ab2abd57ca50d90adb25395be5a7b2d4.ppt

- Количество слайдов: 30

Humber LEP – Skills Network

Gary Warke - Chair Humber LEP Skills Network Terms of Reference (summary) Purpose/Scope of the Humber Skills Network: The purpose of the Humber LEP Skills Network is to support the work of the Employment and Skills Board (ESB) in ensuring that the employment and skills agenda is embedded within the Humber approach to economic development. This approach considers the dynamic changes to the local employment and skills landscape to ensure the delivery of a competent and engaged Humber region. Key priorities The Network will: Support the work of the Humber LEP by assisting the ESB leadership. Providing updates and data regarding developments in the skills agenda, ensuring cross-fertilisation between the Skills Network and ESB. Bring together the key agencies, stakeholders and delivery partners in the Humber to work together in partnership. Providing a forum for all partners involved in employment and skills in the Humber to meet and share information and good practice.

• Share information and provide feedback on skill issues, particularly in those key sectors in which the Humber has added value strengths: – – – – • • • Energy (including Renewables) Ports & Logistics Chemicals Food (including the Agri-business) Engineering Digital The Visitor Economy Ensure that high quality labour market information is produced and disseminated. Help to inform a strategic approach to careers education, information advice and guidance (CEIAG), influencing providers and stakeholders to ensure that the system deliver the needs of the Humber economy. Ensure that the Network operates within the Humber LEP’s governance structure.

Skills Pictures Please email with credit to s. rex@humberlep. org

Update on Skills Strategy • Consultation – closed 24 th February • Strategy structure • Next ESB - 5 th June • Next LEP Board – 27 th June • Implementation Group (was Delivery Group)

The Humber Labour Market by the Regional Economic Intelligence Unit, Leeds City Council REIU (Regional Economic Intelligence Unit)

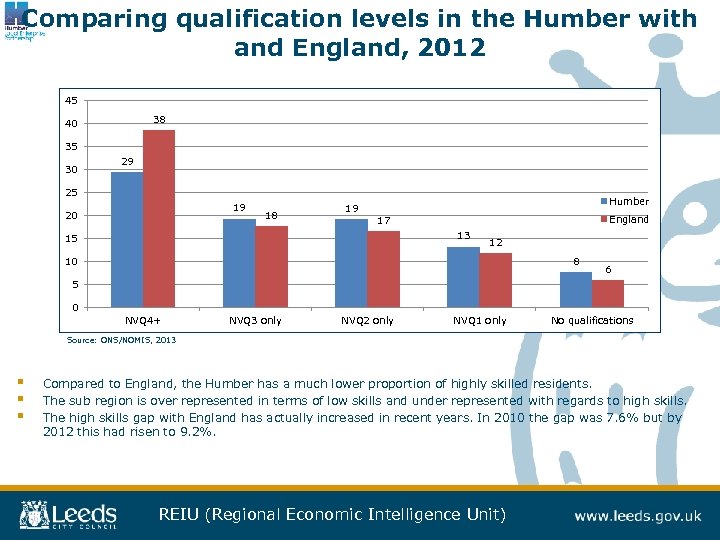

Comparing qualification levels in the Humber with and England, 2012 45 38 40 35 30 29 25 19 20 18 19 Humber England 17 13 15 12 10 8 6 5 0 NVQ 4+ NVQ 3 only NVQ 2 only NVQ 1 only No qualifications Source: ONS/NOMIS, 2013 § § § Compared to England, the Humber has a much lower proportion of highly skilled residents. The sub region is over represented in terms of low skills and under represented with regards to high skills. The high skills gap with England has actually increased in recent years. In 2010 the gap was 7. 6% but by 2012 this had risen to 9. 2%. REIU (Regional Economic Intelligence Unit)

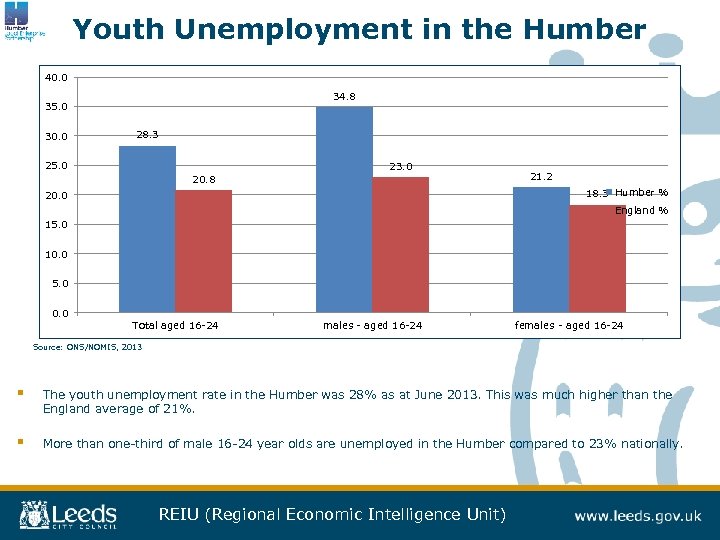

Youth Unemployment in the Humber 40. 0 34. 8 35. 0 30. 0 28. 3 25. 0 23. 0 20. 8 21. 2 18. 3 Humber % 20. 0 England % 15. 0 10. 0 5. 0 0. 0 Total aged 16 -24 males - aged 16 -24 females - aged 16 -24 Source: ONS/NOMIS, 2013 § The youth unemployment rate in the Humber was 28% as at June 2013. This was much higher than the England average of 21%. § More than one-third of male 16 -24 year olds are unemployed in the Humber compared to 23% nationally. REIU (Regional Economic Intelligence Unit)

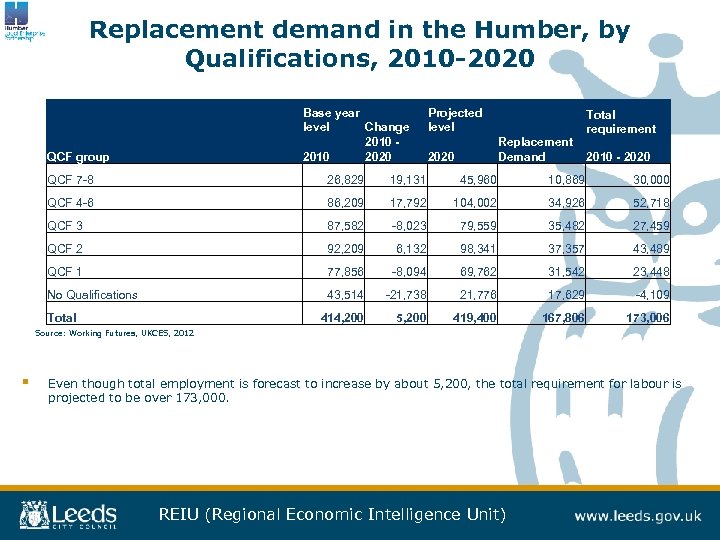

Replacement demand in the Humber, by Qualifications, 2010 -2020 Base year level Change 2010 2020 QCF group Projected level Replacement Demand 2020 Total requirement 2010 - 2020 QCF 7 -8 26, 829 19, 131 45, 960 10, 869 30, 000 QCF 4 -6 86, 209 17, 792 104, 002 34, 926 52, 718 QCF 3 87, 582 -8, 023 79, 559 35, 482 27, 459 QCF 2 92, 209 6, 132 98, 341 37, 357 43, 489 QCF 1 77, 856 -8, 094 69, 762 31, 542 23, 448 No Qualifications 43, 514 -21, 738 21, 776 17, 629 -4, 109 414, 200 5, 200 419, 400 167, 806 173, 006 Total Source: Working Futures, UKCES, 2012 § Even though total employment is forecast to increase by about 5, 200, the total requirement for labour is projected to be over 173, 000. REIU (Regional Economic Intelligence Unit)

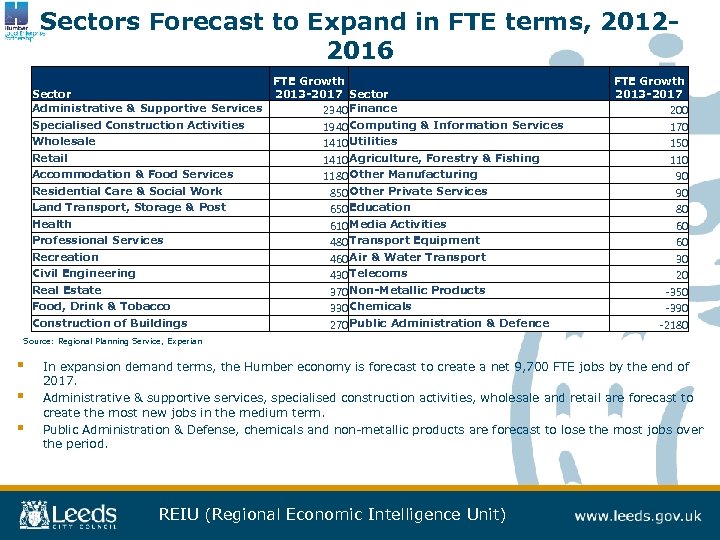

Sectors Forecast to Expand in FTE terms, 20122016 Sector Administrative & Supportive Services Specialised Construction Activities Wholesale Retail Accommodation & Food Services Residential Care & Social Work Land Transport, Storage & Post Health Professional Services Recreation Civil Engineering Real Estate Food, Drink & Tobacco Construction of Buildings FTE Growth 2013 -2017 Sector 2340 Finance 1940 Computing & Information Services 1410 Utilities 1410 Agriculture, Forestry & Fishing 1180 Other Manufacturing 850 Other Private Services 650 Education 610 Media Activities 480 Transport Equipment 460 Air & Water Transport 430 Telecoms 370 Non-Metallic Products 330 Chemicals 270 Public Administration & Defence FTE Growth 2013 -2017 200 170 150 110 90 90 80 60 60 30 20 -350 -390 -2180 Source: Regional Planning Service, Experian § § § In expansion demand terms, the Humber economy is forecast to create a net 9, 700 FTE jobs by the end of 2017. Administrative & supportive services, specialised construction activities, wholesale and retail are forecast to create the most new jobs in the medium term. Public Administration & Defense, chemicals and non-metallic products are forecast to lose the most jobs over the period. REIU (Regional Economic Intelligence Unit)

Young Peoples Partnership Talent Match Humber

Background Talent Match – Big Lottery Fund Ø £ 108 Million Investment Ø 21 Areas across the UK Ø Furthest away from being work ready Ø 18 -24 years old Ø Long term unemployed (12 Months +) Ø Co-designed and delivered with Young People

The YPP and its aims. . . Ensure Young People remain at the forefront of Talent Match Humber Provide a strong representation for all Young People living in the Humber Region Operate as an excellent forum to gain hands on Experience, Self-Confidence and Aspiration

The Young Peoples Partnership

The bid… Almost 300 young people helped to shape Talent Match Humber through 2 surveys, 17 focus groups, and direct involvement on the Bid Group and Core Partnership.

The Launch. . .

The PITCH. . .

The Tendering Process… Our scores counted We had an influence We know what young people need We know what young people want

Where we are now. . . Ø So far we… Ø have engaged 48 members in the past three months Ø Are engaging young people from all walks of life Ø Are involved in every aspect of Talent Match Humber Ø Are running our own projects to help young people gain employment and self-esteem in our local area

Our Stories, Our Future.

Employment and Skills Board Task and Finish Group updates

Employability Skills • Humber Employability Charter – Hull Charter refreshed and relaunched as “Humber” in March 2014 • Employability Passport Kitemark – LEP currently developing a validation framework for employability passports (pilot from September 2014)

Functional Skills Submitted Capacity Building Activity through LRF CPD - Current gap around Training Providers who are delivering work place learning to mixed groups of learners where some have additional needs such as: • Dyslexia • Lower level Maths & English • English as a 2 nd language 1. Workshops to up skill tutors in delivery of Maths & English qualifications (up to L 2). Workshops would be open to all Training Providers across the Humber. 2. Specialist Dyslexia training workshops 3. Specialist ‘English as a 2 nd language in the workplace’ workshops. 4. Create a model for support worker role who could be peripatetic and work across the Humber with all providers. They would help in classes where there is mixed ability and students who have dyslexia or struggle with English as 2 nd language. This could be a ‘Train the Trainer’ role. 5. Mapping exercise to establish where GCSE Maths & English are being delivered. From here a web page could be devised or leaflet and a network established

Apprenticeships • The Apprenticeship Support Service is currently under development although has been delayed due to the approval process for Job Descriptions. All local providers who hold direct SFA contracts and have a head office in the Humber region will be sent full details and an ‘opt in’ once staff are in post. • A response to the Apprenticeship Reforms has been drafted and is currently awaiting approval • A possible LRF bid to support potential apprentices who are finding it difficult to secure employment at interview stage is being explored.

CEIAG/LMI Group Gold Standard for CEIAG • The consultation for the revised framework is now completed • The first draft of the framework and assessment criteria has been circulated to key stakeholders for comment and will be considered by the focus group • Pilot activity will take place between 26 May and 27 June 2014 • Final approval of the standard will be in July 2014 • The standard will be launched and disseminated in September 2014 Pan-Humber Hub for CEIAG/LMI • It has been agreed for the existing portals (Lincs 2 and Log On, Move On) to be supported by the LEP and funding has been provided for development • Developments include extending content to adult provision, accessibility for mobile devices and, crucially, a single point of entry (web page) for both sites • Future developments would see further unification leading to a single portal • All four local authorities have given their commitment to the portal

Enterprise • Group met in Oct 2013 and it was apparent that there were overlaps with other areas of LEP activity. To avoid duplication, the following has been agreed: • LEP Business facing group(s) will lead on support for starting up businesses, supported by Sarah Clinch. • The ESB has identified several priorities related to schools engagement, including employability, work experience, independent careers advice and Enterprise/entrepreneurial skills. The ESB is keen to take a coordinated approach to its schools engagement activity and will carry out a review of its priorities for engaging with schools over the coming months. • Task Group members will have the opportunity to contribute to the businessfacing and schools engagement strands.

Skills Group Update • • • Focussed on STEM related careers in: Engineering Manufacture Chemical Energy Ports and Logistics Identified Skills requirements for 4 levels Semi Skilled Craft Technician Engineer Developed a Database of courses offered by key providers across the Humber that support these skill needs • This database will be the basis of a Humber prospectus

Siemens – How prepared are we? Edited Press Release: Today's announcement by Siemens to invest £ 160 m on two of the enterprise zone sites in the Humber is a huge boost to the region and a catalyst for more investment. Combined with the £ 150 m being invested by Associated British Ports (ABP) in Green Port Hull a total of £ 310 m will be invested creating up to 1, 000 direct jobs, with many extra jobs to be created during construction and indirectly in the supply chain. The announcement adds to the confidence in the offshore wind industry and the Humber as the place in the UK to invest for energy related industries. Lord Haskins said “…. . this is an important development both in its own right and as a signal for what may be to come. The same attributes that have attracted Siemens to the Humber, the UK’s Energy Estuary, are also proving attractive to other companies in the energy sector, and we are working to ensure that further manufacturing investments will follow. “A great number of people and organisations have worked hard together to secure this investment for the UK. It is an excellent example of what can be achieved when the local area pulls together and has strong backing from Government. We must keep up the momentum to ensure that Siemens can be a magnet for further investment across the Humber, and a catalyst for changing our area for the better. Hull and the Humber are in the spotlight for all of the right reasons – now it is up to all of us to make the most of this opportunity and ensure that we deliver. ” The LEP will continue work to invest further in skills and supply chain initiatives to ensure that local people and businesses benefit from such development. "The hard work now begins to use all the strengths we have to maximise job creation in the region and make sure we have a Humber workforce ready to take advantage of them.

Workshops In groups – please discuss: How prepared is the skills sector to deliver support for the Siemens investment? Suggestions include the following considerations: • • Size/Scale of Siemens requirements Curriculum alignment CEIAG The Supply Chain Each group to feedback on one element only. Please nominate someone to take notes which will be collected and shared in full with the network after the meeting.

ab2abd57ca50d90adb25395be5a7b2d4.ppt