e99f35c0b8cb8274cac5616daaca96e2.ppt

- Количество слайдов: 25

How does the plan work?

How does the plan work?

Pension Investments - Key Concepts & Terms Equities – company shares Property – buildings i. e. office, retail, industrial units Bonds – Governments bonds/fixed interests. Name for loans given to governments Cash – money on deposit with a variety of banks and for different lengths of time Managed /Balanced Fund – a fund that invests in: equities, bonds, property and cash Asset Allocation - the decision re. how much to invest in shares, bonds, property & cash Stock Selection - the decision as to what shares to buy Indexed – the fund managers buy shares as per an index i. e. if CRH is 35% of ISEQ then the fund will have 35% invested in CRH

Pension Investments - Key Concepts & Terms Equities – company shares Property – buildings i. e. office, retail, industrial units Bonds – Governments bonds/fixed interests. Name for loans given to governments Cash – money on deposit with a variety of banks and for different lengths of time Managed /Balanced Fund – a fund that invests in: equities, bonds, property and cash Asset Allocation - the decision re. how much to invest in shares, bonds, property & cash Stock Selection - the decision as to what shares to buy Indexed – the fund managers buy shares as per an index i. e. if CRH is 35% of ISEQ then the fund will have 35% invested in CRH

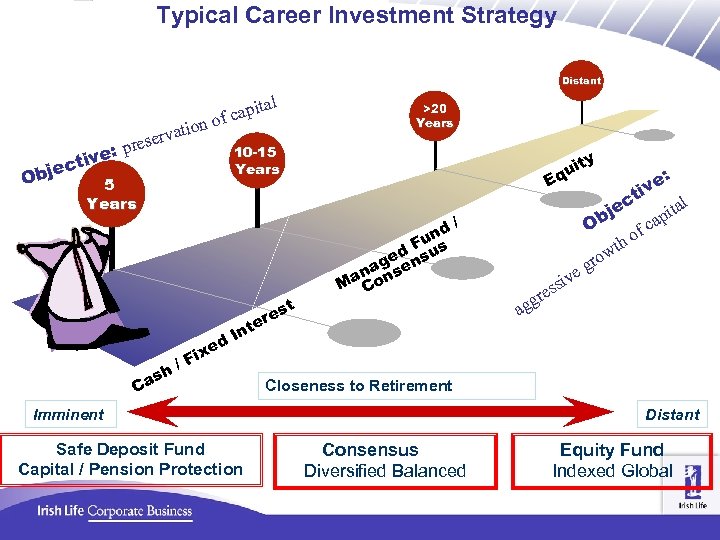

Typical Career Investment Strategy Distant on e: ctiv bje O ti serva pre al capit of 10 -15 Years h s Ca e Fix / >20 Years d t es y it qu E d/ n Fu s d u ge ens a an ons M C er Int c al je pit b a O fc o th row g r g ag Closeness to Retirement Imminent Safe Deposit Fund Capital / Pension Protection e siv es : e iv t Distant Consensus Diversified Balanced Equity Fund Indexed Global

Typical Career Investment Strategy Distant on e: ctiv bje O ti serva pre al capit of 10 -15 Years h s Ca e Fix / >20 Years d t es y it qu E d/ n Fu s d u ge ens a an ons M C er Int c al je pit b a O fc o th row g r g ag Closeness to Retirement Imminent Safe Deposit Fund Capital / Pension Protection e siv es : e iv t Distant Consensus Diversified Balanced Equity Fund Indexed Global

Fund choices Mix of funds Cash Fund Capital Protection Fund Diversified Balanced Fund Active Managed Fund Consensus Fund Indexed 50/50 Equity Fund Or Individual Investment Option

Fund choices Mix of funds Cash Fund Capital Protection Fund Diversified Balanced Fund Active Managed Fund Consensus Fund Indexed 50/50 Equity Fund Or Individual Investment Option

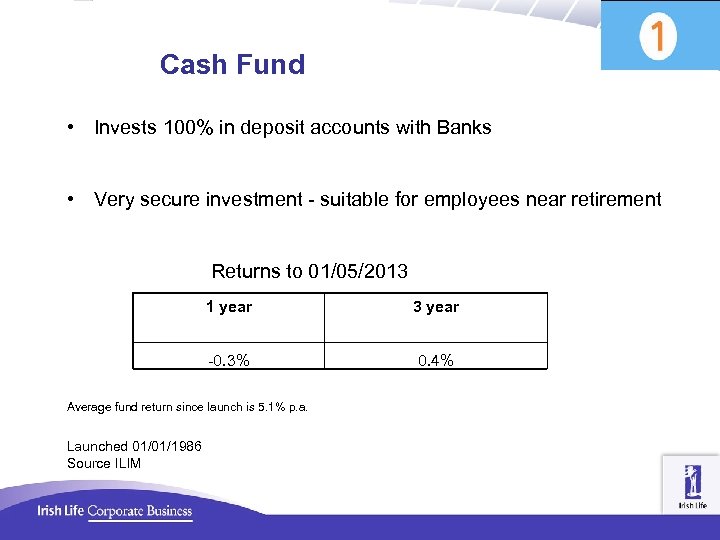

Cash Fund • Invests 100% in deposit accounts with Banks • Very secure investment - suitable for employees near retirement Returns to 01/05/2013 1 year 3 year -0. 3% 0. 4% Average fund return since launch is 5. 1% p. a. Launched 01/01/1986 Source ILIM

Cash Fund • Invests 100% in deposit accounts with Banks • Very secure investment - suitable for employees near retirement Returns to 01/05/2013 1 year 3 year -0. 3% 0. 4% Average fund return since launch is 5. 1% p. a. Launched 01/01/1986 Source ILIM

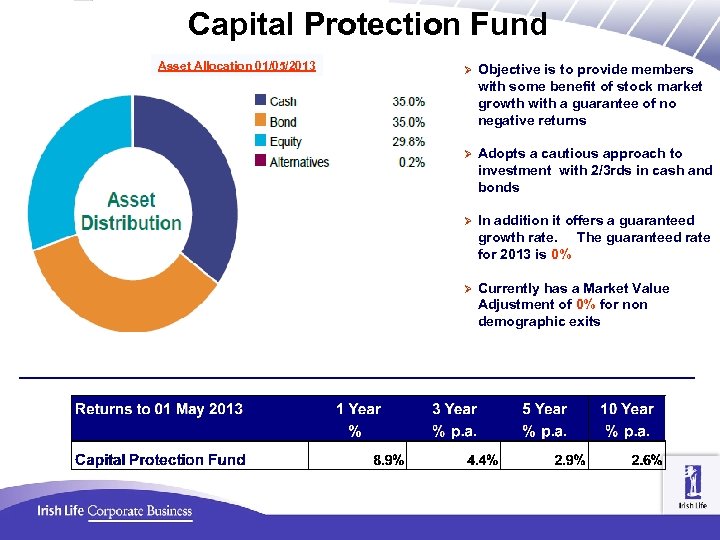

Capital Protection Fund Asset Allocation 01/05/2013 Ø Objective is to provide members with some benefit of stock market growth with a guarantee of no negative returns Ø Adopts a cautious approach to investment with 2/3 rds in cash and bonds Ø In addition it offers a guaranteed growth rate. The guaranteed rate for 2013 is 0% Ø Currently has a Market Value Adjustment of 0% for non demographic exits

Capital Protection Fund Asset Allocation 01/05/2013 Ø Objective is to provide members with some benefit of stock market growth with a guarantee of no negative returns Ø Adopts a cautious approach to investment with 2/3 rds in cash and bonds Ø In addition it offers a guaranteed growth rate. The guaranteed rate for 2013 is 0% Ø Currently has a Market Value Adjustment of 0% for non demographic exits

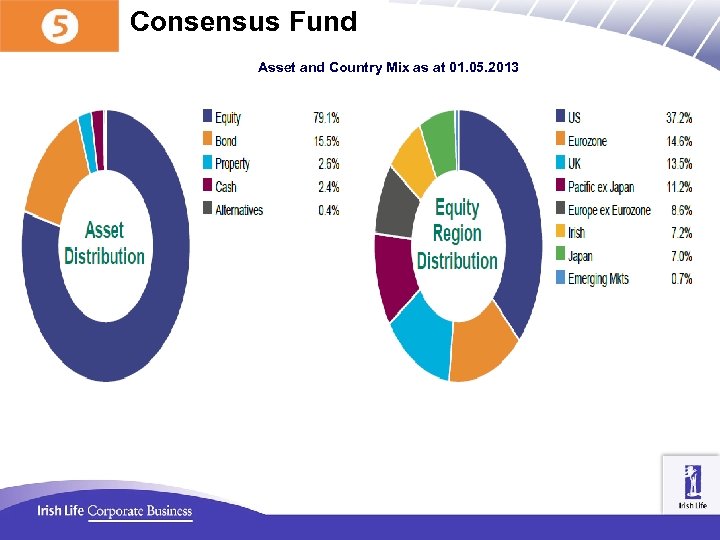

Consensus Fund ØInvested in Equities/Bonds/Property/Cash Ø Tracks the ‘asset allocation’ of 17 fund managers in Ireland (the split of equities/bonds/cash etc) Ø Equities – (Index tracking) – only invests in stocks and shares quoted on the various indices e. g. ISEQ/Dow Jones ØSo not dependant on the view of any one manager ØAims for consistent Top Half Returns

Consensus Fund ØInvested in Equities/Bonds/Property/Cash Ø Tracks the ‘asset allocation’ of 17 fund managers in Ireland (the split of equities/bonds/cash etc) Ø Equities – (Index tracking) – only invests in stocks and shares quoted on the various indices e. g. ISEQ/Dow Jones ØSo not dependant on the view of any one manager ØAims for consistent Top Half Returns

Consensus Fund Asset and Country Mix as at 01. 05. 2013

Consensus Fund Asset and Country Mix as at 01. 05. 2013

Consensus Fund Performance to 1 st May 2013 1 yr p. a. 3 yrs p. a. 5 yrs p. a. 15. 1% 7. 7% 2. 6% Average fund return since launch is 6. 7% p. a. Source: ILIM

Consensus Fund Performance to 1 st May 2013 1 yr p. a. 3 yrs p. a. 5 yrs p. a. 15. 1% 7. 7% 2. 6% Average fund return since launch is 6. 7% p. a. Source: ILIM

Consensus Fund Historical Yearly Returns Year Consensus 1996 15. 5% 2005 21. 1% 1997 35. 1% 2006 13. 4% 1998 21. 1% 2007 -3. 2% 1999 18. 6% 2008 -35. 1% 2000 2. 6% 2009 21. 0% 2001 -4. 7% 2010 11. 0% 2002 -19. 0% 2011 -2. 9% 2003 11. 7% 2012 14. 2% 2004 12. 5% 2013 YTD 8%

Consensus Fund Historical Yearly Returns Year Consensus 1996 15. 5% 2005 21. 1% 1997 35. 1% 2006 13. 4% 1998 21. 1% 2007 -3. 2% 1999 18. 6% 2008 -35. 1% 2000 2. 6% 2009 21. 0% 2001 -4. 7% 2010 11. 0% 2002 -19. 0% 2011 -2. 9% 2003 11. 7% 2012 14. 2% 2004 12. 5% 2013 YTD 8%

Individual Investment Strategy • What is a Lifestyle strategy ? • Strategy aims to reflect the changing investment needs during various stages of your life. Growth Invests in higher risk • funds initially Consensus Fund Consolidation ( 5 years ) Moves to lower risk funds Capital Protection Fund

Individual Investment Strategy • What is a Lifestyle strategy ? • Strategy aims to reflect the changing investment needs during various stages of your life. Growth Invests in higher risk • funds initially Consensus Fund Consolidation ( 5 years ) Moves to lower risk funds Capital Protection Fund

Diversified Balanced Fund Asset Allocation 01. 05. 2013 Ø Invested in developed world equities, Eurozone Govt. Bonds, and range Alternative Assets Ø Objective: Balanced Fund returns with lower volatility levels Ø Suitable for members with number of years to retirement who wish to pursue a strong growth strategy

Diversified Balanced Fund Asset Allocation 01. 05. 2013 Ø Invested in developed world equities, Eurozone Govt. Bonds, and range Alternative Assets Ø Objective: Balanced Fund returns with lower volatility levels Ø Suitable for members with number of years to retirement who wish to pursue a strong growth strategy

Active Managed Fund • Subject to ups and downs of stock markets • Volatile recent returns • Produces good long term returns • Objective to produce above average managed fund performance Active Fund Performance to 1 st May 2013 1 year p. a. 3 years p. a. 5 years p. a. 16. 6% 5. 7% 1. 6% Fund returns since launch (1989): 7. 3% p. a. Source: ILIM

Active Managed Fund • Subject to ups and downs of stock markets • Volatile recent returns • Produces good long term returns • Objective to produce above average managed fund performance Active Fund Performance to 1 st May 2013 1 year p. a. 3 years p. a. 5 years p. a. 16. 6% 5. 7% 1. 6% Fund returns since launch (1989): 7. 3% p. a. Source: ILIM

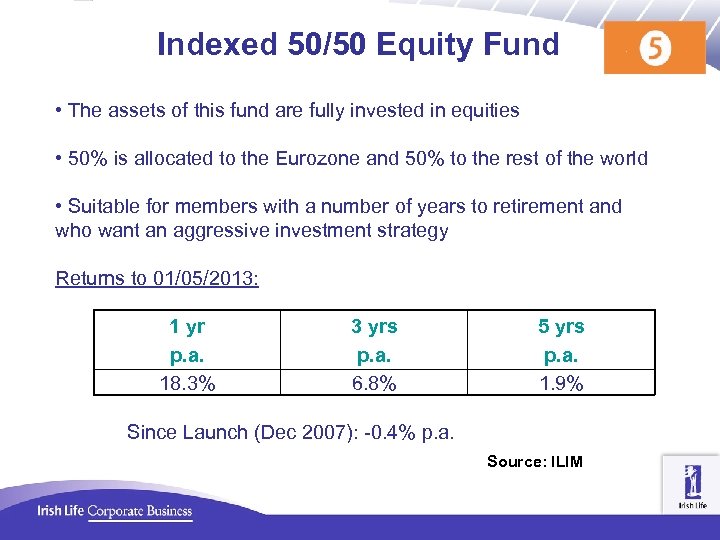

Indexed 50/50 Equity Fund • The assets of this fund are fully invested in equities • 50% is allocated to the Eurozone and 50% to the rest of the world • Suitable for members with a number of years to retirement and who want an aggressive investment strategy Returns to 01/05/2013: 1 yr p. a. 18. 3% 3 yrs p. a. 6. 8% 5 yrs p. a. 1. 9% Since Launch (Dec 2007): -0. 4% p. a. Source: ILIM

Indexed 50/50 Equity Fund • The assets of this fund are fully invested in equities • 50% is allocated to the Eurozone and 50% to the rest of the world • Suitable for members with a number of years to retirement and who want an aggressive investment strategy Returns to 01/05/2013: 1 yr p. a. 18. 3% 3 yrs p. a. 6. 8% 5 yrs p. a. 1. 9% Since Launch (Dec 2007): -0. 4% p. a. Source: ILIM

Keeping in Touch……. • Annual Benefit Statements • Pension. Phone service with PIN • Web access – www. Irishlife. ie/corporatebusiness • www. pensionplanetinteractive. ie – access to your pension account • www. pensionprophet. ie – pension calculator • Smartphone App • Pension Pulse

Keeping in Touch……. • Annual Benefit Statements • Pension. Phone service with PIN • Web access – www. Irishlife. ie/corporatebusiness • www. pensionplanetinteractive. ie – access to your pension account • www. pensionprophet. ie – pension calculator • Smartphone App • Pension Pulse

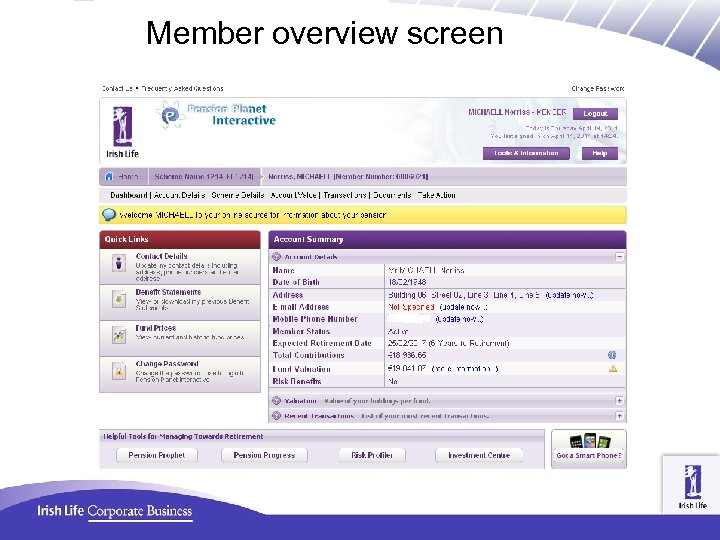

Website Access • Members can view their retirement accounts by accessing - www. pensionplanetinteractive. ie What information is available ? • Fund Values at any date • Your Current Fund Choice • No. of Units and Values in each fund • All Transactions for previous 24 months • Monthly Fund Performance Information and flyers • Your Benefit Statements • Correspondence

Website Access • Members can view their retirement accounts by accessing - www. pensionplanetinteractive. ie What information is available ? • Fund Values at any date • Your Current Fund Choice • No. of Units and Values in each fund • All Transactions for previous 24 months • Monthly Fund Performance Information and flyers • Your Benefit Statements • Correspondence

Login screen www. pensionplanetinteractive. ie

Login screen www. pensionplanetinteractive. ie

Member overview screen

Member overview screen

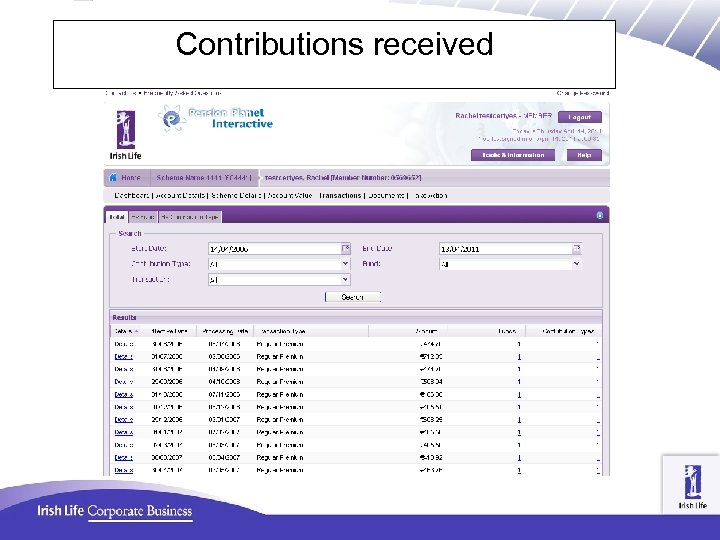

Contributions received

Contributions received

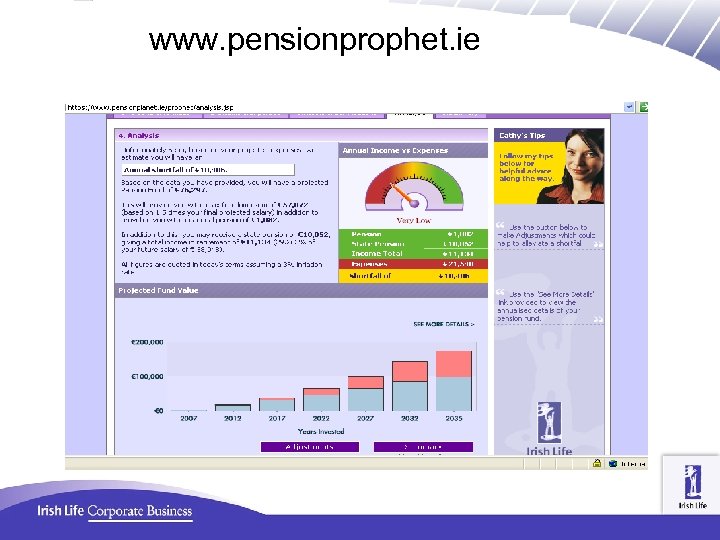

www. pensionprophet. ie

www. pensionprophet. ie

www. pensionprophet. ie

www. pensionprophet. ie

Smartphone App Download from i. Tunes App store or visit www. mypensionapp. ie

Smartphone App Download from i. Tunes App store or visit www. mypensionapp. ie

Key features • Your current fund value • Estimated value of your fund at retirement • Estimated pension at retirement • Impact of making AVCs • Fund factsheets • Regular market updates.

Key features • Your current fund value • Estimated value of your fund at retirement • Estimated pension at retirement • Impact of making AVCs • Fund factsheets • Regular market updates.

UL AVC Plan Irish Life is regulated by the Financial Regulator

UL AVC Plan Irish Life is regulated by the Financial Regulator

Secured Performance Fund Closed to future money Investment Objective To produce managed fund returns on a smoothed basis - Promise of no negative returns. Investment Strategy A return is declared annually Invested in line with Irish Life’s Consensus Fund Market Value Adjuster (penalty) applies (currently 0%) Entry and exit conditions to ensure fairness Single Premiums and Transfer Values are not allowed Return for 2013 is 0. 2% ` Source: ILIM (Net of Fund Management Charge)

Secured Performance Fund Closed to future money Investment Objective To produce managed fund returns on a smoothed basis - Promise of no negative returns. Investment Strategy A return is declared annually Invested in line with Irish Life’s Consensus Fund Market Value Adjuster (penalty) applies (currently 0%) Entry and exit conditions to ensure fairness Single Premiums and Transfer Values are not allowed Return for 2013 is 0. 2% ` Source: ILIM (Net of Fund Management Charge)