7df86cb03f834bb98e7004152a4c9803.ppt

- Количество слайдов: 47

HOW TO MAKE SURE YOUR INVOICES ARE PAID Nadine BOGELMANN – Partner MOLITOR Avocats à la Cour 21 September 2012 1

HOW TO MAKE SURE YOUR INVOICES ARE PAID Nadine BOGELMANN – Partner MOLITOR Avocats à la Cour 21 September 2012 1

INTRODUCTION 2

INTRODUCTION 2

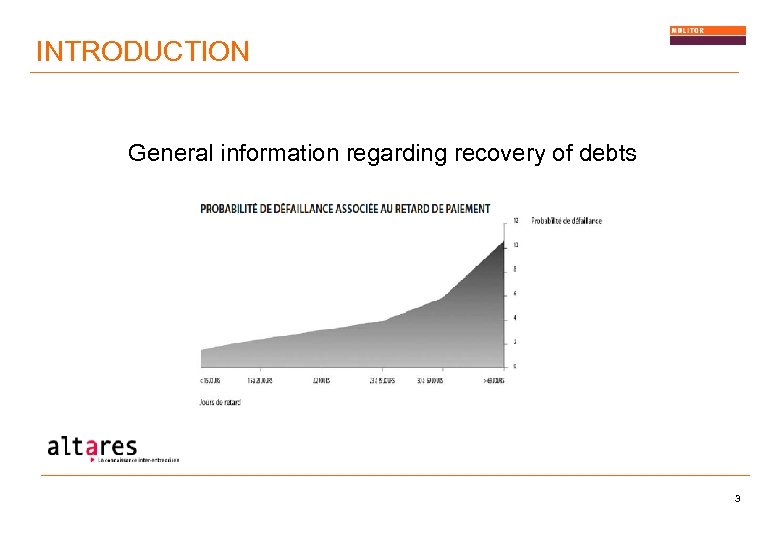

INTRODUCTION General information regarding recovery of debts 3

INTRODUCTION General information regarding recovery of debts 3

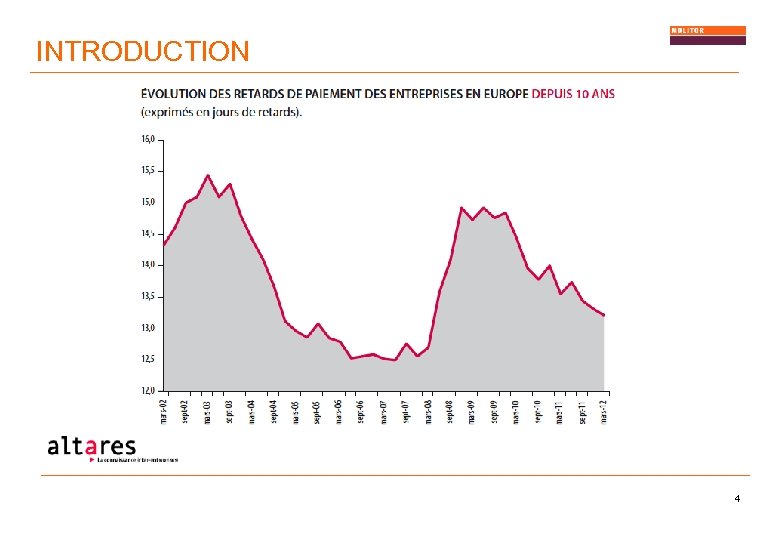

INTRODUCTION 4

INTRODUCTION 4

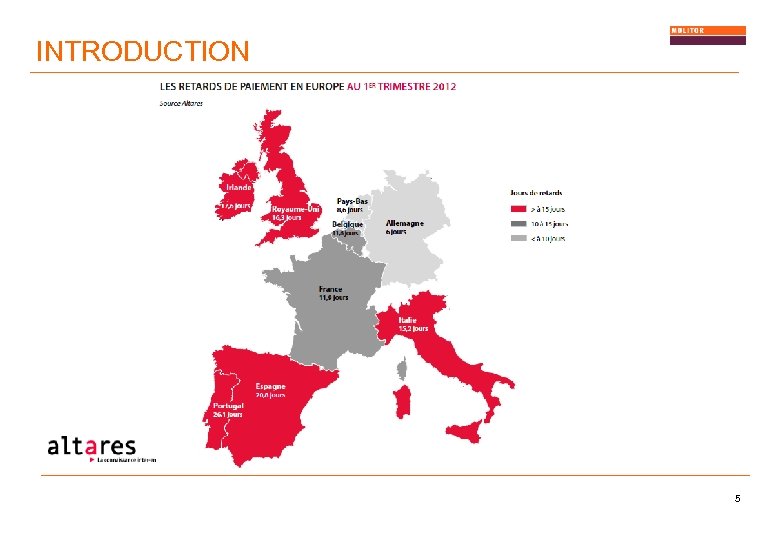

INTRODUCTION 5

INTRODUCTION 5

YOUR CUSTOMER 6

YOUR CUSTOMER 6

A. MINIMISING THE RISK 7

A. MINIMISING THE RISK 7

THE CUSTOMER A. Minimising the risk 1. Manage your client 2. Know your client 8

THE CUSTOMER A. Minimising the risk 1. Manage your client 2. Know your client 8

THE CLIENT 1. Manage your client ü ü Systematic approach Have formal methods and procedures Use the tools you have put in place Cover the client risk 9

THE CLIENT 1. Manage your client ü ü Systematic approach Have formal methods and procedures Use the tools you have put in place Cover the client risk 9

THE CLIENT 2. Know your client ü ü ü Identification of individuals Identification of legal entity Solvency Check (national and international bankruptcy, liquidation, excessive debt) Diversification of customers and activity segments Set up credit limits by client and by activity segment 10

THE CLIENT 2. Know your client ü ü ü Identification of individuals Identification of legal entity Solvency Check (national and international bankruptcy, liquidation, excessive debt) Diversification of customers and activity segments Set up credit limits by client and by activity segment 10

B. CREATING THE CLIENT RELATIONSHIP 11

B. CREATING THE CLIENT RELATIONSHIP 11

THE CLIENT B. Creating the customer relationship 1. Contract 2. General terms and conditions 3. Guarantees 4. Validity of invoice 5. Other ways to reduce the risk of non-payment 12

THE CLIENT B. Creating the customer relationship 1. Contract 2. General terms and conditions 3. Guarantees 4. Validity of invoice 5. Other ways to reduce the risk of non-payment 12

THE CLIENT 1. The Contract ü Definition “A contract is a convention by which one party obliges itself towards one or more other parties, in order to provide, to do, or not to do something. ” (Article 1101 of the Civil Code) 13

THE CLIENT 1. The Contract ü Definition “A contract is a convention by which one party obliges itself towards one or more other parties, in order to provide, to do, or not to do something. ” (Article 1101 of the Civil Code) 13

THE CLIENT ü Validity of the Contract: • Object • Purpose (existence / legality) • Capacity to act (individual / legal entity) • Absence of undue influence ü Form of the Contract: • Oral • Written • Notarised 14

THE CLIENT ü Validity of the Contract: • Object • Purpose (existence / legality) • Capacity to act (individual / legal entity) • Absence of undue influence ü Form of the Contract: • Oral • Written • Notarised 14

THE CLIENT ü Contractual Clauses • Applicable law • Jurisdiction and Competent courts in the event of litigation • Arbitration (only in commercial matters) • Mediation (Law of 24 February 2012) • Burden of proof • Limitation (of liability, transference of risk, etc. ) • Termination • Interest • Penalty 15

THE CLIENT ü Contractual Clauses • Applicable law • Jurisdiction and Competent courts in the event of litigation • Arbitration (only in commercial matters) • Mediation (Law of 24 February 2012) • Burden of proof • Limitation (of liability, transference of risk, etc. ) • Termination • Interest • Penalty 15

THE CLIENT 2. General Terms and Conditions ü ü Understandable by the client / customer Known or accepted by the client / customer Include usual clauses (between professionals and consumers) Exclude abusive clauses 16

THE CLIENT 2. General Terms and Conditions ü ü Understandable by the client / customer Known or accepted by the client / customer Include usual clauses (between professionals and consumers) Exclude abusive clauses 16

THE CLIENT 3. Guarantees ü General principles ü Different types of guarantees: • • Personal guarantees Charges on property 17

THE CLIENT 3. Guarantees ü General principles ü Different types of guarantees: • • Personal guarantees Charges on property 17

THE CLIENT • Personal guarantees require the intervention of a third party who personally undertakes to guarantee payment of the debt • Charges on property relate to goods and chatells, including real estate. In cases of nonpayment by the debtor, the creditor can either retain or seize the item or sell it by public auction to obtain payment. 18

THE CLIENT • Personal guarantees require the intervention of a third party who personally undertakes to guarantee payment of the debt • Charges on property relate to goods and chatells, including real estate. In cases of nonpayment by the debtor, the creditor can either retain or seize the item or sell it by public auction to obtain payment. 18

THE CLIENT ü Personal guarantees: • ü Guarantee on first demand Charges on property: • • Pledge Mortgage Right of retention / lien Reservation of title 19

THE CLIENT ü Personal guarantees: • ü Guarantee on first demand Charges on property: • • Pledge Mortgage Right of retention / lien Reservation of title 19

THE CLIENT 4. Validity of Invoice ü What should be included in the invoice? • Obligatory: description of goods sold, services carried out, amount charged, applicable VAT, VAT number, invoice delivery date, name and address of the sender and the receiver of the invoice • Advisable: bank details, method of payment, credit terms, discount (if any) 20

THE CLIENT 4. Validity of Invoice ü What should be included in the invoice? • Obligatory: description of goods sold, services carried out, amount charged, applicable VAT, VAT number, invoice delivery date, name and address of the sender and the receiver of the invoice • Advisable: bank details, method of payment, credit terms, discount (if any) 20

THE CLIENT 5. Other ways to reduce the risk of non-payment ü 1. Payment on account ü 2. Factoring – The selling of a company’s accounts receivable, at a discount, to a factor, who then assumes the credit risk of the debtor’s account and receives payment as and when the debtor settles his account ü 3. Credit assurance – An insurance policy protecting a company in the event that it does not collect an unusually large amount of its accounts receivable ü 4. Credit finance – Financing the purchase through a credit institution 21

THE CLIENT 5. Other ways to reduce the risk of non-payment ü 1. Payment on account ü 2. Factoring – The selling of a company’s accounts receivable, at a discount, to a factor, who then assumes the credit risk of the debtor’s account and receives payment as and when the debtor settles his account ü 3. Credit assurance – An insurance policy protecting a company in the event that it does not collect an unusually large amount of its accounts receivable ü 4. Credit finance – Financing the purchase through a credit institution 21

CHASING THE DEBTOR 22

CHASING THE DEBTOR 22

CHASING THE DEBTOR A. Managing the debt 1. Send a reminder 2. Try and find an amicable solution 23

CHASING THE DEBTOR A. Managing the debt 1. Send a reminder 2. Try and find an amicable solution 23

CHASING THE DEBTOR 1. Sending a reminder ü ü ü Phone call Friendly visit Reminder by mail / statement of account First official reminder letter Second official reminder letter 24

CHASING THE DEBTOR 1. Sending a reminder ü ü ü Phone call Friendly visit Reminder by mail / statement of account First official reminder letter Second official reminder letter 24

CHASING THE DEBTOR 2. Finding an amicable solution ü Payment by instalments ü Settlement 25

CHASING THE DEBTOR 2. Finding an amicable solution ü Payment by instalments ü Settlement 25

CHASING THE DEBTOR B. Ringing the Alarm Bell 1. Formal notice to pay 2. Bailiff 3. Legal means of applying pressure Note potential defence that you have not performed your part of the contract 26

CHASING THE DEBTOR B. Ringing the Alarm Bell 1. Formal notice to pay 2. Bailiff 3. Legal means of applying pressure Note potential defence that you have not performed your part of the contract 26

CHASING DEBTORS IN LUXEMBOURG 27

CHASING DEBTORS IN LUXEMBOURG 27

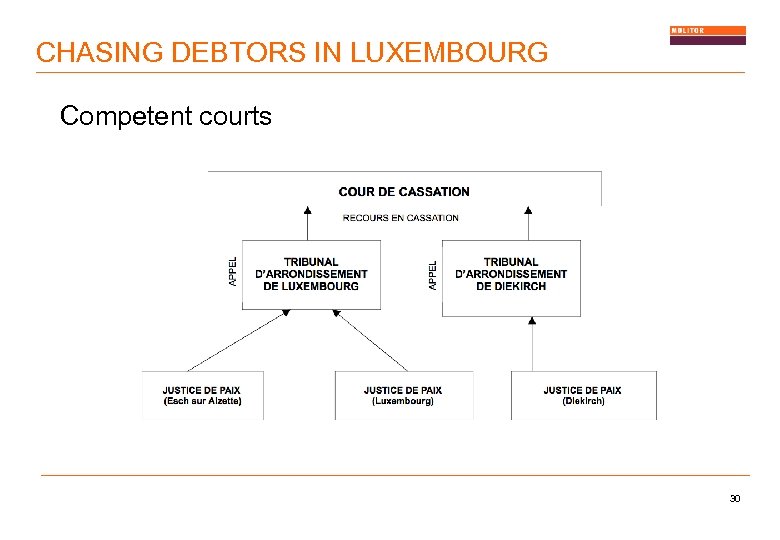

CHASING DEBTORS IN LUXEMBOURG 1. Competent courts 1. Magistrates’ courts (“Justice de Paix”) 3. District courts (“Tribunal d’arrondissement”) 28

CHASING DEBTORS IN LUXEMBOURG 1. Competent courts 1. Magistrates’ courts (“Justice de Paix”) 3. District courts (“Tribunal d’arrondissement”) 28

CHASING DEBTORS IN LUXEMBOURG 1. Competent courts § Competence based on value: above or below EUR 10, 000 § Competence based on locality: domicile of the debtor, the creditor or the place where the contract was made § Competence based on the nature of the debt (civil, commercial or lease rental) 29

CHASING DEBTORS IN LUXEMBOURG 1. Competent courts § Competence based on value: above or below EUR 10, 000 § Competence based on locality: domicile of the debtor, the creditor or the place where the contract was made § Competence based on the nature of the debt (civil, commercial or lease rental) 29

CHASING DEBTORS IN LUXEMBOURG Competent courts 30

CHASING DEBTORS IN LUXEMBOURG Competent courts 30

PROCEDURES FOR THE RECOVERY OF DEBTS 31

PROCEDURES FOR THE RECOVERY OF DEBTS 31

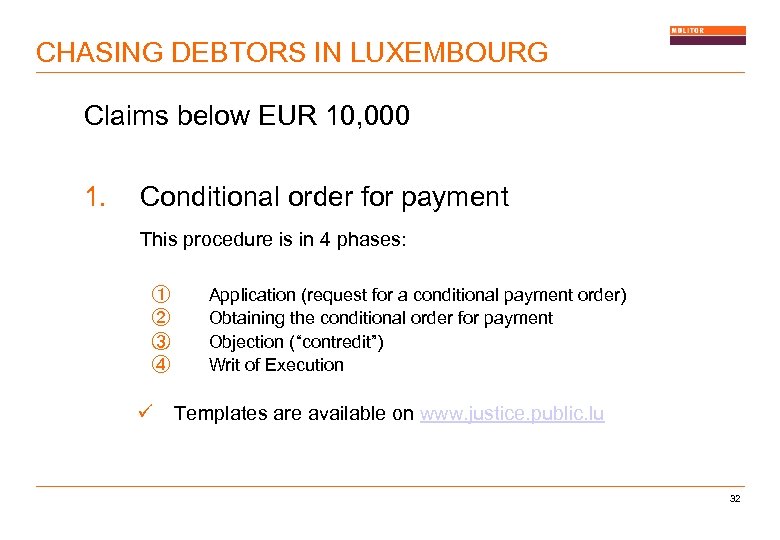

CHASING DEBTORS IN LUXEMBOURG Claims below EUR 10, 000 1. Conditional order for payment This procedure is in 4 phases: ① ② ③ ④ ü Application (request for a conditional payment order) Obtaining the conditional order for payment Objection (“contredit”) Writ of Execution Templates are available on www. justice. public. lu 32

CHASING DEBTORS IN LUXEMBOURG Claims below EUR 10, 000 1. Conditional order for payment This procedure is in 4 phases: ① ② ③ ④ ü Application (request for a conditional payment order) Obtaining the conditional order for payment Objection (“contredit”) Writ of Execution Templates are available on www. justice. public. lu 32

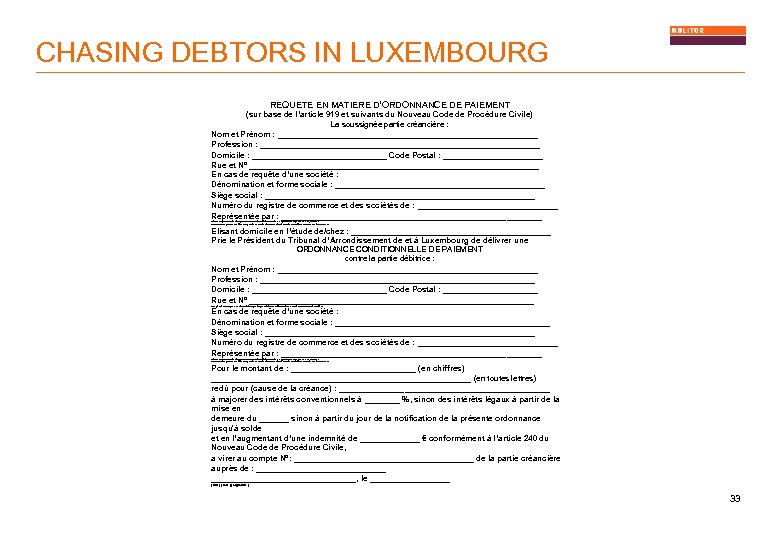

CHASING DEBTORS IN LUXEMBOURG REQUETE EN MATIERE D’ORDONNANCE DE PAIEMENT (sur base de l’article 919 et suivants du Nouveau Code de Procédure Civile) La soussignée partie créancière : Nom et Prénom : __________________________ Profession : ____________________________ Domicile : ______________ Code Postal : __________ Rue et N° _____________________________ En cas de requête d’une société : Dénomination et forme sociale : _____________________ Siège social : ___________________________ Numéro du registre de commerce et des sociétés de : ______________ Représentée par : __________________________ (L’organe représentatif ou son représentant légal (conseil d’administration (S. A. ), gérant (s. àr. l. ), gérant (S. C. I. ), etc. ). Ces renseignements peuvent être obtenus auprès du registre de commerce et des sociétés de Luxembourg (tel. : 26 428 -1 / www. rcsl. lu). ) Elisant domicile en l’étude de/chez : ____________________ Prie le Président du Tribunal d’Arrondissement de et à Luxembourg de délivrer une ORDONNANCE CONDITIONNELLE DE PAIEMENT contre la partie débitrice : Nom et Prénom : __________________________ Profession : ____________________________ Domicile : ______________ Code Postal : __________ Rue et N° _____________________________ En cas de requête d’une société : Dénomination et forme sociale : ______________________ Siège social : ___________________________ Numéro du registre de commerce et des sociétés de : ______________ Représentée par : __________________________ (Les provisions sur requête ne sont accordées que lorsque le débiteur est domicilié dans le Grand-Duché (art. 919 du NCPC)) (L’organe représentatif ou son représentant légal (conseil d’administration (S. A. ), gérant (s. àr. l. ), gérant (S. C. I. ), etc. ). Ces renseignements peuvent être obtenus auprès du registre de commerce et des sociétés de Luxembourg (tel. : 26 428 -1 / www. rcsl. lu). ) Pour le montant de : _____________ (en chiffres) __________________________ (en toutes lettres) redû pour (cause de la créance) : _____________________ à majorer des intérêts conventionnels à _______ %, sinon des intérêts légaux à partir de la mise en demeure du ______ sinon à partir du jour de la notification de la présente ordonnance jusqu'à solde et en l’augmentant d’une indemnité de ______ € conformément à l’article 240 du Nouveau Code de Procédure Civile, a virer au compte N°: __________________ de la partie créancière auprès de : _____________________________, le ________ ( lieu ) ( date ) ( signature ) 33

CHASING DEBTORS IN LUXEMBOURG REQUETE EN MATIERE D’ORDONNANCE DE PAIEMENT (sur base de l’article 919 et suivants du Nouveau Code de Procédure Civile) La soussignée partie créancière : Nom et Prénom : __________________________ Profession : ____________________________ Domicile : ______________ Code Postal : __________ Rue et N° _____________________________ En cas de requête d’une société : Dénomination et forme sociale : _____________________ Siège social : ___________________________ Numéro du registre de commerce et des sociétés de : ______________ Représentée par : __________________________ (L’organe représentatif ou son représentant légal (conseil d’administration (S. A. ), gérant (s. àr. l. ), gérant (S. C. I. ), etc. ). Ces renseignements peuvent être obtenus auprès du registre de commerce et des sociétés de Luxembourg (tel. : 26 428 -1 / www. rcsl. lu). ) Elisant domicile en l’étude de/chez : ____________________ Prie le Président du Tribunal d’Arrondissement de et à Luxembourg de délivrer une ORDONNANCE CONDITIONNELLE DE PAIEMENT contre la partie débitrice : Nom et Prénom : __________________________ Profession : ____________________________ Domicile : ______________ Code Postal : __________ Rue et N° _____________________________ En cas de requête d’une société : Dénomination et forme sociale : ______________________ Siège social : ___________________________ Numéro du registre de commerce et des sociétés de : ______________ Représentée par : __________________________ (Les provisions sur requête ne sont accordées que lorsque le débiteur est domicilié dans le Grand-Duché (art. 919 du NCPC)) (L’organe représentatif ou son représentant légal (conseil d’administration (S. A. ), gérant (s. àr. l. ), gérant (S. C. I. ), etc. ). Ces renseignements peuvent être obtenus auprès du registre de commerce et des sociétés de Luxembourg (tel. : 26 428 -1 / www. rcsl. lu). ) Pour le montant de : _____________ (en chiffres) __________________________ (en toutes lettres) redû pour (cause de la créance) : _____________________ à majorer des intérêts conventionnels à _______ %, sinon des intérêts légaux à partir de la mise en demeure du ______ sinon à partir du jour de la notification de la présente ordonnance jusqu'à solde et en l’augmentant d’une indemnité de ______ € conformément à l’article 240 du Nouveau Code de Procédure Civile, a virer au compte N°: __________________ de la partie créancière auprès de : _____________________________, le ________ ( lieu ) ( date ) ( signature ) 33

CHASING DEBTORS IN LUXEMBOURG Claims below EUR 10, 000 2. Written Summons (citation) on Magistrates’ Court 34

CHASING DEBTORS IN LUXEMBOURG Claims below EUR 10, 000 2. Written Summons (citation) on Magistrates’ Court 34

CHASING DEBTORS IN LUXEMBOURG Claims above EUR 10, 000 Other proceedings (DISTRICT COURT) ü ü ü Summary proceedings on request Summary proceedings (“référé provision”) Writ of summons (assignation) 35

CHASING DEBTORS IN LUXEMBOURG Claims above EUR 10, 000 Other proceedings (DISTRICT COURT) ü ü ü Summary proceedings on request Summary proceedings (“référé provision”) Writ of summons (assignation) 35

PROCEDURES IN CASES OF URGENCY 36

PROCEDURES IN CASES OF URGENCY 36

CHASING DEBTORS IN LUXEMBOURG 1. Special attachment (of earnings) 2. Assignment of salary 1. Attachment on goods or bank account 37

CHASING DEBTORS IN LUXEMBOURG 1. Special attachment (of earnings) 2. Assignment of salary 1. Attachment on goods or bank account 37

ENFORCEMENT OF JUDICIAL DECISIONS 38

ENFORCEMENT OF JUDICIAL DECISIONS 38

CHASING DEBTORS IN LUXEMBOURG Enforcement of judicial decisions » » » » » General issues: procedural costs (costs of bailiff, expert, translation. . ) Serving of the judicial decision Use of bailiff if decision is definitive (not if there is the possibility of appeal or the order is provisional) Means of enforcement: 1. Attachment of goods 2. Attachment against real property 3. Mortgage In the absence of any other means of enforcement: presentation of a bankruptcy petition 39

CHASING DEBTORS IN LUXEMBOURG Enforcement of judicial decisions » » » » » General issues: procedural costs (costs of bailiff, expert, translation. . ) Serving of the judicial decision Use of bailiff if decision is definitive (not if there is the possibility of appeal or the order is provisional) Means of enforcement: 1. Attachment of goods 2. Attachment against real property 3. Mortgage In the absence of any other means of enforcement: presentation of a bankruptcy petition 39

CHASING DEBTORS IN EUROPE 40

CHASING DEBTORS IN EUROPE 40

CHASING DEBTORS IN EUROPE European regulations ① ② ③ ④ ⑤ ⑥ ⑦ The fight against late payment European order for payment European procedure and regulations for small claims European writ of execution The European order of preventative attachment The simplified exequatur procedure Templates are available on www. justice. public. lu 41

CHASING DEBTORS IN EUROPE European regulations ① ② ③ ④ ⑤ ⑥ ⑦ The fight against late payment European order for payment European procedure and regulations for small claims European writ of execution The European order of preventative attachment The simplified exequatur procedure Templates are available on www. justice. public. lu 41

CHASING DEBTORS IN EUROPE ① The fight against late payment » Directive n° 2000/35/EC of the European Parliament and of the Council of 29 June 2000 on combating late payment in commercial transactions » Implemented in Luxembourg law by the Law of 18 April 2004 concerning the payment delays and statutory interests » Directive n° 2011/7/EU of the European Parliament and of the Council of 16 February 2011 on combating late payment in commercial transactions 42

CHASING DEBTORS IN EUROPE ① The fight against late payment » Directive n° 2000/35/EC of the European Parliament and of the Council of 29 June 2000 on combating late payment in commercial transactions » Implemented in Luxembourg law by the Law of 18 April 2004 concerning the payment delays and statutory interests » Directive n° 2011/7/EU of the European Parliament and of the Council of 16 February 2011 on combating late payment in commercial transactions 42

CHASING DEBTORS IN EUROPE ② European order for payment » Regulation (EC) n° 1896/2006 of the European Parliament and of the Council of 12 December 2006 creating a European order for payment procedure » Competent jurisdiction: Regulation (EC) n° 44/2001 of 22 December 2000 on jurisdiction and the recognition and enforcement of judgments in civil and commercial matters 43

CHASING DEBTORS IN EUROPE ② European order for payment » Regulation (EC) n° 1896/2006 of the European Parliament and of the Council of 12 December 2006 creating a European order for payment procedure » Competent jurisdiction: Regulation (EC) n° 44/2001 of 22 December 2000 on jurisdiction and the recognition and enforcement of judgments in civil and commercial matters 43

CHASING DEBTORS IN EUROPE ③ European procedure and regulations for small claims » Regulation (EC) n° 861/2007 of the European Parliament and of the Council of 11 July 2007 establishing a European Small Claims Procedure » For claims not exceeding EUR 2. 000 » Competent jurisdiction: Regulation (EC) n° 44/2001 of 22 December 2000 on jurisdiction and the recognition and enforcement of judgments in civil and commercial matters 44

CHASING DEBTORS IN EUROPE ③ European procedure and regulations for small claims » Regulation (EC) n° 861/2007 of the European Parliament and of the Council of 11 July 2007 establishing a European Small Claims Procedure » For claims not exceeding EUR 2. 000 » Competent jurisdiction: Regulation (EC) n° 44/2001 of 22 December 2000 on jurisdiction and the recognition and enforcement of judgments in civil and commercial matters 44

CHASING DEBTORS IN EUROPE ④ European writ of execution » Regulation (EC) n° 805/2004 of the European Parliament and of the Council of 21 April 2004 creating a European Enforcement Order for uncontested claims 45

CHASING DEBTORS IN EUROPE ④ European writ of execution » Regulation (EC) n° 805/2004 of the European Parliament and of the Council of 21 April 2004 creating a European Enforcement Order for uncontested claims 45

CHASING DEBTORS IN EUROPE ⑤ The European order of preventative attachment » Proposal for a regulation of the European Parliament and of the Council creating a European Account Preservation Order to facilitate cross-border debt recovery in civil and commercial matters: COM(2011) – 2011/0204 (COD) 46

CHASING DEBTORS IN EUROPE ⑤ The European order of preventative attachment » Proposal for a regulation of the European Parliament and of the Council creating a European Account Preservation Order to facilitate cross-border debt recovery in civil and commercial matters: COM(2011) – 2011/0204 (COD) 46

THANK YOU! Nadine BOGELMANN Partner nadine. bogelmann@molitorlegal. lu www. molitorlegal. lu 47

THANK YOU! Nadine BOGELMANN Partner nadine. bogelmann@molitorlegal. lu www. molitorlegal. lu 47