ca507caaf4955769d06142dea364b4b4.ppt

- Количество слайдов: 31

How to Determine the right Channel for the Right Customer Trond Bergestuen VP Commercial Marketing, Gjensidige (Norwegian Mutual) Vienna, 17 September 2009

How to Determine the right Channel for the Right Customer Trond Bergestuen VP Commercial Marketing, Gjensidige (Norwegian Mutual) Vienna, 17 September 2009

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect their decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 2 3/19/2018 How to Determine the Right Channel for the Right Customer

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect their decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 2 3/19/2018 How to Determine the Right Channel for the Right Customer

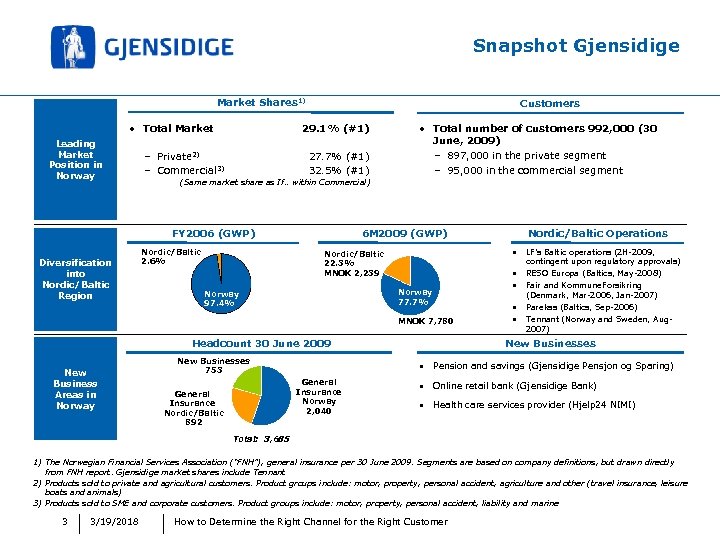

Snapshot Gjensidige Market Shares 1) • Total Market Leading Market Position in Norway Customers 29. 1% (#1) – Private 2) – Commercial 3) 27. 7% (#1) 32. 5% (#1) (Same market share as If. . within Commercial) FY 2006 (GWP) Diversification into Nordic/Baltic Region • Total number of customers 992, 000 (30 June, 2009) – 897, 000 in the private segment – 95, 000 in the commercial segment Nordic/Baltic 2. 6% • Nordic/Baltic 22. 3% MNOK 2, 239 Norway 77. 7% Norway 97. 4% MNOK 7, 780 Headcount 30 June 2009 New Business Areas in Norway New Businesses 753 • • LF’s Baltic operations (2 H-2009, contingent upon regulatory approvals) RESO Europa (Baltics, May-2008) Fair and Kommune. Forsikring (Denmark, Mar-2006, Jan-2007) Parekss (Baltics, Sep-2006) Tennant (Norway and Sweden, Aug 2007) New Businesses • Pension and savings (Gjensidige Pensjon og Sparing) General Insurance Norway 2, 040 General Insurance Nordic/Baltic 892 Nordic/Baltic Operations 6 M 2009 (GWP) • Online retail bank (Gjensidige Bank) • Health care services provider (Hjelp 24 NIMI) Total: 3, 685 1) The Norwegian Financial Services Association (“FNH”), general insurance per 30 June 2009. Segments are based on company definitions, but drawn directly from FNH report. Gjensidige market shares include Tennant 2) Products sold to private and agricultural customers. Product groups include: motor, property, personal accident, agriculture and other (travel insurance, leisure boats and animals) 3) Products sold to SME and corporate customers. Product groups include: motor, property, personal accident, liability and marine 3 3/19/2018 How to Determine the Right Channel for the Right Customer

Snapshot Gjensidige Market Shares 1) • Total Market Leading Market Position in Norway Customers 29. 1% (#1) – Private 2) – Commercial 3) 27. 7% (#1) 32. 5% (#1) (Same market share as If. . within Commercial) FY 2006 (GWP) Diversification into Nordic/Baltic Region • Total number of customers 992, 000 (30 June, 2009) – 897, 000 in the private segment – 95, 000 in the commercial segment Nordic/Baltic 2. 6% • Nordic/Baltic 22. 3% MNOK 2, 239 Norway 77. 7% Norway 97. 4% MNOK 7, 780 Headcount 30 June 2009 New Business Areas in Norway New Businesses 753 • • LF’s Baltic operations (2 H-2009, contingent upon regulatory approvals) RESO Europa (Baltics, May-2008) Fair and Kommune. Forsikring (Denmark, Mar-2006, Jan-2007) Parekss (Baltics, Sep-2006) Tennant (Norway and Sweden, Aug 2007) New Businesses • Pension and savings (Gjensidige Pensjon og Sparing) General Insurance Norway 2, 040 General Insurance Nordic/Baltic 892 Nordic/Baltic Operations 6 M 2009 (GWP) • Online retail bank (Gjensidige Bank) • Health care services provider (Hjelp 24 NIMI) Total: 3, 685 1) The Norwegian Financial Services Association (“FNH”), general insurance per 30 June 2009. Segments are based on company definitions, but drawn directly from FNH report. Gjensidige market shares include Tennant 2) Products sold to private and agricultural customers. Product groups include: motor, property, personal accident, agriculture and other (travel insurance, leisure boats and animals) 3) Products sold to SME and corporate customers. Product groups include: motor, property, personal accident, liability and marine 3 3/19/2018 How to Determine the Right Channel for the Right Customer

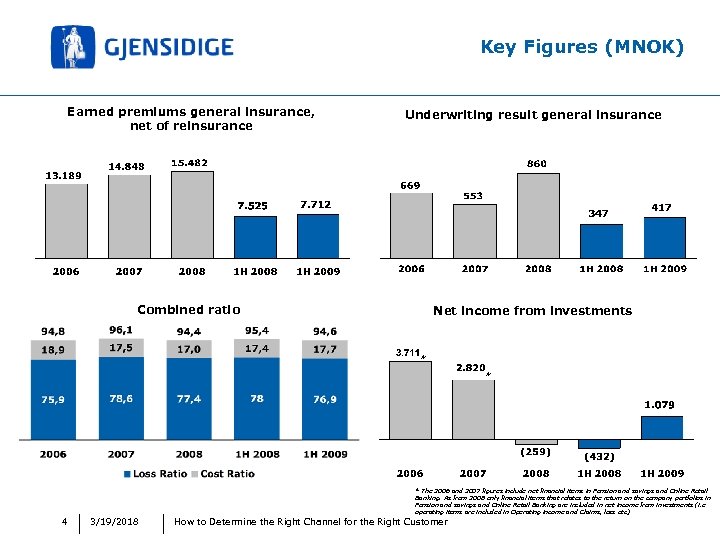

Key Figures (MNOK) Earned premiums general insurance, net of reinsurance Underwriting result general insurance Combined ratio Net income from investments * * 4 3/19/2018 * The 2006 and 2007 figures include net financial items in Pension and savings and Online Retail Banking. As from 2008 only financial items that relates to the return on the company portfolios in Pension and savings and Online Retail Banking are included in net income from investments (i. e operating items are included in Operating income and Claims, loss etc) How to Determine the Right Channel for the Right Customer

Key Figures (MNOK) Earned premiums general insurance, net of reinsurance Underwriting result general insurance Combined ratio Net income from investments * * 4 3/19/2018 * The 2006 and 2007 figures include net financial items in Pension and savings and Online Retail Banking. As from 2008 only financial items that relates to the return on the company portfolios in Pension and savings and Online Retail Banking are included in net income from investments (i. e operating items are included in Operating income and Claims, loss etc) How to Determine the Right Channel for the Right Customer

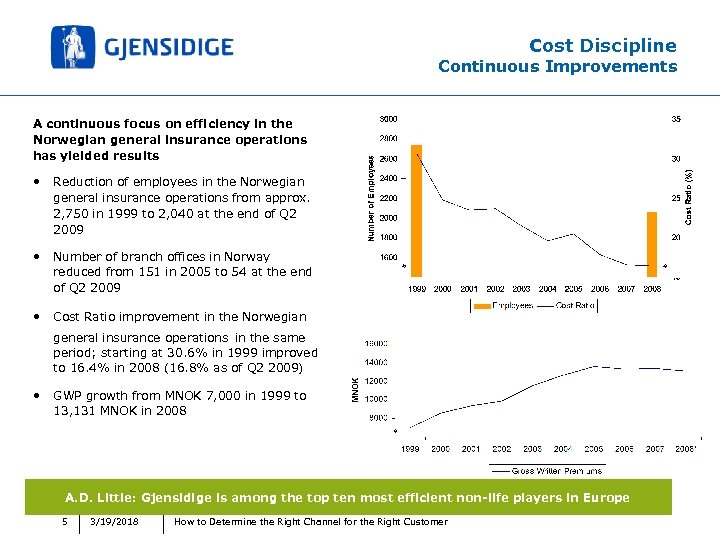

Cost Discipline Continuous Improvements A continuous focus on efficiency in the Norwegian general insurance operations has yielded results • Reduction of employees in the Norwegian general insurance operations from approx. 2, 750 in 1999 to 2, 040 at the end of Q 2 2009 • Number of branch offices in Norway reduced from 151 in 2005 to 54 at the end of Q 2 2009 • Cost Ratio improvement in the Norwegian general insurance operations in the same period; starting at 30. 6% in 1999 improved to 16. 4% in 2008 (16. 8% as of Q 2 2009) • GWP growth from MNOK 7, 000 in 1999 to 13, 131 MNOK in 2008 A. D. Little: Gjensidige is among the top ten most efficient non-life players in Europe 5 3/19/2018 How to Determine the Right Channel for the Right Customer

Cost Discipline Continuous Improvements A continuous focus on efficiency in the Norwegian general insurance operations has yielded results • Reduction of employees in the Norwegian general insurance operations from approx. 2, 750 in 1999 to 2, 040 at the end of Q 2 2009 • Number of branch offices in Norway reduced from 151 in 2005 to 54 at the end of Q 2 2009 • Cost Ratio improvement in the Norwegian general insurance operations in the same period; starting at 30. 6% in 1999 improved to 16. 4% in 2008 (16. 8% as of Q 2 2009) • GWP growth from MNOK 7, 000 in 1999 to 13, 131 MNOK in 2008 A. D. Little: Gjensidige is among the top ten most efficient non-life players in Europe 5 3/19/2018 How to Determine the Right Channel for the Right Customer

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect the decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 6 3/19/2018 How to Determine the Right Channel for the Right Customer

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect the decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 6 3/19/2018 How to Determine the Right Channel for the Right Customer

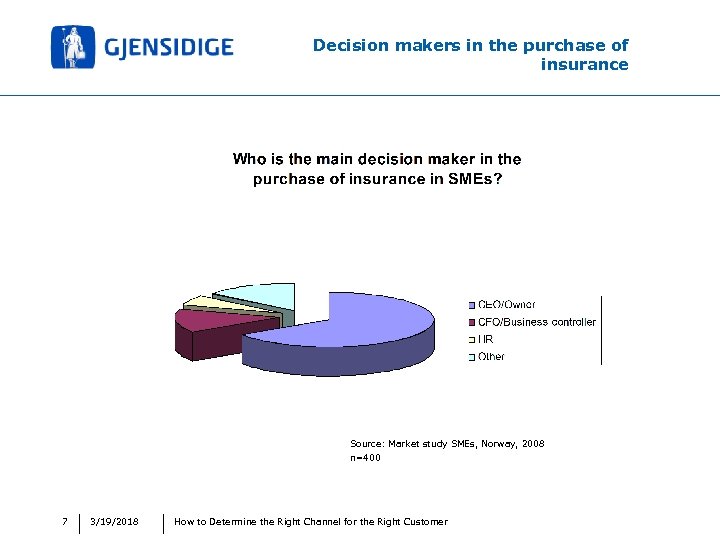

Decision makers in the purchase of insurance Source: Market study SMEs, Norway, 2008 n=400 7 3/19/2018 How to Determine the Right Channel for the Right Customer

Decision makers in the purchase of insurance Source: Market study SMEs, Norway, 2008 n=400 7 3/19/2018 How to Determine the Right Channel for the Right Customer

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect the decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 8 3/19/2018 How to Determine the Right Channel for the Right Customer

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect the decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 8 3/19/2018 How to Determine the Right Channel for the Right Customer

What factors affect the decision process? Internet Local branch services Risk Price management Providers advice industry Brand insight Key account manager 9 3/19/2018 How to Determine the Right Channel for the Right Customer

What factors affect the decision process? Internet Local branch services Risk Price management Providers advice industry Brand insight Key account manager 9 3/19/2018 How to Determine the Right Channel for the Right Customer

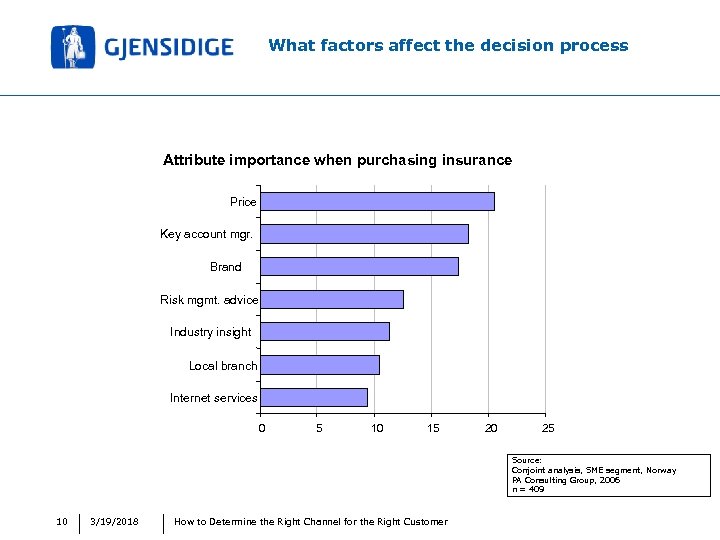

What factors affect the decision process Attribute importance when purchasing insurance Price Key account mgr. Brand Risk mgmt. advice Industry insight Local branch Internet services 0 5 10 15 20 25 Source: Conjoint analysis, SME segment, Norway PA Consulting Group, 2006 n = 409 10 3/19/2018 How to Determine the Right Channel for the Right Customer

What factors affect the decision process Attribute importance when purchasing insurance Price Key account mgr. Brand Risk mgmt. advice Industry insight Local branch Internet services 0 5 10 15 20 25 Source: Conjoint analysis, SME segment, Norway PA Consulting Group, 2006 n = 409 10 3/19/2018 How to Determine the Right Channel for the Right Customer

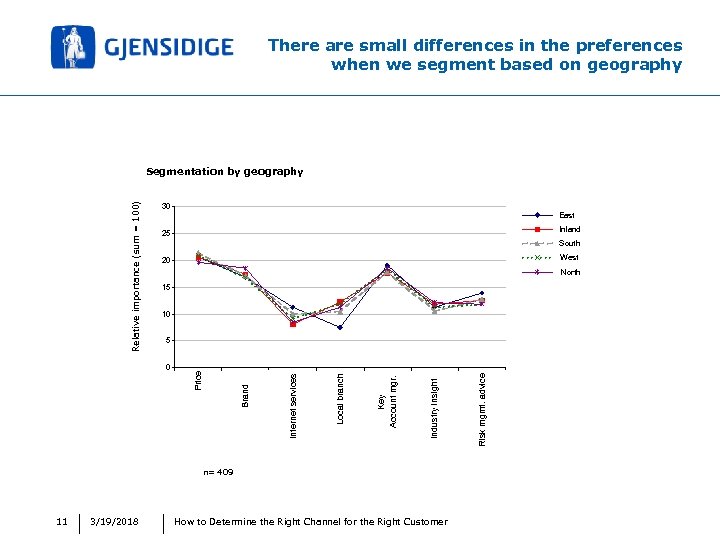

There are small differences in the preferences when we segment based on geography 30 East Inland 25 South West 20 North 15 10 n= 409 11 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr. Local branch Brand 0 Internet services 5 Price Relative importance (sum = 100) Segmentation by geography

There are small differences in the preferences when we segment based on geography 30 East Inland 25 South West 20 North 15 10 n= 409 11 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr. Local branch Brand 0 Internet services 5 Price Relative importance (sum = 100) Segmentation by geography

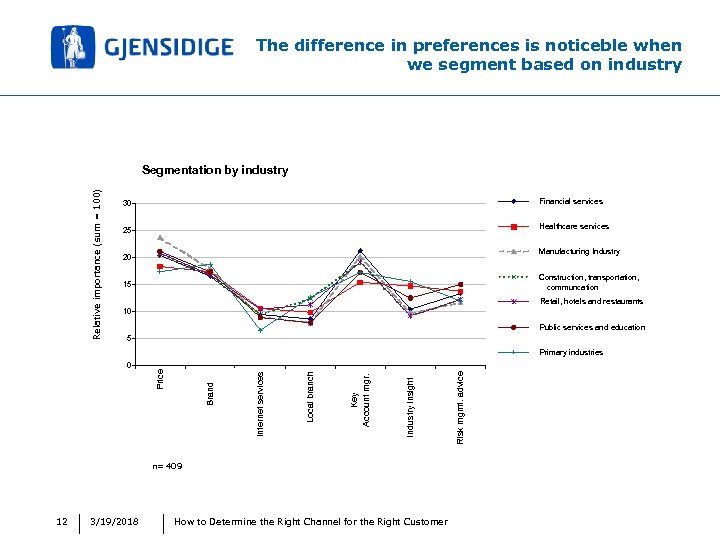

The difference in preferences is noticeble when we segment based on industry Relative importance (sum = 100) Segmentation by industry 30 Financial services 25 Healthcare services Manufacturing Industry 20 Construction, transportation, communcation 15 Retail, hotels and restaurants 10 Public services and education 5 n= 409 12 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr. Local branch Internet services Brand 0 Price Primary industries

The difference in preferences is noticeble when we segment based on industry Relative importance (sum = 100) Segmentation by industry 30 Financial services 25 Healthcare services Manufacturing Industry 20 Construction, transportation, communcation 15 Retail, hotels and restaurants 10 Public services and education 5 n= 409 12 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr. Local branch Internet services Brand 0 Price Primary industries

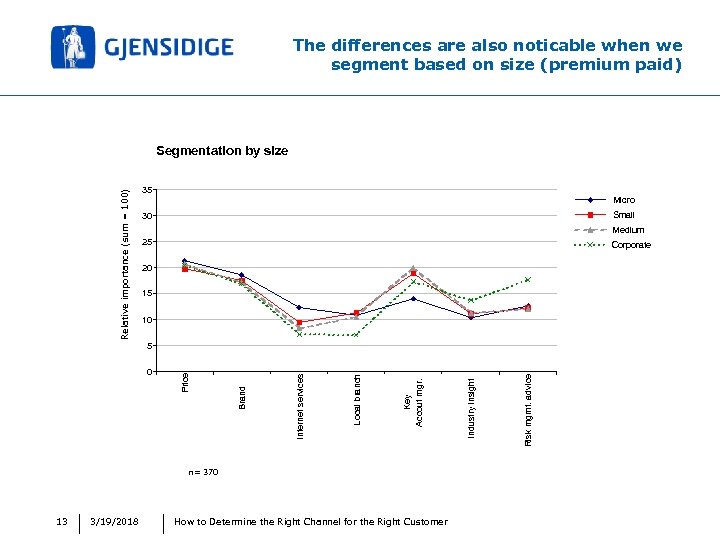

The differences are also noticable when we segment based on size (premium paid) Relative importance (sum = 100) Segmentation by size 35 Micro Small 30 Medium 25 Corporate 20 15 10 n= 370 13 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Accout mgr. Local branch Internet services Brand 0 Price 5

The differences are also noticable when we segment based on size (premium paid) Relative importance (sum = 100) Segmentation by size 35 Micro Small 30 Medium 25 Corporate 20 15 10 n= 370 13 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Accout mgr. Local branch Internet services Brand 0 Price 5

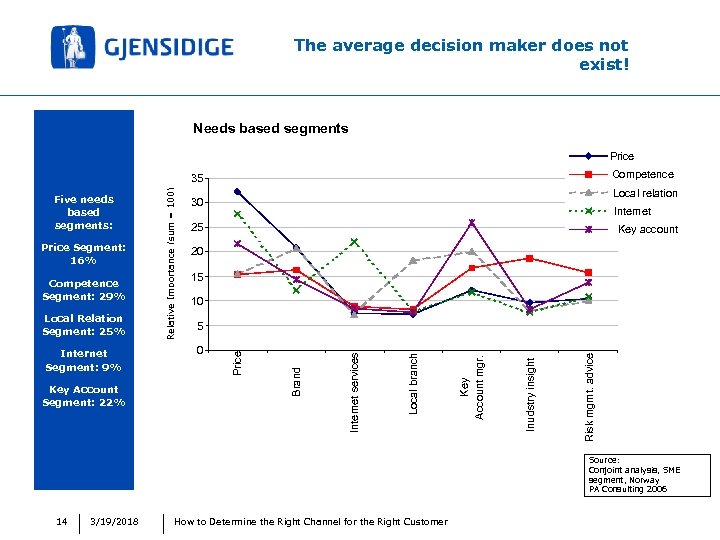

The average decision maker does not exist! Needs based segments Price Competence 15 10 0 Risk mgmt. advice 5 Inudstry insight Key Account Segment: 22% 20 Key Account mgr. Internet Segment: 9% Key account Local branch Local Relation Segment: 25% 25 Internet services Competence Segment: 29% Internet Brand Price Segment: 16% Local relation 30 Price Five needs based segments: Relative Importance (sum = 100) 35 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006 14 3/19/2018 How to Determine the Right Channel for the Right Customer

The average decision maker does not exist! Needs based segments Price Competence 15 10 0 Risk mgmt. advice 5 Inudstry insight Key Account Segment: 22% 20 Key Account mgr. Internet Segment: 9% Key account Local branch Local Relation Segment: 25% 25 Internet services Competence Segment: 29% Internet Brand Price Segment: 16% Local relation 30 Price Five needs based segments: Relative Importance (sum = 100) 35 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006 14 3/19/2018 How to Determine the Right Channel for the Right Customer

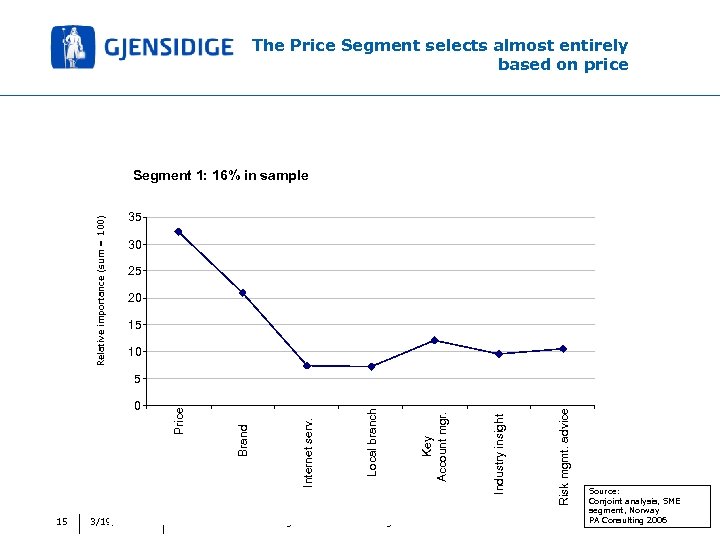

The Price Segment selects almost entirely based on price Relative importance (sum = 100) Price (16% of sample) sample Segment 1: 16% in 35 30 25 20 15 10 15 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr. Local branch Internet serv. Brand 0 Price 5 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

The Price Segment selects almost entirely based on price Relative importance (sum = 100) Price (16% of sample) sample Segment 1: 16% in 35 30 25 20 15 10 15 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr. Local branch Internet serv. Brand 0 Price 5 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

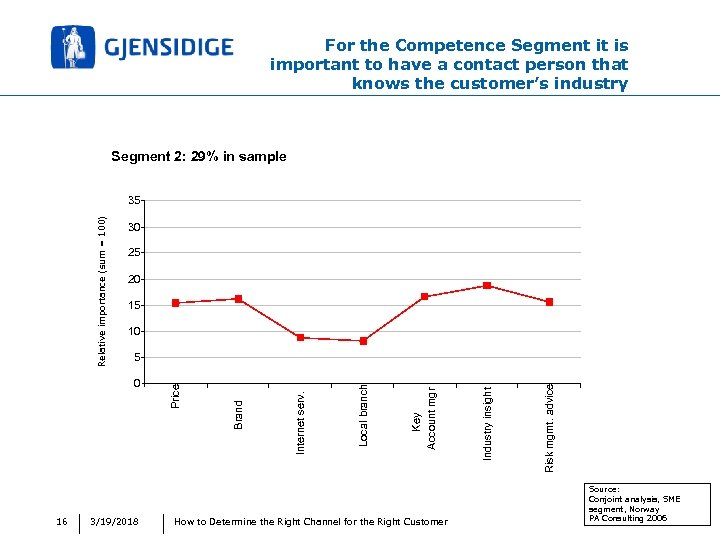

For the Competence Segment it is important to have a contact person that knows the customer’s industry Segment 2: 29% in sample 30 25 20 15 10 16 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr Local branch Internet serv. 0 Brand 5 Price Relative importance (sum = 100) 35 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

For the Competence Segment it is important to have a contact person that knows the customer’s industry Segment 2: 29% in sample 30 25 20 15 10 16 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr Local branch Internet serv. 0 Brand 5 Price Relative importance (sum = 100) 35 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

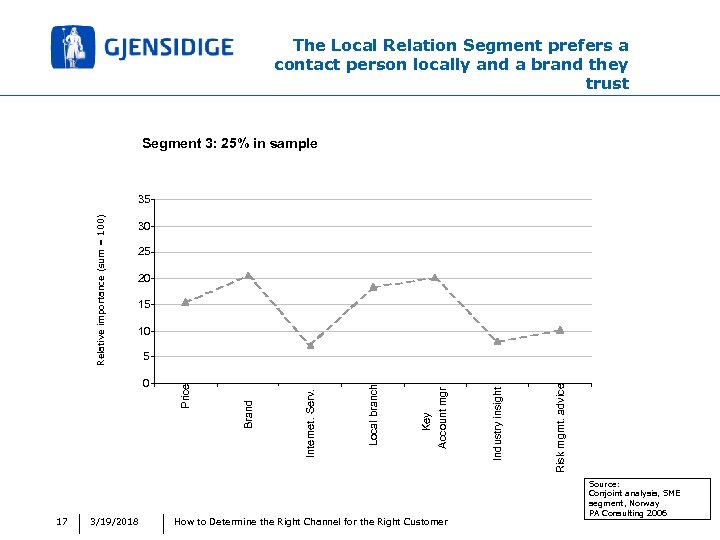

The Local Relation Segment prefers a contact person locally and a brand they trust Segment 3: 25% in sample 30 25 20 15 10 17 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr Local branch Internet. Serv. 0 Brand 5 Price Relative importance (sum = 100) 35 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

The Local Relation Segment prefers a contact person locally and a brand they trust Segment 3: 25% in sample 30 25 20 15 10 17 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr Local branch Internet. Serv. 0 Brand 5 Price Relative importance (sum = 100) 35 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

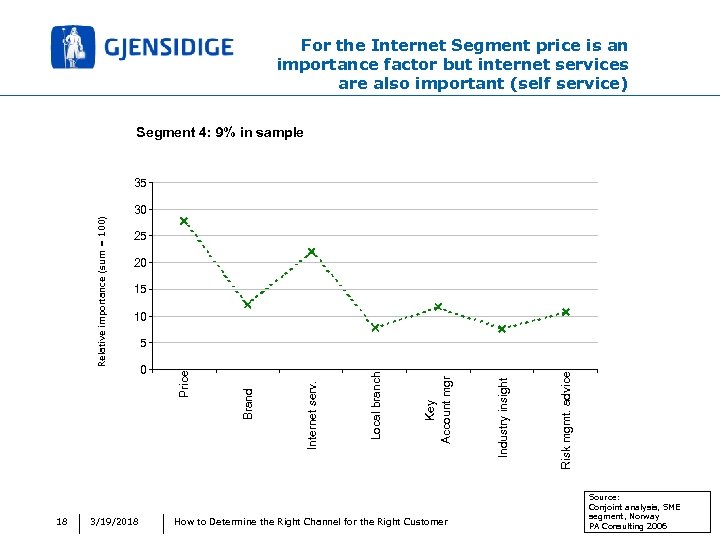

For the Internet Segment price is an importance factor but internet services are also important (self service) Segment 4: 9% in sample 18 30 25 20 15 10 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr Local branch Internet serv. 0 Brand 5 Price Relative importance (sum = 100) 35 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

For the Internet Segment price is an importance factor but internet services are also important (self service) Segment 4: 9% in sample 18 30 25 20 15 10 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr Local branch Internet serv. 0 Brand 5 Price Relative importance (sum = 100) 35 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

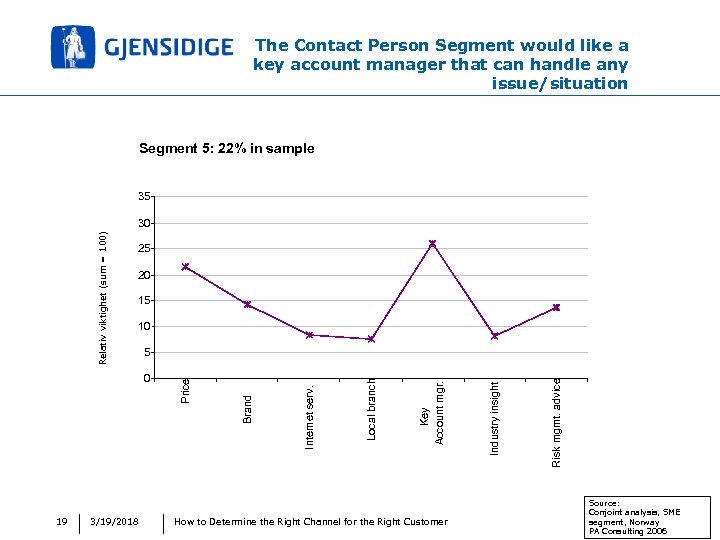

The Contact Person Segment would like a key account manager that can handle any issue/situation Segment 5: 22% in sample 35 25 20 15 10 19 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr. Local branch Internet serv. 0 Brand 5 Price Relativ viktighet (sum = 100) 30 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

The Contact Person Segment would like a key account manager that can handle any issue/situation Segment 5: 22% in sample 35 25 20 15 10 19 3/19/2018 How to Determine the Right Channel for the Right Customer Risk mgmt. advice Industry insight Key Account mgr. Local branch Internet serv. 0 Brand 5 Price Relativ viktighet (sum = 100) 30 Source: Conjoint analysis, SME segment, Norway PA Consulting 2006

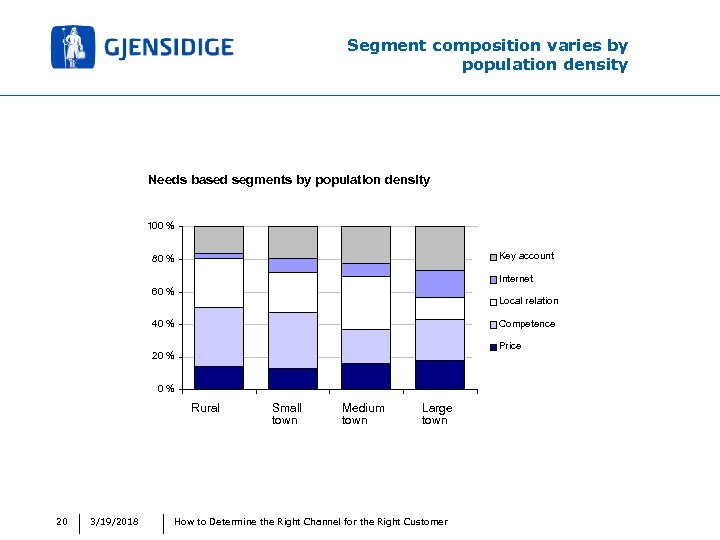

Segment composition varies by population density Needs based segments by population density 100 % Key account 80 % Internet 60 % Local relation 40 % Competence Price 20 % 0% Rural 20 3/19/2018 Small town Medium town Large town How to Determine the Right Channel for the Right Customer

Segment composition varies by population density Needs based segments by population density 100 % Key account 80 % Internet 60 % Local relation 40 % Competence Price 20 % 0% Rural 20 3/19/2018 Small town Medium town Large town How to Determine the Right Channel for the Right Customer

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect the decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 21 3/19/2018 How to Determine the Right Channel for the Right Customer

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect the decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 21 3/19/2018 How to Determine the Right Channel for the Right Customer

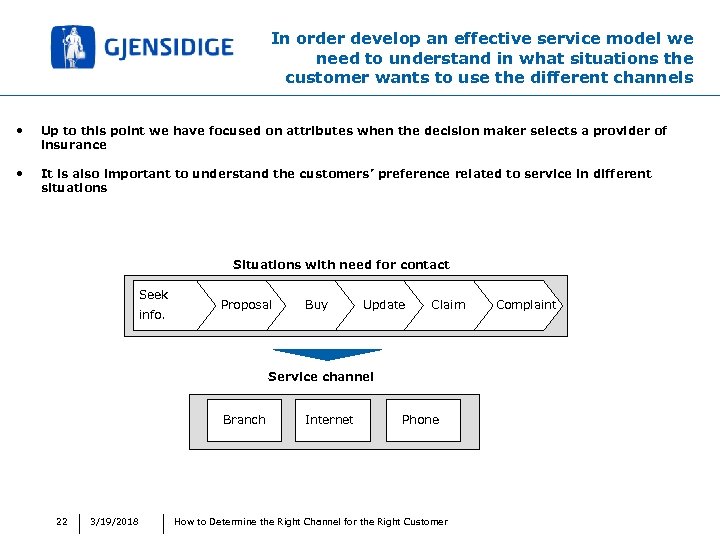

In order develop an effective service model we need to understand in what situations the customer wants to use the different channels • Up to this point we have focused on attributes when the decision maker selects a provider of insurance • It is also important to understand the customers’ preference related to service in different situations Situations with need for contact Seek info. Proposal Buy Update Claim Service channel Branch 22 3/19/2018 Internet Phone How to Determine the Right Channel for the Right Customer Complaint

In order develop an effective service model we need to understand in what situations the customer wants to use the different channels • Up to this point we have focused on attributes when the decision maker selects a provider of insurance • It is also important to understand the customers’ preference related to service in different situations Situations with need for contact Seek info. Proposal Buy Update Claim Service channel Branch 22 3/19/2018 Internet Phone How to Determine the Right Channel for the Right Customer Complaint

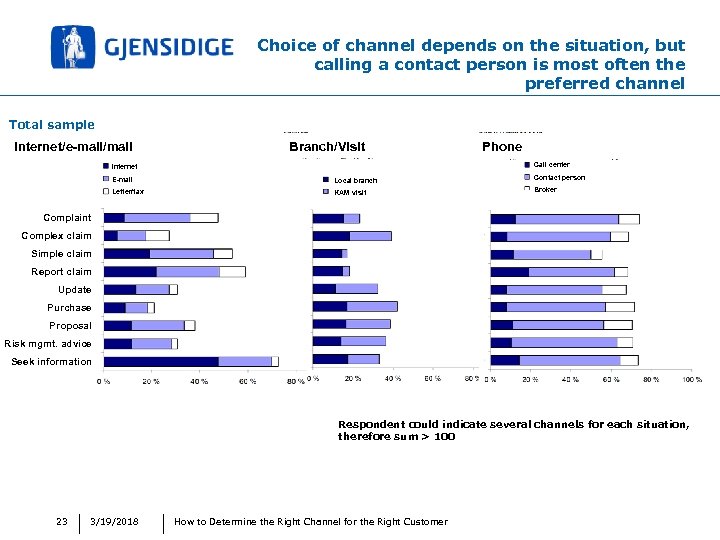

Choice of channel depends on the situation, but calling a contact person is most often the preferred channel Total sample Internet/e-mail/mail Branch/Visit Phone Call center Internet E-mail Local branch Contact person Letter/fax KAM visit Broker Complaint Complex claim Simple claim Report claim Update Purchase Proposal Risk mgmt. advice Seek information Respondent could indicate several channels for each situation, therefore sum > 100 23 3/19/2018 How to Determine the Right Channel for the Right Customer

Choice of channel depends on the situation, but calling a contact person is most often the preferred channel Total sample Internet/e-mail/mail Branch/Visit Phone Call center Internet E-mail Local branch Contact person Letter/fax KAM visit Broker Complaint Complex claim Simple claim Report claim Update Purchase Proposal Risk mgmt. advice Seek information Respondent could indicate several channels for each situation, therefore sum > 100 23 3/19/2018 How to Determine the Right Channel for the Right Customer

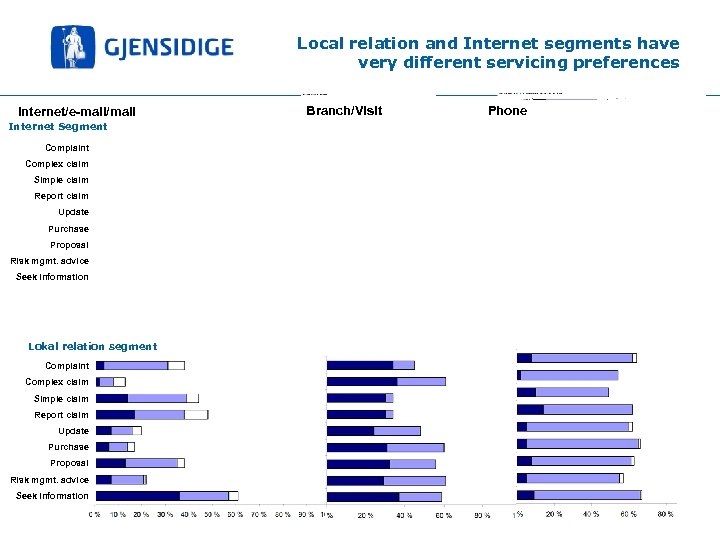

Local relation and Internet segments have very different servicing preferences Internet/e-mail/mail Branch/Visit Internet Segment Complaint Complex claim Simple claim Report claim Update Purchase Proposal Risk mgmt. advice Seek information Lokal relation segment Complaint Complex claim Simple claim Report claim Update Purchase Proposal Risk mgmt. advice Seek information 24 3/19/2018 How to Determine the Right Channel for the Right Customer Phone

Local relation and Internet segments have very different servicing preferences Internet/e-mail/mail Branch/Visit Internet Segment Complaint Complex claim Simple claim Report claim Update Purchase Proposal Risk mgmt. advice Seek information Lokal relation segment Complaint Complex claim Simple claim Report claim Update Purchase Proposal Risk mgmt. advice Seek information 24 3/19/2018 How to Determine the Right Channel for the Right Customer Phone

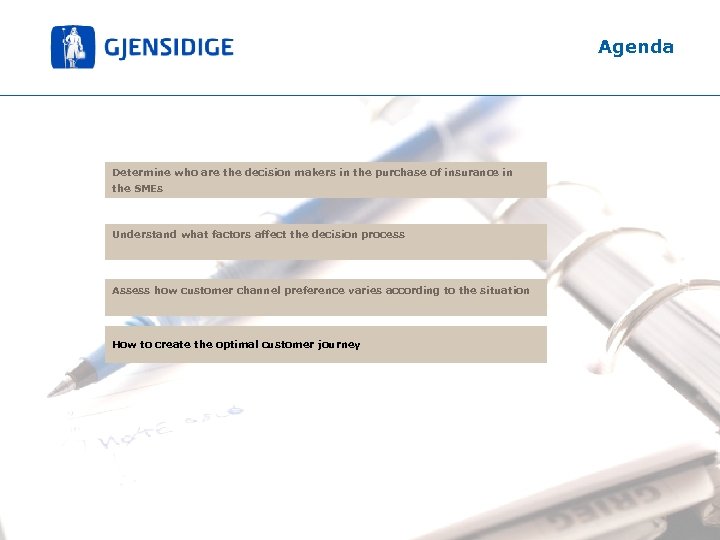

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect the decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 25 3/19/2018 How to Determine the Right Channel for the Right Customer

Agenda Determine who are the decision makers in the purchase of insurance in the SMEs Understand what factors affect the decision process Assess how customer channel preference varies according to the situation How to create the optimal customer journey 25 3/19/2018 How to Determine the Right Channel for the Right Customer

The use of field sales, the phone and the internet as direct sales tools Segment Micro Small Premium/ complexity 26 3/19/2018 How to Determine the Right Channel for the Right Customer Medium Corporate

The use of field sales, the phone and the internet as direct sales tools Segment Micro Small Premium/ complexity 26 3/19/2018 How to Determine the Right Channel for the Right Customer Medium Corporate

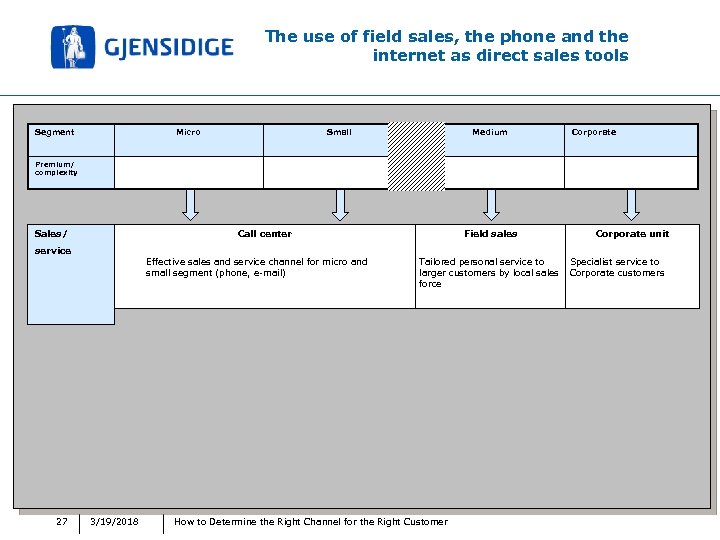

The use of field sales, the phone and the internet as direct sales tools Segment Micro Small Medium Corporate Premium/ complexity Sales/ Call center Field sales Corporate unit service Effective sales and service channel for micro and small segment (phone, e-mail) 27 3/19/2018 Tailored personal service to larger customers by local sales force How to Determine the Right Channel for the Right Customer Specialist service to Corporate customers

The use of field sales, the phone and the internet as direct sales tools Segment Micro Small Medium Corporate Premium/ complexity Sales/ Call center Field sales Corporate unit service Effective sales and service channel for micro and small segment (phone, e-mail) 27 3/19/2018 Tailored personal service to larger customers by local sales force How to Determine the Right Channel for the Right Customer Specialist service to Corporate customers

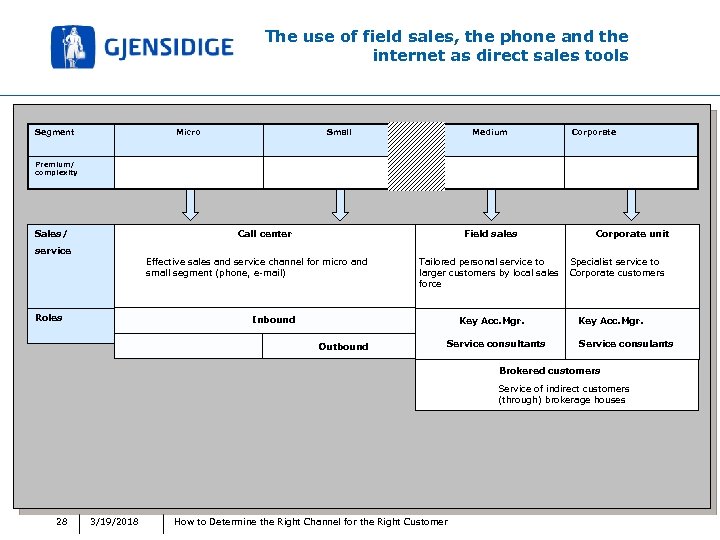

The use of field sales, the phone and the internet as direct sales tools Segment Micro Small Medium Corporate Premium/ complexity Sales/ Call center Field sales Corporate unit service Effective sales and service channel for micro and small segment (phone, e-mail) Roles Tailored personal service to larger customers by local sales force Inbound Key Acc. Mgr. Outbound Service consultants Specialist service to Corporate customers Key Acc. Mgr. Service consulants Brokered customers Service of indirect customers (through) brokerage houses 28 3/19/2018 How to Determine the Right Channel for the Right Customer

The use of field sales, the phone and the internet as direct sales tools Segment Micro Small Medium Corporate Premium/ complexity Sales/ Call center Field sales Corporate unit service Effective sales and service channel for micro and small segment (phone, e-mail) Roles Tailored personal service to larger customers by local sales force Inbound Key Acc. Mgr. Outbound Service consultants Specialist service to Corporate customers Key Acc. Mgr. Service consulants Brokered customers Service of indirect customers (through) brokerage houses 28 3/19/2018 How to Determine the Right Channel for the Right Customer

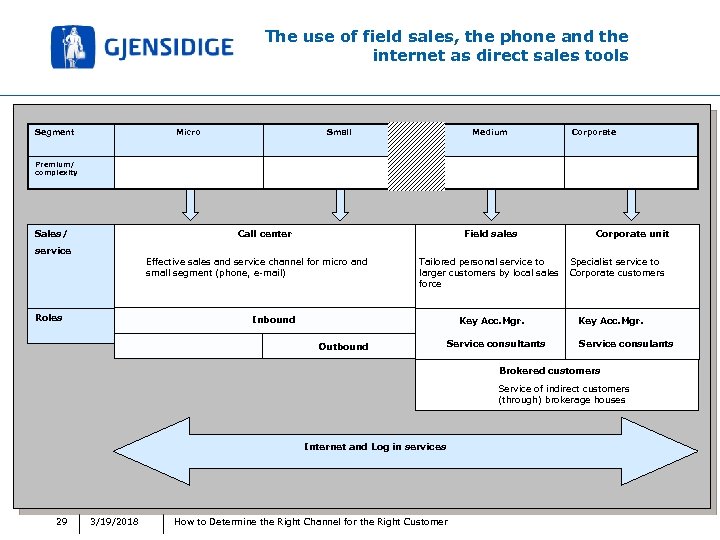

The use of field sales, the phone and the internet as direct sales tools Segment Micro Small Medium Corporate Premium/ complexity Sales/ Call center Field sales Corporate unit service Effective sales and service channel for micro and small segment (phone, e-mail) Roles Tailored personal service to larger customers by local sales force Inbound Key Acc. Mgr. Outbound Service consultants Specialist service to Corporate customers Key Acc. Mgr. Service consulants Brokered customers Service of indirect customers (through) brokerage houses Internet and Log in services 29 3/19/2018 How to Determine the Right Channel for the Right Customer

The use of field sales, the phone and the internet as direct sales tools Segment Micro Small Medium Corporate Premium/ complexity Sales/ Call center Field sales Corporate unit service Effective sales and service channel for micro and small segment (phone, e-mail) Roles Tailored personal service to larger customers by local sales force Inbound Key Acc. Mgr. Outbound Service consultants Specialist service to Corporate customers Key Acc. Mgr. Service consulants Brokered customers Service of indirect customers (through) brokerage houses Internet and Log in services 29 3/19/2018 How to Determine the Right Channel for the Right Customer

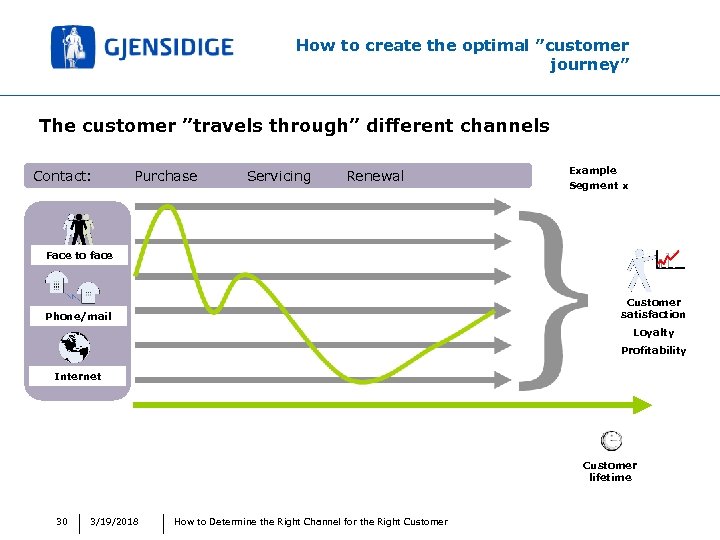

How to create the optimal ”customer journey” The customer ”travels through” different channels Contact: Purchase Servicing Renewal Example Segment x Face to face Customer satisfaction Phone/mail Loyalty Profitability Internet Customer lifetime 30 3/19/2018 How to Determine the Right Channel for the Right Customer

How to create the optimal ”customer journey” The customer ”travels through” different channels Contact: Purchase Servicing Renewal Example Segment x Face to face Customer satisfaction Phone/mail Loyalty Profitability Internet Customer lifetime 30 3/19/2018 How to Determine the Right Channel for the Right Customer

Tusen takk! (A thousand thanks!) 31 3/19/2018 How to Determine the Right Channel for the Right Customer

Tusen takk! (A thousand thanks!) 31 3/19/2018 How to Determine the Right Channel for the Right Customer