80721eba7b68407d4e9731249772e446.ppt

- Количество слайдов: 46

How can we afford social care? Les Mayhew Faculty of Actuarial Science and Insurance Cass Business School May 2011

How can we afford social care? Les Mayhew Faculty of Actuarial Science and Insurance Cass Business School May 2011

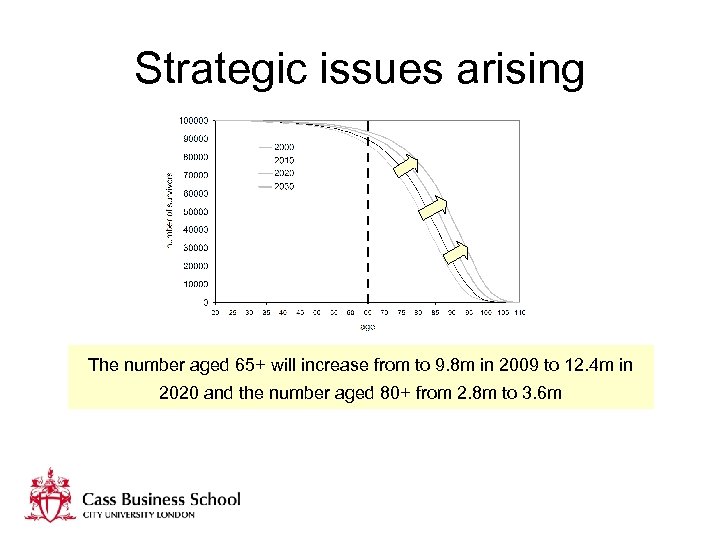

Strategic issues arising The number aged 65+ will increase from to 9. 8 m in 2009 to 12. 4 m in 2020 and the number aged 80+ from 2. 8 m to 3. 6 m

Strategic issues arising The number aged 65+ will increase from to 9. 8 m in 2009 to 12. 4 m in 2020 and the number aged 80+ from 2. 8 m to 3. 6 m

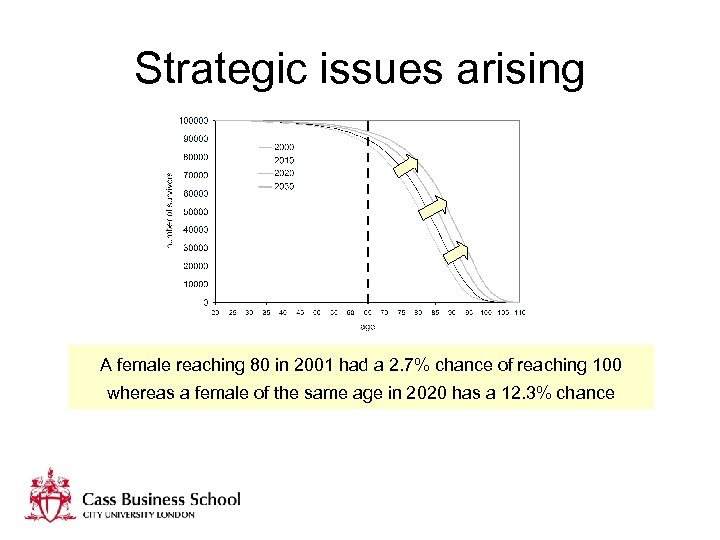

Strategic issues arising A female reaching 80 in 2001 had a 2. 7% chance of reaching 100 whereas a female of the same age in 2020 has a 12. 3% chance

Strategic issues arising A female reaching 80 in 2001 had a 2. 7% chance of reaching 100 whereas a female of the same age in 2020 has a 12. 3% chance

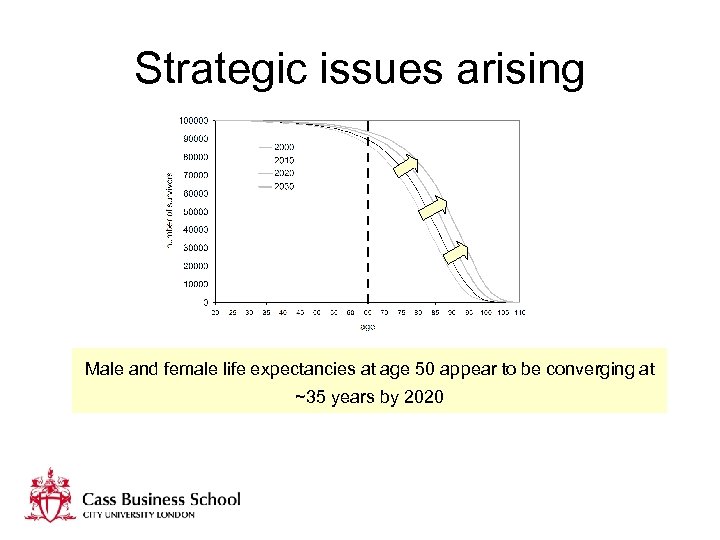

Strategic issues arising Male and female life expectancies at age 50 appear to be converging at ~35 years by 2020

Strategic issues arising Male and female life expectancies at age 50 appear to be converging at ~35 years by 2020

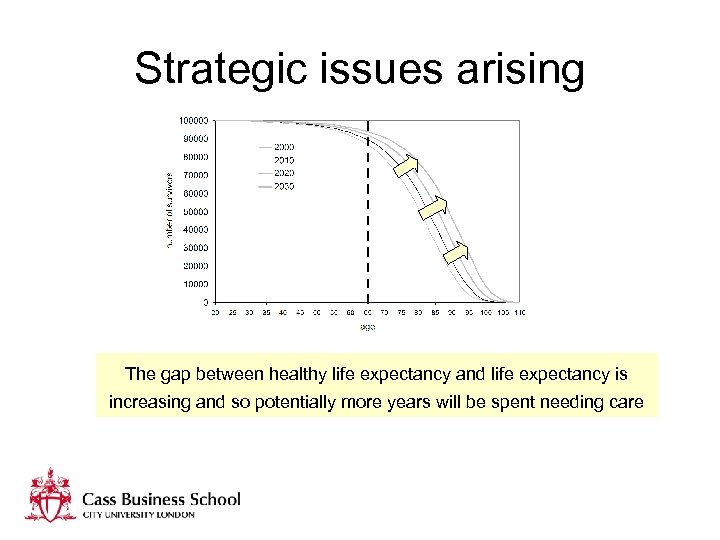

Strategic issues arising The gap between healthy life expectancy and life expectancy is increasing and so potentially more years will be spent needing care

Strategic issues arising The gap between healthy life expectancy and life expectancy is increasing and so potentially more years will be spent needing care

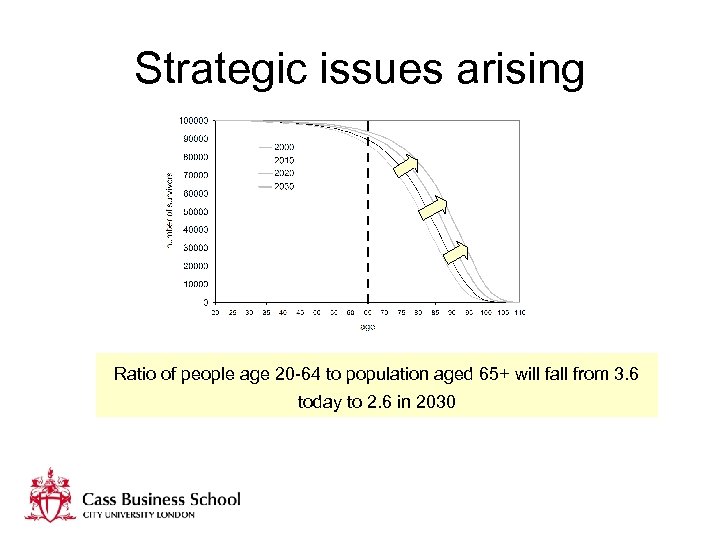

Strategic issues arising Ratio of people age 20 -64 to population aged 65+ will fall from 3. 6 today to 2. 6 in 2030

Strategic issues arising Ratio of people age 20 -64 to population aged 65+ will fall from 3. 6 today to 2. 6 in 2030

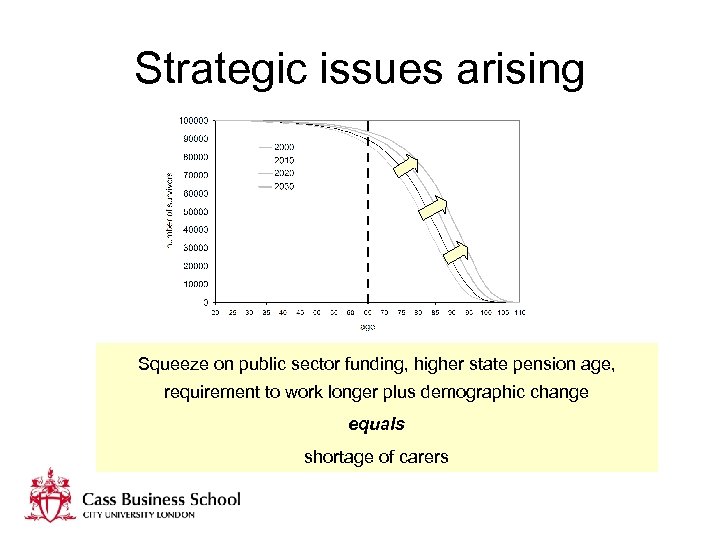

Strategic issues arising Squeeze on public sector funding, higher state pension age, requirement to work longer plus demographic change equals shortage of carers

Strategic issues arising Squeeze on public sector funding, higher state pension age, requirement to work longer plus demographic change equals shortage of carers

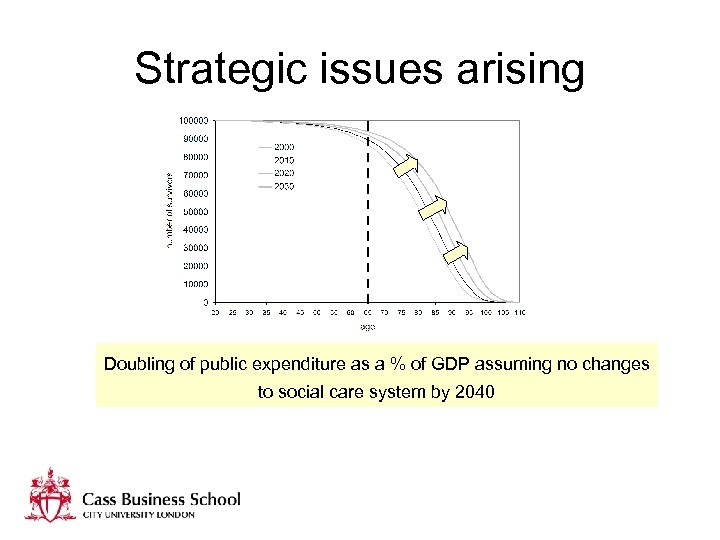

Strategic issues arising Doubling of public expenditure as a % of GDP assuming no changes to social care system by 2040

Strategic issues arising Doubling of public expenditure as a % of GDP assuming no changes to social care system by 2040

Commission on the Funding of Care and Support Terms of reference: • The best way to meet care and support costs as a partnership between individuals and the state • how an individual’s assets are protected against the cost of care • how public funding for the care and support system can be best used to meet needs • how to deliver the preferred option including implementation timescales and impact on local government Report by July 2011 and response by DH in Autumn 2011

Commission on the Funding of Care and Support Terms of reference: • The best way to meet care and support costs as a partnership between individuals and the state • how an individual’s assets are protected against the cost of care • how public funding for the care and support system can be best used to meet needs • how to deliver the preferred option including implementation timescales and impact on local government Report by July 2011 and response by DH in Autumn 2011

Reading the runes – Lord Warner • “No silver bullet” – Lord Warner • “No appetite for compulsion” • “Insurance industry not produced fit for purpose products” • “better means testing – not such steep cut off”

Reading the runes – Lord Warner • “No silver bullet” – Lord Warner • “No appetite for compulsion” • “Insurance industry not produced fit for purpose products” • “better means testing – not such steep cut off”

Reading the runes- Andrew Dilnott • “First priority is to provide for those that cannot provide for themselves” • “We cant find a single solution” • “No compulsory insurance scheme” • “Most people have two big assets their home and pension fund” • “£ 23 k arbitrary cut-off for support was unfair” • “What we are looking at is the space in the middle – ways of sharing the responsibility between the state and the individual”

Reading the runes- Andrew Dilnott • “First priority is to provide for those that cannot provide for themselves” • “We cant find a single solution” • “No compulsory insurance scheme” • “Most people have two big assets their home and pension fund” • “£ 23 k arbitrary cut-off for support was unfair” • “What we are looking at is the space in the middle – ways of sharing the responsibility between the state and the individual”

What do other countries do? • • • Sweden – Funded by municipalities and local income taxes with national government transfers some resources to compensate for regional differences Japan – cost split 50: 50 between general taxation and mandatory insurance for people aged 40 + Germany – social insurance scheme shared between workers and employers, also covers non-working family members, benefits taken in cash, institutional or domiciliary care. Opt outs for high earners and self employed. But: Karlsson et al show that were any of these systems to be adopted in the UK they would be much more expensive, result in a large tax hikes, and be distributionally unfair

What do other countries do? • • • Sweden – Funded by municipalities and local income taxes with national government transfers some resources to compensate for regional differences Japan – cost split 50: 50 between general taxation and mandatory insurance for people aged 40 + Germany – social insurance scheme shared between workers and employers, also covers non-working family members, benefits taken in cash, institutional or domiciliary care. Opt outs for high earners and self employed. But: Karlsson et al show that were any of these systems to be adopted in the UK they would be much more expensive, result in a large tax hikes, and be distributionally unfair

Peculiarities about the UK • • • Very wide distribution of wealth and income System opaque and complex Only the poorest and neediest get any help Depends on where you live whether you get help Different system in Scotland In Northern Ireland health and social care integrated but not in rest of UK

Peculiarities about the UK • • • Very wide distribution of wealth and income System opaque and complex Only the poorest and neediest get any help Depends on where you live whether you get help Different system in Scotland In Northern Ireland health and social care integrated but not in rest of UK

Outline of talk • Look at income and assets in old age • Consider different solutions for people with different circumstances • Show these products would operate with the state and how the poorest in society would be protected • Provide example and suggest how the system could be implemented

Outline of talk • Look at income and assets in old age • Consider different solutions for people with different circumstances • Show these products would operate with the state and how the poorest in society would be protected • Provide example and suggest how the system could be implemented

Present system of adult social care Local authority funding for adult social care (A) Social security benefits Opportunity costs Out of pocket Local authorities (P) Carers Allowance (C) Private funding (Q) Care providers Voluntary sector Private companies Local Authority staff (S) Service users (T) (B) Family and friends (R) England spends around £ 104 bn a year on care. Of this total: • £ 26 bn by tax payers (£ 12 bn in benefits DLA and AA • £ 8 bn private sector; • £ 70 bn is unpaid care • NHS also funds continuing care places Of the £ 104 bn approximately 85% is on older people We focus on the 65+ population which accounts for the majority of expenditure and where scope for private finance is greatest

Present system of adult social care Local authority funding for adult social care (A) Social security benefits Opportunity costs Out of pocket Local authorities (P) Carers Allowance (C) Private funding (Q) Care providers Voluntary sector Private companies Local Authority staff (S) Service users (T) (B) Family and friends (R) England spends around £ 104 bn a year on care. Of this total: • £ 26 bn by tax payers (£ 12 bn in benefits DLA and AA • £ 8 bn private sector; • £ 70 bn is unpaid care • NHS also funds continuing care places Of the £ 104 bn approximately 85% is on older people We focus on the 65+ population which accounts for the majority of expenditure and where scope for private finance is greatest

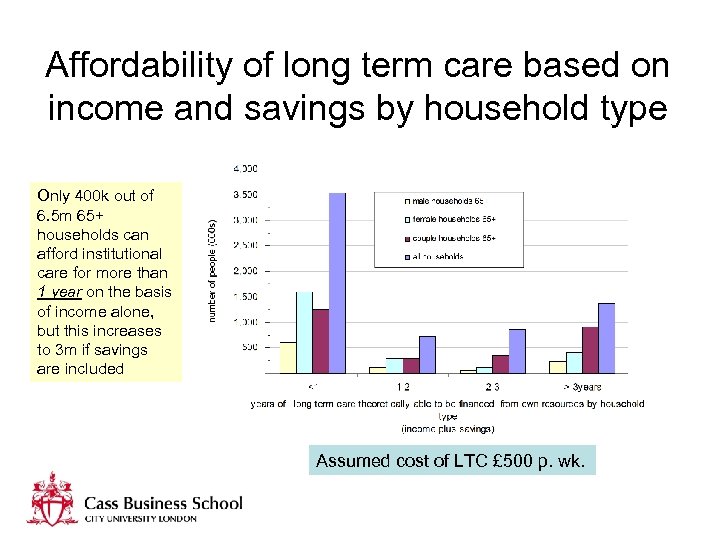

Affordability of long term care based on income and savings by household type Only 400 k out of 6. 5 m 65+ households can afford institutional care for more than 1 year on the basis of income alone, but this increases to 3 m if savings are included Assumed cost of LTC £ 500 p. wk.

Affordability of long term care based on income and savings by household type Only 400 k out of 6. 5 m 65+ households can afford institutional care for more than 1 year on the basis of income alone, but this increases to 3 m if savings are included Assumed cost of LTC £ 500 p. wk.

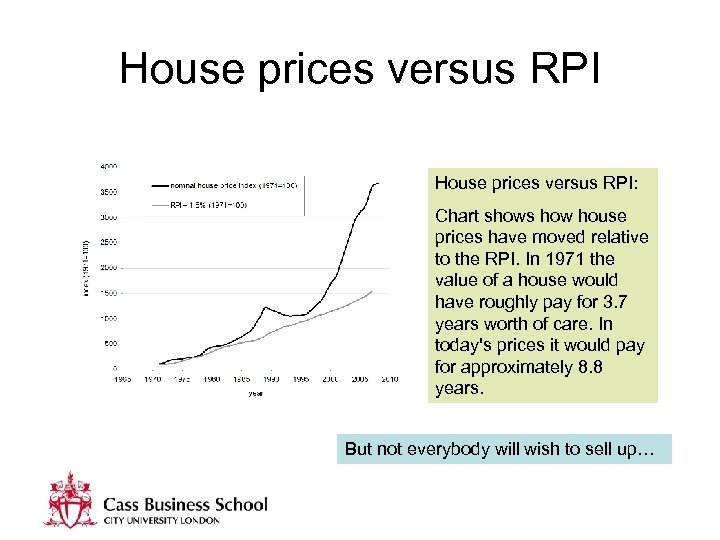

House prices versus RPI: Chart shows how house prices have moved relative to the RPI. In 1971 the value of a house would have roughly pay for 3. 7 years worth of care. In today's prices it would pay for approximately 8. 8 years. But not everybody will wish to sell up…

House prices versus RPI: Chart shows how house prices have moved relative to the RPI. In 1971 the value of a house would have roughly pay for 3. 7 years worth of care. In today's prices it would pay for approximately 8. 8 years. But not everybody will wish to sell up…

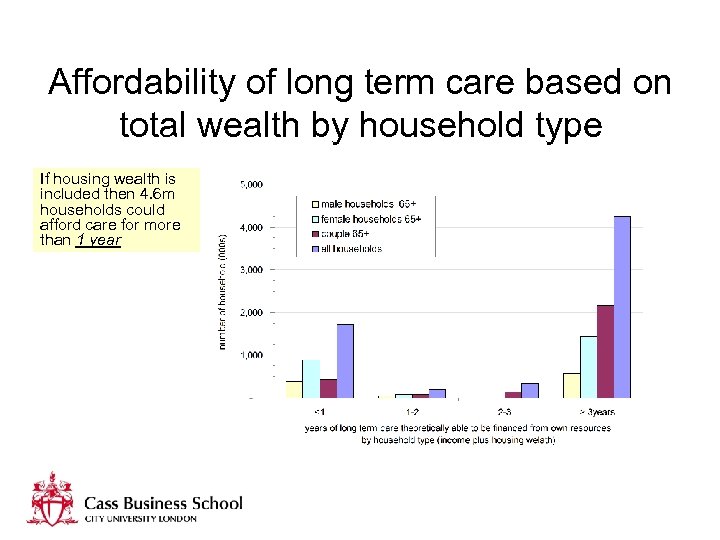

Affordability of long term care based on total wealth by household type If housing wealth is included then 4. 6 m households could afford care for more than 1 year

Affordability of long term care based on total wealth by household type If housing wealth is included then 4. 6 m households could afford care for more than 1 year

What type of funding system do we need? • • • Flexibility and choice Fairness and equity Help for those in greatest need Consistency and certainty Affordability (state and individual) Simplicity

What type of funding system do we need? • • • Flexibility and choice Fairness and equity Help for those in greatest need Consistency and certainty Affordability (state and individual) Simplicity

How to mobilise private finance 3 classes of product: ‘point of need’, ‘point of retirement’, ‘any time’ • • • Equity release products Top up insurance Immediate needs annuities Accelerated life insurance LTC bonds/trust fund Disability Linked Annuities No one product will suit all needs or personal circumstances, so a variety of products and financing mechanisms are proposed

How to mobilise private finance 3 classes of product: ‘point of need’, ‘point of retirement’, ‘any time’ • • • Equity release products Top up insurance Immediate needs annuities Accelerated life insurance LTC bonds/trust fund Disability Linked Annuities No one product will suit all needs or personal circumstances, so a variety of products and financing mechanisms are proposed

Difference between Equity Release and Immediate Needs Annuities • Equity release is cash released from assets, usually a home. It is time limited until the money runs out • Immediate needs annuities are purchased for a lump sum down payment and continue to pay until death

Difference between Equity Release and Immediate Needs Annuities • Equity release is cash released from assets, usually a home. It is time limited until the money runs out • Immediate needs annuities are purchased for a lump sum down payment and continue to pay until death

Why LTC bonds? • There is a large population that cannot afford any LTC • Would pay out only if LTC needed, otherwise go to estate or pay for funeral expenses • Would pay monthly prizes e. g. like premium bonds • Would accrue interest just as in a bank • Evidence tells us that people on low income buy premium bonds, lottery tickets etc. • Would at least be a contribution and would attune the population to saving for care in old age

Why LTC bonds? • There is a large population that cannot afford any LTC • Would pay out only if LTC needed, otherwise go to estate or pay for funeral expenses • Would pay monthly prizes e. g. like premium bonds • Would accrue interest just as in a bank • Evidence tells us that people on low income buy premium bonds, lottery tickets etc. • Would at least be a contribution and would attune the population to saving for care in old age

How do DLAs work? • Works likes a pension annuity and is actuarially fair • But: – Higher payments if become disabled – Even higher payments if go into care • Can apply to any kind of pension – defined benefit or defined contribution, public sector and state pension alike

How do DLAs work? • Works likes a pension annuity and is actuarially fair • But: – Higher payments if become disabled – Even higher payments if go into care • Can apply to any kind of pension – defined benefit or defined contribution, public sector and state pension alike

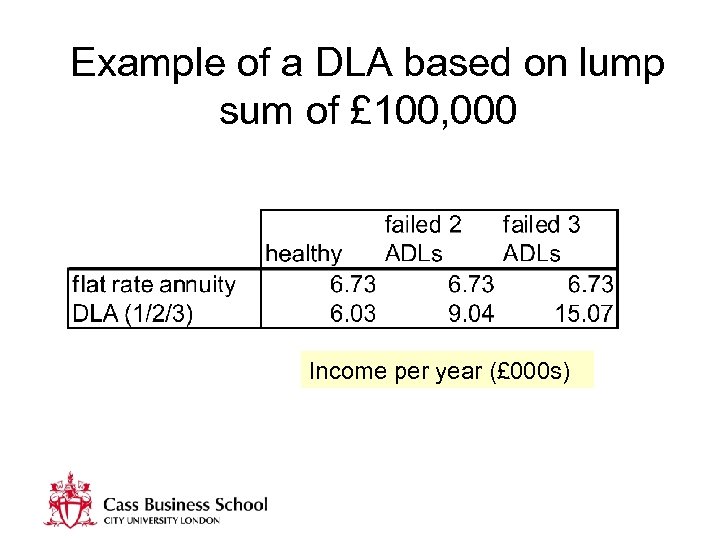

Example of a DLA based on lump sum of £ 100, 000 Income per year (£ 000 s)

Example of a DLA based on lump sum of £ 100, 000 Income per year (£ 000 s)

Attendance Allowance – an aside For consideration • Tax free benefit paid to people aged 65+ with a physical or mental disability or both • However, could be simplified by incorporating it within the state pension • Would increase as person became more disabled • Would be equivalent to a ‘DLA’

Attendance Allowance – an aside For consideration • Tax free benefit paid to people aged 65+ with a physical or mental disability or both • However, could be simplified by incorporating it within the state pension • Would increase as person became more disabled • Would be equivalent to a ‘DLA’

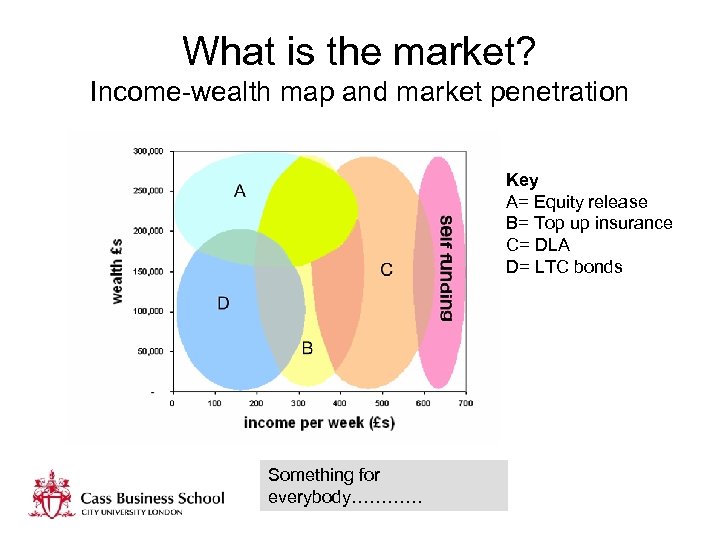

What is the market? Income-wealth map and market penetration Key A= Equity release B= Top up insurance C= DLA D= LTC bonds Something for everybody…………

What is the market? Income-wealth map and market penetration Key A= Equity release B= Top up insurance C= DLA D= LTC bonds Something for everybody…………

Interfacing products with means testing • Current system too complex and not equally applied • Disincentive to save and deters low cost private finance solutions • Unfair because people just above threshold have no state support or limited means to insure against risk • Its not what people want! (Green Paper consultation)

Interfacing products with means testing • Current system too complex and not equally applied • Disincentive to save and deters low cost private finance solutions • Unfair because people just above threshold have no state support or limited means to insure against risk • Its not what people want! (Green Paper consultation)

Principles underpinning new system of public support • All people should receive something unless they are fully self-financing • It should be based on income and assets • It should not dis-incentivise people to save or purchase products • It must be fair and transparent! • It should be affordable in terms of public expenditure • People can by-pass system if they wish

Principles underpinning new system of public support • All people should receive something unless they are fully self-financing • It should be based on income and assets • It should not dis-incentivise people to save or purchase products • It must be fair and transparent! • It should be affordable in terms of public expenditure • People can by-pass system if they wish

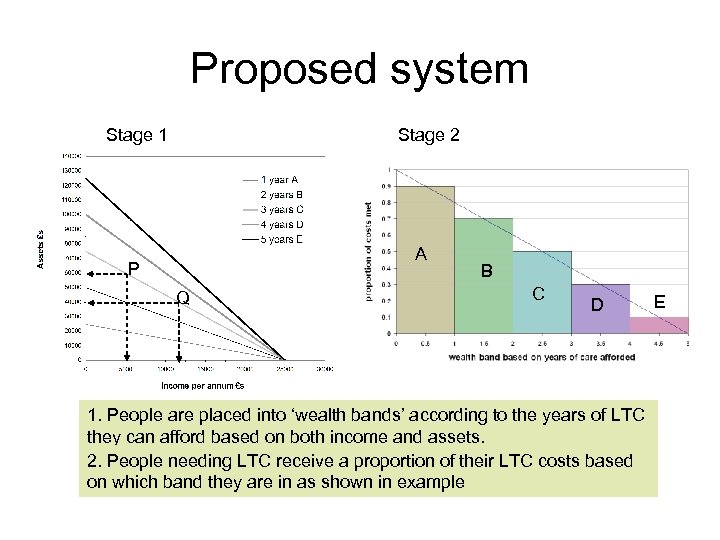

Proposed system Stage 1 Stage 2 A P P Q Q B C D 1. People are placed into ‘wealth bands’ according to the years of LTC they can afford based on both income and assets. 2. People needing LTC receive a proportion of their LTC costs based on which band they are in as shown in example E

Proposed system Stage 1 Stage 2 A P P Q Q B C D 1. People are placed into ‘wealth bands’ according to the years of LTC they can afford based on both income and assets. 2. People needing LTC receive a proportion of their LTC costs based on which band they are in as shown in example E

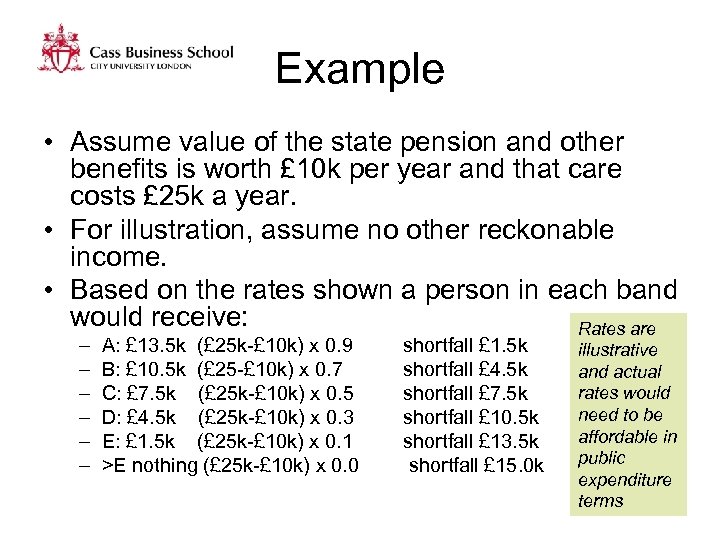

Example • Assume value of the state pension and other benefits is worth £ 10 k per year and that care costs £ 25 k a year. • For illustration, assume no other reckonable income. • Based on the rates shown a person in each band would receive: Rates are – – – A: £ 13. 5 k (£ 25 k-£ 10 k) x 0. 9 B: £ 10. 5 k (£ 25 -£ 10 k) x 0. 7 C: £ 7. 5 k (£ 25 k-£ 10 k) x 0. 5 D: £ 4. 5 k (£ 25 k-£ 10 k) x 0. 3 E: £ 1. 5 k (£ 25 k-£ 10 k) x 0. 1 >E nothing (£ 25 k-£ 10 k) x 0. 0 shortfall £ 1. 5 k shortfall £ 4. 5 k shortfall £ 7. 5 k shortfall £ 10. 5 k shortfall £ 13. 5 k shortfall £ 15. 0 k illustrative and actual rates would need to be affordable in public expenditure terms

Example • Assume value of the state pension and other benefits is worth £ 10 k per year and that care costs £ 25 k a year. • For illustration, assume no other reckonable income. • Based on the rates shown a person in each band would receive: Rates are – – – A: £ 13. 5 k (£ 25 k-£ 10 k) x 0. 9 B: £ 10. 5 k (£ 25 -£ 10 k) x 0. 7 C: £ 7. 5 k (£ 25 k-£ 10 k) x 0. 5 D: £ 4. 5 k (£ 25 k-£ 10 k) x 0. 3 E: £ 1. 5 k (£ 25 k-£ 10 k) x 0. 1 >E nothing (£ 25 k-£ 10 k) x 0. 0 shortfall £ 1. 5 k shortfall £ 4. 5 k shortfall £ 7. 5 k shortfall £ 10. 5 k shortfall £ 13. 5 k shortfall £ 15. 0 k illustrative and actual rates would need to be affordable in public expenditure terms

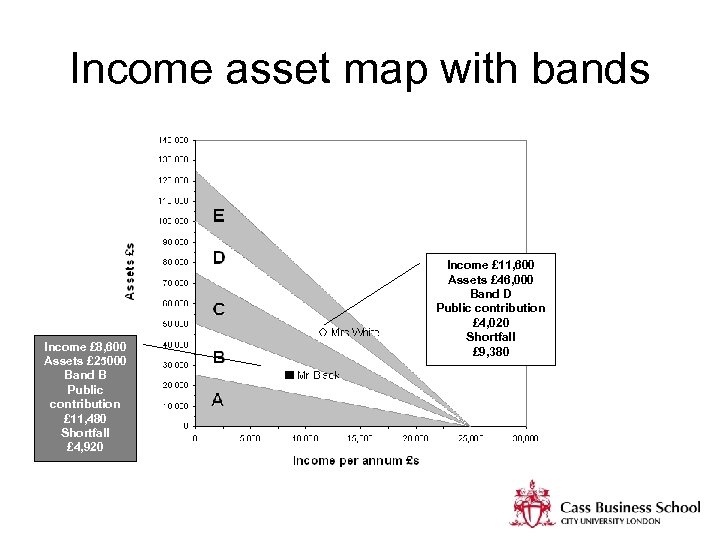

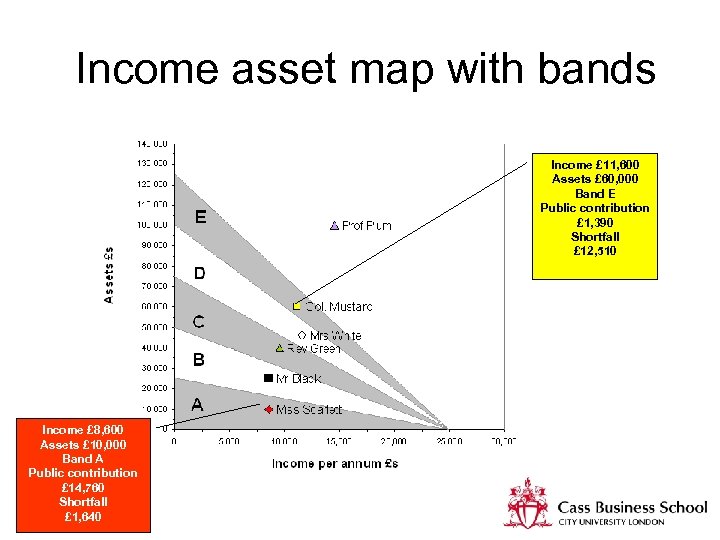

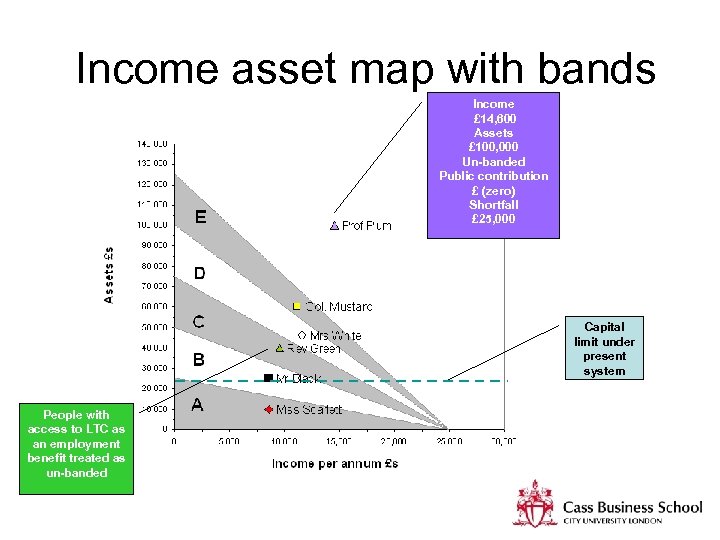

Case studies Illustrative public support rates: A = 90%; B=70%; C=50%; D=30%; E=10%; others: self funding

Case studies Illustrative public support rates: A = 90%; B=70%; C=50%; D=30%; E=10%; others: self funding

Income asset map with bands Income £ 8, 600 Assets £ 25000 Band B Public contribution £ 11, 480 Shortfall £ 4, 920 Income £ 11, 600 Assets £ 46, 000 Band D Public contribution £ 4, 020 Shortfall £ 9, 380

Income asset map with bands Income £ 8, 600 Assets £ 25000 Band B Public contribution £ 11, 480 Shortfall £ 4, 920 Income £ 11, 600 Assets £ 46, 000 Band D Public contribution £ 4, 020 Shortfall £ 9, 380

Income asset map with bands Income £ 11, 600 Assets £ 60, 000 Band E Public contribution £ 1, 390 Shortfall £ 12, 510 Income £ 8, 600 Assets £ 10, 000 Band A Public contribution £ 14, 760 Shortfall £ 1, 640

Income asset map with bands Income £ 11, 600 Assets £ 60, 000 Band E Public contribution £ 1, 390 Shortfall £ 12, 510 Income £ 8, 600 Assets £ 10, 000 Band A Public contribution £ 14, 760 Shortfall £ 1, 640

Income asset map with bands Income £ 14, 600 Assets £ 100, 000 Un-banded Public contribution £ (zero) Shortfall £ 25, 000 Capital limit under present system People with access to LTC as an employment benefit treated as un-banded

Income asset map with bands Income £ 14, 600 Assets £ 100, 000 Un-banded Public contribution £ (zero) Shortfall £ 25, 000 Capital limit under present system People with access to LTC as an employment benefit treated as un-banded

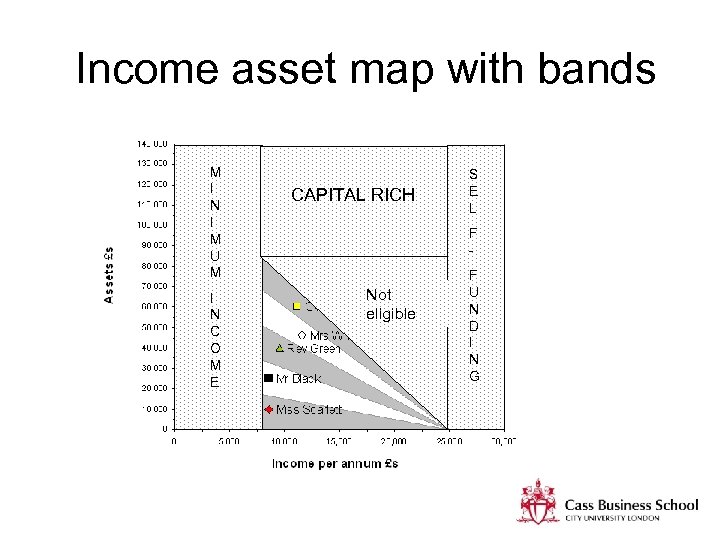

Income asset map with bands M I N I M U M I N C O M E CAPITAL RICH S E L F - Not eligible F U N D I N G

Income asset map with bands M I N I M U M I N C O M E CAPITAL RICH S E L F - Not eligible F U N D I N G

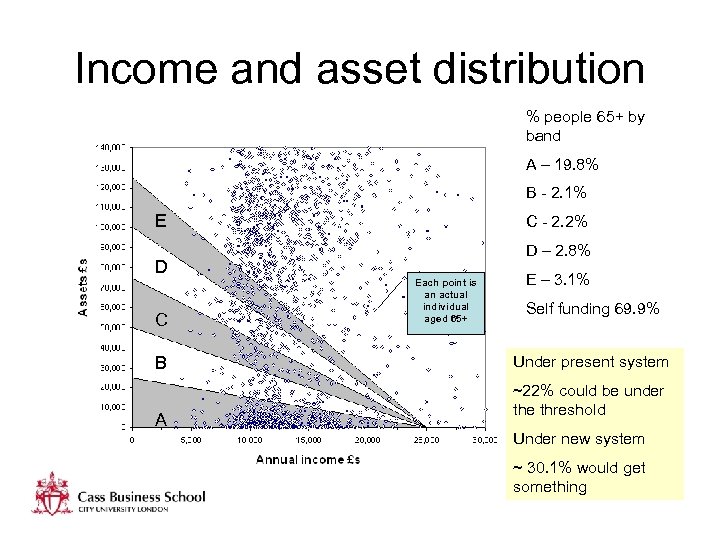

Income and asset distribution % people 65+ by band A – 19. 8% B - 2. 1% E D C B A C - 2. 2% D – 2. 8% Each point is an actual individual aged 65+ E – 3. 1% Self funding 69. 9% Under present system ~22% could be under the threshold Under new system ~ 30. 1% would get something

Income and asset distribution % people 65+ by band A – 19. 8% B - 2. 1% E D C B A C - 2. 2% D – 2. 8% Each point is an actual individual aged 65+ E – 3. 1% Self funding 69. 9% Under present system ~22% could be under the threshold Under new system ~ 30. 1% would get something

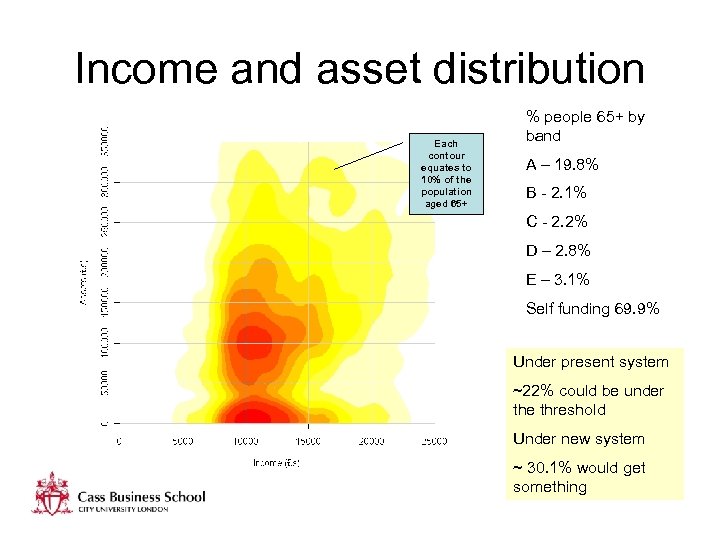

Income and asset distribution Each contour equates to 10% of the population aged 65+ % people 65+ by band A – 19. 8% B - 2. 1% C - 2. 2% D – 2. 8% E – 3. 1% Self funding 69. 9% Under present system ~22% could be under the threshold Under new system ~ 30. 1% would get something

Income and asset distribution Each contour equates to 10% of the population aged 65+ % people 65+ by band A – 19. 8% B - 2. 1% C - 2. 2% D – 2. 8% E – 3. 1% Self funding 69. 9% Under present system ~22% could be under the threshold Under new system ~ 30. 1% would get something

Cohort effects % of individuals by band reaching age 85 in given years Note that the proportion that cannot self fund for more than 1 year goes down over time

Cohort effects % of individuals by band reaching age 85 in given years Note that the proportion that cannot self fund for more than 1 year goes down over time

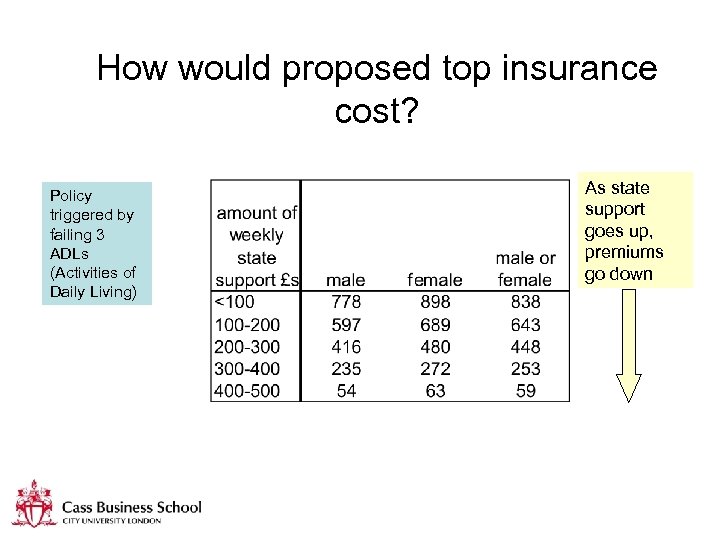

How would proposed top insurance cost? Policy triggered by failing 3 ADLs (Activities of Daily Living) As state support goes up, premiums go down

How would proposed top insurance cost? Policy triggered by failing 3 ADLs (Activities of Daily Living) As state support goes up, premiums go down

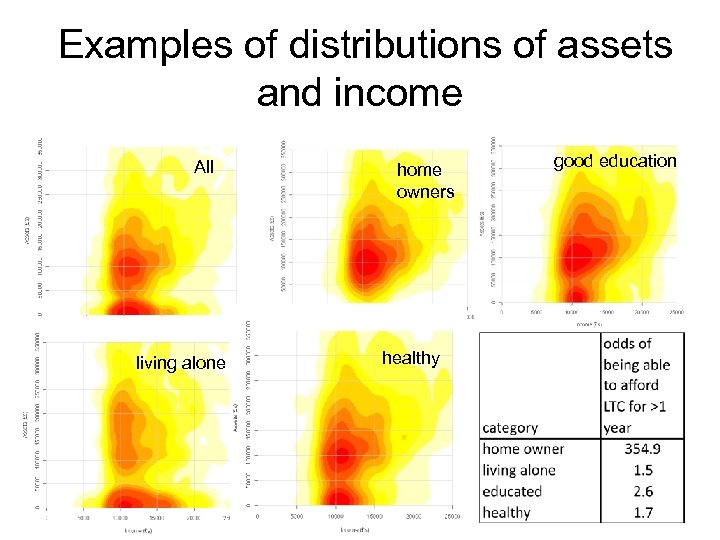

Examples of distributions of assets and income All living alone home owners healthy good education

Examples of distributions of assets and income All living alone home owners healthy good education

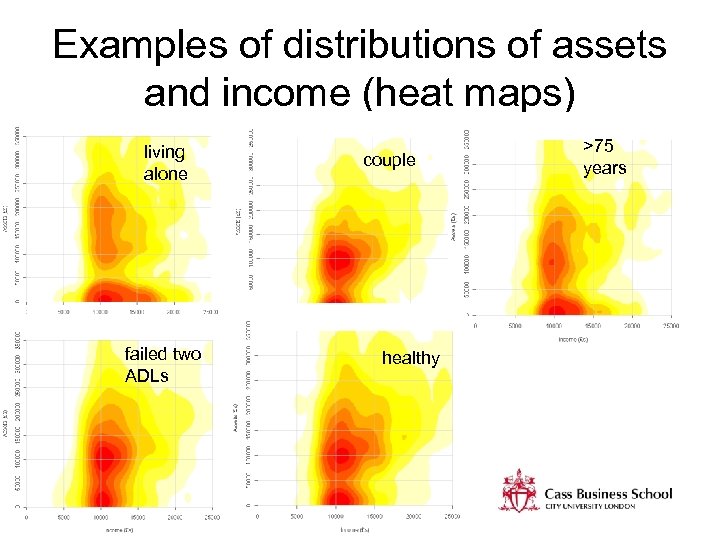

Examples of distributions of assets and income (heat maps) living alone failed two ADLs couple healthy >75 years

Examples of distributions of assets and income (heat maps) living alone failed two ADLs couple healthy >75 years

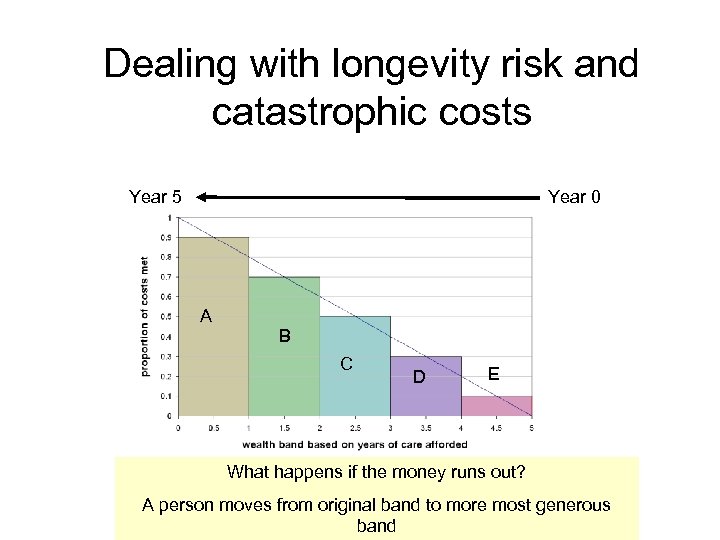

Dealing with longevity risk and catastrophic costs Year 5 Year 0 A B C D E What happens if the money runs out? A person moves from original band to more most generous band

Dealing with longevity risk and catastrophic costs Year 5 Year 0 A B C D E What happens if the money runs out? A person moves from original band to more most generous band

Summary of key proposals 1. Control of public expenditure is maintained: • • • through the personal cap (e. g. £ 25 k) the banding structure and top up rates through the unified assessment system 2. Equity through universality and equal treatment of people with different means 3. Flexibility and choice through the range of products and ways of meeting costs 4. Avoidance of gaming: ‘ 7 -year disposal of assets rule’

Summary of key proposals 1. Control of public expenditure is maintained: • • • through the personal cap (e. g. £ 25 k) the banding structure and top up rates through the unified assessment system 2. Equity through universality and equal treatment of people with different means 3. Flexibility and choice through the range of products and ways of meeting costs 4. Avoidance of gaming: ‘ 7 -year disposal of assets rule’

Suggested role of the state To: • Clarify state entitlement based on a unified assessment system • Provide regulation of products and policy stability • Make it easier to get financial advice and direction at points of need or contact • Provide incentives for people to take up private finance products e. g. through the tax system • Improve the quality and efficiency of care services (e. g. tax breaks for care homes) • Create conditions for private sector to invest

Suggested role of the state To: • Clarify state entitlement based on a unified assessment system • Provide regulation of products and policy stability • Make it easier to get financial advice and direction at points of need or contact • Provide incentives for people to take up private finance products e. g. through the tax system • Improve the quality and efficiency of care services (e. g. tax breaks for care homes) • Create conditions for private sector to invest

Timing issues • New products will take time to mature e. g. LTC bonds may take 10 years or so to reach a steady state • Implies that private finance funding mix will gradually evolve with equity release likely to be most popular initially • Investment in computer systems would be borne largely by private sector providers • Some public investment in IT might be needed for monitoring and regulation purposes

Timing issues • New products will take time to mature e. g. LTC bonds may take 10 years or so to reach a steady state • Implies that private finance funding mix will gradually evolve with equity release likely to be most popular initially • Investment in computer systems would be borne largely by private sector providers • Some public investment in IT might be needed for monitoring and regulation purposes

END lesmayhew@googlemail. com Mayhew, L. , M. Karlsson, and B. Rickayzen, B. (2010) The Role of Private Finance in Paying for Long Term Care. The Economic Journal, Vol 120, Issue 548, F 478–F 504, November 2010 Karlsson, M. , Mayhew L, Rickayzen, B. (2007), 'Long term care financing in four OECD countries: Fiscal burden and distributive effects', Health Policy, 80(1), p. 107 -134 Karlsson. M, Mayhew L, Plumb. R, Rickayzen. B, (2006), Future costs for long-term care: Cost projections for long-term care for older people in the United Kingdom, Health Policy, 75(2), p. 187 -213

END lesmayhew@googlemail. com Mayhew, L. , M. Karlsson, and B. Rickayzen, B. (2010) The Role of Private Finance in Paying for Long Term Care. The Economic Journal, Vol 120, Issue 548, F 478–F 504, November 2010 Karlsson, M. , Mayhew L, Rickayzen, B. (2007), 'Long term care financing in four OECD countries: Fiscal burden and distributive effects', Health Policy, 80(1), p. 107 -134 Karlsson. M, Mayhew L, Plumb. R, Rickayzen. B, (2006), Future costs for long-term care: Cost projections for long-term care for older people in the United Kingdom, Health Policy, 75(2), p. 187 -213