d098331bcf7aa3a1c16c955c980e99af.ppt

- Количество слайдов: 15

How to deal with complex corporate issues under Nevada corporate law in the absence of case law Kummer Kaempfer Bonner Renshaw & Ferrario John Jeppsen, Partner Neal Klegerman, Of Counsel

How to deal with complex corporate issues under Nevada corporate law in the absence of case law Kummer Kaempfer Bonner Renshaw & Ferrario John Jeppsen, Partner Neal Klegerman, Of Counsel

Hypothetical 1 – Exculpation Clauses You are the general counsel of Fun Land, a publicly traded Nevada corporation which produces films, TV shows, and videos. Your CEO calls and tells you that Mr. Big, the COO hired by Fun Land last year, is just not producing and will need to be terminated. Under Mr. Big’s employment agreement, he is entitled to receive a $150 million severance package, which will result in a big loss for the year. (You were on vacation when Mr. Big was hired. ) Word of Mr. Big’s big pay day has leaked and upset stockholders have filed a derivative action in Nevada state court claiming breach of fiduciary duty and waste against the Directors.

Hypothetical 1 – Exculpation Clauses You are the general counsel of Fun Land, a publicly traded Nevada corporation which produces films, TV shows, and videos. Your CEO calls and tells you that Mr. Big, the COO hired by Fun Land last year, is just not producing and will need to be terminated. Under Mr. Big’s employment agreement, he is entitled to receive a $150 million severance package, which will result in a big loss for the year. (You were on vacation when Mr. Big was hired. ) Word of Mr. Big’s big pay day has leaked and upset stockholders have filed a derivative action in Nevada state court claiming breach of fiduciary duty and waste against the Directors.

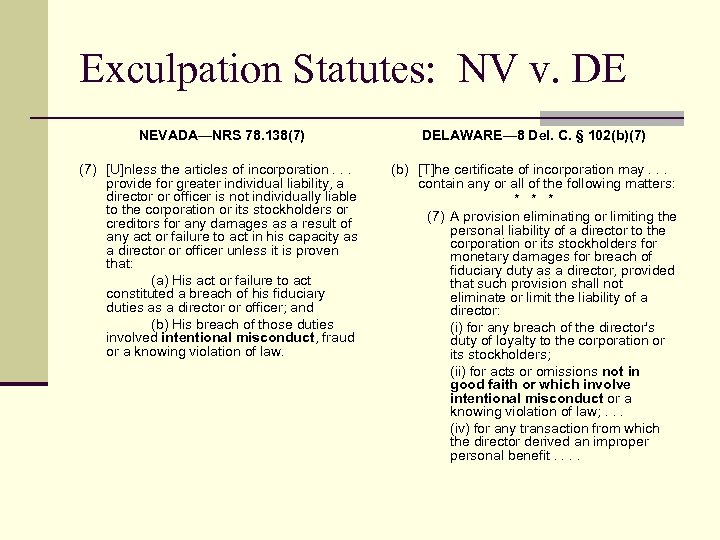

Exculpation Statutes: NV v. DE NEVADA—NRS 78. 138(7) DELAWARE— 8 Del. C. § 102(b)(7) [U]nless the articles of incorporation. . . provide for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his capacity as a director or officer unless it is proven that: (a) His act or failure to act constituted a breach of his fiduciary duties as a director or officer; and (b) His breach of those duties involved intentional misconduct, fraud or a knowing violation of law. (b) [T]he certificate of incorporation may. . . contain any or all of the following matters: * * * (7) A provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provision shall not eliminate or limit the liability of a director: (i) for any breach of the director's duty of loyalty to the corporation or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; . . . (iv) for any transaction from which the director derived an improper personal benefit. .

Exculpation Statutes: NV v. DE NEVADA—NRS 78. 138(7) DELAWARE— 8 Del. C. § 102(b)(7) [U]nless the articles of incorporation. . . provide for greater individual liability, a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his capacity as a director or officer unless it is proven that: (a) His act or failure to act constituted a breach of his fiduciary duties as a director or officer; and (b) His breach of those duties involved intentional misconduct, fraud or a knowing violation of law. (b) [T]he certificate of incorporation may. . . contain any or all of the following matters: * * * (7) A provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, provided that such provision shall not eliminate or limit the liability of a director: (i) for any breach of the director's duty of loyalty to the corporation or its stockholders; (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; . . . (iv) for any transaction from which the director derived an improper personal benefit. .

Hypothetical 2 – Poison Pill Adoption Reports of the derivative action caused an immediate 20% drop in Fun Land’s stock price. Online Co. , a much larger and more profitable company with a flawless business plan, has long been interested in acquiring Fun Land to provide content for Online’s massive internet business. The drop in Fun Land’s stock price piques Online’s interest. Online calls Fun Land’s CEO and wants to talk. Online always pays at least 100% premium in its acquisitions, always outperforms its industry, is flexible on doing stock or cash deals, and for the past 10 years has been unanimously voted the corporation which is best to its employees, suppliers, creditors, customers, suppliers, communities, and to society. Online never terminates anybody in an acquired company except top management and the board. Your CEO wants to know whether Fun Land can adopt a poison pill.

Hypothetical 2 – Poison Pill Adoption Reports of the derivative action caused an immediate 20% drop in Fun Land’s stock price. Online Co. , a much larger and more profitable company with a flawless business plan, has long been interested in acquiring Fun Land to provide content for Online’s massive internet business. The drop in Fun Land’s stock price piques Online’s interest. Online calls Fun Land’s CEO and wants to talk. Online always pays at least 100% premium in its acquisitions, always outperforms its industry, is flexible on doing stock or cash deals, and for the past 10 years has been unanimously voted the corporation which is best to its employees, suppliers, creditors, customers, suppliers, communities, and to society. Online never terminates anybody in an acquired company except top management and the board. Your CEO wants to know whether Fun Land can adopt a poison pill.

Validity of Poison Pills—NV v. DE Nevada—NRS 78. 139 2. If directors and officers take action to resist a change or potential change in control of a corporation which impedes the exercise of the right of stockholders to vote for or remove directors: (a) The directors must have reasonable grounds to believe that a threat to corporate policy and effectiveness exists; and (b) The action taken which impedes the exercise of the stockholders’ rights must be reasonable in relation to that threat. If those facts are found, the directors and officers have the benefit of the Business Judgment Rule. 3. The provisions of subsection 2 do not apply to: (a) Actions that only affect the time of the exercise of stockholders’ voting rights; or (b) The adoption or execution of plans, arrangements or instruments that deny rights, privileges, power or authority to a holder of a specified number or fraction of shares or fraction of voting power. n n Delaware No statutory authority to adopt poison pills; Delaware courts apply the Unocal/Unitrin test to determine validity of poison pills. Unocal/Unitrin: To maintain Business Judgment Rule protection, in responding to a takeover attempt, (1) the Board must have reasonable grounds to believe a threat to corporate policy and effectiveness exists and (2) the action taken must be reasonable in relation to the threat to corporate interests in question.

Validity of Poison Pills—NV v. DE Nevada—NRS 78. 139 2. If directors and officers take action to resist a change or potential change in control of a corporation which impedes the exercise of the right of stockholders to vote for or remove directors: (a) The directors must have reasonable grounds to believe that a threat to corporate policy and effectiveness exists; and (b) The action taken which impedes the exercise of the stockholders’ rights must be reasonable in relation to that threat. If those facts are found, the directors and officers have the benefit of the Business Judgment Rule. 3. The provisions of subsection 2 do not apply to: (a) Actions that only affect the time of the exercise of stockholders’ voting rights; or (b) The adoption or execution of plans, arrangements or instruments that deny rights, privileges, power or authority to a holder of a specified number or fraction of shares or fraction of voting power. n n Delaware No statutory authority to adopt poison pills; Delaware courts apply the Unocal/Unitrin test to determine validity of poison pills. Unocal/Unitrin: To maintain Business Judgment Rule protection, in responding to a takeover attempt, (1) the Board must have reasonable grounds to believe a threat to corporate policy and effectiveness exists and (2) the action taken must be reasonable in relation to the threat to corporate interests in question.

Hypothetical 3 – Stockholder Bylaws Hedge Co. , an event driven hedge fund owns 10% of Fun Land’s outstanding stock and invested primarily with the hope that Fun Land would be a target of Online Co. Hedge Co. learns that Fun Land is considering a poison pill to block a takeover bid by Online. Hedge Co. begins organizing a stockholder consent solicitation to adopt a bylaw to preclude the Board from adopting a poison pill. Your CEO asks if Hedge Co. can do that.

Hypothetical 3 – Stockholder Bylaws Hedge Co. , an event driven hedge fund owns 10% of Fun Land’s outstanding stock and invested primarily with the hope that Fun Land would be a target of Online Co. Hedge Co. learns that Fun Land is considering a poison pill to block a takeover bid by Online. Hedge Co. begins organizing a stockholder consent solicitation to adopt a bylaw to preclude the Board from adopting a poison pill. Your CEO asks if Hedge Co. can do that.

Stockholder Bylaw Proposals n Neither Nevada nor Delaware has adopted a statute addressing this issue. n International Brotherhood of Teamsters: The Oklahoma Supreme Court held that stockholders may adopt bylaws that restrict the Board’s authority to create and implement stockholder rights plans. n Analysis: n n n Nothing under Oklahoma law suggests that stockholder rights plans are somehow exempt from stockholder adopted bylaws. Unlike many other states (Nevada included), Oklahoma has not granted explicit authority to Boards to adopt stockholder rights plans. The Oklahoma Supreme Court points to NRS 78. 378(3), which gives the Board authority to adopt a stockholder rights plan, as an illustration of “how a board of directors can operate with relative autonomy when a rights plan endorsement statute applies. ”

Stockholder Bylaw Proposals n Neither Nevada nor Delaware has adopted a statute addressing this issue. n International Brotherhood of Teamsters: The Oklahoma Supreme Court held that stockholders may adopt bylaws that restrict the Board’s authority to create and implement stockholder rights plans. n Analysis: n n n Nothing under Oklahoma law suggests that stockholder rights plans are somehow exempt from stockholder adopted bylaws. Unlike many other states (Nevada included), Oklahoma has not granted explicit authority to Boards to adopt stockholder rights plans. The Oklahoma Supreme Court points to NRS 78. 378(3), which gives the Board authority to adopt a stockholder rights plan, as an illustration of “how a board of directors can operate with relative autonomy when a rights plan endorsement statute applies. ”

Stockholder Bylaw Proposals n CA, Inc. : Recently, the Delaware Supreme Court held that a stockholder proposed bylaw requiring the Board to reimburse reasonable expenses incurred by stockholders in a successful proxy contest was a proper subject for action by stockholders but that the bylaw would violate Delaware law. n Analysis: This case makes a distinction between bylaw proposals that affect “the process and procedures by which. . . decisions are made” and bylaw proposals that “mandate how the board should decide specific substantive business decisions. ” The proposed expense reimbursement bylaw would violate Delaware law by not reserving to the Board the power to exercise its fiduciary duty to award expenses as appropriate. n A bylaw proposal seeking to preclude adoption of a stockholder rights plan seems to mandate the Board’s decision in a specific instance (whether or not to adopt the plan) rather than adjust their decisionmaking process. Therefore, most commentators believe Delaware would probably not follow International Brotherhood of Teamsters, and would determine that such stockholder proposed bylaws are invalid.

Stockholder Bylaw Proposals n CA, Inc. : Recently, the Delaware Supreme Court held that a stockholder proposed bylaw requiring the Board to reimburse reasonable expenses incurred by stockholders in a successful proxy contest was a proper subject for action by stockholders but that the bylaw would violate Delaware law. n Analysis: This case makes a distinction between bylaw proposals that affect “the process and procedures by which. . . decisions are made” and bylaw proposals that “mandate how the board should decide specific substantive business decisions. ” The proposed expense reimbursement bylaw would violate Delaware law by not reserving to the Board the power to exercise its fiduciary duty to award expenses as appropriate. n A bylaw proposal seeking to preclude adoption of a stockholder rights plan seems to mandate the Board’s decision in a specific instance (whether or not to adopt the plan) rather than adjust their decisionmaking process. Therefore, most commentators believe Delaware would probably not follow International Brotherhood of Teamsters, and would determine that such stockholder proposed bylaws are invalid.

Stockholder Bylaw Proposals n What would Nevada do? n NRS 78. 120 states that: “[t]he board of directors has full control over the affairs of the corporation. ” This is broader than Delaware’s similar statute, which gives the Board the authority to “manage and direct the business affairs. ” n NRS Sections 78. 139 (3)(b), 78. 195(5), 78. 200 and 78. 378(3) seem intended to grant the Board broad discretion to adopt poison pills.

Stockholder Bylaw Proposals n What would Nevada do? n NRS 78. 120 states that: “[t]he board of directors has full control over the affairs of the corporation. ” This is broader than Delaware’s similar statute, which gives the Board the authority to “manage and direct the business affairs. ” n NRS Sections 78. 139 (3)(b), 78. 195(5), 78. 200 and 78. 378(3) seem intended to grant the Board broad discretion to adopt poison pills.

Hypothetical 4 – Asset Sales In an effort to boost Fun Land’s profits in the face of the threatened takeover, your CEO is contemplating transferring 80% of Fun Land’s assets to a newly formed subsidiary organized in Tax Haven, an offshore island nation with amazing tax advantages. In light of the urgency he does not want to seek stockholder approval.

Hypothetical 4 – Asset Sales In an effort to boost Fun Land’s profits in the face of the threatened takeover, your CEO is contemplating transferring 80% of Fun Land’s assets to a newly formed subsidiary organized in Tax Haven, an offshore island nation with amazing tax advantages. In light of the urgency he does not want to seek stockholder approval.

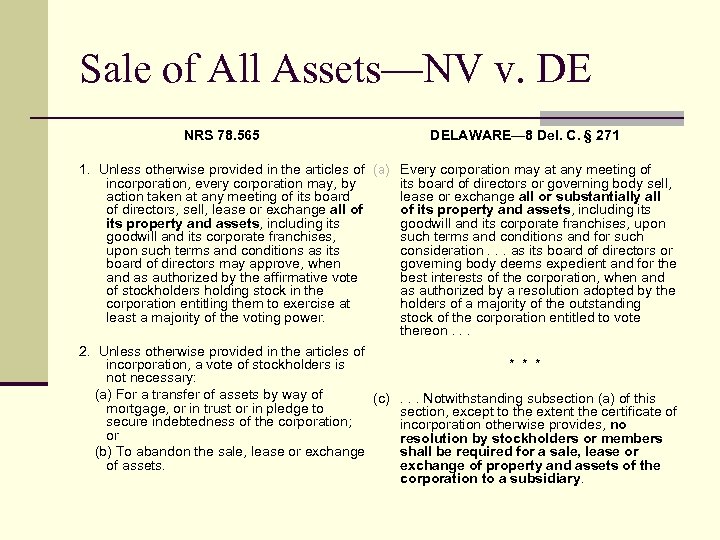

Sale of All Assets—NV v. DE NRS 78. 565 DELAWARE— 8 Del. C. § 271 1. Unless otherwise provided in the articles of (a) Every corporation may at any meeting of incorporation, every corporation may, by its board of directors or governing body sell, action taken at any meeting of its board lease or exchange all or substantially all of directors, sell, lease or exchange all of of its property and assets, including its goodwill and its corporate franchises, upon goodwill and its corporate franchises, such terms and conditions and for such upon such terms and conditions as its consideration. . . as its board of directors or board of directors may approve, when governing body deems expedient and for the and as authorized by the affirmative vote best interests of the corporation, when and of stockholders holding stock in the as authorized by a resolution adopted by the corporation entitling them to exercise at holders of a majority of the outstanding least a majority of the voting power. stock of the corporation entitled to vote thereon. . . 2. Unless otherwise provided in the articles of incorporation, a vote of stockholders is * * * not necessary: (a) For a transfer of assets by way of (c) . . . Notwithstanding subsection (a) of this mortgage, or in trust or in pledge to section, except to the extent the certificate of secure indebtedness of the corporation; incorporation otherwise provides, no or resolution by stockholders or members (b) To abandon the sale, lease or exchange shall be required for a sale, lease or of assets. exchange of property and assets of the corporation to a subsidiary.

Sale of All Assets—NV v. DE NRS 78. 565 DELAWARE— 8 Del. C. § 271 1. Unless otherwise provided in the articles of (a) Every corporation may at any meeting of incorporation, every corporation may, by its board of directors or governing body sell, action taken at any meeting of its board lease or exchange all or substantially all of directors, sell, lease or exchange all of of its property and assets, including its goodwill and its corporate franchises, upon goodwill and its corporate franchises, such terms and conditions and for such upon such terms and conditions as its consideration. . . as its board of directors or board of directors may approve, when governing body deems expedient and for the and as authorized by the affirmative vote best interests of the corporation, when and of stockholders holding stock in the as authorized by a resolution adopted by the corporation entitling them to exercise at holders of a majority of the outstanding least a majority of the voting power. stock of the corporation entitled to vote thereon. . . 2. Unless otherwise provided in the articles of incorporation, a vote of stockholders is * * * not necessary: (a) For a transfer of assets by way of (c) . . . Notwithstanding subsection (a) of this mortgage, or in trust or in pledge to section, except to the extent the certificate of secure indebtedness of the corporation; incorporation otherwise provides, no or resolution by stockholders or members (b) To abandon the sale, lease or exchange shall be required for a sale, lease or of assets. exchange of property and assets of the corporation to a subsidiary.

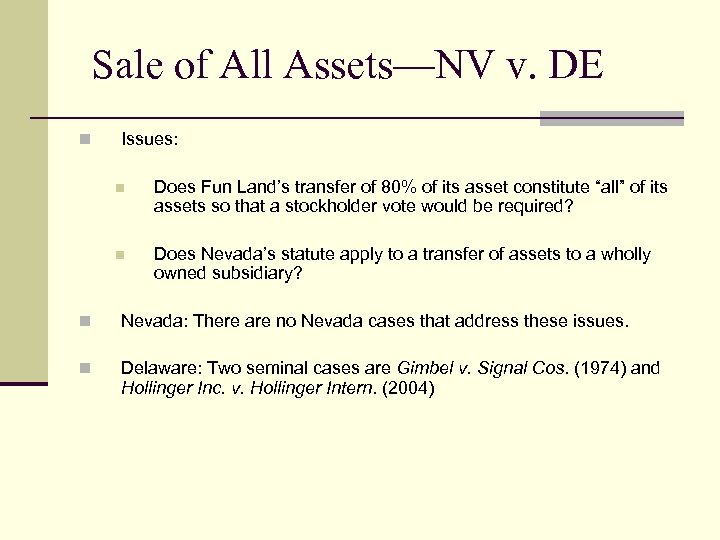

Sale of All Assets—NV v. DE n Issues: n Does Fun Land’s transfer of 80% of its asset constitute “all” of its assets so that a stockholder vote would be required? n Does Nevada’s statute apply to a transfer of assets to a wholly owned subsidiary? n Nevada: There are no Nevada cases that address these issues. n Delaware: Two seminal cases are Gimbel v. Signal Cos. (1974) and Hollinger Inc. v. Hollinger Intern. (2004)

Sale of All Assets—NV v. DE n Issues: n Does Fun Land’s transfer of 80% of its asset constitute “all” of its assets so that a stockholder vote would be required? n Does Nevada’s statute apply to a transfer of assets to a wholly owned subsidiary? n Nevada: There are no Nevada cases that address these issues. n Delaware: Two seminal cases are Gimbel v. Signal Cos. (1974) and Hollinger Inc. v. Hollinger Intern. (2004)

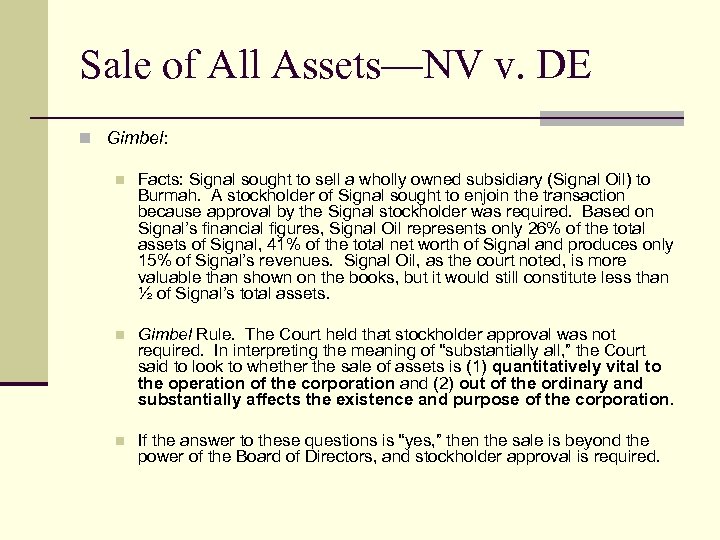

Sale of All Assets—NV v. DE n Gimbel: n Facts: Signal sought to sell a wholly owned subsidiary (Signal Oil) to Burmah. A stockholder of Signal sought to enjoin the transaction because approval by the Signal stockholder was required. Based on Signal’s financial figures, Signal Oil represents only 26% of the total assets of Signal, 41% of the total net worth of Signal and produces only 15% of Signal’s revenues. Signal Oil, as the court noted, is more valuable than shown on the books, but it would still constitute less than ½ of Signal’s total assets. n Gimbel Rule. The Court held that stockholder approval was not required. In interpreting the meaning of “substantially all, ” the Court said to look to whether the sale of assets is (1) quantitatively vital to the operation of the corporation and (2) out of the ordinary and substantially affects the existence and purpose of the corporation. n If the answer to these questions is “yes, ” then the sale is beyond the power of the Board of Directors, and stockholder approval is required.

Sale of All Assets—NV v. DE n Gimbel: n Facts: Signal sought to sell a wholly owned subsidiary (Signal Oil) to Burmah. A stockholder of Signal sought to enjoin the transaction because approval by the Signal stockholder was required. Based on Signal’s financial figures, Signal Oil represents only 26% of the total assets of Signal, 41% of the total net worth of Signal and produces only 15% of Signal’s revenues. Signal Oil, as the court noted, is more valuable than shown on the books, but it would still constitute less than ½ of Signal’s total assets. n Gimbel Rule. The Court held that stockholder approval was not required. In interpreting the meaning of “substantially all, ” the Court said to look to whether the sale of assets is (1) quantitatively vital to the operation of the corporation and (2) out of the ordinary and substantially affects the existence and purpose of the corporation. n If the answer to these questions is “yes, ” then the sale is beyond the power of the Board of Directors, and stockholder approval is required.

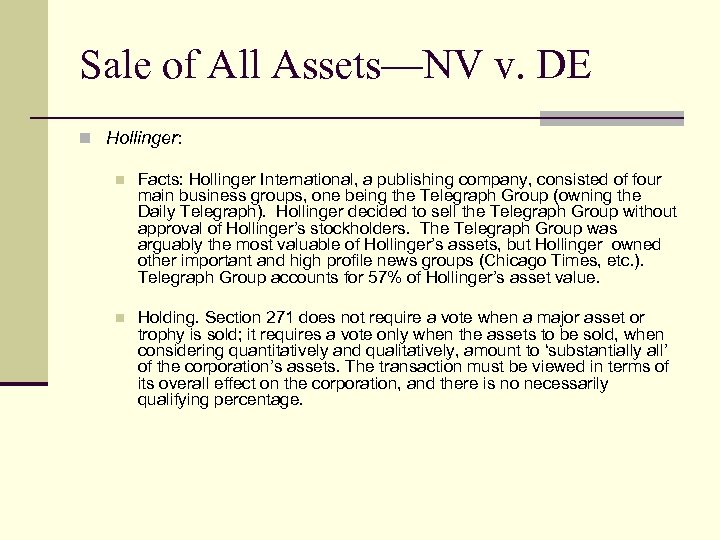

Sale of All Assets—NV v. DE n Hollinger: n Facts: Hollinger International, a publishing company, consisted of four main business groups, one being the Telegraph Group (owning the Daily Telegraph). Hollinger decided to sell the Telegraph Group without approval of Hollinger’s stockholders. The Telegraph Group was arguably the most valuable of Hollinger’s assets, but Hollinger owned other important and high profile news groups (Chicago Times, etc. ). Telegraph Group accounts for 57% of Hollinger’s asset value. n Holding. Section 271 does not require a vote when a major asset or trophy is sold; it requires a vote only when the assets to be sold, when considering quantitatively and qualitatively, amount to ‘substantially all’ of the corporation’s assets. The transaction must be viewed in terms of its overall effect on the corporation, and there is no necessarily qualifying percentage.

Sale of All Assets—NV v. DE n Hollinger: n Facts: Hollinger International, a publishing company, consisted of four main business groups, one being the Telegraph Group (owning the Daily Telegraph). Hollinger decided to sell the Telegraph Group without approval of Hollinger’s stockholders. The Telegraph Group was arguably the most valuable of Hollinger’s assets, but Hollinger owned other important and high profile news groups (Chicago Times, etc. ). Telegraph Group accounts for 57% of Hollinger’s asset value. n Holding. Section 271 does not require a vote when a major asset or trophy is sold; it requires a vote only when the assets to be sold, when considering quantitatively and qualitatively, amount to ‘substantially all’ of the corporation’s assets. The transaction must be viewed in terms of its overall effect on the corporation, and there is no necessarily qualifying percentage.

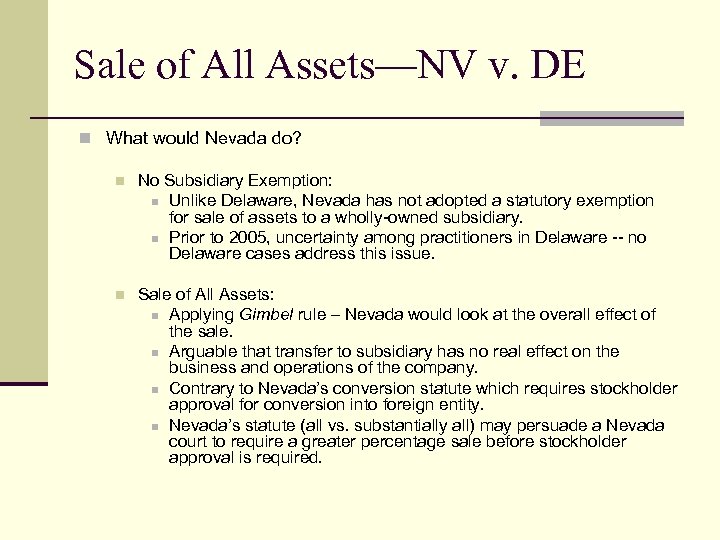

Sale of All Assets—NV v. DE n What would Nevada do? n No Subsidiary Exemption: n Unlike Delaware, Nevada has not adopted a statutory exemption for sale of assets to a wholly-owned subsidiary. n Prior to 2005, uncertainty among practitioners in Delaware -- no Delaware cases address this issue. n Sale of All Assets: n Applying Gimbel rule – Nevada would look at the overall effect of the sale. n Arguable that transfer to subsidiary has no real effect on the business and operations of the company. n Contrary to Nevada’s conversion statute which requires stockholder approval for conversion into foreign entity. n Nevada’s statute (all vs. substantially all) may persuade a Nevada court to require a greater percentage sale before stockholder approval is required.

Sale of All Assets—NV v. DE n What would Nevada do? n No Subsidiary Exemption: n Unlike Delaware, Nevada has not adopted a statutory exemption for sale of assets to a wholly-owned subsidiary. n Prior to 2005, uncertainty among practitioners in Delaware -- no Delaware cases address this issue. n Sale of All Assets: n Applying Gimbel rule – Nevada would look at the overall effect of the sale. n Arguable that transfer to subsidiary has no real effect on the business and operations of the company. n Contrary to Nevada’s conversion statute which requires stockholder approval for conversion into foreign entity. n Nevada’s statute (all vs. substantially all) may persuade a Nevada court to require a greater percentage sale before stockholder approval is required.