52c5a972c64e7768a461ec231c6f70be.ppt

- Количество слайдов: 32

How to Make Sure You Don’t Have a Debtor Problem in the First Place!

How to Make Sure You Don’t Have a Debtor Problem in the First Place!

You’ll discover: • Some new ways of doing business • Why it’s important to do something • Before you have something to lose 1

You’ll discover: • Some new ways of doing business • Why it’s important to do something • Before you have something to lose 1

You’ll discover: • A way to secure payment up front • Understand a weird quirk about value • How to keep it rolling in unannounced! 2

You’ll discover: • A way to secure payment up front • Understand a weird quirk about value • How to keep it rolling in unannounced! 2

One way to avoid debtor issues: • Don’t offer accounts! • Can be done • Still need to make it easy to buy 3

One way to avoid debtor issues: • Don’t offer accounts! • Can be done • Still need to make it easy to buy 3

One great way is to position it like so: ‘How would you like to pay for that? Cash, cheque, or credit card? ’ 4

One great way is to position it like so: ‘How would you like to pay for that? Cash, cheque, or credit card? ’ 4

Some new ways of doing business: Debtor problems require 2 strategies. • 1 st: Stop re-creating the problem. • 2 nd: Recover what you’re owed. 5

Some new ways of doing business: Debtor problems require 2 strategies. • 1 st: Stop re-creating the problem. • 2 nd: Recover what you’re owed. 5

Consider this: • Debt can be created only if you do work BEFORE you get paid. • What if you insisted on starting work only AFTER you were paid? 6

Consider this: • Debt can be created only if you do work BEFORE you get paid. • What if you insisted on starting work only AFTER you were paid? 6

Consider this : • While it might seem difficult, many businesses are doing just that! 7

Consider this : • While it might seem difficult, many businesses are doing just that! 7

Consider this • Allows you to confront the issue up front • Before you’ve invested hours of effort • Before you really have something to lose 8

Consider this • Allows you to confront the issue up front • Before you’ve invested hours of effort • Before you really have something to lose 8

Consider this : • • Consider partial payment up front Deposits Or an ongoing payment plan Builds a routine with customers 9

Consider this : • • Consider partial payment up front Deposits Or an ongoing payment plan Builds a routine with customers 9

How do you establish this? • Spell out benefits • Articulate your abilities • Offer something distinct 10

How do you establish this? • Spell out benefits • Articulate your abilities • Offer something distinct 10

Examples: • Offer a guarantee of performance. • Or ‘cash on delivery. ’ • Refer to later example in your Topic Handout. 11

Examples: • Offer a guarantee of performance. • Or ‘cash on delivery. ’ • Refer to later example in your Topic Handout. 11

Examples : • Make it ‘company standard. ’ • Ensure clients understand ‘what’s in it for them. ’ 12

Examples : • Make it ‘company standard. ’ • Ensure clients understand ‘what’s in it for them. ’ 12

Another way to secure payment up front: • • Offer a ‘membership’ Includes special privileges Or advantages For ongoing or advance payments 13

Another way to secure payment up front: • • Offer a ‘membership’ Includes special privileges Or advantages For ongoing or advance payments 13

Discuss with clients: • Your list of preferred clients • How to get on that list • What that entitles them to 14

Discuss with clients: • Your list of preferred clients • How to get on that list • What that entitles them to 14

Discuss with clients: • When customers understand advantages • You’ve created ongoing inflow of funds • Create your ideal scenario • Ensure it adds value to the clients also 15

Discuss with clients: • When customers understand advantages • You’ve created ongoing inflow of funds • Create your ideal scenario • Ensure it adds value to the clients also 15

Understand a weird quirk about value ‘Namely, the value of any service declines after delivery. ’ 17

Understand a weird quirk about value ‘Namely, the value of any service declines after delivery. ’ 17

Understand a weird quirk about value : • Before delivery—we want it! • Eager and waiting. • Afterward, more likely to take it for granted. 18

Understand a weird quirk about value : • Before delivery—we want it! • Eager and waiting. • Afterward, more likely to take it for granted. 18

Understand a weird quirk about value: • Particularly true if payment hasn’t been made. • Devalues the item or service. • Debt collection then becomes more difficult. 19

Understand a weird quirk about value: • Particularly true if payment hasn’t been made. • Devalues the item or service. • Debt collection then becomes more difficult. 19

Understand a weird quirk about value • • Converse is true When customers pay in advance Or through a payment schedule They are more likely to appreciate the item 20

Understand a weird quirk about value • • Converse is true When customers pay in advance Or through a payment schedule They are more likely to appreciate the item 20

What to do right now? • Before you establish a system like that • Adopt some easy changes now 21

What to do right now? • Before you establish a system like that • Adopt some easy changes now 21

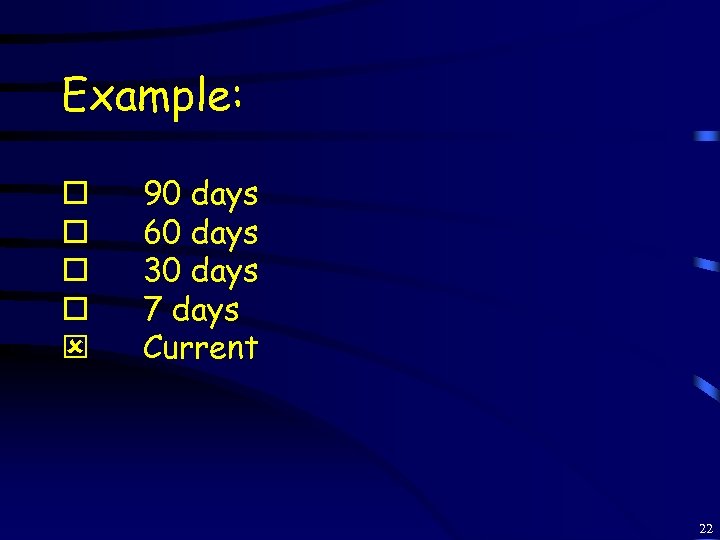

Example: 90 days 60 days 30 days 7 days Current 22

Example: 90 days 60 days 30 days 7 days Current 22

This creates the problem! • Remove this from invoices or statements. • Broadcasts the fact that people can pay late. • In fact, up to 90 days late! • Adapt an alternative. . . 23

This creates the problem! • Remove this from invoices or statements. • Broadcasts the fact that people can pay late. • In fact, up to 90 days late! • Adapt an alternative. . . 23

Example: ‘Thank you in advance for fixing this quickly. It really does help us both reduce the paperwork pile and become even more productive. I appreciate your help with that. ’ 24

Example: ‘Thank you in advance for fixing this quickly. It really does help us both reduce the paperwork pile and become even more productive. I appreciate your help with that. ’ 24

Alternatively: • • Use ‘due now’ ‘Overdue now’ ‘Due on September 14’ Or a combination 25

Alternatively: • • Use ‘due now’ ‘Overdue now’ ‘Due on September 14’ Or a combination 25

Keep it rolling in as arranged! • Use ‘direct debit’ funds transfer. • Or ‘periodic payments. ’ • Transfers funds from your customer’s bank directly to yours on agreed dates. • Easier for everyone. 26

Keep it rolling in as arranged! • Use ‘direct debit’ funds transfer. • Or ‘periodic payments. ’ • Transfers funds from your customer’s bank directly to yours on agreed dates. • Easier for everyone. 26

Keep it rolling in as arranged! : • Establish ‘until further notice’ agreement. • Customers continue to pay ‘until further notice. ’ • Decreases time spent collecting debtors. • And provides a more even cash flow. • Increases ease for customer. 27

Keep it rolling in as arranged! : • Establish ‘until further notice’ agreement. • Customers continue to pay ‘until further notice. ’ • Decreases time spent collecting debtors. • And provides a more even cash flow. • Increases ease for customer. 27

Some examples: • Refer to your Topic Handout • Draft a letter establishing monthly payments • Another describing it ‘matter of factly’ • Adapted to suit your business 28

Some examples: • Refer to your Topic Handout • Draft a letter establishing monthly payments • Another describing it ‘matter of factly’ • Adapted to suit your business 28

One last thing—just do it • • You have to want to do it. All it takes is ‘positioning. ’ E. g. , ‘This is how we do it here. ’ Payment schedules or advances become the norm. • Test it and see! 29

One last thing—just do it • • You have to want to do it. All it takes is ‘positioning. ’ E. g. , ‘This is how we do it here. ’ Payment schedules or advances become the norm. • Test it and see! 29

How do you apply this to your business? 30

How do you apply this to your business? 30

Your Action Plan: 1. Consider asking, ‘How would you like to pay for that? ’ 2. And establishing a membership. 3. Remove ‘current, 30, 60, etc. ’

Your Action Plan: 1. Consider asking, ‘How would you like to pay for that? ’ 2. And establishing a membership. 3. Remove ‘current, 30, 60, etc. ’

Your Action Plan: 4. Speak with your bank about ‘direct debit. ’ 5. Get ‘matter of fact’ about it. Review letters here and adapt to suit. 6. Talk with me if you need any assistance in this area. Further information is available.

Your Action Plan: 4. Speak with your bank about ‘direct debit. ’ 5. Get ‘matter of fact’ about it. Review letters here and adapt to suit. 6. Talk with me if you need any assistance in this area. Further information is available.