31c2d526bbf98b1f5bb30c9f7cd497c4.ppt

- Количество слайдов: 15

HP Assist/Auto Bridge Prepared by: PR Dreyer BBA MBA

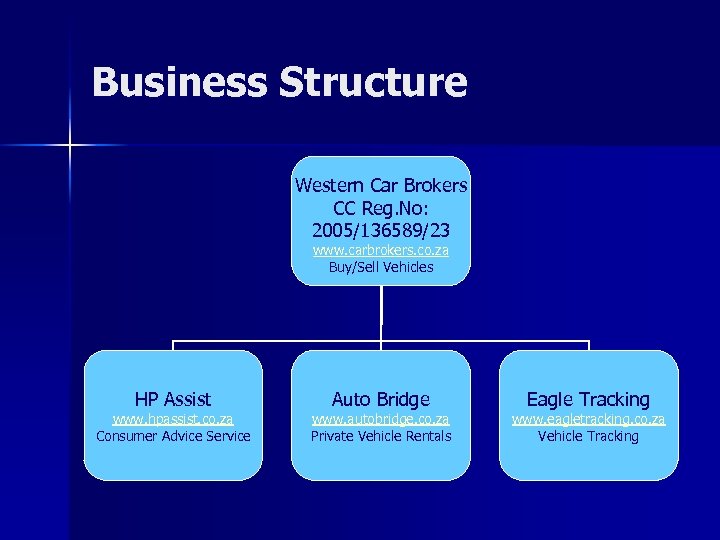

Business Structure Western Car Brokers CC Reg. No: 2005/136589/23 www. carbrokers. co. za Buy/Sell Vehicles HP Assist www. hpassist. co. za Consumer Advice Service Auto Bridge www. autobridge. co. za Private Vehicle Rentals Eagle Tracking www. eagletracking. co. za Vehicle Tracking

Background n n Business established at a time when finance houses were unsympathetic to the plight of consumers who defaulted on their vehicle repayments Vehicles were repossessed then auctioned resulting in shortfall owing by consumer Ultimately resulting in judgement against consumer and ITC listing Thus preventing future credit

Background (cont) n n n Since intro of NCA finance houses have softened and are more consumer accomodating by extending lending terms thereby reducing repayments Debt counselling has also assisted consumers in retaining assets with lower repayments However, market still exists for consumers not wanting to go the above routes

Background (cont) n n n In order to overcome consumer problems associated with repossession, judgement and ITC listing HP Assist/Auto Bridge investigated alternative solutions Research indicated a number of operators in the area of “vehicle take-overs” where practice is to facilitate a deal on the basis that immediate ownership passes to the person taking over the vehicle We construed this as misrepresentation and pursued an alternative business model

Business Model n n Based on the principle of private vehicle rental agreements The business model operated as follows:

Business Model (cont) n n Consumer facing potential problem hands over vehicle to HP Assist/Auto Bridge which is then placed in a rental pool HP Assist/Auto Bridge then source client to rent vehicle from consumer Client pays deposit to cover arrears on vehicle and fees charged by HP Assist/Auto bridge Vehicle Rental documentation completed

Business Model (cont) n n Monthly rentals are collected and paid over to finance houses Rental continues until end of financing term at which point transfer of ownership occurs Vehicle insurance is facilitated on owner/nominated driver basis Tracking units are installed to facilitate easy recovery in event of rental default

Risk Management n n n Client renting vehicle must qualify in terms of risk assessment criteria – detail contained in submission document Includes providing RSA drivers license, proof of residence and payslip Computerised debtors and credit control systems to aid with collection of rentals

Risks n n Failure to insure vehicle with risk of theft or damage to vehicle Rental default with risk that finance house can still proceed with repossession – although this is overcome by recovery of vehicle and placing back in the rental pool for rental purposes

Legality n n Consumers who contacted finance houses direct were told “not allowed” but as long as instalments were being paid there would be no problem Finance houses have been aware of this practice for many years and discussions held with bank officials, lawyers, SAPS have all stated that as long as instalments paid there would not be a problem

Legality

About HP Assist/Auto Bridge n n Ceased operations October 2008 when advised that business could be classified as harmful in terms of Consumer Affairs Act Had been in operation for 3 years Book of approx 100 vehicles Paid over R 4. 1 m to finance houses

Conclusion n At no stage aware that the business may be considered a harmful business practice Business operated within which we believed to be legitimate boundaries Conclude – Although we have ceased operations there are still a number of entities presently operating in this specific market

HP Assist/Auto Bridge End of Slide Show

31c2d526bbf98b1f5bb30c9f7cd497c4.ppt