7acff122b1356b6a6345a976df9e0bf2.ppt

- Количество слайдов: 40

How to export to Norway Pretoria - 16 July 2009 Håvard Figenschou Raaen Norwegian Ministry of Trade and Industry

How to export to Norway Pretoria - 16 July 2009 Håvard Figenschou Raaen Norwegian Ministry of Trade and Industry

Photo: Innovation Norway 8

Photo: Innovation Norway 8

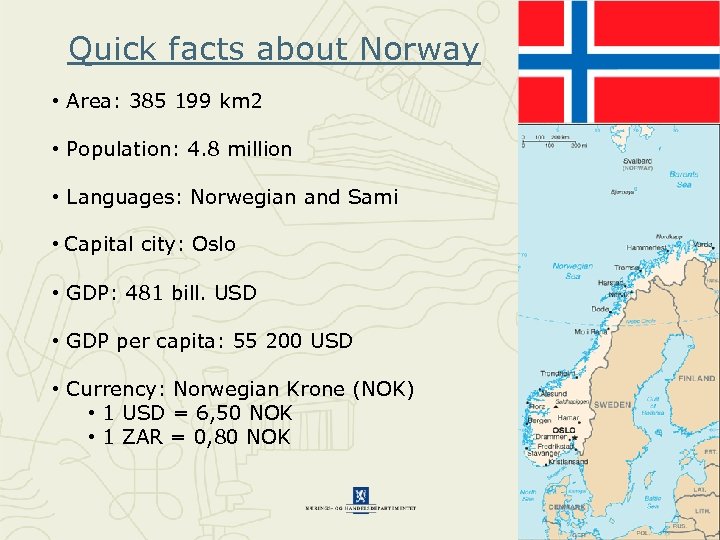

Quick facts about Norway • Area: 385 199 km 2 • Population: 4. 8 million • Languages: Norwegian and Sami • Capital city: Oslo • GDP: 481 bill. USD • GDP per capita: 55 200 USD • Currency: Norwegian Krone (NOK) • 1 USD = 6, 50 NOK • 1 ZAR = 0, 80 NOK

Quick facts about Norway • Area: 385 199 km 2 • Population: 4. 8 million • Languages: Norwegian and Sami • Capital city: Oslo • GDP: 481 bill. USD • GDP per capita: 55 200 USD • Currency: Norwegian Krone (NOK) • 1 USD = 6, 50 NOK • 1 ZAR = 0, 80 NOK

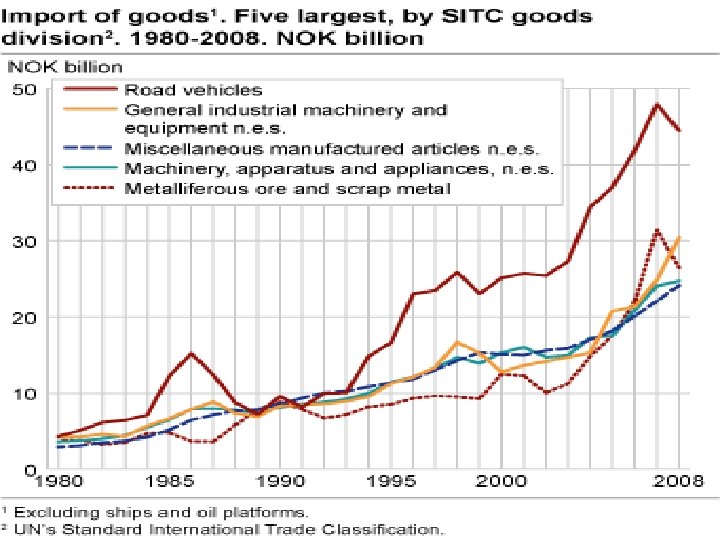

Norway in international trade • 0, 1 % of world population • 1, 2 % of world export (no. 28 in the world) • 1, 1 % of world import (no. 38 in the world) • 75 % of GDP consists of trade (average OECD 45%) • Value of total import: 88 bill. USD (2008) • Less than 25 % of imports are consumption goods

Norway in international trade • 0, 1 % of world population • 1, 2 % of world export (no. 28 in the world) • 1, 1 % of world import (no. 38 in the world) • 75 % of GDP consists of trade (average OECD 45%) • Value of total import: 88 bill. USD (2008) • Less than 25 % of imports are consumption goods

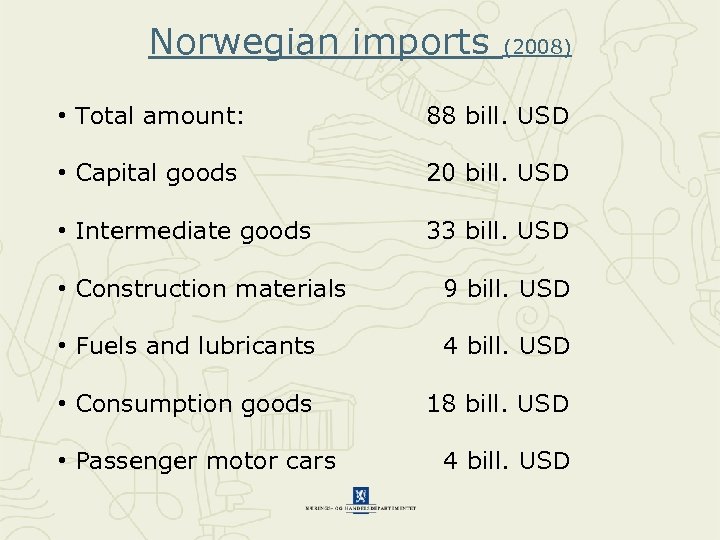

Norwegian imports (2008) • Total amount: 88 bill. USD • Capital goods 20 bill. USD • Intermediate goods 33 bill. USD • Construction materials 9 bill. USD • Fuels and lubricants 4 bill. USD • Consumption goods 18 bill. USD • Passenger motor cars 4 bill. USD

Norwegian imports (2008) • Total amount: 88 bill. USD • Capital goods 20 bill. USD • Intermediate goods 33 bill. USD • Construction materials 9 bill. USD • Fuels and lubricants 4 bill. USD • Consumption goods 18 bill. USD • Passenger motor cars 4 bill. USD

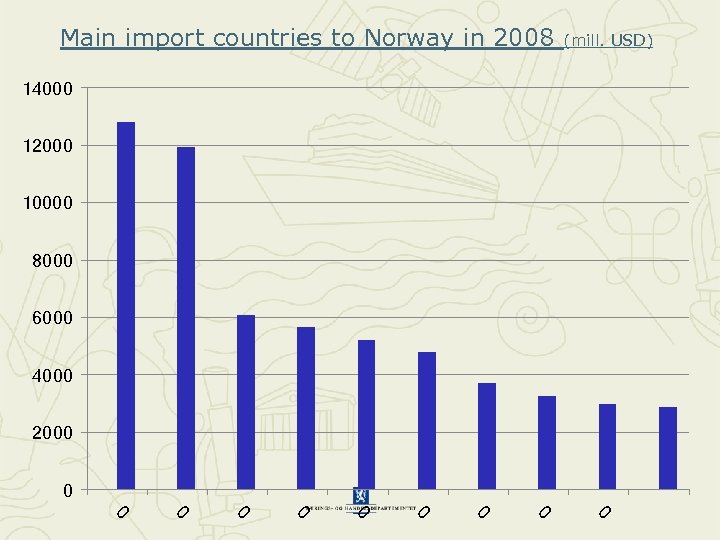

Main import countries to Norway in 2008 (mill. USD) 14000 12000 10000 8000 6000 4000 2000 0 0

Main import countries to Norway in 2008 (mill. USD) 14000 12000 10000 8000 6000 4000 2000 0 0

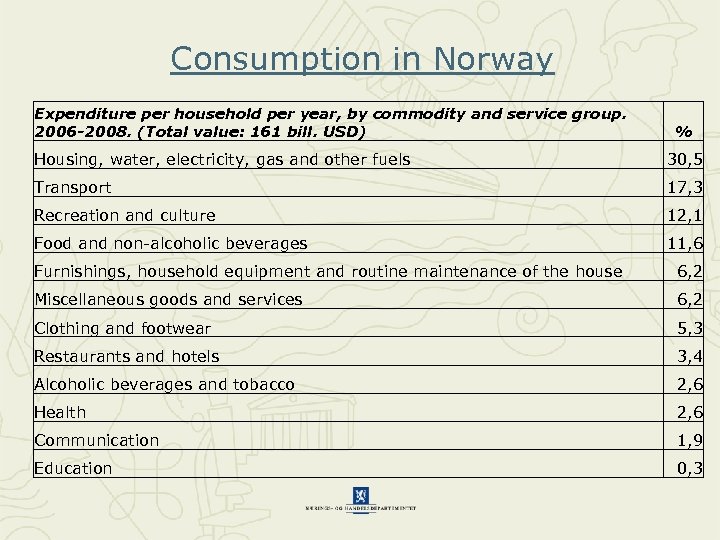

Consumption in Norway Expenditure per household per year, by commodity and service group. 2006 -2008. (Total value: 161 bill. USD) % Housing, water, electricity, gas and other fuels 30, 5 Transport 17, 3 Recreation and culture 12, 1 Food and non-alcoholic beverages 11, 6 Furnishings, household equipment and routine maintenance of the house 6, 2 Miscellaneous goods and services 6, 2 Clothing and footwear 5, 3 Restaurants and hotels 3, 4 Alcoholic beverages and tobacco 2, 6 Health 2, 6 Communication 1, 9 Education 0, 3

Consumption in Norway Expenditure per household per year, by commodity and service group. 2006 -2008. (Total value: 161 bill. USD) % Housing, water, electricity, gas and other fuels 30, 5 Transport 17, 3 Recreation and culture 12, 1 Food and non-alcoholic beverages 11, 6 Furnishings, household equipment and routine maintenance of the house 6, 2 Miscellaneous goods and services 6, 2 Clothing and footwear 5, 3 Restaurants and hotels 3, 4 Alcoholic beverages and tobacco 2, 6 Health 2, 6 Communication 1, 9 Education 0, 3

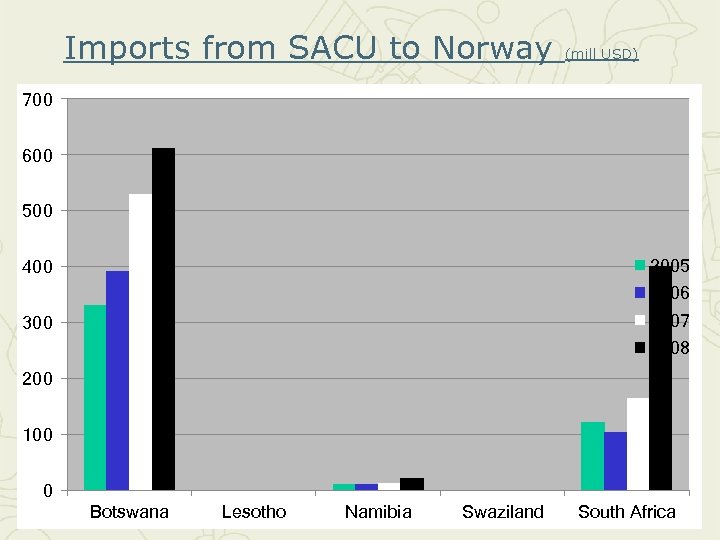

Imports from SACU to Norway (mill USD) 700 600 500 2005 400 2006 2007 300 2008 200 100 0 Botswana Lesotho Namibia Swaziland South Africa

Imports from SACU to Norway (mill USD) 700 600 500 2005 400 2006 2007 300 2008 200 100 0 Botswana Lesotho Namibia Swaziland South Africa

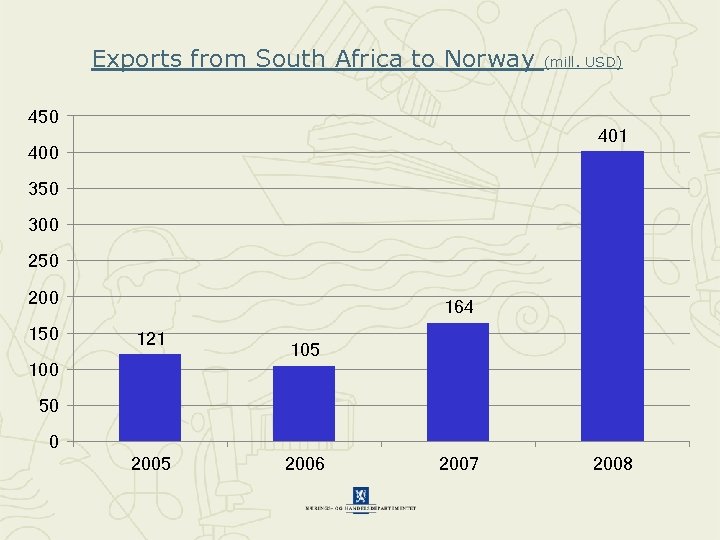

Exports from South Africa to Norway (mill. USD) 450 401 400 350 300 250 200 150 164 121 100 105 50 0 2005 2006 2007 2008

Exports from South Africa to Norway (mill. USD) 450 401 400 350 300 250 200 150 164 121 100 105 50 0 2005 2006 2007 2008

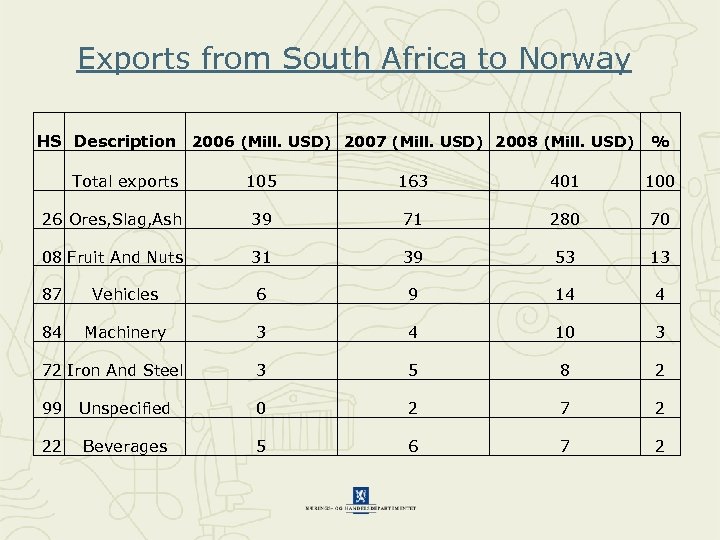

Exports from South Africa to Norway HS Description 2006 (Mill. USD) 2007 (Mill. USD) 2008 (Mill. USD) Total exports % 105 163 401 100 26 Ores, Slag, Ash 39 71 280 70 08 Fruit And Nuts 31 39 53 13 87 Vehicles 6 9 14 4 84 Machinery 3 4 10 3 72 Iron And Steel 3 5 8 2 99 Unspecified 0 2 7 2 22 Beverages 5 6 7 2

Exports from South Africa to Norway HS Description 2006 (Mill. USD) 2007 (Mill. USD) 2008 (Mill. USD) Total exports % 105 163 401 100 26 Ores, Slag, Ash 39 71 280 70 08 Fruit And Nuts 31 39 53 13 87 Vehicles 6 9 14 4 84 Machinery 3 4 10 3 72 Iron And Steel 3 5 8 2 99 Unspecified 0 2 7 2 22 Beverages 5 6 7 2

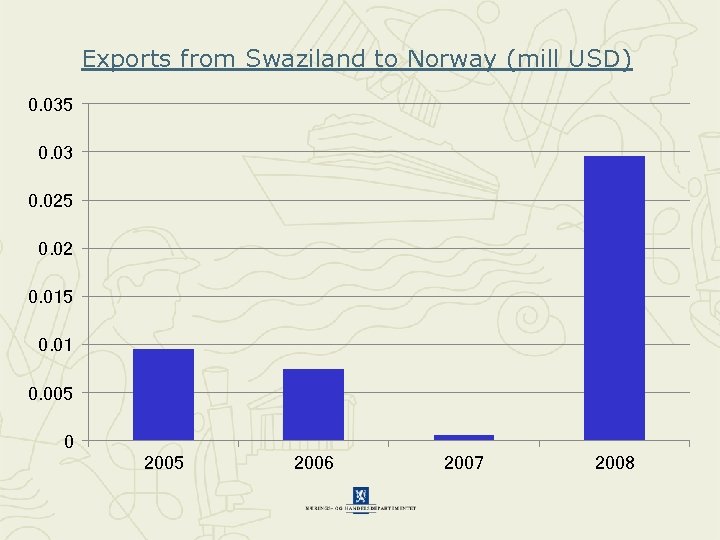

Exports from Swaziland to Norway (mill USD) 0. 035 0. 03 0. 025 0. 02 0. 015 0. 01 0. 005 0 2005 2006 2007 2008

Exports from Swaziland to Norway (mill USD) 0. 035 0. 03 0. 025 0. 02 0. 015 0. 01 0. 005 0 2005 2006 2007 2008

The Norwegian Market – Export Opportunities • Groceries • Fruit and vegetables • Textiles and clothing • Sports Equipment • Wine

The Norwegian Market – Export Opportunities • Groceries • Fruit and vegetables • Textiles and clothing • Sports Equipment • Wine

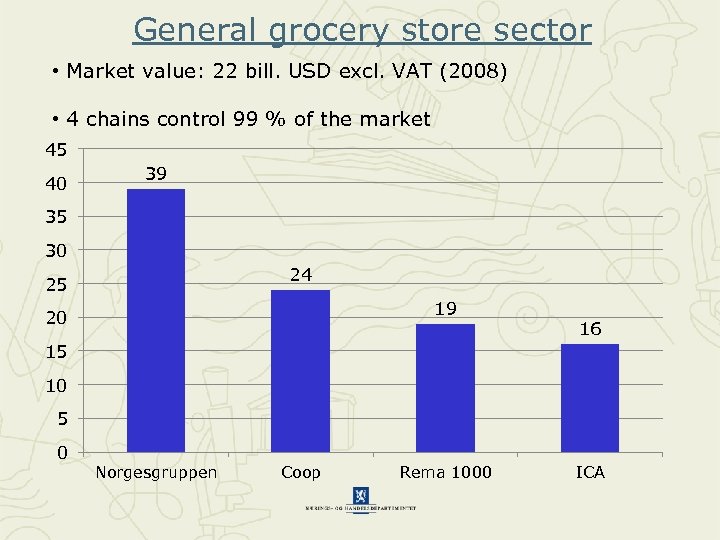

General grocery store sector • Market value: 22 bill. USD excl. VAT (2008) • 4 chains control 99 % of the market 45 40 39 35 30 24 25 19 20 16 15 10 5 0 Norgesgruppen Coop Rema 1000 ICA

General grocery store sector • Market value: 22 bill. USD excl. VAT (2008) • 4 chains control 99 % of the market 45 40 39 35 30 24 25 19 20 16 15 10 5 0 Norgesgruppen Coop Rema 1000 ICA

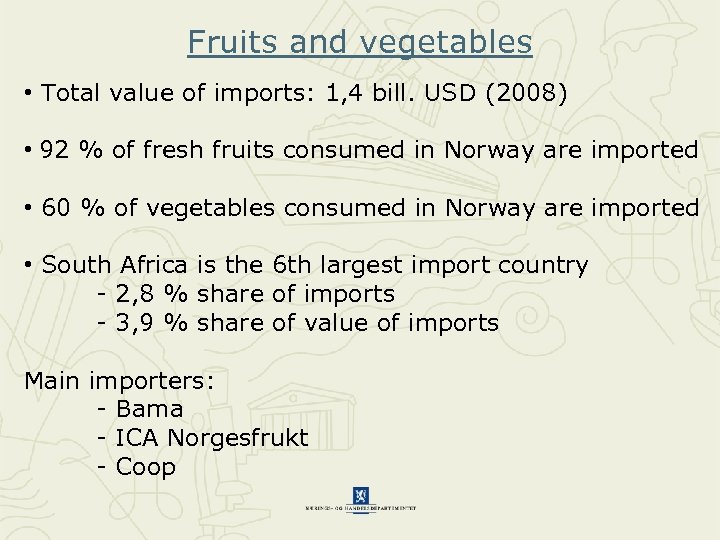

Fruits and vegetables • Total value of imports: 1, 4 bill. USD (2008) • 92 % of fresh fruits consumed in Norway are imported • 60 % of vegetables consumed in Norway are imported • South Africa is the 6 th largest import country - 2, 8 % share of imports - 3, 9 % share of value of imports Main importers: - Bama - ICA Norgesfrukt - Coop

Fruits and vegetables • Total value of imports: 1, 4 bill. USD (2008) • 92 % of fresh fruits consumed in Norway are imported • 60 % of vegetables consumed in Norway are imported • South Africa is the 6 th largest import country - 2, 8 % share of imports - 3, 9 % share of value of imports Main importers: - Bama - ICA Norgesfrukt - Coop

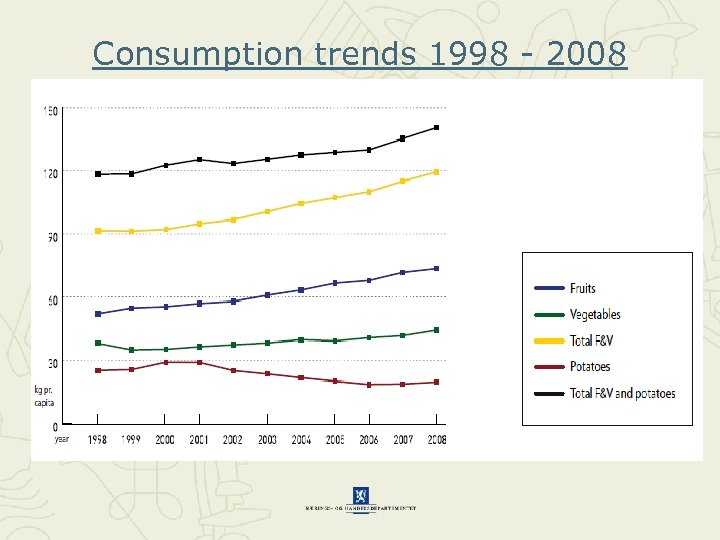

Consumption trends 1998 - 2008

Consumption trends 1998 - 2008

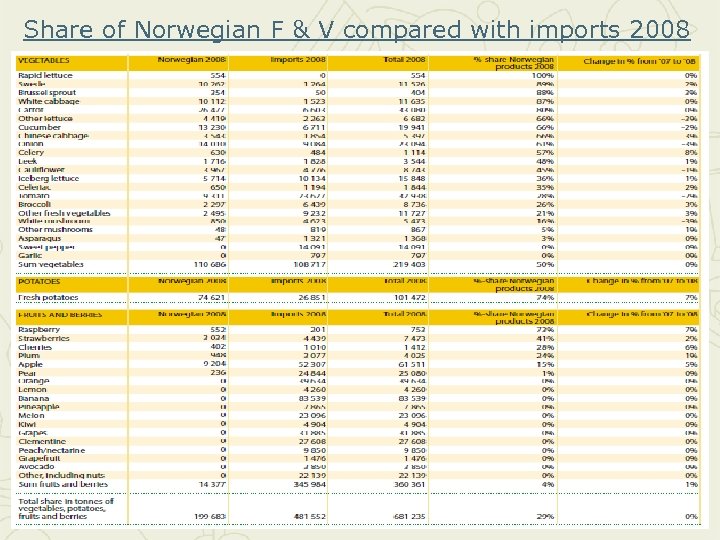

Share of Norwegian F & V compared with imports 2008

Share of Norwegian F & V compared with imports 2008

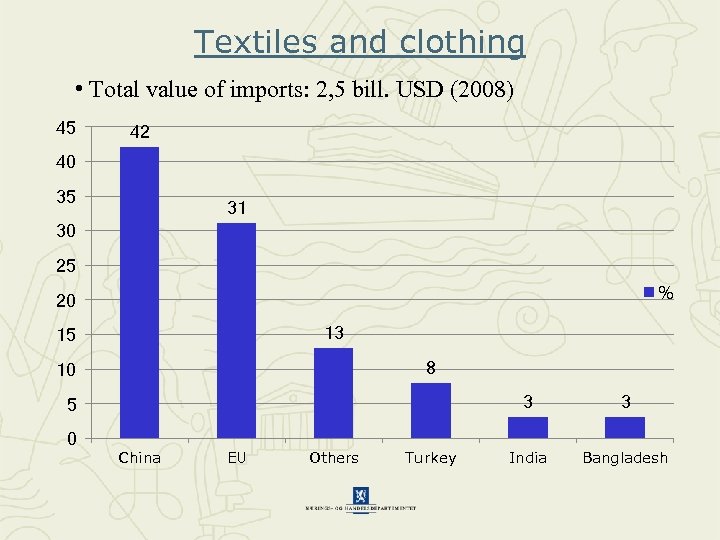

Textiles and clothing • Total value of imports: 2, 5 bill. USD (2008) 45 42 40 35 31 30 25 % 20 13 15 8 10 3 5 0 China EU Others Turkey 3 India Bangladesh

Textiles and clothing • Total value of imports: 2, 5 bill. USD (2008) 45 42 40 35 31 30 25 % 20 13 15 8 10 3 5 0 China EU Others Turkey 3 India Bangladesh

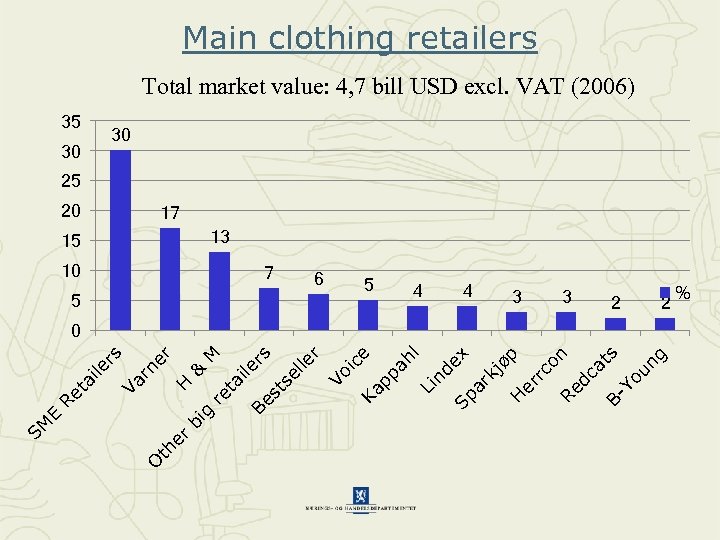

Main clothing retailers Total market value: 4, 7 bill USD excl. VAT (2006) 35 30 30 25 20 17 13 15 10 7 6 5 5 4 4 3 3 2 2 Li nd Sp ex ar kj øp H er rc on Re dc at s BYo un g hl pp a e Ka ic Vo lle r st se rs et r ig b O th er SM Be & H ai le M er rn Va E R et ai le rs 0 %

Main clothing retailers Total market value: 4, 7 bill USD excl. VAT (2006) 35 30 30 25 20 17 13 15 10 7 6 5 5 4 4 3 3 2 2 Li nd Sp ex ar kj øp H er rc on Re dc at s BYo un g hl pp a e Ka ic Vo lle r st se rs et r ig b O th er SM Be & H ai le M er rn Va E R et ai le rs 0 %

Sports equipment retail chains (2006) 30 26 25 20 16 15 15 12 10 8 8 % 7 5 5 3 hu se t p Sp o rts C oo 25 or t Sp XX L Sp or t X O th er s M In t er sp or t 1 Sp or t G -S po r t 0

Sports equipment retail chains (2006) 30 26 25 20 16 15 15 12 10 8 8 % 7 5 5 3 hu se t p Sp o rts C oo 25 or t Sp XX L Sp or t X O th er s M In t er sp or t 1 Sp or t G -S po r t 0

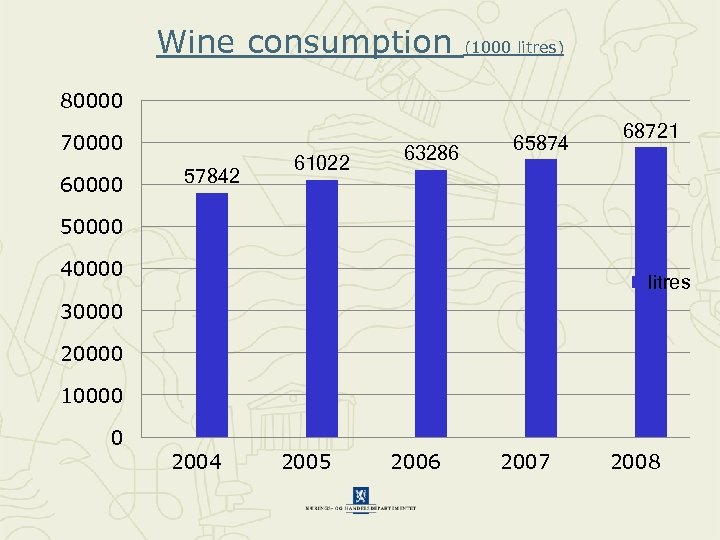

Wine consumption (1000 litres) 80000 70000 60000 57842 61022 63286 65874 68721 50000 40000 litres 30000 20000 10000 0 2004 2005 2006 2007 2008

Wine consumption (1000 litres) 80000 70000 60000 57842 61022 63286 65874 68721 50000 40000 litres 30000 20000 10000 0 2004 2005 2006 2007 2008

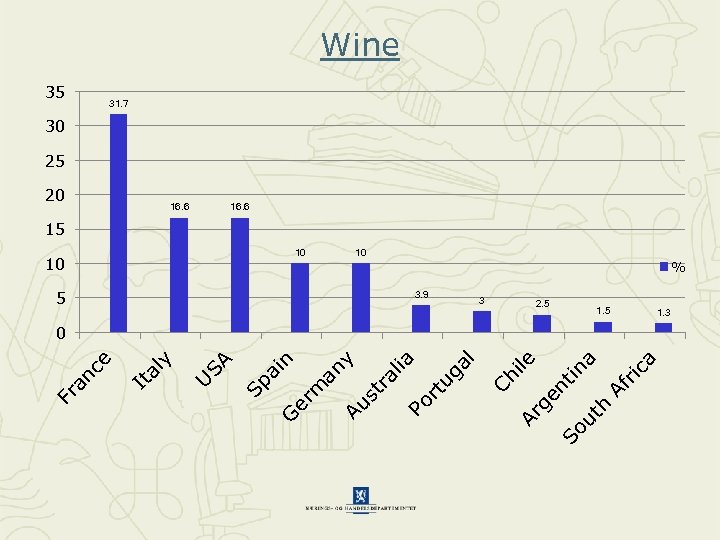

The Norwegian Wine and Spirits Monopoly • Vinmonopolet has the exclusive right to retail wine, spirits and strong beer in Norway. (Similar system in Sweden, Iceland Finland) • The products are purchased from importers holding the required licence and who have signed a purchase agreement with Vinmonopolet • 200 wholesalers have signed purchase agreements with Vinmonopolet • 239 shops with more than 10 000 different products • Approx. 270 new products are purchased per year. • New products are launched every second month. • South Africa will be the focus area for the period of July - August 2010!

The Norwegian Wine and Spirits Monopoly • Vinmonopolet has the exclusive right to retail wine, spirits and strong beer in Norway. (Similar system in Sweden, Iceland Finland) • The products are purchased from importers holding the required licence and who have signed a purchase agreement with Vinmonopolet • 200 wholesalers have signed purchase agreements with Vinmonopolet • 239 shops with more than 10 000 different products • Approx. 270 new products are purchased per year. • New products are launched every second month. • South Africa will be the focus area for the period of July - August 2010!

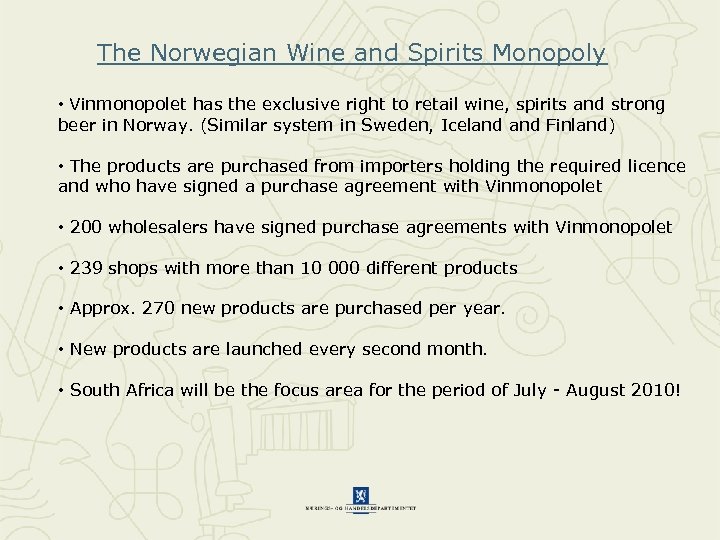

y ile Ar ge nt So in a ut h Af ric a 3. 9 Ch 5 ug al Po rt 10 ra lia st Au n 10 an er m G 16. 6 Sp ai 20 U SA y al 35 It e an c Fr Wine 31. 7 30 25 16. 6 15 10 % 3 2. 5 1. 5 0 1. 3

y ile Ar ge nt So in a ut h Af ric a 3. 9 Ch 5 ug al Po rt 10 ra lia st Au n 10 an er m G 16. 6 Sp ai 20 U SA y al 35 It e an c Fr Wine 31. 7 30 25 16. 6 15 10 % 3 2. 5 1. 5 0 1. 3

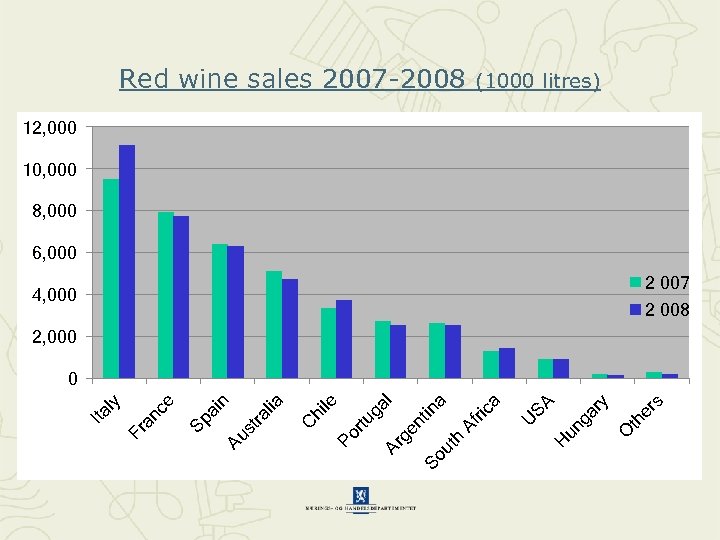

Red wine sales 2007 -2008 (1000 litres) 12, 000 10, 000 8, 000 6, 000 2 007 4, 000 2 008 2, 000 er s O th ry H un ga SA U tin So a ut h Af ric a ge n l Ar Po r tu ga le hi C lia Au st ra Sp ai n an ce Fr Ita ly 0

Red wine sales 2007 -2008 (1000 litres) 12, 000 10, 000 8, 000 6, 000 2 007 4, 000 2 008 2, 000 er s O th ry H un ga SA U tin So a ut h Af ric a ge n l Ar Po r tu ga le hi C lia Au st ra Sp ai n an ce Fr Ita ly 0

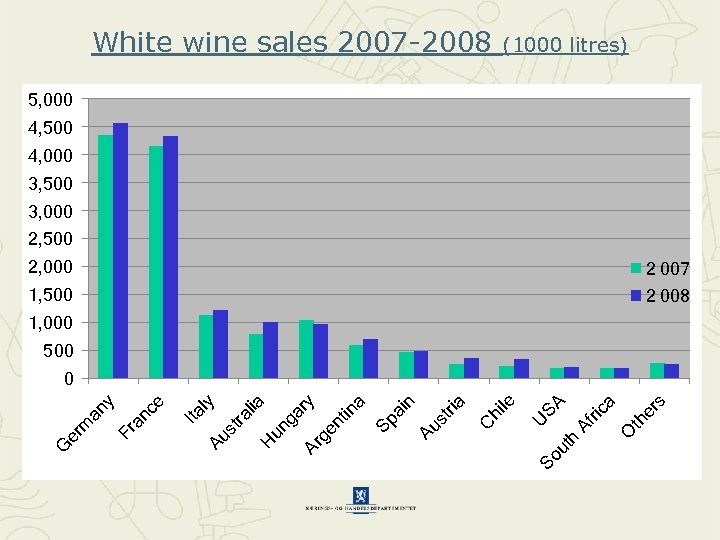

White wine sales 2007 -2008 (1000 litres) 5, 000 4, 500 4, 000 3, 500 3, 000 2, 500 2, 000 2 007 1, 500 2 008 1, 000 500 U So SA ut h Af ric a O th er s le hi C H un ga ry Ar ge nt in a Sp ai n Au st ria ra lia Ita ly e an c Fr Au st G er m an y 0

White wine sales 2007 -2008 (1000 litres) 5, 000 4, 500 4, 000 3, 500 3, 000 2, 500 2, 000 2 007 1, 500 2 008 1, 000 500 U So SA ut h Af ric a O th er s le hi C H un ga ry Ar ge nt in a Sp ai n Au st ria ra lia Ita ly e an c Fr Au st G er m an y 0

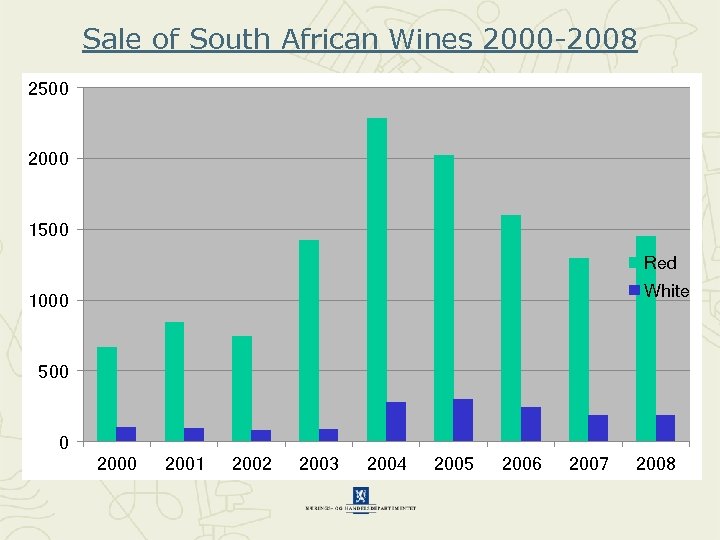

Sale of South African Wines 2000 -2008 2500 2000 1500 Red White 1000 500 0 2001 2002 2003 2004 2005 2006 2007 2008

Sale of South African Wines 2000 -2008 2500 2000 1500 Red White 1000 500 0 2001 2002 2003 2004 2005 2006 2007 2008

Main wine importers • V & S Norway • Arcus • Ekjord AS • Engelstad Vin og Brennevin • Best Buys International AS • Brand Partners AS • Red & White SD • Vectura AS • Stenberg & Blom AS • Eurowine AS • Fondberg AS • Contact: The Association of Norwegian Wine & Spirit Suppliers: http: //www. vbf-org. no/index. php? language=en

Main wine importers • V & S Norway • Arcus • Ekjord AS • Engelstad Vin og Brennevin • Best Buys International AS • Brand Partners AS • Red & White SD • Vectura AS • Stenberg & Blom AS • Eurowine AS • Fondberg AS • Contact: The Association of Norwegian Wine & Spirit Suppliers: http: //www. vbf-org. no/index. php? language=en

How to access the Norwegian market? • Focus on consumer goods? • Agricultural products? • Appointing an agent? • Direct deliveries?

How to access the Norwegian market? • Focus on consumer goods? • Agricultural products? • Appointing an agent? • Direct deliveries?

Importer requirements • Quality • Health safety • Traceability • Reliability: Adherence to contracts and deadlines • Ethical Trade / Corporate social responsibility • Price

Importer requirements • Quality • Health safety • Traceability • Reliability: Adherence to contracts and deadlines • Ethical Trade / Corporate social responsibility • Price

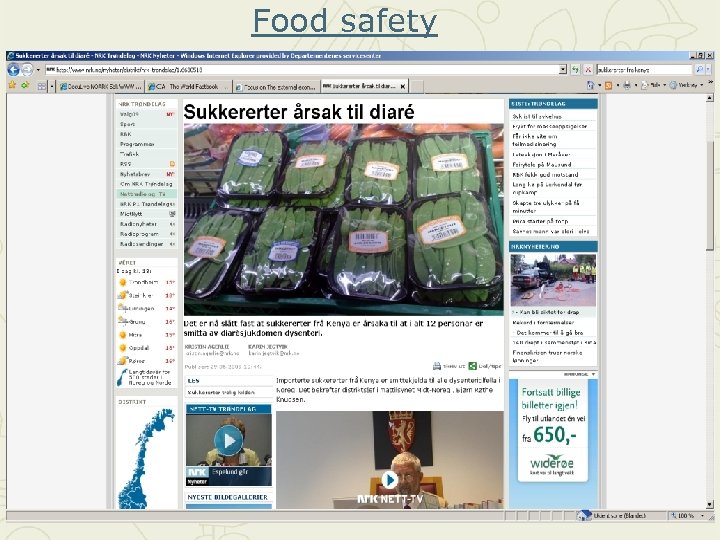

Food safety

Food safety

Ethical trade • Ethical trade is a deciding factor for Norwegian consumers and importers • As trade is their core activity, ethical trade is an important CSR aspect for retailers/merchandisers/importers • Ethical trade relates to labour and environmental standards in the entire value chain, where ethical labelling is either not possible or advisable • Normative principles and standards based on ILO & UN standards • Ethical purchasing policy/Code of Conduct also includes principles of implementation and follow-up

Ethical trade • Ethical trade is a deciding factor for Norwegian consumers and importers • As trade is their core activity, ethical trade is an important CSR aspect for retailers/merchandisers/importers • Ethical trade relates to labour and environmental standards in the entire value chain, where ethical labelling is either not possible or advisable • Normative principles and standards based on ILO & UN standards • Ethical purchasing policy/Code of Conduct also includes principles of implementation and follow-up

The Ethical Trading Initiative: ETI-Norway • Established in 2000 by: Coop, HSH, the Norwegian Confederation of Trade Unions and the Norwegian Church Aid • Overall objective: Ensure that trade does not contravene human-and labour rights, development and environment • Strategic objectives: - Strengthen the support for ethical trade issues - Supporting members in developing ethical trade practices

The Ethical Trading Initiative: ETI-Norway • Established in 2000 by: Coop, HSH, the Norwegian Confederation of Trade Unions and the Norwegian Church Aid • Overall objective: Ensure that trade does not contravene human-and labour rights, development and environment • Strategic objectives: - Strengthen the support for ethical trade issues - Supporting members in developing ethical trade practices

ETI-Norway member characteristics • 113 members as of July 2009 (24 new members in 2009) • Open to all organisations, public institutions and business sectors • Mix of SME’s and strong brands such as: Varner, Norgesgruppen, Rema 1000, Helly Hansen, IKEA, Kapp. Ahl, ICA and the Norwegian Olympic Committee and Federation of Sports

ETI-Norway member characteristics • 113 members as of July 2009 (24 new members in 2009) • Open to all organisations, public institutions and business sectors • Mix of SME’s and strong brands such as: Varner, Norgesgruppen, Rema 1000, Helly Hansen, IKEA, Kapp. Ahl, ICA and the Norwegian Olympic Committee and Federation of Sports

Business culture • Rules before relations • The business contract is considered irrevocable • Flat business hierarchy • Punctuality • Open and straightforward negotiations of terms • Not common for business partners to exchange gifts

Business culture • Rules before relations • The business contract is considered irrevocable • Flat business hierarchy • Punctuality • Open and straightforward negotiations of terms • Not common for business partners to exchange gifts

The Federation of Norwegian Commercial and Service Enterprises (HSH) • HSH is the principal organisation in Norway within the trade and service industry • 13 000 member businesses and 174 000 employees • In trade, HSH covers all sectors and sales activities, i. e. retailers, wholesalers, agents and importers within all sectors. • Most Norwegian imports are dealt with by companies belonging to HSH • Besides commercial interests, HSH has members such as voluntary organisations, private health and care institutions, museums, travel companies, accounting services, employment bureaux and other organisations

The Federation of Norwegian Commercial and Service Enterprises (HSH) • HSH is the principal organisation in Norway within the trade and service industry • 13 000 member businesses and 174 000 employees • In trade, HSH covers all sectors and sales activities, i. e. retailers, wholesalers, agents and importers within all sectors. • Most Norwegian imports are dealt with by companies belonging to HSH • Besides commercial interests, HSH has members such as voluntary organisations, private health and care institutions, museums, travel companies, accounting services, employment bureaux and other organisations

HSH - Department of International Trade Cooperation (DITC) • Established according to an agreement between HSH and NORAD (Norwegian Agency for Development Cooperation) • DICT provides: • • Market information Capacity building Advice on market access Company matchmaking • Website: www. hsh-org. no • Contact: Director, Ms. Ellen D. Gjeruldsen, e. d. gjeruldsen@hsh-org. no

HSH - Department of International Trade Cooperation (DITC) • Established according to an agreement between HSH and NORAD (Norwegian Agency for Development Cooperation) • DICT provides: • • Market information Capacity building Advice on market access Company matchmaking • Website: www. hsh-org. no • Contact: Director, Ms. Ellen D. Gjeruldsen, e. d. gjeruldsen@hsh-org. no

Assistance to exporters 1. HSH - Federation of Norwegian Commercial and Service Enterprises: Website: http: //www. hsh-org. no/eway/default. aspx? pid=273 Contact: Executive Director, Mr. Thomas Angell: thomas. angell@hsh-org. no 2. Department of International Trade Cooperation: Website: http: //www. hshorg. no/eway/default. aspx? pid=274&trg=Main_5801&Main_5801=5822: 0: 10, 1812: 1: 0: 0: : : 0: 0 Contact: Director, Ms. Ellen D. Gjeruldsen, e. d. gjeruldsen@hsh-org. no 3. Norwegian Directorate of Customs and Excise Website: http: //www. toll. no/default. aspx? id=94&epslanguage=EN Contact: tad@toll. no 4. Norwegian Ministry of Trade and Industry Website: http: //www. regjeringen. no/en/dep/nhd. html? id=709 Contact: postmottak@nhd. dep. no 5. International Trade Centre (ITC): Website: http: //www. intracen. org/ ITC is the joint agency of the WTO and the UN working to help developing and transition countries achieve sustainable development through exports.

Assistance to exporters 1. HSH - Federation of Norwegian Commercial and Service Enterprises: Website: http: //www. hsh-org. no/eway/default. aspx? pid=273 Contact: Executive Director, Mr. Thomas Angell: thomas. angell@hsh-org. no 2. Department of International Trade Cooperation: Website: http: //www. hshorg. no/eway/default. aspx? pid=274&trg=Main_5801&Main_5801=5822: 0: 10, 1812: 1: 0: 0: : : 0: 0 Contact: Director, Ms. Ellen D. Gjeruldsen, e. d. gjeruldsen@hsh-org. no 3. Norwegian Directorate of Customs and Excise Website: http: //www. toll. no/default. aspx? id=94&epslanguage=EN Contact: tad@toll. no 4. Norwegian Ministry of Trade and Industry Website: http: //www. regjeringen. no/en/dep/nhd. html? id=709 Contact: postmottak@nhd. dep. no 5. International Trade Centre (ITC): Website: http: //www. intracen. org/ ITC is the joint agency of the WTO and the UN working to help developing and transition countries achieve sustainable development through exports.

Thank you for your attention! E-mail: hfr@nhd. dep. no

Thank you for your attention! E-mail: hfr@nhd. dep. no