52b389e36d28bd491a5fbd618e75654b.ppt

- Количество слайдов: 16

How does Social Performance Management (SPM) initiative translate into social returns (benefits and costs of SPM) Irina Ignatieva, Microfinance Advisor, Concern Worldwide www. concern. net

How does Social Performance Management (SPM) initiative translate into social returns (benefits and costs of SPM) Irina Ignatieva, Microfinance Advisor, Concern Worldwide www. concern. net

About Concern Worldwide • Non-governmental, international, humanitarian organisation • Dedicated to reduction of suffering and ultimate elimination of extreme poverty in the world’s poorest countries • In 2008 worked in 30 countries and reached 10 million people directly • Long-term development work: health, education, livelihoods, HIV and AIDS programmes • Responses to emergency situations • Addressing the root causes of poverty through its advocacy and development education work

About Concern Worldwide • Non-governmental, international, humanitarian organisation • Dedicated to reduction of suffering and ultimate elimination of extreme poverty in the world’s poorest countries • In 2008 worked in 30 countries and reached 10 million people directly • Long-term development work: health, education, livelihoods, HIV and AIDS programmes • Responses to emergency situations • Addressing the root causes of poverty through its advocacy and development education work

Objectives of the Presentation § Review a case study of AMK, in Cambodia § Discuss Concern Worldwide’s approach to Social Returns and SPM

Objectives of the Presentation § Review a case study of AMK, in Cambodia § Discuss Concern Worldwide’s approach to Social Returns and SPM

Where Concern Worldwide is involved in SPM in microfinance AMK, Cambodia – a subsidiary of Concern Worldwide in Cambodia; serving the rural poor; 200, 000 clients across the country, 85% of clients are women – Concern Worldwide’s focus at AMK governance level - SPM committee in AMK: overseeing social research and reporting; advisory role to the Board Africa Microfinance Initiative – a joint initiative of Concern Worldwide and Agora Microfinance Fund, since 2009 – access to finance for the poorest where the need for access to financial services is the greatest and the supply is the lowest – green field microfinance operations in Sub-Saharan Africa; initially, Zambia and Malawi – defining and measuring social returns in Africa Microfinance Initiative with focus on mission, market and social research, setting reporting standards, ensuring SPM is imbedded in the operations

Where Concern Worldwide is involved in SPM in microfinance AMK, Cambodia – a subsidiary of Concern Worldwide in Cambodia; serving the rural poor; 200, 000 clients across the country, 85% of clients are women – Concern Worldwide’s focus at AMK governance level - SPM committee in AMK: overseeing social research and reporting; advisory role to the Board Africa Microfinance Initiative – a joint initiative of Concern Worldwide and Agora Microfinance Fund, since 2009 – access to finance for the poorest where the need for access to financial services is the greatest and the supply is the lowest – green field microfinance operations in Sub-Saharan Africa; initially, Zambia and Malawi – defining and measuring social returns in Africa Microfinance Initiative with focus on mission, market and social research, setting reporting standards, ensuring SPM is imbedded in the operations

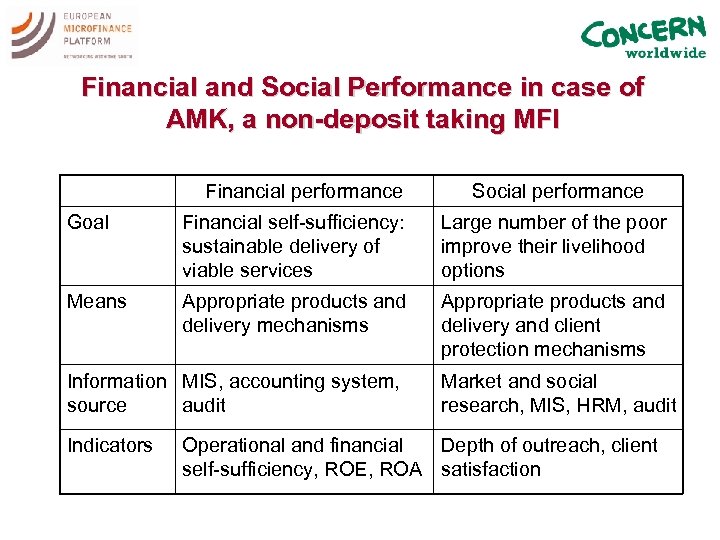

Financial and Social Performance in case of AMK, a non-deposit taking MFI Financial performance Social performance Goal Financial self-sufficiency: sustainable delivery of viable services Large number of the poor improve their livelihood options Means Appropriate products and delivery mechanisms Appropriate products and delivery and client protection mechanisms Information MIS, accounting system, source audit Indicators Market and social research, MIS, HRM, audit Operational and financial Depth of outreach, client self-sufficiency, ROE, ROA satisfaction

Financial and Social Performance in case of AMK, a non-deposit taking MFI Financial performance Social performance Goal Financial self-sufficiency: sustainable delivery of viable services Large number of the poor improve their livelihood options Means Appropriate products and delivery mechanisms Appropriate products and delivery and client protection mechanisms Information MIS, accounting system, source audit Indicators Market and social research, MIS, HRM, audit Operational and financial Depth of outreach, client self-sufficiency, ROE, ROA satisfaction

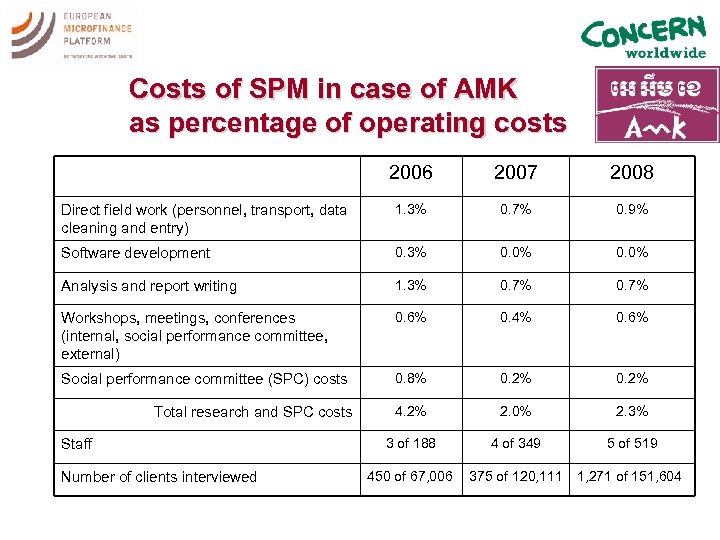

Costs of SPM in case of AMK as percentage of operating costs 2006 2007 2008 Direct field work (personnel, transport, data cleaning and entry) 1. 3% 0. 7% 0. 9% Software development 0. 3% 0. 0% Analysis and report writing 1. 3% 0. 7% Workshops, meetings, conferences (internal, social performance committee, external) 0. 6% 0. 4% 0. 6% Social performance committee (SPC) costs 0. 8% 0. 2% 4. 2% 2. 0% 2. 3% 3 of 188 4 of 349 5 of 519 450 of 67, 006 375 of 120, 111 1, 271 of 151, 604 Total research and SPC costs Staff Number of clients interviewed

Costs of SPM in case of AMK as percentage of operating costs 2006 2007 2008 Direct field work (personnel, transport, data cleaning and entry) 1. 3% 0. 7% 0. 9% Software development 0. 3% 0. 0% Analysis and report writing 1. 3% 0. 7% Workshops, meetings, conferences (internal, social performance committee, external) 0. 6% 0. 4% 0. 6% Social performance committee (SPC) costs 0. 8% 0. 2% 4. 2% 2. 0% 2. 3% 3 of 188 4 of 349 5 of 519 450 of 67, 006 375 of 120, 111 1, 271 of 151, 604 Total research and SPC costs Staff Number of clients interviewed

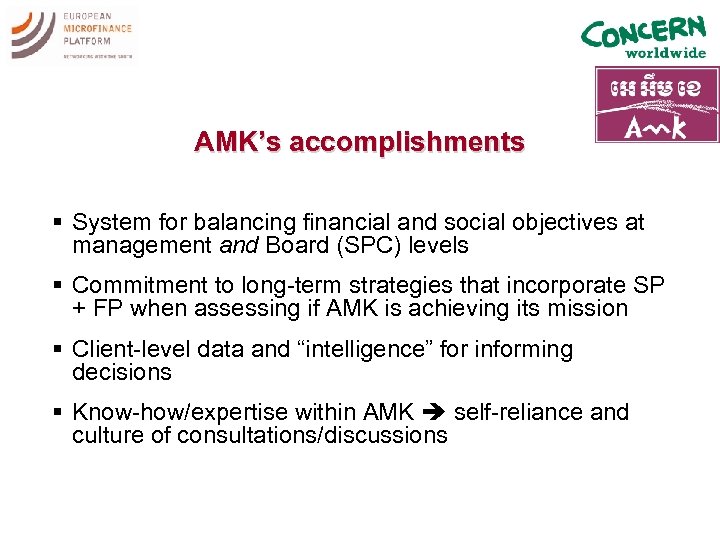

AMK’s accomplishments § System for balancing financial and social objectives at management and Board (SPC) levels § Commitment to long-term strategies that incorporate SP + FP when assessing if AMK is achieving its mission § Client-level data and “intelligence” for informing decisions § Know-how/expertise within AMK self-reliance and culture of consultations/discussions

AMK’s accomplishments § System for balancing financial and social objectives at management and Board (SPC) levels § Commitment to long-term strategies that incorporate SP + FP when assessing if AMK is achieving its mission § Client-level data and “intelligence” for informing decisions § Know-how/expertise within AMK self-reliance and culture of consultations/discussions

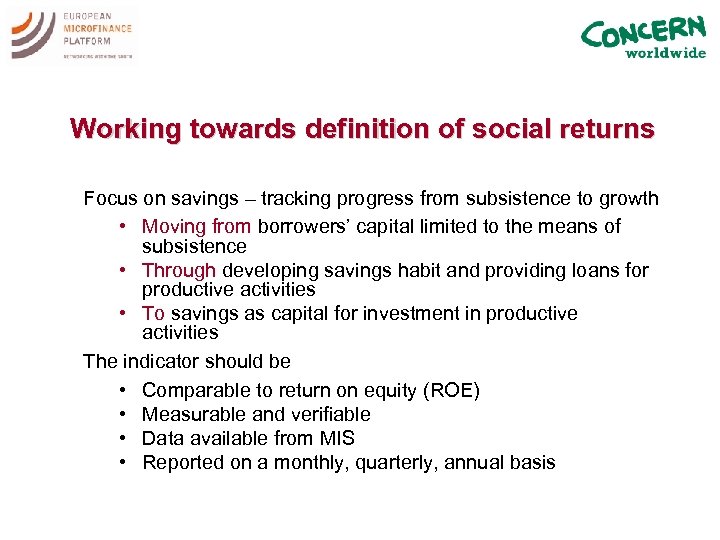

Working towards definition of social returns Focus on savings – tracking progress from subsistence to growth • Moving from borrowers’ capital limited to the means of subsistence • Through developing savings habit and providing loans for productive activities • To savings as capital for investment in productive activities The indicator should be • Comparable to return on equity (ROE) • Measurable and verifiable • Data available from MIS • Reported on a monthly, quarterly, annual basis

Working towards definition of social returns Focus on savings – tracking progress from subsistence to growth • Moving from borrowers’ capital limited to the means of subsistence • Through developing savings habit and providing loans for productive activities • To savings as capital for investment in productive activities The indicator should be • Comparable to return on equity (ROE) • Measurable and verifiable • Data available from MIS • Reported on a monthly, quarterly, annual basis

Defining social returns: savings as a source of capital for the poor • Financial returns: capital growth indicator in MFI = ROE • We suggest social returns: capital growth indicator in client households = the borrowers’ average deposit amount change, viewing savings as clients’ capital

Defining social returns: savings as a source of capital for the poor • Financial returns: capital growth indicator in MFI = ROE • We suggest social returns: capital growth indicator in client households = the borrowers’ average deposit amount change, viewing savings as clients’ capital

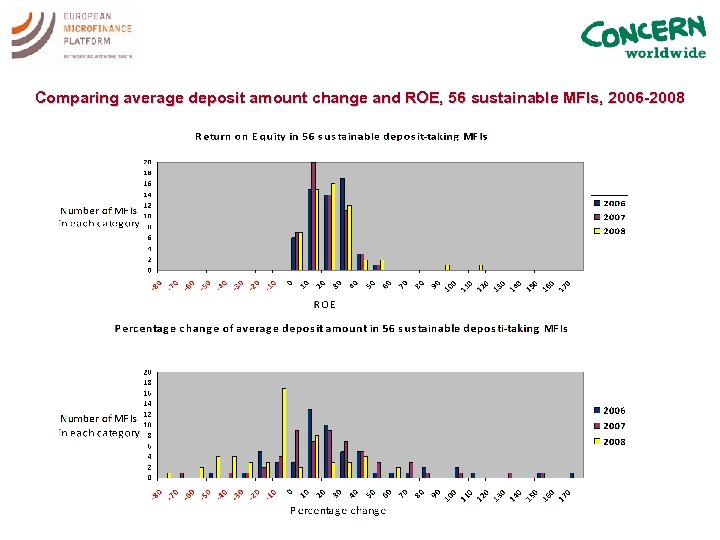

Comparing average deposit amount change and ROE, 56 sustainable MFIs, 2006 -2008

Comparing average deposit amount change and ROE, 56 sustainable MFIs, 2006 -2008

Comparing social returns to financial returns Observation: Ø MFIs clients’ savings diminished: 2008 in 61% of MFIs; 2007 in 16 % of MFIs; 2006 in 18% of MFIs while the capital of the MFIs increased Conclusion: Ø If social returns reflect average savings amount growth in poor households, social returns in 34 MFIs (61%) were negative in 2008, while the MFIs’ financial returns were positive

Comparing social returns to financial returns Observation: Ø MFIs clients’ savings diminished: 2008 in 61% of MFIs; 2007 in 16 % of MFIs; 2006 in 18% of MFIs while the capital of the MFIs increased Conclusion: Ø If social returns reflect average savings amount growth in poor households, social returns in 34 MFIs (61%) were negative in 2008, while the MFIs’ financial returns were positive

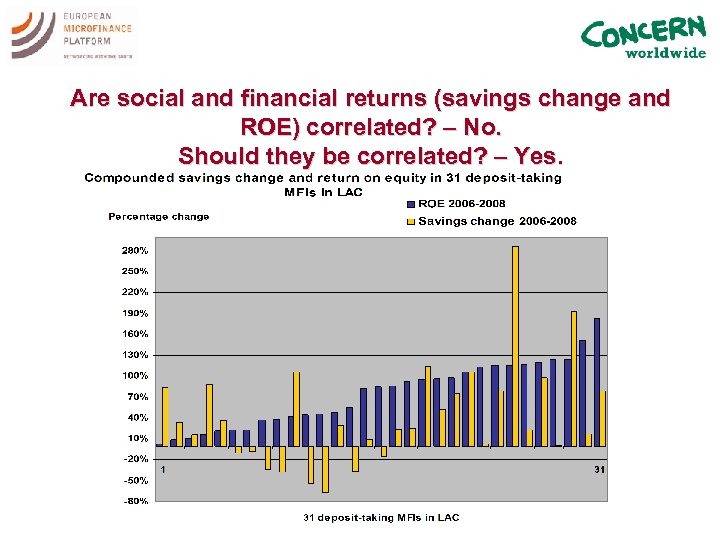

Are social and financial returns (savings change and ROE) correlated? – No. Should they be correlated? – Yes.

Are social and financial returns (savings change and ROE) correlated? – No. Should they be correlated? – Yes.

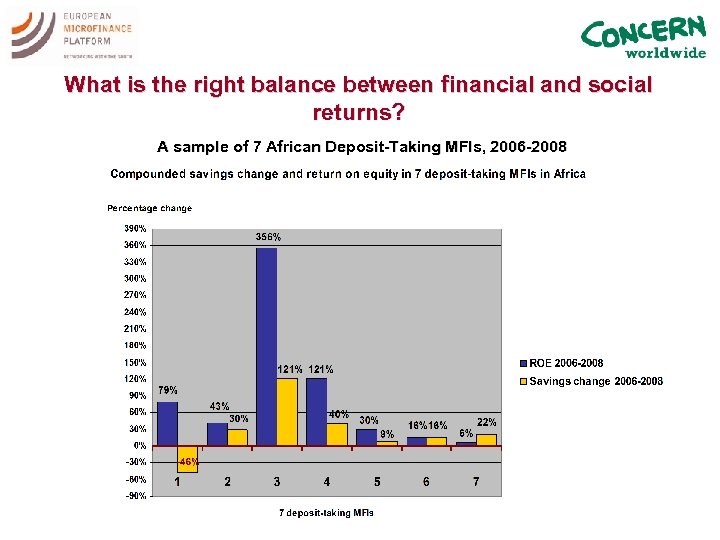

What is the right balance between financial and social returns? A sample of 7 African Deposit-Taking MFIs, 2006 -2008

What is the right balance between financial and social returns? A sample of 7 African Deposit-Taking MFIs, 2006 -2008

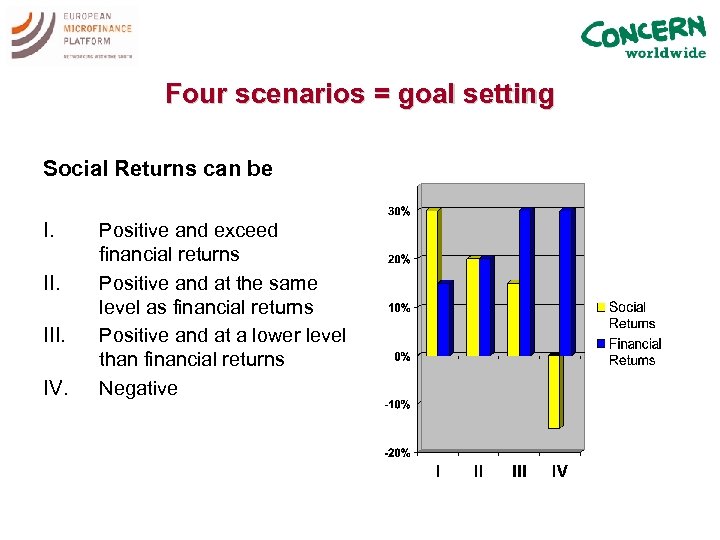

Four scenarios = goal setting Social Returns can be I. III. IV. Positive and exceed financial returns Positive and at the same level as financial returns Positive and at a lower level than financial returns Negative

Four scenarios = goal setting Social Returns can be I. III. IV. Positive and exceed financial returns Positive and at the same level as financial returns Positive and at a lower level than financial returns Negative

Decisions to be made by the stakeholders • What is the expected level of financial returns for the social investors? • Which returns should be maximised – financial or social? • What is the desired balance between the social and financial returns?

Decisions to be made by the stakeholders • What is the expected level of financial returns for the social investors? • Which returns should be maximised – financial or social? • What is the desired balance between the social and financial returns?

Thank you ! Irina Ignatieva

Thank you ! Irina Ignatieva