baf5aa8b51bc8c2e7779dc4083a10e6f.ppt

- Количество слайдов: 27

How to Get Your Board “Onboard” with Non-Profit Financial Statements Stephanie O’Leary, Senior Consultant at AMS December 4, 2014 12: 30 pm – 1: 30 pm

Why this training was developed Board Members in non-profit organizations often: • Come from the for-profit world • Do not have a financial or accounting background • Need to be trained on understanding what their role is regarding “financial management oversight” 2

Why this training was developed • Help us train our board members on how non profit financial statements work • Highlight some best practices to help board members know how to provide proper financial oversight • Provide necessary tools for monitoring and strengthening our programs and services 3

Agenda Training Overview: • Non-Profit Terminology • Best Practices for Reporting, Budgeting and Cash Flow Management • Ratios and Dashboards • Struggles/Issues you face 4

Non-Profit Terminology 5

Non-Profit Terminology Key: Understanding what the Organization does and where the $$ come from • Board members need to understand the organization before they can understand the financial statements • Revenue cycle – government contracts, development fees, grants, fee for services/revenues are much different than for-profits • Cash • Accounts Receivable 6

Non-Profit Terminology Key: Non-Profit Characteristics • Fiscal Year – what is the organization’s FYE? • Reporting Requirements – can be a burden • Annual, federal and state audits • Lack of staff capacity • Equity is much different • Funds need to be used for programmatic services 7

Non-Profit Terminology Key: Communicating what the Financial Statements mean Financial Statements • Balance Sheet vs Statement of Financial Position • Profit and Loss/Income Statement vs Statement of Activities • Statement of Functional Expenses For-Profits – focus the report on generating more profits Non-Profits – focus on the programs, research and services provided by the organization 8

Non-Profit Terminology • Losses – what does this mean for a non-profit? • Even though we had a loss, did we meet our goals and objectives? • We need cash but non-profits aren’t in the business for “accumulating assets. ” • Fluctuate year to year • Purpose is to spend $ on charitable programs • **Continual losses year after year do signal financial trouble • Financially Stable • The organization is able to stay out of debt • The organization can fund its current programs 9

Non-Profit Terminology • Negative Fund Balance - what does this mean for a non-profit? • Total liabilities exceed assets (Current Ratio) • Looking at historical performance • Looking at revenue performance by program • Looking at cost structure by program 10

Non-Profit Terminology • Financial Health of a non-profit • Don’t judge a non-profit’s financial health as if it’s a for-profit company • An investment to a non profit will not grow and return a profit to the donor • Non-profits do not exist for the purpose of enriching shareholders 11

Non-Profit Terminology Revenue Restrictions • Temporary restricted revenues • Unrestricted revenues Net Assets • Unrestricted • Temporarily Restricted • Permanently Restricted 12

Best Practices for Reporting, Budgeting and Cash Flow Management 13

Reporting for Non-Profits • Link to strategic plan/mission • Plan linked to budget • Shows cash inflows and outflows • Easy to understand • Measures: Key Performance Indicators (KPI) based on strategy • Provide meaningful information

Reporting for Non-Profits Internal Financial Reporting • Basics: • Statement of Position • Statement of Activities/Budget vs Actual • Statement of Cash Flows/Internal Cash Flow Statement • Best Practices: • Dashboard – having key financial and reporting indicators • Statistic by program (number served, cost per member) • Variance explanations (what do the numbers mean) • Graphs, charts 15

Reporting for Non-Profits What Boards should be asking: • Can the organization (it) pay it’s bills (meet it’s obligations)? • Are we raising revenues to cover expenses (surplus)? • Are we managing fiscal operations well? • Are we collecting accounts receivable? • Are we paying our vendors/employees? • Are we managing to budget? • Are we adjusting expenses to revenue results?

Reporting for Non-Profits What Boards should be asking: • What is our project pipeline? • What is our revenue mix and are there risks of funding continuation? • Are our program profitable or breaking even? Do we need to fundraise for different programs? • What is our administration rate for expenses? • Is it spending money wisely and in accordance with it’s mission? • Are we meeting the goals of our strategic plan? • Is it planning for the future? • Is it saving money for a “rainy day? ”

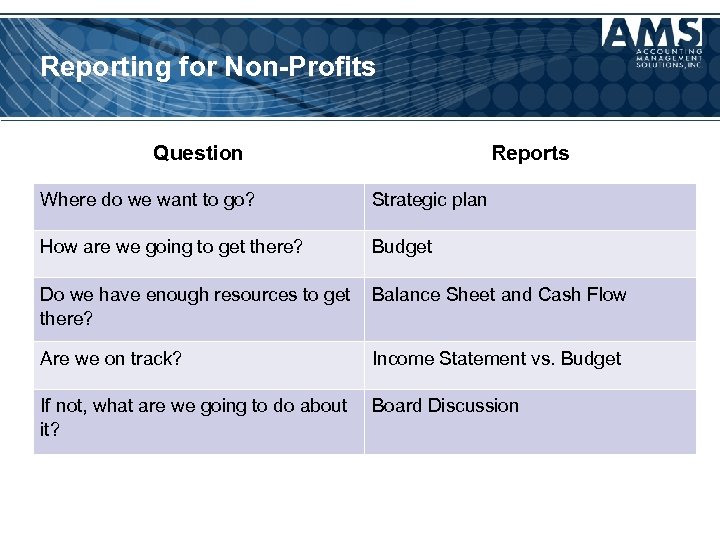

Reporting for Non-Profits Question Reports Where do we want to go? Strategic plan How are we going to get there? Budget Do we have enough resources to get there? Balance Sheet and Cash Flow Are we on track? Income Statement vs. Budget If not, what are we going to do about it? Board Discussion

Budgeting for Non-Profits What Boards should know about budgeting: • Know your goals and objectives • Upper Management Support and “Buy In” on your process • De-centralize the budgeting process • Involve staff at other levels • Create Strong Tools and Training (as needed) • Work closely with revenue-generating staff • Budget capital expenditures • Budget a surplus • Project cash flow • Budget temporary and permanently restricted revenue • Manage to your operating budget and your audited financial statements

Cash Flow Management • Prepare a cash flow projection with your budget • Monitor and adjust cash flow projections monthly based on actual performance • Report findings and identified issues to Senior Management and the Board as early as possible • Review rolling 12 -month cash flow projections with management and the board • Increase or speed up cash inflows • Decrease and/or slow down cash outflows • Access additional cash through financing • Line of credit • Bridge loan

Ratios and Dashboards 21

Ratios/Top Indicators Of Financial Health • Financial ratio analysis is one tool used to improve financial decision making and alert management about “issues. ” • Ratios use financial data to summarize organizational performance. • See how one organization’s financial indicators stack up against its peers. 22

Ratios • Profit margins typically do not apply to non-profits • Revenue reliability – evaluate an organization’s track record of bringing in recurring dollars, on an unrestricted basis, year after year. • Consistent surpluses – a healthy business model is one characterized by reliable revenue that covers operating expenses and contributes to surpluses – all in the service of the mission. Positive operating results (unrestricted revenue consistently exceeding expenses) are an indicator of strong financial management. • Full cost coverage • • Set revenue targets high enough to cover not just direct and indirect operating expenses but also the full cost of doing business (i. e. purchase of fixed assets, reduction of principal on debt, etc. ) Surpluses contribute to savings (i. e. strategic opportunity, rainy day fund) 23

Ratios • Debt to Equity (Leverage Ratio) – measures an organization’s ability to meet financial obligations. The number of dollars of Debt owed for every $1 in Net Worth. (Total Liabilities / Net Worth Should ideally be less than 1. 0). Example – a Debt to Equity ratio of 1. 10 means that for every $1. 00 of Equity that the organization has invested, it owes $1. 10 of debt to its creditors. • Current Ratio – measures an organization’s ability to pay short-term obligations (1. 25 – 1. 50 is considered adequate). A ratio of 1. 14 means that for every $1. 00 of current liabilities, the organization has $1. 14 in Cash/AR with which to pay them. • Ability to steward facilities – if an organization owns property/equipment, it is responsible for maintaining and replacing these assets over time; should have “reserves” dedicated by the BOD for these improvements/replacements. If not, are there appropriate levels of liquidity to meet these needs? • Appropriate liquidity – one way to measure this is to see how many months of expenses can be covered with available unrestricted operating cash (or access to it). As a general guideline, fewer than 3 months of cash is tight for non profits (though it depends on different elements). 24

Ratios • Ratios for Program, Administration and Fundraising Expenses – high admin costs are considered a “red flag” • Contributions and Grants Ratio – % received from donors, foundations, etc. 25

Questions?

Contact Information Stephanie O’Leary Senior Consultant, Nonprofit Client Practice Accounting Management Solutions, Inc 800 South Street Suite 195 Waltham, MA 02453 Phone: 781 -419 -9220 E-mail: soleary@amsolutions. net

baf5aa8b51bc8c2e7779dc4083a10e6f.ppt