92e48d09de2db99be790985f491d7fb1.ppt

- Количество слайдов: 48

How to Attract Investors Fifth Annual Conference of the Technopolicy Network. Halifax, Nova Scotia, Canada September 2008 “Show Me the MONEY !$$$$!” Professor Alan Barrell

How to Attract Investors Fifth Annual Conference of the Technopolicy Network. Halifax, Nova Scotia, Canada September 2008 “Show Me the MONEY !$$$$!” Professor Alan Barrell

Attracting Investors - Some Issues…. There will be more…. § WHO – might be the investors? Types and motivations § Knowing their Goals and Criteria § Innovative Regions and Sub-Regions - special conditions § “Investment Readiness” – A big issue…. § Preparation, Support and Presentation § What do Investors look for? How to find out? § Connecting with Investors – importance of Networking § The “rock and hard place” of Valuation § The issues of “Matching” – it isn’t just the money! What else do we get ? § The Investment Climate !!!!

Attracting Investors - Some Issues…. There will be more…. § WHO – might be the investors? Types and motivations § Knowing their Goals and Criteria § Innovative Regions and Sub-Regions - special conditions § “Investment Readiness” – A big issue…. § Preparation, Support and Presentation § What do Investors look for? How to find out? § Connecting with Investors – importance of Networking § The “rock and hard place” of Valuation § The issues of “Matching” – it isn’t just the money! What else do we get ? § The Investment Climate !!!!

Would you invest in this team ?

Would you invest in this team ?

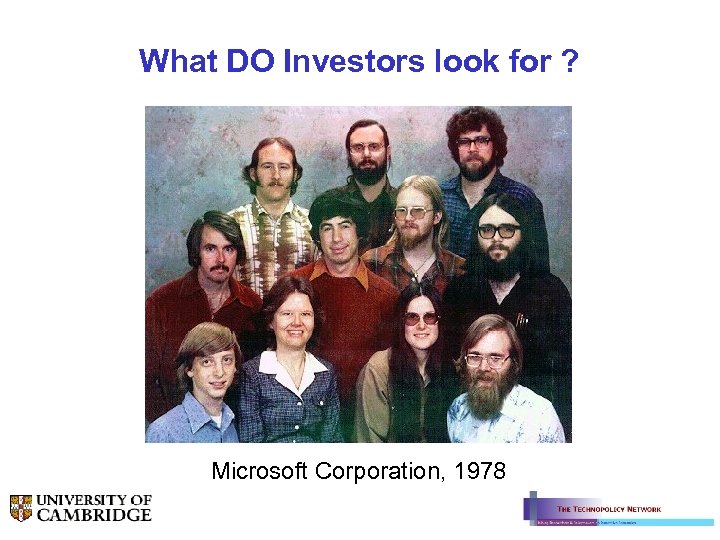

What DO Investors look for ? Microsoft Corporation, 1978

What DO Investors look for ? Microsoft Corporation, 1978

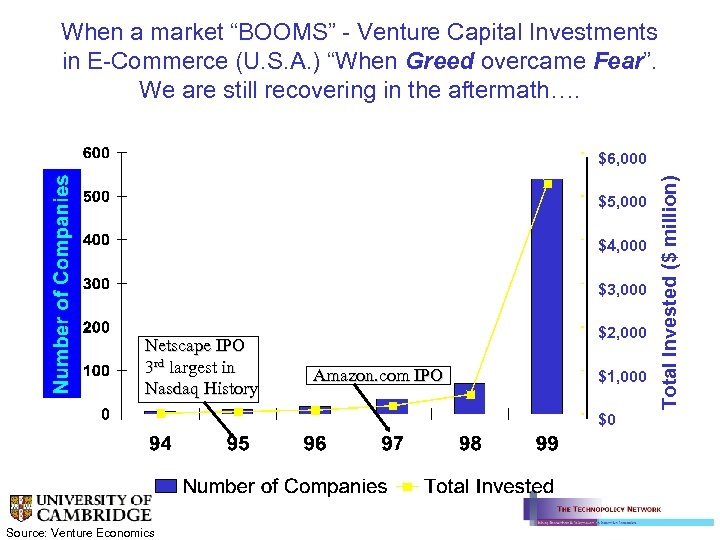

When a market “BOOMS” - Venture Capital Investments in E-Commerce (U. S. A. ) “When Greed overcame Fear”. We are still recovering in the aftermath…. $5, 000 $4, 000 $3, 000 Netscape IPO 3 rd largest in Nasdaq History $2, 000 Amazon. com IPO $1, 000 $0 Source: Venture Economics Total Invested ($ million) $6, 000

When a market “BOOMS” - Venture Capital Investments in E-Commerce (U. S. A. ) “When Greed overcame Fear”. We are still recovering in the aftermath…. $5, 000 $4, 000 $3, 000 Netscape IPO 3 rd largest in Nasdaq History $2, 000 Amazon. com IPO $1, 000 $0 Source: Venture Economics Total Invested ($ million) $6, 000

Stay Cool! Dilbert - Scott Adams

Stay Cool! Dilbert - Scott Adams

Stay Cool! Dilbert - Scott Adams

Stay Cool! Dilbert - Scott Adams

Stay Cool! Dilbert - Scott Adams

Stay Cool! Dilbert - Scott Adams

What do investors look for in an Entrepreneur ? “You look at things and ask - why? but I dream of things that never were and ask why not? ” George Bernard Shaw

What do investors look for in an Entrepreneur ? “You look at things and ask - why? but I dream of things that never were and ask why not? ” George Bernard Shaw

And they look for “change agents” Joseph Schumpeter (1911) “Entrepreneurs blow gales of creative destruction. ” Role of the entrepreneur in transforming economies by developing: · New products · New methods of production · New ways of organizing · Untapped raw materials · Enhanced competitive performance

And they look for “change agents” Joseph Schumpeter (1911) “Entrepreneurs blow gales of creative destruction. ” Role of the entrepreneur in transforming economies by developing: · New products · New methods of production · New ways of organizing · Untapped raw materials · Enhanced competitive performance

What else do investors like to see? . .

What else do investors like to see? . .

Einstein on IMAGINATION…. “Imagination is more important than knowledge. Knowledge is limited. Imagination encircles the world” Albert Einstein 1879 - 1955

Einstein on IMAGINATION…. “Imagination is more important than knowledge. Knowledge is limited. Imagination encircles the world” Albert Einstein 1879 - 1955

Do investors really like Risk ?

Do investors really like Risk ?

If at first you don’t succeed…. try again…. but learn from the mistakes! Can RISK be eliminated ?

If at first you don’t succeed…. try again…. but learn from the mistakes! Can RISK be eliminated ?

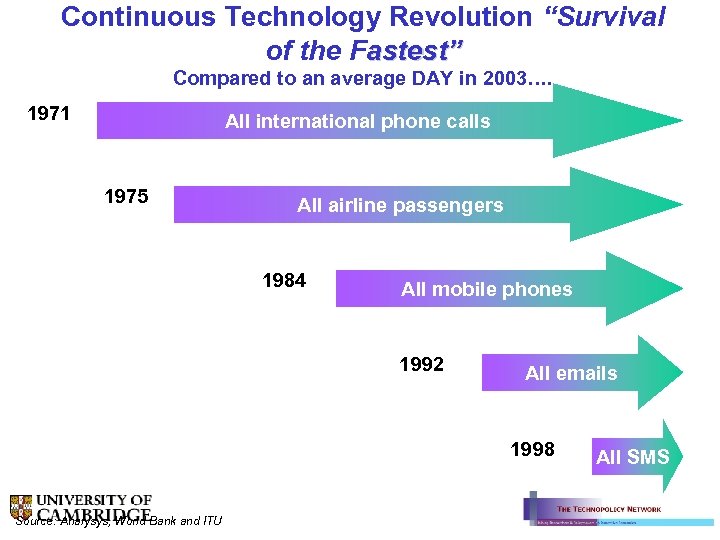

Continuous Technology Revolution “Survival of the Fastest” Compared to an average DAY in 2003…. 1971 All international phone calls 1975 All airline passengers 1984 All mobile phones 1992 All emails 1998 Source: Analysys, World Bank and ITU All SMS

Continuous Technology Revolution “Survival of the Fastest” Compared to an average DAY in 2003…. 1971 All international phone calls 1975 All airline passengers 1984 All mobile phones 1992 All emails 1998 Source: Analysys, World Bank and ITU All SMS

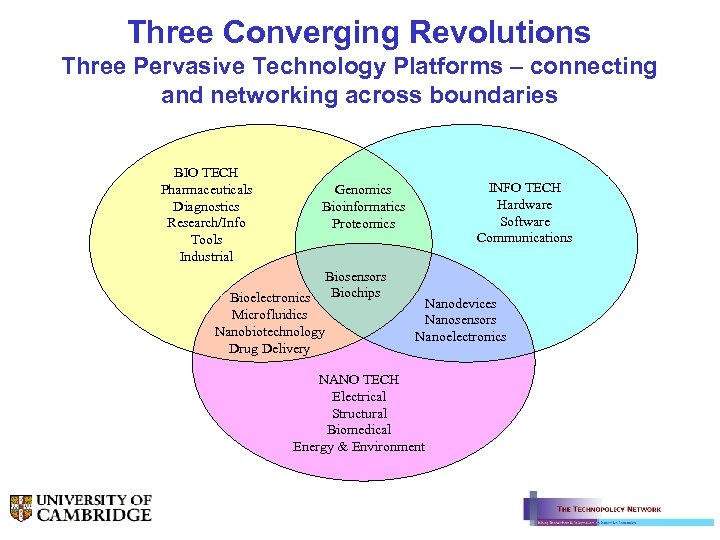

Three Converging Revolutions Three Pervasive Technology Platforms – connecting and networking across boundaries BIO TECH Pharmaceuticals Diagnostics Research/Info Tools Industrial INFO TECH Hardware Software Communications Genomics Bioinformatics Proteomics Bioelectronics Microfluidics Nanobiotechnology Drug Delivery Biosensors Biochips Nanodevices Nanosensors Nanoelectronics NANO TECH Electrical Structural Biomedical Energy & Environment

Three Converging Revolutions Three Pervasive Technology Platforms – connecting and networking across boundaries BIO TECH Pharmaceuticals Diagnostics Research/Info Tools Industrial INFO TECH Hardware Software Communications Genomics Bioinformatics Proteomics Bioelectronics Microfluidics Nanobiotechnology Drug Delivery Biosensors Biochips Nanodevices Nanosensors Nanoelectronics NANO TECH Electrical Structural Biomedical Energy & Environment

Characteristics for High Technology Regions – and potential for talent and $$$$ to meet § § Universities and centres of academic excellence Entrepreneurs with marketable ideas and products § Business angels and established seed funds § Sources of early stage venture capital § Core of successful large companies § Quality management teams and talent § Supportive infrastructure § Affordable space for growing businesses § Access to capital markets § Attractive living environment and accommodation § Social and Business Networks - Connectivity source : - Gibbons - Stanford University 1998

Characteristics for High Technology Regions – and potential for talent and $$$$ to meet § § Universities and centres of academic excellence Entrepreneurs with marketable ideas and products § Business angels and established seed funds § Sources of early stage venture capital § Core of successful large companies § Quality management teams and talent § Supportive infrastructure § Affordable space for growing businesses § Access to capital markets § Attractive living environment and accommodation § Social and Business Networks - Connectivity source : - Gibbons - Stanford University 1998

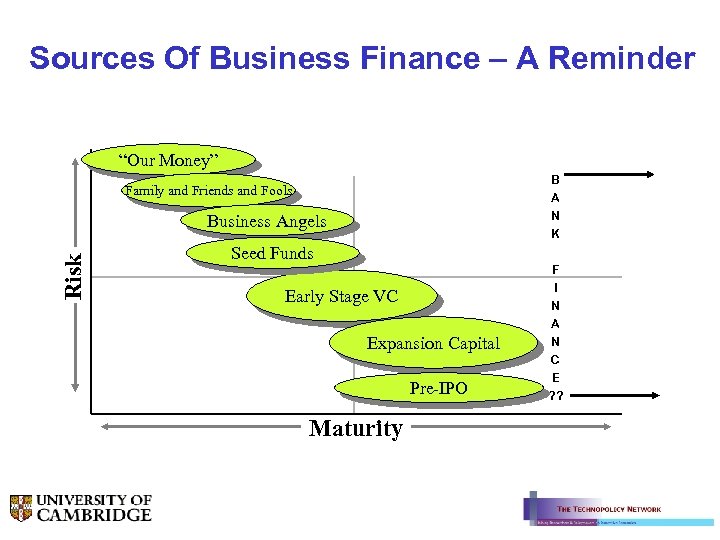

Sources Of Business Finance – A Reminder “Our Money” B A Family and Friends and Fools N K Risk Business Angels Seed Funds Early Stage VC Expansion Capital Pre-IPO Maturity F I N A N C E ? ?

Sources Of Business Finance – A Reminder “Our Money” B A Family and Friends and Fools N K Risk Business Angels Seed Funds Early Stage VC Expansion Capital Pre-IPO Maturity F I N A N C E ? ?

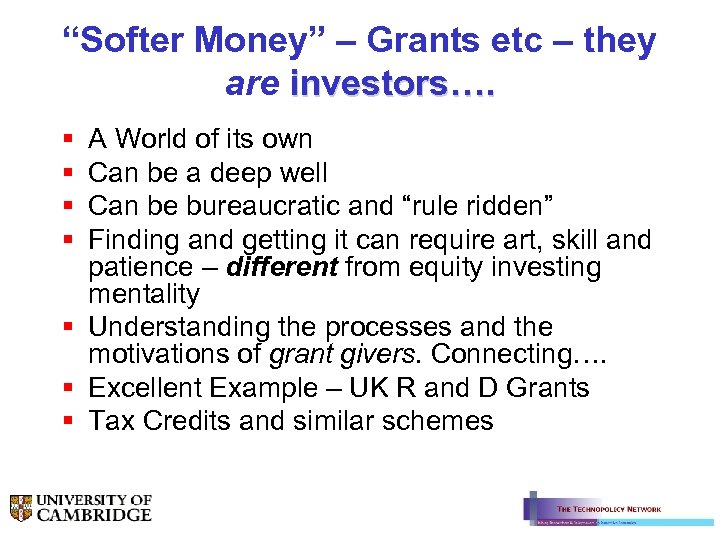

“Softer Money” – Grants etc – they are investors…. § § A World of its own Can be a deep well Can be bureaucratic and “rule ridden” Finding and getting it can require art, skill and patience – different from equity investing mentality § Understanding the processes and the motivations of grant givers. Connecting…. § Excellent Example – UK R and D Grants § Tax Credits and similar schemes

“Softer Money” – Grants etc – they are investors…. § § A World of its own Can be a deep well Can be bureaucratic and “rule ridden” Finding and getting it can require art, skill and patience – different from equity investing mentality § Understanding the processes and the motivations of grant givers. Connecting…. § Excellent Example – UK R and D Grants § Tax Credits and similar schemes

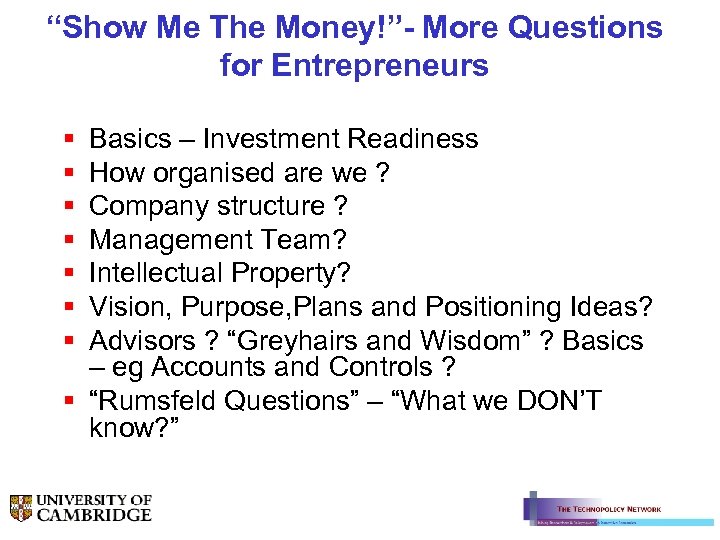

“Show Me The Money!”- More Questions for Entrepreneurs § § § § Basics – Investment Readiness How organised are we ? Company structure ? Management Team? Intellectual Property? Vision, Purpose, Plans and Positioning Ideas? Advisors ? “Greyhairs and Wisdom” ? Basics – eg Accounts and Controls ? § “Rumsfeld Questions” – “What we DON’T know? ”

“Show Me The Money!”- More Questions for Entrepreneurs § § § § Basics – Investment Readiness How organised are we ? Company structure ? Management Team? Intellectual Property? Vision, Purpose, Plans and Positioning Ideas? Advisors ? “Greyhairs and Wisdom” ? Basics – eg Accounts and Controls ? § “Rumsfeld Questions” – “What we DON’T know? ”

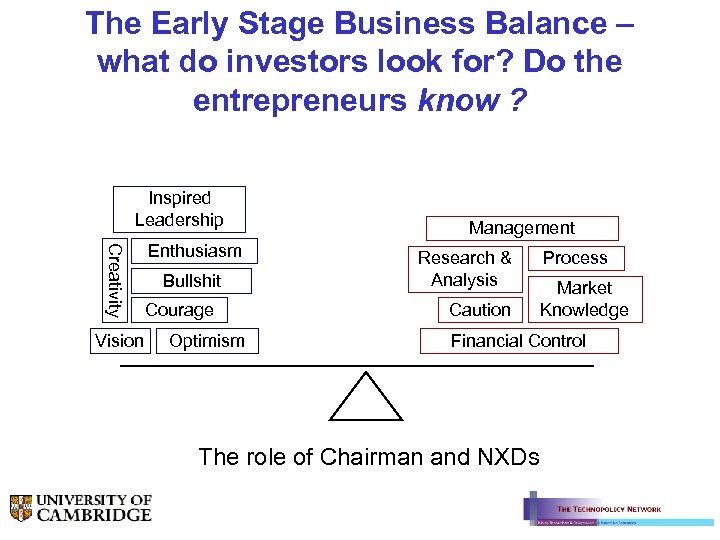

The Early Stage Business Balance – what do investors look for? Do the entrepreneurs know ? Inspired Leadership Creativity Vision Enthusiasm Bullshit Courage Optimism Management Research & Analysis Caution Process Market Knowledge Financial Control The role of Chairman and NXDs

The Early Stage Business Balance – what do investors look for? Do the entrepreneurs know ? Inspired Leadership Creativity Vision Enthusiasm Bullshit Courage Optimism Management Research & Analysis Caution Process Market Knowledge Financial Control The role of Chairman and NXDs

Valuation – how and why? – Destroying the myths – “Valuations to die for…. ” § Why do we need it ? -To indicate value to potential investors § What is a company worth? - What someone will pay for it § What is this determined by? - Other investment choices (there are usually MANY !)

Valuation – how and why? – Destroying the myths – “Valuations to die for…. ” § Why do we need it ? -To indicate value to potential investors § What is a company worth? - What someone will pay for it § What is this determined by? - Other investment choices (there are usually MANY !)

Connecting Investors to Entrepreneurs Two Way Experiences in “The Cambridge Cluster and an Enlightened Europe” From – “Poacher and Gamekeeper “…. Alan Barrell Entrepreneur in Residence – University of Cambridge

Connecting Investors to Entrepreneurs Two Way Experiences in “The Cambridge Cluster and an Enlightened Europe” From – “Poacher and Gamekeeper “…. Alan Barrell Entrepreneur in Residence – University of Cambridge

How and Where do Investors and Entrepreneurs find each other and get connected ? ?

How and Where do Investors and Entrepreneurs find each other and get connected ? ?

But I work in The East of England Region – and in France Map of Silicon Valley inset Cambridge source: Cambridge 2020 report - 1998

But I work in The East of England Region – and in France Map of Silicon Valley inset Cambridge source: Cambridge 2020 report - 1998

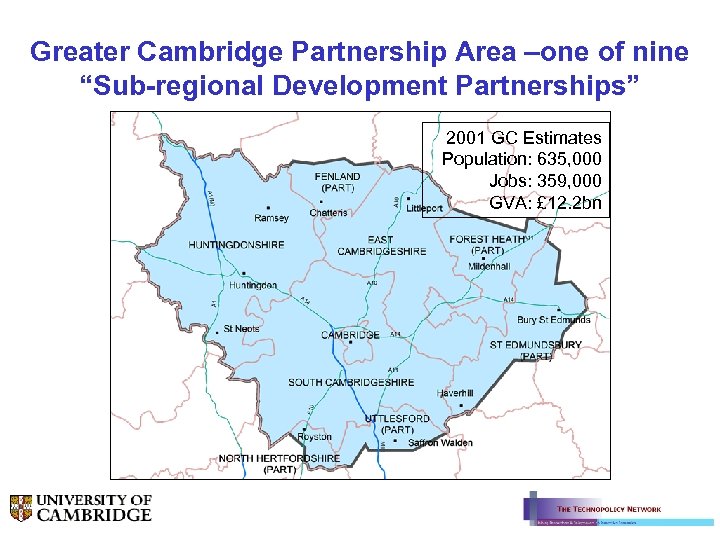

Greater Cambridge Partnership Area –one of nine “Sub-regional Development Partnerships” 2001 GC Estimates Population: 635, 000 Jobs: 359, 000 GVA: £ 12. 2 bn

Greater Cambridge Partnership Area –one of nine “Sub-regional Development Partnerships” 2001 GC Estimates Population: 635, 000 Jobs: 359, 000 GVA: £ 12. 2 bn

Trinity College’s History and Scientific Development – Cambridge – Science, Innovation and Invention § Trinity always had a strong scientific tradition* § First use of the word “scientist” 1835 (Whewell) § First European Science Park – 1970 – Dr Sir John Bradfield *Alumni include Newton, Clerk-Maxwell, Rayleigh, Thomson, Walton, Rutherford, Aston, Lyle, both Braggs, Bohr, Hopkins, Klug, Kendrew

Trinity College’s History and Scientific Development – Cambridge – Science, Innovation and Invention § Trinity always had a strong scientific tradition* § First use of the word “scientist” 1835 (Whewell) § First European Science Park – 1970 – Dr Sir John Bradfield *Alumni include Newton, Clerk-Maxwell, Rayleigh, Thomson, Walton, Rutherford, Aston, Lyle, both Braggs, Bohr, Hopkins, Klug, Kendrew

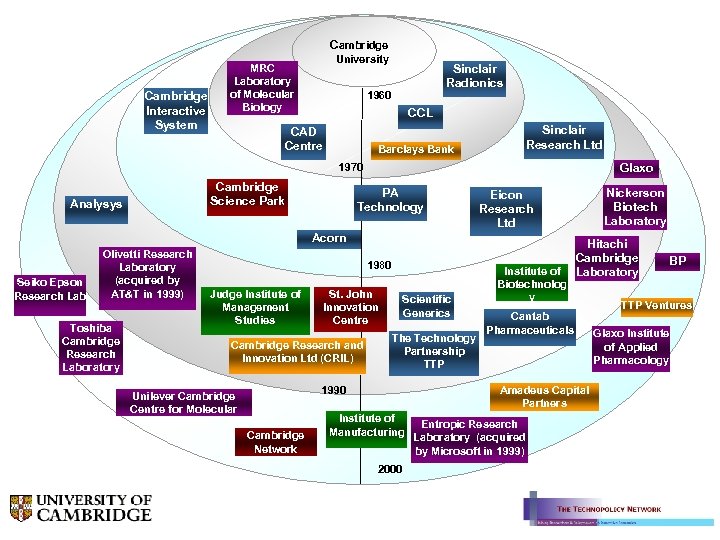

Cambridge Interactive System University MRC Laboratory of Molecular Biology Sinclair Radionics 1960 CCL CAD Centre Sinclair Research Ltd Barclays Bank 1970 Cambridge Science Park Analysys Glaxo PA Technology Acorn Seiko Epson Research Lab Olivetti Research Laboratory (acquired by AT&T in 1999) Toshiba Cambridge Research Laboratory 1980 Judge Institute of Management Studies St. John Innovation Centre Cambridge Research and Innovation Ltd (CRIL) Scientific Generics The Technology Partnership TTP 1990 Unilever Cambridge Centre for Molecular Informatics Cambridge Network Nickerson Biotech Laboratory Eicon Research Ltd Institute of Biotechnolog y Hitachi Cambridge Laboratory Cantab Pharmaceuticals Amadeus Capital Partners Institute of Manufacturing 2000 Entropic Research Laboratory (acquired by Microsoft in 1999) BP TTP Ventures Glaxo Institute of Applied Pharmacology

Cambridge Interactive System University MRC Laboratory of Molecular Biology Sinclair Radionics 1960 CCL CAD Centre Sinclair Research Ltd Barclays Bank 1970 Cambridge Science Park Analysys Glaxo PA Technology Acorn Seiko Epson Research Lab Olivetti Research Laboratory (acquired by AT&T in 1999) Toshiba Cambridge Research Laboratory 1980 Judge Institute of Management Studies St. John Innovation Centre Cambridge Research and Innovation Ltd (CRIL) Scientific Generics The Technology Partnership TTP 1990 Unilever Cambridge Centre for Molecular Informatics Cambridge Network Nickerson Biotech Laboratory Eicon Research Ltd Institute of Biotechnolog y Hitachi Cambridge Laboratory Cantab Pharmaceuticals Amadeus Capital Partners Institute of Manufacturing 2000 Entropic Research Laboratory (acquired by Microsoft in 1999) BP TTP Ventures Glaxo Institute of Applied Pharmacology

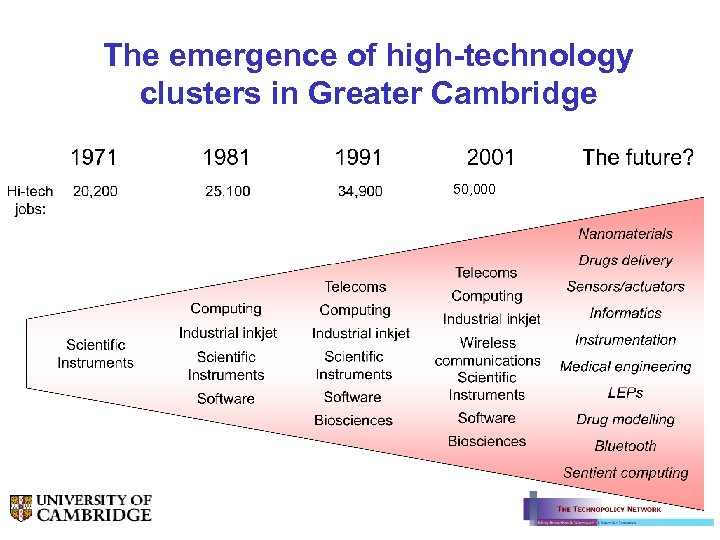

The emergence of high-technology clusters in Greater Cambridge 50, 000

The emergence of high-technology clusters in Greater Cambridge 50, 000

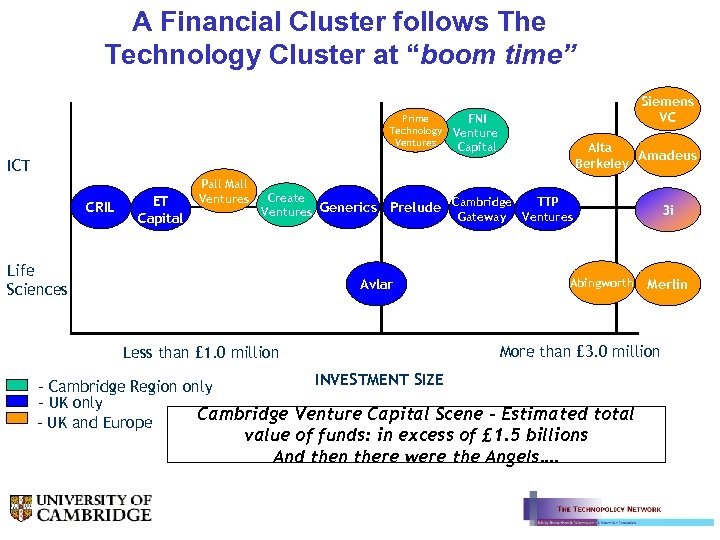

A Financial Cluster follows The Technology Cluster at “boom time” Prime Technology Ventures Siemens VC FNI Venture Capital Alta Amadeus Berkeley ICT CRIL ET Capital Pall Mall Ventures Create Ventures Generics Life Sciences Prelude Cambridge Avlar Less than £ 1. 0 million Gateway TTP Ventures Abingworth 3 i Merlin More than £ 3. 0 million INVESTMENT SIZE - Cambridge Region only - UK only Cambridge Venture Capital Scene – Estimated total - UK and Europe value of funds: in excess of £ 1. 5 billions And then there were the Angels….

A Financial Cluster follows The Technology Cluster at “boom time” Prime Technology Ventures Siemens VC FNI Venture Capital Alta Amadeus Berkeley ICT CRIL ET Capital Pall Mall Ventures Create Ventures Generics Life Sciences Prelude Cambridge Avlar Less than £ 1. 0 million Gateway TTP Ventures Abingworth 3 i Merlin More than £ 3. 0 million INVESTMENT SIZE - Cambridge Region only - UK only Cambridge Venture Capital Scene – Estimated total - UK and Europe value of funds: in excess of £ 1. 5 billions And then there were the Angels….

Connecting and Information Points and principles § Networks and Networking – importance +++++ § Business Schools and Entrepreneurship Centres Region wide and cross border § Other Entrepreneurs / Support and Mentoring Structures § Online Channels – numerous eg…. www. funded. com § “Network Nodes” – Individual referrals § Cross Border contacts § Attitudes and Culture

Connecting and Information Points and principles § Networks and Networking – importance +++++ § Business Schools and Entrepreneurship Centres Region wide and cross border § Other Entrepreneurs / Support and Mentoring Structures § Online Channels – numerous eg…. www. funded. com § “Network Nodes” – Individual referrals § Cross Border contacts § Attitudes and Culture

Thinking Of Angels! – we keep referring to them !

Thinking Of Angels! – we keep referring to them !

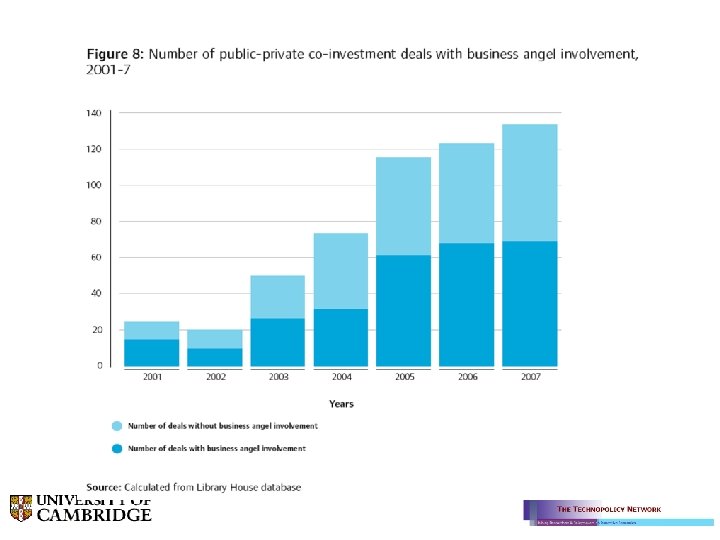

US Angels – The REAL early stage funders ! § In 2000 US business Angels invested more than $200 billions in early stage companies § This was much more than the so called “venture capital industry” which did not reach investment levels that year of $150 billions. § In the difficult year of 2002 – when VCS “sat on hands” – Cambridge Angels kept the early stage and emerging business sector alive and well § Cambridge Angels are adopting the US success model and working more closely together.

US Angels – The REAL early stage funders ! § In 2000 US business Angels invested more than $200 billions in early stage companies § This was much more than the so called “venture capital industry” which did not reach investment levels that year of $150 billions. § In the difficult year of 2002 – when VCS “sat on hands” – Cambridge Angels kept the early stage and emerging business sector alive and well § Cambridge Angels are adopting the US success model and working more closely together.

“Syndication Nodes” and Business Angels – Connecting in and from Cambridge § Cambridge has four active Angel Groups – Cambridge Angels, Cambridge Capital Group, Equus, G. Eastern Investment Forum § MOUs and Syndication with- Other UK Angels, Sophia Angels ( France) Luxembourg BAN, B. A. of Slovenia, US Angels Networked with all known, useful VCs and Grant bodies § Joint events, Deal and Portfolio Sharing § Common Network and Portfolio Management Angelsoft § Keeping well informed – eg. French Wealth Tax changes – Transformational impact. § Strong International VC connections

“Syndication Nodes” and Business Angels – Connecting in and from Cambridge § Cambridge has four active Angel Groups – Cambridge Angels, Cambridge Capital Group, Equus, G. Eastern Investment Forum § MOUs and Syndication with- Other UK Angels, Sophia Angels ( France) Luxembourg BAN, B. A. of Slovenia, US Angels Networked with all known, useful VCs and Grant bodies § Joint events, Deal and Portfolio Sharing § Common Network and Portfolio Management Angelsoft § Keeping well informed – eg. French Wealth Tax changes – Transformational impact. § Strong International VC connections

The Business Angels we help Entrepreneurs look for…. Cambridge Mentors Database § § § § § Technical Expertise Marketing Expertise Those who bring added Contacts & Networks value – in one or all of…. Decision Making skills Presentation skills Dealmaking skills Money-raising skills Other Financial skills Possible exit routes and practical help with exit – international focus 7

The Business Angels we help Entrepreneurs look for…. Cambridge Mentors Database § § § § § Technical Expertise Marketing Expertise Those who bring added Contacts & Networks value – in one or all of…. Decision Making skills Presentation skills Dealmaking skills Money-raising skills Other Financial skills Possible exit routes and practical help with exit – international focus 7

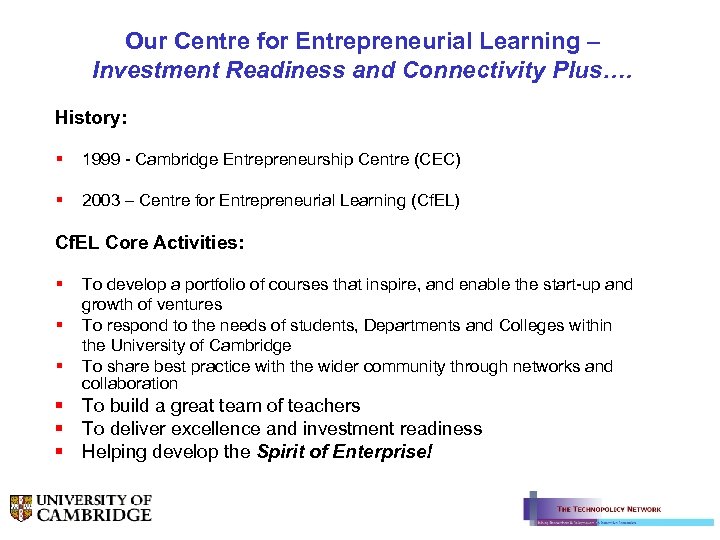

Our Centre for Entrepreneurial Learning – Investment Readiness and Connectivity Plus…. History: § 1999 - Cambridge Entrepreneurship Centre (CEC) § 2003 – Centre for Entrepreneurial Learning (Cf. EL) Cf. EL Core Activities: § § § To develop a portfolio of courses that inspire, and enable the start-up and growth of ventures To respond to the needs of students, Departments and Colleges within the University of Cambridge To share best practice with the wider community through networks and collaboration § To build a great team of teachers § To deliver excellence and investment readiness § Helping develop the Spirit of Enterprise!

Our Centre for Entrepreneurial Learning – Investment Readiness and Connectivity Plus…. History: § 1999 - Cambridge Entrepreneurship Centre (CEC) § 2003 – Centre for Entrepreneurial Learning (Cf. EL) Cf. EL Core Activities: § § § To develop a portfolio of courses that inspire, and enable the start-up and growth of ventures To respond to the needs of students, Departments and Colleges within the University of Cambridge To share best practice with the wider community through networks and collaboration § To build a great team of teachers § To deliver excellence and investment readiness § Helping develop the Spirit of Enterprise!

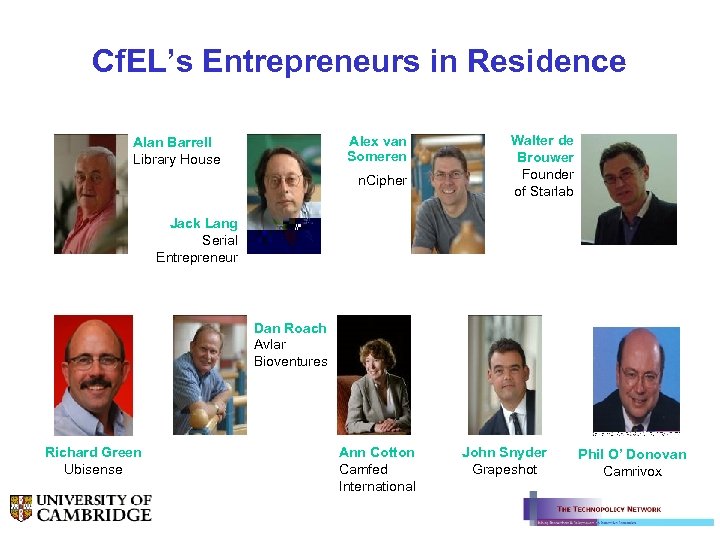

Cf. EL’s Entrepreneurs in Residence Alex van Someren Alan Barrell Library House n. Cipher Walter de Brouwer Founder of Starlab Jack Lang Serial Entrepreneur Dan Roach Avlar Bioventures Richard Green Ubisense Ann Cotton Camfed International John Snyder Grapeshot Phil O’ Donovan Camrivox

Cf. EL’s Entrepreneurs in Residence Alex van Someren Alan Barrell Library House n. Cipher Walter de Brouwer Founder of Starlab Jack Lang Serial Entrepreneur Dan Roach Avlar Bioventures Richard Green Ubisense Ann Cotton Camfed International John Snyder Grapeshot Phil O’ Donovan Camrivox

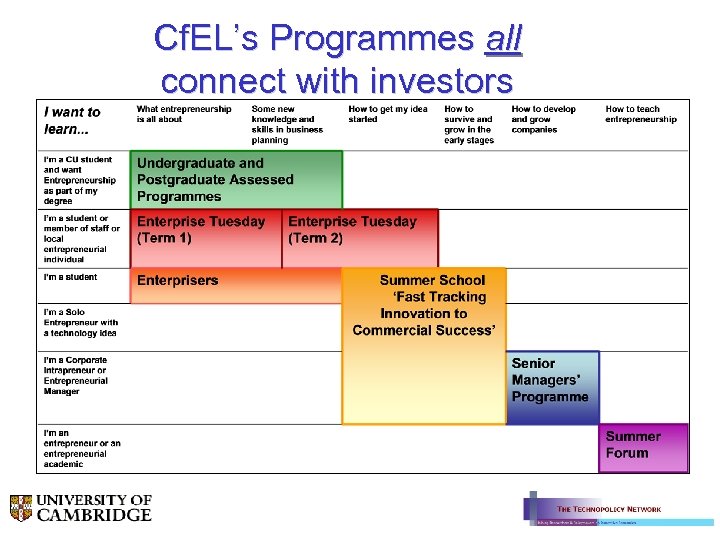

Cf. EL’s Programmes all connect with investors

Cf. EL’s Programmes all connect with investors

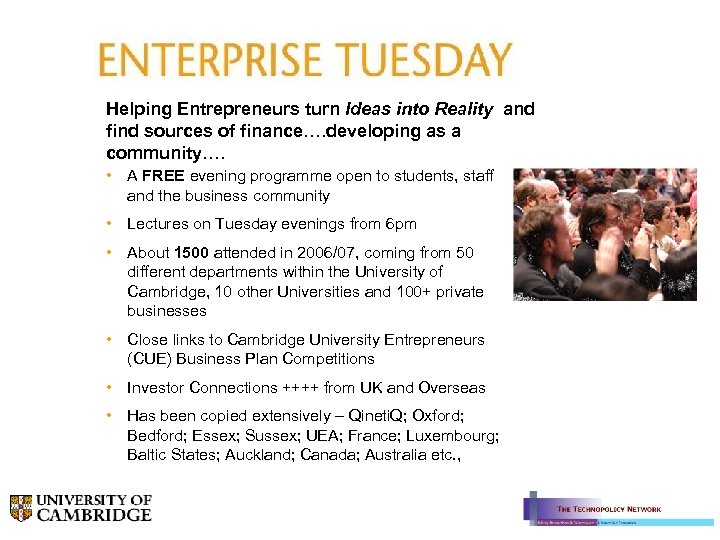

Helping Entrepreneurs turn Ideas into Reality and find sources of finance…. developing as a community…. • A FREE evening programme open to students, staff and the business community • Lectures on Tuesday evenings from 6 pm • About 1500 attended in 2006/07, coming from 50 different departments within the University of Cambridge, 10 other Universities and 100+ private businesses • Close links to Cambridge University Entrepreneurs (CUE) Business Plan Competitions • Investor Connections ++++ from UK and Overseas • Has been copied extensively – Qineti. Q; Oxford; Bedford; Essex; Sussex; UEA; France; Luxembourg; Baltic States; Auckland; Canada; Australia etc. ,

Helping Entrepreneurs turn Ideas into Reality and find sources of finance…. developing as a community…. • A FREE evening programme open to students, staff and the business community • Lectures on Tuesday evenings from 6 pm • About 1500 attended in 2006/07, coming from 50 different departments within the University of Cambridge, 10 other Universities and 100+ private businesses • Close links to Cambridge University Entrepreneurs (CUE) Business Plan Competitions • Investor Connections ++++ from UK and Overseas • Has been copied extensively – Qineti. Q; Oxford; Bedford; Essex; Sussex; UEA; France; Luxembourg; Baltic States; Auckland; Canada; Australia etc. ,

Developing “Enterprisers” § An intensive four day residential programme for energetic individuals, from any organisation, background or discipline. Connecting, Networking and Learning. § Focus on developing fundamental entrepreneurial skills § Networking opportunity – investors attend § Run by facilitators, Enterprisers alumni and faculty members from universities § Unlocks creativity, confidence and a ‘can do’ attitude

Developing “Enterprisers” § An intensive four day residential programme for energetic individuals, from any organisation, background or discipline. Connecting, Networking and Learning. § Focus on developing fundamental entrepreneurial skills § Networking opportunity – investors attend § Run by facilitators, Enterprisers alumni and faculty members from universities § Unlocks creativity, confidence and a ‘can do’ attitude

Thank you for your attention…. More on my website – www. alanbarrell. com E-mail – alan@alanbarrell. com

Thank you for your attention…. More on my website – www. alanbarrell. com E-mail – alan@alanbarrell. com