bf7e655ec57d6d566b1fb2a196daa7ae.ppt

- Количество слайдов: 53

How to raise risk capital using intellectual assets Name of speaker www. ip 4 inno. eu Venue & date 1

How to raise risk capital using intellectual assets Name of speaker www. ip 4 inno. eu Venue & date 1

ip 4 inno is brought to you by: • European Commission, DG Enterprise & Industry • European Patent Office • 19 consortium partners in the first ip 4 inno project This particular module was written by: META Group www. meta-group. com with funding from the EC and EPO www. ip 4 inno. eu 2

ip 4 inno is brought to you by: • European Commission, DG Enterprise & Industry • European Patent Office • 19 consortium partners in the first ip 4 inno project This particular module was written by: META Group www. meta-group. com with funding from the EC and EPO www. ip 4 inno. eu 2

The Disclaimer! This training material concerns intellectual property and business strategies only in general terms. This training material should not be relied upon when taking specific business or legal decisions. Rather, professional advice should be obtained which suits the circumstances in question. www. ip 4 inno. eu 3

The Disclaimer! This training material concerns intellectual property and business strategies only in general terms. This training material should not be relied upon when taking specific business or legal decisions. Rather, professional advice should be obtained which suits the circumstances in question. www. ip 4 inno. eu 3

Terms & Definitions Equity means ownership interest in a company, represented by the shares issued to investors; Quasi-equity investment instruments’ means instruments whose return for the holder (investor/ lender) is predominantly based on the profits or losses of the underlying target company, are unsecured in the event of default. www. ip 4 inno. eu 4

Terms & Definitions Equity means ownership interest in a company, represented by the shares issued to investors; Quasi-equity investment instruments’ means instruments whose return for the holder (investor/ lender) is predominantly based on the profits or losses of the underlying target company, are unsecured in the event of default. www. ip 4 inno. eu 4

Terms & Definitions Risk capital means equity and quasi-equity financing to companies during their early-growth stages (seed, startup and expansion phases), including informal investment by business angels, venture capital and alternative stock markets specialized in SMEs including high-growth companies www. ip 4 inno. eu 5

Terms & Definitions Risk capital means equity and quasi-equity financing to companies during their early-growth stages (seed, startup and expansion phases), including informal investment by business angels, venture capital and alternative stock markets specialized in SMEs including high-growth companies www. ip 4 inno. eu 5

Terms & Definitions Early-stage capital means seed and start-up capital; Seed capital means financing provided to study, assess and develop an initial concept, preceding the start-up phase; Start-up capital means financing provided to companies, which have not sold their product or service commercially and are not yet generating a profit, for product development and initial marketing; www. ip 4 inno. eu 6

Terms & Definitions Early-stage capital means seed and start-up capital; Seed capital means financing provided to study, assess and develop an initial concept, preceding the start-up phase; Start-up capital means financing provided to companies, which have not sold their product or service commercially and are not yet generating a profit, for product development and initial marketing; www. ip 4 inno. eu 6

Terms & Definitions Expansion capital means financing provided for the growth and expansion of a company, which may or may not break even or trade profitably, for the purposes of increasing production capacity, market or product development or the provision of additional working capital; Source: Community Guidelines -2006/C 194/02 www. ip 4 inno. eu 7

Terms & Definitions Expansion capital means financing provided for the growth and expansion of a company, which may or may not break even or trade profitably, for the purposes of increasing production capacity, market or product development or the provision of additional working capital; Source: Community Guidelines -2006/C 194/02 www. ip 4 inno. eu 7

Terms & Definitions Venture capital means investment in unquoted (not listed on the stock exchange) companies by investment funds (venture capital funds) that, acting as principals, manage individual, institutional or in-house money and includes early-stage and expansion financing, but not replacement finance and buy-outs; Buyout means the purchase of at least a controlling percentage of a company's equity from the current shareholders to take over its assets and operations through negotiation or a tender offer; www. ip 4 inno. eu 8

Terms & Definitions Venture capital means investment in unquoted (not listed on the stock exchange) companies by investment funds (venture capital funds) that, acting as principals, manage individual, institutional or in-house money and includes early-stage and expansion financing, but not replacement finance and buy-outs; Buyout means the purchase of at least a controlling percentage of a company's equity from the current shareholders to take over its assets and operations through negotiation or a tender offer; www. ip 4 inno. eu 8

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 9

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 9

Knowledge Intensive Companies (KICs) KICs are small in numbers but cover a critical role • strongly affecting employment • playing an increasingly active part in Global Markets and Value Chains: initiators www. ip 4 inno. eu 10

Knowledge Intensive Companies (KICs) KICs are small in numbers but cover a critical role • strongly affecting employment • playing an increasingly active part in Global Markets and Value Chains: initiators www. ip 4 inno. eu 10

Knowledge Intensive companies • Quality and quantity employment: in USA young companies generated roughly two-third of job creation, and fast growing young firms, who represent less than 1 percent of all companies, generate around 10 % of new jobs in any given year (source Reports of Kauffman Foundation) • Dynamism of the economy: Nokia alone has changed Finland physiognomy and perception • 75% of Fortune 500 did not exist 25 years ago www. ip 4 inno. eu 11

Knowledge Intensive companies • Quality and quantity employment: in USA young companies generated roughly two-third of job creation, and fast growing young firms, who represent less than 1 percent of all companies, generate around 10 % of new jobs in any given year (source Reports of Kauffman Foundation) • Dynamism of the economy: Nokia alone has changed Finland physiognomy and perception • 75% of Fortune 500 did not exist 25 years ago www. ip 4 inno. eu 11

KICs 3 Key issues www. ip 4 inno. eu 12

KICs 3 Key issues www. ip 4 inno. eu 12

1 st “issue” their value (assets) is mainly represented by Intangibles • the research(ers) capabilities – human capital • the technology (Knowledge) embedded and • the possession of “IP products” www. ip 4 inno. eu 13

1 st “issue” their value (assets) is mainly represented by Intangibles • the research(ers) capabilities – human capital • the technology (Knowledge) embedded and • the possession of “IP products” www. ip 4 inno. eu 13

2 nd “issue” Knowledge intensive companies need (a lot of) money! 3 Fs (Fools/Founders, Family, Friends) are not enough! www. ip 4 inno. eu 14

2 nd “issue” Knowledge intensive companies need (a lot of) money! 3 Fs (Fools/Founders, Family, Friends) are not enough! www. ip 4 inno. eu 14

3 rd “issue” Research (knowledge) + Finance = Innovation ? What are the ways and means to enhance cooperation between research and finance in order to efficiently support innovation? V/S What are the ways and means to enhance cooperation between entrepreneurs, research(ers) and finance …. . ? www. ip 4 inno. eu 15

3 rd “issue” Research (knowledge) + Finance = Innovation ? What are the ways and means to enhance cooperation between research and finance in order to efficiently support innovation? V/S What are the ways and means to enhance cooperation between entrepreneurs, research(ers) and finance …. . ? www. ip 4 inno. eu 15

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What early stage investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 16

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What early stage investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 16

It is important to understand that all forms of finance do not have the same aims. Motivations, expectations and criteria of different funding parties will vary according both to the life cycle of the business idea and the related level of risk perceived. Therefore, business plan quality and contents, as well as its presentation to potential investors need to be adjusted to their specific requirements and expectations. This explains the Anglo-Saxon expression « All money is not the same » . www. ip 4 inno. eu 17

It is important to understand that all forms of finance do not have the same aims. Motivations, expectations and criteria of different funding parties will vary according both to the life cycle of the business idea and the related level of risk perceived. Therefore, business plan quality and contents, as well as its presentation to potential investors need to be adjusted to their specific requirements and expectations. This explains the Anglo-Saxon expression « All money is not the same » . www. ip 4 inno. eu 17

Entrepreneurs need to have an understanding of the type of finance fitting best to the position of the enterprise in its life cycle. The enterprise finance market can be divided in 5 segments: • • • I Initial and unorthodox sources of funding; II Equity; III Debt finance; IV Combination of equity and debt V Public Finance www. ip 4 inno. eu 18

Entrepreneurs need to have an understanding of the type of finance fitting best to the position of the enterprise in its life cycle. The enterprise finance market can be divided in 5 segments: • • • I Initial and unorthodox sources of funding; II Equity; III Debt finance; IV Combination of equity and debt V Public Finance www. ip 4 inno. eu 18

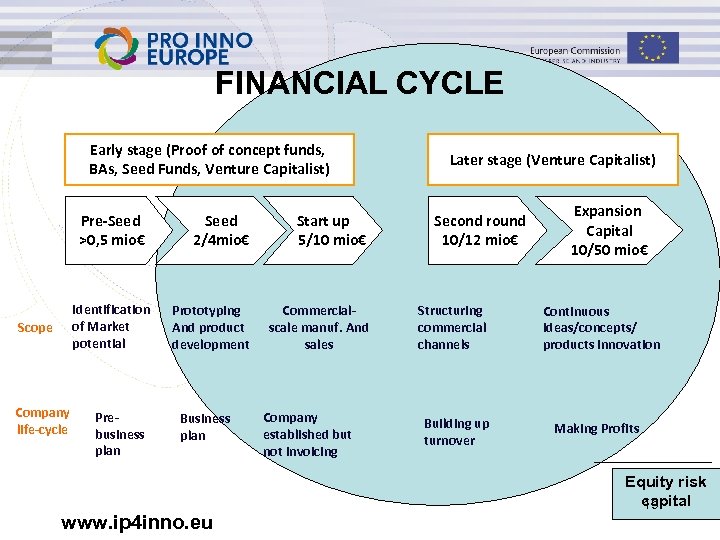

FINANCIAL CYCLE Early stage (Proof of concept funds, BAs, Seed Funds, Venture Capitalist) Pre-Seed >0, 5 mio€ Identification of Market potential Scope Company life-cycle Prebusiness plan Seed 2/4 mio€ Start up 5/10 mio€ Prototyping And product development Commercialscale manuf. And sales Business plan www. ip 4 inno. eu Company established but not invoicing Later stage (Venture Capitalist) Second round 10/12 mio€ Structuring commercial channels Building up turnover Expansion Capital 10/50 mio€ Continuous ideas/concepts/ products innovation Making Profits Equity risk capital 19

FINANCIAL CYCLE Early stage (Proof of concept funds, BAs, Seed Funds, Venture Capitalist) Pre-Seed >0, 5 mio€ Identification of Market potential Scope Company life-cycle Prebusiness plan Seed 2/4 mio€ Start up 5/10 mio€ Prototyping And product development Commercialscale manuf. And sales Business plan www. ip 4 inno. eu Company established but not invoicing Later stage (Venture Capitalist) Second round 10/12 mio€ Structuring commercial channels Building up turnover Expansion Capital 10/50 mio€ Continuous ideas/concepts/ products innovation Making Profits Equity risk capital 19

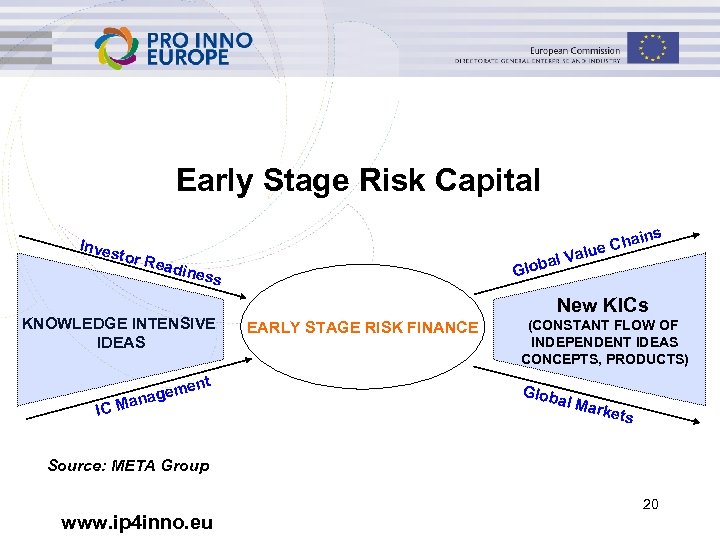

Early Stage Risk Capital ns Inves tor R a bal V Glo eadin ess KNOWLEDGE INTENSIVE IDEAS nt eme nag C Ma I ai e Ch lu New KICs EARLY STAGE RISK FINANCE (CONSTANT FLOW OF INDEPENDENT IDEAS CONCEPTS, PRODUCTS) Glob al Ma rkets Source: META Group www. ip 4 inno. eu 20

Early Stage Risk Capital ns Inves tor R a bal V Glo eadin ess KNOWLEDGE INTENSIVE IDEAS nt eme nag C Ma I ai e Ch lu New KICs EARLY STAGE RISK FINANCE (CONSTANT FLOW OF INDEPENDENT IDEAS CONCEPTS, PRODUCTS) Glob al Ma rkets Source: META Group www. ip 4 inno. eu 20

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What seed investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 21

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What seed investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 21

Seed Investors are looking for… • Balanced & committed Management Team • High growth potentials • Sustainable Business Model • Suitable strategies: with deliverable goals … a clear way out strategy …. presence of a strong strategy for intellectual capital www. ip 4 inno. eu 22

Seed Investors are looking for… • Balanced & committed Management Team • High growth potentials • Sustainable Business Model • Suitable strategies: with deliverable goals … a clear way out strategy …. presence of a strong strategy for intellectual capital www. ip 4 inno. eu 22

Key elements investors look at • • You need to be an entrepreneur You need to have a business not an invention preferably covered with a strong IP You need to have a balanced core team You need to have a clear view of financial resources needed Making money is not the only motivation but is how the shareholders measure success www. ip 4 inno. eu 23

Key elements investors look at • • You need to be an entrepreneur You need to have a business not an invention preferably covered with a strong IP You need to have a balanced core team You need to have a clear view of financial resources needed Making money is not the only motivation but is how the shareholders measure success www. ip 4 inno. eu 23

Issues of concern for a risk capital investor O O Want their money back Want more (much more) than they put Want to know when Want to measure the opportunity/risk www. ip 4 inno. eu 24

Issues of concern for a risk capital investor O O Want their money back Want more (much more) than they put Want to know when Want to measure the opportunity/risk www. ip 4 inno. eu 24

Financial tools (early stage financing) for knowledge based start ups • Proof of concept funds • Business Angels • Seed funds www. ip 4 inno. eu 25

Financial tools (early stage financing) for knowledge based start ups • Proof of concept funds • Business Angels • Seed funds www. ip 4 inno. eu 25

Early stage investors – evaluation approach Proof of concept • • • Innovativeness (+) IPR – Valorisation of research results Entrepreneurial spirit www. ip 4 inno. eu 26

Early stage investors – evaluation approach Proof of concept • • • Innovativeness (+) IPR – Valorisation of research results Entrepreneurial spirit www. ip 4 inno. eu 26

Early stage investors – evaluation approach Business angels • Atmosphere of trust between individuals and positive feeling, confidence (+) • Possibility of hands on intervention • Credible business plan in the eyes of the Business Angel • Availability of exit route • Return on investment (capital gain) www. ip 4 inno. eu 27

Early stage investors – evaluation approach Business angels • Atmosphere of trust between individuals and positive feeling, confidence (+) • Possibility of hands on intervention • Credible business plan in the eyes of the Business Angel • Availability of exit route • Return on investment (capital gain) www. ip 4 inno. eu 27

Early stage investors – evaluation approach Seed capital funds • • Team (+) Clear Business model Intellectual capital Growth potential (High) – international dimension of market • Availability of exit route • Return on investment (capital gain) www. ip 4 inno. eu 28

Early stage investors – evaluation approach Seed capital funds • • Team (+) Clear Business model Intellectual capital Growth potential (High) – international dimension of market • Availability of exit route • Return on investment (capital gain) www. ip 4 inno. eu 28

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What early stage investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 29

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What early stage investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 29

Intellectual capital V/S Intellectual property Intellectual capital is “knowledge” that can be exploited for money-making or for creating value. A combinations of human capital, instructional capital and individual capital employed in productive enterprise are usually what is meant by the term, when it is used to actually refer to a capital asset whose yield is intellectual rights. Due to their industry focus, the term "intellectual capital" is employed mostly in information technology, innovation research, technology transfer and other fields concerned primarily with technology, standards, and venture capital. (Source: Wikipedia) www. ip 4 inno. eu 30

Intellectual capital V/S Intellectual property Intellectual capital is “knowledge” that can be exploited for money-making or for creating value. A combinations of human capital, instructional capital and individual capital employed in productive enterprise are usually what is meant by the term, when it is used to actually refer to a capital asset whose yield is intellectual rights. Due to their industry focus, the term "intellectual capital" is employed mostly in information technology, innovation research, technology transfer and other fields concerned primarily with technology, standards, and venture capital. (Source: Wikipedia) www. ip 4 inno. eu 30

IC Readiness of intangibles in KICs What, we, investors look for is the intellectual capital (explicit + tacit knowledge) strategy: • Monitoring of competitive products/technologies/patents • Correctly employing the legal tools in protecting products/technologies • Ensuring key resources (including people) are available, valorised and protected IP protection will augment early stage investors’ interests by providing further, strong, guarantees on future returns on investments! www. ip 4 inno. eu 31

IC Readiness of intangibles in KICs What, we, investors look for is the intellectual capital (explicit + tacit knowledge) strategy: • Monitoring of competitive products/technologies/patents • Correctly employing the legal tools in protecting products/technologies • Ensuring key resources (including people) are available, valorised and protected IP protection will augment early stage investors’ interests by providing further, strong, guarantees on future returns on investments! www. ip 4 inno. eu 31

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What early stage investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 32

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What early stage investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 32

……What’s Investment readiness about? Investment Readiness = Being able to present to early stage investors your business proposition in a convincing way, given that…. . www. ip 4 inno. eu

……What’s Investment readiness about? Investment Readiness = Being able to present to early stage investors your business proposition in a convincing way, given that…. . www. ip 4 inno. eu

… is it possible to sleep in the same bed with different dreams? www. ip 4 inno. eu 34

… is it possible to sleep in the same bed with different dreams? www. ip 4 inno. eu 34

Your company is not “investment ready” if • The management team is not really committed and involved in the company/entrepreneurial project • The Business plan is week (or do not exist at all!) • The market need and/or the market opportunity is not identified • Entrepreneurs do not consider international markets • The business model is not sustainable • The financial forecast is not well fine-tuned and realistic www. ip 4 inno. eu

Your company is not “investment ready” if • The management team is not really committed and involved in the company/entrepreneurial project • The Business plan is week (or do not exist at all!) • The market need and/or the market opportunity is not identified • Entrepreneurs do not consider international markets • The business model is not sustainable • The financial forecast is not well fine-tuned and realistic www. ip 4 inno. eu

“you” are not investor ready if … • You are not committed toward a fast growth (not ambitious) • You are not ready to yield the share of your company or accept the investors rules • You do not approve that investor will be involved in the company management and decision making process • You expect to receive the money in 2 weeks skipping the due diligence process… www. ip 4 inno. eu

“you” are not investor ready if … • You are not committed toward a fast growth (not ambitious) • You are not ready to yield the share of your company or accept the investors rules • You do not approve that investor will be involved in the company management and decision making process • You expect to receive the money in 2 weeks skipping the due diligence process… www. ip 4 inno. eu

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What early stage investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 37

AGENDA ● Knowledge Intensive Companies ● Where money comes from ● What early stage investors are looking for? ● Intellectual capital: key driver for accessing finance ● Investment readiness ● How to deliver an effective company presentation www. ip 4 inno. eu 37

PITCHING: to clearly and convincing present your business proposition in a few minutes www. ip 4 inno. eu 38

PITCHING: to clearly and convincing present your business proposition in a few minutes www. ip 4 inno. eu 38

1) Why are you pitching (Which is your objective? ) 2) Who is the audience? 3) What are you looking for? (how much – to do what) www. ip 4 inno. eu 39

1) Why are you pitching (Which is your objective? ) 2) Who is the audience? 3) What are you looking for? (how much – to do what) www. ip 4 inno. eu 39

10 minutes pitch to present (10 slides) containing all is needed to : • Let a third person understand the business idea and the related needs • Convince the audience that what is offered is in line with what is required An effective presentation must contain at least: • Introduction • Key message • Conclusion (financial request and why they should invest) www. ip 4 inno. eu 40

10 minutes pitch to present (10 slides) containing all is needed to : • Let a third person understand the business idea and the related needs • Convince the audience that what is offered is in line with what is required An effective presentation must contain at least: • Introduction • Key message • Conclusion (financial request and why they should invest) www. ip 4 inno. eu 40

The first 30 seconds are crucial you have to make an impact by presenting: • • What problem you are going to solve Your value proposition (how does your venture solve such problem? ) Why you are the right people to achieve the result Why your company is a good deal for investors www. ip 4 inno. eu 41

The first 30 seconds are crucial you have to make an impact by presenting: • • What problem you are going to solve Your value proposition (how does your venture solve such problem? ) Why you are the right people to achieve the result Why your company is a good deal for investors www. ip 4 inno. eu 41

Introduction to the business opportunity www. ip 4 inno. eu (1/9) 42

Introduction to the business opportunity www. ip 4 inno. eu (1/9) 42

Achievement to date (2/9) e. g. : • • • Date Founded Sales Customers Funding obtained Patents … www. ip 4 inno. eu 43

Achievement to date (2/9) e. g. : • • • Date Founded Sales Customers Funding obtained Patents … www. ip 4 inno. eu 43

Management Team (3/9) • • • Shareholders Expertise and experience Partnerships …. www. ip 4 inno. eu 44

Management Team (3/9) • • • Shareholders Expertise and experience Partnerships …. www. ip 4 inno. eu 44

Product / Service (4/9) • • • The need solved The proposed solution Advantages (Benefits not features) www. ip 4 inno. eu 45

Product / Service (4/9) • • • The need solved The proposed solution Advantages (Benefits not features) www. ip 4 inno. eu 45

Target Market (5/9) • • • Size Growth rate Opportunity Target customer Competitors www. ip 4 inno. eu 46

Target Market (5/9) • • • Size Growth rate Opportunity Target customer Competitors www. ip 4 inno. eu 46

Business Model (6/9) • • • How we make money How we create profits How we create value www. ip 4 inno. eu 47

Business Model (6/9) • • • How we make money How we create profits How we create value www. ip 4 inno. eu 47

Economic and Financial objectives (7/9) • • • Turnover Gross profit Net Profit www. ip 4 inno. eu 48

Economic and Financial objectives (7/9) • • • Turnover Gross profit Net Profit www. ip 4 inno. eu 48

Investment plan (8/9) • • How much is needed How the money will be invested? www. ip 4 inno. eu 49

Investment plan (8/9) • • How much is needed How the money will be invested? www. ip 4 inno. eu 49

Why investing in us? www. ip 4 inno. eu (9/9) 50

Why investing in us? www. ip 4 inno. eu (9/9) 50

Key elements for delivering a speech/pitch • • • Voice Body language Eye touch Attitude Presence Use of the space www. ip 4 inno. eu 51

Key elements for delivering a speech/pitch • • • Voice Body language Eye touch Attitude Presence Use of the space www. ip 4 inno. eu 51

• • Say only key things • Do not speak too fast • Use short clear sentences • Use pauses • Talk to the audience • Respect time • www. ip 4 inno. eu Avoid slow start (first 30 seconds are crucial) Exercise!!! 52

• • Say only key things • Do not speak too fast • Use short clear sentences • Use pauses • Talk to the audience • Respect time • www. ip 4 inno. eu Avoid slow start (first 30 seconds are crucial) Exercise!!! 52

Thank you for your attention!

Thank you for your attention!