executive Management – Board – Compliance Committee – Legal Department – Internal Audit – Investor/Public Relations Recording of this session via any media type is strictly prohibited. 54 Page 54

Risk Assessment Best Practices What do we do with the results? • Leverage the results to prioritize and make decisions re: ethics and compliance program, insurance, mitigation measures • Establish controls • Establish metrics to measure risk mitigation Recording of this session via any media type is strictly prohibited. 55 Page 55

TAKE AWAYS Recording of this session via any media type is strictly prohibited. Page 56

Start ! Start slowly. (With projects) Rate risks AND opportunities Evaluate: (F, I, R, E, S) Involve Executive & Board of directors Recording of this session via any media type is strictly prohibited. Page 57

BE careful not to reduce EEV Be careful: Loss Aversion Myopia Syndrome Framing Impact Recording of this session via any media type is strictly prohibited. Page 58

Start by having a « yes » attitude to Innovation Companies who engage themselves through innovation… • Create value • Offer better training for employees • Are more sustainable • Are more fun to work at Recording of this session via any media type is strictly prohibited. Page 59

References Strategic Risk Taking: A Framework for Risk Management By: Aswath Damodaran COSO - Thought Leadership in ERM By Deloitte & Touche LLP Dr. Patchin Curtis | Mark Carey Fundamentals of Risk Management, 2 nd Edition By: Paul Hopkin How to Manage Project Opportunity and Risk: Why uncertainty management can be a much better approach than risk management By: Chris Chapman; Stephen Ward Recording of this session via any media type is strictly prohibited. Page 60

Questions and Final Comments Contacts Risk management: martin. berthiaume@telus. com Compliance and Ethics, risks management: Amy. hutchens@clearesources. com Sherpa ERM solution: marie-claude. cote 1@telus. com Recording of this session via any media type is strictly prohibited. Page 61

3a3b593c621efda7563249a1c7ac54a6.ppt