861b2d3b48e6fe6dc46e547584015e58.ppt

- Количество слайдов: 27

How important are tariffs and nontariff measures for developing countries’ agricultural processed products exports? Dr Sushil Mohan Head of Economics Brighton Business School s. mohan@brighton. ac. uk

How important are tariffs and nontariff measures for developing countries’ agricultural processed products exports? Dr Sushil Mohan Head of Economics Brighton Business School s. mohan@brighton. ac. uk

Motivation • Agriculture important for developing countries (DCs) – 50 -70% of their GDP – DCs main producers of agri-products • 2/3 rd of world production (FAOSTAT, 2016) • Yet developed countries main exporters of agricultural products

Motivation • Agriculture important for developing countries (DCs) – 50 -70% of their GDP – DCs main producers of agri-products • 2/3 rd of world production (FAOSTAT, 2016) • Yet developed countries main exporters of agricultural products

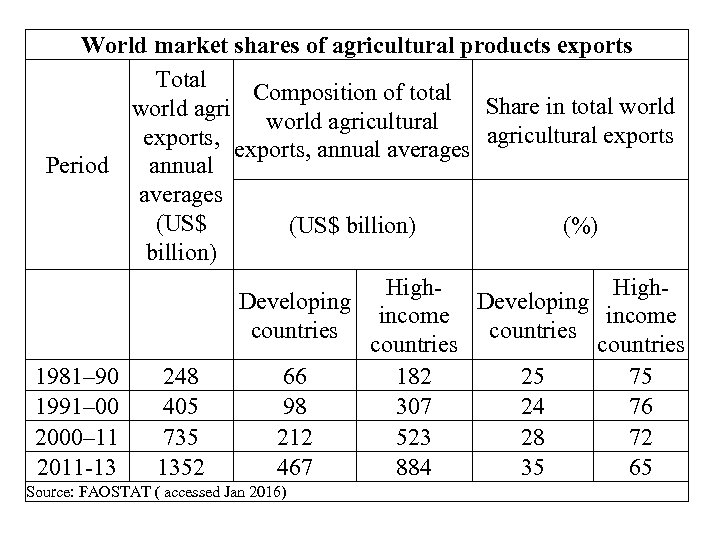

World market shares of agricultural products exports Total Composition of total Share in total world agricultural exports, annual averages Period annual averages (US$ billion) (%) billion) High- Developing income countries 1981– 90 248 66 182 25 75 1991– 00 405 98 307 24 76 2000– 11 735 212 523 28 72 2011 -13 1352 467 884 35 65 Source: FAOSTAT ( accessed Jan 2016)

World market shares of agricultural products exports Total Composition of total Share in total world agricultural exports, annual averages Period annual averages (US$ billion) (%) billion) High- Developing income countries 1981– 90 248 66 182 25 75 1991– 00 405 98 307 24 76 2000– 11 735 212 523 28 72 2011 -13 1352 467 884 35 65 Source: FAOSTAT ( accessed Jan 2016)

Primary vs Processed DCs low share because of low exports of agricultural processed/final products

Primary vs Processed DCs low share because of low exports of agricultural processed/final products

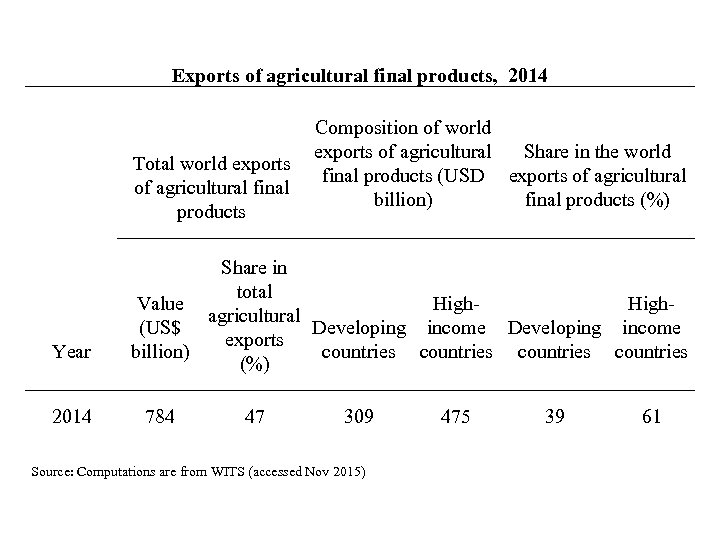

Exports of agricultural final products, 2014 Year 2014 Composition of world exports of agricultural Share in the world Total world exports final products (USD exports of agricultural final billion) final products (%) products Share in total Value High- agricultural (US$ Developing income exports billion) countries (%) 784 47 309 Source: Computations are from WITS (accessed Nov 2015) 475 39 61

Exports of agricultural final products, 2014 Year 2014 Composition of world exports of agricultural Share in the world Total world exports final products (USD exports of agricultural final billion) final products (%) products Share in total Value High- agricultural (US$ Developing income exports billion) countries (%) 784 47 309 Source: Computations are from WITS (accessed Nov 2015) 475 39 61

Objective • Why have DCs failed to increase their agri processed exports? – To what extent due to trade barriers in agriculture • Use case study of selected agri products important for DCs

Objective • Why have DCs failed to increase their agri processed exports? – To what extent due to trade barriers in agriculture • Use case study of selected agri products important for DCs

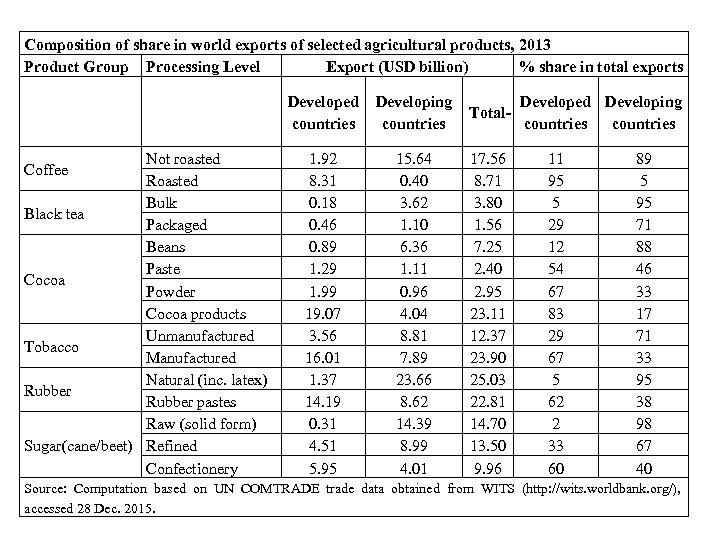

Composition of share in world exports of selected agricultural products, 2013 Product Group Processing Level Export (USD billion) % share in total exports Developed Developing Total countries Not roasted Roasted Bulk Black tea Packaged Beans Paste Cocoa Powder Cocoa products Unmanufactured Tobacco Manufactured Natural (inc. latex) Rubber pastes Raw (solid form) Sugar(cane/beet) Refined Confectionery Coffee 1. 92 8. 31 0. 18 0. 46 0. 89 1. 29 1. 99 19. 07 3. 56 16. 01 1. 37 14. 19 0. 31 4. 51 5. 95 15. 64 0. 40 3. 62 1. 10 6. 36 1. 11 0. 96 4. 04 8. 81 7. 89 23. 66 8. 62 14. 39 8. 99 4. 01 17. 56 8. 71 3. 80 1. 56 7. 25 2. 40 2. 95 23. 11 12. 37 23. 90 25. 03 22. 81 14. 70 13. 50 9. 96 11 95 5 29 12 54 67 83 29 67 5 62 2 33 60 89 5 95 71 88 46 33 17 71 33 95 38 98 67 40 Source: Computation based on UN COMTRADE trade data obtained from WITS (http: //wits. worldbank. org/), accessed 28 Dec. 2015.

Composition of share in world exports of selected agricultural products, 2013 Product Group Processing Level Export (USD billion) % share in total exports Developed Developing Total countries Not roasted Roasted Bulk Black tea Packaged Beans Paste Cocoa Powder Cocoa products Unmanufactured Tobacco Manufactured Natural (inc. latex) Rubber pastes Raw (solid form) Sugar(cane/beet) Refined Confectionery Coffee 1. 92 8. 31 0. 18 0. 46 0. 89 1. 29 1. 99 19. 07 3. 56 16. 01 1. 37 14. 19 0. 31 4. 51 5. 95 15. 64 0. 40 3. 62 1. 10 6. 36 1. 11 0. 96 4. 04 8. 81 7. 89 23. 66 8. 62 14. 39 8. 99 4. 01 17. 56 8. 71 3. 80 1. 56 7. 25 2. 40 2. 95 23. 11 12. 37 23. 90 25. 03 22. 81 14. 70 13. 50 9. 96 11 95 5 29 12 54 67 83 29 67 5 62 2 33 60 89 5 95 71 88 46 33 17 71 33 95 38 98 67 40 Source: Computation based on UN COMTRADE trade data obtained from WITS (http: //wits. worldbank. org/), accessed 28 Dec. 2015.

Tariff escalation (TE) • TE often blamed for this – Provides effective protection for developed countries’ processing sector • Inhibits their expansion in DCs • Look at tariff & TE faced by these products

Tariff escalation (TE) • TE often blamed for this – Provides effective protection for developed countries’ processing sector • Inhibits their expansion in DCs • Look at tariff & TE faced by these products

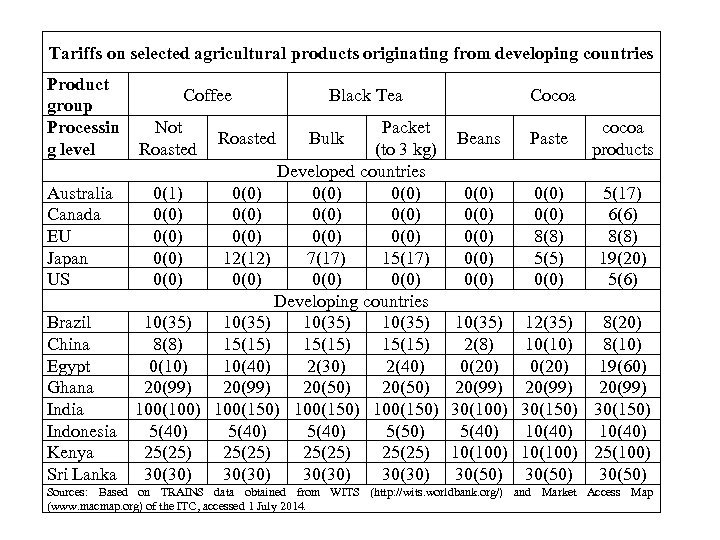

Tariffs on selected agricultural products originating from developing countries Product group Processin g level Coffee Not Roasted Black Tea Packet (to 3 kg) Developed countries 0(1) 0(0) Australia 0(0) Canada 0(0) EU 0(0) 12(12) 7(17) 15(17) Japan 0(0) US Developing countries 10(35) Brazil 8(8) 15(15) China 0(10) 10(40) 2(30) 2(40) Egypt 20(99) 20(50) Ghana 100(100) 100(150) India 5(40) 5(50) Indonesia 25(25) Kenya 30(30) Sri Lanka 30(30) Roasted Bulk Cocoa Beans Paste cocoa products 0(0) 0(0) 8(8) 5(5) 0(0) 5(17) 6(6) 8(8) 19(20) 5(6) 10(35) 2(8) 0(20) 20(99) 30(100) 5(40) 10(100) 30(50) 12(35) 8(20) 10(10) 8(10) 0(20) 19(60) 20(99) 30(150) 10(40) 10(100) 25(100) 30(50) Sources: Based on TRAINS data obtained from WITS (http: //wits. worldbank. org/) and Market Access Map (www. macmap. org) of the ITC, accessed 1 July 2014.

Tariffs on selected agricultural products originating from developing countries Product group Processin g level Coffee Not Roasted Black Tea Packet (to 3 kg) Developed countries 0(1) 0(0) Australia 0(0) Canada 0(0) EU 0(0) 12(12) 7(17) 15(17) Japan 0(0) US Developing countries 10(35) Brazil 8(8) 15(15) China 0(10) 10(40) 2(30) 2(40) Egypt 20(99) 20(50) Ghana 100(100) 100(150) India 5(40) 5(50) Indonesia 25(25) Kenya 30(30) Sri Lanka 30(30) Roasted Bulk Cocoa Beans Paste cocoa products 0(0) 0(0) 8(8) 5(5) 0(0) 5(17) 6(6) 8(8) 19(20) 5(6) 10(35) 2(8) 0(20) 20(99) 30(100) 5(40) 10(100) 30(50) 12(35) 8(20) 10(10) 8(10) 0(20) 19(60) 20(99) 30(150) 10(40) 10(100) 25(100) 30(50) Sources: Based on TRAINS data obtained from WITS (http: //wits. worldbank. org/) and Market Access Map (www. macmap. org) of the ITC, accessed 1 July 2014.

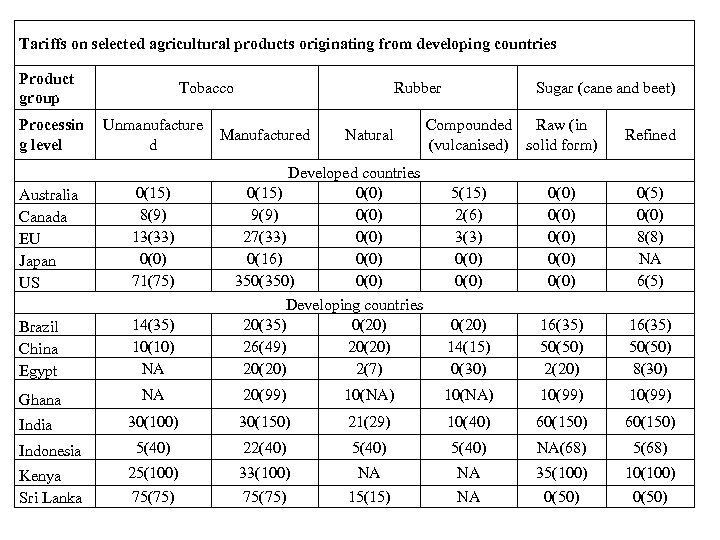

Tariffs on selected agricultural products originating from developing countries Product group Processin g level Tobacco Unmanufacture d Rubber Manufactured Natural Developed countries 0(15) 0(0) 9(9) 0(0) 27(33) 0(0) 0(16) 0(0) 350(350) 0(0) Developing countries 20(35) 0(20) 26(49) 20(20) 2(7) Australia Canada EU Japan US 0(15) 8(9) 13(33) 0(0) 71(75) Brazil China Egypt 14(35) 10(10) NA Ghana NA 20(99) India 30(100) Indonesia Kenya Sri Lanka Sugar (cane and beet) Compounded Raw (in (vulcanised) solid form) Refined 5(15) 2(6) 3(3) 0(0) 0(0) 0(5) 0(0) 8(8) NA 6(5) 0(20) 14(15) 0(30) 16(35) 50(50) 2(20) 16(35) 50(50) 8(30) 10(NA) 10(99) 30(150) 21(29) 10(40) 60(150) 5(40) 22(40) 5(40) NA(68) 5(68) 25(100) 75(75) 33(100) 75(75) NA 15(15) NA NA 35(100) 0(50) 10(100) 0(50)

Tariffs on selected agricultural products originating from developing countries Product group Processin g level Tobacco Unmanufacture d Rubber Manufactured Natural Developed countries 0(15) 0(0) 9(9) 0(0) 27(33) 0(0) 0(16) 0(0) 350(350) 0(0) Developing countries 20(35) 0(20) 26(49) 20(20) 2(7) Australia Canada EU Japan US 0(15) 8(9) 13(33) 0(0) 71(75) Brazil China Egypt 14(35) 10(10) NA Ghana NA 20(99) India 30(100) Indonesia Kenya Sri Lanka Sugar (cane and beet) Compounded Raw (in (vulcanised) solid form) Refined 5(15) 2(6) 3(3) 0(0) 0(0) 0(5) 0(0) 8(8) NA 6(5) 0(20) 14(15) 0(30) 16(35) 50(50) 2(20) 16(35) 50(50) 8(30) 10(NA) 10(99) 30(150) 21(29) 10(40) 60(150) 5(40) 22(40) 5(40) NA(68) 5(68) 25(100) 75(75) 33(100) 75(75) NA 15(15) NA NA 35(100) 0(50) 10(100) 0(50)

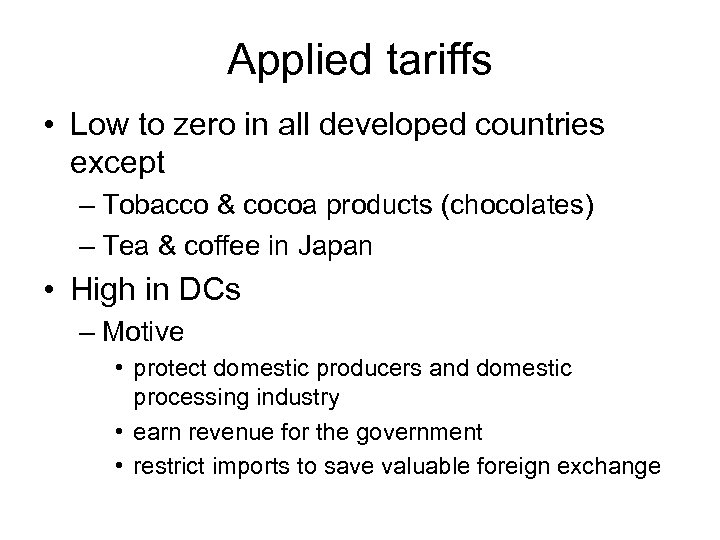

Applied tariffs • Low to zero in all developed countries except – Tobacco & cocoa products (chocolates) – Tea & coffee in Japan • High in DCs – Motive • protect domestic producers and domestic processing industry • earn revenue for the government • restrict imports to save valuable foreign exchange

Applied tariffs • Low to zero in all developed countries except – Tobacco & cocoa products (chocolates) – Tea & coffee in Japan • High in DCs – Motive • protect domestic producers and domestic processing industry • earn revenue for the government • restrict imports to save valuable foreign exchange

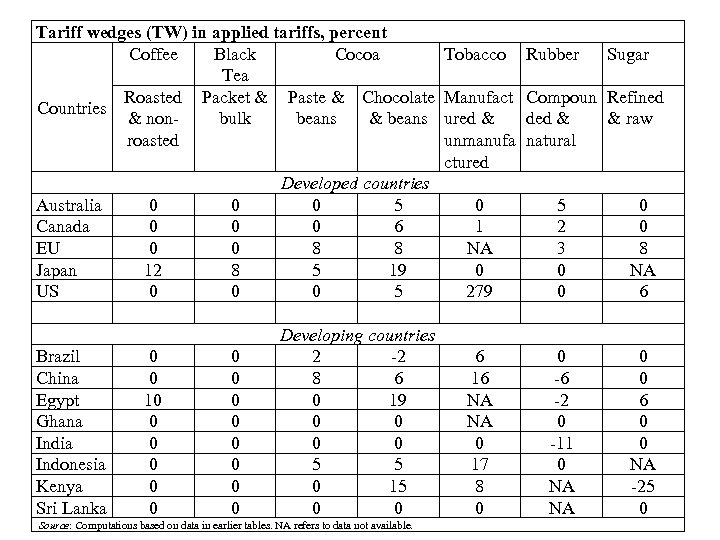

Tariff wedges (TW) in applied tariffs, percent Coffee Black Cocoa Tobacco Tea Roasted Packet & Paste & Chocolate Manufact Countries & nonbulk beans & beans ured & roasted unmanufa ctured Developed countries Australia 0 0 0 5 0 Canada 0 0 0 6 1 EU 0 0 8 8 NA Japan 12 8 5 19 0 US 0 0 0 5 279 Developing countries Brazil 0 0 2 -2 6 China 0 0 8 6 16 Egypt 10 0 0 19 NA Ghana 0 0 NA India 0 0 0 Indonesia 0 0 5 5 17 Kenya 0 0 0 15 8 Sri Lanka 0 0 0 Source: Computations based on data in earlier tables. NA refers to data not available. Rubber Sugar Compoun Refined ded & & raw natural 5 2 3 0 0 8 NA 6 0 -6 -2 0 -11 0 NA NA 0 0 6 0 0 NA -25 0

Tariff wedges (TW) in applied tariffs, percent Coffee Black Cocoa Tobacco Tea Roasted Packet & Paste & Chocolate Manufact Countries & nonbulk beans & beans ured & roasted unmanufa ctured Developed countries Australia 0 0 0 5 0 Canada 0 0 0 6 1 EU 0 0 8 8 NA Japan 12 8 5 19 0 US 0 0 0 5 279 Developing countries Brazil 0 0 2 -2 6 China 0 0 8 6 16 Egypt 10 0 0 19 NA Ghana 0 0 NA India 0 0 0 Indonesia 0 0 5 5 17 Kenya 0 0 0 15 8 Sri Lanka 0 0 0 Source: Computations based on data in earlier tables. NA refers to data not available. Rubber Sugar Compoun Refined ded & & raw natural 5 2 3 0 0 8 NA 6 0 -6 -2 0 -11 0 NA NA 0 0 6 0 0 NA -25 0

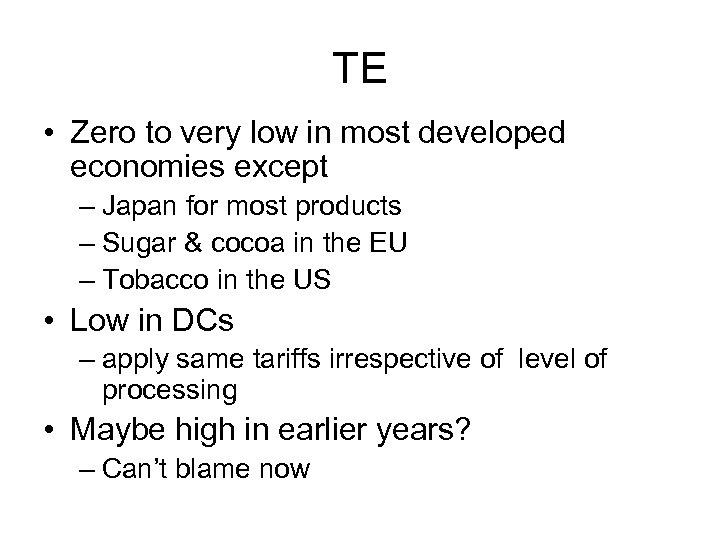

TE • Zero to very low in most developed economies except – Japan for most products – Sugar & cocoa in the EU – Tobacco in the US • Low in DCs – apply same tariffs irrespective of level of processing • Maybe high in earlier years? – Can’t blame now

TE • Zero to very low in most developed economies except – Japan for most products – Sugar & cocoa in the EU – Tobacco in the US • Low in DCs – apply same tariffs irrespective of level of processing • Maybe high in earlier years? – Can’t blame now

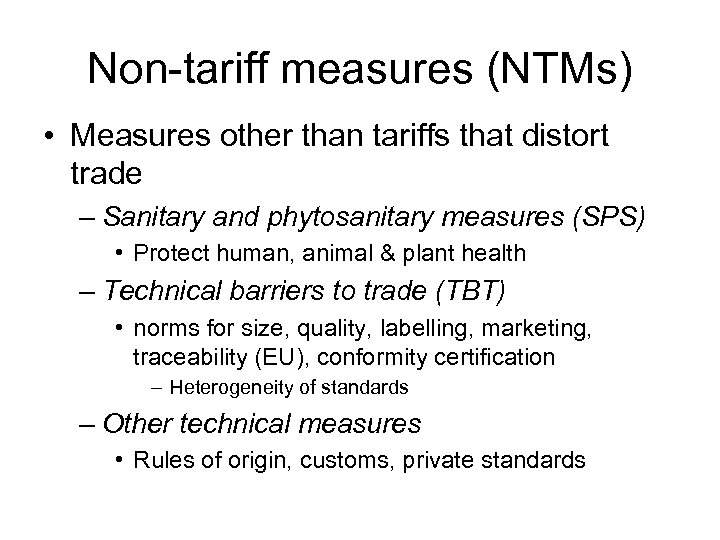

Non-tariff measures (NTMs) • Measures other than tariffs that distort trade – Sanitary and phytosanitary measures (SPS) • Protect human, animal & plant health – Technical barriers to trade (TBT) • norms for size, quality, labelling, marketing, traceability (EU), conformity certification – Heterogeneity of standards – Other technical measures • Rules of origin, customs, private standards

Non-tariff measures (NTMs) • Measures other than tariffs that distort trade – Sanitary and phytosanitary measures (SPS) • Protect human, animal & plant health – Technical barriers to trade (TBT) • norms for size, quality, labelling, marketing, traceability (EU), conformity certification – Heterogeneity of standards – Other technical measures • Rules of origin, customs, private standards

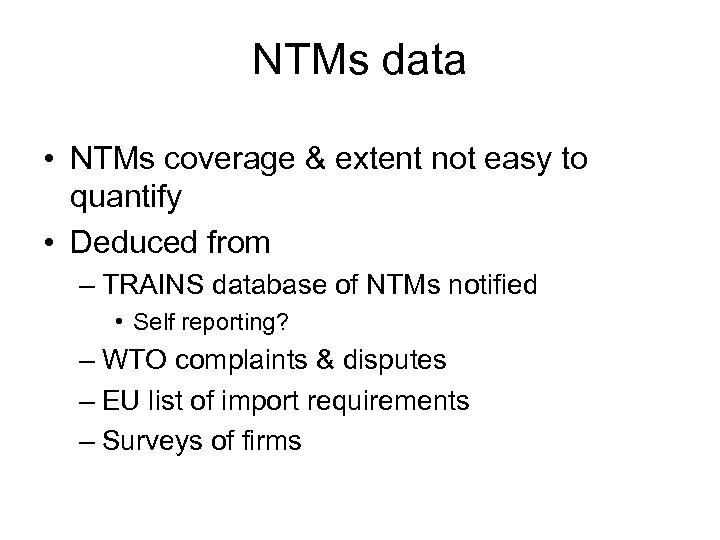

NTMs data • NTMs coverage & extent not easy to quantify • Deduced from – TRAINS database of NTMs notified • Self reporting? – WTO complaints & disputes – EU list of import requirements – Surveys of firms

NTMs data • NTMs coverage & extent not easy to quantify • Deduced from – TRAINS database of NTMs notified • Self reporting? – WTO complaints & disputes – EU list of import requirements – Surveys of firms

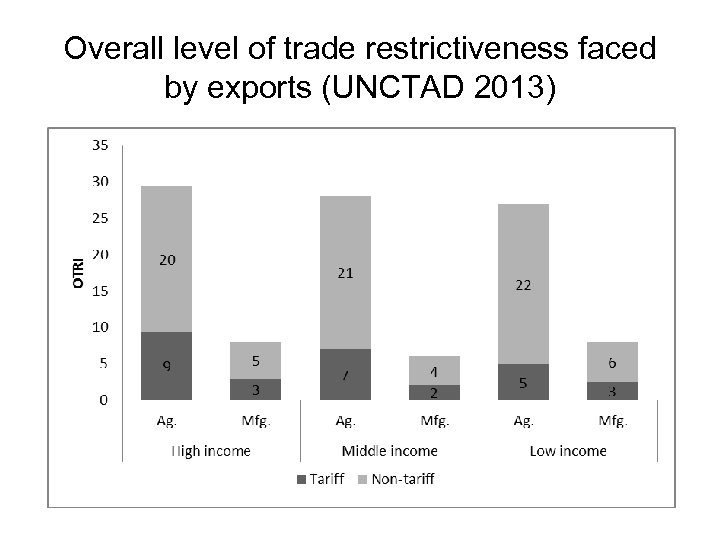

Overall level of trade restrictiveness faced by exports (UNCTAD 2013)

Overall level of trade restrictiveness faced by exports (UNCTAD 2013)

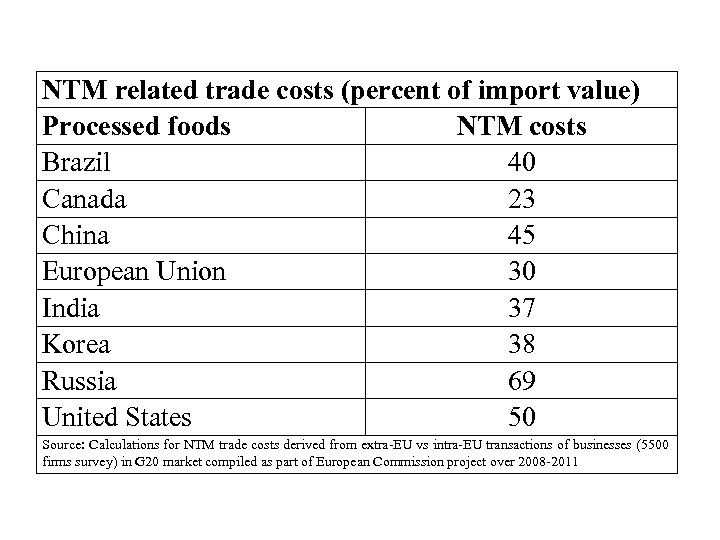

NTM related trade costs (percent of import value) Processed foods NTM costs Brazil 40 Canada 23 China 45 European Union 30 India 37 Korea 38 Russia 69 United States 50 Source: Calculations for NTM trade costs derived from extra-EU vs intra-EU transactions of businesses (5500 firms survey) in G 20 market compiled as part of European Commission project over 2008 -2011

NTM related trade costs (percent of import value) Processed foods NTM costs Brazil 40 Canada 23 China 45 European Union 30 India 37 Korea 38 Russia 69 United States 50 Source: Calculations for NTM trade costs derived from extra-EU vs intra-EU transactions of businesses (5500 firms survey) in G 20 market compiled as part of European Commission project over 2008 -2011

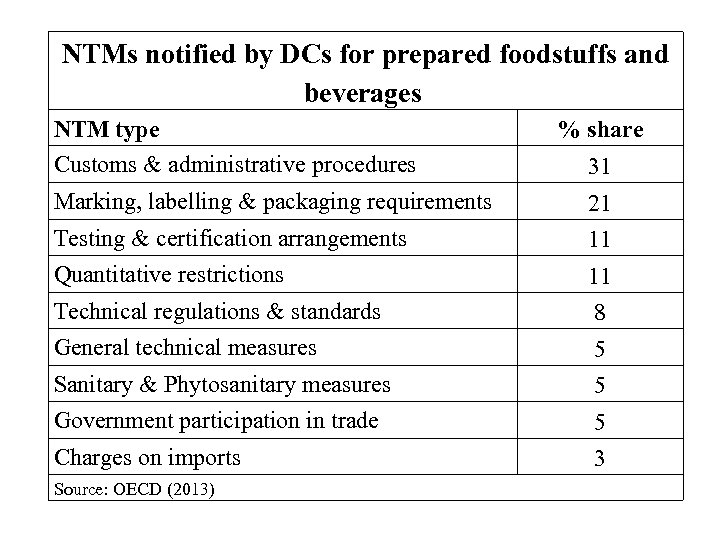

NTMs notified by DCs for prepared foodstuffs and beverages NTM type Customs & administrative procedures % share 31 Marking, labelling & packaging requirements 21 Testing & certification arrangements 11 Quantitative restrictions 11 Technical regulations & standards 8 General technical measures 5 Sanitary & Phytosanitary measures 5 Government participation in trade 5 Charges on imports 3 Source: OECD (2013)

NTMs notified by DCs for prepared foodstuffs and beverages NTM type Customs & administrative procedures % share 31 Marking, labelling & packaging requirements 21 Testing & certification arrangements 11 Quantitative restrictions 11 Technical regulations & standards 8 General technical measures 5 Sanitary & Phytosanitary measures 5 Government participation in trade 5 Charges on imports 3 Source: OECD (2013)

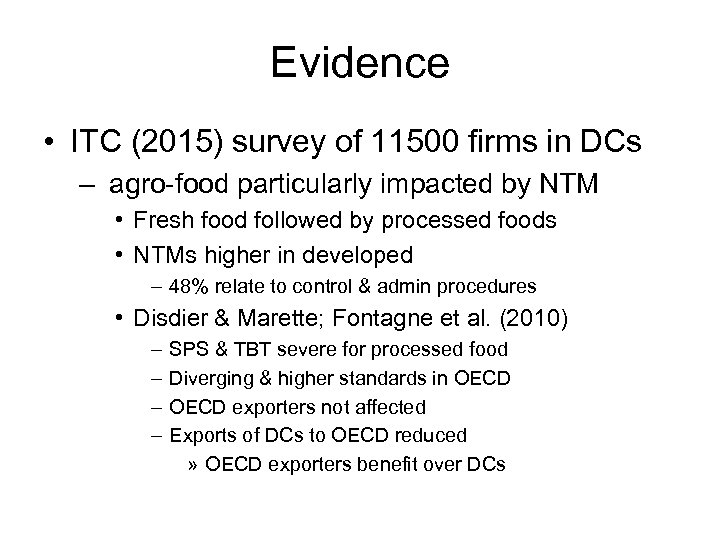

Evidence • ITC (2015) survey of 11500 firms in DCs – agro-food particularly impacted by NTM • Fresh food followed by processed foods • NTMs higher in developed – 48% relate to control & admin procedures • Disdier & Marette; Fontagne et al. (2010) – – SPS & TBT severe for processed food Diverging & higher standards in OECD exporters not affected Exports of DCs to OECD reduced » OECD exporters benefit over DCs

Evidence • ITC (2015) survey of 11500 firms in DCs – agro-food particularly impacted by NTM • Fresh food followed by processed foods • NTMs higher in developed – 48% relate to control & admin procedures • Disdier & Marette; Fontagne et al. (2010) – – SPS & TBT severe for processed food Diverging & higher standards in OECD exporters not affected Exports of DCs to OECD reduced » OECD exporters benefit over DCs

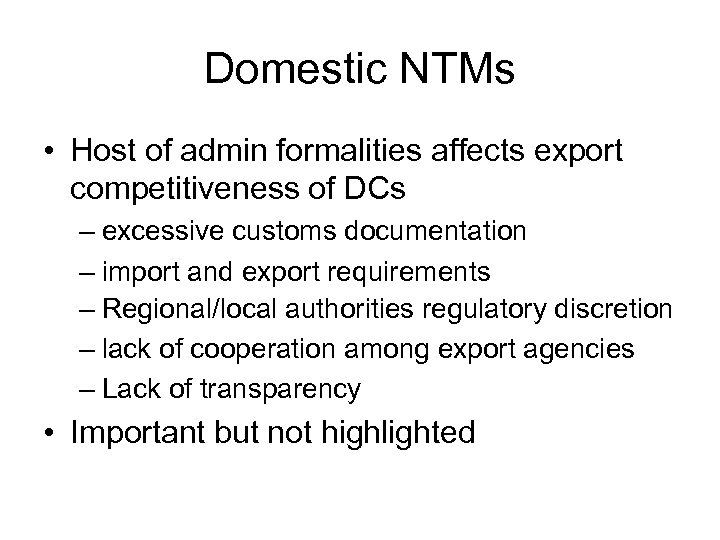

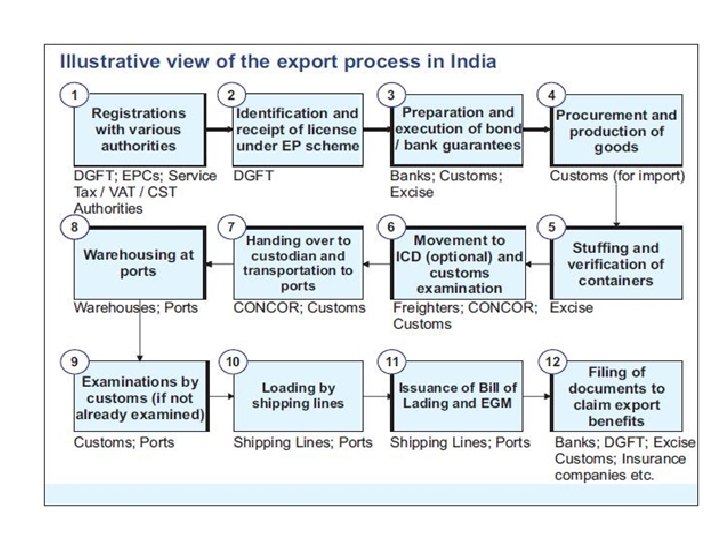

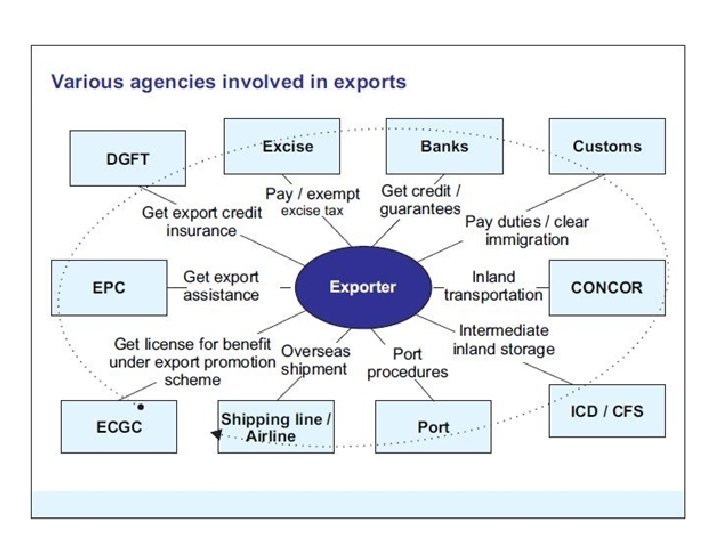

Domestic NTMs • Host of admin formalities affects export competitiveness of DCs – excessive customs documentation – import and export requirements – Regional/local authorities regulatory discretion – lack of cooperation among export agencies – Lack of transparency • Important but not highlighted

Domestic NTMs • Host of admin formalities affects export competitiveness of DCs – excessive customs documentation – import and export requirements – Regional/local authorities regulatory discretion – lack of cooperation among export agencies – Lack of transparency • Important but not highlighted

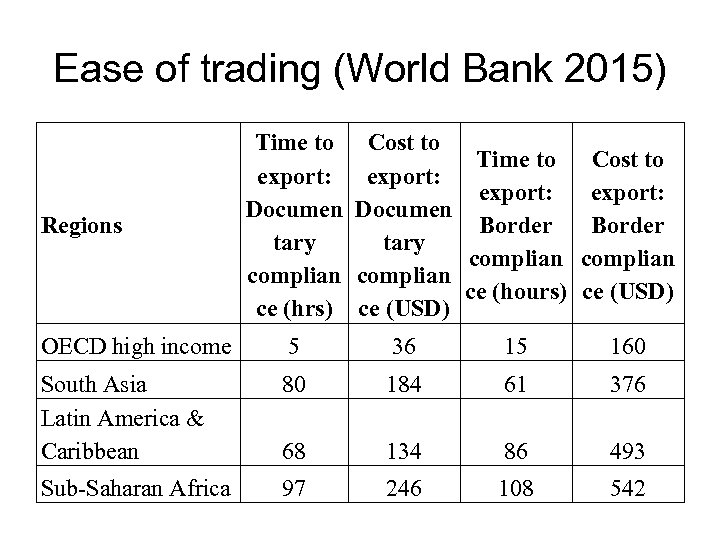

Ease of trading (World Bank 2015) Regions Time to export: Documen tary complian ce (hrs) Cost to Time to Cost to export: Documen Border tary complian ce (hours) ce (USD) OECD high income 5 36 15 160 South Asia Latin America & Caribbean 80 184 61 376 68 134 86 493 Sub-Saharan Africa 97 246 108 542

Ease of trading (World Bank 2015) Regions Time to export: Documen tary complian ce (hrs) Cost to Time to Cost to export: Documen Border tary complian ce (hours) ce (USD) OECD high income 5 36 15 160 South Asia Latin America & Caribbean 80 184 61 376 68 134 86 493 Sub-Saharan Africa 97 246 108 542

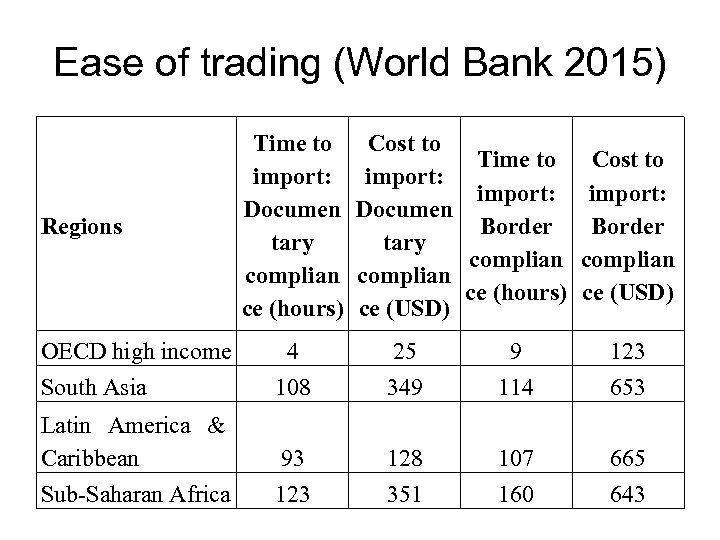

Ease of trading (World Bank 2015) Time to import: Documen tary complian ce (hours) Cost to import: Documen tary complian ce (USD) OECD high income South Asia 4 108 25 349 9 114 123 653 Latin America & Caribbean Sub-Saharan Africa 93 128 351 107 160 665 643 Regions Time to Cost to import: Border complian ce (hours) ce (USD)

Ease of trading (World Bank 2015) Time to import: Documen tary complian ce (hours) Cost to import: Documen tary complian ce (USD) OECD high income South Asia 4 108 25 349 9 114 123 653 Latin America & Caribbean Sub-Saharan Africa 93 128 351 107 160 665 643 Regions Time to Cost to import: Border complian ce (hours) ce (USD)

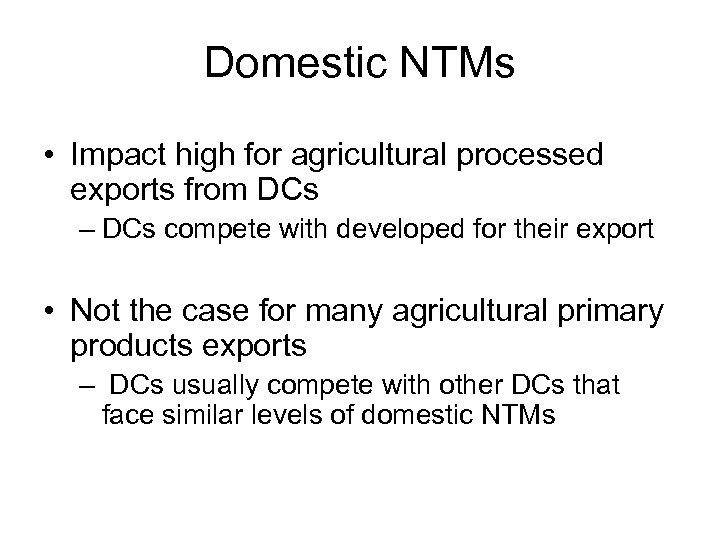

Domestic NTMs • Impact high for agricultural processed exports from DCs – DCs compete with developed for their export • Not the case for many agricultural primary products exports – DCs usually compete with other DCs that face similar levels of domestic NTMs

Domestic NTMs • Impact high for agricultural processed exports from DCs – DCs compete with developed for their export • Not the case for many agricultural primary products exports – DCs usually compete with other DCs that face similar levels of domestic NTMs

Conclusion • Widespread prevalence of NTMs – Deserve more attention – Domestic NTMs too important • DCs need to set their own house in order!! • Supply-side constraints in DCs • Does not justify NTMs • Some NTMs can facilitate trade – Separate protectionist & non-protectionist – International collaboration to identify those less onerous for DCs agri trade

Conclusion • Widespread prevalence of NTMs – Deserve more attention – Domestic NTMs too important • DCs need to set their own house in order!! • Supply-side constraints in DCs • Does not justify NTMs • Some NTMs can facilitate trade – Separate protectionist & non-protectionist – International collaboration to identify those less onerous for DCs agri trade

Thank You Questions?

Thank You Questions?