How to Graphically Analyze Any Market A recipe in 15 steps • This recipe can be used to analyze any market: to predict the effect of some change in the country or the world on the prices and quantities transacted of: bonds loanable funds stocks currencies commodities pollution permits, . . . anything GO to next

How to Graphically Analyze Any Market A recipe in 15 steps • This recipe can be used to analyze any market: to predict the effect of some change in the country or the world on the prices and quantities transacted of: bonds loanable funds stocks currencies commodities pollution permits, . . . anything GO to next

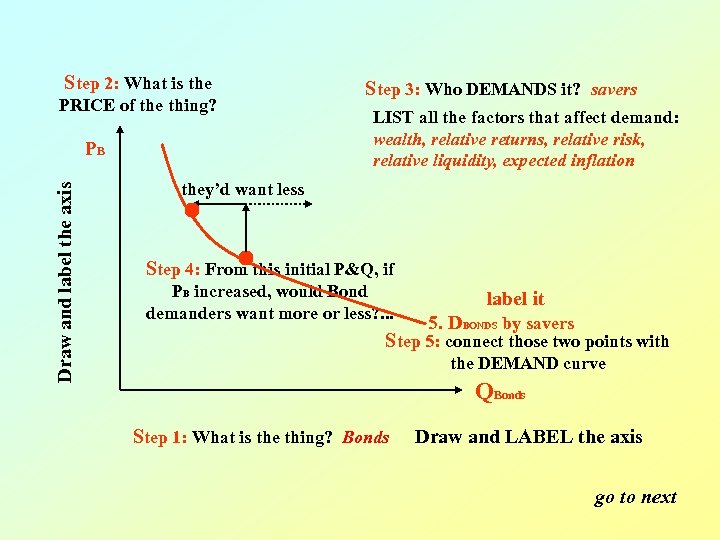

Step 2: What is the PRICE of the thing? Draw and label the axis PB Step 3: Who DEMANDS it? savers LIST all the factors that affect demand: wealth, relative returns, relative risk, relative liquidity, expected inflation they’d want less Step 4: From this initial P&Q, if PB increased, would Bond demanders want more or less? . . . label it 5. DBONDS by savers Step 5: connect those two points with the DEMAND curve QBonds Step 1: What is the thing? Bonds Draw and LABEL the axis go to next

Step 2: What is the PRICE of the thing? Draw and label the axis PB Step 3: Who DEMANDS it? savers LIST all the factors that affect demand: wealth, relative returns, relative risk, relative liquidity, expected inflation they’d want less Step 4: From this initial P&Q, if PB increased, would Bond demanders want more or less? . . . label it 5. DBONDS by savers Step 5: connect those two points with the DEMAND curve QBonds Step 1: What is the thing? Bonds Draw and LABEL the axis go to next

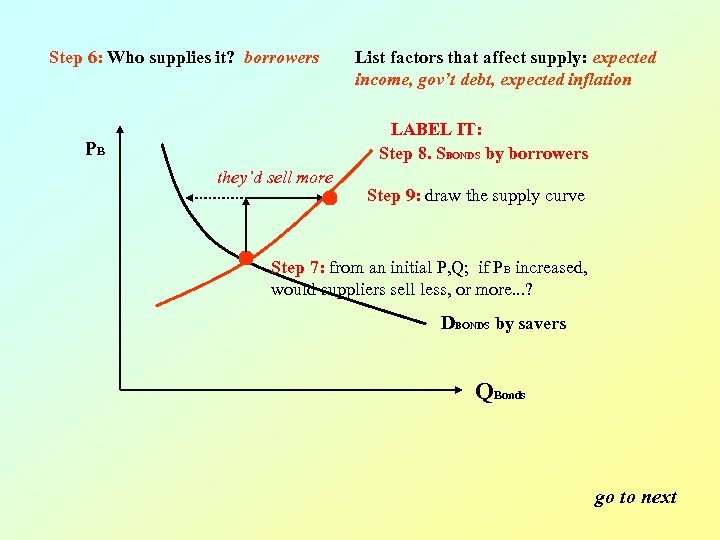

Step 6: Who supplies it? borrowers List factors that affect supply: expected income, gov’t debt, expected inflation LABEL IT: Step 8. SBONDS by borrowers PB they’d sell more Step 9: draw the supply curve Step 7: from an initial P, Q; if PB increased, would suppliers sell less, or more. . . ? DBONDS by savers QBonds go to next

Step 6: Who supplies it? borrowers List factors that affect supply: expected income, gov’t debt, expected inflation LABEL IT: Step 8. SBONDS by borrowers PB they’d sell more Step 9: draw the supply curve Step 7: from an initial P, Q; if PB increased, would suppliers sell less, or more. . . ? DBONDS by savers QBonds go to next

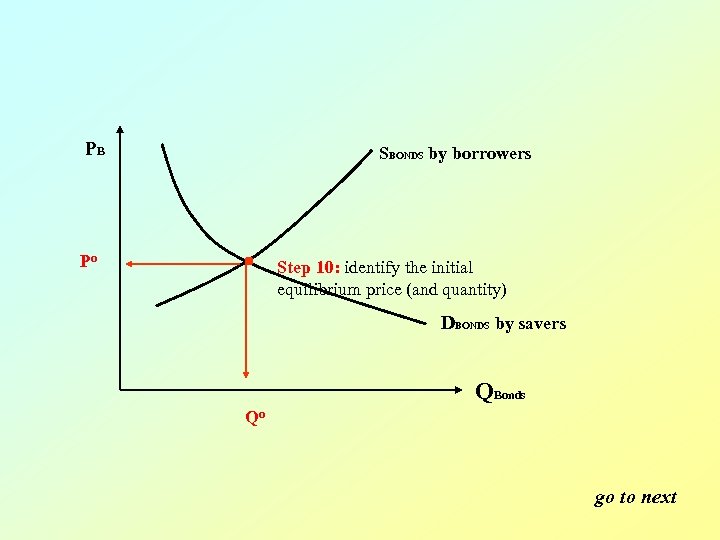

PB SBONDS by borrowers Po Step 10: identify the initial equilibrium price (and quantity) DBONDS by savers QBonds Qo go to next

PB SBONDS by borrowers Po Step 10: identify the initial equilibrium price (and quantity) DBONDS by savers QBonds Qo go to next

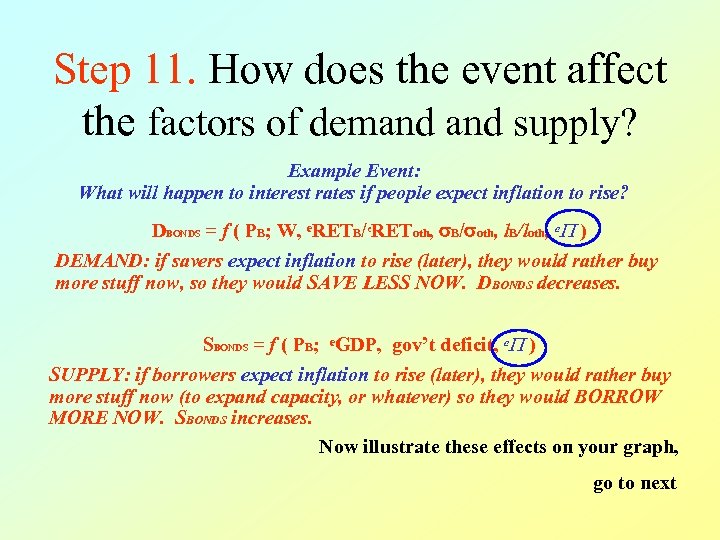

Step 11. How does the event affect the factors of demand supply? Example Event: What will happen to interest rates if people expect inflation to rise? DBONDS = f ( PB; W, e. RETB/e. REToth, B/ oth, l. B/loth, e ) DEMAND: if savers expect inflation to rise (later), they would rather buy more stuff now, so they would SAVE LESS NOW. DBONDS decreases. SBONDS = f ( PB; e. GDP, gov’t deficit, e ) SUPPLY: if borrowers expect inflation to rise (later), they would rather buy more stuff now (to expand capacity, or whatever) so they would BORROW MORE NOW. SBONDS increases. Now illustrate these effects on your graph, go to next

Step 11. How does the event affect the factors of demand supply? Example Event: What will happen to interest rates if people expect inflation to rise? DBONDS = f ( PB; W, e. RETB/e. REToth, B/ oth, l. B/loth, e ) DEMAND: if savers expect inflation to rise (later), they would rather buy more stuff now, so they would SAVE LESS NOW. DBONDS decreases. SBONDS = f ( PB; e. GDP, gov’t deficit, e ) SUPPLY: if borrowers expect inflation to rise (later), they would rather buy more stuff now (to expand capacity, or whatever) so they would BORROW MORE NOW. SBONDS increases. Now illustrate these effects on your graph, go to next

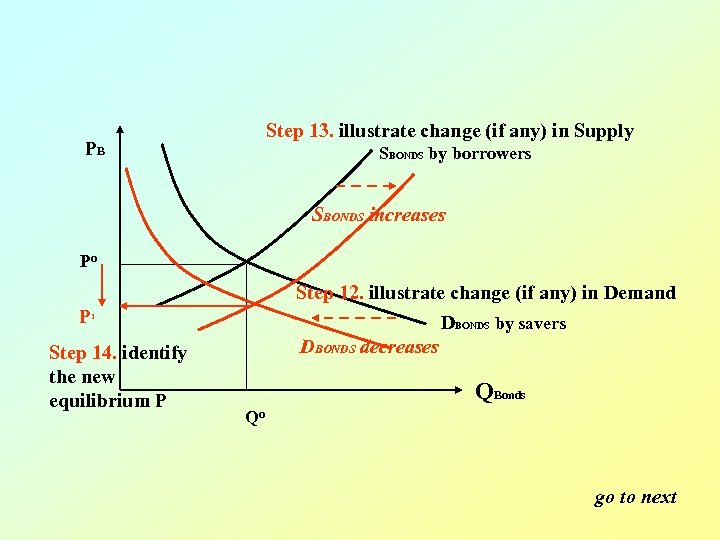

Step 13. illustrate change (if any) in Supply PB SBONDS by borrowers SBONDS increases Po P Step 12. illustrate change (if any) in Demand DBONDS by savers DBONDS decreases 1 Step 14. identify the new equilibrium P QBonds Qo go to next

Step 13. illustrate change (if any) in Supply PB SBONDS by borrowers SBONDS increases Po P Step 12. illustrate change (if any) in Demand DBONDS by savers DBONDS decreases 1 Step 14. identify the new equilibrium P QBonds Qo go to next

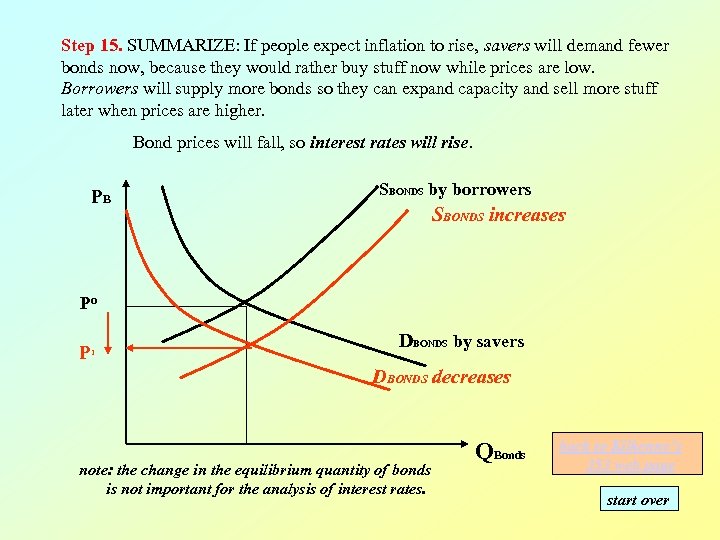

Step 15. SUMMARIZE: If people expect inflation to rise, savers will demand fewer bonds now, because they would rather buy stuff now while prices are low. Borrowers will supply more bonds so they can expand capacity and sell more stuff later when prices are higher. Bond prices will fall, so interest rates will rise. PB SBONDS by borrowers SBONDS increases Po P 1 DBONDS by savers DBONDS decreases note: the change in the equilibrium quantity of bonds is not important for the analysis of interest rates. QBonds back to Kilkenny’s 353 web page start over

Step 15. SUMMARIZE: If people expect inflation to rise, savers will demand fewer bonds now, because they would rather buy stuff now while prices are low. Borrowers will supply more bonds so they can expand capacity and sell more stuff later when prices are higher. Bond prices will fall, so interest rates will rise. PB SBONDS by borrowers SBONDS increases Po P 1 DBONDS by savers DBONDS decreases note: the change in the equilibrium quantity of bonds is not important for the analysis of interest rates. QBonds back to Kilkenny’s 353 web page start over