fd0bbe8e8107e61046bb55a4a14938f4.ppt

- Количество слайдов: 53

How to Prepare and Present Proposals: a twelve session trainers’ workshop “Improving our capacity to prepare complete and balanced proposals shortens the path from good ideas to implementation. ”

How to Prepare and Present Proposals: a twelve session trainers’ workshop “Improving our capacity to prepare complete and balanced proposals shortens the path from good ideas to implementation. ”

Session 1 Overview • Why are we here? • What are we expected to accomplish? • What information and techniques will we share? • What are the different examples and problems we will work on? • How will we critique our work? Information Technique Cases Teaching Options Feedback Improvements

Session 1 Overview • Why are we here? • What are we expected to accomplish? • What information and techniques will we share? • What are the different examples and problems we will work on? • How will we critique our work? Information Technique Cases Teaching Options Feedback Improvements

Proposal Samples • • • Mozambique Sugar to Ethanol Egypt Waste to Electricity Kenya Bagasse to Electricity China Waste Water Treatment Senegal Solar Milling

Proposal Samples • • • Mozambique Sugar to Ethanol Egypt Waste to Electricity Kenya Bagasse to Electricity China Waste Water Treatment Senegal Solar Milling

Typical Proposal Problems • Incomplete or Imbalanced • Misdirected • Non-responsive • Terminology Gap

Typical Proposal Problems • Incomplete or Imbalanced • Misdirected • Non-responsive • Terminology Gap

Schedule and Approach • • • Day 1 -preparatory work Day 2 -building a proposals Day 3 -presenting a proposal and training others Lectures + Exercises + Feedback Primary Exercises-Working as teams, sharing five proposal examples. • Authors will help teams understand the proposal; teams will assist authors in suggesting improvements • Feedback will concentrate on the strengths and weaknesses of each session • Wiki, Memory Sticks and all-in-one

Schedule and Approach • • • Day 1 -preparatory work Day 2 -building a proposals Day 3 -presenting a proposal and training others Lectures + Exercises + Feedback Primary Exercises-Working as teams, sharing five proposal examples. • Authors will help teams understand the proposal; teams will assist authors in suggesting improvements • Feedback will concentrate on the strengths and weaknesses of each session • Wiki, Memory Sticks and all-in-one

Preparing and Presenting Proposals A Guidebook on Preparing Technology Transfer Projects for Financing Chapter 1…Summary Chapter 2…Before Preparing a Proposal Chapter 3…Preparing a Proposal Chapter 4…Presenting a Proposal Chapter 5…Customizing a Proposal Information Boxes and Lessons Learned Templates and Other Annexes

Preparing and Presenting Proposals A Guidebook on Preparing Technology Transfer Projects for Financing Chapter 1…Summary Chapter 2…Before Preparing a Proposal Chapter 3…Preparing a Proposal Chapter 4…Presenting a Proposal Chapter 5…Customizing a Proposal Information Boxes and Lessons Learned Templates and Other Annexes

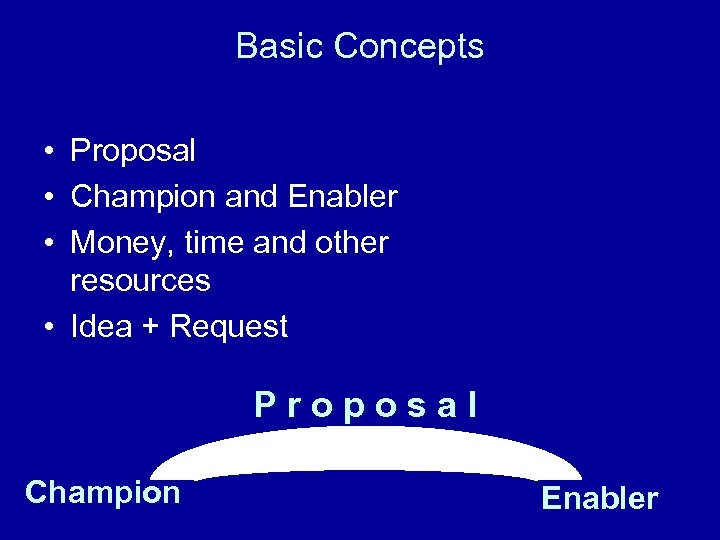

Basic Concepts • Proposal • Champion and Enabler • Money, time and other resources • Idea + Request P r o p o s a l Champion Enabler

Basic Concepts • Proposal • Champion and Enabler • Money, time and other resources • Idea + Request P r o p o s a l Champion Enabler

Session 1 Exercise • You are preparing a budget. How is this a proposal? • You are asked to approve a trip. How is this a proposal? • A school needs books. You decide to raise money for the school. Who is the Champion and how is your decision a proposal? Who are the enablers? • Is it still a proposal if you simply buy the books yourself and send the books to the school?

Session 1 Exercise • You are preparing a budget. How is this a proposal? • You are asked to approve a trip. How is this a proposal? • A school needs books. You decide to raise money for the school. Who is the Champion and how is your decision a proposal? Who are the enablers? • Is it still a proposal if you simply buy the books yourself and send the books to the school?

Feedback and Break • • Too long, too short? Too simple, too much? Lecture and Exercise Critique Questions and Discussions helped, distracted?

Feedback and Break • • Too long, too short? Too simple, too much? Lecture and Exercise Critique Questions and Discussions helped, distracted?

Session 2 Method: Seven Questions • Information-the seven key questions • Technique-building block approach • Information-content for two of the five proposals • Exercise-as a group we will conduct a preliminary inventory of two proposals, identify the seven key pieces of content (or not) and address a core issue: “Is it clear what is being requested? ”

Session 2 Method: Seven Questions • Information-the seven key questions • Technique-building block approach • Information-content for two of the five proposals • Exercise-as a group we will conduct a preliminary inventory of two proposals, identify the seven key pieces of content (or not) and address a core issue: “Is it clear what is being requested? ”

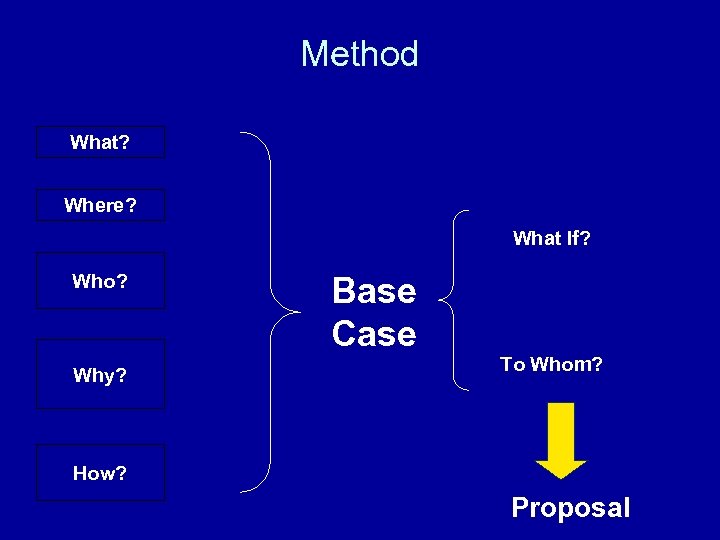

Method What? Where? Who? Why? How? What If? Base Case To Whom? Proposal

Method What? Where? Who? Why? How? What If? Base Case To Whom? Proposal

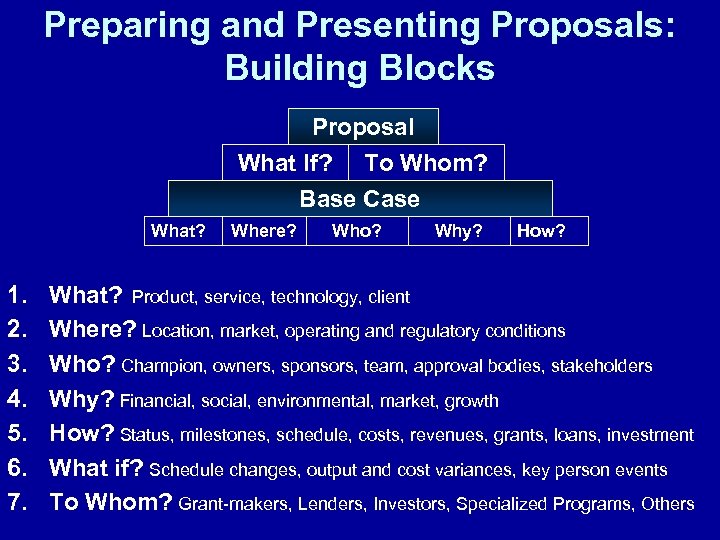

Preparing and Presenting Proposals: Building Blocks Proposal What If? To Whom? Base Case What? 1. 2. 3. 4. 5. 6. 7. Where? Who? Why? How? What? Product, service, technology, client Where? Location, market, operating and regulatory conditions Who? Champion, owners, sponsors, team, approval bodies, stakeholders Why? Financial, social, environmental, market, growth How? Status, milestones, schedule, costs, revenues, grants, loans, investment What if? Schedule changes, output and cost variances, key person events To Whom? Grant-makers, Lenders, Investors, Specialized Programs, Others

Preparing and Presenting Proposals: Building Blocks Proposal What If? To Whom? Base Case What? 1. 2. 3. 4. 5. 6. 7. Where? Who? Why? How? What? Product, service, technology, client Where? Location, market, operating and regulatory conditions Who? Champion, owners, sponsors, team, approval bodies, stakeholders Why? Financial, social, environmental, market, growth How? Status, milestones, schedule, costs, revenues, grants, loans, investment What if? Schedule changes, output and cost variances, key person events To Whom? Grant-makers, Lenders, Investors, Specialized Programs, Others

Guidebook Checklist • Read Egypt and Kenya • See Page 16 of Guidebook • Conduct a “preliminary” inventory of proposals • Identify included and missing parts • Is it clear what is being requested?

Guidebook Checklist • Read Egypt and Kenya • See Page 16 of Guidebook • Conduct a “preliminary” inventory of proposals • Identify included and missing parts • Is it clear what is being requested?

Feedback and Break • • Too long, too short? Too simple, too much? Lecture and Exercise Critique Questions and Discussions helped, distracted?

Feedback and Break • • Too long, too short? Too simple, too much? Lecture and Exercise Critique Questions and Discussions helped, distracted?

Session 3 - Numbers: accounting, finance and scheduling concepts • Information: key terms used in the quantitative portions of proposals • Technique: debt service, net present value, internal rate of return …income statement, balance sheet … planning, construction and operations • Exercise: simple payback Ellen and Niki Buy a Coffeepot)… compound interest calculations…see Guidebook Page 39

Session 3 - Numbers: accounting, finance and scheduling concepts • Information: key terms used in the quantitative portions of proposals • Technique: debt service, net present value, internal rate of return …income statement, balance sheet … planning, construction and operations • Exercise: simple payback Ellen and Niki Buy a Coffeepot)… compound interest calculations…see Guidebook Page 39

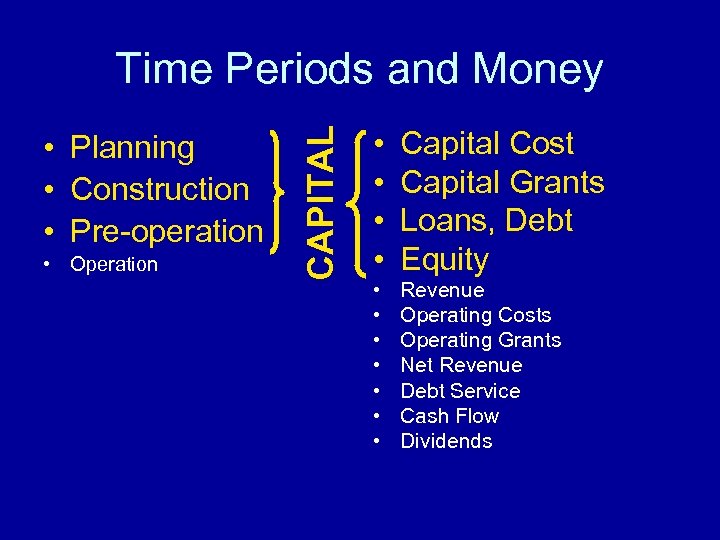

Basic Concepts Time Periods and Money • • Planning Construction Pre-operation Operation • • • Capital Cost Capital Grants Loans, Debt Equity Revenue Operating Costs Operating Grants Net Operating Revenue Debt Service Cash Flow Dividends

Basic Concepts Time Periods and Money • • Planning Construction Pre-operation Operation • • • Capital Cost Capital Grants Loans, Debt Equity Revenue Operating Costs Operating Grants Net Operating Revenue Debt Service Cash Flow Dividends

• Planning • Construction • Pre-operation • Operation CAPITAL Time Periods and Money • • Capital Cost Capital Grants Loans, Debt Equity • • Revenue Operating Costs Operating Grants Net Revenue Debt Service Cash Flow Dividends

• Planning • Construction • Pre-operation • Operation CAPITAL Time Periods and Money • • Capital Cost Capital Grants Loans, Debt Equity • • Revenue Operating Costs Operating Grants Net Revenue Debt Service Cash Flow Dividends

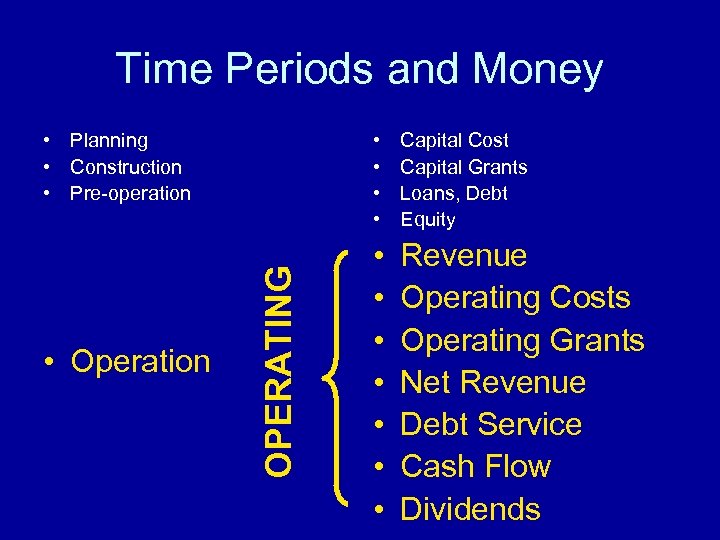

Time Periods and Money • Operation • • OPERATING • Planning • Construction • Pre-operation Capital Cost Capital Grants Loans, Debt Equity • • Revenue Operating Costs Operating Grants Net Revenue Debt Service Cash Flow Dividends

Time Periods and Money • Operation • • OPERATING • Planning • Construction • Pre-operation Capital Cost Capital Grants Loans, Debt Equity • • Revenue Operating Costs Operating Grants Net Revenue Debt Service Cash Flow Dividends

Planning includes • • • Technical analysis Site selection Environmental and social assessments Feasibility analysis Obtaining all permits and approvals Finding, negotiating and “closing” the necessary funding to make a proposal reality • During the planning period, the Champion must track and record time spent on activities. Sometimes called “sweat equity”, this information becomes extremely helpful in later discussions, especially with new potential investorowners.

Planning includes • • • Technical analysis Site selection Environmental and social assessments Feasibility analysis Obtaining all permits and approvals Finding, negotiating and “closing” the necessary funding to make a proposal reality • During the planning period, the Champion must track and record time spent on activities. Sometimes called “sweat equity”, this information becomes extremely helpful in later discussions, especially with new potential investorowners.

Construction and pre-operation include: • • Site acquisition Preparation of land Building of structures Installation of infrastructure Acquisition and installation of equipment Setting up offices and distribution points Acquisition of operating equipment (vehicles, office, maintenance) • Fees to be paid to experts • Fees to be paid or credited as shares of ownership to Champions

Construction and pre-operation include: • • Site acquisition Preparation of land Building of structures Installation of infrastructure Acquisition and installation of equipment Setting up offices and distribution points Acquisition of operating equipment (vehicles, office, maintenance) • Fees to be paid to experts • Fees to be paid or credited as shares of ownership to Champions

An operating budget and plan includes: • Revenue estimates that show both the number of units expected to be produced and the value of each unit • Labour costs (separated between labour to produce the product or service and labour to run the company or the programme) • Raw materials to produce the product or service (e. g. , fuel to produce electricity or untreated bed-nets and the special coating to be applied) • Transport: fuel, maintenance • Communications: phone, fax, e-mail, postage • Utilities: heat, cooling, water, electricity • Packaging • Office supplies • Equipment rental • Insurance • Accounting and auditing services

An operating budget and plan includes: • Revenue estimates that show both the number of units expected to be produced and the value of each unit • Labour costs (separated between labour to produce the product or service and labour to run the company or the programme) • Raw materials to produce the product or service (e. g. , fuel to produce electricity or untreated bed-nets and the special coating to be applied) • Transport: fuel, maintenance • Communications: phone, fax, e-mail, postage • Utilities: heat, cooling, water, electricity • Packaging • Office supplies • Equipment rental • Insurance • Accounting and auditing services

Basic Concepts Financial Analysis • • Cash Flow Interest Debt Service Net Present Value Internal Rate of Return Debt Service Coverage Ratios Project “Rate of Return

Basic Concepts Financial Analysis • • Cash Flow Interest Debt Service Net Present Value Internal Rate of Return Debt Service Coverage Ratios Project “Rate of Return

Ellen and Niki Buy a Coffeepot Lesson One of Three

Ellen and Niki Buy a Coffeepot Lesson One of Three

Ellen and Niki work in the same office … • Every day Ellen and Niki stop at Starbucks on the way to work … Picture of Starbucks

Ellen and Niki work in the same office … • Every day Ellen and Niki stop at Starbucks on the way to work … Picture of Starbucks

They each spend $1. 70 … Picture of two cups of coffee

They each spend $1. 70 … Picture of two cups of coffee

$3. 40 per day … Picture of Calendar • … at least 20 days per month

$3. 40 per day … Picture of Calendar • … at least 20 days per month

“We’re spending $68 a month …” Ellen and Niki in conversation • “What would it cost if we made coffee instead of buying it? ”

“We’re spending $68 a month …” Ellen and Niki in conversation • “What would it cost if we made coffee instead of buying it? ”

“We would need a good coffeepot …” Picture of coffeepot With price tag of $158. 00

“We would need a good coffeepot …” Picture of coffeepot With price tag of $158. 00

“We would need to buy coffee, milk and sugar …” Picture of coffee, milk and sugar bowl • About $12. 00 per pound

“We would need to buy coffee, milk and sugar …” Picture of coffee, milk and sugar bowl • About $12. 00 per pound

“How many cups will that make? picture of random cups

“How many cups will that make? picture of random cups

Seventeen cups

Seventeen cups

How much will each cup cost? $12. 00 / 17 = $0. 71 per cup

How much will each cup cost? $12. 00 / 17 = $0. 71 per cup

“But we need to buy the coffeepot? • “Yes” Picture of coffeepot with $158 price tag

“But we need to buy the coffeepot? • “Yes” Picture of coffeepot with $158 price tag

“So, every cup we make saves $0. 99 ($1. 70 minus $0. 71). . . “ … we save $1. 98 each day … “How many days of savings pay for the coffeepot? ”

“So, every cup we make saves $0. 99 ($1. 70 minus $0. 71). . . “ … we save $1. 98 each day … “How many days of savings pay for the coffeepot? ”

79 Days $158. 00 / $1. 98 = 79

79 Days $158. 00 / $1. 98 = 79

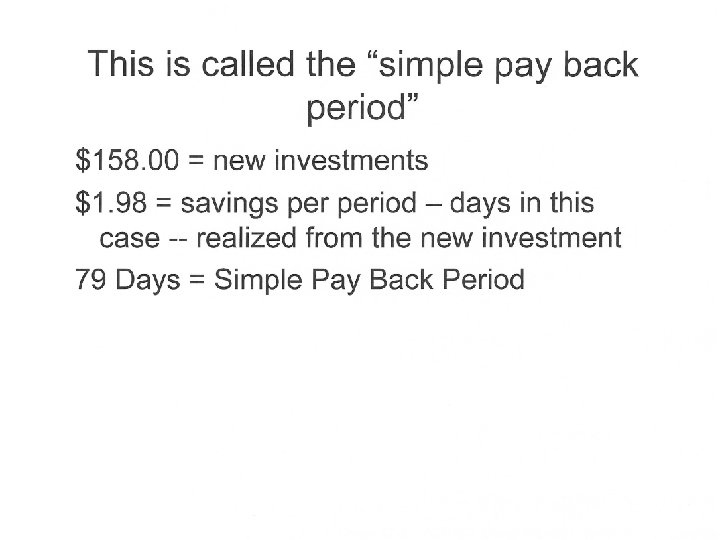

This is called the “simple pay back period” $158. 00 = new investments $1. 98 = savings period – days in this case -- realized from the new investment 79 Days = Simple Pay Back Period

This is called the “simple pay back period” $158. 00 = new investments $1. 98 = savings period – days in this case -- realized from the new investment 79 Days = Simple Pay Back Period

What does it mean? “Simple Pay Back Period is the amount of time required to recover the cost of a new investment on the basis of the new savings or revenue created by the new investment. ” In 79 days my savings from making my own coffee will justify the investment of $158 to buy a new coffeepot.

What does it mean? “Simple Pay Back Period is the amount of time required to recover the cost of a new investment on the basis of the new savings or revenue created by the new investment. ” In 79 days my savings from making my own coffee will justify the investment of $158 to buy a new coffeepot.

How useful is it? “Simple Pay Back” is a rough approximation of whether a decision makes sense or not. It might take ninety days to achieve simple payback. Or maybe only sixty. Since the coffeemaker is expected to last more than two years, that’s 480 days during which to recover the investment. There’s a good margin for error.

How useful is it? “Simple Pay Back” is a rough approximation of whether a decision makes sense or not. It might take ninety days to achieve simple payback. Or maybe only sixty. Since the coffeemaker is expected to last more than two years, that’s 480 days during which to recover the investment. There’s a good margin for error.

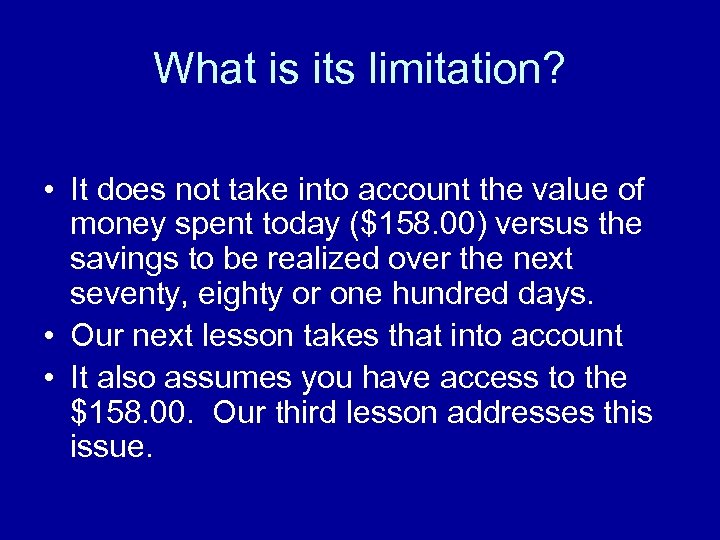

What is its limitation? • It does not take into account the value of money spent today ($158. 00) versus the savings to be realized over the next seventy, eighty or one hundred days. • Our next lesson takes that into account • It also assumes you have access to the $158. 00. Our third lesson addresses this issue.

What is its limitation? • It does not take into account the value of money spent today ($158. 00) versus the savings to be realized over the next seventy, eighty or one hundred days. • Our next lesson takes that into account • It also assumes you have access to the $158. 00. Our third lesson addresses this issue.

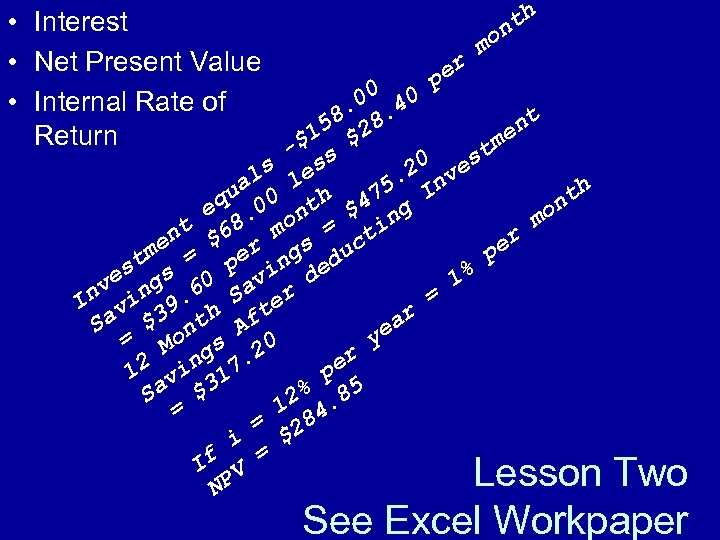

th • Interest on m • Net Present Value er 0 0 p • Internal Rate of . 0. 4 58 28 nt Return $1 $ me - s st 0 ls les. 2 nve ua 0 th h 475 I eq. 0 nt $ ng on m o nt $68 m s = cti er r g me = u p t pe in ed es gs 0 av d 1% nv in. 6 S er = I v 9 h t ar Sa $3 nt Af ye = Mo s 20 2 ing 7. er 1 v p a $31 S 2%. 85 1 4 = = 28 $ i If V = NP Lesson Two See Excel Workpaper

th • Interest on m • Net Present Value er 0 0 p • Internal Rate of . 0. 4 58 28 nt Return $1 $ me - s st 0 ls les. 2 nve ua 0 th h 475 I eq. 0 nt $ ng on m o nt $68 m s = cti er r g me = u p t pe in ed es gs 0 av d 1% nv in. 6 S er = I v 9 h t ar Sa $3 nt Af ye = Mo s 20 2 ing 7. er 1 v p a $31 S 2%. 85 1 4 = = 28 $ i If V = NP Lesson Two See Excel Workpaper

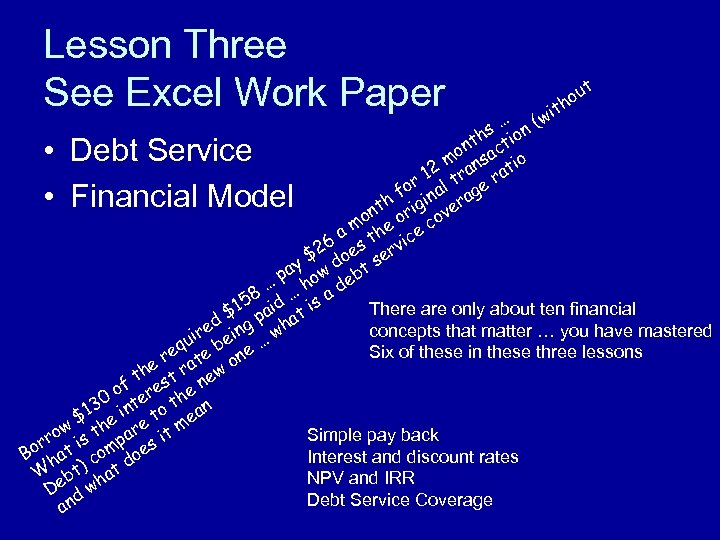

Lesson Three See Excel Work Paper t u ho it … (w s n th ctio n a mo ns tio 2 a r 1 l tr e ra g fo a h igin era t on or cov a m the ice 6 s v $2 doe ser y pa ow ebt h … … sad 8 5 d There are only about ten financial $1 pai at i d g h concepts that matter … you have mastered ire ein … w u b q Six of these in these three lessons re ate one e r h w f t rest e ne o 30 inte o th an $1 e e t me h w Simple pay back ro is t par s it or at om oe B h Interest and discount rates ) c at d W bt h NPV and IRR De d w Debt Service Coverage an • Debt Service • Financial Model

Lesson Three See Excel Work Paper t u ho it … (w s n th ctio n a mo ns tio 2 a r 1 l tr e ra g fo a h igin era t on or cov a m the ice 6 s v $2 doe ser y pa ow ebt h … … sad 8 5 d There are only about ten financial $1 pai at i d g h concepts that matter … you have mastered ire ein … w u b q Six of these in these three lessons re ate one e r h w f t rest e ne o 30 inte o th an $1 e e t me h w Simple pay back ro is t par s it or at om oe B h Interest and discount rates ) c at d W bt h NPV and IRR De d w Debt Service Coverage an • Debt Service • Financial Model

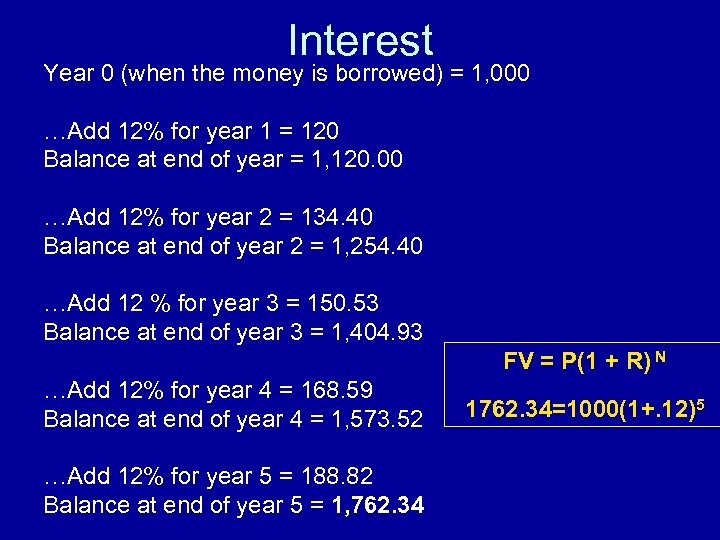

Interest Year 0 (when the money is borrowed) = 1, 000 …Add 12% for year 1 = 120 Balance at end of year = 1, 120. 00 …Add 12% for year 2 = 134. 40 Balance at end of year 2 = 1, 254. 40 …Add 12 % for year 3 = 150. 53 Balance at end of year 3 = 1, 404. 93 FV = P(1 + R) N …Add 12% for year 4 = 168. 59 Balance at end of year 4 = 1, 573. 52 …Add 12% for year 5 = 188. 82 Balance at end of year 5 = 1, 762. 34 1762. 34=1000(1+. 12)5

Interest Year 0 (when the money is borrowed) = 1, 000 …Add 12% for year 1 = 120 Balance at end of year = 1, 120. 00 …Add 12% for year 2 = 134. 40 Balance at end of year 2 = 1, 254. 40 …Add 12 % for year 3 = 150. 53 Balance at end of year 3 = 1, 404. 93 FV = P(1 + R) N …Add 12% for year 4 = 168. 59 Balance at end of year 4 = 1, 573. 52 …Add 12% for year 5 = 188. 82 Balance at end of year 5 = 1, 762. 34 1762. 34=1000(1+. 12)5

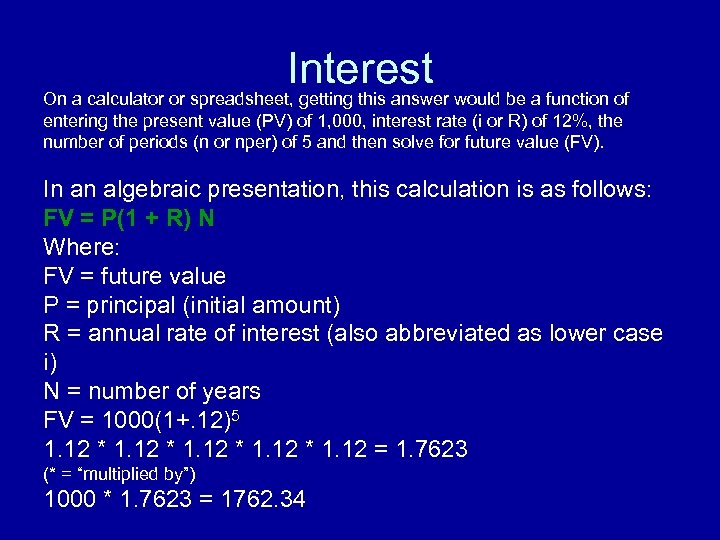

Interest On a calculator or spreadsheet, getting this answer would be a function of entering the present value (PV) of 1, 000, interest rate (i or R) of 12%, the number of periods (n or nper) of 5 and then solve for future value (FV). In an algebraic presentation, this calculation is as follows: FV = P(1 + R) N Where: FV = future value P = principal (initial amount) R = annual rate of interest (also abbreviated as lower case i) N = number of years FV = 1000(1+. 12)5 1. 12 * 1. 12 = 1. 7623 (* = “multiplied by”) 1000 * 1. 7623 = 1762. 34

Interest On a calculator or spreadsheet, getting this answer would be a function of entering the present value (PV) of 1, 000, interest rate (i or R) of 12%, the number of periods (n or nper) of 5 and then solve for future value (FV). In an algebraic presentation, this calculation is as follows: FV = P(1 + R) N Where: FV = future value P = principal (initial amount) R = annual rate of interest (also abbreviated as lower case i) N = number of years FV = 1000(1+. 12)5 1. 12 * 1. 12 = 1. 7623 (* = “multiplied by”) 1000 * 1. 7623 = 1762. 34

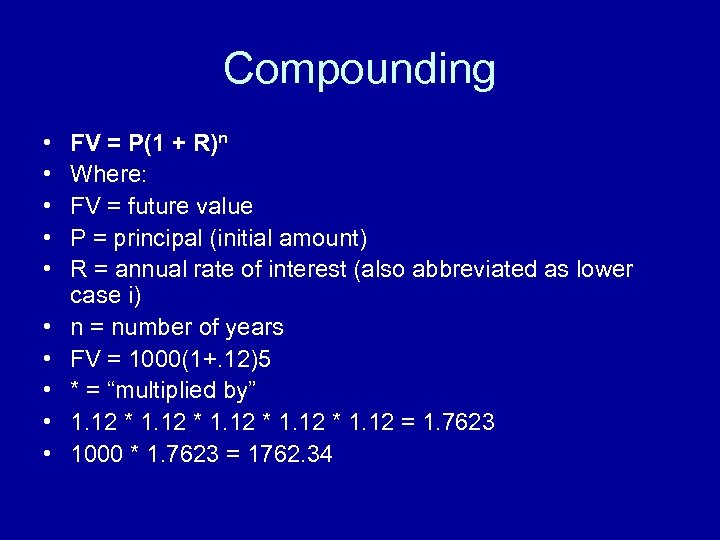

Compounding • • • FV = P(1 + R)n Where: FV = future value P = principal (initial amount) R = annual rate of interest (also abbreviated as lower case i) n = number of years FV = 1000(1+. 12)5 * = “multiplied by” 1. 12 * 1. 12 = 1. 7623 1000 * 1. 7623 = 1762. 34

Compounding • • • FV = P(1 + R)n Where: FV = future value P = principal (initial amount) R = annual rate of interest (also abbreviated as lower case i) n = number of years FV = 1000(1+. 12)5 * = “multiplied by” 1. 12 * 1. 12 = 1. 7623 1000 * 1. 7623 = 1762. 34

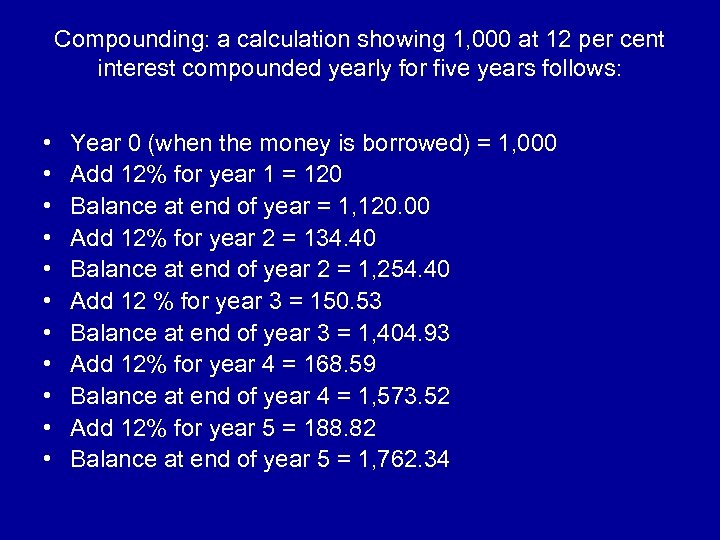

Compounding: a calculation showing 1, 000 at 12 per cent interest compounded yearly for five years follows: • • • Year 0 (when the money is borrowed) = 1, 000 Add 12% for year 1 = 120 Balance at end of year = 1, 120. 00 Add 12% for year 2 = 134. 40 Balance at end of year 2 = 1, 254. 40 Add 12 % for year 3 = 150. 53 Balance at end of year 3 = 1, 404. 93 Add 12% for year 4 = 168. 59 Balance at end of year 4 = 1, 573. 52 Add 12% for year 5 = 188. 82 Balance at end of year 5 = 1, 762. 34

Compounding: a calculation showing 1, 000 at 12 per cent interest compounded yearly for five years follows: • • • Year 0 (when the money is borrowed) = 1, 000 Add 12% for year 1 = 120 Balance at end of year = 1, 120. 00 Add 12% for year 2 = 134. 40 Balance at end of year 2 = 1, 254. 40 Add 12 % for year 3 = 150. 53 Balance at end of year 3 = 1, 404. 93 Add 12% for year 4 = 168. 59 Balance at end of year 4 = 1, 573. 52 Add 12% for year 5 = 188. 82 Balance at end of year 5 = 1, 762. 34

Debt Service Repay 1, 000 over five years at 12 per cent – three methods Payment Methods A - Bullet Year Year Total 1 2 3 4 5 payment 120 120 1, 600 B - Equal Annual or 277 Mortgage 277 277 1, 385 C - Equal principal 296 272 248 224 1, 360 320

Debt Service Repay 1, 000 over five years at 12 per cent – three methods Payment Methods A - Bullet Year Year Total 1 2 3 4 5 payment 120 120 1, 600 B - Equal Annual or 277 Mortgage 277 277 1, 385 C - Equal principal 296 272 248 224 1, 360 320

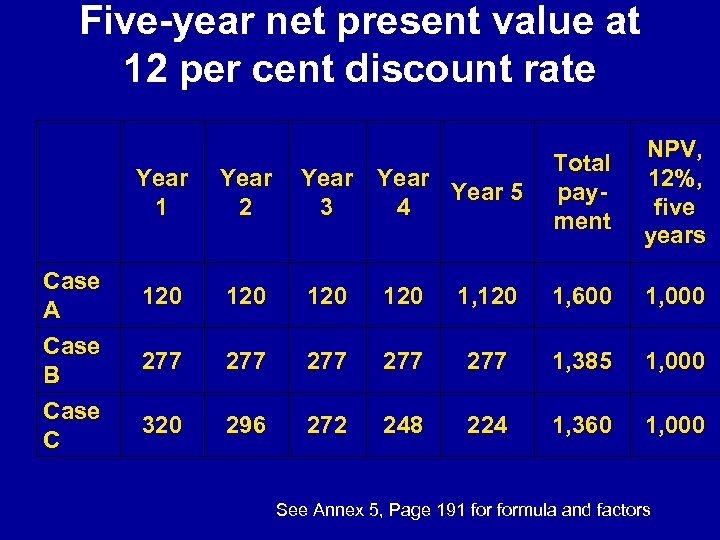

Five-year net present value at 12 per cent discount rate NPV, 12%, five years Year 1 Case A Case B Case C Year 5 2 3 4 Total payment 120 120 1, 600 1, 000 277 277 277 1, 385 1, 000 320 296 272 248 224 1, 360 1, 000 See Annex 5, Page 191 formula and factors

Five-year net present value at 12 per cent discount rate NPV, 12%, five years Year 1 Case A Case B Case C Year 5 2 3 4 Total payment 120 120 1, 600 1, 000 277 277 277 1, 385 1, 000 320 296 272 248 224 1, 360 1, 000 See Annex 5, Page 191 formula and factors

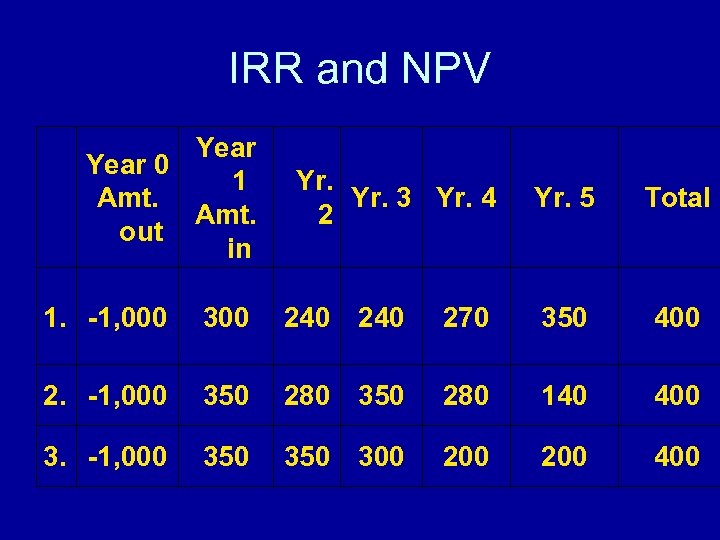

IRR and NPV Year 0 1 Yr. Amt. Yr. 3 Yr. 4 2 Amt. out in Yr. 5 Total 1. -1, 000 300 240 270 350 400 2. -1, 000 350 280 140 400 3. -1, 000 350 300 200 400

IRR and NPV Year 0 1 Yr. Amt. Yr. 3 Yr. 4 2 Amt. out in Yr. 5 Total 1. -1, 000 300 240 270 350 400 2. -1, 000 350 280 140 400 3. -1, 000 350 300 200 400

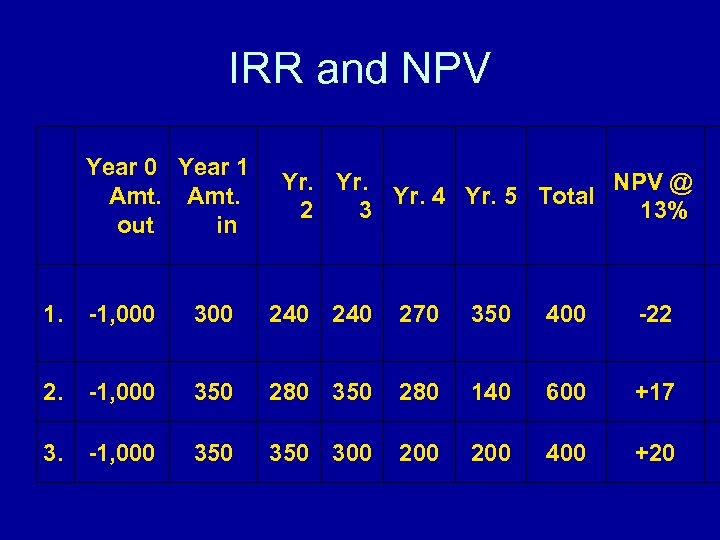

IRR and NPV Year 0 Year 1 Amt. out in Yr. NPV @ Yr. 4 Yr. 5 Total 2 3 13% 1. -1, 000 300 240 270 350 400 -22 2. -1, 000 350 280 140 600 +17 3. -1, 000 350 300 200 400 +20

IRR and NPV Year 0 Year 1 Amt. out in Yr. NPV @ Yr. 4 Yr. 5 Total 2 3 13% 1. -1, 000 300 240 270 350 400 -22 2. -1, 000 350 280 140 600 +17 3. -1, 000 350 300 200 400 +20

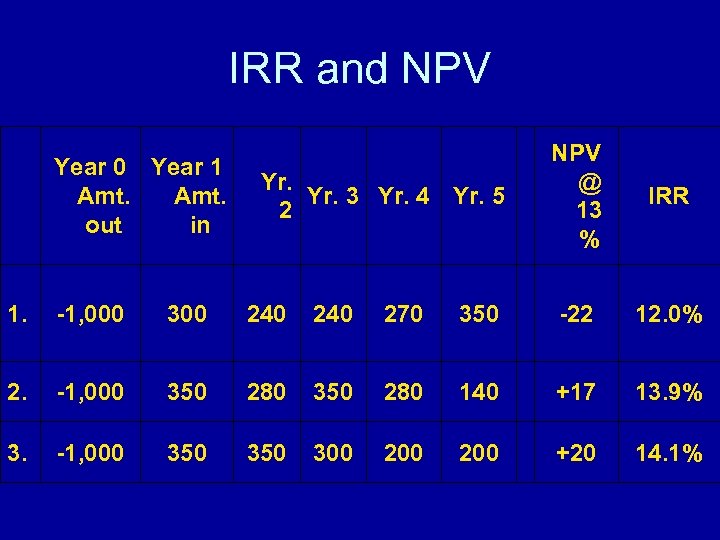

IRR and NPV Year 0 Year 1 Yr. Amt. Yr. 3 Yr. 4 Yr. 5 2 out in NPV @ 13 % IRR 1. -1, 000 300 240 270 350 -22 12. 0% 2. -1, 000 350 280 140 +17 13. 9% 3. -1, 000 350 300 200 +20 14. 1%

IRR and NPV Year 0 Year 1 Yr. Amt. Yr. 3 Yr. 4 Yr. 5 2 out in NPV @ 13 % IRR 1. -1, 000 300 240 270 350 -22 12. 0% 2. -1, 000 350 280 140 +17 13. 9% 3. -1, 000 350 300 200 +20 14. 1%

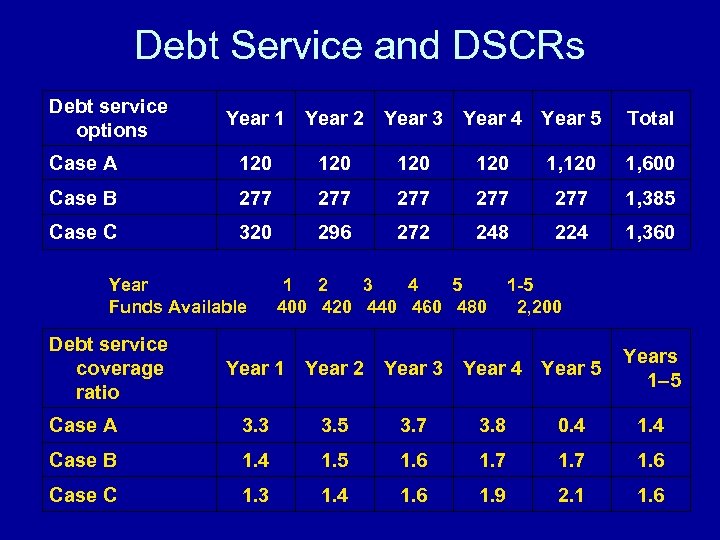

Debt Service and DSCRs Debt service options Year 1 Year 2 Year 3 Year 4 Year 5 Total Case A 120 120 1, 600 Case B 277 277 277 1, 385 Case C 320 296 272 248 224 1, 360 Year 1 2 3 4 5 1 -5 Funds Available 400 420 440 460 480 2, 200 Debt service coverage ratio Year 1 Year 2 Year 3 Year 4 Year 5 Years 1– 5 Case A 3. 3 3. 5 3. 7 3. 8 0. 4 1. 4 Case B 1. 4 1. 5 1. 6 1. 7 1. 6 Case C 1. 3 1. 4 1. 6 1. 9 2. 1 1. 6

Debt Service and DSCRs Debt service options Year 1 Year 2 Year 3 Year 4 Year 5 Total Case A 120 120 1, 600 Case B 277 277 277 1, 385 Case C 320 296 272 248 224 1, 360 Year 1 2 3 4 5 1 -5 Funds Available 400 420 440 460 480 2, 200 Debt service coverage ratio Year 1 Year 2 Year 3 Year 4 Year 5 Years 1– 5 Case A 3. 3 3. 5 3. 7 3. 8 0. 4 1. 4 Case B 1. 4 1. 5 1. 6 1. 7 1. 6 Case C 1. 3 1. 4 1. 6 1. 9 2. 1 1. 6

Financial Concepts • • • Interest Principal Debt Service Net Present Value Internal Rate of Return Debt Service Coverage Ratios • • • i P or p P+I NPV IRR DSCR

Financial Concepts • • • Interest Principal Debt Service Net Present Value Internal Rate of Return Debt Service Coverage Ratios • • • i P or p P+I NPV IRR DSCR

Feedback and Break • • Too long, too short? Too simple, too much? Lecture and Exercise Critique Questions and Discussions helped, distracted?

Feedback and Break • • Too long, too short? Too simple, too much? Lecture and Exercise Critique Questions and Discussions helped, distracted?