924635419251b5088deaa1fb5c4b80cd.ppt

- Количество слайдов: 20

HOW DO I FIND AN INVESTOR? Presentation by Dr. Andreas O. Tobler October 19, 2010 Tento projekt je spolufinancován Evropským sociálním fondem a státním rozpočtem České republiky

Private Equity is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange

Private Equity is generally used to ➤ develop new products and technologies ➤ to expand working capital ➤ to make acquisitions or to strengthen a company’s balance sheet. ➤ to resolve ownership and management issues or a succession in family-owned companies ➤ to buy out or buy into a business by experienced managers

Venture Capital Venture capital is, strictly speaking, a subset of private equity and refers to equity investments typically in less mature companies (i. e. startups) made for ➤the launch ➤early development ➤expansion of a business. or

Who is behind Venture Capital? Venture Capital is raised primarily from ➤Friends & Family ➤Private Investors (also referred to as “Angel Investors” or “Business Angels”) ➤Institutional Investors

Who is behind Venture Capital? The term “Friends & Family” investors is self -explanatory; they typically invest less than $100, 000 in a start-up as a 1 st round financing Jokingly, they are sometimes referred to as “FFF”, which stands for "friends, family and fools"

Who is behind Venture Capital? Private or Angel Investors are typically affluent individuals who provide capital for a business start-up Private or Angel Investors typically invest between $100 k to $2 million in a 1 st or 2 nd round financing An increasing number of angel investors organize themselves into angel groups or angel networks to share research and pool their investment capital

Who is behind Venture Capital? Institutional Investors are organizations which pool large sums of money and invest those in different asset classes, including Venture Capital Institutional Investors typically invest $2+ million in 2 nd and follow-up rounds of financing

Who is behind Venture Capital? Types of typical Institutional Investors include: ➤ banks ➤ insurance companies ➤ retirement or pension funds ➤ hedge funds ➤ investment advisors ➤ mutual funds

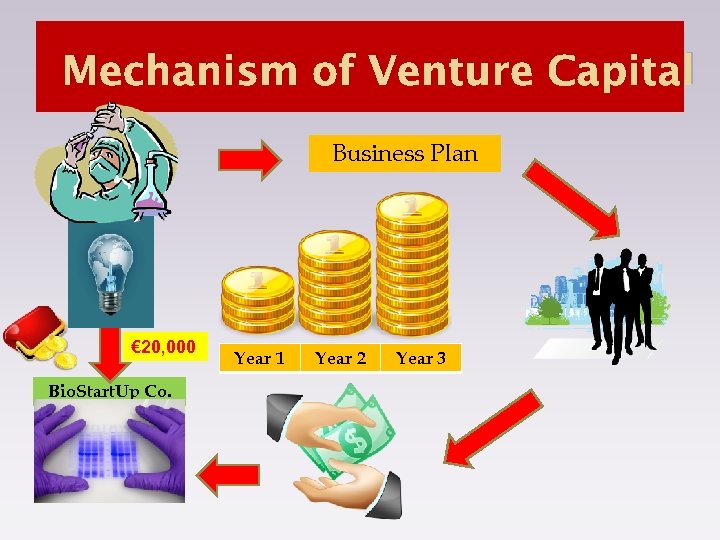

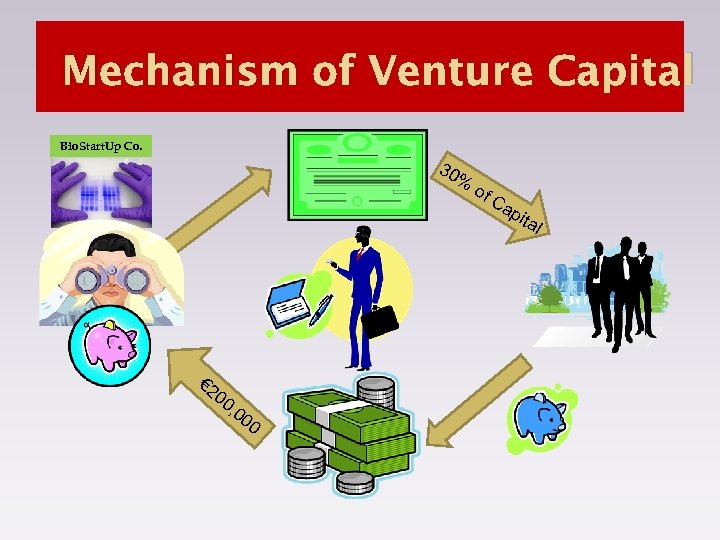

Mechanism of Venture Capital Business Plan € 20, 000 Bio. Start. Up Co. Year 1 Year 2 Year 3

Mechanism of Venture Capital Bio. Start. Up Co. 30 % of Ca p ita l € 2 00 , 0 00

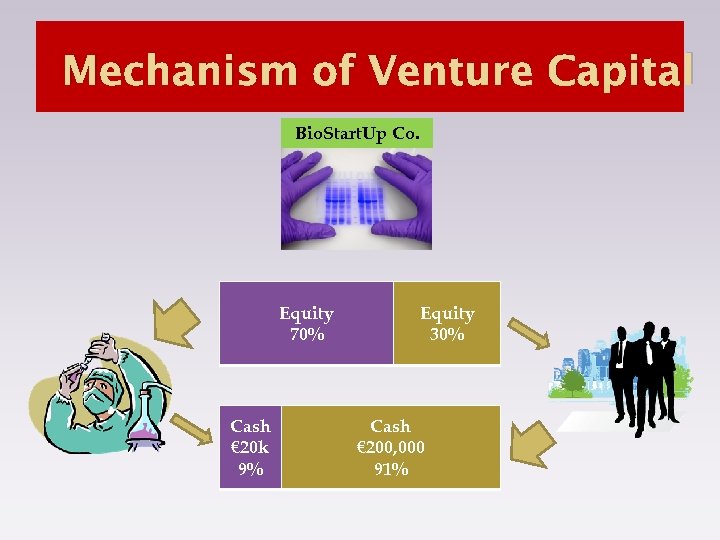

Mechanism of Venture Capital Bio. Start. Up Co. Equity 70% Cash € 20 k 9% Equity 30% Cash € 200, 000 91%

How do I find VC? Internet - the source: http: //www. vfinance. com http: //angelsoft. net/startup-tools/investorsearch http: //www. startangels. ch/ …however, there are many thousand options!

How do I find VC in the Czech Republic? “…finding venture capital in what one expert calls "the worst country" in Europe for startups” (The Prague Post, March 3, 2010) http: //www. thebusinessplace. com/vent ure-capital-in-Czech%20 Republic

How do I find VC in the Czech Republic? Private equity news resources: http: //www. altassets. net/private-equity -news/by-region/europe/central-eastern -europe/czech-republic. html

How do I find VC in the Czech Republic? Go to the source: http: //www. genesis. cz/index_en. html

How do I find VC in the Czech Republic? Network!

How do I find VC if I don’t find it within the Czech Republic? Go abroad! Set up a subsidiary in a “venture friendly” country with good venture capital infrastructure, e. g. USA, UK etc.

How do I survive until I find VC? Build your business creatively with other funding/revenue sources first: ➤ ➤ ➤ Grants Strategic alliances Revenues

Questions? 1. What is “private equity” 2. What is “venture capital” 3. Name three categories of investors 4. How much does each category typically invest? 5. If you can’t find venture capital, name an alternative source of funding 6. Name a country with a good venture capital infrastructure

924635419251b5088deaa1fb5c4b80cd.ppt