616b1fcb659e87328a2a6606b98a1cf6.ppt

- Количество слайдов: 17

How do banks position themselves in e&m channels and payments EPFSF/EIF joint event April 1 2008 European Parliament, Brussels Dag-Inge Flatraaker General Manager, Dn. B NOR Chairman EPC Standards Support Group and EPC e&m Expert Group

e&m payments - How do banks position themselves in e&m channels and payments Agenda - Internett banking – the Nordic case - e. Innvoicing - EPC/SEPA – e-commerce & mobile channel approach Dag-Inge Flatraaker – Dn. B NOR 2

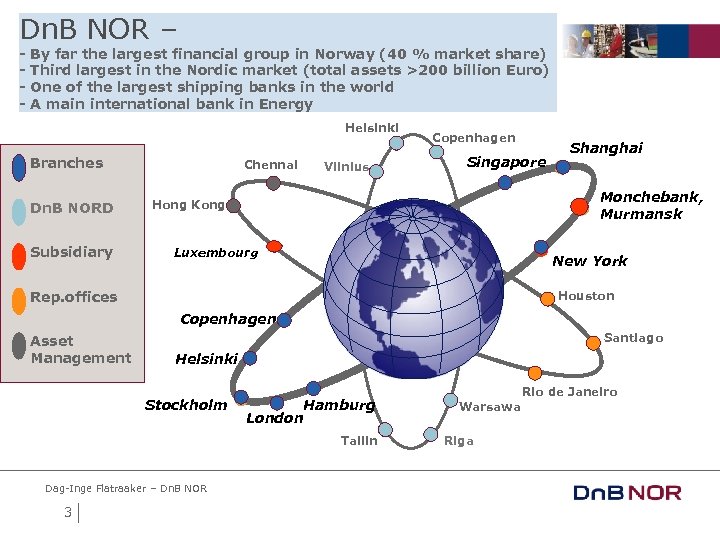

Dn. B NOR – - By far the largest financial group in Norway (40 % market share) Third largest in the Nordic market (total assets >200 billion Euro) One of the largest shipping banks in the world A main international bank in Energy Helsinki Branches Dn. B NORD Subsidiary Chennai Vilnius Copenhagen Singapore Shanghai Monchebank, Murmansk Hong Kong Luxembourg New York Rep. offices Houston Copenhagen Asset Management Santiago Helsinki Stockholm Hamburg London Tallin Dag-Inge Flatraaker – Dn. B NOR 3 Rio de Janeiro Warsawa Riga

The Nordic and Baltic countries are well positioned for the future. Example Norway • Early adopters of new technology and high penetration in technology use: • 3 mill persons above 13 years with Internet access • 2 mill people use the Internet daily • 100 % mobile penetration (40% in 1997) • Fixed line penetration 73% • The most dynamic mobile internet market outside Japan • The highest use of mobile content services • Almost all households and corporates are using e-banking services (internet banking) • Electronic multi-channelling and holistic approach has paved the way for a very efficient payment infrastructure Dag-Inge Flatraaker – Dn. B NOR 4

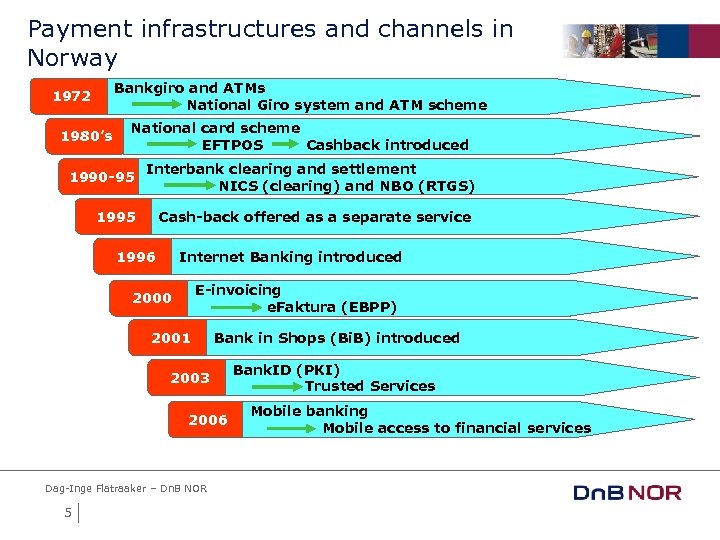

Payment infrastructures and channels in Norway Bankgiro and ATMs National Giro system and ATM scheme 1972 1980’s National card scheme EFTPOS Cashback introduced 1990 -95 Interbank clearing and settlement NICS (clearing) and NBO (RTGS) 1995 Cash-back offered as a separate service 1996 Internet Banking introduced E-invoicing e. Faktura (EBPP) 2000 2001 Bank in Shops (Bi. B) introduced 2003 2006 Dag-Inge Flatraaker – Dn. B NOR 5 Bank. ID (PKI) Trusted Services Mobile banking Mobile access to financial services

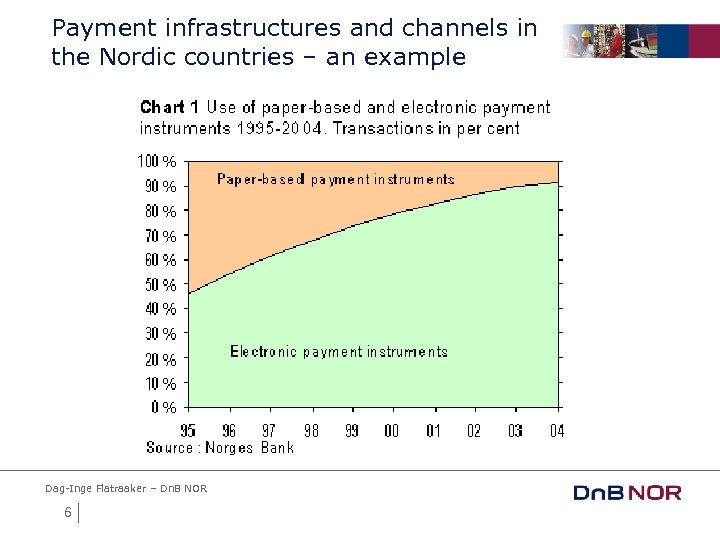

Payment infrastructures and channels in the Nordic countries – an example Dag-Inge Flatraaker – Dn. B NOR 6

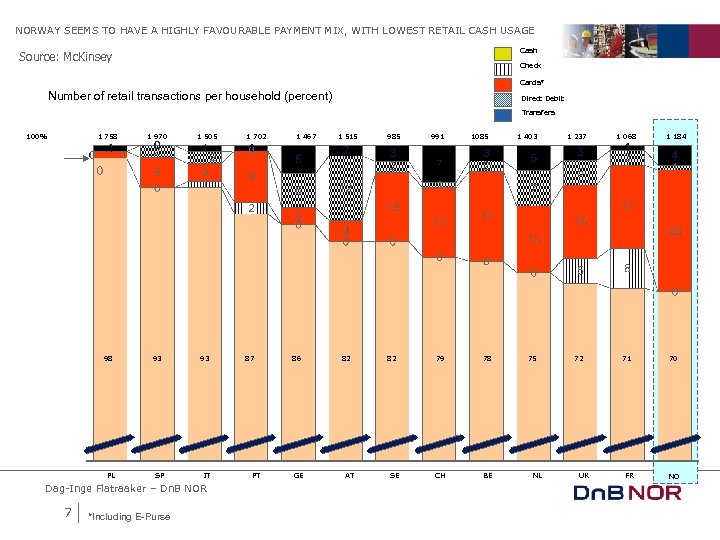

NORWAY SEEMS TO HAVE A HIGHLY FAVOURABLE PAYMENT MIX, WITH LOWEST RETAIL CASH USAGE Cash Source: Mc. Kinsey Check Cards* Number of retail transactions per household (percent) Direct Debit Transfers 100% 1 758 1 970 98 93 PL SP 1 505 93 IT Dag-Inge Flatraaker – Dn. B NOR 7 *Including E-Purse 1 702 87 PT 1 467 86 GE 1 515 82 AT 985 82 SE 991 1085 79 78 CH BE 1 403 75 NL 1 237 1 068 72 71 UK FR 1 184 70 NO

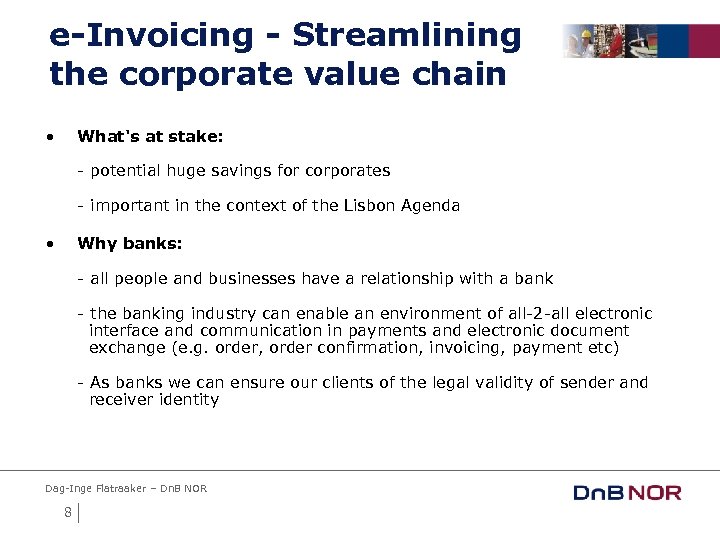

e-Invoicing - Streamlining the corporate value chain • What's at stake: - potential huge savings for corporates - important in the context of the Lisbon Agenda • Why banks: - all people and businesses have a relationship with a bank - the banking industry can enable an environment of all-2 -all electronic interface and communication in payments and electronic document exchange (e. g. order, order confirmation, invoicing, payment etc) - As banks we can ensure our clients of the legal validity of sender and receiver identity Dag-Inge Flatraaker – Dn. B NOR 8

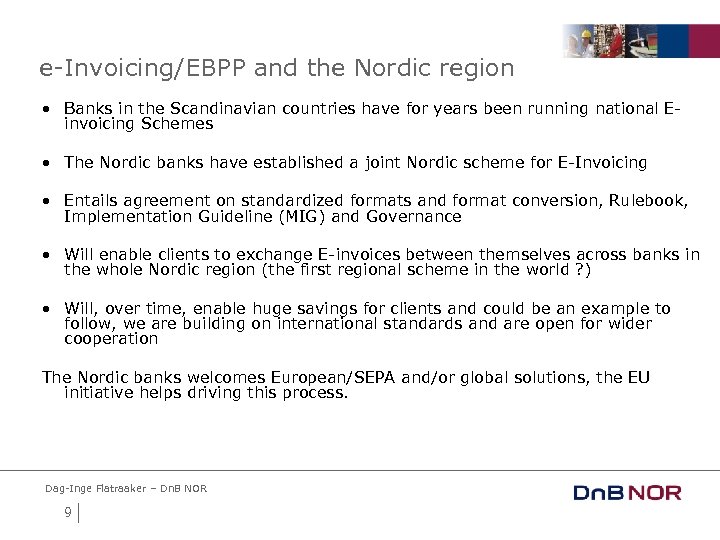

e-Invoicing/EBPP and the Nordic region • Banks in the Scandinavian countries have for years been running national Einvoicing Schemes • The Nordic banks have established a joint Nordic scheme for E-Invoicing • Entails agreement on standardized formats and format conversion, Rulebook, Implementation Guideline (MIG) and Governance • Will enable clients to exchange E-invoices between themselves across banks in the whole Nordic region (the first regional scheme in the world ? ) • Will, over time, enable huge savings for clients and could be an example to follow, we are building on international standards and are open for wider cooperation The Nordic banks welcomes European/SEPA and/or global solutions, the EU initiative helps driving this process. Dag-Inge Flatraaker – Dn. B NOR 9

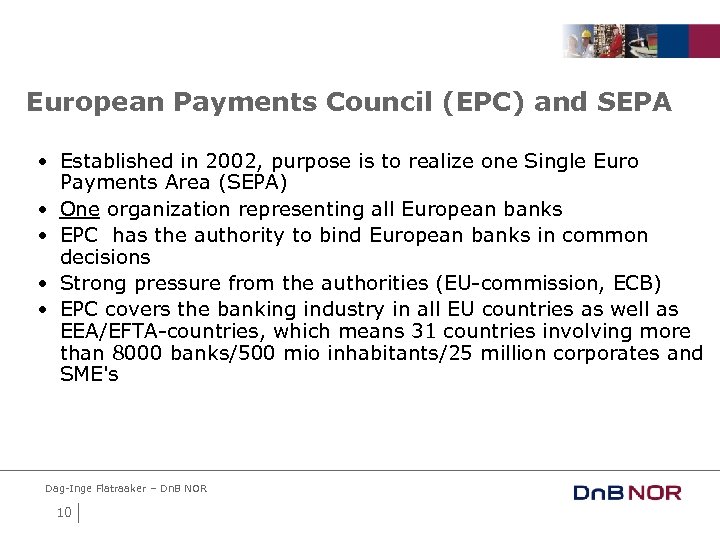

European Payments Council (EPC) and SEPA • Established in 2002, purpose is to realize one Single Euro Payments Area (SEPA) • One organization representing all European banks • EPC has the authority to bind European banks in common decisions • Strong pressure from the authorities (EU-commission, ECB) • EPC covers the banking industry in all EU countries as well as EEA/EFTA-countries, which means 31 countries involving more than 8000 banks/500 mio inhabitants/25 million corporates and SME's Dag-Inge Flatraaker – Dn. B NOR 10

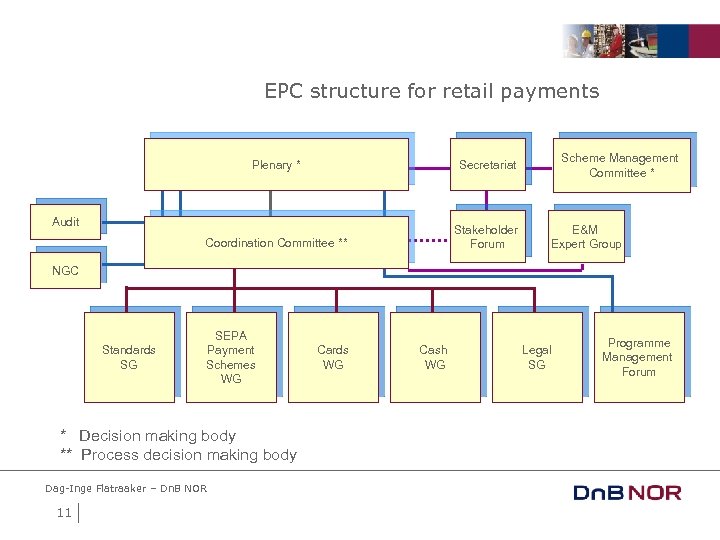

EPC structure for retail payments Plenary * Coordination Committee ** Stakeholder Forum Scheme Management Committee * Secretariat Audit E&M Expert Group NGC Standards SG SEPA Payment Schemes WG * Decision making body ** Process decision making body Dag-Inge Flatraaker – Dn. B NOR 11 Cards WG Cash WG Legal SG Programme Management Forum

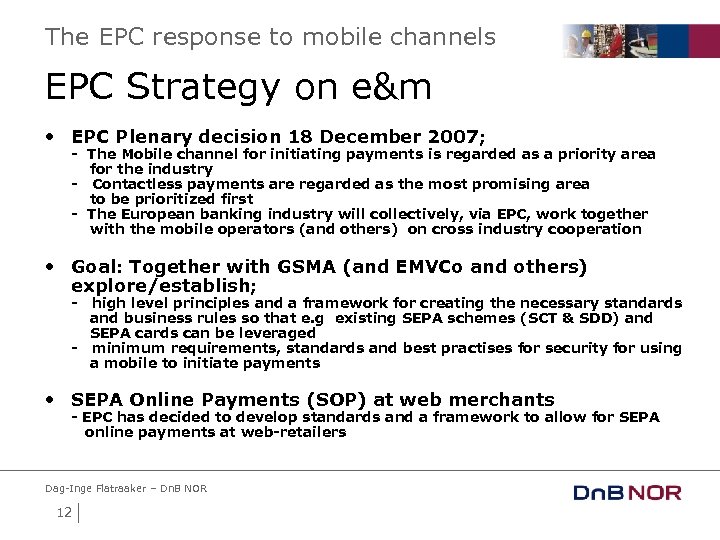

The EPC response to mobile channels EPC Strategy on e&m • EPC Plenary decision 18 December 2007; - The Mobile channel for initiating payments is regarded as a priority area for the industry - Contactless payments are regarded as the most promising area to be prioritized first - The European banking industry will collectively, via EPC, work together with the mobile operators (and others) on cross industry cooperation • Goal: Together with GSMA (and EMVCo and others) explore/establish; - high level principles and a framework for creating the necessary standards and business rules so that e. g existing SEPA schemes (SCT & SDD) and SEPA cards can be leveraged - minimum requirements, standards and best practises for security for using a mobile to initiate payments • SEPA Online Payments (SOP) at web merchants - EPC has decided to develop standards and a framework to allow for SEPA online payments at web-retailers Dag-Inge Flatraaker – Dn. B NOR 12

Mobile banking - the next big step ? • Need for cooperation on standards, security features and business models across industries (banks, telcos etc) • Collaboration with Telecom/mobile operators necessary and key !! Mobile operators dominates today the mobile distribution (both handset and services) • For both industries to succeed, business models needs to encompass both banks and mobile operators Dag-Inge Flatraaker – Dn. B NOR 13

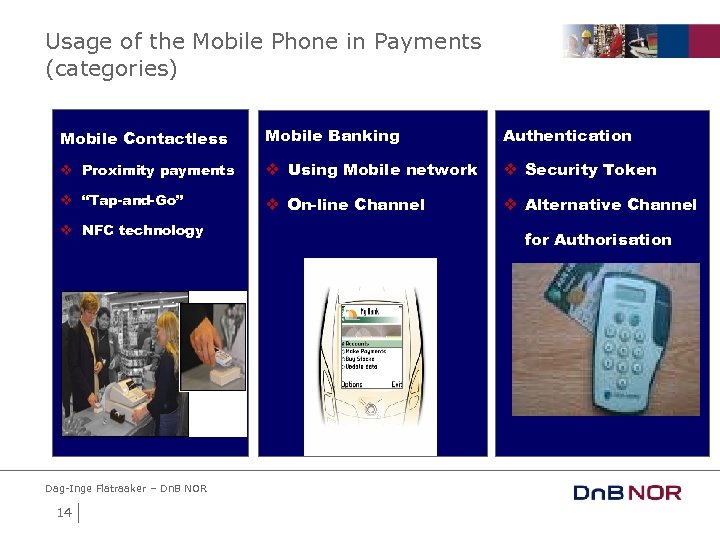

Usage of the Mobile Phone in Payments (categories) Mobile Contactless Mobile Banking Authentication v Proximity payments Reduce Cash v “Tap-and-Go” v Using Mobile network v Security Token v On-line Channel v Alternative Channel v NFC technology Dag-Inge Flatraaker – Dn. B NOR 14 for Authorisation

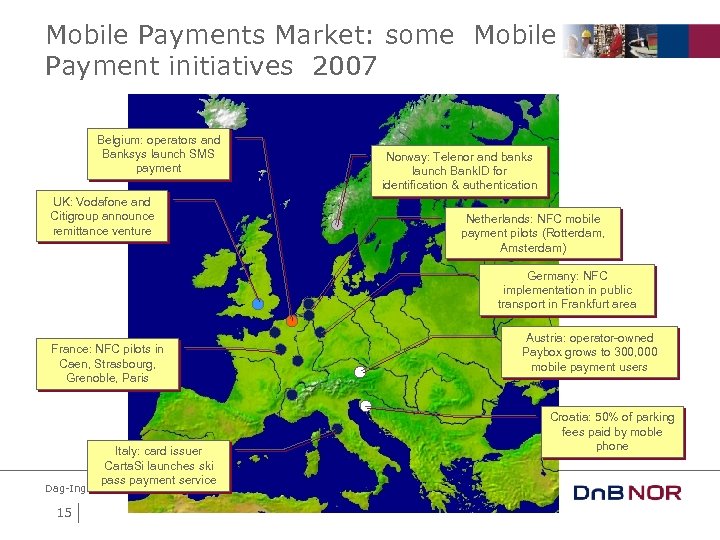

Mobile Payments Market: some Mobile Payment initiatives 2007 Belgium: operators and Banksys launch SMS payment UK: Vodafone and Citigroup announce remittance venture Norway: Telenor and banks launch Bank. ID for identification & authentication Netherlands: NFC mobile payment pilots (Rotterdam, Amsterdam) Germany: NFC implementation in public transport in Frankfurt area France: NFC pilots in Caen, Strasbourg, Grenoble, Paris Italy: card issuer Carta. Si launches ski pass payment service Dag-Inge Flatraaker – Dn. B NOR 15 Austria: operator-owned Paybox grows to 300, 000 mobile payment users Croatia: 50% of parking fees paid by moble phone

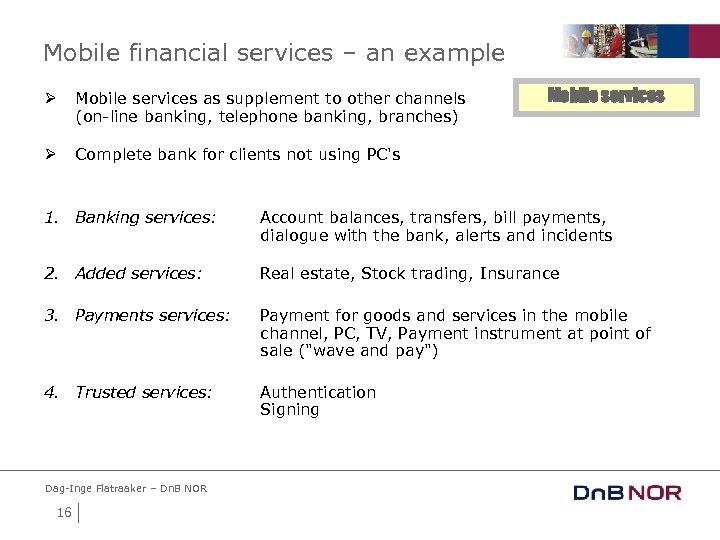

Mobile financial services – an example Ø Mobile services as supplement to other channels (on-line banking, telephone banking, branches) Ø Mobile services Complete bank for clients not using PC's 1. Banking services: Account balances, transfers, bill payments, dialogue with the bank, alerts and incidents 2. Added services: Real estate, Stock trading, Insurance 3. Payments services: Payment for goods and services in the mobile channel, PC, TV, Payment instrument at point of sale ("wave and pay") 4. Trusted services: Authentication Signing Dag-Inge Flatraaker – Dn. B NOR 16

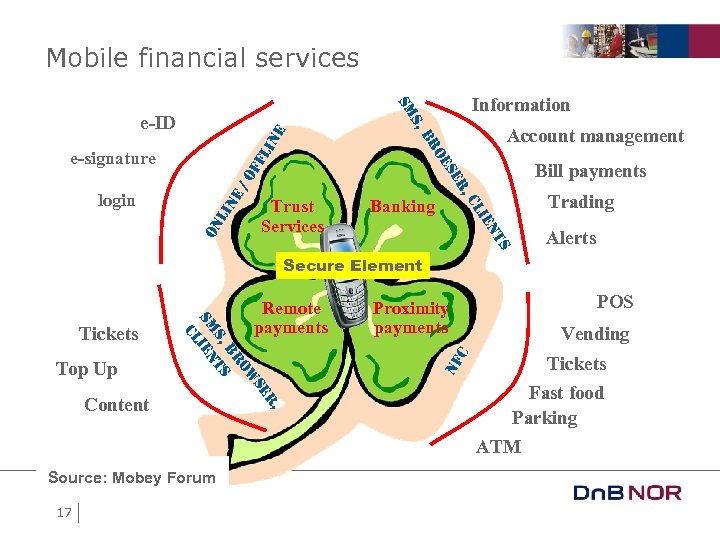

Mobile financial services li n ne li On Banking Trading S n. T Trust Services ie Cl login Bill payments R, /O ff Se Oe e-signature Account management BR e e-ID S, SM Information Alerts Secure Element Vending C R, Se Content POS Proximity payments Tickets nf Top Up OW BR S, TS SM ien Cl Tickets Remote payments Fast food Parking ATM Source: Mobey Forum Dag-Inge Flatraaker – Dn. B NOR 17

616b1fcb659e87328a2a6606b98a1cf6.ppt