2925e15075aef8ac36140bd3235ba378.ppt

- Количество слайдов: 32

http: //www. evergreen. loyola. edu/~pptallon/is 356. htm IS 356 IT for Financial Services The Market for the Next 100 Years!

http: //www. evergreen. loyola. edu/~pptallon/is 356. htm IS 356 IT for Financial Services The Market for the Next 100 Years!

© Paul Tallon 19 March 2018 2/28

© Paul Tallon 19 March 2018 2/28

Outline 4 How is NASDAQ different from NYSE? 4 Technology 4 Select. Net 4 SOES (small order execution system) 4 Super. SOES 4 Understanding order flow: some tricks of the trade 4 Super. Montage 4 Existing © Paul Tallon market shortcomings 19 March 2018 3 / 32

Outline 4 How is NASDAQ different from NYSE? 4 Technology 4 Select. Net 4 SOES (small order execution system) 4 Super. SOES 4 Understanding order flow: some tricks of the trade 4 Super. Montage 4 Existing © Paul Tallon market shortcomings 19 March 2018 3 / 32

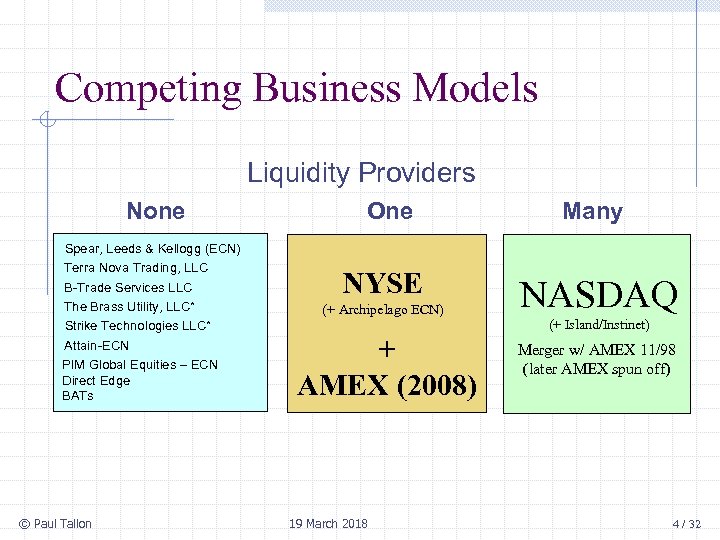

Competing Business Models Liquidity Providers None Spear, Leeds & Kellogg (ECN) Terra Nova Trading, LLC B-Trade Services LLC The Brass Utility, LLC* Strike Technologies LLC* Attain-ECN PIM Global Equities – ECN Direct Edge BATs © Paul Tallon One Many NYSE NASDAQ (+ Archipelago ECN) (+ Island/Instinet) + AMEX (2008) 19 March 2018 Merger w/ AMEX 11/98 (later AMEX spun off) 4 / 32

Competing Business Models Liquidity Providers None Spear, Leeds & Kellogg (ECN) Terra Nova Trading, LLC B-Trade Services LLC The Brass Utility, LLC* Strike Technologies LLC* Attain-ECN PIM Global Equities – ECN Direct Edge BATs © Paul Tallon One Many NYSE NASDAQ (+ Archipelago ECN) (+ Island/Instinet) + AMEX (2008) 19 March 2018 Merger w/ AMEX 11/98 (later AMEX spun off) 4 / 32

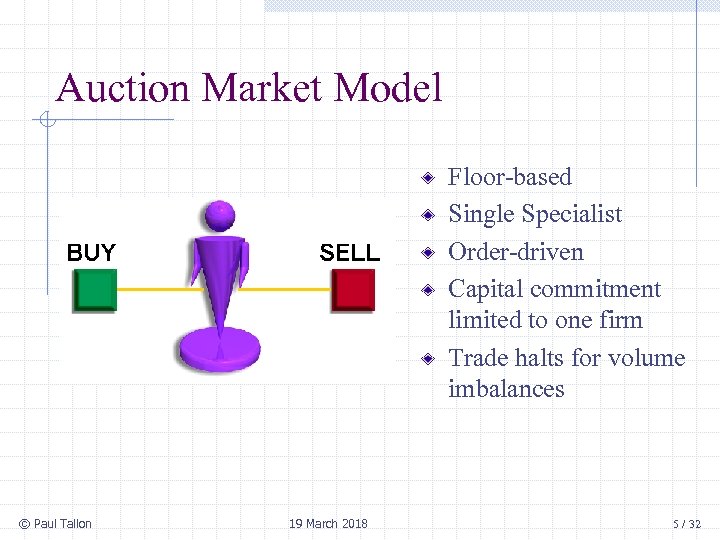

Auction Market Model Floor-based Single Specialist Order-driven Capital commitment limited to one firm Trade halts for volume imbalances © Paul Tallon 19 March 2018 5 / 32

Auction Market Model Floor-based Single Specialist Order-driven Capital commitment limited to one firm Trade halts for volume imbalances © Paul Tallon 19 March 2018 5 / 32

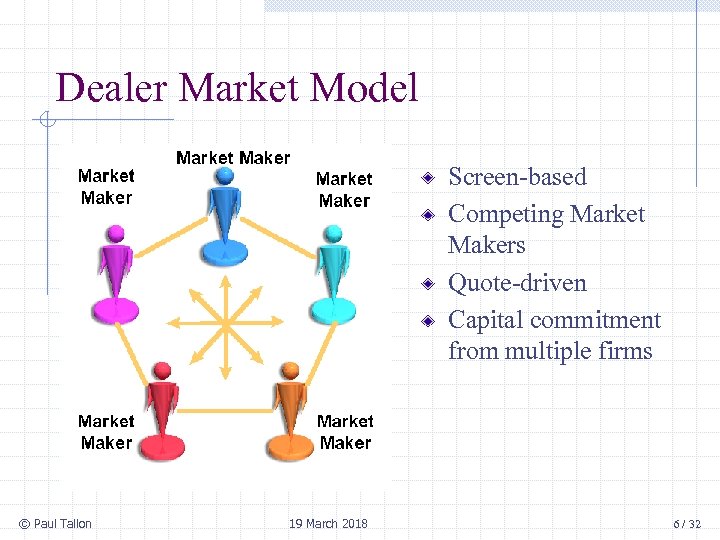

Dealer Market Model Screen-based Competing Market Makers Quote-driven Capital commitment from multiple firms © Paul Tallon 19 March 2018 6 / 32

Dealer Market Model Screen-based Competing Market Makers Quote-driven Capital commitment from multiple firms © Paul Tallon 19 March 2018 6 / 32

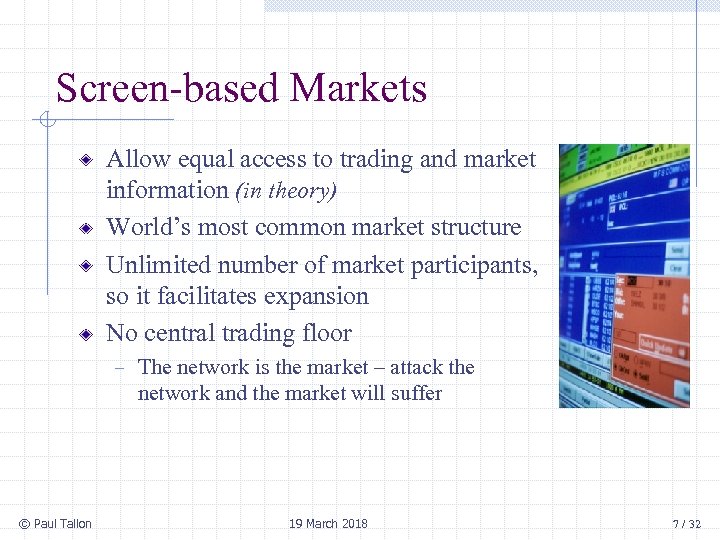

Screen-based Markets Allow equal access to trading and market information (in theory) World’s most common market structure Unlimited number of market participants, so it facilitates expansion No central trading floor − © Paul Tallon The network is the market – attack the network and the market will suffer 19 March 2018 7 / 32

Screen-based Markets Allow equal access to trading and market information (in theory) World’s most common market structure Unlimited number of market participants, so it facilitates expansion No central trading floor − © Paul Tallon The network is the market – attack the network and the market will suffer 19 March 2018 7 / 32

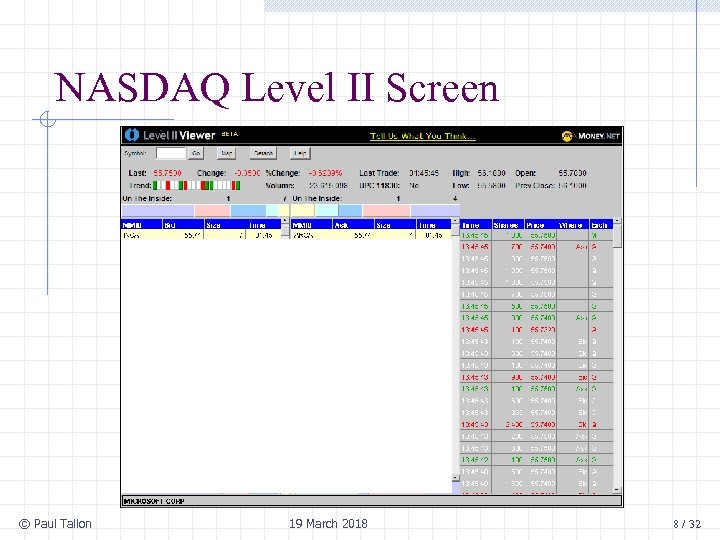

NASDAQ Level II Screen © Paul Tallon 19 March 2018 8 / 32

NASDAQ Level II Screen © Paul Tallon 19 March 2018 8 / 32

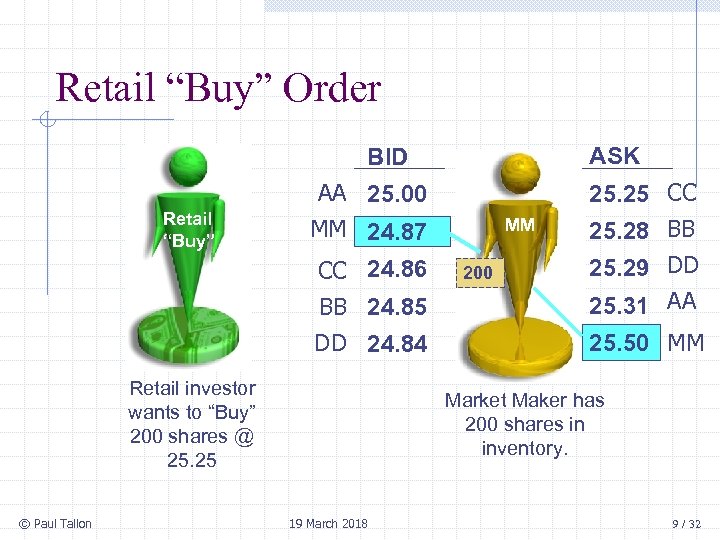

Retail “Buy” Order ASK BID Retail “Buy” AA 25. 00 MM 24. 87 CC 24. 86 BB 24. 85 DD 24. 84 Retail investor wants to “Buy” 200 shares @ 25. 25 © Paul Tallon MM 200 25. 25 CC 25. 28 BB 25. 29 DD 25. 31 AA 25. 50 MM Market Maker has 200 shares in inventory. 19 March 2018 9 / 32

Retail “Buy” Order ASK BID Retail “Buy” AA 25. 00 MM 24. 87 CC 24. 86 BB 24. 85 DD 24. 84 Retail investor wants to “Buy” 200 shares @ 25. 25 © Paul Tallon MM 200 25. 25 CC 25. 28 BB 25. 29 DD 25. 31 AA 25. 50 MM Market Maker has 200 shares in inventory. 19 March 2018 9 / 32

Execution – Scenario 1 BID 25. 00 Retail “Buy” ASK 25. 25 24. 87 24. 86 MM 200 25. 28 25. 29 24. 85 Retail investor wants to “Buy” 200 shares @ 25. 31 24. 84 “Sell” 25. 50 Market Maker fills “Buy” order at best offer price of 25. Trade Report: 200 @ 25. 25 © Paul Tallon 19 March 2018 10 / 32

Execution – Scenario 1 BID 25. 00 Retail “Buy” ASK 25. 25 24. 87 24. 86 MM 200 25. 28 25. 29 24. 85 Retail investor wants to “Buy” 200 shares @ 25. 31 24. 84 “Sell” 25. 50 Market Maker fills “Buy” order at best offer price of 25. Trade Report: 200 @ 25. 25 © Paul Tallon 19 March 2018 10 / 32

Retail “Buy” Order – Scenario 2 BID 25. 00 Retail “Buy” ASK 25. 25 24. 87 “Sell” MM 25. 28 25. 29 24. 85 25. 31 24. 84 Retail investor wants to “Buy” 200 shares @ 25. 24. 86 25. 50 Market Maker does not have shares in inventory. Market Maker sells short 200 shares at 25. Trade Report: 200 @ 25. 25 © Paul Tallon 19 March 2018 11 / 32

Retail “Buy” Order – Scenario 2 BID 25. 00 Retail “Buy” ASK 25. 25 24. 87 “Sell” MM 25. 28 25. 29 24. 85 25. 31 24. 84 Retail investor wants to “Buy” 200 shares @ 25. 24. 86 25. 50 Market Maker does not have shares in inventory. Market Maker sells short 200 shares at 25. Trade Report: 200 @ 25. 25 © Paul Tallon 19 March 2018 11 / 32

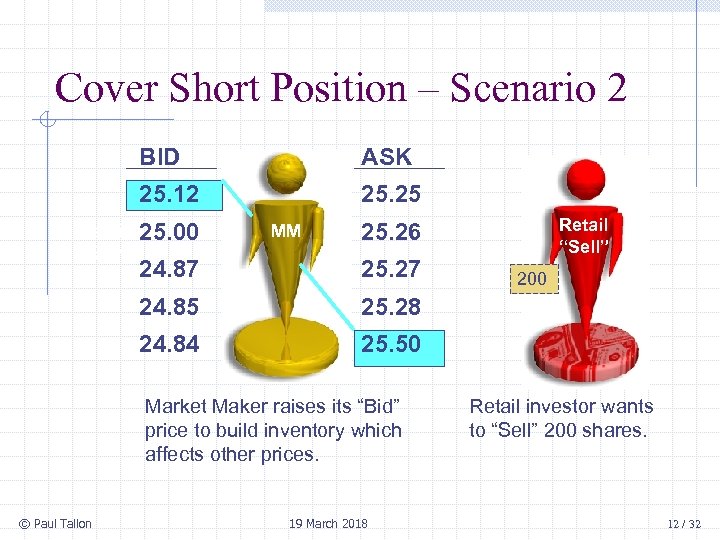

Cover Short Position – Scenario 2 BID 25. 12 Retail “Buy” ASK 25. 25 25. 00 MM 24. 87 25. 27 24. 85 25. 28 24. 84 25. 50 Market Maker raises its “Bid” price to build inventory which affects other prices. © Paul Tallon Retail “Sell” 25. 26 19 March 2018 200 Retail investor wants to “Sell” 200 shares. 12 / 32

Cover Short Position – Scenario 2 BID 25. 12 Retail “Buy” ASK 25. 25 25. 00 MM 24. 87 25. 27 24. 85 25. 28 24. 84 25. 50 Market Maker raises its “Bid” price to build inventory which affects other prices. © Paul Tallon Retail “Sell” 25. 26 19 March 2018 200 Retail investor wants to “Sell” 200 shares. 12 / 32

Execution – Scenario 2 BID ASK 25. 12 25. 25 25. 00 MM Retail “Sell” 25. 26 24. 87 25. 27 24. 85 25. 28 24. 84 “Buy” 200 shares 25. 50 Market Maker “Buys” 200 shares at its best bid price of 25. 12 200 Retail investor “Sells” 200 shares to Market Maker. Trade Report: 200 @ 25. 12 © Paul Tallon 19 March 2018 13 / 32

Execution – Scenario 2 BID ASK 25. 12 25. 25 25. 00 MM Retail “Sell” 25. 26 24. 87 25. 27 24. 85 25. 28 24. 84 “Buy” 200 shares 25. 50 Market Maker “Buys” 200 shares at its best bid price of 25. 12 200 Retail investor “Sells” 200 shares to Market Maker. Trade Report: 200 @ 25. 12 © Paul Tallon 19 March 2018 13 / 32

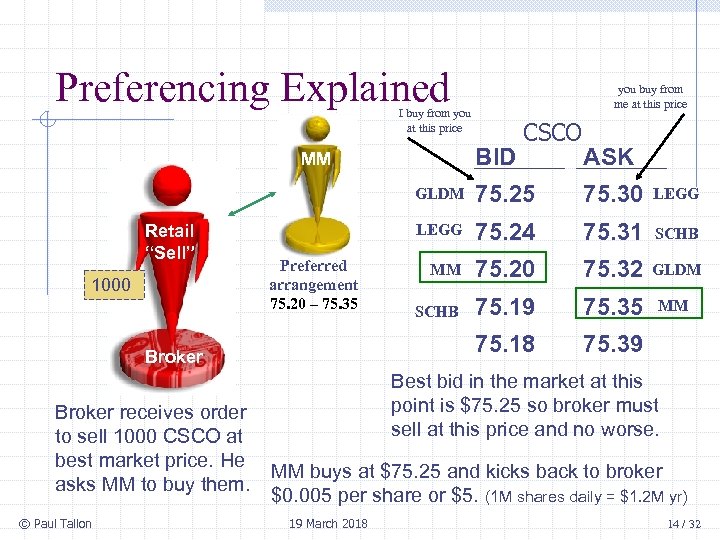

Preferencing Explained you buy from me at this price I buy from you at this price BID MM CSCO ASK GLDM Retail “Sell” “Buy” 1000 Broker receives order to sell 1000 CSCO at best market price. He asks MM to buy them. © Paul Tallon LEGG 75. 24 75. 31 SCHB MM 75. 20 75. 32 GLDM SCHB 75. 19 75. 35 MM 75. 18 Broker 75. 30 LEGG Preferred arrangement 75. 20 – 75. 35 75. 25 75. 39 Best bid in the market at this point is $75. 25 so broker must sell at this price and no worse. MM buys at $75. 25 and kicks back to broker $0. 005 per share or $5. (1 M shares daily = $1. 2 M yr) 19 March 2018 14 / 32

Preferencing Explained you buy from me at this price I buy from you at this price BID MM CSCO ASK GLDM Retail “Sell” “Buy” 1000 Broker receives order to sell 1000 CSCO at best market price. He asks MM to buy them. © Paul Tallon LEGG 75. 24 75. 31 SCHB MM 75. 20 75. 32 GLDM SCHB 75. 19 75. 35 MM 75. 18 Broker 75. 30 LEGG Preferred arrangement 75. 20 – 75. 35 75. 25 75. 39 Best bid in the market at this point is $75. 25 so broker must sell at this price and no worse. MM buys at $75. 25 and kicks back to broker $0. 005 per share or $5. (1 M shares daily = $1. 2 M yr) 19 March 2018 14 / 32

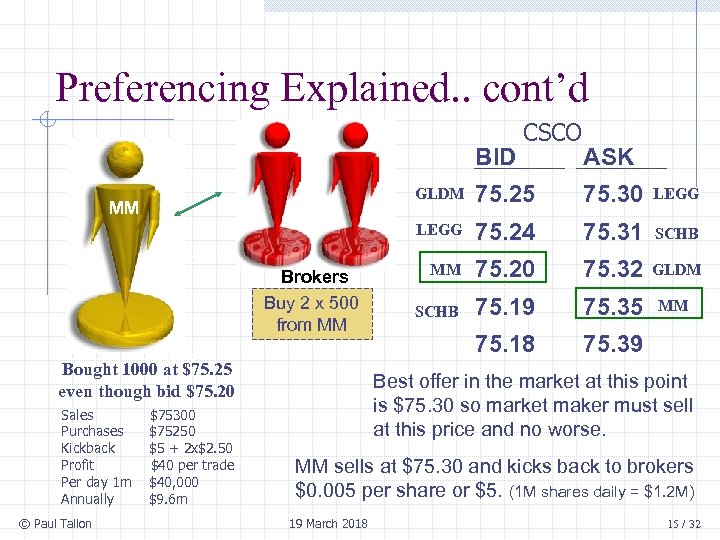

Preferencing Explained. . cont’d BID Brokers Buy 2 x 500 from MM Broker Bought 1000 at $75. 25 even though bid $75. 20 $75300 $75250 $5 + 2 x$2. 50 $40 per trade $40, 000 $9. 6 m 75. 25 75. 30 LEGG Retail “Buy” © Paul Tallon ASK GLDM MM Sales Purchases Kickback Profit Per day 1 m Annually CSCO 75. 24 75. 31 SCHB MM 75. 20 75. 32 GLDM SCHB 75. 19 75. 35 MM 75. 18 75. 39 Best offer in the market at this point is $75. 30 so market maker must sell at this price and no worse. MM sells at $75. 30 and kicks back to brokers $0. 005 per share or $5. (1 M shares daily = $1. 2 M) 19 March 2018 15 / 32

Preferencing Explained. . cont’d BID Brokers Buy 2 x 500 from MM Broker Bought 1000 at $75. 25 even though bid $75. 20 $75300 $75250 $5 + 2 x$2. 50 $40 per trade $40, 000 $9. 6 m 75. 25 75. 30 LEGG Retail “Buy” © Paul Tallon ASK GLDM MM Sales Purchases Kickback Profit Per day 1 m Annually CSCO 75. 24 75. 31 SCHB MM 75. 20 75. 32 GLDM SCHB 75. 19 75. 35 MM 75. 18 75. 39 Best offer in the market at this point is $75. 30 so market maker must sell at this price and no worse. MM sells at $75. 30 and kicks back to brokers $0. 005 per share or $5. (1 M shares daily = $1. 2 M) 19 March 2018 15 / 32

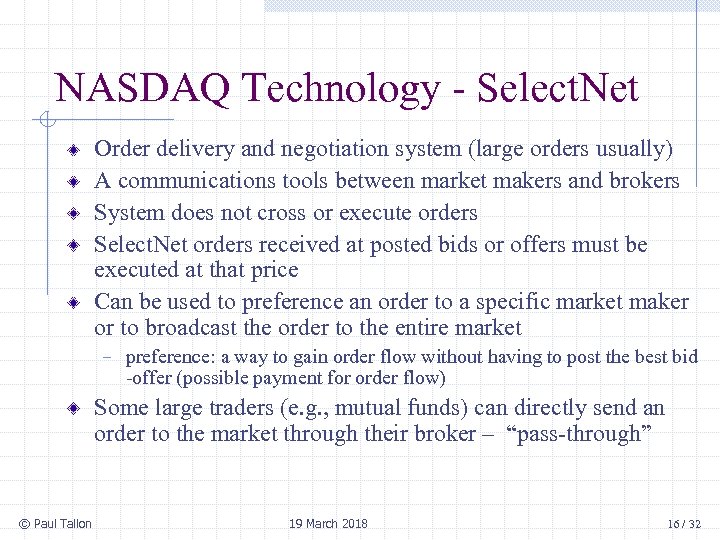

NASDAQ Technology - Select. Net Order delivery and negotiation system (large orders usually) A communications tools between market makers and brokers System does not cross or execute orders Select. Net orders received at posted bids or offers must be executed at that price Can be used to preference an order to a specific market maker or to broadcast the order to the entire market − preference: a way to gain order flow without having to post the best bid -offer (possible payment for order flow) Some large traders (e. g. , mutual funds) can directly send an order to the market through their broker – “pass-through” © Paul Tallon 19 March 2018 16 / 32

NASDAQ Technology - Select. Net Order delivery and negotiation system (large orders usually) A communications tools between market makers and brokers System does not cross or execute orders Select. Net orders received at posted bids or offers must be executed at that price Can be used to preference an order to a specific market maker or to broadcast the order to the entire market − preference: a way to gain order flow without having to post the best bid -offer (possible payment for order flow) Some large traders (e. g. , mutual funds) can directly send an order to the market through their broker – “pass-through” © Paul Tallon 19 March 2018 16 / 32

NASDAQ Technology - SOES (small order execution system) Electronic system for routing small orders from brokers to market makers Automated system – if a market maker’s quote is hit, they cannot back out of the trade Originally capped at 1, 000 shares maximum Problems from day traders – Select. Net trade followed rapidly by SOES order – Creates dual liability: “SOES bandits” NASDAQ dropped limit – at market maker’s discretion Day traders moved to Select. Net instead – developed very fast order execution interface: installed an automatic “back-away” complaint procedure, forcing market makers to comply. © Paul Tallon 19 March 2018 17 / 32

NASDAQ Technology - SOES (small order execution system) Electronic system for routing small orders from brokers to market makers Automated system – if a market maker’s quote is hit, they cannot back out of the trade Originally capped at 1, 000 shares maximum Problems from day traders – Select. Net trade followed rapidly by SOES order – Creates dual liability: “SOES bandits” NASDAQ dropped limit – at market maker’s discretion Day traders moved to Select. Net instead – developed very fast order execution interface: installed an automatic “back-away” complaint procedure, forcing market makers to comply. © Paul Tallon 19 March 2018 17 / 32

NASDAQ Technology - Super. SOES Automated execution up to 9, 900 shares 5 second delay between orders received from same broker Difficult for market maker to back away from a trade ECNs were included in the montage (or display of available market makers) for each share but were liable to be cut off if their response to a trade request was deemed “slow” Went live late 2001 Set the stage for Super. Montage © Paul Tallon 19 March 2018 18 / 32

NASDAQ Technology - Super. SOES Automated execution up to 9, 900 shares 5 second delay between orders received from same broker Difficult for market maker to back away from a trade ECNs were included in the montage (or display of available market makers) for each share but were liable to be cut off if their response to a trade request was deemed “slow” Went live late 2001 Set the stage for Super. Montage © Paul Tallon 19 March 2018 18 / 32

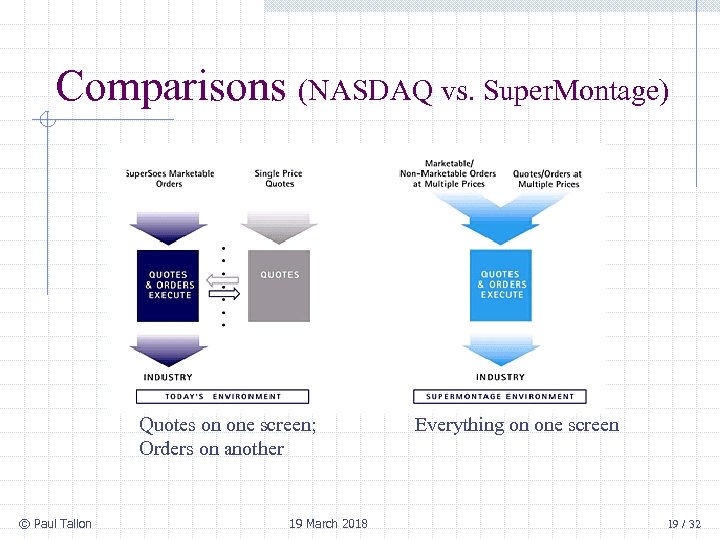

Comparisons (NASDAQ vs. Super. Montage) Quotes on one screen; Orders on another © Paul Tallon 19 March 2018 Everything on one screen 19 / 32

Comparisons (NASDAQ vs. Super. Montage) Quotes on one screen; Orders on another © Paul Tallon 19 March 2018 Everything on one screen 19 / 32

Super. Montage - features Shows depth of market on buy and sell side Enter multiple quotes/orders at the same time for a stock Ability to hold stock in reserve – don’t show the entire order to the market at any one time. To avail of this, you must show a minimum order size of 1, 000 Anonymity is possible – market maker’s name is masked Broker could previously cancel an order within 10 seconds of submission (even if it was accepted by a market maker) – that is now removed so execution is automatic (ECNs can still refuse an order) © Paul Tallon 19 March 2018 20 / 32

Super. Montage - features Shows depth of market on buy and sell side Enter multiple quotes/orders at the same time for a stock Ability to hold stock in reserve – don’t show the entire order to the market at any one time. To avail of this, you must show a minimum order size of 1, 000 Anonymity is possible – market maker’s name is masked Broker could previously cancel an order within 10 seconds of submission (even if it was accepted by a market maker) – that is now removed so execution is automatic (ECNs can still refuse an order) © Paul Tallon 19 March 2018 20 / 32

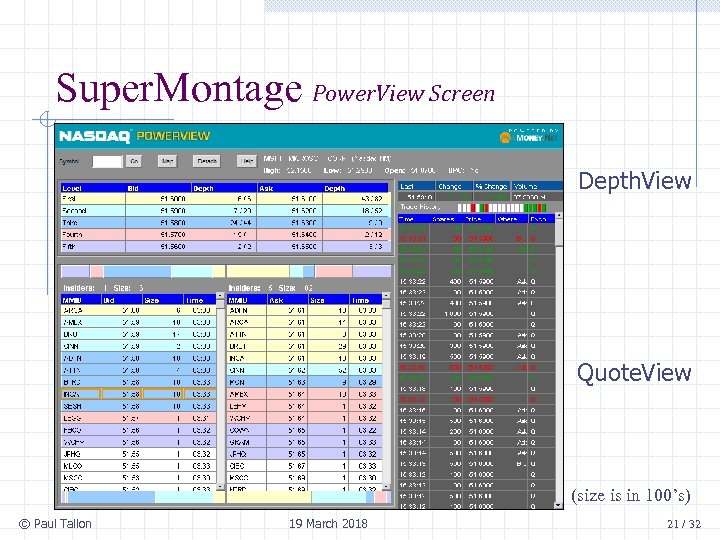

Super. Montage Power. View Screen Depth. View Quote. View (size is in 100’s) © Paul Tallon 19 March 2018 21 / 32

Super. Montage Power. View Screen Depth. View Quote. View (size is in 100’s) © Paul Tallon 19 March 2018 21 / 32

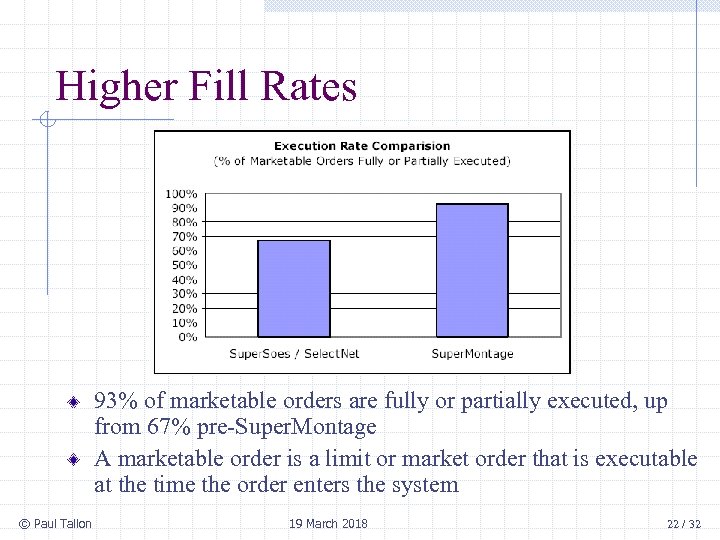

Higher Fill Rates 93% of marketable orders are fully or partially executed, up from 67% pre-Super. Montage A marketable order is a limit or market order that is executable at the time the order enters the system © Paul Tallon 19 March 2018 22 / 32

Higher Fill Rates 93% of marketable orders are fully or partially executed, up from 67% pre-Super. Montage A marketable order is a limit or market order that is executable at the time the order enters the system © Paul Tallon 19 March 2018 22 / 32

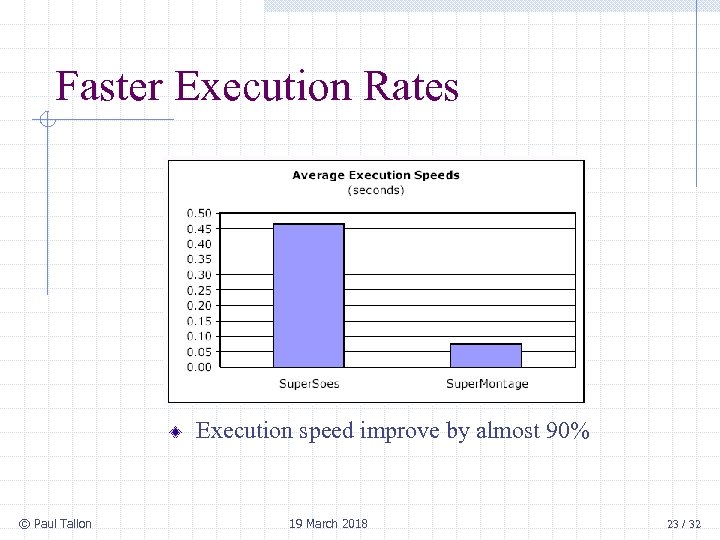

Faster Execution Rates Execution speed improve by almost 90% © Paul Tallon 19 March 2018 23 / 32

Faster Execution Rates Execution speed improve by almost 90% © Paul Tallon 19 March 2018 23 / 32

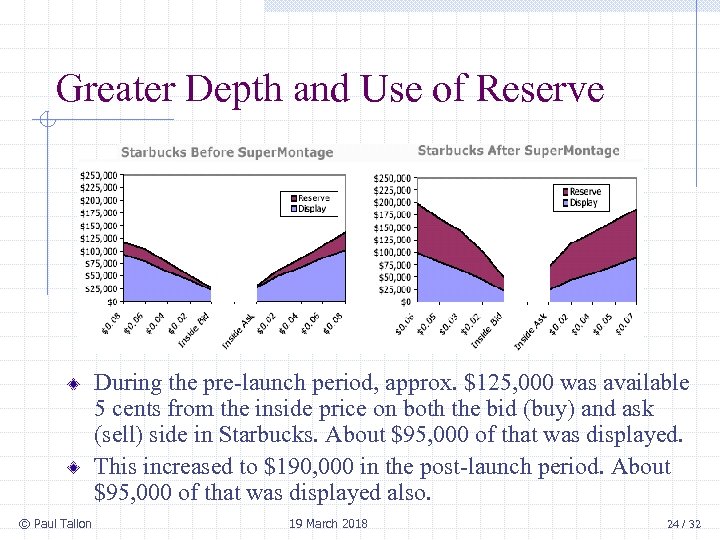

Greater Depth and Use of Reserve During the pre-launch period, approx. $125, 000 was available 5 cents from the inside price on both the bid (buy) and ask (sell) side in Starbucks. About $95, 000 of that was displayed. This increased to $190, 000 in the post-launch period. About $95, 000 of that was displayed also. © Paul Tallon 19 March 2018 24 / 32

Greater Depth and Use of Reserve During the pre-launch period, approx. $125, 000 was available 5 cents from the inside price on both the bid (buy) and ask (sell) side in Starbucks. About $95, 000 of that was displayed. This increased to $190, 000 in the post-launch period. About $95, 000 of that was displayed also. © Paul Tallon 19 March 2018 24 / 32

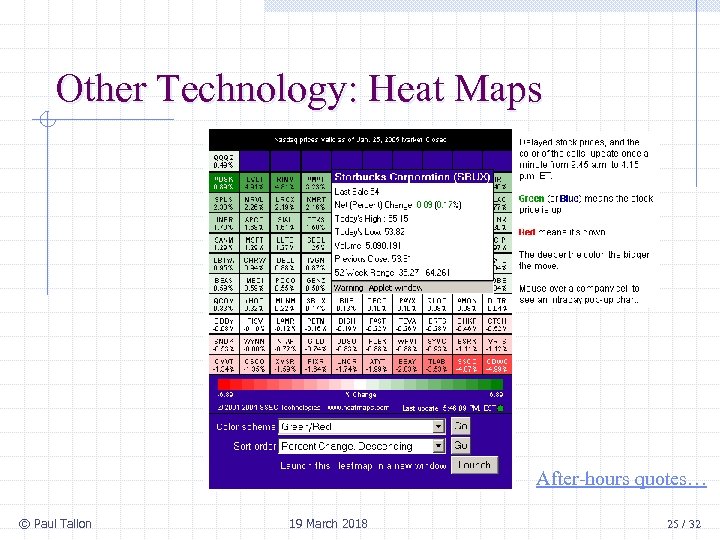

Other Technology: Heat Maps After-hours quotes… © Paul Tallon 19 March 2018 25 / 32

Other Technology: Heat Maps After-hours quotes… © Paul Tallon 19 March 2018 25 / 32

Opening Prices – still some concerns 4 No consolidated order book for all market makers 4 Opening prices are set between 8: 00 am and 9: 30 am 4 Problem came to a head with dot. com IPOs 4 Possibility of wide range of quotes at market open, trades executed at inappropriate prices – not at the inside bid or ask © Paul Tallon 19 March 2018 26 / 32

Opening Prices – still some concerns 4 No consolidated order book for all market makers 4 Opening prices are set between 8: 00 am and 9: 30 am 4 Problem came to a head with dot. com IPOs 4 Possibility of wide range of quotes at market open, trades executed at inappropriate prices – not at the inside bid or ask © Paul Tallon 19 March 2018 26 / 32

Intra-day Volatility (NYSE) The First 1/2 Hour Source: Robert Schwartz, Baruch College, 2008 © Paul Tallon 19 March 2018 27 / 32

Intra-day Volatility (NYSE) The First 1/2 Hour Source: Robert Schwartz, Baruch College, 2008 © Paul Tallon 19 March 2018 27 / 32

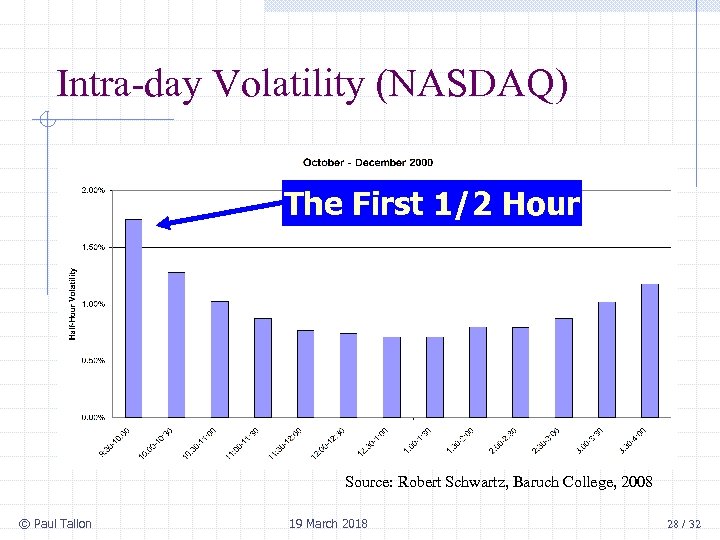

Intra-day Volatility (NASDAQ) The First 1/2 Hour Source: Robert Schwartz, Baruch College, 2008 © Paul Tallon 19 March 2018 28 / 32

Intra-day Volatility (NASDAQ) The First 1/2 Hour Source: Robert Schwartz, Baruch College, 2008 © Paul Tallon 19 March 2018 28 / 32

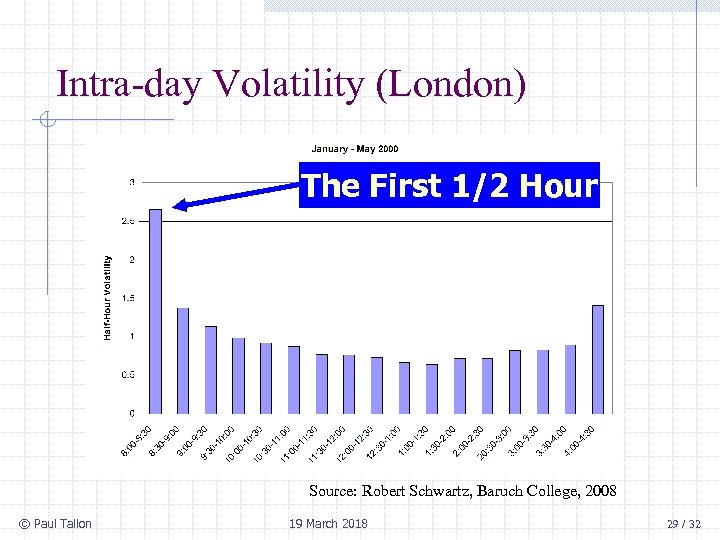

Intra-day Volatility (London) The First 1/2 Hour Source: Robert Schwartz, Baruch College, 2008 © Paul Tallon 19 March 2018 29 / 32

Intra-day Volatility (London) The First 1/2 Hour Source: Robert Schwartz, Baruch College, 2008 © Paul Tallon 19 March 2018 29 / 32

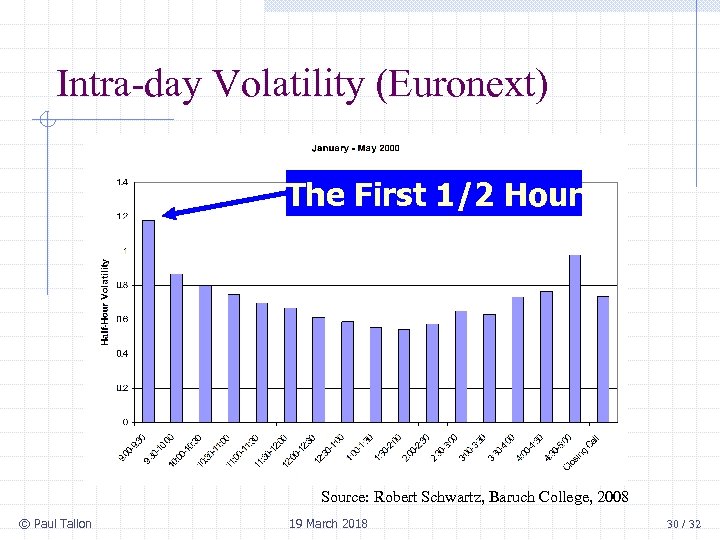

Intra-day Volatility (Euronext) The First 1/2 Hour Source: Robert Schwartz, Baruch College, 2008 © Paul Tallon 19 March 2018 30 / 32

Intra-day Volatility (Euronext) The First 1/2 Hour Source: Robert Schwartz, Baruch College, 2008 © Paul Tallon 19 March 2018 30 / 32

Current Issues 4 4 4 NASDAQ merged with Island/Instinet (ECN): April 22, 2005 Countered merger between NYSE and Arca|Ex: April 20, 2005 Fight between NYSE and NASDAQ goes international 4 4 NYSE Euro. Next NASDAQ OM … interest from Dubai, Deutsche Bourse, etc. Evolution of hybrid markets © Paul Tallon 19 March 2018 31 / 32

Current Issues 4 4 4 NASDAQ merged with Island/Instinet (ECN): April 22, 2005 Countered merger between NYSE and Arca|Ex: April 20, 2005 Fight between NYSE and NASDAQ goes international 4 4 NYSE Euro. Next NASDAQ OM … interest from Dubai, Deutsche Bourse, etc. Evolution of hybrid markets © Paul Tallon 19 March 2018 31 / 32

For Next Class… 4 Read – ECNs – check out http: //en. wikipedia. org/wiki/Electronic_Communication_Network – © Paul Tallon Articles on class website 19 March 2018 32 / 32

For Next Class… 4 Read – ECNs – check out http: //en. wikipedia. org/wiki/Electronic_Communication_Network – © Paul Tallon Articles on class website 19 March 2018 32 / 32