883af1a6433e02884249a8e979bc9708.ppt

- Количество слайдов: 21

How to Conceptualize and Value Earnings Growth Jim Ohlson Stern School of Business New York University August 2008

How to Conceptualize and Value Earnings Growth Jim Ohlson Stern School of Business New York University August 2008

Key Result A formula (“OJ”) that expresses value in terms of next year expected EPS and growth in EPS Model Variables: Value depends on n EPS 1: Next-year expected EPS or “forward EPS”. n Year 2 vs. Year 1 growth (STG) in expected EPS n Some measure of long-term growth (LTG) in expected EPS n Discount factor which reflects risk (Cost of Equity Capital) P 0 EPS 1 EPS 2 LTG 2

Key Result A formula (“OJ”) that expresses value in terms of next year expected EPS and growth in EPS Model Variables: Value depends on n EPS 1: Next-year expected EPS or “forward EPS”. n Year 2 vs. Year 1 growth (STG) in expected EPS n Some measure of long-term growth (LTG) in expected EPS n Discount factor which reflects risk (Cost of Equity Capital) P 0 EPS 1 EPS 2 LTG 2

Compelling Empirical Realities n n P 0 / EPS 1 correlates with short-term growth in EPS, but by no means perfectly P 0 / EPS 1 rates often exceed any reasonable estimate of the inverse of the cost of capital Short-term growth in EPS often substantially exceeds any reasonable estimate of cost of capital (e. g. , Google’s growth in estimated 2008 EPS vs. 2008 EPS is 28%) Analysts typically expect that superior EPS growth rates revert to “normal” rates over time 3

Compelling Empirical Realities n n P 0 / EPS 1 correlates with short-term growth in EPS, but by no means perfectly P 0 / EPS 1 rates often exceed any reasonable estimate of the inverse of the cost of capital Short-term growth in EPS often substantially exceeds any reasonable estimate of cost of capital (e. g. , Google’s growth in estimated 2008 EPS vs. 2008 EPS is 28%) Analysts typically expect that superior EPS growth rates revert to “normal” rates over time 3

Implications of Empirical Realities The Constant (Gordon) Growth Model works only if cost of capital exceeds the perpetual growth rate. n One must model a decaying growth rate in EPS when short-term growth is relatively large. n 4

Implications of Empirical Realities The Constant (Gordon) Growth Model works only if cost of capital exceeds the perpetual growth rate. n One must model a decaying growth rate in EPS when short-term growth is relatively large. n 4

Approach to Assumptions n n Short-term growth (EPS 2 vs. EPS 1 adjusted for DPS 1) -- decays gradually to a steady state growth also determines the rate of decay in EPS growth. n P 0 equals the present value of expected DPS using the discount factor r (cost of equity capital). n Assumptions build in dividend policy irrelevancy. 5

Approach to Assumptions n n Short-term growth (EPS 2 vs. EPS 1 adjusted for DPS 1) -- decays gradually to a steady state growth also determines the rate of decay in EPS growth. n P 0 equals the present value of expected DPS using the discount factor r (cost of equity capital). n Assumptions build in dividend policy irrelevancy. 5

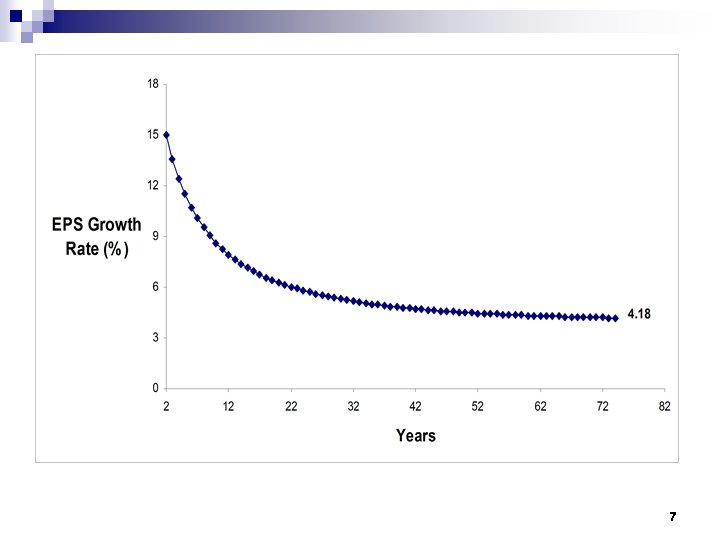

A Hypothetical Example Model Dynamics: Assuming full payout: Numerical illustration: These assumptions imply the following growth pattern. 6

A Hypothetical Example Model Dynamics: Assuming full payout: Numerical illustration: These assumptions imply the following growth pattern. 6

7

7

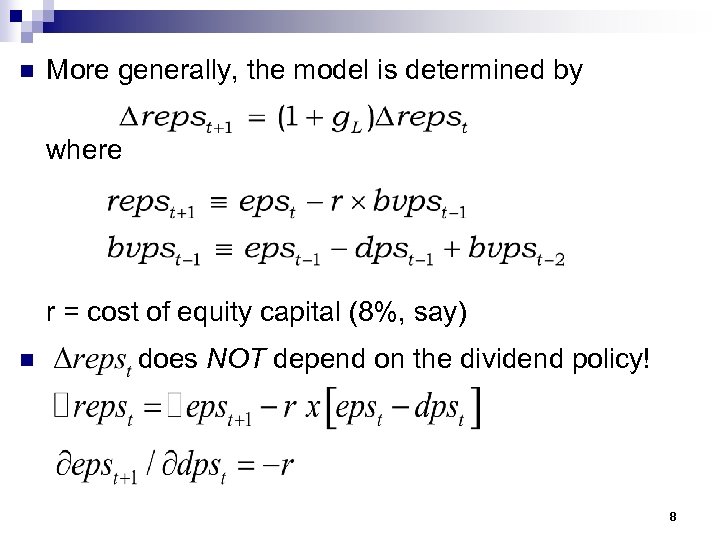

n More generally, the model is determined by where r = cost of equity capital (8%, say) n does NOT depend on the dividend policy! 8

n More generally, the model is determined by where r = cost of equity capital (8%, say) n does NOT depend on the dividend policy! 8

Basic Valuation Formula r = cost of equity capital = long-term EPS growth given full payout = as arguably approximates steady state growth in GNP 9

Basic Valuation Formula r = cost of equity capital = long-term EPS growth given full payout = as arguably approximates steady state growth in GNP 9

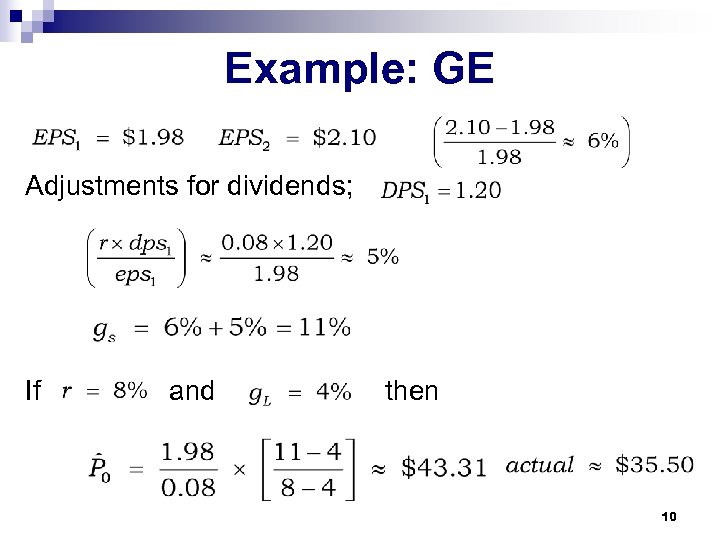

Example: GE Adjustments for dividends; If and then 10

Example: GE Adjustments for dividends; If and then 10

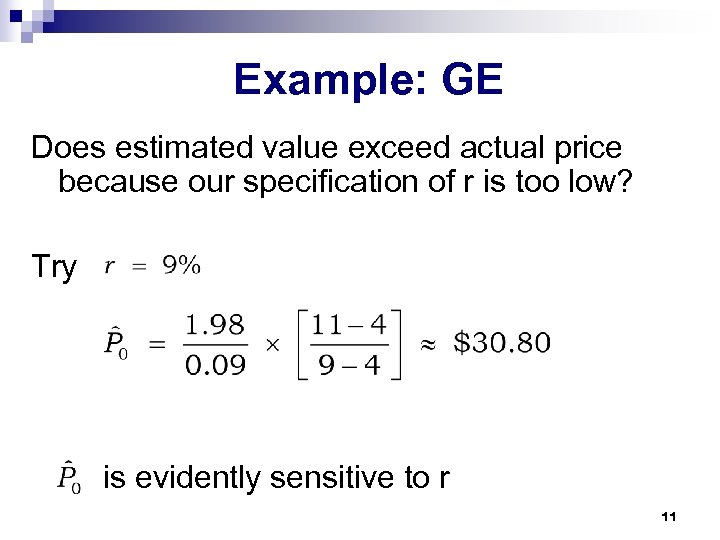

Example: GE Does estimated value exceed actual price because our specification of r is too low? Try is evidently sensitive to r 11

Example: GE Does estimated value exceed actual price because our specification of r is too low? Try is evidently sensitive to r 11

Reverse Engineering: Infer r Familiar Problem: Estimates of intrinsic values are very sensitive to choice of discount factor n A More Sensible Approach: Solve for r given EPS 1/P 0, gs, and g. L. Leads to square-root formula: n 12

Reverse Engineering: Infer r Familiar Problem: Estimates of intrinsic values are very sensitive to choice of discount factor n A More Sensible Approach: Solve for r given EPS 1/P 0, gs, and g. L. Leads to square-root formula: n 12

Reverse Engineering: Infer r n In the case of GE, 13

Reverse Engineering: Infer r n In the case of GE, 13

Comparative analysis r as P 0 r as gs or or EPS 1 g. L If g. L = 0 implies where PEG is “Price-to-Earnings divided by Growth”: 14

Comparative analysis r as P 0 r as gs or or EPS 1 g. L If g. L = 0 implies where PEG is “Price-to-Earnings divided by Growth”: 14

Very popular as a buy/sell signal, given risk is not a problem. n If two firms have the same and then the firm with the higher P 0 / EPS 1 ratio has lower risk. n 15

Very popular as a buy/sell signal, given risk is not a problem. n If two firms have the same and then the firm with the higher P 0 / EPS 1 ratio has lower risk. n 15

What Factors Should Determine r? In theory: r equals expected return, which depends upon risk (e. g. , CAPM b). In practice, r may be affected by the following: n Broader perceptions about equity risk n Market is expecting EPS 1 (and/or EPS 2) will soon be revised. n A high r implies an expected downward revision in EPS, and vice versa. n Mispricing 16

What Factors Should Determine r? In theory: r equals expected return, which depends upon risk (e. g. , CAPM b). In practice, r may be affected by the following: n Broader perceptions about equity risk n Market is expecting EPS 1 (and/or EPS 2) will soon be revised. n A high r implies an expected downward revision in EPS, and vice versa. n Mispricing 16

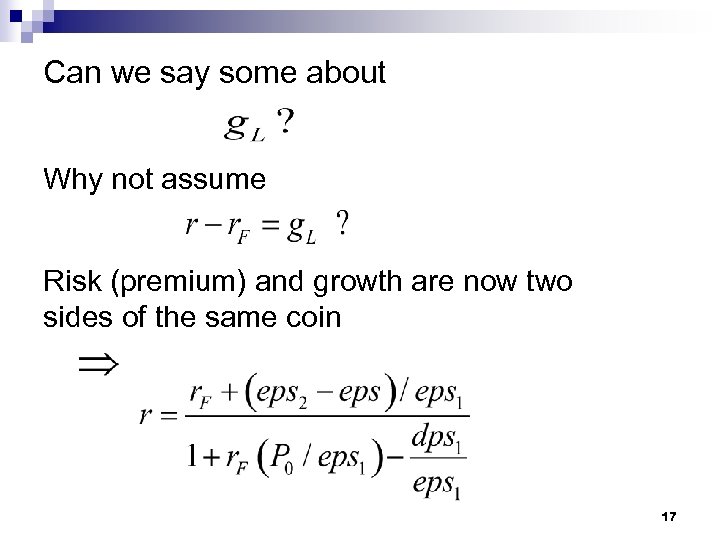

Can we say some about Why not assume Risk (premium) and growth are now two sides of the same coin 17

Can we say some about Why not assume Risk (premium) and growth are now two sides of the same coin 17

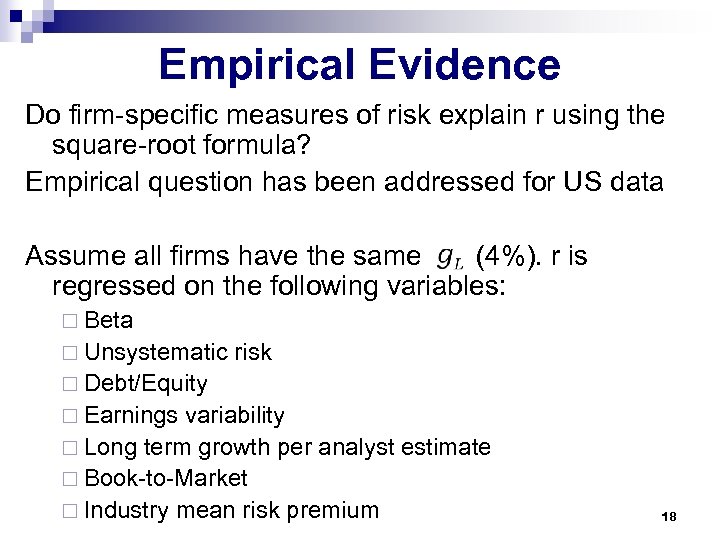

Empirical Evidence Do firm-specific measures of risk explain r using the square-root formula? Empirical question has been addressed for US data Assume all firms have the same (4%). r is regressed on the following variables: ¨ Beta ¨ Unsystematic risk ¨ Debt/Equity ¨ Earnings variability ¨ Long term growth per analyst estimate ¨ Book-to-Market ¨ Industry mean risk premium 18

Empirical Evidence Do firm-specific measures of risk explain r using the square-root formula? Empirical question has been addressed for US data Assume all firms have the same (4%). r is regressed on the following variables: ¨ Beta ¨ Unsystematic risk ¨ Debt/Equity ¨ Earnings variability ¨ Long term growth per analyst estimate ¨ Book-to-Market ¨ Industry mean risk premium 18

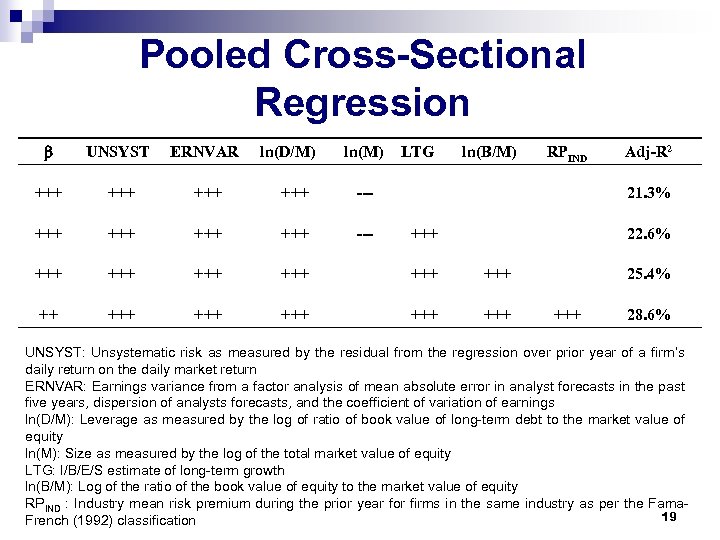

Pooled Cross-Sectional Regression UNSYST ERNVAR +++ +++ --- +++ +++ +++ +++ ln(D/M) ln(M) LTG ln(B/M) RPIND Adj-R 2 21. 3% +++ 22. 6% 25. 4% +++ 28. 6% UNSYST: Unsystematic risk as measured by the residual from the regression over prior year of a firm’s daily return on the daily market return ERNVAR: Earnings variance from a factor analysis of mean absolute error in analyst forecasts in the past five years, dispersion of analysts forecasts, and the coefficient of variation of earnings ln(D/M): Leverage as measured by the log of ratio of book value of long-term debt to the market value of equity ln(M): Size as measured by the log of the total market value of equity LTG: I/B/E/S estimate of long-term growth ln(B/M): Log of the ratio of the book value of equity to the market value of equity RPIND : Industry mean risk premium during the prior year for firms in the same industry as per the Fama 19 French (1992) classification

Pooled Cross-Sectional Regression UNSYST ERNVAR +++ +++ --- +++ +++ +++ +++ ln(D/M) ln(M) LTG ln(B/M) RPIND Adj-R 2 21. 3% +++ 22. 6% 25. 4% +++ 28. 6% UNSYST: Unsystematic risk as measured by the residual from the regression over prior year of a firm’s daily return on the daily market return ERNVAR: Earnings variance from a factor analysis of mean absolute error in analyst forecasts in the past five years, dispersion of analysts forecasts, and the coefficient of variation of earnings ln(D/M): Leverage as measured by the log of ratio of book value of long-term debt to the market value of equity ln(M): Size as measured by the log of the total market value of equity LTG: I/B/E/S estimate of long-term growth ln(B/M): Log of the ratio of the book value of equity to the market value of equity RPIND : Industry mean risk premium during the prior year for firms in the same industry as per the Fama 19 French (1992) classification

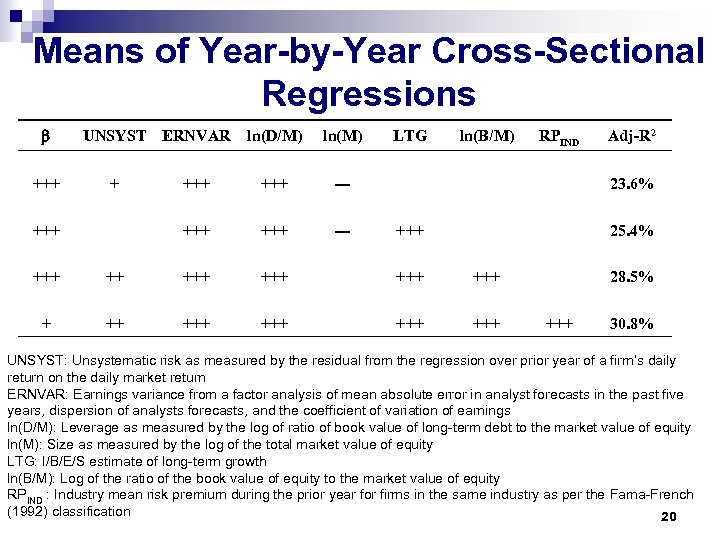

Means of Year-by-Year Cross-Sectional Regressions +++ UNSYST ERNVAR +++ ln(M) +++ --- +++ + ln(D/M) +++ --- LTG ln(B/M) RPIND Adj-R 2 23. 6% +++ 25. 4% +++ +++ +++ +++ 28. 5% +++ 30. 8% UNSYST: Unsystematic risk as measured by the residual from the regression over prior year of a firm’s daily return on the daily market return ERNVAR: Earnings variance from a factor analysis of mean absolute error in analyst forecasts in the past five years, dispersion of analysts forecasts, and the coefficient of variation of earnings ln(D/M): Leverage as measured by the log of ratio of book value of long-term debt to the market value of equity ln(M): Size as measured by the log of the total market value of equity LTG: I/B/E/S estimate of long-term growth ln(B/M): Log of the ratio of the book value of equity to the market value of equity RPIND : Industry mean risk premium during the prior year for firms in the same industry as per the Fama-French (1992) classification 20

Means of Year-by-Year Cross-Sectional Regressions +++ UNSYST ERNVAR +++ ln(M) +++ --- +++ + ln(D/M) +++ --- LTG ln(B/M) RPIND Adj-R 2 23. 6% +++ 25. 4% +++ +++ +++ +++ 28. 5% +++ 30. 8% UNSYST: Unsystematic risk as measured by the residual from the regression over prior year of a firm’s daily return on the daily market return ERNVAR: Earnings variance from a factor analysis of mean absolute error in analyst forecasts in the past five years, dispersion of analysts forecasts, and the coefficient of variation of earnings ln(D/M): Leverage as measured by the log of ratio of book value of long-term debt to the market value of equity ln(M): Size as measured by the log of the total market value of equity LTG: I/B/E/S estimate of long-term growth ln(B/M): Log of the ratio of the book value of equity to the market value of equity RPIND : Industry mean risk premium during the prior year for firms in the same industry as per the Fama-French (1992) classification 20

Summary n n Instead of using a constant growth assumption, we derive a simple formula expressing as a function of four variables: (i) next year estimated EPS (ii) short term EPS growth (iii) long term EPS growth (iv) cost of capital. The valuation formula is easy to implement using analysts’ forecasts. The “square-root” formula expresses the market’s assessment of a firm’s cost of capital; it depends only on (i) P 0 / EPS 1, and (ii), and (iii) Inferred cost of capital (r) are explained by (i) risk (ii) misleading “consensus” estimates of EPS 1 and , (iii) market inefficiencies. 21

Summary n n Instead of using a constant growth assumption, we derive a simple formula expressing as a function of four variables: (i) next year estimated EPS (ii) short term EPS growth (iii) long term EPS growth (iv) cost of capital. The valuation formula is easy to implement using analysts’ forecasts. The “square-root” formula expresses the market’s assessment of a firm’s cost of capital; it depends only on (i) P 0 / EPS 1, and (ii), and (iii) Inferred cost of capital (r) are explained by (i) risk (ii) misleading “consensus” estimates of EPS 1 and , (iii) market inefficiencies. 21