4e21d300adbafb953409d8186c904e0e.ppt

- Количество слайдов: 32

HSA-Qualified Health Plan from CIGNA ABC Organization name and/or logo 12/06 CUSTOMIZE THIS SLIDE 1

What if. . . You bought health care the way you buy groceries? You would: n Insist on quality and value n Look for the best price n Have easy access to information to help you decide what care is right for you 2

CIGNA can help you. . . n Find the highest quality providers – The CIGNA Open Access Plus network offers discounts from more than 520, 000 physicians and health care providers and over 8, 800 hospitals and healthcare facilities nationwide n Learn how to make the most of your patient/doctor relationship n Make informed decisions about your care n Use your plan as more than just a safety net in case of illness or injury 3

Today’s Discussion n CIGNA HSA-qualified health plan components n How it works n Tools and resources n Why an HSA-qualified plan from CIGNA 4

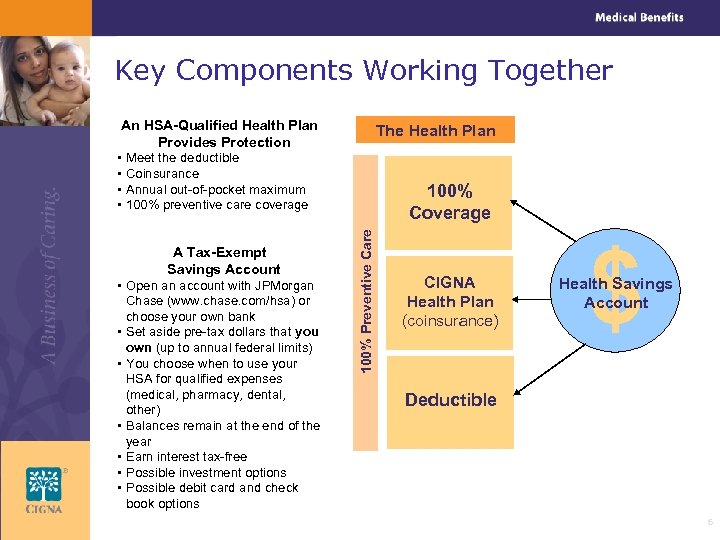

Key Components Working Together An HSA-Qualified Health Plan Provides Protection • Meet the deductible • Coinsurance • Annual out-of-pocket maximum • 100% preventive care coverage • Open an account with JPMorgan Chase (www. chase. com/hsa) or choose your own bank • Set aside pre-tax dollars that you own (up to annual federal limits) • You choose when to use your HSA for qualified expenses (medical, pharmacy, dental, other) • Balances remain at the end of the year • Earn interest tax-free • Possible investment options • Possible debit card and check book options 100% Coverage 100% Preventive Care A Tax-Exempt Savings Account The Health Plan CIGNA Health Plan (coinsurance) $ Health Savings Account Deductible 5

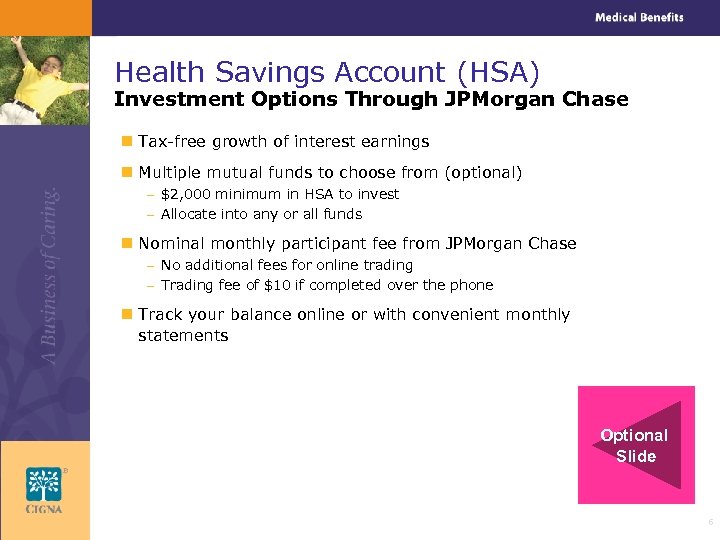

Health Savings Account (HSA) Investment Options Through JPMorgan Chase n Tax-free growth of interest earnings n Multiple mutual funds to choose from (optional) – $2, 000 minimum in HSA to invest – Allocate into any or all funds n Nominal monthly participant fee from JPMorgan Chase – No additional fees for online trading – Trading fee of $10 if completed over the phone n Track your balance online or with convenient monthly statements Optional Slide 6

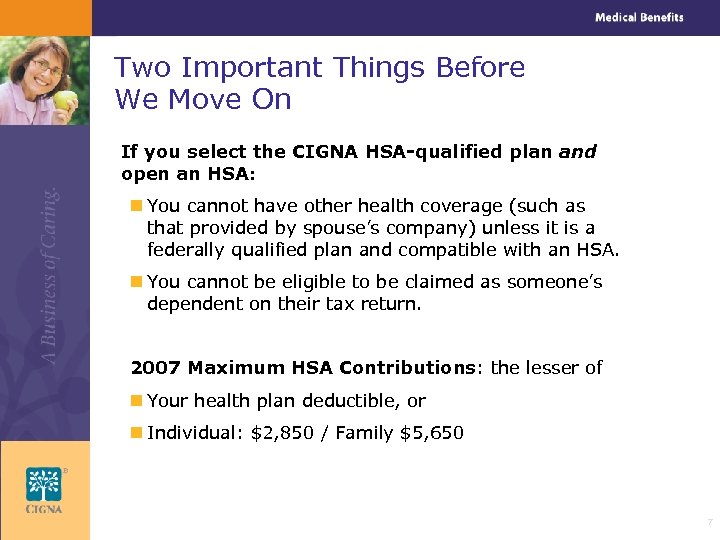

Two Important Things Before We Move On If you select the CIGNA HSA-qualified plan and open an HSA: n You cannot have other health coverage (such as that provided by spouse’s company) unless it is a federally qualified plan and compatible with an HSA. n You cannot be eligible to be claimed as someone’s dependent on their tax return. 2007 Maximum HSA Contributions: the lesser of n Your health plan deductible, or n Individual: $2, 850 / Family $5, 650 7

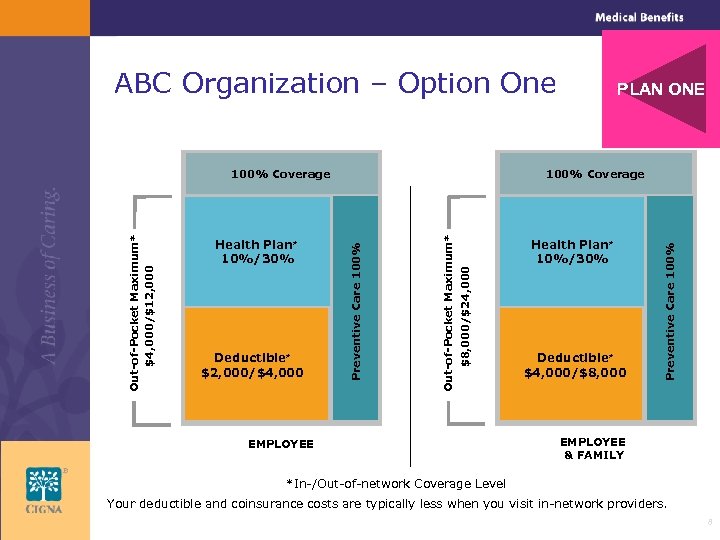

ABC Organization – Option One EMPLOYEE Health Plan* 10%/30% Deductible* $4, 000/$8, 000 Preventive Care 100% $8, 000/$24, 000 Deductible* $2, 000/$4, 000 Out-of-Pocket Maximum* Health Plan* 10%/30% 100% Coverage Preventive Care 100% Out-of-Pocket Maximum* $4, 000/$12, 000 100% Coverage PLAN ONE EMPLOYEE & FAMILY *In-/Out-of-network Coverage Level Your deductible and coinsurance costs are typically less when you visit in-network providers. 8

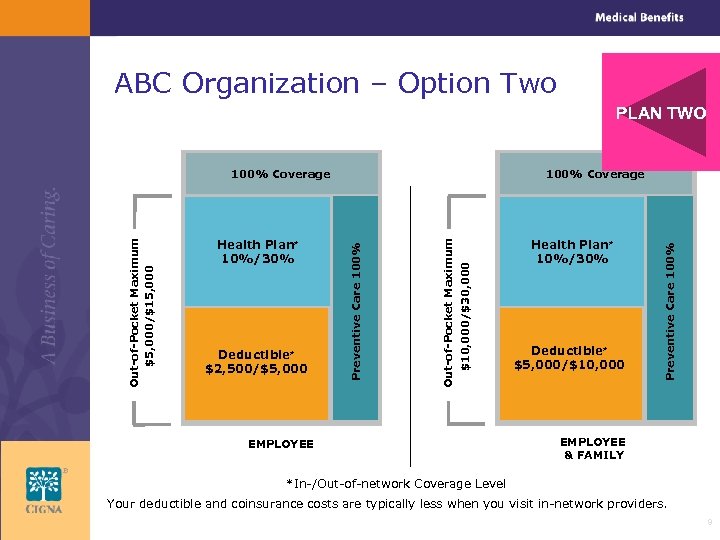

ABC Organization – Option Two PLAN TWO EMPLOYEE Health Plan* 10%/30% Deductible* $5, 000/$10, 000 Preventive Care 100% $10, 000/$30, 000 Deductible* $2, 500/$5, 000 Out-of-Pocket Maximum Health Plan* 10%/30% 100% Coverage Preventive Care 100% Out-of-Pocket Maximum $5, 000/$15, 000 100% Coverage EMPLOYEE & FAMILY *In-/Out-of-network Coverage Level Your deductible and coinsurance costs are typically less when you visit in-network providers. 9

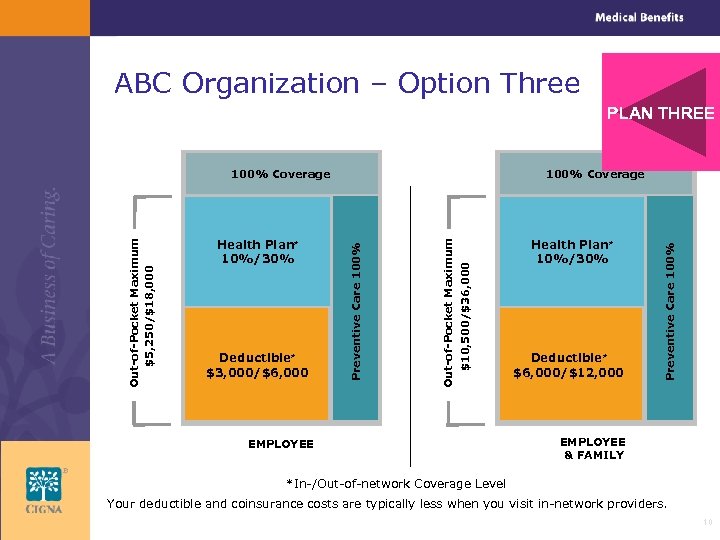

ABC Organization – Option Three PLAN THREE EMPLOYEE Health Plan* 10%/30% Deductible* $6, 000/$12, 000 Preventive Care 100% $10, 500/$36, 000 Deductible* $3, 000/$6, 000 Out-of-Pocket Maximum Health Plan* 10%/30% 100% Coverage Preventive Care 100% Out-of-Pocket Maximum $5, 250/$18, 000 100% Coverage EMPLOYEE & FAMILY *In-/Out-of-network Coverage Level Your deductible and coinsurance costs are typically less when you visit in-network providers. 10

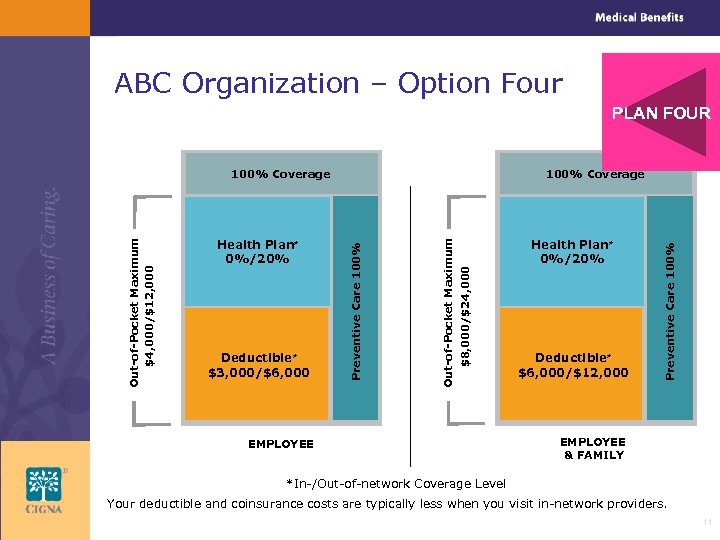

ABC Organization – Option Four PLAN FOUR EMPLOYEE Health Plan* 0%/20% Deductible* $6, 000/$12, 000 Preventive Care 100% $8, 000/$24, 000 Deductible* $3, 000/$6, 000 Out-of-Pocket Maximum Health Plan* 0%/20% 100% Coverage Preventive Care 100% Out-of-Pocket Maximum $4, 000/$12, 000 100% Coverage EMPLOYEE & FAMILY *In-/Out-of-network Coverage Level Your deductible and coinsurance costs are typically less when you visit in-network providers. 11

An Ounce of Prevention. . . and Then Some n 100% coverage for preventive care from in-network providers n What is Preventive Care? – Screening tests or interventions provided, when no symptoms are present, to people at general risk in the population to detect or prevent a common or targeted condition n Preventive care tests are recommended based on age, gender, family history and health status n Take charge and schedule a preventive care visit 12

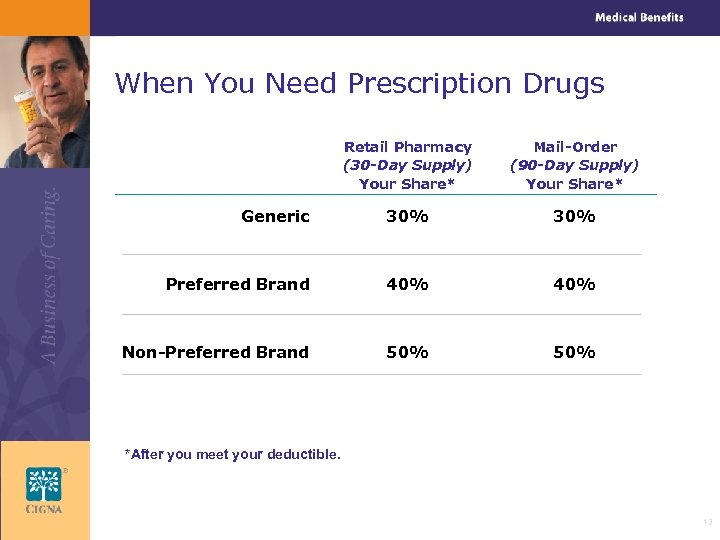

When You Need Prescription Drugs Retail Pharmacy (30 -Day Supply) Your Share* Mail-Order (90 -Day Supply) Your Share* Generic 30% Preferred Brand 40% Non-Preferred Brand 50% *After you meet your deductible. 13

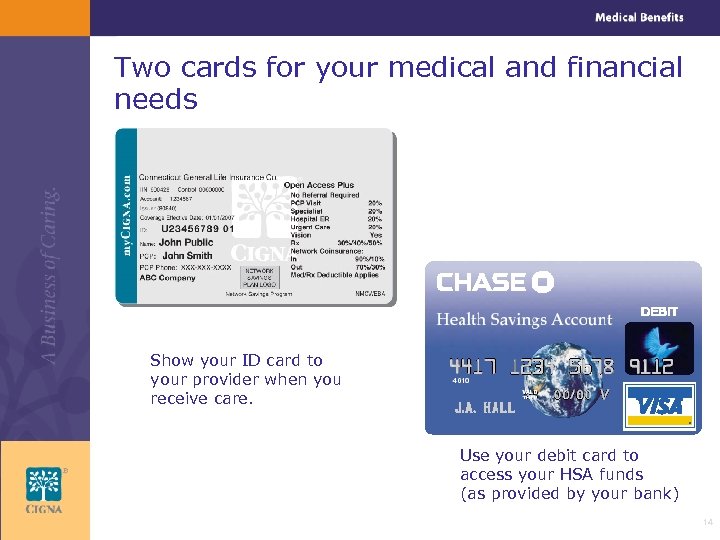

Two cards for your medical and financial needs Show your ID card to your provider when you receive care. Use your debit card to access your HSA funds (as provided by your bank) 14

Using Your CIGNA HSA-Qualified Plan n Step 1 - Select a CIGNA participating provider* n Step 2 - Present your CIGNA ID Card n Step 3 - Your provider’s office bills CIGNA n Step 4 – CIGNA receives the bill and determines what you owe n Step 5 - CIGNA sends you an Explanation of Benefit (EOB), including: – Amounts CIGNA paid to your provider – Any amount you owe your provider CIGNA Health. Care n Step 6 – You decide how to pay your share: with your HSA or out of your pocket. n Step 7 – You can track your claim through my. CIGNA. com and your EOBs. – If you select JPMorgan Chase for your HSA, you can track your HSA transaction and balance information through monthly statements provided by Chase, or by linking to the Chase website from my. CIGNA. com. *Non-participating providers may require you to file claims. 15

Using Your HSA at the Pharmacy n Step 1 - Select a CIGNA Health. Care participating pharmacy* n Step 2 – The pharmacy processes your claim and determines how much you owe n Step 3 – You decide how to pay your share: with your HSA or out of your pocket. – If you open an account with JPMorgan Chase you may use your JPMorgan Chase Visa® debit card or checkbook to pay for the expense from your HSA. *Benefits apply only with participating pharmacies. 16

Meet Tracy is married and in her late 30 s. She and her husband are starting a family, so she has a new focus on health. She’s concerned about managing her diabetes during her pregnancy. Plan One Her CIGNA HSA-qualified plan includes: n HSA (with her $500 contribution) $ n Family deductible (in-network) $ 4, 000 n Coinsurance (in-network) n Family out-of-pocket maximum (in-network) 500 10% $ 8, 000 Pharmacy benefits are part of her CIGNA health plan 17

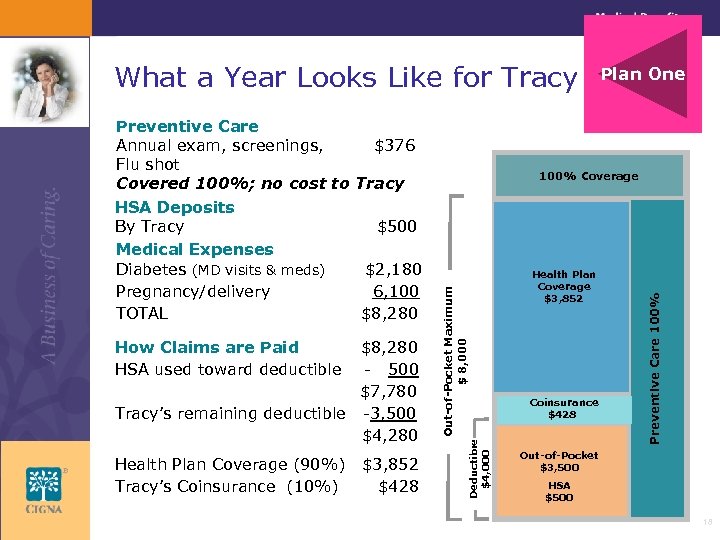

What a Year Looks Like for Tracy Health Plan Coverage (90%) Tracy’s Coinsurance (10%) $3, 852 $428 Health Plan Coverage $3, 852 Coinsurance $428 Preventive Care 100% $8, 280 - 500 $7, 780 Tracy’s remaining deductible -3, 500 $4, 280 Deductible $4, 000 How Claims are Paid HSA used toward deductible 100% Coverage Out-of-Pocket Maximum $ 8, 000 Preventive Care Annual exam, screenings, $376 Flu shot Covered 100%; no cost to Tracy HSA Deposits By Tracy $500 Medical Expenses Diabetes (MD visits & meds) $2, 180 Pregnancy/delivery 6, 100 TOTAL $8, 280 Plan One Out-of-Pocket $3, 500 HSA $500 18

Meet Tracy is married and in her late 30 s. She and her husband are starting a family, so she has a new focus on health. She’s concerned about managing her diabetes during her pregnancy. Plan Two Her CIGNA HSA-qualified plan includes: n HSA (with her $500 contribution ) $ n Family deductible (in-network) $ 5, 000 n Coinsurance (in-network) n Family out-of-pocket maximum (in-network) 500 10% $ 10, 000 Pharmacy benefits are part of her CIGNA health plan 19

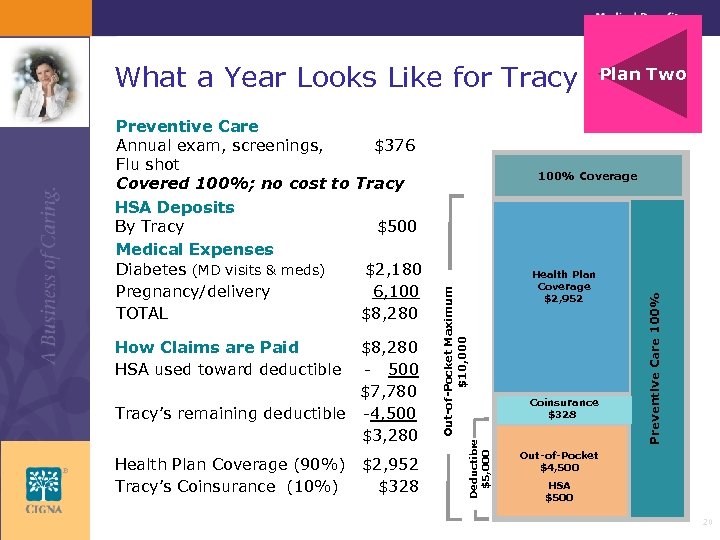

What a Year Looks Like for Tracy Health Plan Coverage (90%) Tracy’s Coinsurance (10%) $2, 952 $328 Health Plan Coverage $2, 952 Coinsurance $328 Preventive Care 100% $8, 280 - 500 $7, 780 Tracy’s remaining deductible -4, 500 $3, 280 Deductible $5, 000 How Claims are Paid HSA used toward deductible 100% Coverage Out-of-Pocket Maximum $10, 000 Preventive Care Annual exam, screenings, $376 Flu shot Covered 100%; no cost to Tracy HSA Deposits By Tracy $500 Medical Expenses Diabetes (MD visits & meds) $2, 180 Pregnancy/delivery 6, 100 TOTAL $8, 280 Plan Two Out-of-Pocket $4, 500 HSA $500 20

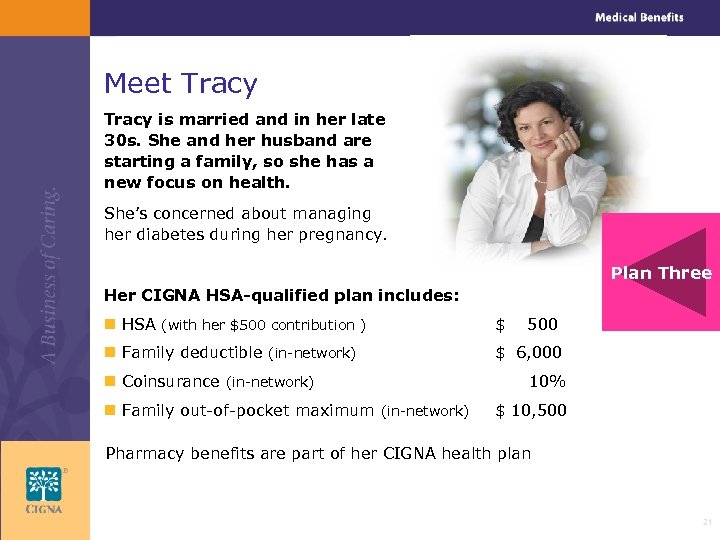

Meet Tracy is married and in her late 30 s. She and her husband are starting a family, so she has a new focus on health. She’s concerned about managing her diabetes during her pregnancy. Plan Three Her CIGNA HSA-qualified plan includes: n HSA (with her $500 contribution ) $ n Family deductible (in-network) $ 6, 000 n Coinsurance (in-network) n Family out-of-pocket maximum (in-network) 500 10% $ 10, 500 Pharmacy benefits are part of her CIGNA health plan 21

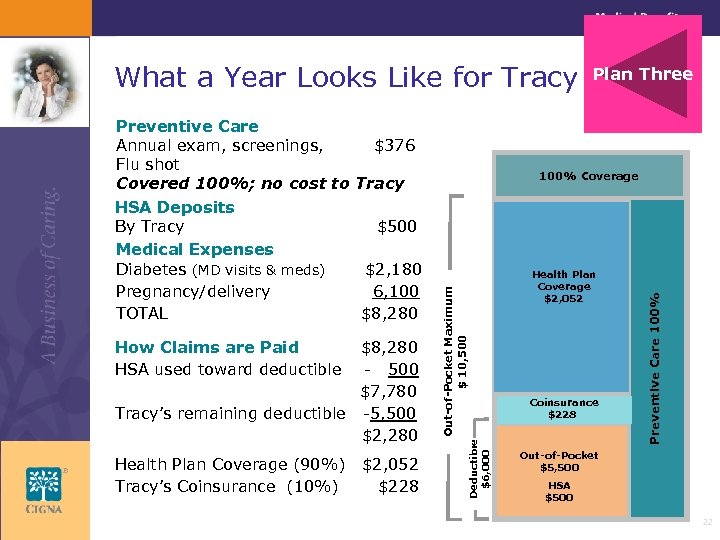

What a Year Looks Like for Tracy Health Plan Coverage (90%) Tracy’s Coinsurance (10%) $2, 052 $228 Health Plan Coverage $2, 052 Coinsurance $228 Preventive Care 100% $8, 280 - 500 $7, 780 Tracy’s remaining deductible -5, 500 $2, 280 Deductible $6, 000 How Claims are Paid HSA used toward deductible 100% Coverage Out-of-Pocket Maximum $ 10, 500 Preventive Care Annual exam, screenings, $376 Flu shot Covered 100%; no cost to Tracy HSA Deposits By Tracy $500 Medical Expenses Diabetes (MD visits & meds) $2, 180 Pregnancy/delivery 6, 100 TOTAL $8, 280 Plan Three Out-of-Pocket $5, 500 HSA $500 22

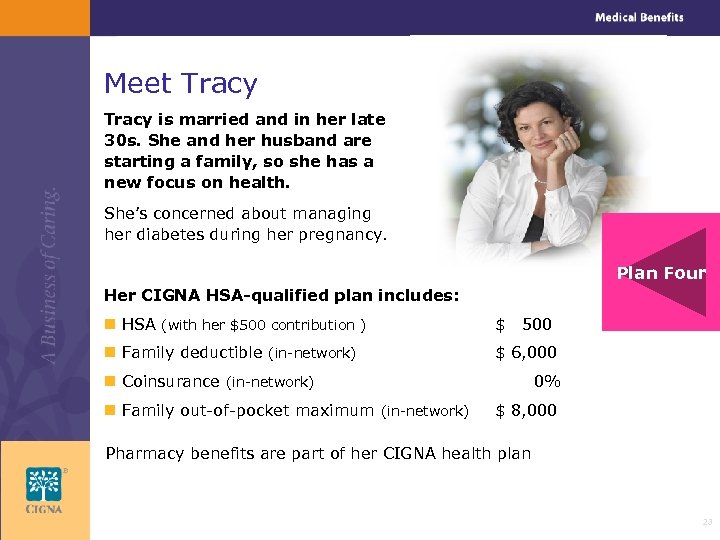

Meet Tracy is married and in her late 30 s. She and her husband are starting a family, so she has a new focus on health. She’s concerned about managing her diabetes during her pregnancy. Plan Four Her CIGNA HSA-qualified plan includes: n HSA (with her $500 contribution ) $ 500 n Family deductible (in-network) $ 6, 000 n Coinsurance (in-network) n Family out-of-pocket maximum (in-network) 0% $ 8, 000 Pharmacy benefits are part of her CIGNA health plan 23

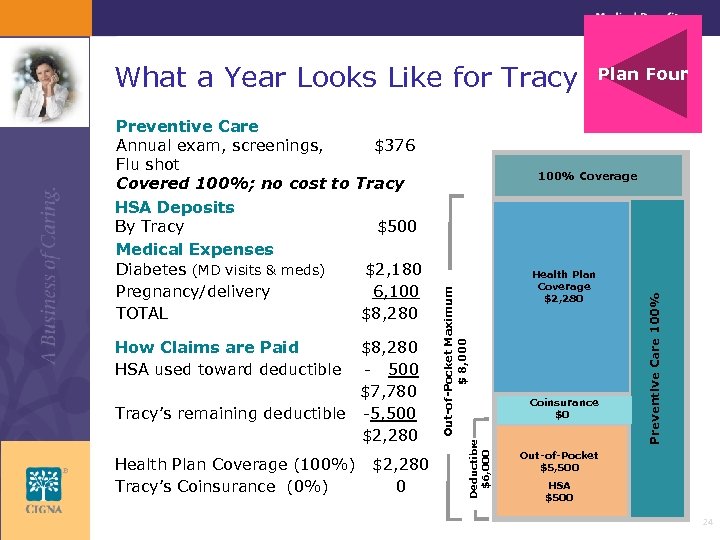

What a Year Looks Like for Tracy Health Plan Coverage (100%) Tracy’s Coinsurance (0%) $2, 280 0 Health Plan Coverage $2, 280 Coinsurance $0 Preventive Care 100% $8, 280 - 500 $7, 780 Tracy’s remaining deductible -5, 500 $2, 280 Deductible $6, 000 How Claims are Paid HSA used toward deductible 100% Coverage Out-of-Pocket Maximum $ 8, 000 Preventive Care Annual exam, screenings, $376 Flu shot Covered 100%; no cost to Tracy HSA Deposits By Tracy $500 Medical Expenses Diabetes (MD visits & meds) $2, 180 Pregnancy/delivery 6, 100 TOTAL $8, 280 Plan Four Out-of-Pocket $5, 500 HSA $500 24

Support and Resources CIGNA supports Tracy in a number of ways n Easy access to care since no referrals are needed n The provider directory on my. CIGNA. com helps her find an OB/GYN n Personal contact with a Well Aware Advisor helps her manage her diabetes and her pregnancy n Personalized messages on my. CIGNA. com help her monitor her progress and continue to focus on her health 25

Support Continues Throughout the Year n Toll-free member service line 1. 800. CIGNA 24 n CIGNA Health. Care 24 -Hour Health Information Line. SM – Round the clock access to registered nurses n Healthy Rewards® — discounts on laser vision correction, weight management, smoking cessation and more n EOBs to help track claim transactions – Monthly Statements from JPMorgan Chase (other banks may vary) n Online Well-Being newsletter on my. CIGNA. com n Award-winning personal member website, my. CIGNA. com 26

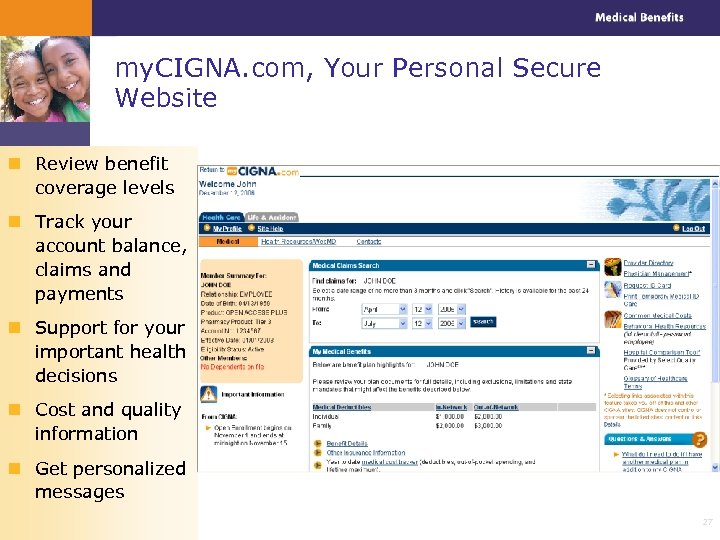

my. CIGNA. com, Your Personal Secure Website n Review benefit coverage levels n Track your account balance, claims and payments n Support for your important health decisions n Cost and quality information n Get personalized messages 27

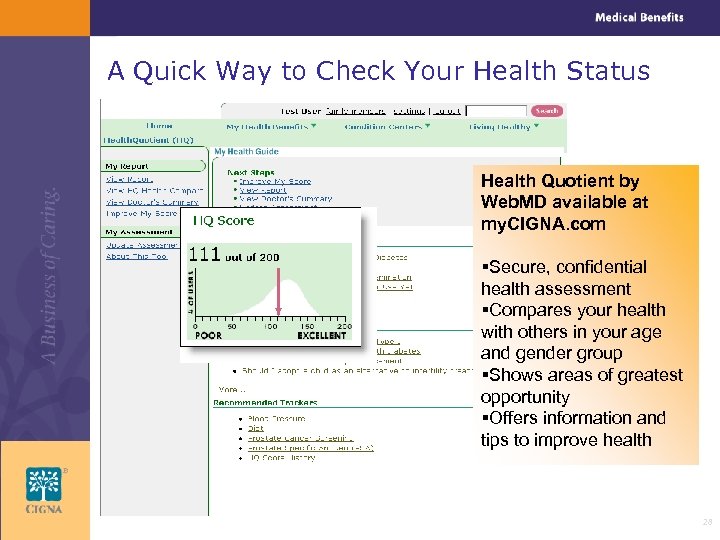

A Quick Way to Check Your Health Status Health Quotient by Web. MD available at my. CIGNA. com §Secure, confidential health assessment §Compares your health with others in your age and gender group §Shows areas of greatest opportunity §Offers information and tips to improve health 28

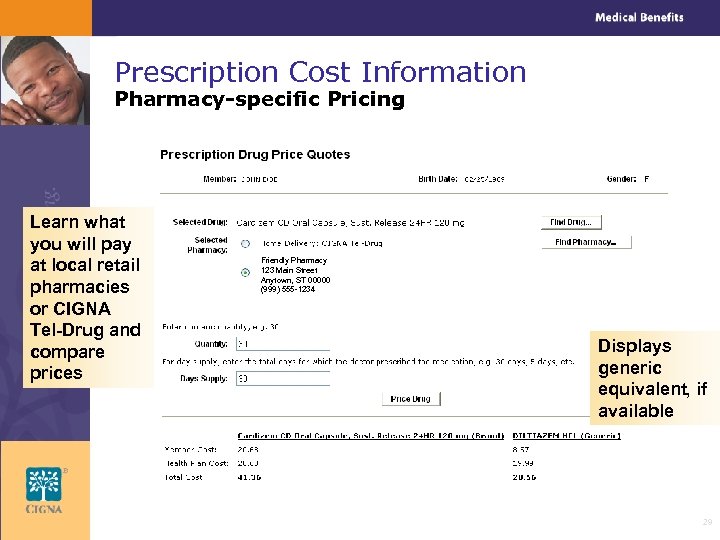

Prescription Cost Information Pharmacy-specific Pricing Learn what you will pay at local retail pharmacies or CIGNA Tel-Drug and compare prices Friendly Pharmacy 123 Main Street Anytown, ST 00000 (999) 555 -1234 Displays generic equivalent, if available 29

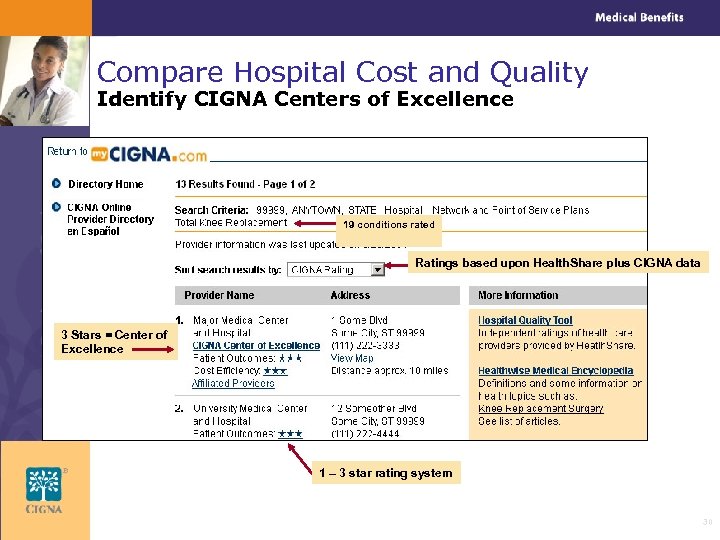

Compare Hospital Cost and Quality Identify CIGNA Centers of Excellence 19 conditions rated Ratings based upon Health. Share plus CIGNA data 3 Stars = Center of Excellence 1 – 3 star rating system 30

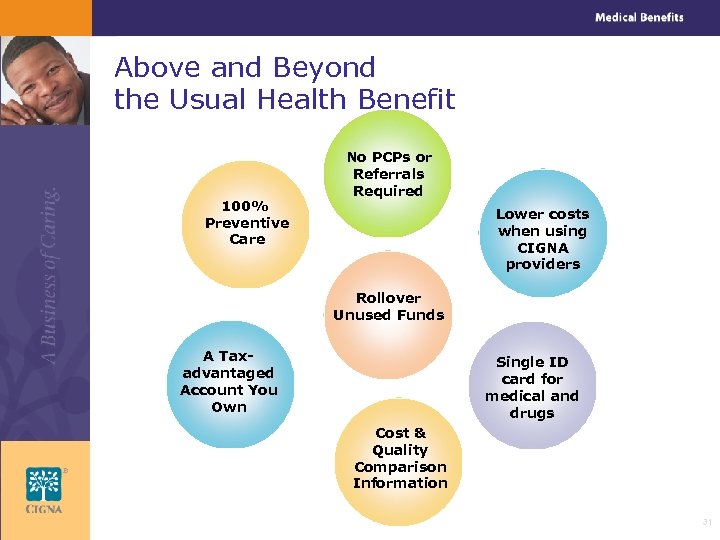

Above and Beyond the Usual Health Benefit 100% Preventive Care No PCPs or Referrals Required Lower costs when using CIGNA providers Rollover Unused Funds A Taxadvantaged Account You Own Single ID card for medical and drugs Cost & Quality Comparison Information 31

“CIGNA” and “CIGNA Health. Care” refers to various operating subsidiaries of CIGNA Corporation. Products and services are provided by these subsidiaries and not by CIGNA Corporation. These subsidiaries include Connecticut General Life Insurance Company, Tel-Drug, Inc. and its affiliates, CIGNA Behavioral Health, Inc. , Intracorp, and HMO or service company subsidiaries of CIGNA Health Corporation and CIGNA Dental Health, Inc. In Arizona, HMO plans are offered by CIGNA Health. Care of Arizona, Inc. In California, HMO plans are offered by CIGNA Health. Care of California, Inc. In Virginia, HMO plans are offered by CIGNA Health. Care of Virginia, Inc. and CIGNA Health. Care Mid-Atlantic, Inc. In North Carolina, HMO plans are offered by CIGNA Health. Care of North Carolina, Inc. All other medical plans in these states are insured or administered by Connecticut General Life Insurance Company. 12/06 © 2006 CIGNA 32

4e21d300adbafb953409d8186c904e0e.ppt