2bdf94e1084d9e9afd40105db648242e.ppt

- Количество слайдов: 31

HUD/FHA’s Lean Section 232 Program Tim Gruenes Office of Insured Health Care Facilities Tim. Gruenes@hud. gov

HUD/FHA’s Lean Section 232 Program Tim Gruenes Office of Insured Health Care Facilities Tim. Gruenes@hud. gov

HUD/FHA Insurance FHA Approved Lender underwrites & provides mortgage/loan $’s. FHA Insurance - if default/claim, HUD steps in and pays off lender Acceptable risk for FHA Insurance Fund? Not competitive process and no subsidy/grant provided by HUD

HUD/FHA Insurance FHA Approved Lender underwrites & provides mortgage/loan $’s. FHA Insurance - if default/claim, HUD steps in and pays off lender Acceptable risk for FHA Insurance Fund? Not competitive process and no subsidy/grant provided by HUD

Basics of Section 232 Housing for Frail Elderly: Nursing Homes Assisted Living Facilities Board and Care Can include up to 25% Independent Living Units Can be more than 1 type of above Uses of Loan Proceeds: Purchase/Refinance – provided 3 + years old New Construction/Substantial Rehabilitation Combination of above

Basics of Section 232 Housing for Frail Elderly: Nursing Homes Assisted Living Facilities Board and Care Can include up to 25% Independent Living Units Can be more than 1 type of above Uses of Loan Proceeds: Purchase/Refinance – provided 3 + years old New Construction/Substantial Rehabilitation Combination of above

MAP to Lean Processing of 232’s previously processed by Multifamily Now processed by OIHCF

MAP to Lean Processing of 232’s previously processed by Multifamily Now processed by OIHCF

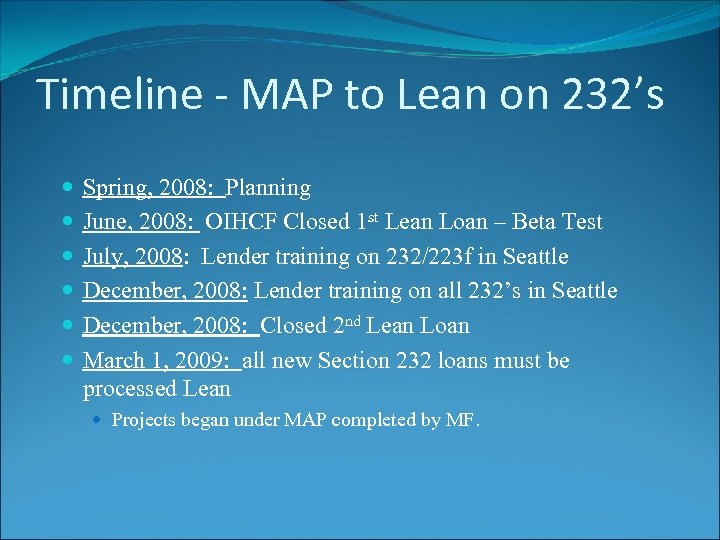

Timeline - MAP to Lean on 232’s Spring, 2008: Planning June, 2008: OIHCF Closed 1 st Lean Loan – Beta Test July, 2008: Lender training on 232/223 f in Seattle December, 2008: Lender training on all 232’s in Seattle December, 2008: Closed 2 nd Lean Loan March 1, 2009: all new Section 232 loans must be processed Lean Projects began under MAP completed by MF.

Timeline - MAP to Lean on 232’s Spring, 2008: Planning June, 2008: OIHCF Closed 1 st Lean Loan – Beta Test July, 2008: Lender training on 232/223 f in Seattle December, 2008: Lender training on all 232’s in Seattle December, 2008: Closed 2 nd Lean Loan March 1, 2009: all new Section 232 loans must be processed Lean Projects began under MAP completed by MF.

Where Did Lean Come From? 1990 1996

Where Did Lean Come From? 1990 1996

232 Basics

232 Basics

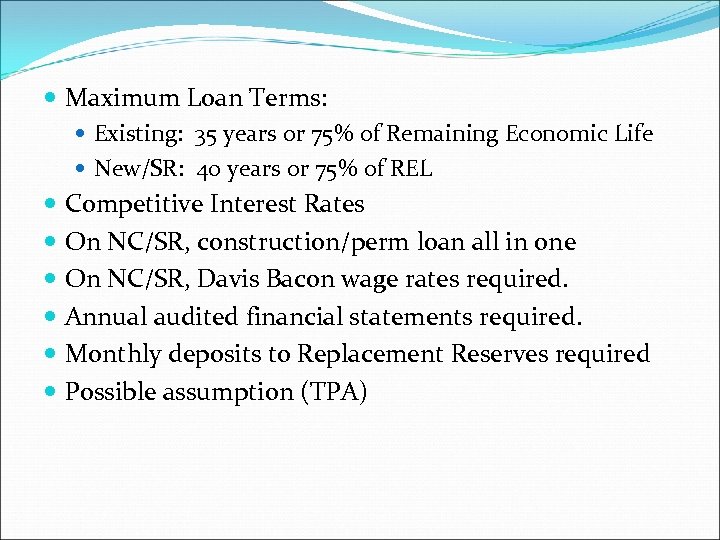

Maximum Loan Terms: Existing: 35 years or 75% of Remaining Economic Life New/SR: 40 years or 75% of REL Competitive Interest Rates On NC/SR, construction/perm loan all in one On NC/SR, Davis Bacon wage rates required. Annual audited financial statements required. Monthly deposits to Replacement Reserves required Possible assumption (TPA)

Maximum Loan Terms: Existing: 35 years or 75% of Remaining Economic Life New/SR: 40 years or 75% of REL Competitive Interest Rates On NC/SR, construction/perm loan all in one On NC/SR, Davis Bacon wage rates required. Annual audited financial statements required. Monthly deposits to Replacement Reserves required Possible assumption (TPA)

232 Loan Sizing

232 Loan Sizing

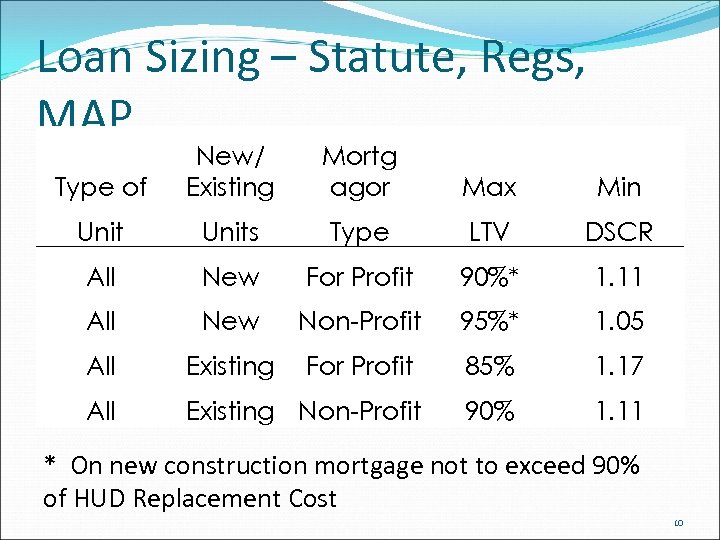

Loan Sizing – Statute, Regs, MAP Type of New/ Existing Mortg agor Max Min Units Type LTV DSCR All New For Profit 90%* 1. 11 All New Non-Profit 95%* 1. 05 All Existing For Profit 85% 1. 17 All Existing Non-Profit 90% 1. 11 * On new construction mortgage not to exceed 90% of HUD Replacement Cost 10

Loan Sizing – Statute, Regs, MAP Type of New/ Existing Mortg agor Max Min Units Type LTV DSCR All New For Profit 90%* 1. 11 All New Non-Profit 95%* 1. 05 All Existing For Profit 85% 1. 17 All Existing Non-Profit 90% 1. 11 * On new construction mortgage not to exceed 90% of HUD Replacement Cost 10

For Lean Projects, Start here……………. .

For Lean Projects, Start here……………. .

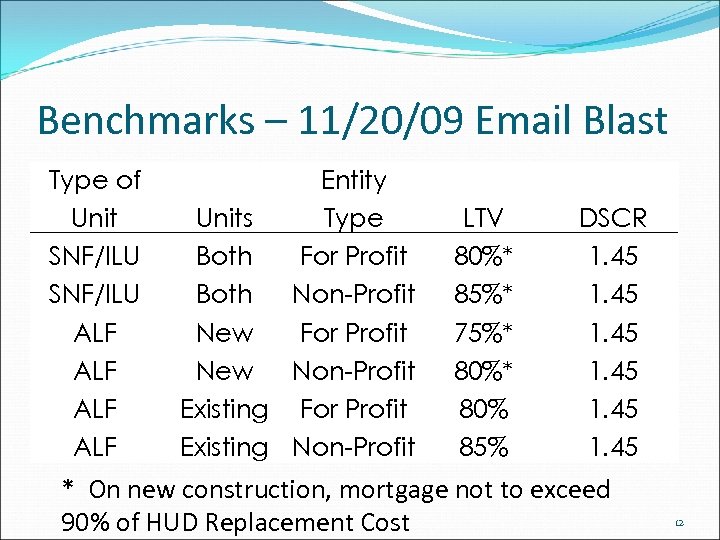

Benchmarks – 11/20/09 Email Blast Type of Unit SNF/ILU ALF ALF Entity Units Type Both For Profit Both Non-Profit New For Profit New Non-Profit Existing For Profit Existing Non-Profit LTV 80%* 85%* 75%* 80% 85% DSCR 1. 45 * On new construction, mortgage not to exceed 90% of HUD Replacement Cost 12

Benchmarks – 11/20/09 Email Blast Type of Unit SNF/ILU ALF ALF Entity Units Type Both For Profit Both Non-Profit New For Profit New Non-Profit Existing For Profit Existing Non-Profit LTV 80%* 85%* 75%* 80% 85% DSCR 1. 45 * On new construction, mortgage not to exceed 90% of HUD Replacement Cost 12

Loan Sizing – Continued Not-for-Profit Owners and Operators: To achieve the more liberal LTV benchmark, must demonstrate: A successful operating track record Significant project operating and management experience A solid financial track record If exceeding LTV’s on previous slide, need significant justification/mitigation of why low risk for HUD. 13

Loan Sizing – Continued Not-for-Profit Owners and Operators: To achieve the more liberal LTV benchmark, must demonstrate: A successful operating track record Significant project operating and management experience A solid financial track record If exceeding LTV’s on previous slide, need significant justification/mitigation of why low risk for HUD. 13

HUD. GOV www. hud. gov/healthcare 14

HUD. GOV www. hud. gov/healthcare 14

LEAN Section 232 Home Page Welcome to the home page for the Office of Insured Health Care Facilities’ Section 232 LEAN program. Our website contains information on "Underwriting Guidance" and "Loan Servicing Guidance" as well as a "General Overview of FHA Insurance and LEAN Section 232. " Underwriting Guidance--Deals with situations where you will be placing a new FHA Insured Loan on the project. Loan Servicing Guidance--Deals with asset management activities of FHA-Insured Loans. General Overview of FHA Insurance and HUD’s LEAN Section 232 Program

LEAN Section 232 Home Page Welcome to the home page for the Office of Insured Health Care Facilities’ Section 232 LEAN program. Our website contains information on "Underwriting Guidance" and "Loan Servicing Guidance" as well as a "General Overview of FHA Insurance and LEAN Section 232. " Underwriting Guidance--Deals with situations where you will be placing a new FHA Insured Loan on the project. Loan Servicing Guidance--Deals with asset management activities of FHA-Insured Loans. General Overview of FHA Insurance and HUD’s LEAN Section 232 Program

Overview and Statistics

Overview and Statistics

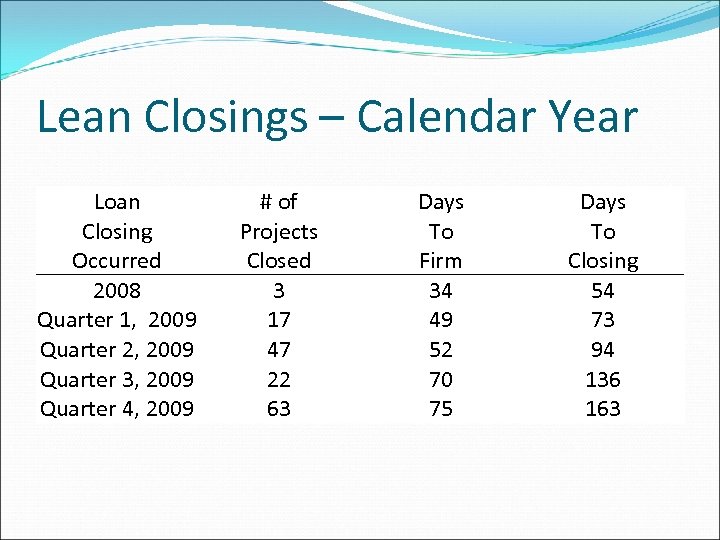

Lean Closings – Calendar Year Loan Closing Occurred 2008 Quarter 1, 2009 Quarter 2, 2009 Quarter 3, 2009 Quarter 4, 2009 # of Projects Closed 3 17 47 22 63 Days To Firm 34 49 52 70 75 Days To Closing 54 73 94 136 163

Lean Closings – Calendar Year Loan Closing Occurred 2008 Quarter 1, 2009 Quarter 2, 2009 Quarter 3, 2009 Quarter 4, 2009 # of Projects Closed 3 17 47 22 63 Days To Firm 34 49 52 70 75 Days To Closing 54 73 94 136 163

Queue Statistics Queue = 124 Projects Of these, currently 23 with Risk Assessments that passed

Queue Statistics Queue = 124 Projects Of these, currently 23 with Risk Assessments that passed

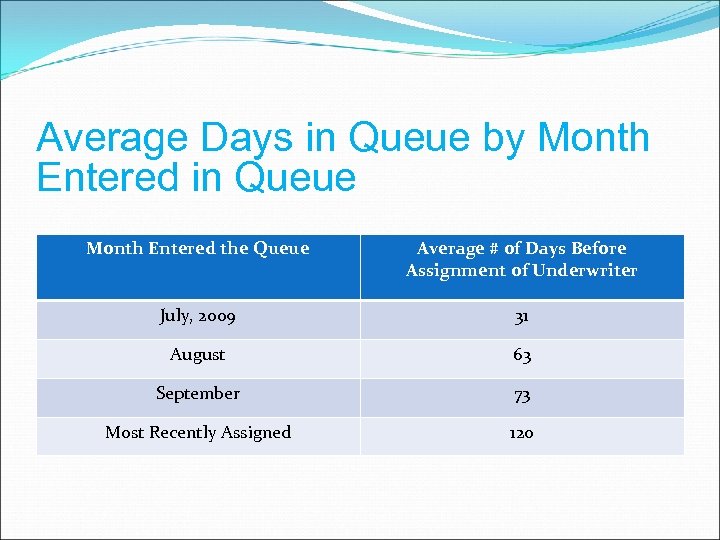

Average Days in Queue by Month Entered in Queue Month Entered the Queue Average # of Days Before Assignment of Underwriter July, 2009 31 August 63 September 73 Most Recently Assigned 120

Average Days in Queue by Month Entered in Queue Month Entered the Queue Average # of Days Before Assignment of Underwriter July, 2009 31 August 63 September 73 Most Recently Assigned 120

Changes we’ve made in attempt to deal with shortage of staffing/overwelming demand: Green Team: existing projects that pass Risk Assessment Removed Preapplication process and implementing two step Firm process to replace

Changes we’ve made in attempt to deal with shortage of staffing/overwelming demand: Green Team: existing projects that pass Risk Assessment Removed Preapplication process and implementing two step Firm process to replace

New Two Stage Process for New Construction & Sub-Rehab

New Two Stage Process for New Construction & Sub-Rehab

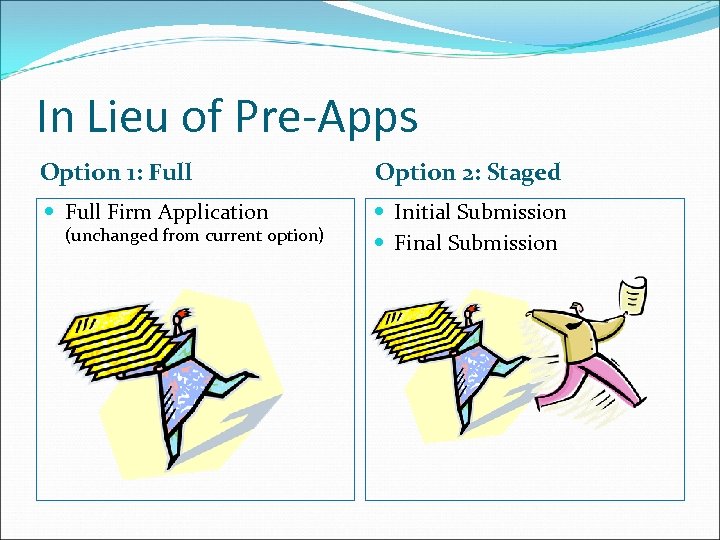

In Lieu of Pre-Apps Option 1: Full Option 2: Staged Full Firm Application Initial Submission Final Submission (unchanged from current option)

In Lieu of Pre-Apps Option 1: Full Option 2: Staged Full Firm Application Initial Submission Final Submission (unchanged from current option)

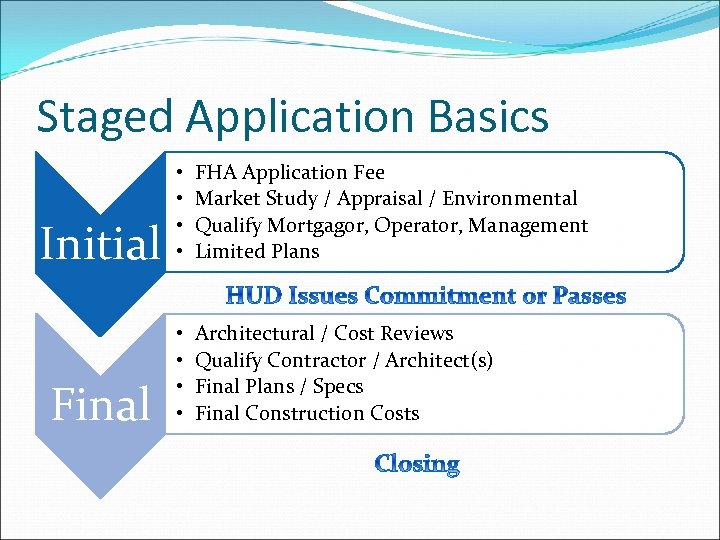

Staged Application Basics Initial • • FHA Application Fee Market Study / Appraisal / Environmental Qualify Mortgagor, Operator, Management Limited Plans Final • • Architectural / Cost Reviews Qualify Contractor / Architect(s) Final Plans / Specs Final Construction Costs

Staged Application Basics Initial • • FHA Application Fee Market Study / Appraisal / Environmental Qualify Mortgagor, Operator, Management Limited Plans Final • • Architectural / Cost Reviews Qualify Contractor / Architect(s) Final Plans / Specs Final Construction Costs

Initial Submission FHA Application Fee – 0. 3% of mortgage If HUD elects NOT to continue with the loan, ½ of the application fee can be refunded. If HUD issues a commitment, the Lender has 10 business days to decline the commitment and request a refund of ½ of the application fee. Market Study / Appraisal / Environmental Complete review and approval of Market and Value Environmental review starts immediately Same expiration time frames

Initial Submission FHA Application Fee – 0. 3% of mortgage If HUD elects NOT to continue with the loan, ½ of the application fee can be refunded. If HUD issues a commitment, the Lender has 10 business days to decline the commitment and request a refund of ½ of the application fee. Market Study / Appraisal / Environmental Complete review and approval of Market and Value Environmental review starts immediately Same expiration time frames

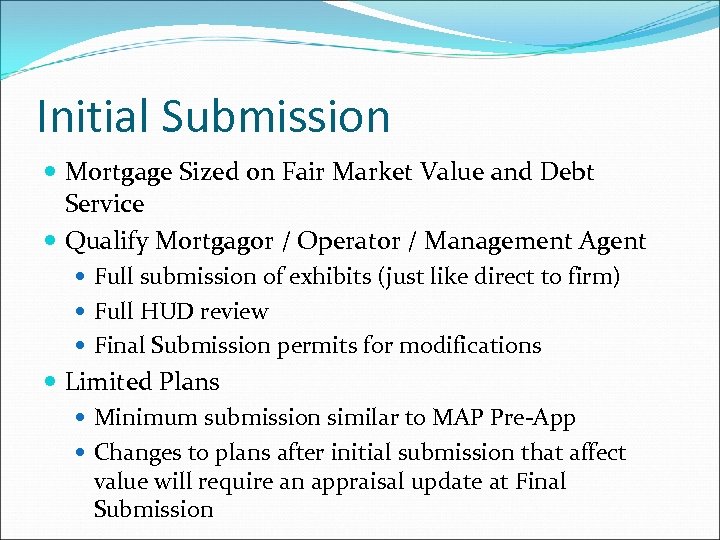

Initial Submission Mortgage Sized on Fair Market Value and Debt Service Qualify Mortgagor / Operator / Management Agent Full submission of exhibits (just like direct to firm) Full HUD review Final Submission permits for modifications Limited Plans Minimum submission similar to MAP Pre-App Changes to plans after initial submission that affect value will require an appraisal update at Final Submission

Initial Submission Mortgage Sized on Fair Market Value and Debt Service Qualify Mortgagor / Operator / Management Agent Full submission of exhibits (just like direct to firm) Full HUD review Final Submission permits for modifications Limited Plans Minimum submission similar to MAP Pre-App Changes to plans after initial submission that affect value will require an appraisal update at Final Submission

Initial Submission Other Submission Exhibits Site Control Certificate of Need (if applicable) Title Search & Pro Forma Land Title Survey Budgets Stabilized Operations Initial Lease-Up Development Costs Affirmative Fair Housing Marketing Plan Additional Facility Information Early Commencement of Construction Exhibits (if applicable)

Initial Submission Other Submission Exhibits Site Control Certificate of Need (if applicable) Title Search & Pro Forma Land Title Survey Budgets Stabilized Operations Initial Lease-Up Development Costs Affirmative Fair Housing Marketing Plan Additional Facility Information Early Commencement of Construction Exhibits (if applicable)

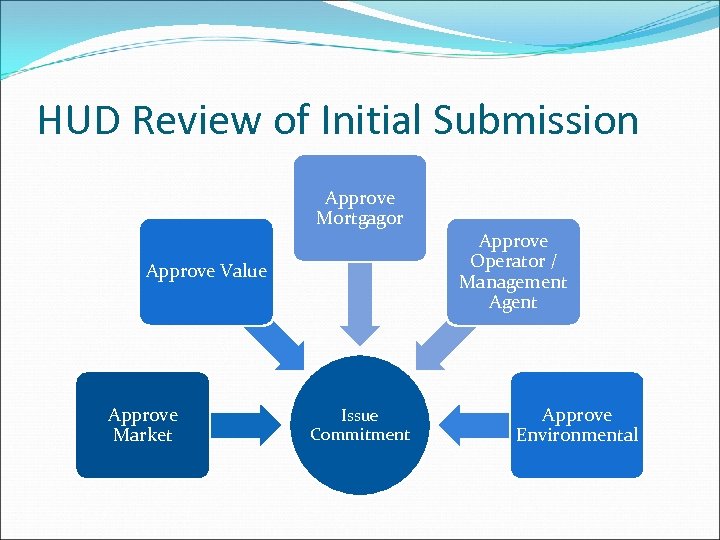

HUD Review of Initial Submission Approve Mortgagor Approve Value Approve Market Issue Commitment Approve Operator / Management Agent Approve Environmental

HUD Review of Initial Submission Approve Mortgagor Approve Value Approve Market Issue Commitment Approve Operator / Management Agent Approve Environmental

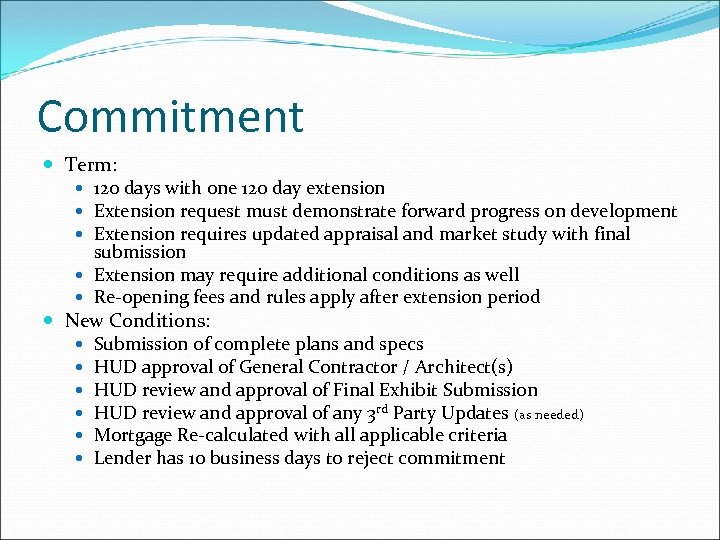

Commitment Term: 120 days with one 120 day extension Extension request must demonstrate forward progress on development Extension requires updated appraisal and market study with final submission Extension may require additional conditions as well Re-opening fees and rules apply after extension period New Conditions: Submission of complete plans and specs HUD approval of General Contractor / Architect(s) HUD review and approval of Final Exhibit Submission HUD review and approval of any 3 rd Party Updates (as needed) Mortgage Re-calculated with all applicable criteria Lender has 10 business days to reject commitment

Commitment Term: 120 days with one 120 day extension Extension request must demonstrate forward progress on development Extension requires updated appraisal and market study with final submission Extension may require additional conditions as well Re-opening fees and rules apply after extension period New Conditions: Submission of complete plans and specs HUD approval of General Contractor / Architect(s) HUD review and approval of Final Exhibit Submission HUD review and approval of any 3 rd Party Updates (as needed) Mortgage Re-calculated with all applicable criteria Lender has 10 business days to reject commitment

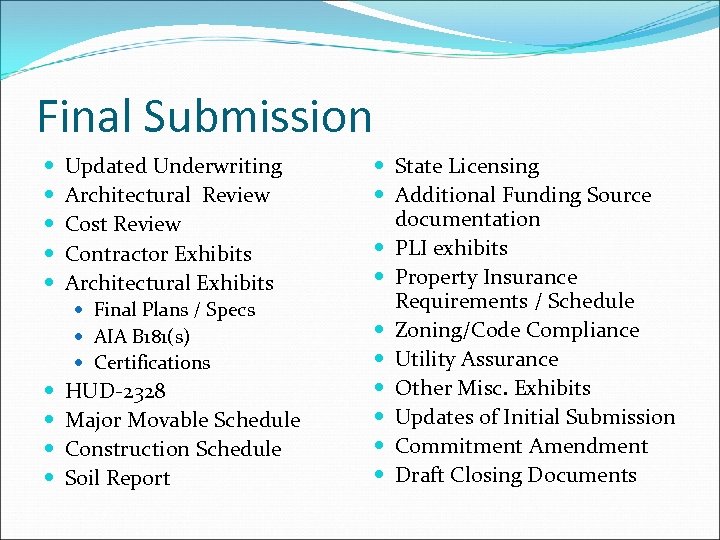

Final Submission Updated Underwriting Architectural Review Cost Review Contractor Exhibits Architectural Exhibits Final Plans / Specs AIA B 181(s) Certifications HUD-2328 Major Movable Schedule Construction Schedule Soil Report State Licensing Additional Funding Source documentation PLI exhibits Property Insurance Requirements / Schedule Zoning/Code Compliance Utility Assurance Other Misc. Exhibits Updates of Initial Submission Commitment Amendment Draft Closing Documents

Final Submission Updated Underwriting Architectural Review Cost Review Contractor Exhibits Architectural Exhibits Final Plans / Specs AIA B 181(s) Certifications HUD-2328 Major Movable Schedule Construction Schedule Soil Report State Licensing Additional Funding Source documentation PLI exhibits Property Insurance Requirements / Schedule Zoning/Code Compliance Utility Assurance Other Misc. Exhibits Updates of Initial Submission Commitment Amendment Draft Closing Documents

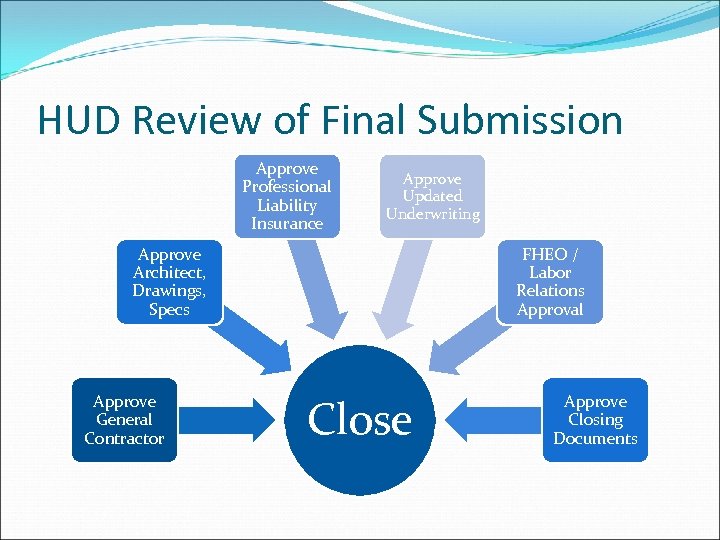

HUD Review of Final Submission Approve Professional Liability Insurance Approve Updated Underwriting Approve Architect, Drawings, Specs Approve General Contractor FHEO / Labor Relations Approval Close Approve Closing Documents

HUD Review of Final Submission Approve Professional Liability Insurance Approve Updated Underwriting Approve Architect, Drawings, Specs Approve General Contractor FHEO / Labor Relations Approval Close Approve Closing Documents

Update on Status of This Program Draft documents are posted for the initial submission process on HUD. GOV Beta testing of a live deal to verify process and documents are correct Final Submission documents will be posted to HUD. GOV upon the beta test coming in for final submission

Update on Status of This Program Draft documents are posted for the initial submission process on HUD. GOV Beta testing of a live deal to verify process and documents are correct Final Submission documents will be posted to HUD. GOV upon the beta test coming in for final submission