718497697035f83a22f912a410c4f875.ppt

- Количество слайдов: 32

Hungary – the added value Budapest, 6 June 2006 Presentation by Ildikó KUKUCSKA Senior Consultant ITD Hungary

Agenda 1. About ITD Hungary, what can we offer? 2. Hungarian Economy, Foreign Direct Investments in Hungary 3. Is Hungary still competitive? 4. Which sectors are perspective? 5. New Economic Policy in Hungary

ITD Hungary The Hungarian Investment and Trade Development Agency is the agency of the Hungarian Government foreign investment promotion and trade development. Network: • Central Office in Budapest • 6 Regional Offices • 54 Foreign Trade Offices • 8 Representative Offices in the border regions of neighbouring countries

Main Tasks of ITDH 1. Investment promotion 2. Trade development 3. EU integration-oriented SME development 4. Hungarian capital export promotion

Complimentary services foreign investors: In the preparatory phase: § General and detailed information § Tailor-made site proposals § Organizing detailed program for the investors’ visits in Hungary – site visits – meetings – reference visits – introducing potential Hungarian suppliers In the realization phase of the project: § Accelerating permitting procedures § Assistance in incentive applications § Organizing press conferences, ground breaking ceremonies Follow-up services

Some important features of Hungarian economy ü Heavy reliance on FDI as a driving force in the economy ü High integration with the EU in terms of trade ü Gross output per worker grew 2. 4 times since 1989 ü Hungarian financial system is one of the most developed ones in Central Europe ü Legal framework conforms to international standards ü Well-prepared and motivated labour force provides a strong base foreign business operations Source: WIIW

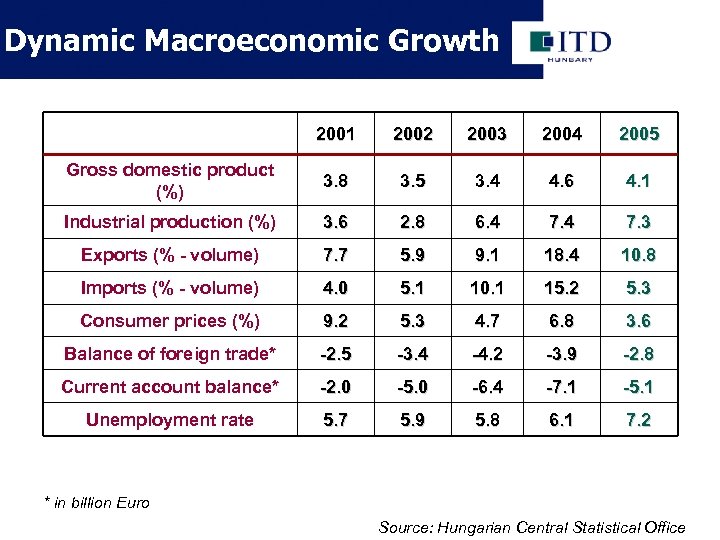

Dynamic Macroeconomic Growth 2001 2002 2003 2004 2005 Gross domestic product (%) 3. 8 3. 5 3. 4 4. 6 4. 1 Industrial production (%) 3. 6 2. 8 6. 4 7. 3 Exports (% - volume) 7. 7 5. 9 9. 1 18. 4 10. 8 Imports (% - volume) 4. 0 5. 1 10. 1 15. 2 5. 3 Consumer prices (%) 9. 2 5. 3 4. 7 6. 8 3. 6 Balance of foreign trade* -2. 5 -3. 4 -4. 2 -3. 9 -2. 8 Current account balance* -2. 0 -5. 0 -6. 4 -7. 1 -5. 1 Unemployment rate 5. 7 5. 9 5. 8 6. 1 7. 2 * in billion Euro Source: Hungarian Central Statistical Office

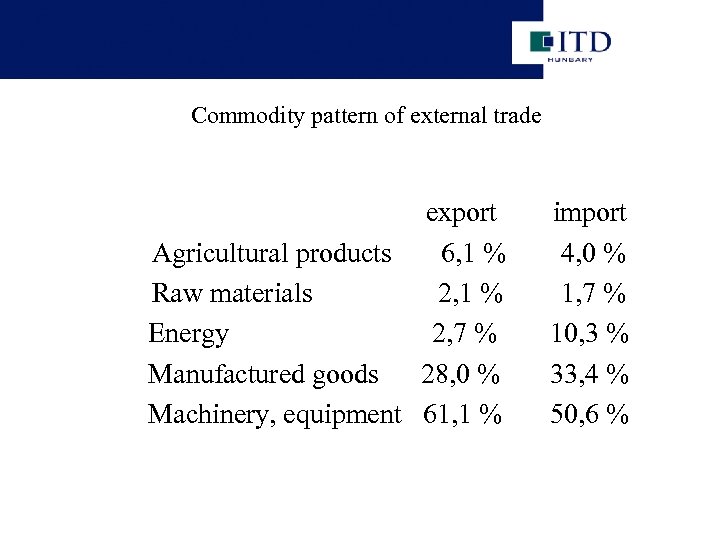

Commodity pattern of external trade export Agricultural products 6, 1 % Raw materials 2, 1 % Energy 2, 7 % Manufactured goods 28, 0 % Machinery, equipment 61, 1 % import 4, 0 % 1, 7 % 10, 3 % 33, 4 % 50, 6 %

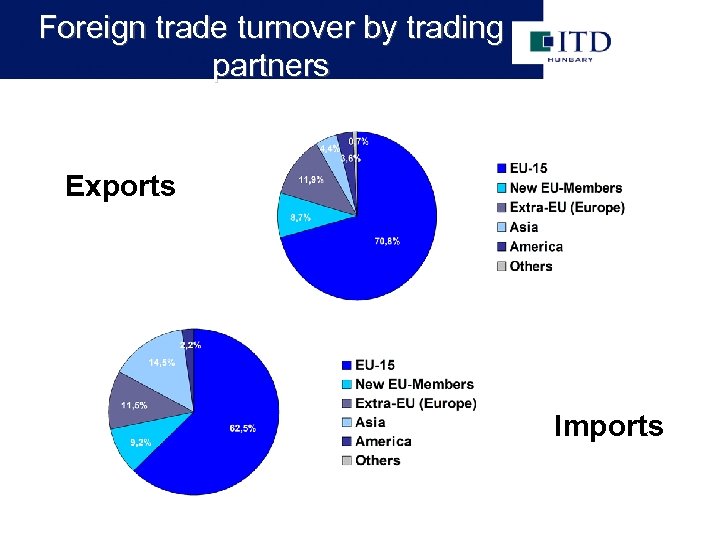

Foreign trade turnover by trading partners Exports Imports

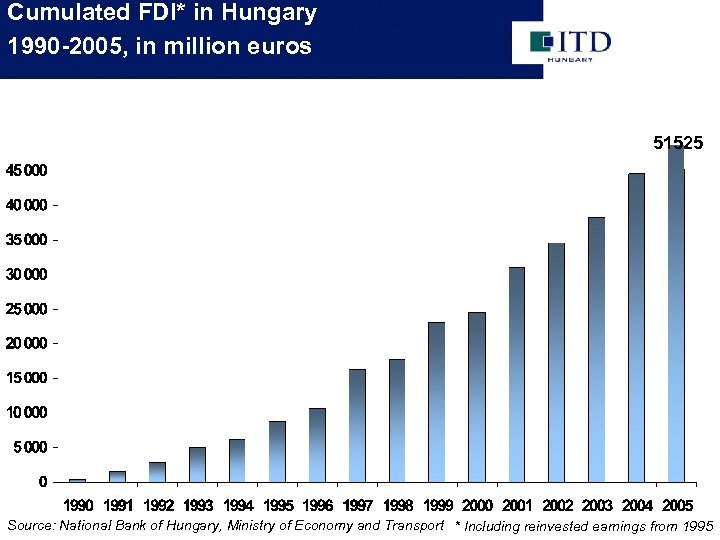

Cumulated FDI* in Hungary 1990 -2005, in million euros 51525 Source: National Bank of Hungary, Ministry of Economy and Transport * Including reinvested earnings from 1995

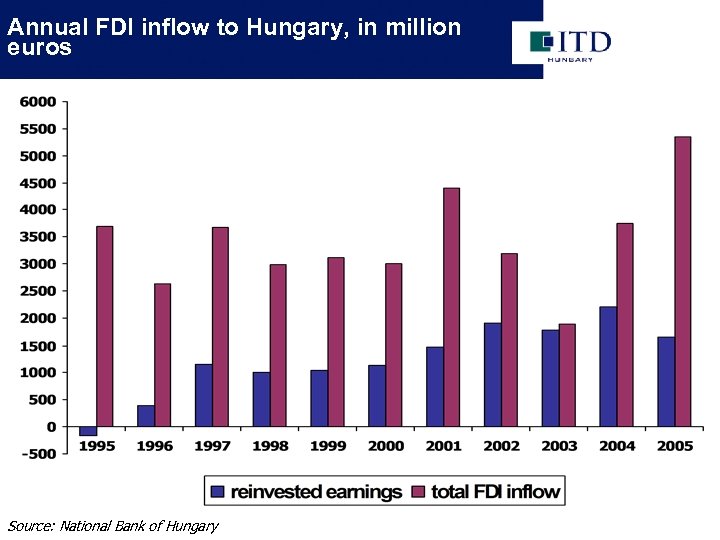

Annual FDI inflow to Hungary, in million euros Source: National Bank of Hungary

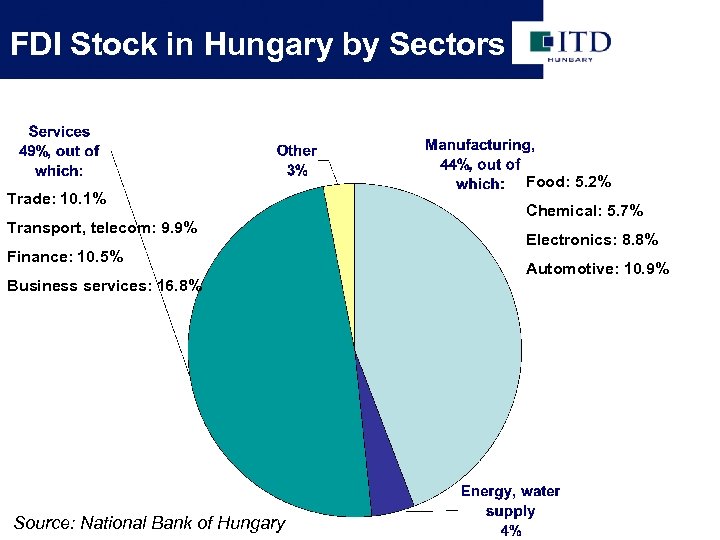

FDI Stock in Hungary by Sectors Trade: 10. 1% Transport, telecom: 9. 9% Finance: 10. 5% Business services: 16. 8% Source: National Bank of Hungary Food: 5. 2% Chemical: 5. 7% Electronics: 8. 8% Automotive: 10. 9%

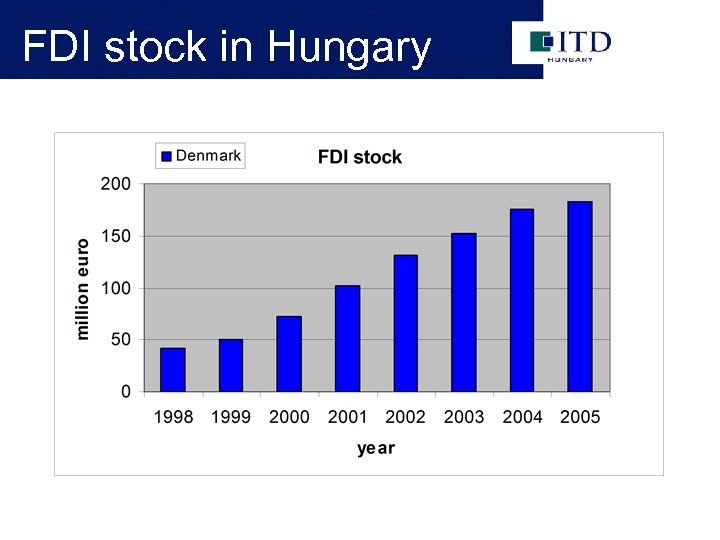

FDI stock in Hungary

Major Danish investors in Hungary • • • Velux – Grundfos – Coloplast – Nordisk-Wavin – SOS/Falck – Inreco – Rockwool – Danaeg Products – Novo-Nordisk – sky-lights electric engines plastic health care products rubber and plastic products ambulance service road construction insulation material pasteurised liquid eggs pharmaceutical products

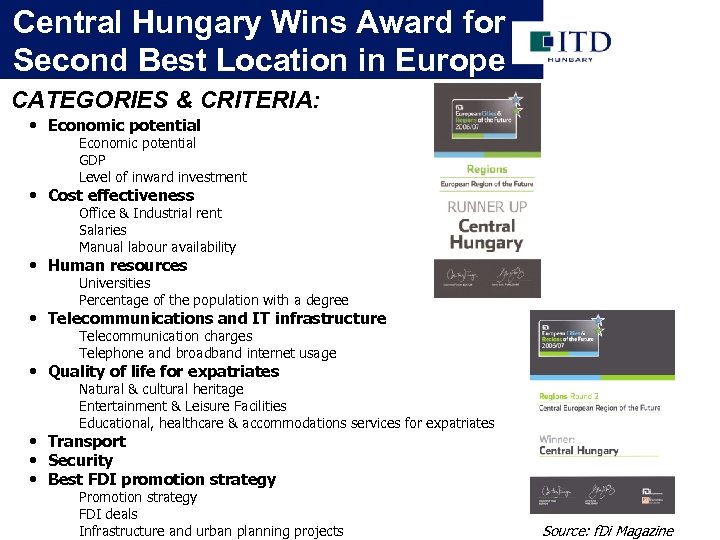

Central Hungary Wins Award for Second Best Location in Europe CATEGORIES & CRITERIA: • Economic potential GDP Level of inward investment • Cost effectiveness Office & Industrial rent Salaries Manual labour availability • Human resources Universities Percentage of the population with a degree • Telecommunications and IT infrastructure Telecommunication charges Telephone and broadband internet usage • Quality of life for expatriates Natural & cultural heritage Entertainment & Leisure Facilities Educational, healthcare & accommodations services for expatriates • Transport • Security • Best FDI promotion strategy Promotion strategy FDI deals Infrastructure and urban planning projects Source: f. Di Magazine

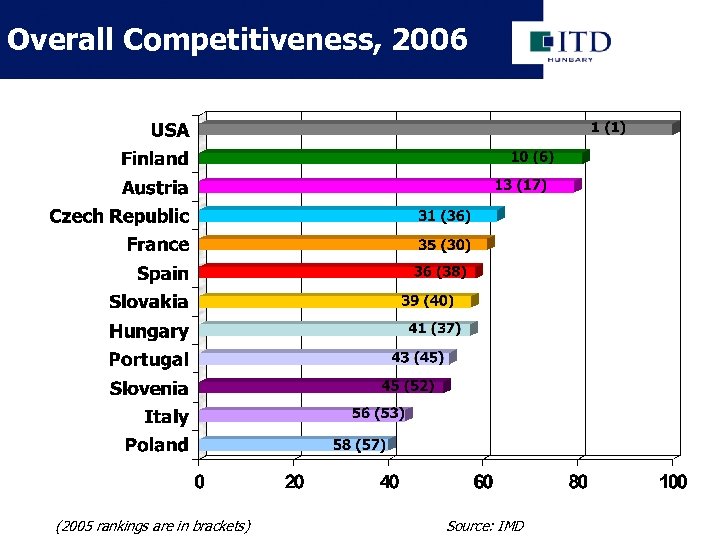

Overall Competitiveness, 2006 (2005 rankings are in brackets) Source: IMD

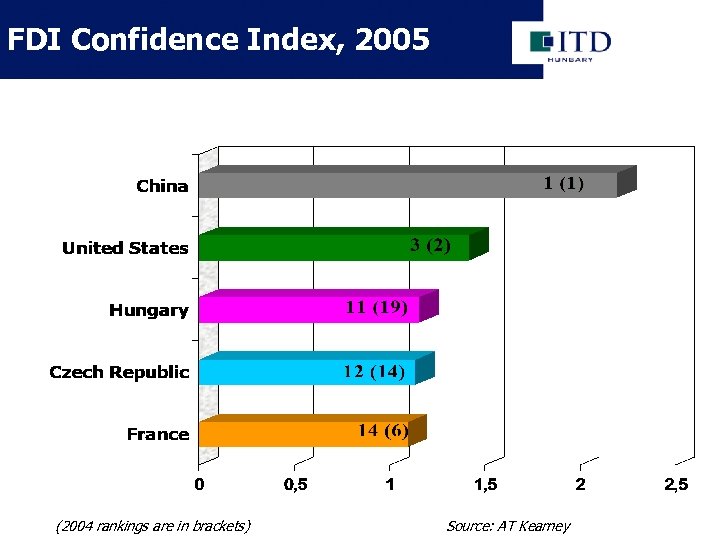

FDI Confidence Index, 2005 (2004 rankings are in brackets) Source: AT Kearney

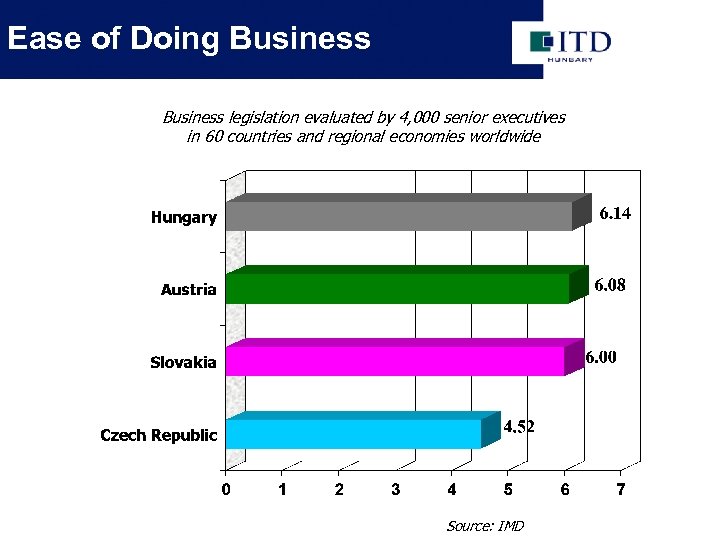

Ease of Doing Business legislation evaluated by 4, 000 senior executives in 60 countries and regional economies worldwide Source: IMD

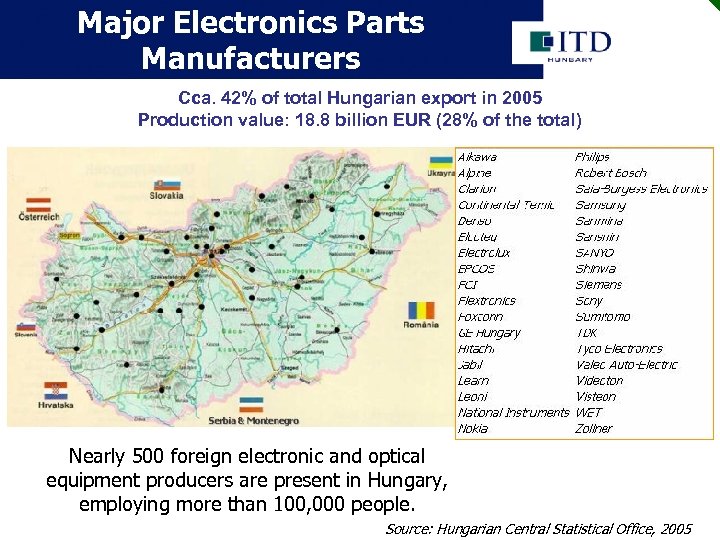

Major Electronics Parts Manufacturers Cca. 42% of total Hungarian export in 2005 Production value: 18. 8 billion EUR (28% of the total) Serbia & Montenegro Nearly 500 foreign electronic and optical equipment producers are present in Hungary, employing more than 100, 000 people. Source: Hungarian Central Statistical Office, 2005

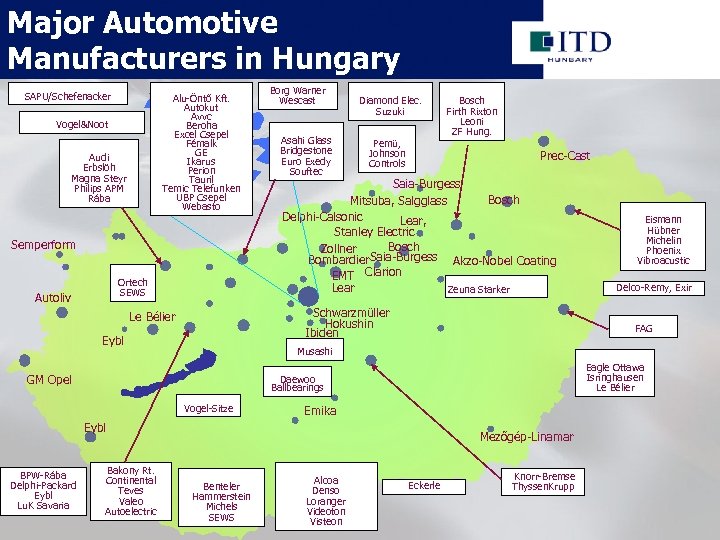

Major Automotive Manufacturers in Hungary SAPU/Schefenacker Alu-Öntő Kft. Autokut Avvc Beroha Excel Csepel Fémalk GE Ikarus Perion Tauril Temic Telefunken UBP Csepel Webasto Vogel&Noot Audi Erbslöh Magna Steyr Philips APM Rába Semperform Ortech SEWS Autoliv Borg Warner Wescast Asahi Glass Bridgestone Euro Exedy Souftec Diamond Elec. Suzuki Pemü, Johnson Controls Prec-Cast Saia-Burgess Bosch Mitsuba, Salgglass Delphi-Calsonic Lear, Stanley Electric Bosch Zollner Saia-Burgess Akzo-Nobel Coating Bombardier EMT Clarion Lear Zeuna Starker Schwarzmüller Hokushin Ibiden Le Bélier Eybl Delco-Remy, Exir FAG Eagle Ottawa Isringhausen Le Bélier Daewoo Ballbearings Vogel-Sitze Emika Eybl Bakony Rt. Continental Teves Valeo Autoelectric Eismann Hübner Michelin Phoenix Vibroacustic Musashi GM Opel BPW-Rába Delphi-Packard Eybl Lu. K Savaria Bosch Firth Rixton Leoni ZF Hung. Mezőgép-Linamar Benteler Hammerstein Michels SEWS Alcoa Denso Loranger Videoton Visteon Eckerle Knorr-Bremse Thyssen. Krupp

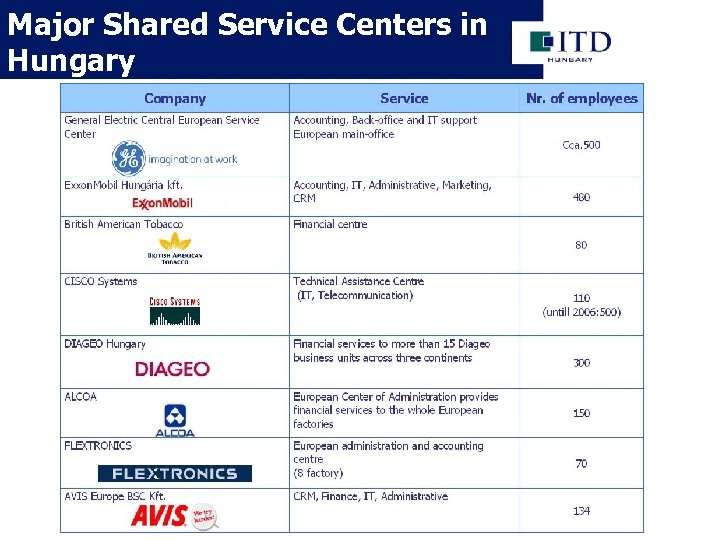

Major Shared Service Centers in Hungary

Hungary is an ideal site for conducting clinical research Hungary has a solid record of attracting and conducting international clinical trials, with over 250 clinical trials performed each year – an outstanding number compared to Hungary’s population. Reasons for conducting clinical trials in Hungary: • Rapid and reliable recruitment of study population • Investigators are motivated and qualified • High Quality of Data • Reasonable price advantage • Qualification of local study monitors is above international average Clinical Research CEE Center of Astra. Zeneca Hungary co-ordinating the work of § 160 well-trained Astra. Zeneca experts located in seven countries of the region. § Astra. Zeneca spends approx. € 6 million on clinical research in Hungary alone, § which also covers the work of 1, 000 -1, 200 colleagues.

Hungary an ideal location for biopharmaceutical manufacturing Sanofi-Aventis § The Hungarian research unit is currently involved, § in 45 Sanofi-Aventis development projects, § Including initial research and clinical testing, § The company employs 2, 300 people in Hungary, § invested more than € 400 million in its Hungarian subsidiary since 1991. Teva Hungary, a subsidiary of number two generic company Teva Pharmaceuticals, § is to build a € 75 million factory for the production of active pharmaceutical ingredients (APIs) in Sajobabony, Hungary, § 60 -100 people will be employed at the facility, § and its production will be mostly exported, §Teva started manufacturing in Hungary in 1995 and now employs 2, 300 people there.

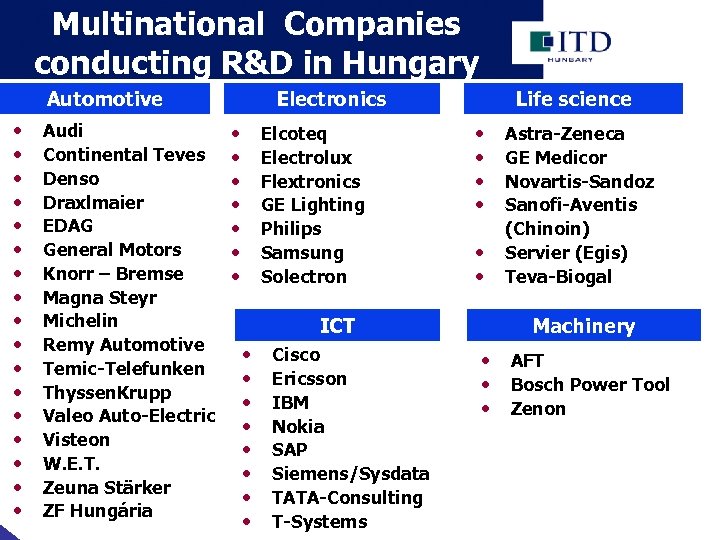

Multinational Companies conducting R&D in Hungary Automotive • • • • • Audi Continental Teves Denso Draxlmaier EDAG General Motors Knorr – Bremse Magna Steyr Michelin Remy Automotive Temic-Telefunken Thyssen. Krupp Valeo Auto-Electric Visteon W. E. T. Zeuna Stärker ZF Hungária Electronics • • Elcoteq Electrolux Flextronics GE Lighting Philips Samsung Solectron ICT • • Cisco Ericsson IBM Nokia SAP Siemens/Sysdata TATA-Consulting T-Systems Life science • • • Astra-Zeneca GE Medicor Novartis-Sandoz Sanofi-Aventis (Chinoin) Servier (Egis) Teva-Biogal Machinery • AFT • Bosch Power Tool • Zenon

Logistic Centres in Hungary

Investment Incentive System I. I. Direct Subsidies for Investments 1. Tender applications in the framework of the Economic Competitiveness Operative Program (ECOP) 2. Special incentive package for strategic investors 3. Subsidy for employment creation and training (in the responsibility of the Ministry of Employment and Labour) II. Tax-related Incentives (in the responsibility of the Ministry of Finance) III. Supplier Development Program

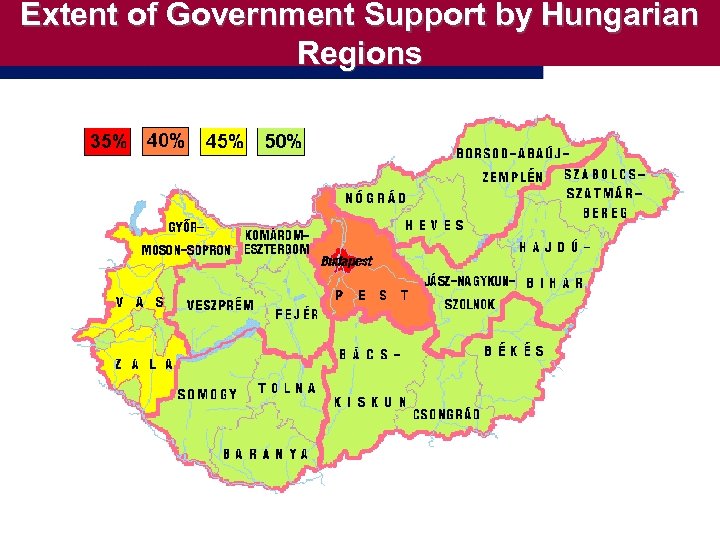

Extent of Government Support by Hungarian Regions

Investment Incentive System II. Special Incentive Package for Strategic Investments If the investment volume reaches • EUR 10 millions of projects of the manufacturing industry, logistics and in case of establishing regional corporate service centers The Hungarian Government may decide on granting a customized incentive package and VIP treatment Within the customized incentive package more favourable and significant subsidy is available than through ECOP tender applications. Important condition: in the field of LOGISTICS at least 10 persons should be employed

New Government in June 2006 PROGRAM of the NEW GOVERNMENT Investment Promotion Remains one of the Main Goals of the Economic Policy - Infrastructure Development - Labour Force Development Meeting Requirements of Companies - Incentives, concentrating on priority sectors

Priority Sectors ● Electronics ● Automotive industry ● Pharmaceautical industry ● Biotechnology ● Bioenergy ● ICT ● Finacial and Logistical Services ● Tourism

Environmental protection in the Program of the New Government There are 13 points for the cleaner and healthier environment in the new Program. Among others: ● Increase of share of renewable energy sources ● Development of - drinking water’s quality in different regions - Sewage water treatment - Solid waste treatment - safety from floods and inland waters ● Elimination of remains of old pollutions etc.

Contact: ITD Hungary 1061 Budapest, Andrássy út 12. Mrs. Ildikó KUKUCSKA Senior Consultant Phone: 473 -82 -14 E-mail: kukucska@itd. hu

718497697035f83a22f912a410c4f875.ppt