846b0aead1dcc32041f87c791167e10e.ppt

- Количество слайдов: 26

How do Female Entrepreneurs Perform ? Evidence from Three Developing Regions Shwetlena Sabarwal, World Bank Katherine Terrell, University of Michigan Elena Bardasi, World Bank Conference on Female Entrepreneurship (June 2, 2009)

How do Female Entrepreneurs Perform ? Evidence from Three Developing Regions Shwetlena Sabarwal, World Bank Katherine Terrell, University of Michigan Elena Bardasi, World Bank Conference on Female Entrepreneurship (June 2, 2009)

Question and Motivation • Entrepreneurship is important for economic growth and job creation • LDCs need to examine whether women are participating and co-creating at the same rate as men. If not, why?

Question and Motivation • Entrepreneurship is important for economic growth and job creation • LDCs need to examine whether women are participating and co-creating at the same rate as men. If not, why?

Question and Motivation We empirically test this hypothesis in the formal sectors of three developing regions: Eastern Europe and Central Asia (ECA) Latin America (LA) Sub-Saharan Africa (SSA) We ask: 1. Do FEs perform worse? In terms of: Size? Performance? 2. If so, can we identify potential explanations, such as: Sectoral concentration? Access to credit?

Question and Motivation We empirically test this hypothesis in the formal sectors of three developing regions: Eastern Europe and Central Asia (ECA) Latin America (LA) Sub-Saharan Africa (SSA) We ask: 1. Do FEs perform worse? In terms of: Size? Performance? 2. If so, can we identify potential explanations, such as: Sectoral concentration? Access to credit?

Our Contribution • Examining three entire regions (61 countries) which have not been studied in this context. • Measuring performance gaps on a number of dimensions. • Providing analysis of gender differences in production technology • Providing an in-depth analysis of gender-gaps in access to entrepreneurial credit.

Our Contribution • Examining three entire regions (61 countries) which have not been studied in this context. • Measuring performance gaps on a number of dimensions. • Providing analysis of gender differences in production technology • Providing an in-depth analysis of gender-gaps in access to entrepreneurial credit.

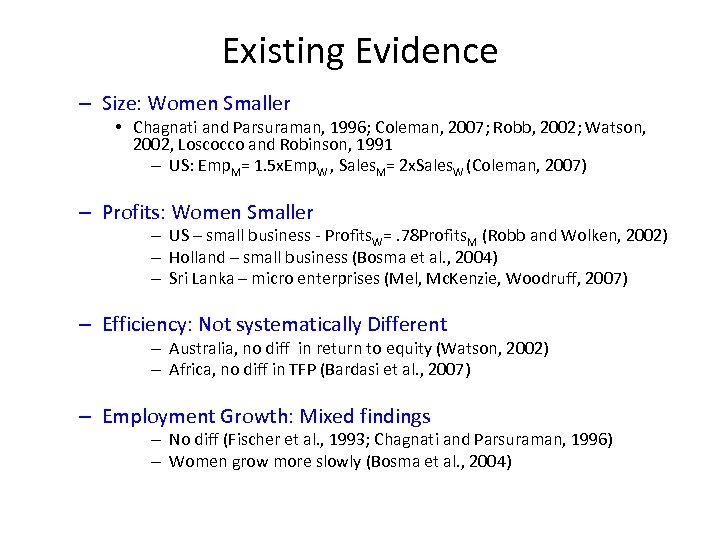

Existing Evidence – Size: Women Smaller • Chagnati and Parsuraman, 1996; Coleman, 2007; Robb, 2002; Watson, 2002, Loscocco and Robinson, 1991 – US: Emp. M= 1. 5 x. Emp. W , Sales. M= 2 x. Sales. W (Coleman, 2007) – Profits: Women Smaller – US – small business - Profits. W=. 78 Profits. M (Robb and Wolken, 2002) – Holland – small business (Bosma et al. , 2004) – Sri Lanka – micro enterprises (Mel, Mc. Kenzie, Woodruff, 2007) – Efficiency: Not systematically Different – Australia, no diff in return to equity (Watson, 2002) – Africa, no diff in TFP (Bardasi et al. , 2007) – Employment Growth: Mixed findings – No diff (Fischer et al. , 1993; Chagnati and Parsuraman, 1996) – Women grow more slowly (Bosma et al. , 2004)

Existing Evidence – Size: Women Smaller • Chagnati and Parsuraman, 1996; Coleman, 2007; Robb, 2002; Watson, 2002, Loscocco and Robinson, 1991 – US: Emp. M= 1. 5 x. Emp. W , Sales. M= 2 x. Sales. W (Coleman, 2007) – Profits: Women Smaller – US – small business - Profits. W=. 78 Profits. M (Robb and Wolken, 2002) – Holland – small business (Bosma et al. , 2004) – Sri Lanka – micro enterprises (Mel, Mc. Kenzie, Woodruff, 2007) – Efficiency: Not systematically Different – Australia, no diff in return to equity (Watson, 2002) – Africa, no diff in TFP (Bardasi et al. , 2007) – Employment Growth: Mixed findings – No diff (Fischer et al. , 1993; Chagnati and Parsuraman, 1996) – Women grow more slowly (Bosma et al. , 2004)

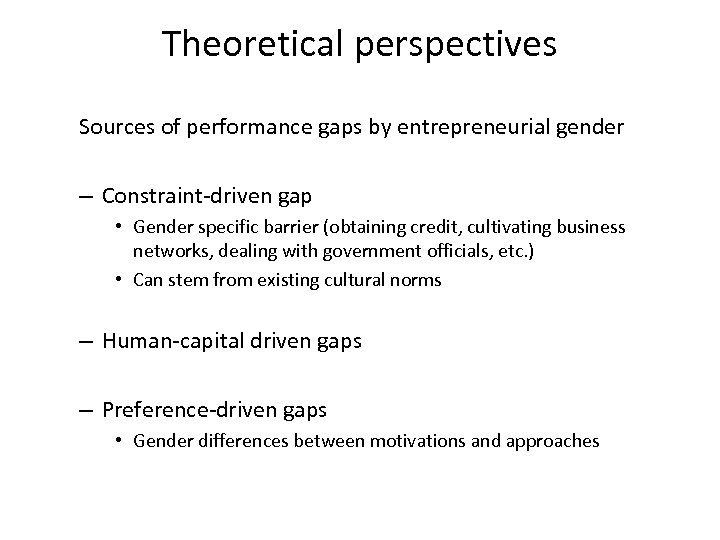

Theoretical perspectives Sources of performance gaps by entrepreneurial gender – Constraint-driven gap • Gender specific barrier (obtaining credit, cultivating business networks, dealing with government officials, etc. ) • Can stem from existing cultural norms – Human-capital driven gaps – Preference-driven gaps • Gender differences between motivations and approaches

Theoretical perspectives Sources of performance gaps by entrepreneurial gender – Constraint-driven gap • Gender specific barrier (obtaining credit, cultivating business networks, dealing with government officials, etc. ) • Can stem from existing cultural norms – Human-capital driven gaps – Preference-driven gaps • Gender differences between motivations and approaches

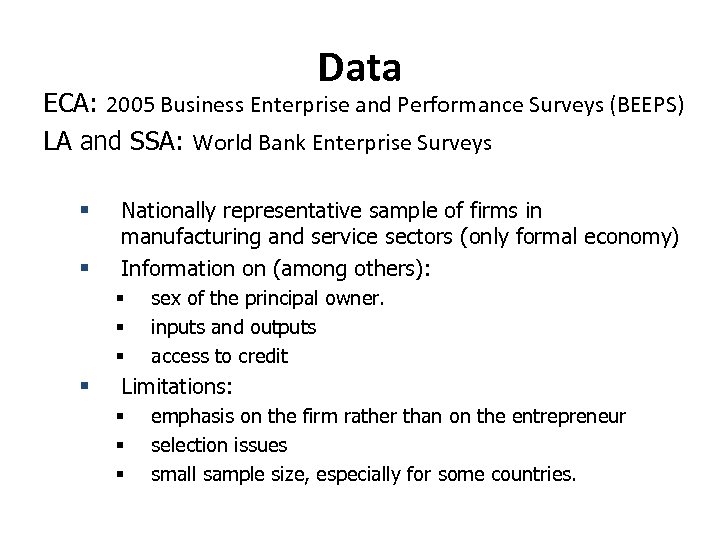

Data ECA: 2005 Business Enterprise and Performance Surveys (BEEPS) LA and SSA: World Bank Enterprise Surveys § § Nationally representative sample of firms in manufacturing and service sectors (only formal economy) Information on (among others): § § sex of the principal owner. inputs and outputs access to credit Limitations: § § § emphasis on the firm rather than on the entrepreneur selection issues small sample size, especially for some countries.

Data ECA: 2005 Business Enterprise and Performance Surveys (BEEPS) LA and SSA: World Bank Enterprise Surveys § § Nationally representative sample of firms in manufacturing and service sectors (only formal economy) Information on (among others): § § sex of the principal owner. inputs and outputs access to credit Limitations: § § § emphasis on the firm rather than on the entrepreneur selection issues small sample size, especially for some countries.

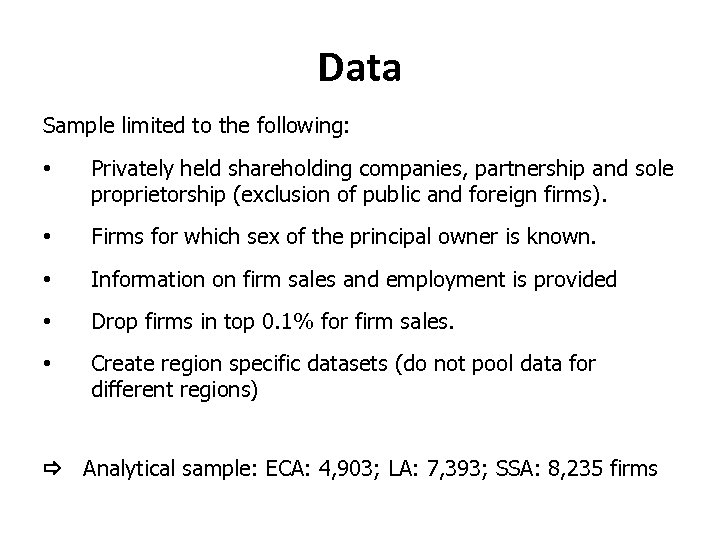

Data Sample limited to the following: • Privately held shareholding companies, partnership and sole proprietorship (exclusion of public and foreign firms). • Firms for which sex of the principal owner is known. • Information on firm sales and employment is provided • Drop firms in top 0. 1% for firm sales. • Create region specific datasets (do not pool data for different regions) Analytical sample: ECA: 4, 903; LA: 7, 393; SSA: 8, 235 firms

Data Sample limited to the following: • Privately held shareholding companies, partnership and sole proprietorship (exclusion of public and foreign firms). • Firms for which sex of the principal owner is known. • Information on firm sales and employment is provided • Drop firms in top 0. 1% for firm sales. • Create region specific datasets (do not pool data for different regions) Analytical sample: ECA: 4, 903; LA: 7, 393; SSA: 8, 235 firms

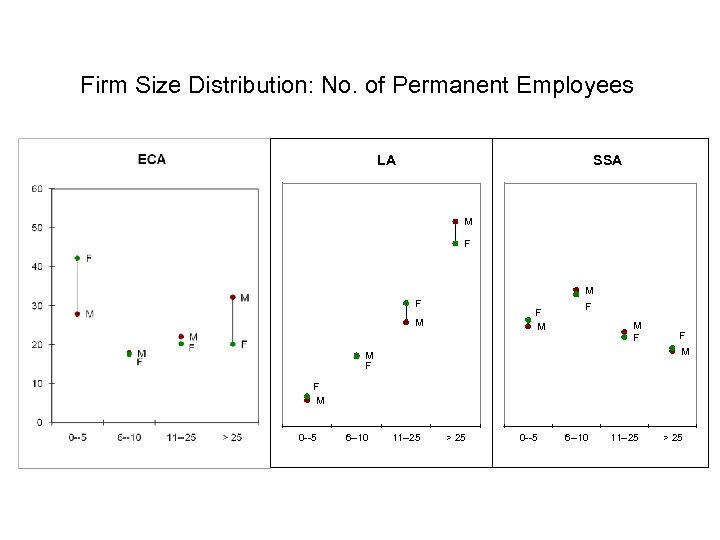

Firm Size Distribution: No. of Permanent Employees LA SSA M F M F F M 0 --5 6 --10 11 --25 > 25

Firm Size Distribution: No. of Permanent Employees LA SSA M F M F F M 0 --5 6 --10 11 --25 > 25

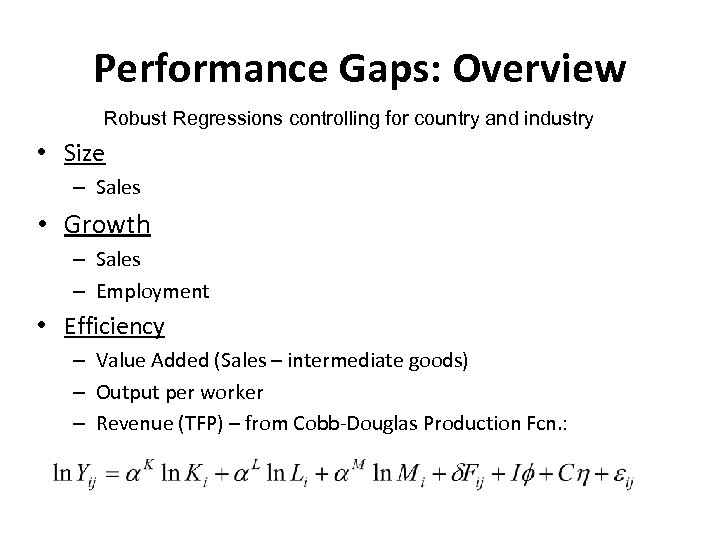

Performance Gaps: Overview Robust Regressions controlling for country and industry • Size – Sales • Growth – Sales – Employment • Efficiency – Value Added (Sales – intermediate goods) – Output per worker – Revenue (TFP) – from Cobb-Douglas Production Fcn. :

Performance Gaps: Overview Robust Regressions controlling for country and industry • Size – Sales • Growth – Sales – Employment • Efficiency – Value Added (Sales – intermediate goods) – Output per worker – Revenue (TFP) – from Cobb-Douglas Production Fcn. :

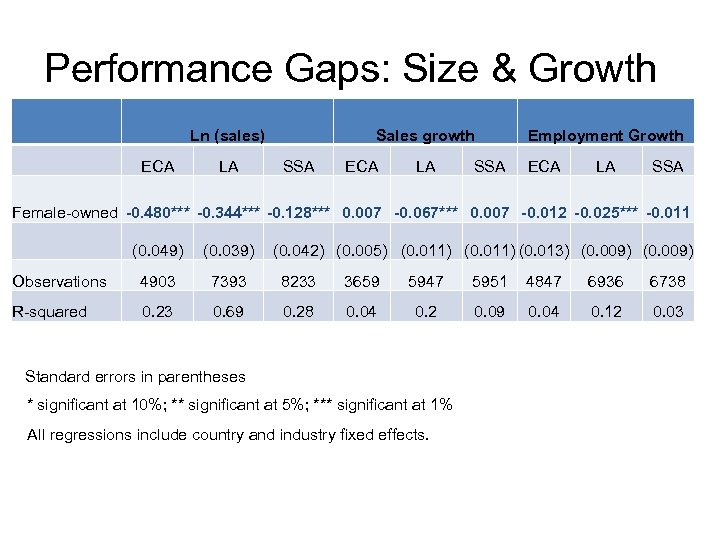

Performance Gaps: Size & Growth Ln (sales) ECA LA Sales growth SSA ECA LA SSA Employment Growth ECA LA SSA Female-owned -0. 480*** -0. 344*** -0. 128*** 0. 007 -0. 067*** 0. 007 -0. 012 -0. 025*** -0. 011 (0. 049) (0. 039) (0. 042) (0. 005) (0. 011) (0. 013) (0. 009) Observations 4903 7393 8233 3659 5947 5951 4847 6936 6738 R-squared 0. 23 0. 69 0. 28 0. 04 0. 2 0. 09 0. 04 0. 12 0. 03 Standard errors in parentheses * significant at 10%; ** significant at 5%; *** significant at 1% All regressions include country and industry fixed effects.

Performance Gaps: Size & Growth Ln (sales) ECA LA Sales growth SSA ECA LA SSA Employment Growth ECA LA SSA Female-owned -0. 480*** -0. 344*** -0. 128*** 0. 007 -0. 067*** 0. 007 -0. 012 -0. 025*** -0. 011 (0. 049) (0. 039) (0. 042) (0. 005) (0. 011) (0. 013) (0. 009) Observations 4903 7393 8233 3659 5947 5951 4847 6936 6738 R-squared 0. 23 0. 69 0. 28 0. 04 0. 2 0. 09 0. 04 0. 12 0. 03 Standard errors in parentheses * significant at 10%; ** significant at 5%; *** significant at 1% All regressions include country and industry fixed effects.

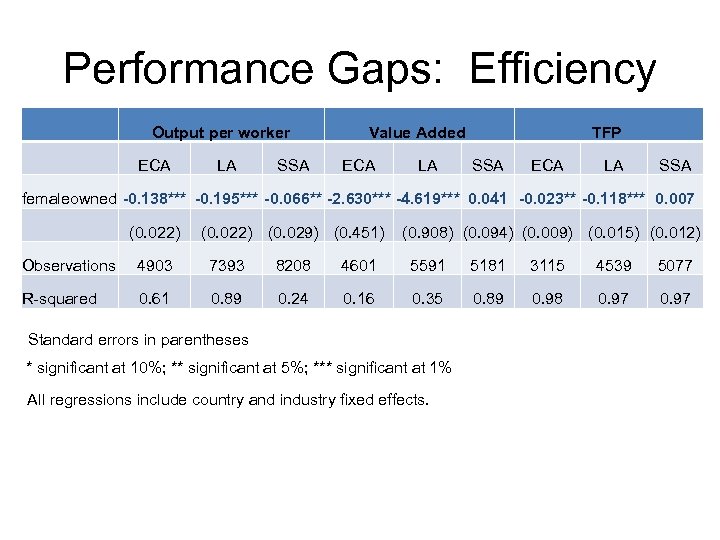

Performance Gaps: Efficiency Output per worker ECA LA SSA Value Added ECA LA TFP SSA ECA LA SSA femaleowned -0. 138*** -0. 195*** -0. 066** -2. 630*** -4. 619*** 0. 041 -0. 023** -0. 118*** 0. 007 (0. 022) (0. 029) (0. 451) (0. 908) (0. 094) (0. 009) (0. 015) (0. 012) Observations 4903 7393 8208 4601 5591 5181 3115 4539 5077 R-squared 0. 61 0. 89 0. 24 0. 16 0. 35 0. 89 0. 98 0. 97 Standard errors in parentheses * significant at 10%; ** significant at 5%; *** significant at 1% All regressions include country and industry fixed effects.

Performance Gaps: Efficiency Output per worker ECA LA SSA Value Added ECA LA TFP SSA ECA LA SSA femaleowned -0. 138*** -0. 195*** -0. 066** -2. 630*** -4. 619*** 0. 041 -0. 023** -0. 118*** 0. 007 (0. 022) (0. 029) (0. 451) (0. 908) (0. 094) (0. 009) (0. 015) (0. 012) Observations 4903 7393 8208 4601 5591 5181 3115 4539 5077 R-squared 0. 61 0. 89 0. 24 0. 16 0. 35 0. 89 0. 98 0. 97 Standard errors in parentheses * significant at 10%; ** significant at 5%; *** significant at 1% All regressions include country and industry fixed effects.

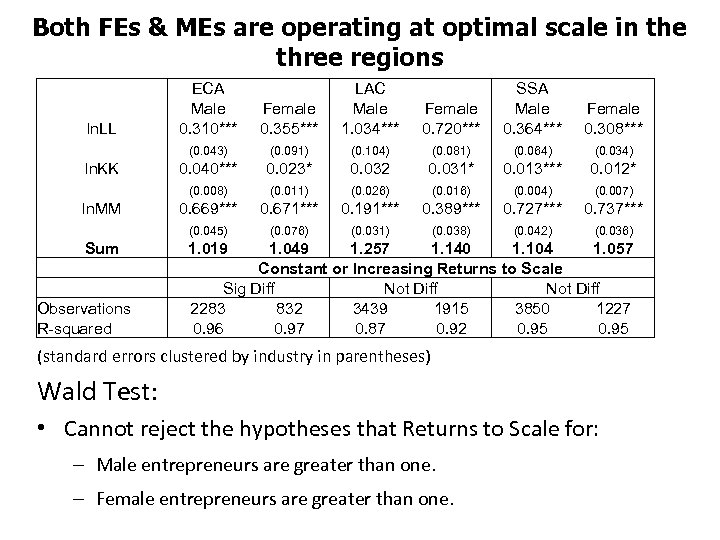

Both FEs & MEs are operating at optimal scale in the three regions ln. LL ln. KK ln. MM Sum Observations R-squared ECA Male 0. 310*** Female 0. 355*** LAC Male 1. 034*** Female 0. 720*** SSA Male 0. 364*** Female 0. 308*** (0. 043) (0. 091) (0. 104) (0. 081) (0. 064) (0. 034) 0. 040*** 0. 023* 0. 032 0. 031* 0. 013*** 0. 012* (0. 008) (0. 011) (0. 026) (0. 016) (0. 004) (0. 007) 0. 669*** 0. 671*** 0. 191*** 0. 389*** 0. 727*** 0. 737*** (0. 045) (0. 076) (0. 031) (0. 038) (0. 042) (0. 036) 1. 019 1. 049 1. 257 1. 140 1. 104 1. 057 Constant or Increasing Returns to Scale Sig Diff Not Diff 2283 832 3439 1915 3850 1227 0. 96 0. 97 0. 87 0. 92 0. 95 (standard errors clustered by industry in parentheses) Wald Test: • Cannot reject the hypotheses that Returns to Scale for: – Male entrepreneurs are greater than one. – Female entrepreneurs are greater than one.

Both FEs & MEs are operating at optimal scale in the three regions ln. LL ln. KK ln. MM Sum Observations R-squared ECA Male 0. 310*** Female 0. 355*** LAC Male 1. 034*** Female 0. 720*** SSA Male 0. 364*** Female 0. 308*** (0. 043) (0. 091) (0. 104) (0. 081) (0. 064) (0. 034) 0. 040*** 0. 023* 0. 032 0. 031* 0. 013*** 0. 012* (0. 008) (0. 011) (0. 026) (0. 016) (0. 004) (0. 007) 0. 669*** 0. 671*** 0. 191*** 0. 389*** 0. 727*** 0. 737*** (0. 045) (0. 076) (0. 031) (0. 038) (0. 042) (0. 036) 1. 019 1. 049 1. 257 1. 140 1. 104 1. 057 Constant or Increasing Returns to Scale Sig Diff Not Diff 2283 832 3439 1915 3850 1227 0. 96 0. 97 0. 87 0. 92 0. 95 (standard errors clustered by industry in parentheses) Wald Test: • Cannot reject the hypotheses that Returns to Scale for: – Male entrepreneurs are greater than one. – Female entrepreneurs are greater than one.

What explains why women are operating smaller businesses? • Due to industrial location? (Women concentrated in “poorly performing” industries) • Women are constrained in access to finance?

What explains why women are operating smaller businesses? • Due to industrial location? (Women concentrated in “poorly performing” industries) • Women are constrained in access to finance?

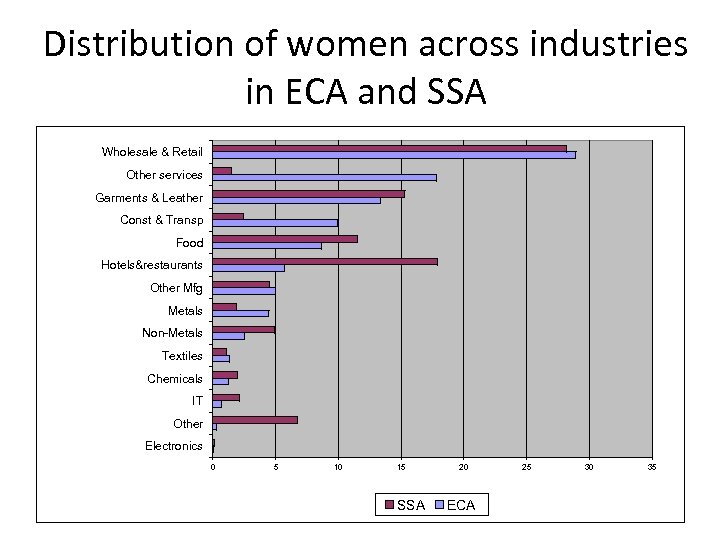

Distribution of women across industries in ECA and SSA Wholesale & Retail Other services Garments & Leather Const & Transp Food Hotels&restaurants Other Mfg Metals Non-Metals Textiles Chemicals IT Other Electronics 0 5 10 15 SSA 20 ECA 25 30 35

Distribution of women across industries in ECA and SSA Wholesale & Retail Other services Garments & Leather Const & Transp Food Hotels&restaurants Other Mfg Metals Non-Metals Textiles Chemicals IT Other Electronics 0 5 10 15 SSA 20 ECA 25 30 35

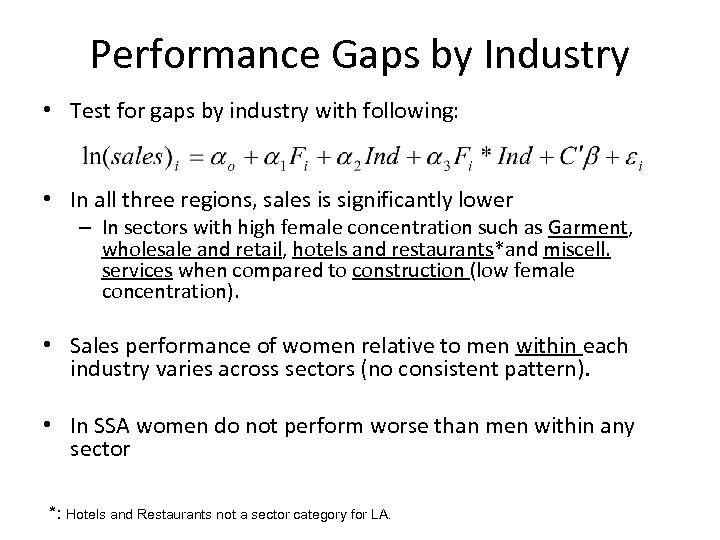

Performance Gaps by Industry • Test for gaps by industry with following: • In all three regions, sales is significantly lower – In sectors with high female concentration such as Garment, wholesale and retail, hotels and restaurants*and miscell. services when compared to construction (low female concentration). • Sales performance of women relative to men within each industry varies across sectors (no consistent pattern). • In SSA women do not perform worse than men within any sector *: Hotels and Restaurants not a sector category for LA.

Performance Gaps by Industry • Test for gaps by industry with following: • In all three regions, sales is significantly lower – In sectors with high female concentration such as Garment, wholesale and retail, hotels and restaurants*and miscell. services when compared to construction (low female concentration). • Sales performance of women relative to men within each industry varies across sectors (no consistent pattern). • In SSA women do not perform worse than men within any sector *: Hotels and Restaurants not a sector category for LA.

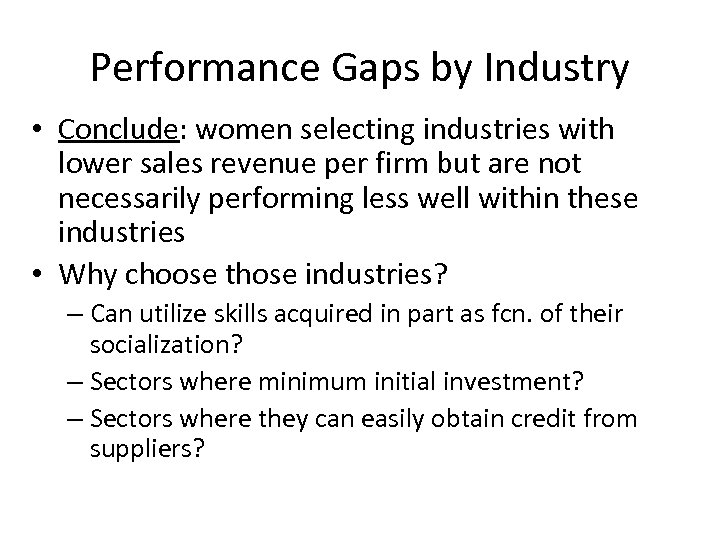

Performance Gaps by Industry • Conclude: women selecting industries with lower sales revenue per firm but are not necessarily performing less well within these industries • Why choose those industries? – Can utilize skills acquired in part as fcn. of their socialization? – Sectors where minimum initial investment? – Sectors where they can easily obtain credit from suppliers?

Performance Gaps by Industry • Conclude: women selecting industries with lower sales revenue per firm but are not necessarily performing less well within these industries • Why choose those industries? – Can utilize skills acquired in part as fcn. of their socialization? – Sectors where minimum initial investment? – Sectors where they can easily obtain credit from suppliers?

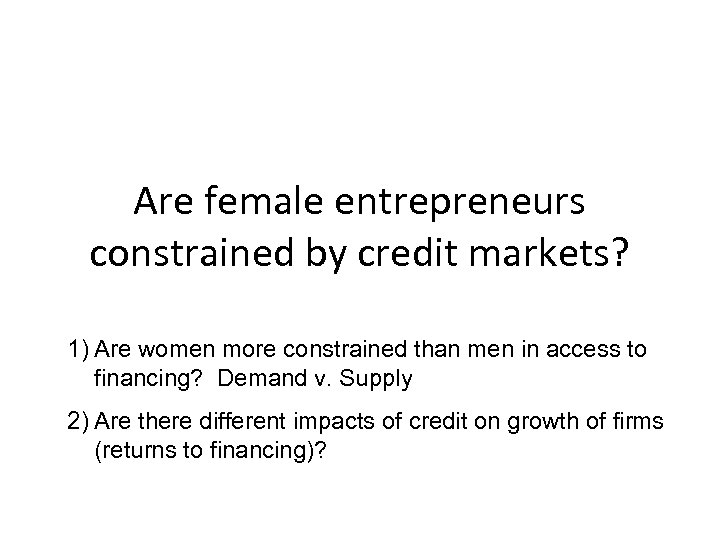

Are female entrepreneurs constrained by credit markets? 1) Are women more constrained than men in access to financing? Demand v. Supply 2) Are there different impacts of credit on growth of firms (returns to financing)?

Are female entrepreneurs constrained by credit markets? 1) Are women more constrained than men in access to financing? Demand v. Supply 2) Are there different impacts of credit on growth of firms (returns to financing)?

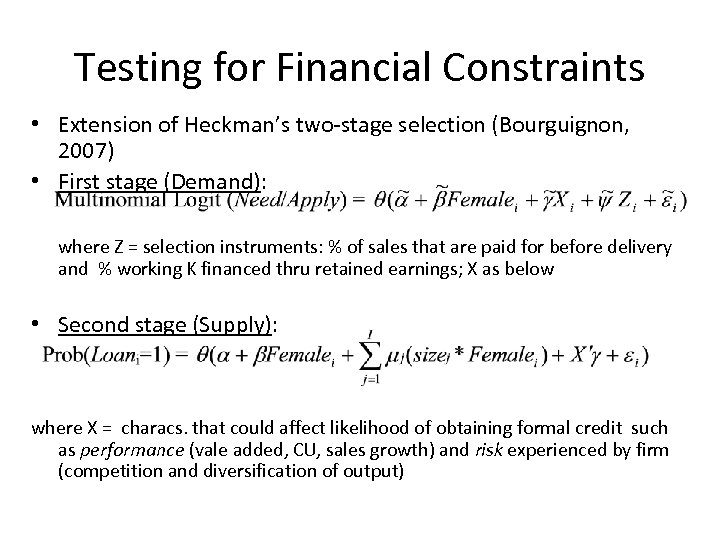

Testing for Financial Constraints • Extension of Heckman’s two-stage selection (Bourguignon, 2007) • First stage (Demand): where Z = selection instruments: % of sales that are paid for before delivery and % working K financed thru retained earnings; X as below • Second stage (Supply): where X = characs. that could affect likelihood of obtaining formal credit such as performance (vale added, CU, sales growth) and risk experienced by firm (competition and diversification of output)

Testing for Financial Constraints • Extension of Heckman’s two-stage selection (Bourguignon, 2007) • First stage (Demand): where Z = selection instruments: % of sales that are paid for before delivery and % working K financed thru retained earnings; X as below • Second stage (Supply): where X = characs. that could affect likelihood of obtaining formal credit such as performance (vale added, CU, sales growth) and risk experienced by firm (competition and diversification of output)

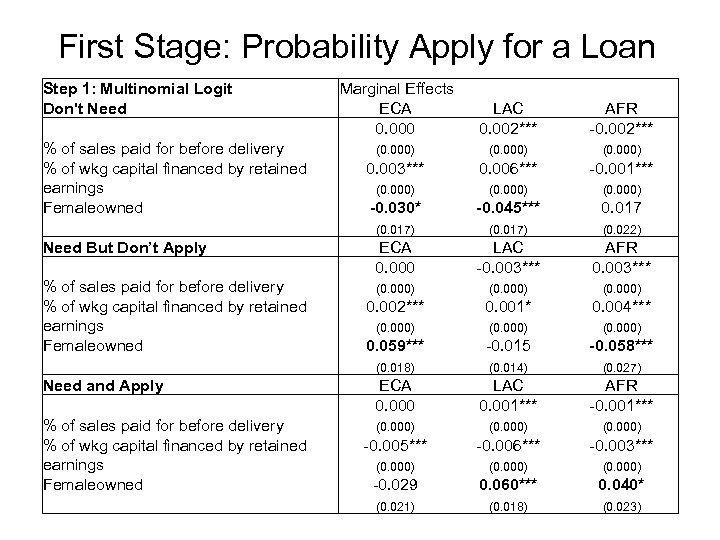

First Stage: Probability Apply for a Loan Step 1: Multinomial Logit Don't Need % of sales paid for before delivery % of wkg capital financed by retained earnings Femaleowned Need But Don’t Apply % of sales paid for before delivery % of wkg capital financed by retained earnings Femaleowned Need and Apply % of sales paid for before delivery % of wkg capital financed by retained earnings Femaleowned Marginal Effects ECA 0. 000 LAC 0. 002*** AFR -0. 002*** (0. 000) 0. 003*** 0. 006*** -0. 001*** (0. 000) -0. 030* -0. 045*** 0. 017 (0. 017) (0. 022) ECA 0. 000 LAC -0. 003*** AFR 0. 003*** (0. 000) 0. 002*** 0. 001* 0. 004*** (0. 000) 0. 059*** -0. 015 -0. 058*** (0. 018) (0. 014) (0. 027) ECA 0. 000 LAC 0. 001*** AFR -0. 001*** (0. 000) -0. 005*** -0. 006*** -0. 003*** (0. 000) -0. 029 0. 060*** 0. 040* (0. 021) (0. 018) (0. 023)

First Stage: Probability Apply for a Loan Step 1: Multinomial Logit Don't Need % of sales paid for before delivery % of wkg capital financed by retained earnings Femaleowned Need But Don’t Apply % of sales paid for before delivery % of wkg capital financed by retained earnings Femaleowned Need and Apply % of sales paid for before delivery % of wkg capital financed by retained earnings Femaleowned Marginal Effects ECA 0. 000 LAC 0. 002*** AFR -0. 002*** (0. 000) 0. 003*** 0. 006*** -0. 001*** (0. 000) -0. 030* -0. 045*** 0. 017 (0. 017) (0. 022) ECA 0. 000 LAC -0. 003*** AFR 0. 003*** (0. 000) 0. 002*** 0. 001* 0. 004*** (0. 000) 0. 059*** -0. 015 -0. 058*** (0. 018) (0. 014) (0. 027) ECA 0. 000 LAC 0. 001*** AFR -0. 001*** (0. 000) -0. 005*** -0. 006*** -0. 003*** (0. 000) -0. 029 0. 060*** 0. 040* (0. 021) (0. 018) (0. 023)

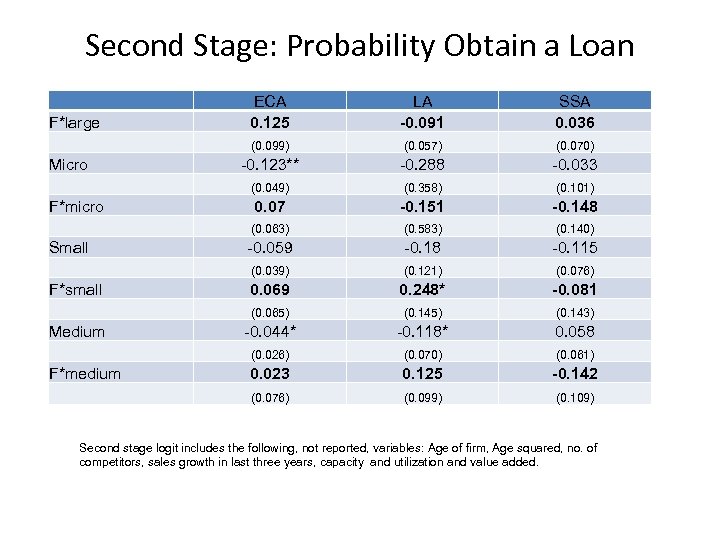

Second Stage: Probability Obtain a Loan F*large Micro F*micro Small F*small Medium F*medium ECA 0. 125 LA -0. 091 SSA 0. 036 (0. 099) (0. 057) (0. 070) -0. 123** -0. 288 -0. 033 (0. 049) (0. 358) (0. 101) 0. 07 -0. 151 -0. 148 (0. 063) (0. 583) (0. 140) -0. 059 -0. 18 -0. 115 (0. 039) (0. 121) (0. 076) 0. 069 0. 248* -0. 081 (0. 065) (0. 143) -0. 044* -0. 118* 0. 058 (0. 026) (0. 070) (0. 061) 0. 023 0. 125 -0. 142 (0. 076) (0. 099) (0. 109) Second stage logit includes the following, not reported, variables: Age of firm, Age squared, no. of competitors, sales growth in last three years, capacity and utilization and value added.

Second Stage: Probability Obtain a Loan F*large Micro F*micro Small F*small Medium F*medium ECA 0. 125 LA -0. 091 SSA 0. 036 (0. 099) (0. 057) (0. 070) -0. 123** -0. 288 -0. 033 (0. 049) (0. 358) (0. 101) 0. 07 -0. 151 -0. 148 (0. 063) (0. 583) (0. 140) -0. 059 -0. 18 -0. 115 (0. 039) (0. 121) (0. 076) 0. 069 0. 248* -0. 081 (0. 065) (0. 143) -0. 044* -0. 118* 0. 058 (0. 026) (0. 070) (0. 061) 0. 023 0. 125 -0. 142 (0. 076) (0. 099) (0. 109) Second stage logit includes the following, not reported, variables: Age of firm, Age squared, no. of competitors, sales growth in last three years, capacity and utilization and value added.

Are female entrepreneurs more constrained in use of credit?

Are female entrepreneurs more constrained in use of credit?

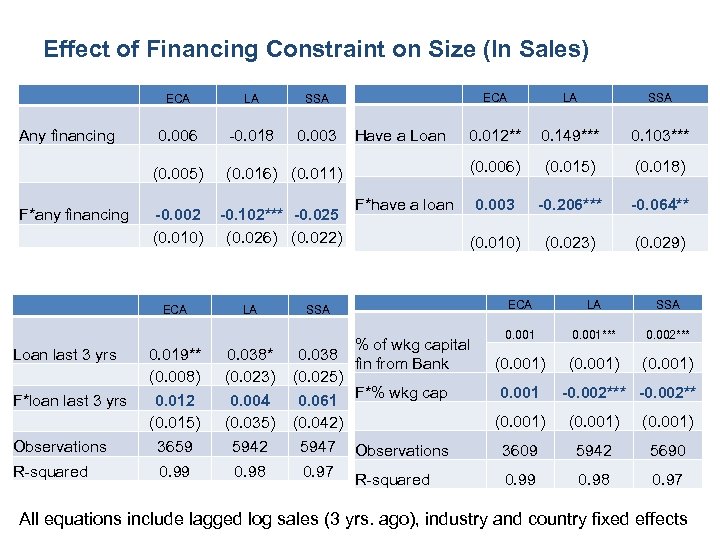

Effect of Financing Constraint on Size (ln Sales) Any financing ECA LA 0. 006 -0. 018 0. 003 (0. 005) F*any financing -0. 002 (0. 010) ECA (0. 016) (0. 011) -0. 102*** -0. 025 (0. 026) (0. 022) LA SSA Loan last 3 yrs 0. 019** (0. 008) 0. 038* (0. 023) 0. 038 (0. 025) F*loan last 3 yrs 0. 012 (0. 015) 0. 004 (0. 035) Observations 3659 5942 5947 R-squared 0. 99 0. 98 0. 97 SSA 0. 012** 0. 149*** 0. 103*** (0. 006) Have a Loan LA (0. 015) (0. 018) 0. 003 -0. 206*** -0. 064** (0. 010) SSA (0. 023) (0. 029) F*have a loan % of wkg capital fin from Bank F*% wkg cap 0. 061 (0. 042) ECA LA SSA 0. 001*** 0. 002*** (0. 001) 0. 001 -0. 002*** -0. 002** (0. 001) Observations 3609 5942 5690 R-squared 0. 99 0. 98 0. 97 All equations include lagged log sales (3 yrs. ago), industry and country fixed effects

Effect of Financing Constraint on Size (ln Sales) Any financing ECA LA 0. 006 -0. 018 0. 003 (0. 005) F*any financing -0. 002 (0. 010) ECA (0. 016) (0. 011) -0. 102*** -0. 025 (0. 026) (0. 022) LA SSA Loan last 3 yrs 0. 019** (0. 008) 0. 038* (0. 023) 0. 038 (0. 025) F*loan last 3 yrs 0. 012 (0. 015) 0. 004 (0. 035) Observations 3659 5942 5947 R-squared 0. 99 0. 98 0. 97 SSA 0. 012** 0. 149*** 0. 103*** (0. 006) Have a Loan LA (0. 015) (0. 018) 0. 003 -0. 206*** -0. 064** (0. 010) SSA (0. 023) (0. 029) F*have a loan % of wkg capital fin from Bank F*% wkg cap 0. 061 (0. 042) ECA LA SSA 0. 001*** 0. 002*** (0. 001) 0. 001 -0. 002*** -0. 002** (0. 001) Observations 3609 5942 5690 R-squared 0. 99 0. 98 0. 97 All equations include lagged log sales (3 yrs. ago), industry and country fixed effects

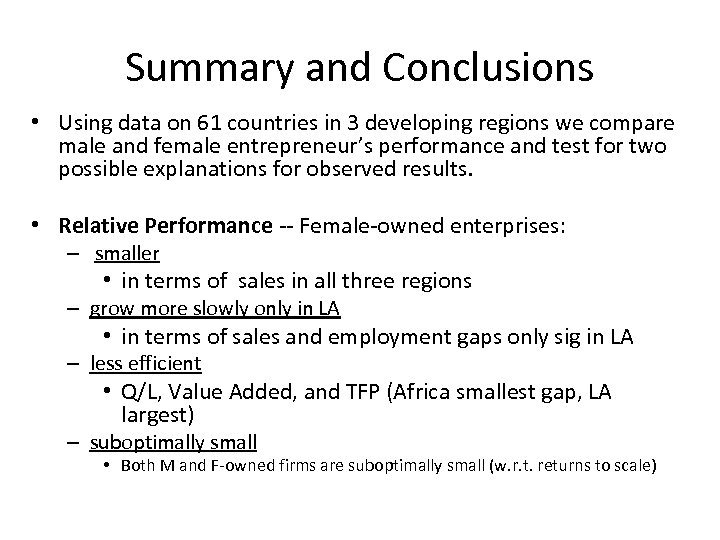

Summary and Conclusions • Using data on 61 countries in 3 developing regions we compare male and female entrepreneur’s performance and test for two possible explanations for observed results. • Relative Performance -- Female-owned enterprises: – smaller • in terms of sales in all three regions – grow more slowly only in LA • in terms of sales and employment gaps only sig in LA – less efficient • Q/L, Value Added, and TFP (Africa smallest gap, LA largest) – suboptimally small • Both M and F-owned firms are suboptimally small (w. r. t. returns to scale)

Summary and Conclusions • Using data on 61 countries in 3 developing regions we compare male and female entrepreneur’s performance and test for two possible explanations for observed results. • Relative Performance -- Female-owned enterprises: – smaller • in terms of sales in all three regions – grow more slowly only in LA • in terms of sales and employment gaps only sig in LA – less efficient • Q/L, Value Added, and TFP (Africa smallest gap, LA largest) – suboptimally small • Both M and F-owned firms are suboptimally small (w. r. t. returns to scale)

Summary and Conclusions • Explanations: – Concentrated in industries with lower sales • BUT – not systematically performing less well within each industry – Demand for credit: • ECA: Less likely to apply for loans when need it; • SSA and LA: More likely to apply – Supply of credit: • No evidence that women less likely to obtain a loan once control for selection and performance/risk (credit worthiness from bank’s viewpoint). – Use of credit: • ECA: No difference in impact on sales growth • SSA and LA: returns are lower for women

Summary and Conclusions • Explanations: – Concentrated in industries with lower sales • BUT – not systematically performing less well within each industry – Demand for credit: • ECA: Less likely to apply for loans when need it; • SSA and LA: More likely to apply – Supply of credit: • No evidence that women less likely to obtain a loan once control for selection and performance/risk (credit worthiness from bank’s viewpoint). – Use of credit: • ECA: No difference in impact on sales growth • SSA and LA: returns are lower for women

Next Steps Policy Recommendations • Need to understand – Drivers of demand formal bank loans in ECA v. SSA and LA • Availability of credit? – Why impact of loans on sales revenue is no different for men and women in ECA and lower for women in SSA and LA • Women’s preference? • Other constraints – Business training needed?

Next Steps Policy Recommendations • Need to understand – Drivers of demand formal bank loans in ECA v. SSA and LA • Availability of credit? – Why impact of loans on sales revenue is no different for men and women in ECA and lower for women in SSA and LA • Women’s preference? • Other constraints – Business training needed?